Overview

Understanding mortgage affordability is crucial for many families, and we know how challenging this can be. Several key factors influence this process, including:

- Income

- Debt-to-income ratio

- Credit score

- Initial deposit

- Interest rates

- Types of loans available

It’s important to recognize that these elements can significantly impact your ability to secure a mortgage.

However, potential homeowners often face obstacles that can complicate their journey. Changing economic conditions and the complexity of financial products can make it difficult to assess what you can truly afford. We’re here to support you every step of the way as you navigate these challenges.

As you consider your options, remember that understanding these factors is the first step toward making informed decisions. By recognizing the challenges and seeking guidance, you can empower yourself to find a mortgage that fits your needs.

Introduction

Understanding mortgage affordability is essential for anyone navigating the complex landscape of homeownership. We know how challenging this can be, especially with rising home prices and fluctuating interest rates. Determining how much you can feasibly borrow may feel overwhelming. This article delves into the key factors that influence mortgage affordability, including:

- Income

- Credit scores

as well as the challenges that often arise during the assessment process. How can potential homeowners ensure they are making informed decisions in an unpredictable market? We’re here to support you every step of the way.

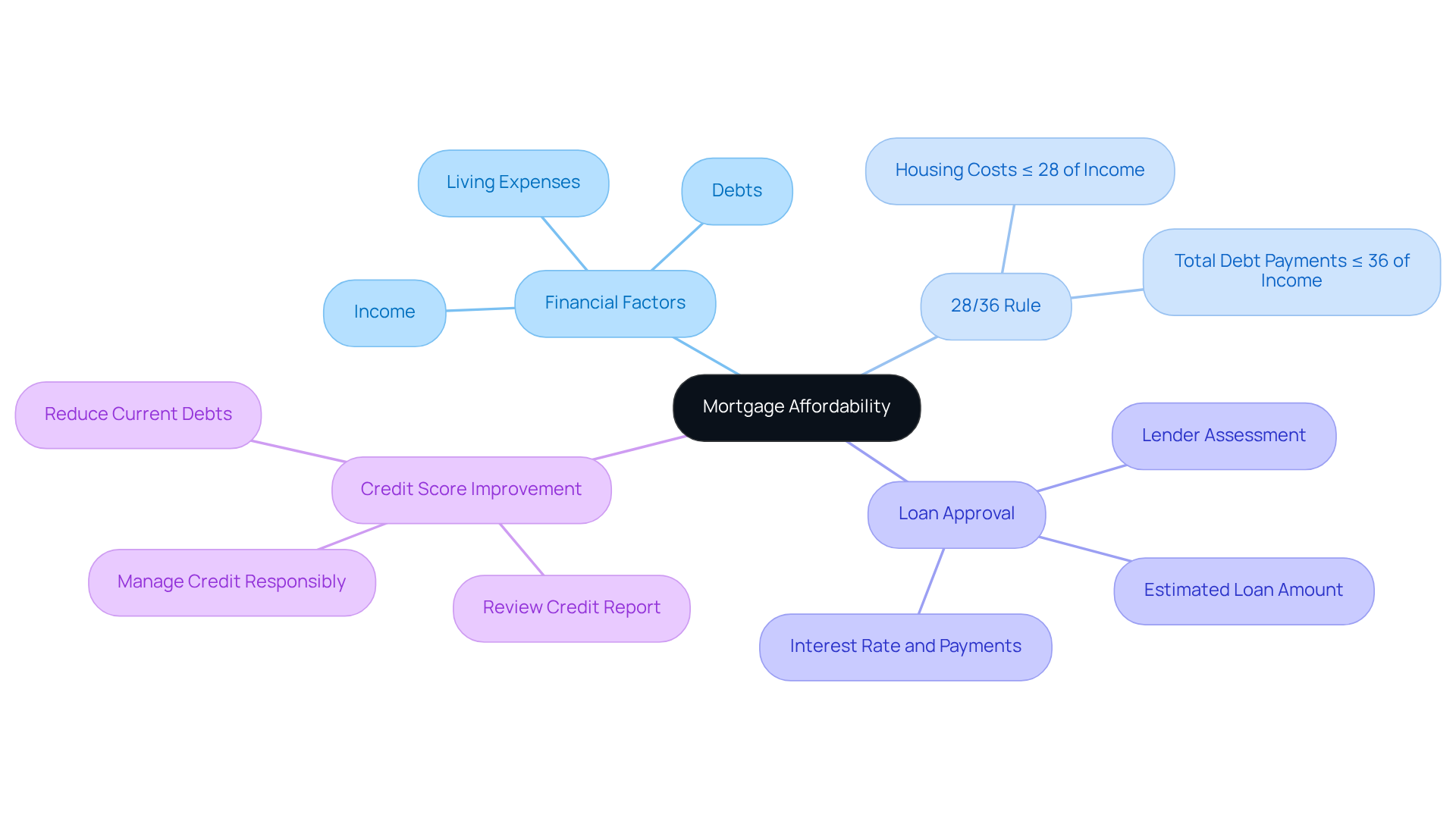

Define Mortgage Affordability and Its Importance

is about your ability to manage alongside other . We understand how challenging this can be, and usually involves looking at your income, debts, and living expenses. Understanding your mortgage affordability is crucial; it helps you avoid and ensures you can make .

Lenders often refer to guidelines like the 28/36 rule. This suggests that your housing costs should not exceed 28% of your gross monthly income, while should stay below 36%. By following these guidelines, you can maintain a balanced budget while ensuring mortgage affordability and fulfilling your loan commitments.

Securing is a vital step in the journey toward achieving mortgage affordability. It indicates that a lender sees you as a strong candidate for financing based on your financial profile. Typically, this approval includes an estimate of your loan amount, interest rate, and potential monthly payments, which are essential for understanding your borrowing capacity.

Moreover, boosting your can enhance your loan options. We’re here to support you every step of the way, so reviewing your credit report for errors, reducing current debts, and managing credit responsibly can make a significant difference in your financial future.

Explore Factors Influencing Mortgage Affordability

Several key factors significantly influence , and we recognize how crucial this is for you as you navigate your .

- Income: generally enhance borrowing capacity, enabling potential homeowners to qualify for larger mortgage amounts. We know how challenging it can be to keep up with rising costs; for instance, the has risen to nearly $117,000, reflecting a 49.5% increase since January 2020. This trend underscores the importance of stable income in determining your home-buying power.

- : This ratio assesses total regular debt obligations in relation to gross income. A lower DTI, ideally below 36%, indicates better mortgage affordability and financial health. We encourage you to strive for keeping your loan costs at or below 28% of your gross income each month to maintain a manageable budget.

- : A higher credit score can lead to lower interest rates, making home loans more affordable. Lenders perceive borrowers with good credit as lower risk, which can translate into significant savings over the life of the loan. We’re here to support you in improving your credit score if needed.

- : The magnitude of the initial deposit directly influences the loan sum and recurring charges. For example, a 20% deposit on a $300,000 house leads to a charge of $1,597 each month, whereas a 5% deposit raises the cost to $1,896, along with extra private mortgage insurance (PMI) expenses. Therefore, a larger initial deposit not only decreases the principal but can also remove PMI, thereby improving mortgage affordability.

- Interest Rates: have a direct effect on monthly costs. Recent trends suggest that home loan rates, which peaked near 8%, are now declining, offering hope for buyers encountering affordability challenges. Lower rates can significantly enhance mortgage affordability, while higher rates may strain budgets.

- : Different loan products, such as FHA or VA loans, come with varying requirements and benefits that can influence affordability. Some loans allow for lower down payments, making homeownership more accessible for a broader range of buyers.

Understanding these elements empowers you as a prospective homeowner to make informed choices regarding your loan options. We’re here to support you every step of the way, ultimately leading to a more .

Identify Challenges in Assessing Mortgage Affordability

Assessing mortgage affordability can be a daunting journey for potential homeowners, as it is filled with challenges that require careful navigation.

Changing economic conditions, such as rising interest rates and increasing home prices, can significantly impact your . For example, as interest rates climb, the cost of borrowing rises, making it more challenging for buyers to qualify for loans.

- Incorrect Monetary Evaluations: It’s common for borrowers to misjudge their financial situations, either by underestimating expenses or overestimating income. This can lead to unrealistic expectations about mortgage affordability, potentially causing financial strain.

- : The home loan market offers a vast array of options, which can feel overwhelming. Understanding the nuances of , , and other alternatives is crucial for making informed decisions that align with your personal financial situation.

Insufficient economic knowledge can lead many potential homeowners to have a limited understanding of economic concepts, which may result in unwise choices regarding mortgage affordability. Thankfully, educational resources and can help bridge this knowledge gap, empowering you to make confident decisions.

- External Factors: Life can be unpredictable. , such as job loss, medical emergencies, or unexpected expenses, can severely impact your ability to meet loan obligations. These realities highlight the importance of having a financial buffer and a realistic assessment of your financial resilience.

Recognizing these challenges is essential for approaching the financing process with a realistic mindset. Remember, seeking guidance from knowledgeable professionals can empower you to make informed decisions and navigate the complexities of mortgage financing effectively. We’re here to .

Conclusion

Understanding mortgage affordability is essential for anyone looking to navigate the complexities of homeownership. We know how challenging this can be. It encompasses not only the ability to make regular loan payments but also the broader financial implications that come with purchasing a home. By grasping the concept of mortgage affordability, prospective homeowners can make informed decisions that align with their financial capabilities, ultimately fostering a more sustainable approach to homeownership.

Key factors influencing mortgage affordability include:

- Income levels

- Debt-to-income ratios

- Credit scores

- Initial deposits

- Interest rates

- The types of loans available

Each of these elements plays a crucial role in determining an individual’s borrowing capacity and overall financial health. Additionally, recognizing the challenges—such as fluctuating economic conditions, miscalculations, and the complexity of financial products—can help potential buyers prepare for the realities of the mortgage landscape.

As the journey toward homeownership unfolds, it is vital to remain informed and proactive. Seeking guidance from financial professionals and utilizing educational resources can empower individuals to make confident decisions regarding their mortgage options. Embracing a comprehensive understanding of mortgage affordability not only aids in achieving homeownership but also contributes to long-term financial stability. We’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage affordability?

Mortgage affordability refers to your ability to manage regular loan payments alongside other financial obligations, taking into account your income, debts, and living expenses.

Why is understanding mortgage affordability important?

Understanding mortgage affordability is crucial because it helps you avoid financial strain and ensures you can make informed decisions about homeownership.

What is the 28/36 rule in mortgage affordability?

The 28/36 rule suggests that your housing costs should not exceed 28% of your gross monthly income, while total debt payments should stay below 36%. This guideline helps maintain a balanced budget and ensures mortgage affordability.

How does loan approval relate to mortgage affordability?

Securing loan approval is a vital step toward achieving mortgage affordability, as it indicates that a lender views you as a strong candidate for financing based on your financial profile. It typically includes an estimate of your loan amount, interest rate, and potential monthly payments.

How can I improve my mortgage options?

Boosting your credit score can enhance your loan options. Reviewing your credit report for errors, reducing current debts, and managing credit responsibly can significantly impact your financial future.