Overview

Navigating the world of mortgage payments can feel overwhelming, especially when considering a significant loan amount like $400,000. This article delves into the key factors and costs associated with such a loan, highlighting essential components like principal, interest, property taxes, and insurance.

We understand how challenging this can be, and it’s important to grasp these elements fully. Alongside these factors, considerations such as loan type and duration play a crucial role in accurately assessing your monthly financial obligations. By understanding these components, you can make informed decisions regarding home financing.

Our goal is to empower you with the knowledge needed to navigate this process confidently. We’re here to support you every step of the way, ensuring you feel equipped to handle your mortgage responsibilities.

Introduction

Understanding the intricacies of a mortgage payment on a $400,000 loan can feel overwhelming. We know how challenging this can be for many prospective homeowners. This article will gently guide you through the essential components that shape your monthly obligations. From principal and interest to property taxes and insurance, we aim to provide a clear breakdown of what you can expect.

As interest rates fluctuate and loan types vary, it’s natural to wonder: how can you strategically navigate these factors? We’re here to support you every step of the way. Exploring these questions will empower you to make informed decisions in your home-buying journey, ensuring your financial stability.

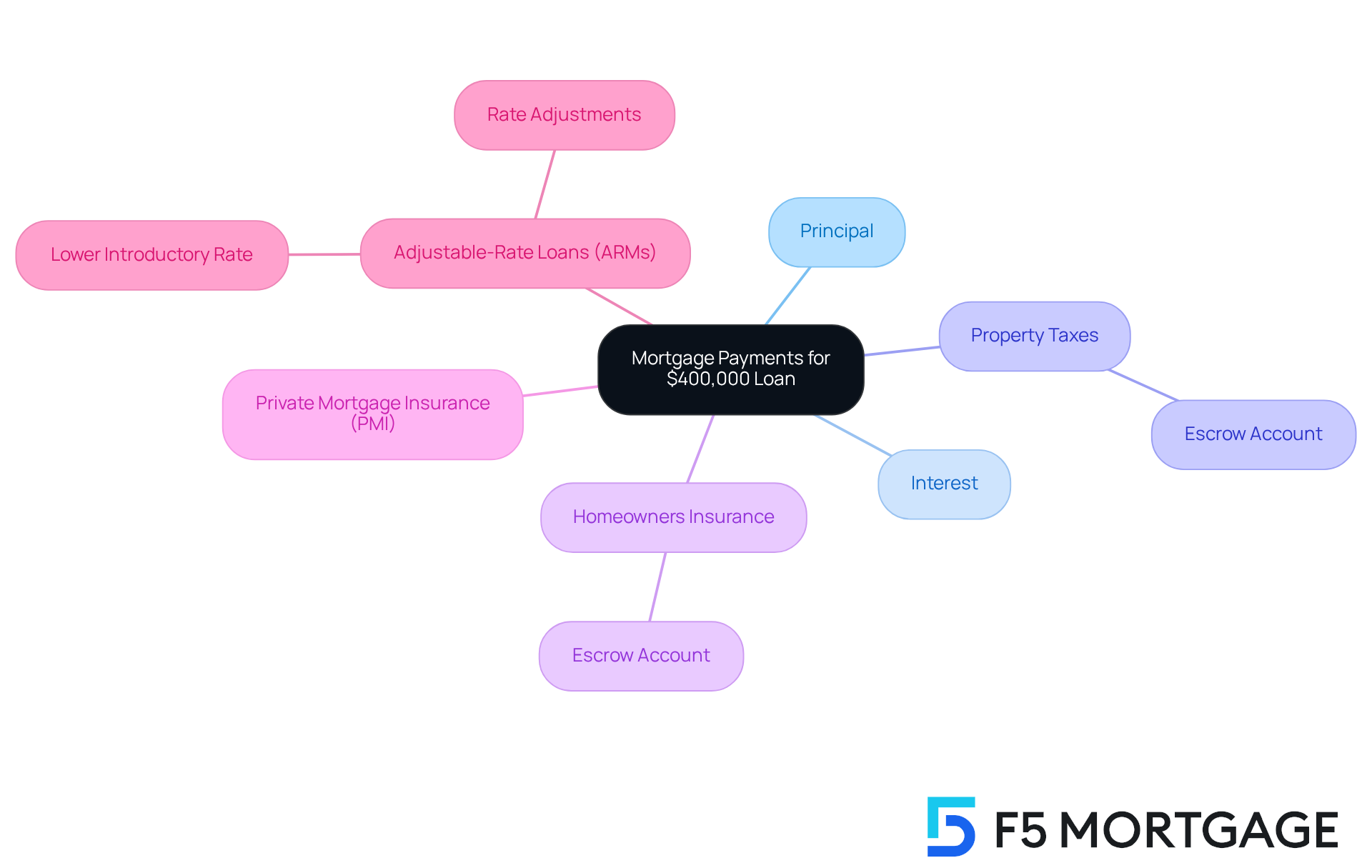

Defining Mortgage Payments for a $400,000 Loan

When considering the mortgage payment on 400k, we understand that it can feel overwhelming. Typically, the mortgage payment on 400k will include not just the principal and interest, but also property taxes, homeowners insurance, and possibly private mortgage insurance (PMI). The principal is simply the amount you borrow, while interest represents the cost of borrowing that sum.

Many homeowners find that property taxes and homeowners insurance are included in their monthly payments through an escrow account. This is a helpful way to gather and manage these costs, ensuring that funds are available when needed.

If you’re thinking about adjustable-rate loans (ARMs), it’s important to know that they often start with a lower introductory rate, which can mean smaller initial payments. However, after this period, the rate adjusts based on market conditions, leading to potential fluctuations in your monthly costs.

Understanding these components is crucial for anyone looking to navigate the process of a mortgage payment on 400k. It allows you to accurately assess your monthly financial obligations and plan ahead. Remember, we’re here to support you every step of the way.

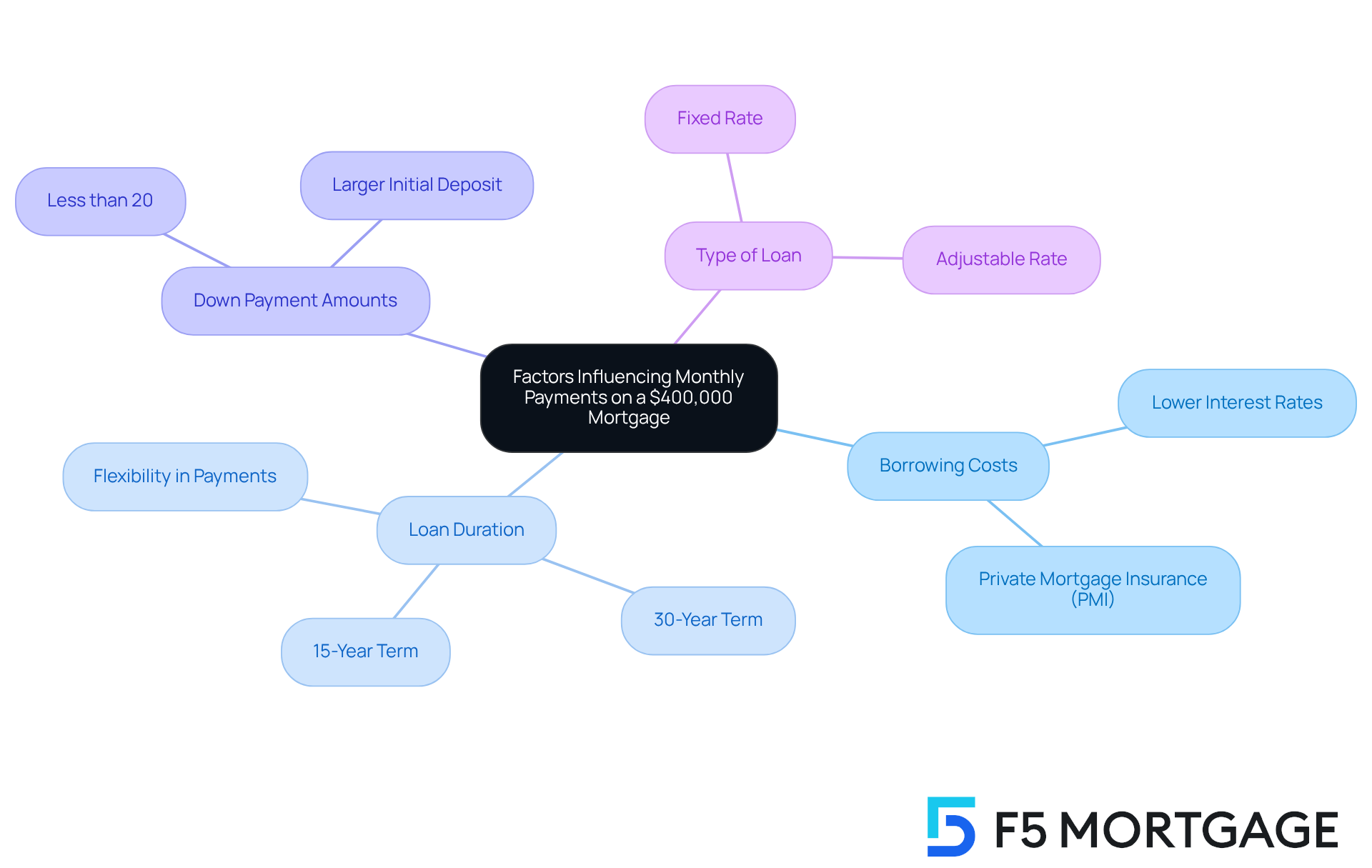

Factors Influencing Monthly Payments on a $400,000 Mortgage

When considering the mortgage payment on 400k for a home loan, we know how challenging it can be to navigate the various costs involved. Factors such as:

- Borrowing costs

- Loan duration—whether it’s 15 or 30 years

- Down payment amounts

- The type of loan, whether fixed or adjustable

all play significant roles in determining your mortgage payment on 400k.

A lower interest rate or a larger initial deposit can dramatically reduce these monthly costs, providing some relief. Additionally, adjusting the loan duration can offer flexibility. For instance, extending the term may lower your monthly payments, while choosing a shorter term can help you pay off your debt sooner.

If you purchased your home with a conventional loan and made a down payment of less than 20%, refinancing might enable you to eliminate private mortgage insurance (PMI). Given the significant home appreciation levels in California, this could allow you to achieve that goal more quickly by recalculating your loan-to-value (LTV) ratio based on your home’s increased value.

Understanding these factors and exploring the available refinancing options empowers you to make strategic decisions that align with your financial goals. We’re here to support you every step of the way.

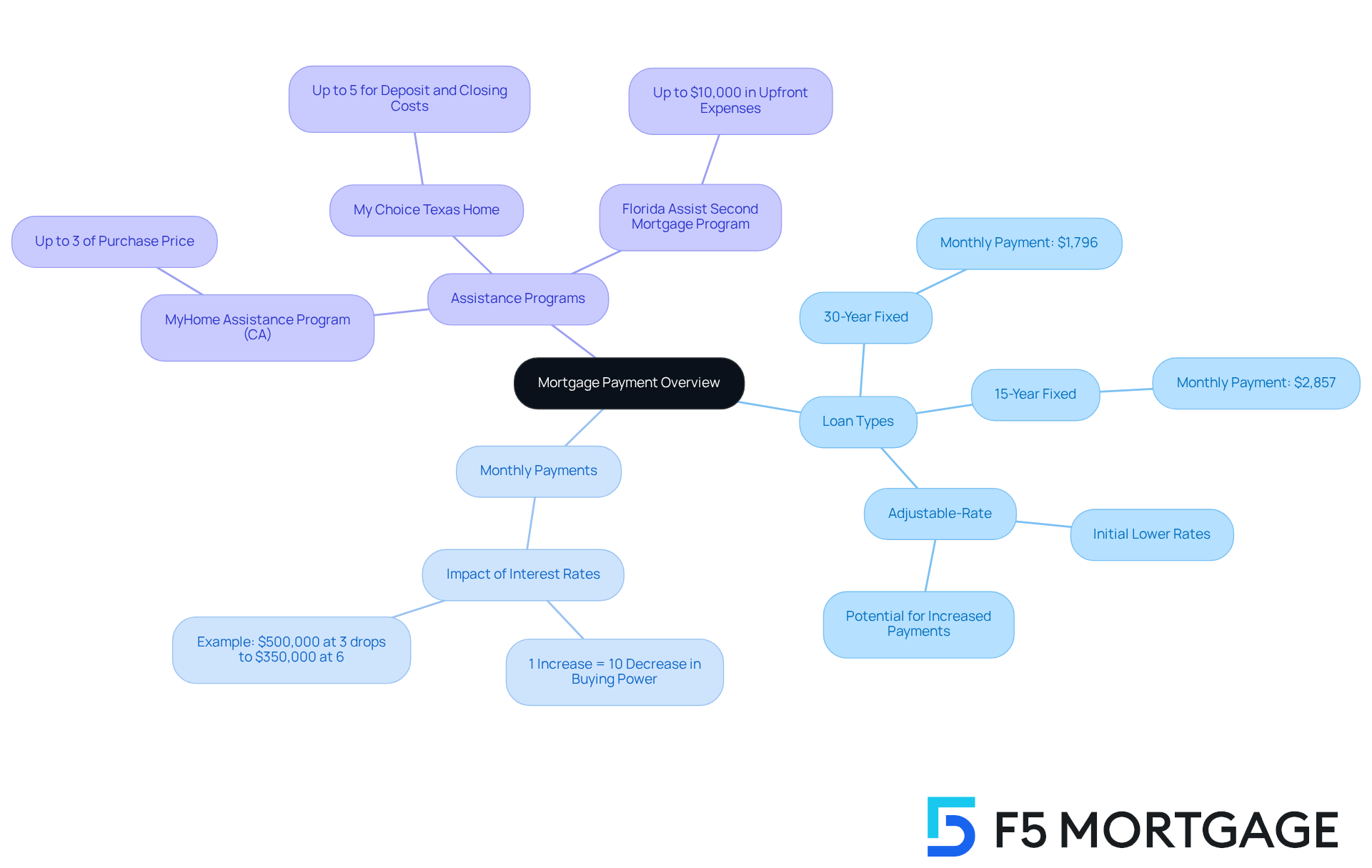

Examples of Monthly Payments Based on Loan Types and Interest Rates

Navigating the world of loans can be overwhelming, especially when you have to think about the mortgage payment on 400k. Monthly contributions can vary significantly based on the type of loan and the current financial landscape. For instance, a 30-year fixed loan at a borrowing cost of 3.5% results in a mortgage payment on 400k of about $1,796. On the other hand, choosing a 15-year fixed loan at the same interest rate results in a higher mortgage payment on 400k, which is approximately $2,857. However, this choice can save you considerably on overall costs throughout the life of the loan.

Adjustable-rate home loans may seem attractive initially due to lower starting interest rates, which can reduce your payments at first. Yet, as borrowing costs fluctuate, these payments can increase, potentially affecting long-term affordability. We understand how challenging this can be, especially for families contemplating such a significant financial commitment. Remember the 1/10 guideline: a 1% rise in borrowing costs can reduce your purchasing power by 10%. This knowledge is crucial when considering your options.

Moreover, the Federal Reserve’s interest rate adjustments can have a substantial impact on mortgage rates. Staying informed about these changes is essential for making sound financial decisions. We’re here to support you every step of the way.

To ease the financial burden, families can explore down payment assistance programs. For example:

- The MyHome Assistance Program in California offers up to 3% of the home’s purchase price.

- Texas’s My Choice Texas Home program provides up to 5% for the deposit and closing costs.

- In Florida, programs like the Florida Assist Second Mortgage Program can help with up to $10,000 in upfront expenses.

Understanding these dynamics and available support programs is vital for empowering your financing choices. We know that making informed decisions can feel daunting, but you don’t have to navigate this journey alone.

Understanding the Total Cost of a $400,000 Mortgage Over Time

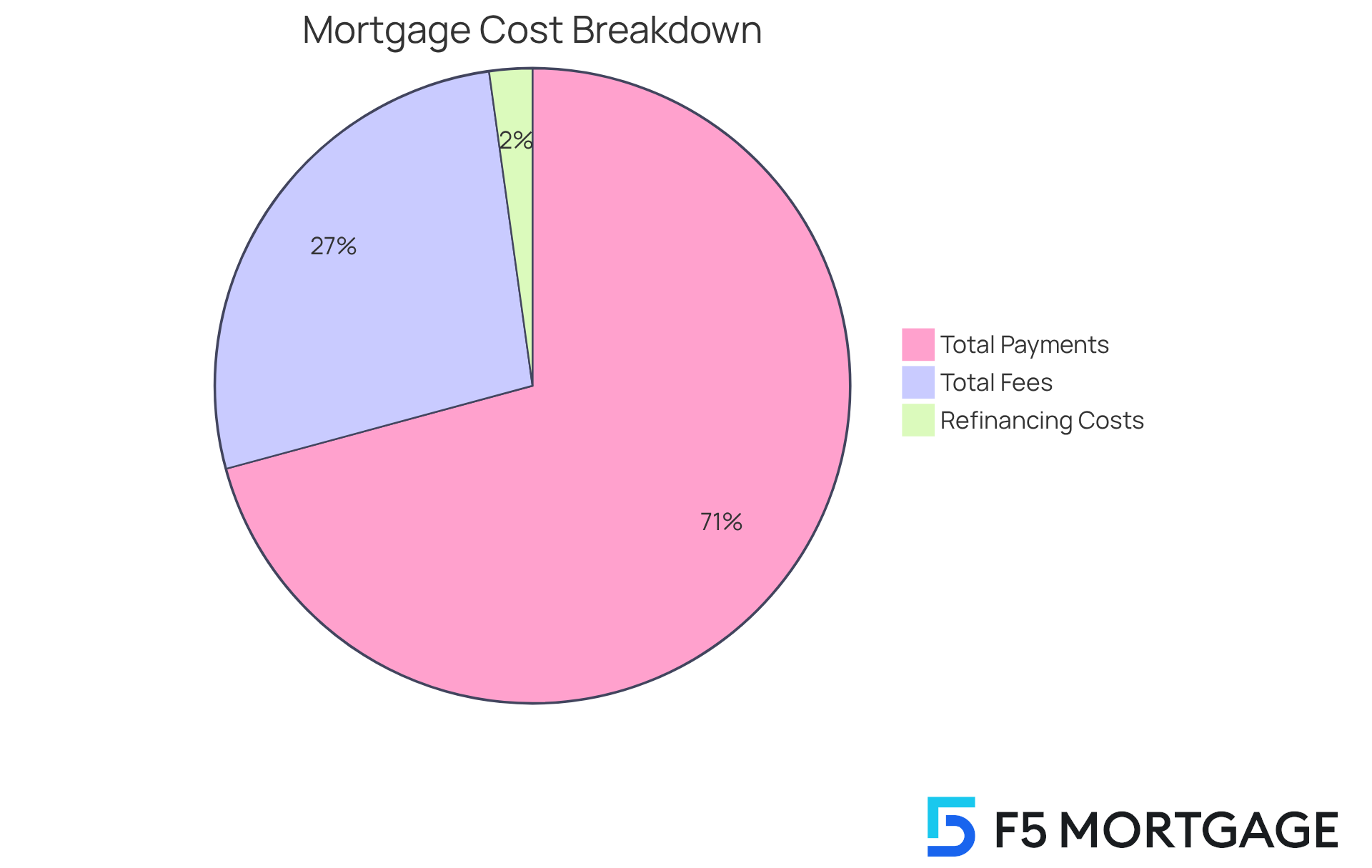

Understanding the total cost of a $400,000 loan involves more than just the mortgage payment on 400k. Over a 30-year period at a 3.5% interest rate, you could find yourself paying approximately $647,000 in total, which includes around $247,000 in fees alone. We know how challenging this can be, and it’s vital to grasp the long-term financial obligations involved in home loan borrowing.

If you’re considering refinancing your loan in Colorado, it can often lead to lower monthly payments, especially if you secure a better borrowing fee. However, it’s important to note that refinancing typically comes with initial charges. The average cost to refinance ranges from 2% to 5% of the total loan amount. For example, the mortgage payment on 400k when refinancing a home valued at $400,000 could mean closing costs of up to $20,000.

But don’t worry—thanks to down payment assistance programs, not all Colorado homeowners will face such high refinancing costs. It’s crucial to consider factors like prepayment options, refinancing possibilities, and potential interest rate fluctuations, as these can significantly impact your overall expenses. Evaluating your long-term financial strategy when acquiring a mortgage is essential.

At F5 Mortgage, we’re here to support you every step of the way. We work with top lenders to help you compare rates and find the most affordable refinance options tailored to your needs.

Conclusion

Understanding the intricacies of mortgage payments on a $400,000 loan is essential for anyone looking to make informed financial decisions. We know how challenging this can be. The various components—such as principal, interest, property taxes, homeowners insurance, and potentially private mortgage insurance—combine to form a comprehensive view of monthly obligations. By grasping these elements, homeowners can better navigate their financial landscape and plan effectively for the future.

Throughout this article, we have highlighted several key factors influencing mortgage payments. These include:

- The type of loan

- Interest rates

- Down payment amounts

- Loan duration

Each of these elements plays a significant role in determining the total monthly payment, as well as the overall cost of the mortgage over time. Additionally, understanding the impact of refinancing options and available assistance programs can empower borrowers to make strategic financial decisions that align with their long-term goals.

Ultimately, the journey of securing a mortgage is filled with complexities, but it is crucial to approach it with knowledge and confidence. By staying informed about the various factors that affect mortgage payments and exploring available resources, homeowners can take control of their financial futures. Engaging with professionals for support and guidance can further enhance this process, ensuring that every step taken is a step toward financial stability and success. We’re here to support you every step of the way.

Frequently Asked Questions

What does a mortgage payment on a $400,000 loan include?

A mortgage payment on a $400,000 loan typically includes the principal and interest, property taxes, homeowners insurance, and possibly private mortgage insurance (PMI).

What is the principal in a mortgage payment?

The principal is the amount you borrow from the lender.

What does the interest in a mortgage payment represent?

The interest represents the cost of borrowing the principal amount.

How are property taxes and homeowners insurance typically handled in mortgage payments?

Many homeowners have property taxes and homeowners insurance included in their monthly payments through an escrow account, which helps manage these costs.

What is an adjustable-rate mortgage (ARM)?

An adjustable-rate mortgage (ARM) is a type of loan that often starts with a lower introductory rate, resulting in smaller initial payments. However, the rate can adjust based on market conditions after the introductory period, potentially changing your monthly costs.

Why is it important to understand the components of a mortgage payment?

Understanding these components is crucial for accurately assessing your monthly financial obligations and planning ahead when navigating the mortgage process.