Overview

Private mortgages offer a flexible solution, tailored to meet the unique needs of individuals who may find it challenging to qualify for traditional loans. We understand how daunting the mortgage process can be, especially with stricter bank lending standards. This growing demand for private mortgages is particularly evident among self-employed individuals and real estate investors who need quicker access to funds.

These loans not only provide a viable alternative but also address diverse financial needs with their adaptable qualification criteria, interest rates, and repayment terms. By considering private mortgages, you can find a pathway that aligns with your financial situation, allowing you to move forward with confidence.

We know how important it is to feel supported during this journey. Private mortgages can be the key to unlocking opportunities, and we’re here to guide you every step of the way. If you’re exploring your options, reach out to learn more about how these loans can work for you.

Introduction

Navigating the complexities of personal financing can often feel daunting. We know how challenging this can be, especially as traditional lending avenues tighten their grip. Private mortgages emerge as a flexible alternative, offering unique benefits tailored to diverse financial situations.

Whether you’re self-employed or a real estate investor seeking quick capital, these options can provide support. Yet, with these opportunities come inherent risks and challenges that potential borrowers must carefully consider.

How can one effectively weigh the pros and cons of private mortgages in a rapidly evolving market? We’re here to support you every step of the way.

Define Private Mortgages: Key Characteristics and Differences

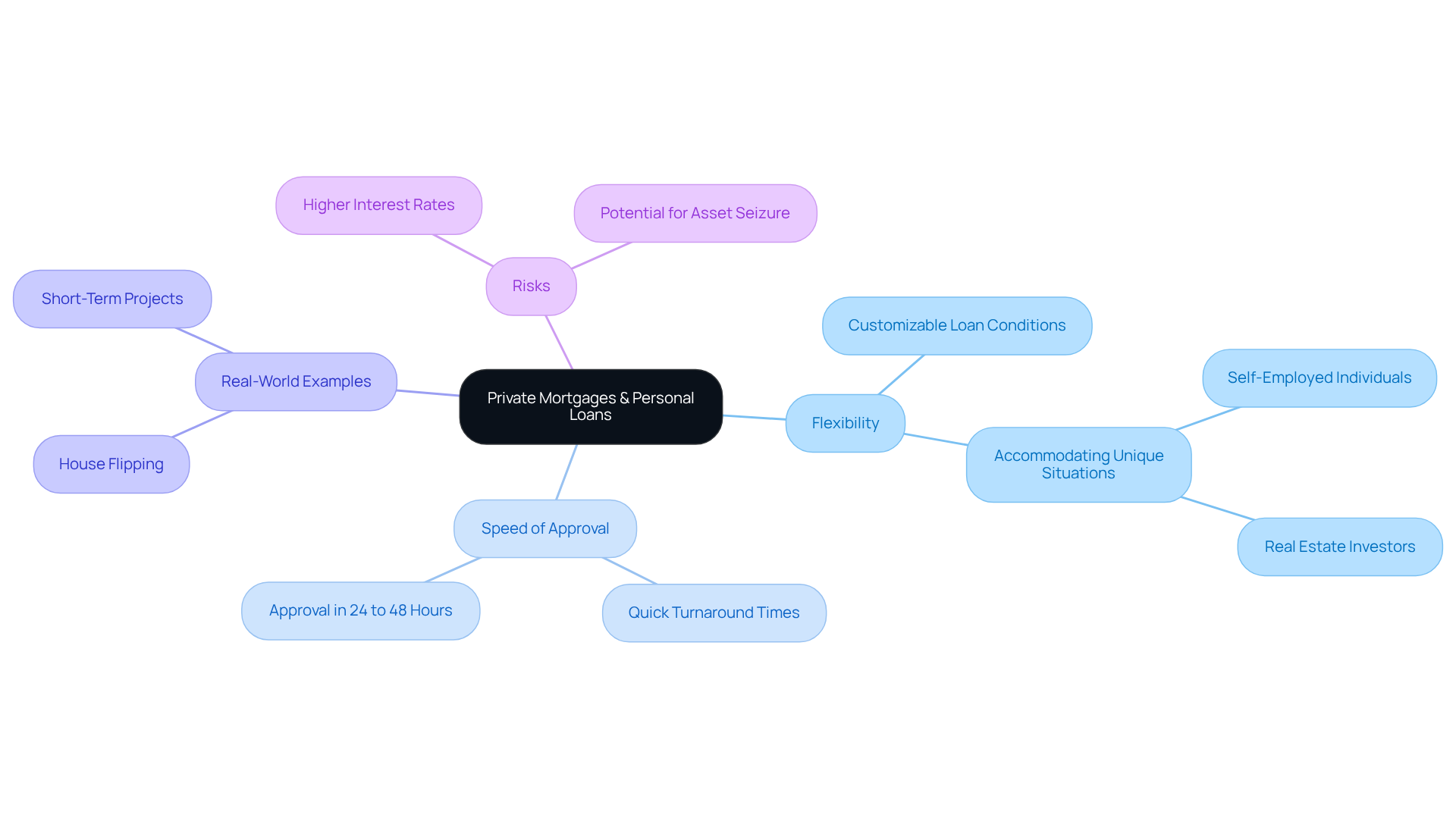

Navigating personal financing options can feel overwhelming, especially when traditional routes seem out of reach. Personal loans, offered by individual lenders such as private individuals, investment groups, or personal firms, provide an alternative to conventional financial institutions and can include options like private mortgage. These loans are particularly appealing due to their flexibility in qualification criteria, interest rates, and repayment terms. Unlike traditional loans that often impose strict requirements regarding credit scores and income verification, personal loans are designed to accommodate individuals with , such as self-employed individuals or those with less-than-perfect credit histories. This adaptability makes personal loans a viable option for those who might otherwise feel that conventional funding is unattainable.

One of the standout features of personal loans is the speed of approval, often within just a few days. This means that borrowers can customize loan conditions to meet their specific needs. For instance, individual lenders may offer tailored repayment plans or interest-only payment options, allowing borrowers to align their loan terms with their financial strategies. This flexibility is crucial, especially considering that approximately 80% of all outstanding loans in Canada are due for renewal in 2024, amounting to around $250 billion. This statistic highlights the increasing demand for alternative financing solutions that can cater to diverse financial needs.

Real-world examples further illustrate the advantages of personal loans. For example, real estate investors frequently turn to personal lending for quick financing on short-term projects, like house flipping, where timing is essential. Additionally, self-employed individuals, who often face hurdles in qualifying for traditional loans, can benefit from alternative financing options that prioritize asset-based evaluations over stringent income documentation. It’s important to note that private mortgage loans typically have interest rates ranging from 6.5% to 12%, which is a key consideration for potential borrowers.

Financial experts emphasize the importance of this flexibility in today’s lending landscape. Personal loans serve as a vital resource for those in need of prompt funding or who may not meet conventional lending criteria. However, it’s essential to be aware of the potential risks associated with personal loans, such as higher interest rates and the possibility of asset seizure in the event of default. As the market evolves, the role of personal loans is expected to grow, providing crucial liquidity and options for individuals navigating the complexities of home financing. Furthermore, the increasing regulatory scrutiny in the lending industry adds another layer of consideration for both lenders and borrowers. Remember, we understand how challenging this can be, and we’re here to support you every step of the way.

Contextualize Private Mortgages: Trends and Borrower Motivations

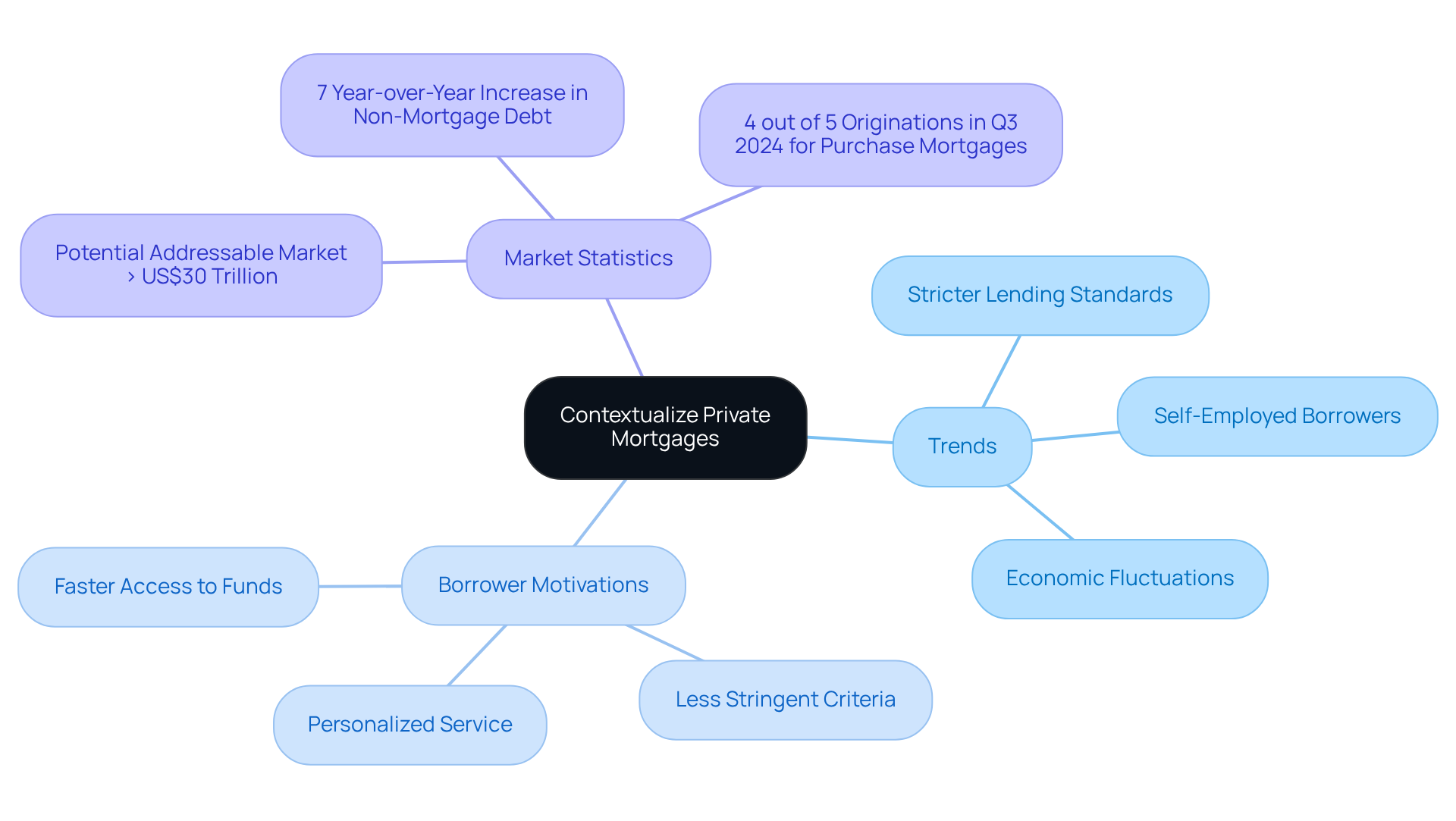

In recent years, the demand for personal loans has surged, and we understand how this can impact you. Factors such as stricter lending standards from traditional banks and an increasing number of self-employed individuals seeking financing are driving this trend. Economic fluctuations and rising property prices have also led many to explore alternative lending solutions.

Borrowers often desire faster access to funds, less stringent qualification criteria, and the personalized service that individual lenders frequently offer. This is especially true for real estate investors who need to fund properties quickly, avoiding the lengthy approval processes associated with traditional loans.

Statistics reveal that the potential addressable market for personal credit exceeds US$30 trillion. This significant shift in financing preferences highlights the growing importance of private lenders. As conventional lenders tighten their credit criteria, more individuals are seeking alternative funding sources that provide adaptable conditions and quicker approvals.

This trend underscores the critical role private lenders play in meeting the urgent financing needs of a diverse range of borrowers, including those facing challenges like high-interest rates and complicated paperwork. We know how challenging this can be, and we’re here to .

Explore Types of Private Mortgages: Features and Variations

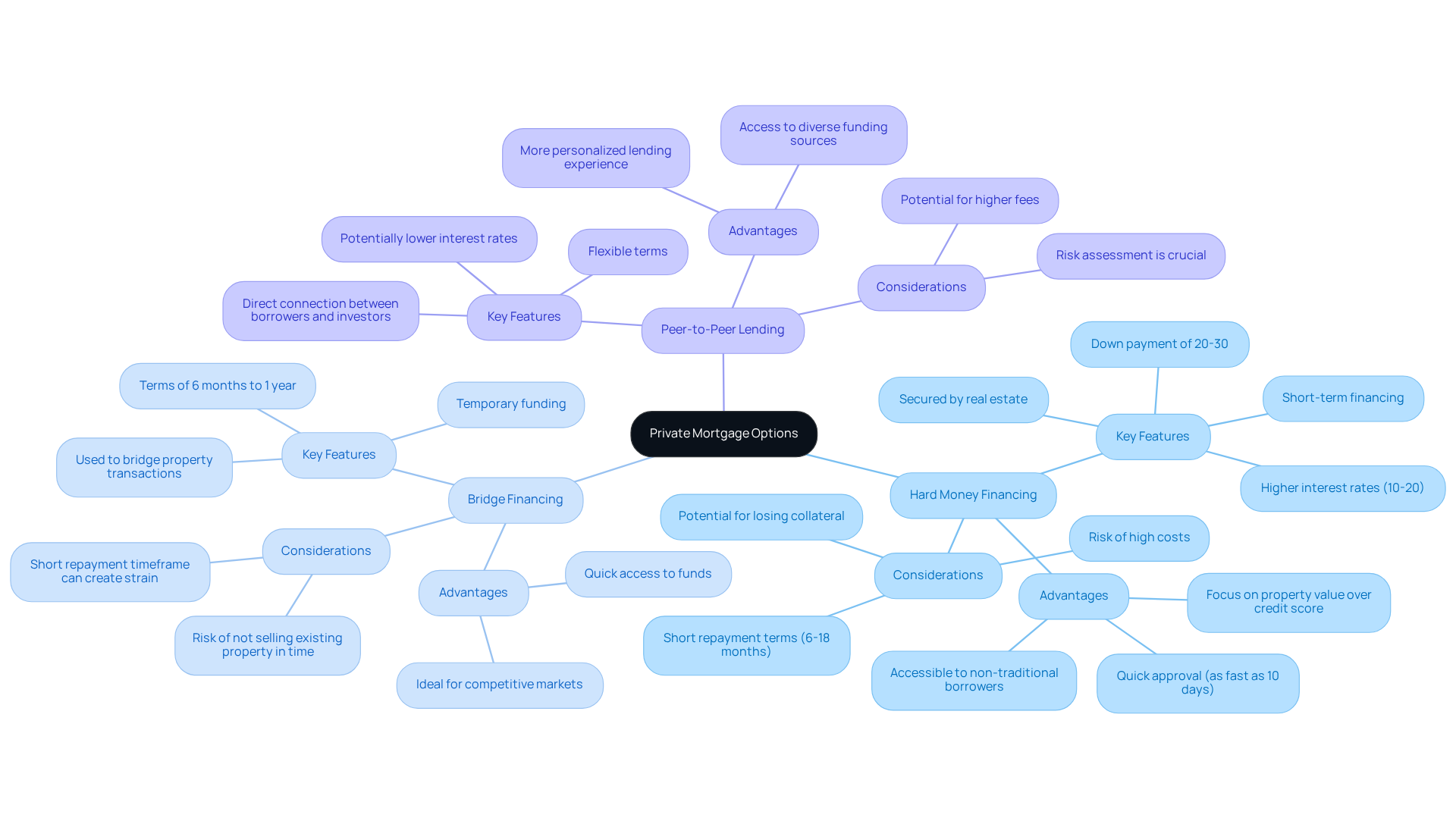

Navigating the world of private mortgage options can feel overwhelming, but understanding them can empower you. Private mortgage options encompass various types, including hard money financing, bridge financing, and peer-to-peer lending.

Hard money funding serves as a short-term financing option secured by real estate, primarily aimed at investors who need quick access to capital. While these loans can provide rapid funding, they typically come with higher interest rates, often in the double digits. This makes them particularly appealing for property flippers or those in urgent need of cash flow. However, it’s important to note that they often require a down payment of at least 20% to 30%, which can be a significant financial commitment for those seeking loans. Moreover, hard money lenders may not finance owner-occupied residences due to regulatory oversight, limiting their applicability for certain individuals. For many, the speed of hard money financing is a key advantage—approval can occur in as little as ten business days, allowing borrowers to seize pressing opportunities.

Bridge financing offers a different solution, providing temporary funds to ‘bridge’ the gap between purchasing a new property and selling a current one. This type of financing is especially beneficial in competitive real estate markets where timing is crucial. With terms typically ranging from six months to a year, bridge loans enable buyers to secure new properties while awaiting the sale of their current homes. However, it’s essential to approach this option with caution, as the need to repay the loan within a short timeframe can create financial strain if property transactions do not unfold as planned.

Peer-to-peer lending platforms present another avenue, connecting individuals in need of funds directly with private investors. This model can offer more flexible terms and potentially lower interest rates compared to traditional lending. However, it’s crucial for borrowers to carefully assess the risks and benefits associated with each type of private mortgage, as each has its own unique features and implications for financial stability.

Understanding the in contrast to conventional financing is vital. For instance, while conventional financing may require a down payment as low as 3%, hard money funding typically necessitates a down payment of at least 20% to 30%. Additionally, hard money financing focuses more on the property’s value rather than the individual’s credit profile, making it accessible to those who may not qualify for traditional funding. This flexibility can be a significant advantage for individuals facing unique financial situations. Having a clear repayment or refinancing strategy is also crucial for hard money bridge loans, which must be settled within the agreed term.

Remember, we’re here to support you every step of the way as you explore these options.

Assess Risks and Benefits: Weighing the Pros and Cons of Private Mortgages

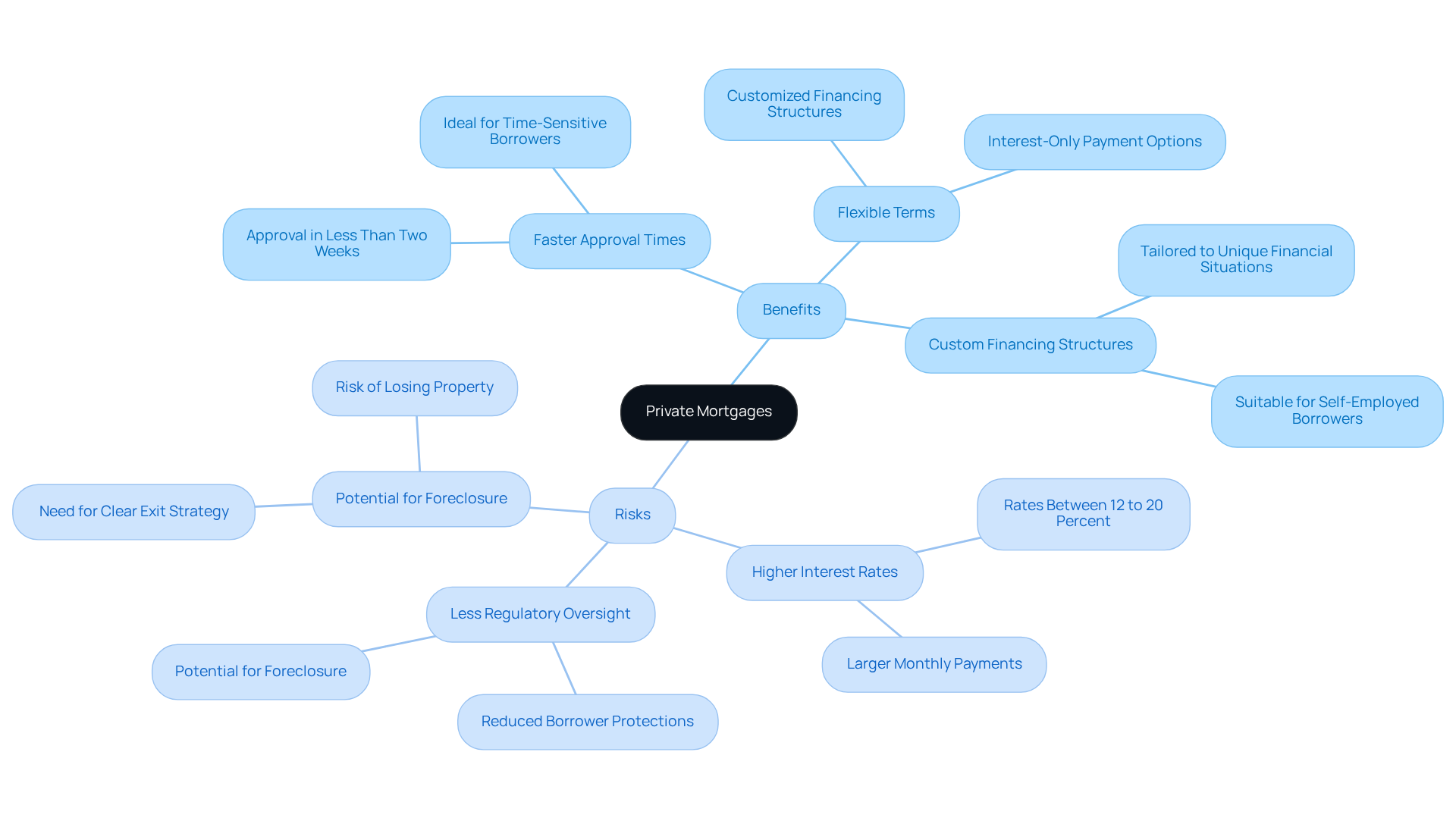

Private loans can offer a range of benefits, especially for those navigating unique financial situations. They often provide faster approval times, closing in less than two weeks—significantly quicker than the 30 to 45 days typically required for traditional bank mortgages. This speed can be crucial for individuals who need prompt funding, such as real estate investors or homeowners looking to renovate properties that may not qualify for conventional financing. Additionally, private lenders tend to offer flexible terms, allowing for customized financing structures that can include options like interest-only payments.

However, it’s important to recognize that these benefits come with notable risks. Private mortgage loans usually carry higher interest rates, often between 12 to 20 percent per year, which can lead to larger monthly payments and increased financial pressure. The lack of regulatory oversight compared to conventional lenders means that borrowers may encounter reduced protection, making it essential to fully understand the loan terms before proceeding. For instance, those who struggle to meet repayment terms may face foreclosure, underscoring the necessity of having a clear exit strategy.

Real-life examples illustrate how personal loans can be effective for individuals with less-than-perfect credit or those who are self-employed and find it challenging to provide proof of consistent income. Financial experts emphasize that while these loans can be a viable option, they should be approached with caution due to the associated risks. As Brian Frederick, a certified financial planner, noted, “The underwriting of the hard money financing is not so ‘person’ focused as it is ‘property’ focused.” This perspective can be beneficial, but it also carries risks if the property does not perform as expected.

In summary, while private mortgage loans can serve as a valuable alternative for those facing challenges with traditional financing, it is crucial for prospective borrowers to conduct thorough research, assess their financial situations, and fully understand the implications of the private mortgage terms. We know how challenging this can be, and we’re here to support you every step of the way in .

Current Trends in Private Mortgage Lending

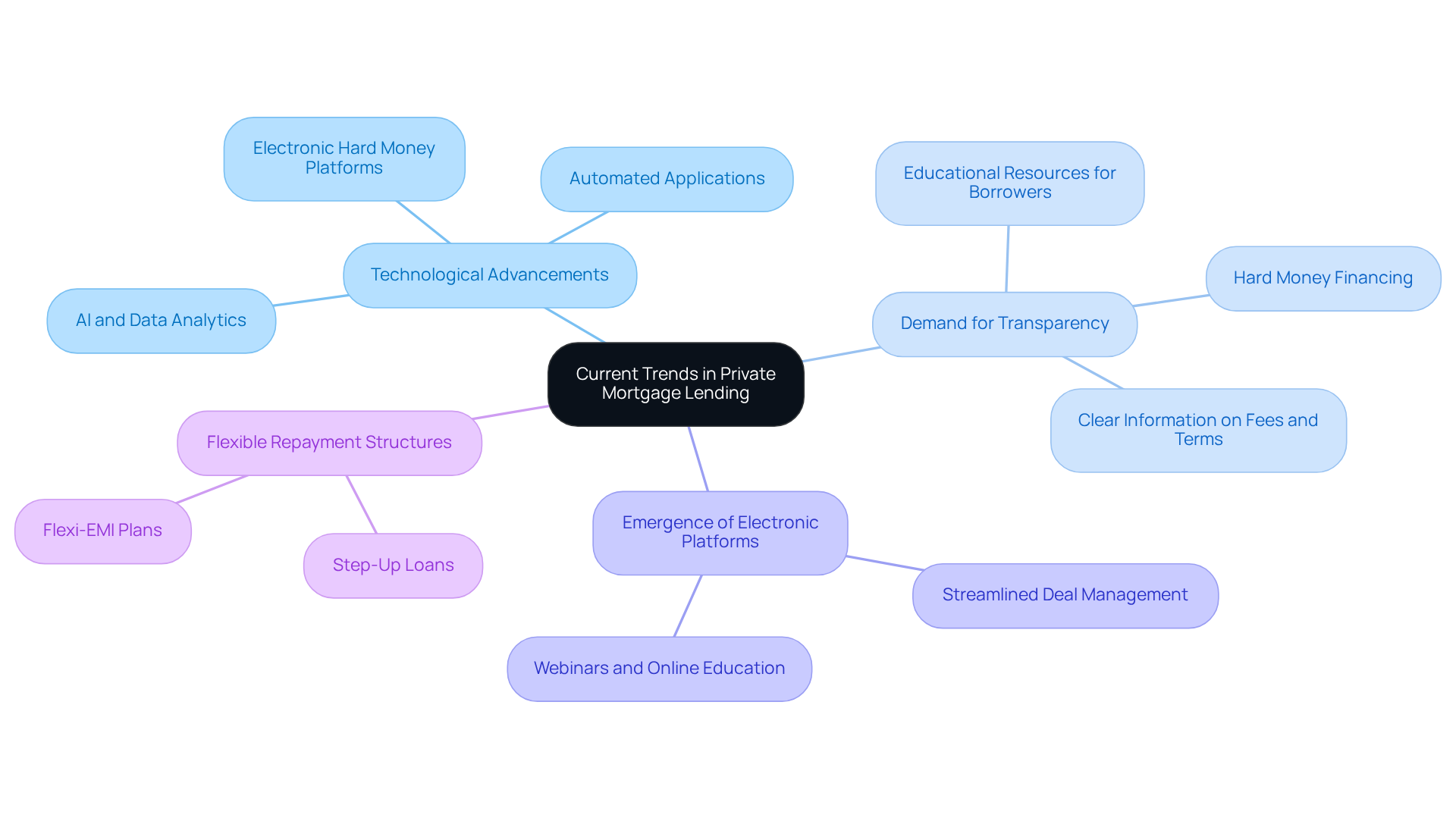

The landscape of private mortgage lending is experiencing a significant transformation, and we understand how challenging it can be to navigate this process. Technological advancements are streamlining the borrowing experience, making it easier than ever for individuals seeking loans to connect with lenders. By 2025, the integration of AI and data analytics is expected to enhance risk assessment accuracy by up to 40%, which means faster approval times for you. This shift not only increases accessibility but also fosters a competitive environment among lenders, giving you a wider selection of options tailored to your unique needs.

A notable trend we are seeing is the rising demand for transparency in lending practices. Borrowers, like you, are more inclined to seek clear and comprehensive information about fees and terms. This reflects a broader expectation for accountability in financial transactions. As banks tighten their underwriting standards, a projected 12% rise in hard money financing originations by 2025 highlights the growing reliance on private mortgages to satisfy diverse funding needs.

Moreover, the emergence of electronic hard money platforms is a game-changer. These platforms allow brokers to manage deals and documentation seamlessly from one console, enhancing efficiency and client satisfaction. They are crucial in reducing funding times and improving the overall borrower experience. Additionally, lenders are increasingly informing clients about hard money financing through webinars and other resources, which helps enhance transparency and understanding.

With the anticipated , the focus on speed and adaptability in lending will continue to shape the industry. Flexible repayment structures, such as step-up loans and Flexi-EMI plans, are becoming increasingly important to accommodate individual financial circumstances. As these trends evolve, the private mortgage sector is expected to play a crucial role in fulfilling the financing needs of a dynamic market, and we’re here to support you every step of the way.

Conclusion

Private mortgages are a flexible and rapidly evolving financial solution, especially for individuals who may find traditional lending options challenging. As the demand for personalized financing grows, it’s crucial to understand the distinct characteristics, benefits, and risks associated with private mortgages to make informed decisions.

We know how challenging this can be, and key insights reveal that private loans offer unique advantages. These include:

- Quicker approval times

- Customizable terms

- Accessibility for those with unconventional financial profiles

However, it’s important to remain vigilant about the higher interest rates and risks of asset seizure that can accompany these loans. The landscape is further influenced by technological advancements and shifting borrower expectations, highlighting the need for transparency and efficiency in the lending process.

Ultimately, private mortgages are becoming increasingly significant in meeting diverse financing needs, particularly as traditional banks tighten their credit standards. As the market continues to evolve, we encourage you to thoroughly research your options, weigh the pros and cons, and seek guidance to navigate this complex landscape effectively. Embracing the potential of private mortgages can lead to valuable opportunities for those ready to take charge of their financial futures.

Frequently Asked Questions

What are private mortgages?

Private mortgages are personal loans offered by individual lenders, investment groups, or personal firms as an alternative to traditional financial institutions. They provide flexibility in qualification criteria, interest rates, and repayment terms.

How do private mortgages differ from traditional loans?

Unlike traditional loans that impose strict requirements regarding credit scores and income verification, private mortgages are designed to accommodate individuals with unique financial situations, such as self-employed individuals or those with less-than-perfect credit histories.

What are the benefits of private mortgages?

Benefits include faster approval times, customized loan conditions, tailored repayment plans, and interest-only payment options. They are particularly appealing for real estate investors and self-employed individuals who may face challenges with conventional loans.

What are the typical interest rates for private mortgages?

Private mortgage loans typically have interest rates ranging from 6.5% to 12%.

Why has the demand for private mortgages increased recently?

The demand has surged due to stricter lending standards from traditional banks, an increasing number of self-employed individuals, economic fluctuations, and rising property prices.

Who typically benefits from private mortgages?

Borrowers who need faster access to funds, less stringent qualification criteria, and personalized service, such as real estate investors and self-employed individuals, often benefit from private mortgages.

What risks are associated with private mortgages?

Potential risks include higher interest rates and the possibility of asset seizure in the event of default.

What is the current market trend for personal loans?

The market for personal loans is evolving, with a potential addressable market exceeding US$30 trillion, indicating a growing preference for alternative funding sources as conventional lenders tighten credit criteria.