Overview

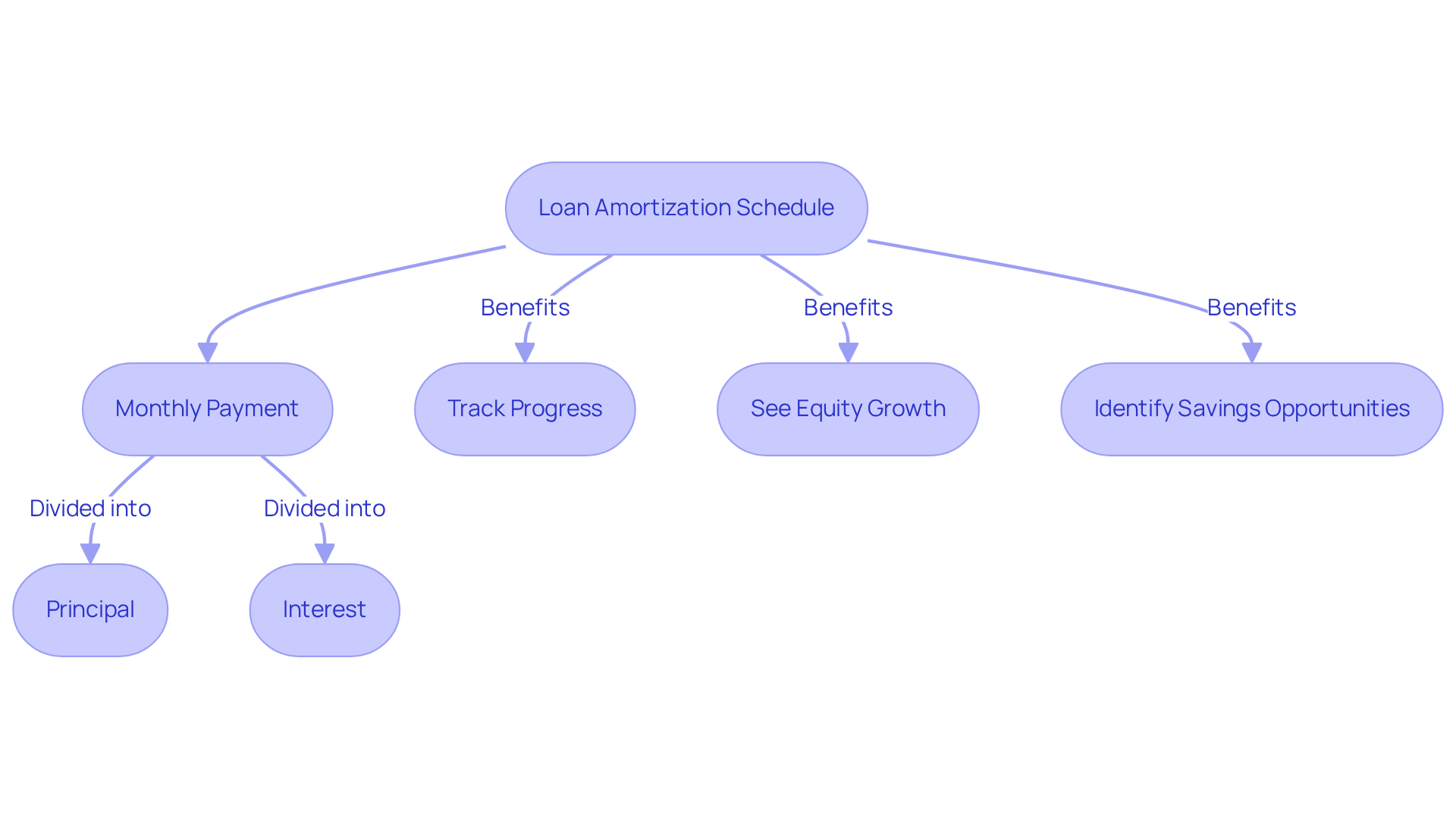

Understanding the mortgage process can feel overwhelming, and we know how challenging this can be. This article highlights the significance of a loan amortization schedule for homebuyers. By breaking down your mortgage payments into principal and interest, you can gain clarity on your financial commitments.

Imagine tracking your equity growth over time. With a loan amortization schedule, you can see how each payment contributes to your home’s value. This insight empowers you to make informed decisions about extra payments or refinancing options, ultimately leading to better financial outcomes.

We’re here to support you every step of the way. By utilizing this schedule, you can manage your mortgage with confidence, ensuring that your financial journey is as smooth as possible. Take control of your future and explore how a loan amortization schedule can work for you.

Introduction

Understanding the intricacies of a loan amortization schedule is crucial for homebuyers embarking on their mortgage journey. We know how challenging this can be. This essential tool not only details how each payment is allocated between principal and interest but also empowers borrowers to make informed financial decisions that can lead to significant savings. However, with the complexities of long-term financial commitments and the potential for unexpected costs, how can homebuyers effectively navigate this landscape? Together, let’s explore ways to maximize your investment and minimize your expenses.

Define Loan Amortization Schedule

A is an important tool that outlines every installment made throughout its duration. It clearly shows how each monthly payment is divided between the principal—the amount you initially borrowed—and the interest, which represents the cost of borrowing. Typically covering a period of 15 to 30 years, this schedule provides a valuable roadmap for borrowers, helping them understand their . By breaking down contributions into principal and interest, the amortization plan allows you to and see how your equity in the property grows over time.

Understanding the loan amortization schedule is essential for . It not only clarifies the but also highlights , such as making extra payments. For instance, if you have a $400,000 mortgage at a 6.4% interest rate, you would notice your monthly interest payment is approximately $2,133.33. This emphasizes the importance of managing your payments wisely.

In 2025, the average mortgage amortization period in the U.S. remains predominantly at 30 years, reflecting a common preference among homebuyers. While this extended duration can lead to , it’s crucial to understand the implications of such a long-term commitment. By using tools like , you can gain insights into your loan amortization schedule and explore methods to minimize your overall borrowing costs, ultimately leading to better financial outcomes.

We know how challenging this can be, and we’re here to support you every step of the way as you navigate your .

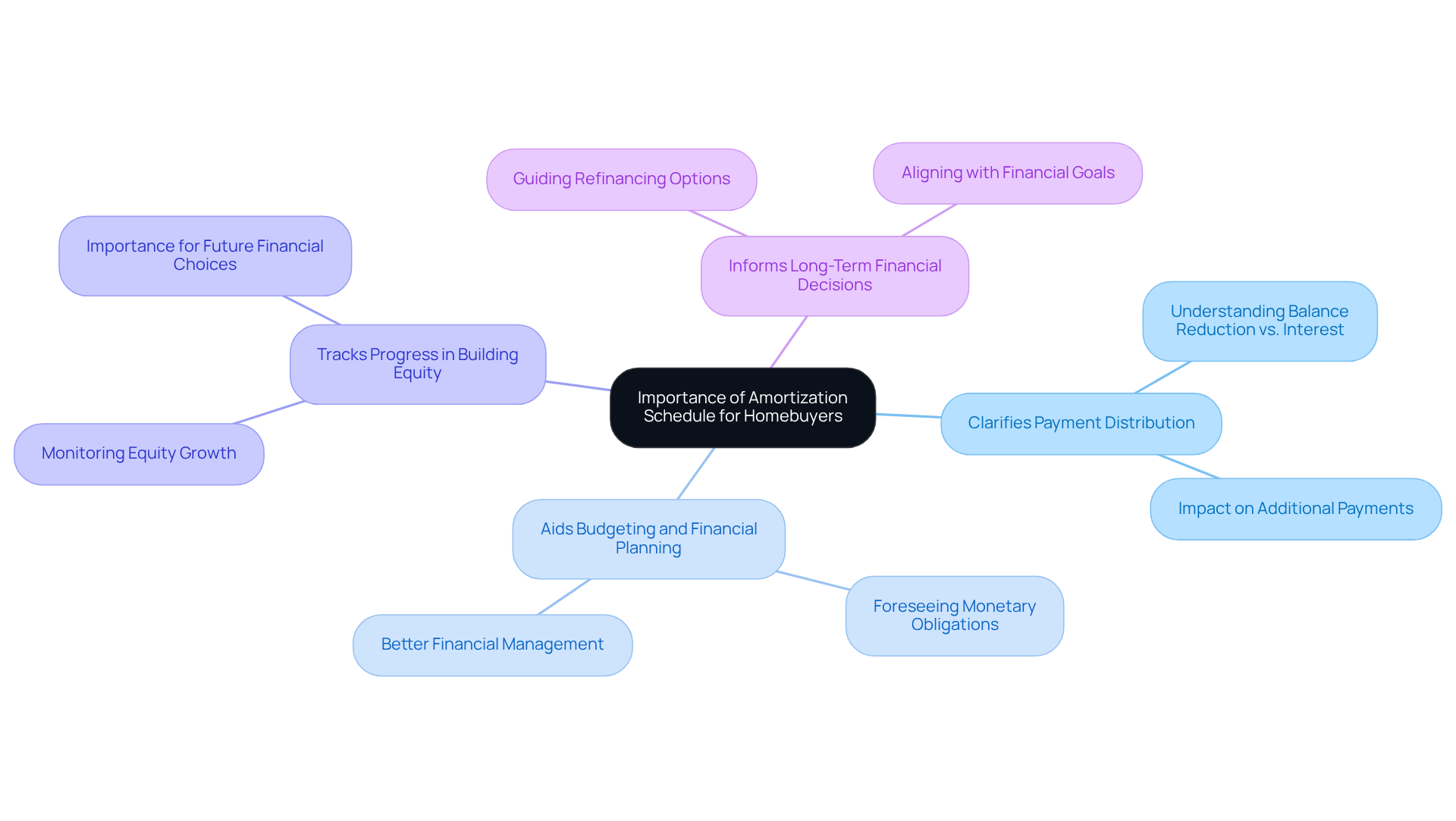

Explain Importance for Homebuyers

For homebuyers, an is essential for several reasons. We understand how challenging navigating the can be, and this tool can help clarify how each payment is distributed between reducing the balance and covering interest expenses. This understanding can greatly impact your decisions regarding additional payments or .

Moreover, it allows you to foresee your over the term of the loan, aiding in better budgeting and . By regularly reviewing the amortization schedule, you can track your progress in —a crucial element for future financial choices, such as selling your property or obtaining .

This knowledge not only assists in immediate financial management but also empowers you to make informed decisions that align with your . With F5 Mortgage’s and commitment to providing a stress-free service, you can navigate your mortgage journey with confidence and clarity.

Outline Components of an Amortization Schedule

An amortization schedule is a crucial tool for , and it encompasses several key components that can help you navigate this journey:

- Payment Number: Each row corresponds to a specific payment due date, usually on a monthly basis.

- Payment Amount: This represents the , which remains constant for , ensuring predictability in budgeting.

- Principal Repayment: This signifies the segment of the monthly contribution that decreases the principal balance, enabling you to monitor your progress in settling the debt.

- Interest Charge: This indicates the portion of the expense directed towards costs, which is generally greater in the initial years of borrowing.

- Remaining Balance: Following each transaction, this column shows the remaining balance owed, offering insight into how much is left to settle.

- Cumulative Charges: This monitors the total fees paid throughout the duration of the credit, emphasizing the expense of borrowing.

We know how challenging it can be to , but comprehending them allows you to recognize how your contributions affect your balance and expenses over time. For instance, on a $240,000 loan at a 3.5% rate, the first month’s contribution might include roughly $700 for charges and $1,016 for principal, demonstrating the initial emphasis on charge costs.

By utilizing a , you can make informed decisions about your . This includes assessing the potential benefits of making and shorten your loan term.

At , we’re here to support you every step of the way. We highlight the significance of understanding these monetary tools while providing ultra-competitive rates and tailored assistance. This approach empowers you in your , ensuring a stress-free experience as you explore your options and make the most of your loan amortization schedule.

Discuss Implications for Financial Planning

The implications of for are significant, especially as F5 Mortgage seeks to refresh the . We understand how overwhelming , but by grasping how these transactions are organized, you can make strategic choices regarding your mortgage. For example, while early contributions primarily address fees, you might be encouraged to make additional payments toward the principal. This proactive approach can greatly reduce overall interest costs. Imagine a homeowner making on a $300,000 mortgage at a 6.75% interest rate—this could save over $144,000 in interest and shorten the repayment term by more than nine years, as highlighted in the case study titled “.”

Additionally, a can assist you in planning for future financial needs, such as retirement savings or education funding, by clearly outlining your monthly responsibilities. It’s essential to understand how various financing terms influence the loan amortization schedule. For instance, opting for a 30-year term allows borrowers to qualify for about 8.5% more in loan amounts. However, it also means paying an extra CAD 260,000 in interest over five years compared to a shorter term, underscoring the of this decision.

Unlike the aggressive sales tactics and biased information often found in traditional banking, F5 Mortgage offers a , empowering you to make informed choices. Ultimately, a thoughtful loan amortization schedule not only impacts your immediate financial decisions but also shapes your long-term economic health. With F5 Mortgage’s technology-driven, consumer-centric approach, you can thoughtfully engage with the loan amortization schedule, ensuring that your decisions align with your financial goals. Experts like Robert McLister emphasize the importance of understanding these dynamics to navigate the complexities of effectively. We’re here to support you every step of the way.

Conclusion

A loan amortization schedule is more than just numbers; it’s a vital tool for homebuyers. It provides a clear breakdown of how each payment is divided between principal and interest throughout the life of the loan. This understanding not only clarifies the financial commitment involved in homeownership but also empowers buyers to make informed decisions, leading to significant savings and improved financial planning.

In this article, we explored key insights that resonate with many families. We discussed:

- The importance of tracking progress in equity building

- The benefits of making extra payments

- The implications of selecting different loan terms

By familiarizing yourself with the components of an amortization schedule—like payment amounts, principal repayment, and interest charges—you can navigate your mortgage journey with confidence and optimize your financial outcomes.

Ultimately, understanding the intricacies of a loan amortization schedule is essential for effective financial planning. It allows you to envision your long-term financial health while making decisions that align with your goals. By leveraging tools and knowledge about amortization, you can take proactive steps toward reducing interest costs and enhancing your overall financial well-being. Engaging with these insights not only simplifies the mortgage process but also fosters a sense of confidence and clarity in achieving your homeownership dreams. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a loan amortization schedule?

A loan amortization schedule is a tool that outlines every installment made throughout the duration of a loan, showing how each monthly payment is divided between the principal (the amount borrowed) and the interest (the cost of borrowing).

How long does a typical loan amortization schedule cover?

A typical loan amortization schedule covers a period of 15 to 30 years.

Why is understanding the loan amortization schedule important for homebuyers?

Understanding the loan amortization schedule is essential for homebuyers as it clarifies their financial commitment and highlights opportunities for savings, such as making extra payments.

Can you provide an example of how monthly payments are affected by interest rates?

For instance, with a $400,000 mortgage at a 6.4% interest rate, the monthly interest payment would be approximately $2,133.33, emphasizing the importance of managing payments wisely.

What is the average mortgage amortization period in the U.S. as of 2025?

As of 2025, the average mortgage amortization period in the U.S. is predominantly 30 years, which is a common preference among homebuyers.

What are the implications of a long-term mortgage commitment?

While a long-term mortgage commitment can lead to lower monthly payments, it is crucial to understand the long-term financial implications of such a commitment.

How can tools like amortization calculators help borrowers?

Amortization calculators can help borrowers gain insights into their loan amortization schedule and explore methods to minimize overall borrowing costs, leading to better financial outcomes.