Overview

When it comes to securing a home loan in Canada, understanding your credit score is crucial. We know how challenging this can be, especially when you’re trying to navigate the mortgage process. Typically, a credit score of around 680 is what lenders look for. But here’s the good news: if your score is above this threshold, you’re likely to enjoy better loan terms and lower interest rates.

A higher credit score reflects a lower risk to lenders. This means that not only does it enhance your chances of mortgage approval, but it also opens the door to more favorable conditions. Imagine being able to secure a loan that fits your family’s needs without the stress of high interest rates weighing you down.

So, what can you do to improve your credit score? Start by checking your credit report for any inaccuracies and addressing them. Paying down existing debts and making timely payments can also make a significant difference. Remember, we’re here to support you every step of the way as you work towards your homeownership goals.

Introduction

Understanding the credit score necessary for securing a home loan is a pivotal step in your mortgage journey. We know how challenging this can be. This three-digit number reflects your financial reliability and plays a crucial role in determining loan terms and interest rates. With lenders increasingly scrutinizing credit scores, navigating the complex factors that influence this vital metric can feel overwhelming.

But don’t worry; there are strategies you can employ to enhance your credit score. By taking proactive steps, you can unlock better mortgage opportunities and feel more confident in your financial future. What if you could improve your score and open doors to your dream home? We’re here to support you every step of the way.

Define Credit Scores and Their Importance in Home Loans

Understanding the credit score required for a home loan is essential, especially when navigating the mortgage process. A rating is a three-digit figure, typically ranging from 300 to 850, that reflects your financial reliability. It’s determined by several factors, including:

- Your payment history

- Amounts owed

- Duration of borrowing history

- New loans

- Types of financing used

We know how challenging this can be, but a higher rating can make a significant difference. In the world of home loans, lenders consider the credit score required for a home loan as an indication that you’re likely to meet your obligations on time. This can lead to better loan conditions and lower interest rates, which is something every family desires.

For instance, achieving a score above 740 is generally seen as excellent and can greatly reduce your borrowing costs. Understanding the credit score required for a home loan not only affects your ability to qualify for a mortgage but also influences the interest rates and terms you may receive.

So, take the time to understand your rating. It’s a crucial step in empowering yourself to make informed financial decisions. Remember, we’re here to support you every step of the way.

Identify Minimum Credit Score Requirements for Home Loans in Canada

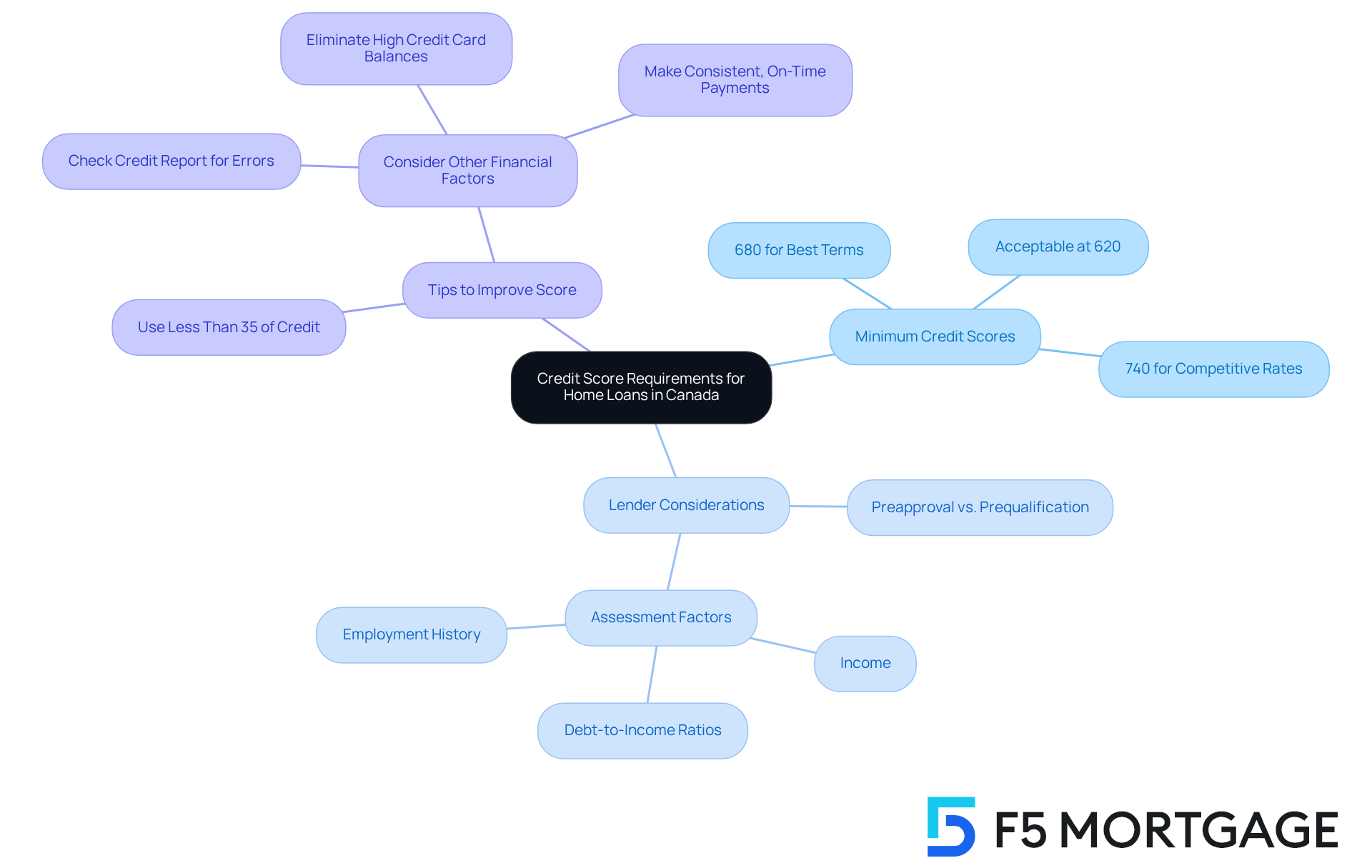

In Canada, securing a traditional mortgage often starts with a credit score required for home loan of 680. While some lenders might accept scores as low as 620—especially for government-supported financing—aiming for the credit score required for home loan of 680 is crucial for getting the best terms. A score above 680 is seen as favorable, indicating a lower risk of default. This can lead to better interest rates and more loan options. For example, if your score exceeds 740, you could qualify for the most competitive rates available.

When you receive an approval from a financial institution, it means they believe, based on the information you provide, that you’re a strong candidate for a mortgage. This approval usually comes with an estimate of your loan amount, interest rate, and potential monthly payment. Understanding this process is vital, as it can differ among lenders. Some may refer to it as “preapproval” or “prequalification.”

To boost your credit score, try to use less than 35% of your available credit. This simple step can positively impact your creditworthiness. Lenders often associate a higher rating with lower risk, making it essential to maintain the credit score required for home loan. Additionally, lenders look at other factors beyond just your credit rating, such as your income, debt-to-income ratios, and employment history. These elements significantly influence the overall assessment of your mortgage application.

We know how challenging this can be, but understanding these requirements and working to improve your financial rating can greatly enhance your chances of mortgage approval and favorable loan terms. Remember, we’re here to support you every step of the way.

Explore Factors That Affect Your Credit Score

Understanding your credit score can feel overwhelming, but we’re here to support you every step of the way. Several key factors influence your credit score, and knowing them can empower you to take control of your financial future.

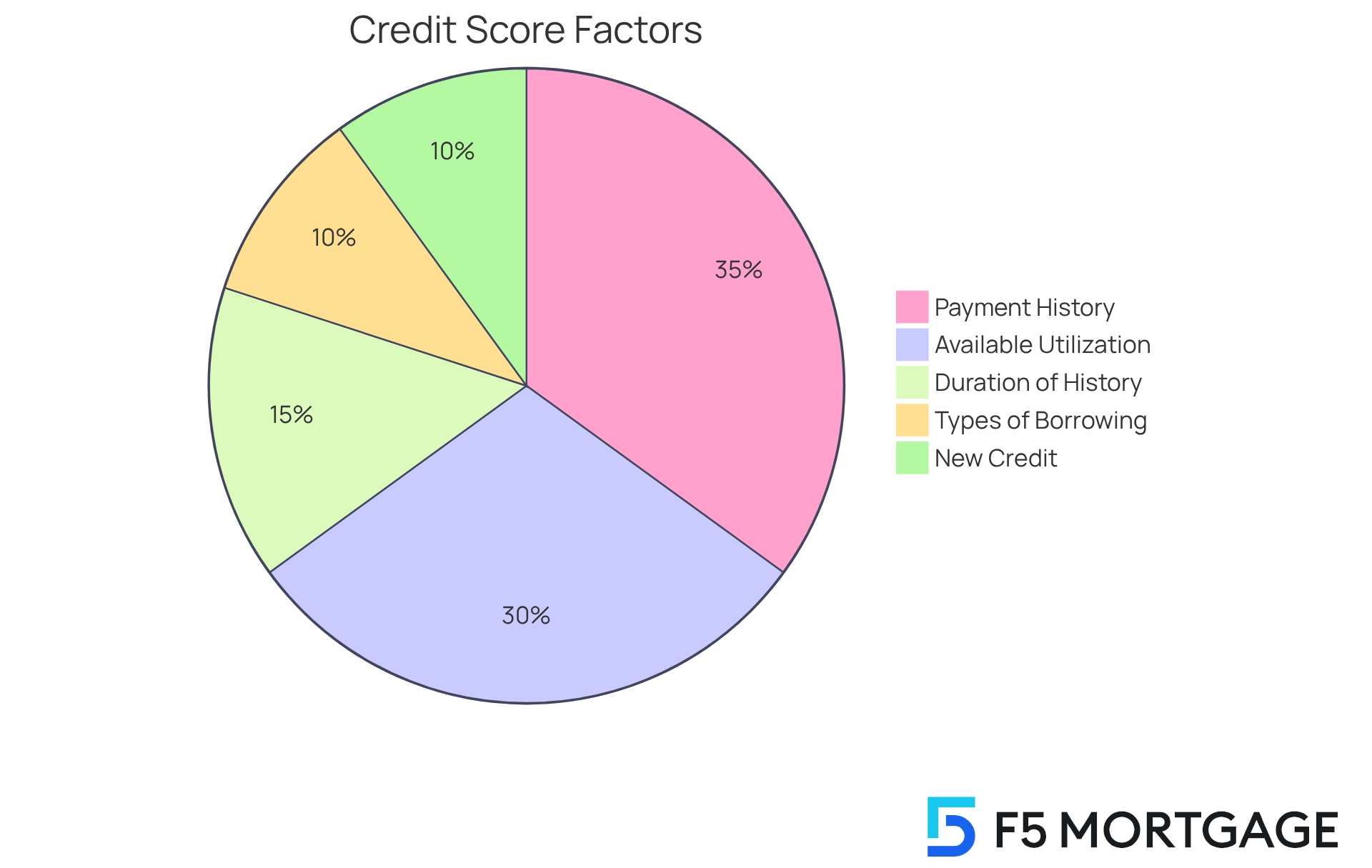

Payment History (35%): This is the most crucial element affecting your rating. Making prompt payments on loans and credit cards can significantly boost your score. However, just one late payment can have a serious negative impact. Public records, like bankruptcies and foreclosures, also play a role. For instance, consistently paying on time not only shows responsible financial management but also enhances your score over time. As Jim Akin points out, understanding what contributes to your score can help you see how your actions affect it.

Available Utilization (30%): This ratio looks at how much of your available credit limit you’re using. To keep your score healthy, aim to keep your utilization below 30%. For example, if your total limit is $20,000, try to keep your outstanding balances under $6,000.

Duration of Financial History (15%): A longer financial history can positively impact your score, as it gives lenders insight into your spending habits and repayment behavior. Those with a history of responsible financial management often enjoy better scores.

Types of Borrowing (10%): Having a mix of account types—like credit cards, auto loans, and mortgages—can enhance your score. This variety shows that you can manage different kinds of debt effectively.

New Credit (10%): Opening several new accounts in a short period can lower your score, as it may signal higher risk to lenders. For example, multiple requests for new credit within a brief timeframe can negatively affect your score. However, if you’re applying for the same type of loan within a 14-day window, it counts as just one hard inquiry.

Understanding these factors is essential for managing your finances effectively and improving your score over time. Regularly tracking your score can help you stay informed about your financial standing and make necessary adjustments. Remember, we know how challenging this can be, but with the right knowledge and tools, you can navigate this journey successfully.

Implement Strategies to Improve Your Credit Score

Improving your credit score can feel overwhelming, but we’re here to support you every step of the way. Here are some caring strategies to help you on this journey:

Pay Your Bills on Time: Setting up reminders or automatic payments can be a lifesaver. This way, you’ll never miss a due date, easing some of that stress.

Lower Your Borrowing Utilization: Aim to keep your borrowing utilization under 30%. Focus on paying down existing debts and try to avoid taking on new ones. Every little bit helps!

Check Your Financial Reports Regularly: It’s important to stay informed. Obtain free copies of your financial reports from major reporting agencies and review them for any errors. If you spot inaccuracies, don’t hesitate to dispute them.

Restrict New Loan Requests: We know how tempting it can be to apply for new loans, but each application can temporarily lower your score. So, apply for new loans sparingly to protect your rating.

Maintain Old Accounts: Keeping older accounts open is beneficial, as they contribute positively to your credit history length. It’s a simple step that can make a difference.

Diversify Your Credit Mix: If it makes sense for your situation, consider adding different types of credit, like an installment loan. This can enhance your credit rating and show lenders you’re responsible.

By implementing these strategies, you can gradually improve the credit score required for a home loan. This not only boosts your financial health but also enhances the credit score required for home loan, making you a more attractive candidate for mortgage lenders. Remember, we understand how challenging this can be, but with patience and persistence, you can achieve your goals.

Conclusion

Understanding the credit score needed for a home loan is crucial for anyone looking to secure a mortgage. This three-digit number reflects your financial reliability and significantly influences loan terms and interest rates. By recognizing the importance of credit scores and the factors that affect them, you can navigate the mortgage landscape more effectively and position yourself for better outcomes.

In this article, we’ve shared key insights about the minimum credit score requirements for home loans, especially in Canada, where a score of 680 is often seen as the threshold for traditional mortgages. Factors like payment history, credit utilization, and the overall duration of your credit history play vital roles in determining your score. We’ve also outlined practical strategies for improving your credit score, such as making timely bill payments and monitoring your financial reports, to empower you on your financial journey.

Ultimately, understanding and improving your credit score isn’t just about securing a home loan; it’s about building a solid foundation for your future financial health. By taking proactive steps to enhance your creditworthiness, you can access better loan options and interest rates, ensuring a smoother path to homeownership. Embracing this knowledge is the first step toward making informed financial decisions that pave the way for a brighter financial future. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is a credit score?

A credit score is a three-digit number, typically ranging from 300 to 850, that reflects an individual’s financial reliability based on various factors.

What factors determine a credit score?

A credit score is determined by several factors, including payment history, amounts owed, duration of borrowing history, new loans, and types of financing used.

Why is a credit score important for home loans?

A credit score is important for home loans because it indicates to lenders how likely you are to meet your obligations on time, which can lead to better loan conditions and lower interest rates.

What is considered an excellent credit score for home loans?

A credit score above 740 is generally seen as excellent and can significantly reduce borrowing costs.

How does understanding your credit score affect your mortgage options?

Understanding your credit score is crucial as it affects your ability to qualify for a mortgage and influences the interest rates and terms you may receive.