Overview

Loan amortization is a structured repayment method that helps you manage your debt through scheduled payments that cover both principal and interest. We understand how crucial this is for effective budgeting and financial planning. By grasping this process, homeowners can build equity over time, which is an empowering step towards financial stability.

Moreover, making extra payments can significantly reduce your overall interest costs and shorten your loan terms. This not only lightens your financial burden but also enhances your overall well-being. We know how challenging this can be, but taking these steps can lead to a brighter financial future. Remember, we’re here to support you every step of the way.

Introduction

Navigating the complexities of borrowing can be daunting, especially when it comes to understanding loan amortization. We know how challenging this can be, particularly for those stepping into homeownership. This structured repayment method not only clarifies your financial obligations but also plays a pivotal role in building equity over time.

However, many borrowers remain unaware of how their payments are allocated between principal and interest. This lack of understanding can lead to missed opportunities for savings. What if you could change that? By exploring effective strategies, homeowners can maximize their financial benefits and reduce the total interest paid on their loans.

Let’s delve into how you can take control of your mortgage journey, empowering you to make informed decisions that positively impact your financial future.

Define Loan Amortization and Its Importance

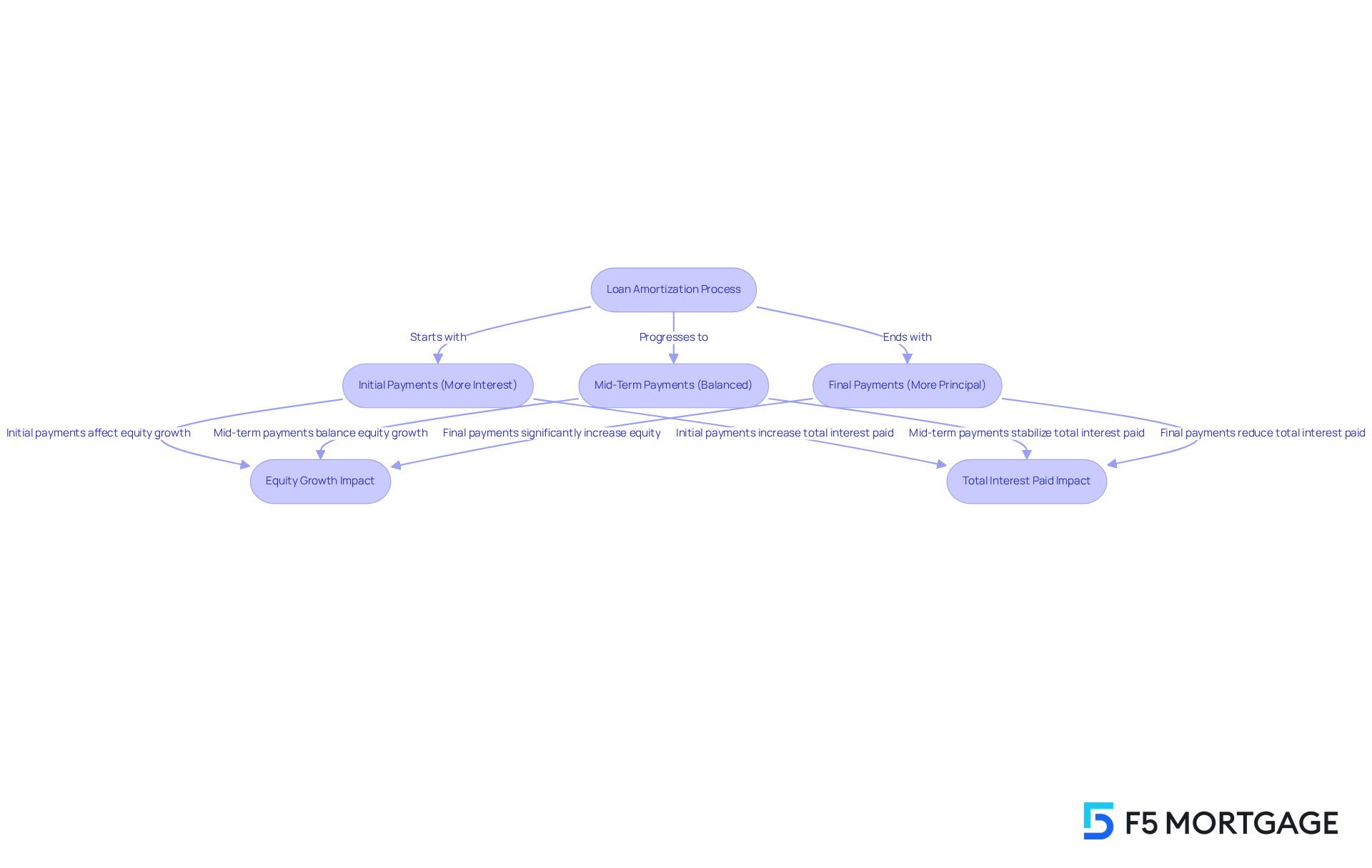

Loan amortization is an organized way to repay a debt through scheduled, periodic contributions that encompass both principal and interest. At the beginning, a larger portion of each payment goes toward interest, but as the loan matures, this gradually shifts, allowing more of your payment to reduce the principal balance. This structured repayment plan is essential for borrowers, as it clarifies financial commitments and supports effective budgeting.

For homeowners, understanding amortization is particularly important, as it directly impacts the growth of equity in their properties. For instance, consider a $250,000 mortgage at a 4% interest rate over 30 years. This results in monthly payments of approximately $955, with equity increasing gradually as you make contributions. This steady increase in equity not only strengthens your financial position but also becomes a valuable asset over time.

Experts emphasize that making extra contributions toward the principal can significantly accelerate equity growth, reducing the total interest paid throughout the borrowing period. For example, homeowners who opt for biweekly payments instead of monthly ones can contribute 26 times a year, leading to faster principal reduction and interest savings. As Kim Gallagher wisely notes, “If you make at least the minimum monthly payment, you can repay a fully amortized debt by the end of the payment term.”

Ultimately, understanding loan amortization enables borrowers to make informed choices about their financing options. This ensures that you choose products that align with your financial goals and enhance your home equity over time. Additionally, F5 Mortgage is here to support you every step of the way, offering valuable resources like a comprehensive home buyer’s guide and refinancing guides to help you navigate your mortgage journey.

Explain How Mortgage Payments Are Structured

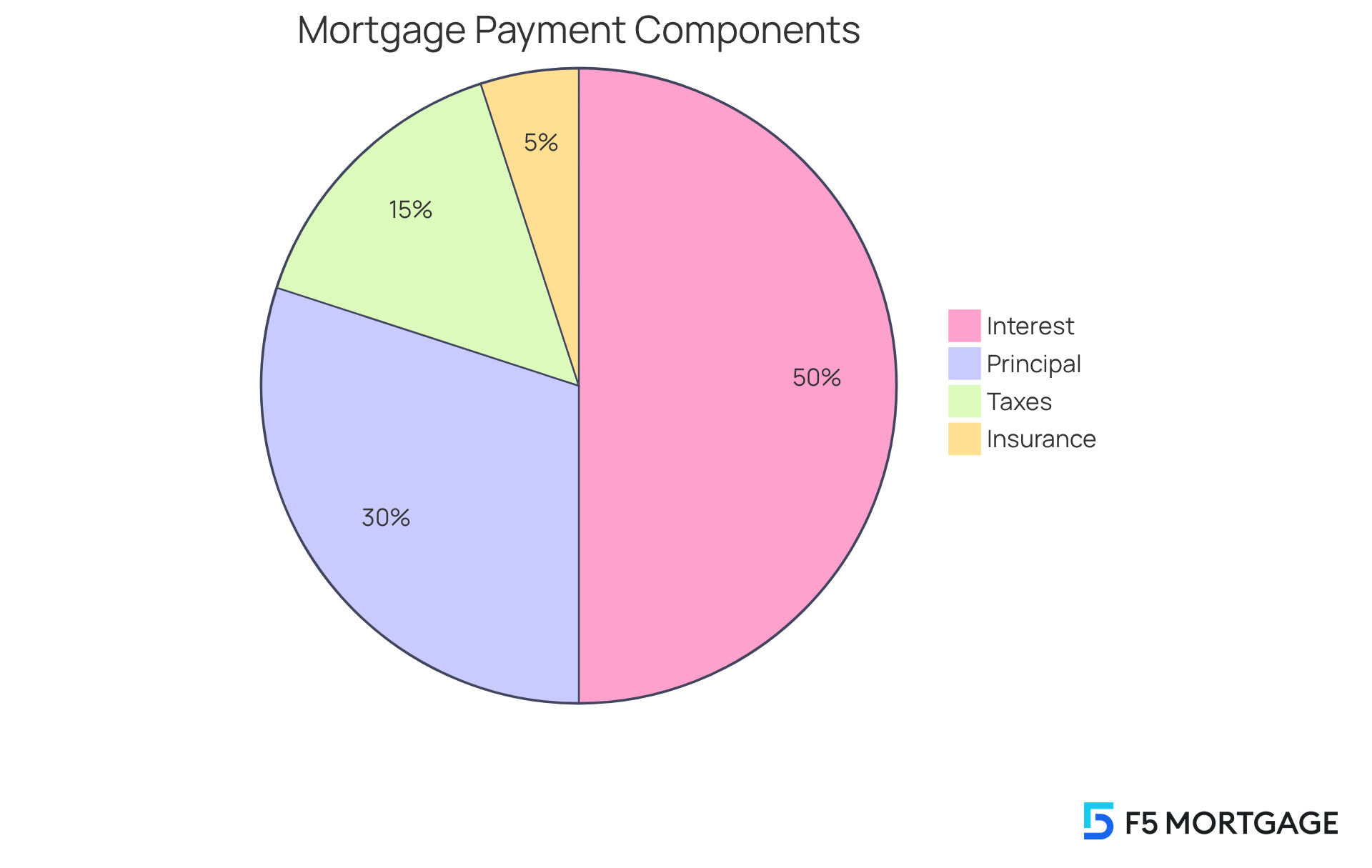

Mortgage installments consist of four essential components, known as PITI: Principal, Interest, Taxes, and Insurance. The principal is the amount borrowed to finance your home, while interest is the fee charged by the lender for this borrowing, calculated as a percentage of the principal. Property taxes, often included in your monthly payments, are based on the appraised value of your home. For example, the expected monthly property tax for a $400,000 house is around $400. Homeowners insurance protects your property and is typically part of your monthly housing cost, with the average expense for $400,000 in dwelling coverage estimated at $269 a month. Additionally, loan insurance may be required if your down payment is smaller.

Understanding these components is crucial for you as a borrower. In the early years of your loan, a large portion of your monthly payment goes toward interest rather than principal. This can lead to higher overall costs if not managed carefully. For instance, if you have a 30-year fixed-rate mortgage of $320,000 at a 6.75% interest rate, your monthly payment would be about $2,076, with a significant part directed towards interest in the beginning.

Using tools like a loan amortization calculator can provide valuable insights into how your contributions will change over time. You can see how making extra payments can significantly reduce the total interest paid throughout the life of the loan. As Taylor Freitas points out, changes in property taxes and homeowners insurance premiums, which often rise over time, will also affect your PITI. This understanding empowers you to make informed decisions about refinancing or accelerating your payments, ultimately enhancing your financial well-being.

Moreover, calculating your maximum PITI based on a gross monthly income of $8,000 and $250 in student debt can help you assess your affordability. This calculation reflects the highest monthly housing cost you can manage based on your DTI ratio, monthly income, and other financial obligations. Recognizing the importance of PITI is vital, as lenders use it to determine your financing approval, making it a key factor in the home financing journey. We know how challenging this can be, and we’re here to support you every step of the way.

Discuss Benefits of Making Extra Payments

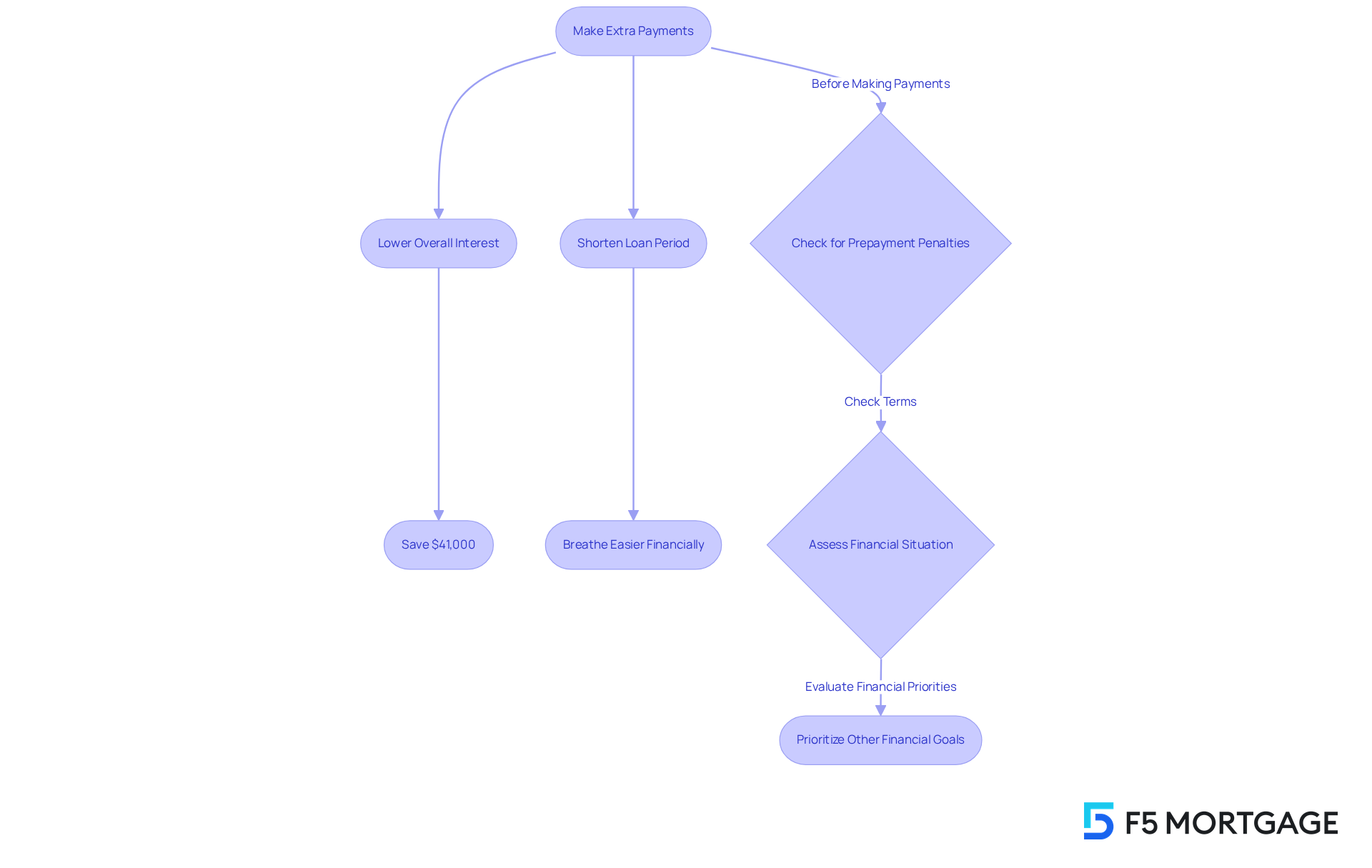

Making additional contributions can truly make a difference in your loan amortization. Not only can it decrease the overall interest you pay throughout the loan’s duration, but it can also affect loan amortization by shortening the loan period. When you contribute extra funds, those amounts typically go directly toward reducing the principal balance and improving loan amortization. This, in turn, lowers the amount of interest you incur in the following months as a result of loan amortization.

For example, imagine contributing just two extra payments each year on a $400,000 mortgage at a 3.5% interest rate. This simple step could save you roughly $41,000 and shorten your mortgage term by five years. It’s a significant saving that can help you breathe easier financially.

Additionally, consider rounding up your monthly contributions to the nearest hundred. This small adjustment allows you to add extra without putting too much strain on your budget. However, it’s essential to check for any prepayment penalties in your financing terms regarding loan amortization before committing to these additional contributions, as these could lead to fees for paying off your debt early.

As economic specialist Nancy Zambell highlights, making two extra payments each year can significantly improve loan amortization, reducing the duration of your debt and saving you tens of thousands of dollars. Yet, it’s also crucial to assess your financial situation and prioritize other economic goals, such as maintaining an emergency fund, before directing surplus resources toward your loan.

This approach not only accelerates equity accumulation in your home but also enhances your financial flexibility for future investments or expenses. We know how challenging this can be, but by taking these thoughtful steps, you’re empowering yourself to achieve your financial dreams.

Highlight the Importance of Financial Education in Homeownership

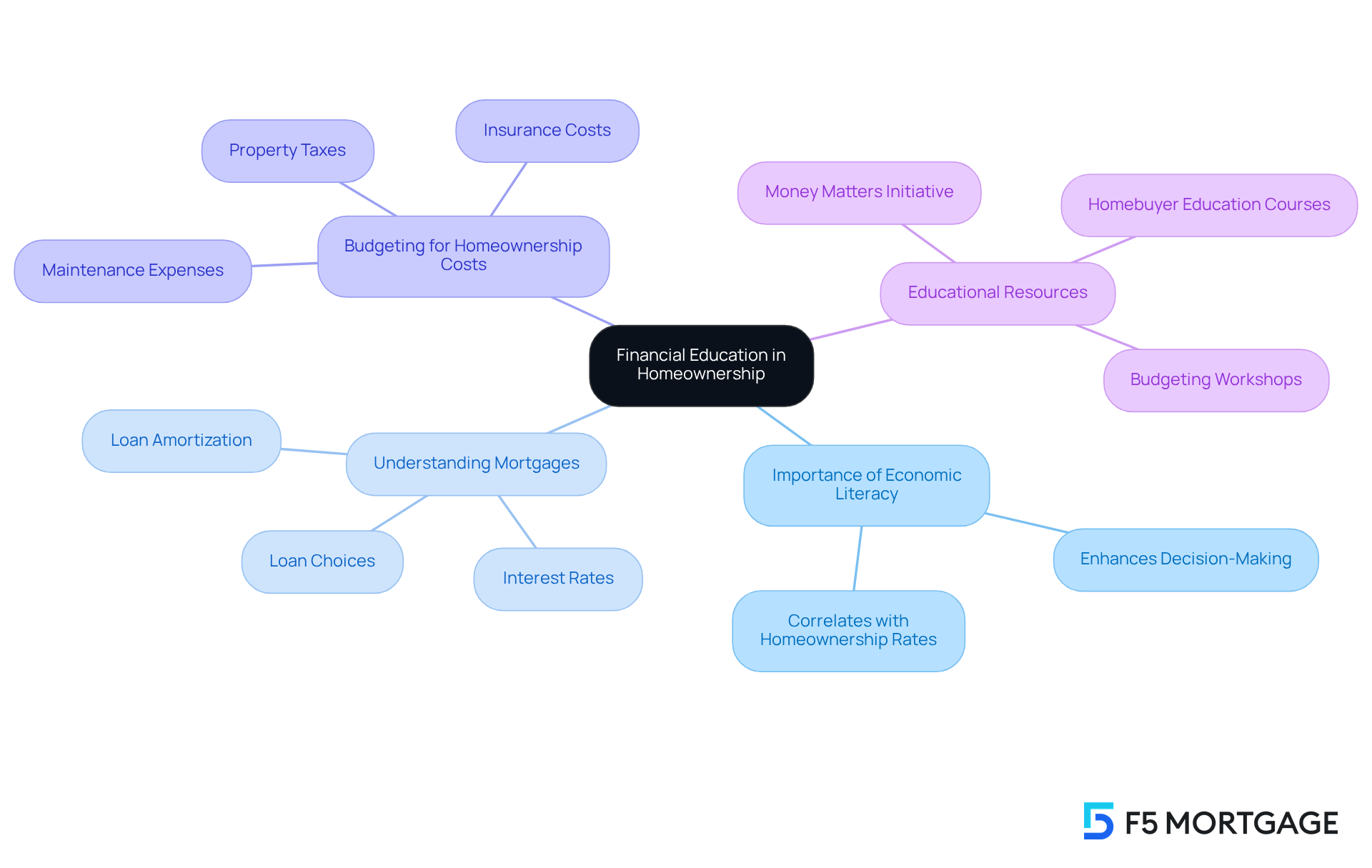

Economic education is essential for successful homeownership. We know how challenging this can be, and equipping individuals with the knowledge to navigate the complexities of mortgages and the broader economic landscape is crucial. Comprehending loan choices, interest rates, and the consequences of loan amortization and different payment arrangements enables buyers to make informed monetary decisions.

Moreover, financial literacy allows homeowners to anticipate and budget for additional expenses related to homeownership, such as maintenance, property taxes, and insurance. By fostering a culture of monetary education, organizations like F5 Mortgage LLC, which has assisted over 1,000 families and boasts a customer satisfaction rate of 94%, can support clients through their mortgage journeys with assurance. This nurturing approach results in more successful homeownership experiences.

Resources such as homebuyer education courses and budgeting workshops, including programs like the Money Matters initiative offered by Habitat for Humanity, provide valuable insights and tools that significantly enhance decision-making processes. Significantly, studies suggest that economic literacy positively correlates with homeownership rates. This highlights the importance of educational initiatives in fostering informed buyers.

As financial literacy remains a widespread issue, targeted programs can bridge the knowledge gap. By doing so, we can ultimately enhance the prospects for families seeking to achieve their homeownership dreams. We’re here to support you every step of the way.

Conclusion

Understanding loan amortization is essential for anyone navigating the world of borrowing, especially in the realm of mortgages. It acts as a structured roadmap for repaying debt, where each scheduled payment not only contributes to interest but also gradually reduces the principal. This knowledge empowers you to make informed financial decisions, ultimately enhancing your equity and financial stability.

We recognize how overwhelming mortgage payments can be, and it’s vital to understand their structure, particularly the PITI components: Principal, Interest, Taxes, and Insurance. Additionally, consider the benefits of making extra payments—these can shorten loan terms and reduce overall interest, leading to significant financial savings. Remember, financial education is your ally; it equips you with the necessary tools to navigate the complexities of homeownership and make informed choices that align with your long-term goals.

In summary, embracing the principles of loan amortization and prioritizing financial literacy can transform your homeownership experience. By taking proactive steps, such as making extra payments and seeking educational resources, you can improve your current financial standing and lay the groundwork for future economic success. Fostering a culture of financial understanding is vital for empowering families like yours to achieve their homeownership dreams, making it a worthy investment in your financial future.

Frequently Asked Questions

What is loan amortization?

Loan amortization is a structured method of repaying a debt through scheduled, periodic payments that include both principal and interest. Initially, a larger portion of each payment goes toward interest, but over time, more of the payment reduces the principal balance.

Why is loan amortization important for borrowers?

Amortization is important because it clarifies financial commitments and aids in effective budgeting. It also helps borrowers understand how their payments impact the growth of equity in their properties.

How does loan amortization affect homeowners?

For homeowners, understanding amortization is crucial as it directly impacts the growth of equity in their homes. As they make payments, their equity increases gradually, strengthening their financial position over time.

Can making extra payments affect loan amortization?

Yes, making extra contributions toward the principal can significantly accelerate equity growth and reduce the total interest paid over the borrowing period.

What is the benefit of biweekly payments?

Homeowners who make biweekly payments instead of monthly payments can contribute 26 times a year, leading to a faster reduction of the principal balance and interest savings.

How can understanding loan amortization help borrowers?

Understanding loan amortization enables borrowers to make informed choices about their financing options, ensuring they select products that align with their financial goals and enhance home equity over time.

What resources does F5 Mortgage provide to assist borrowers?

F5 Mortgage offers valuable resources such as a comprehensive home buyer’s guide and refinancing guides to help borrowers navigate their mortgage journey.