Introduction

Many homeowners grapple with misconceptions about home equity loans. Often, they see these loans as a last resort rather than a versatile financial tool. We understand how challenging this can be. This article aims to illuminate the true potential of home equity loans, showcasing how they can:

- Fund renovations

- Consolidate debt

- Support educational pursuits

But what are the real challenges and requirements involved in securing a home equity loan in 2025? By understanding these aspects, you can navigate the complexities of property financing with confidence. We’re here to support you every step of the way.

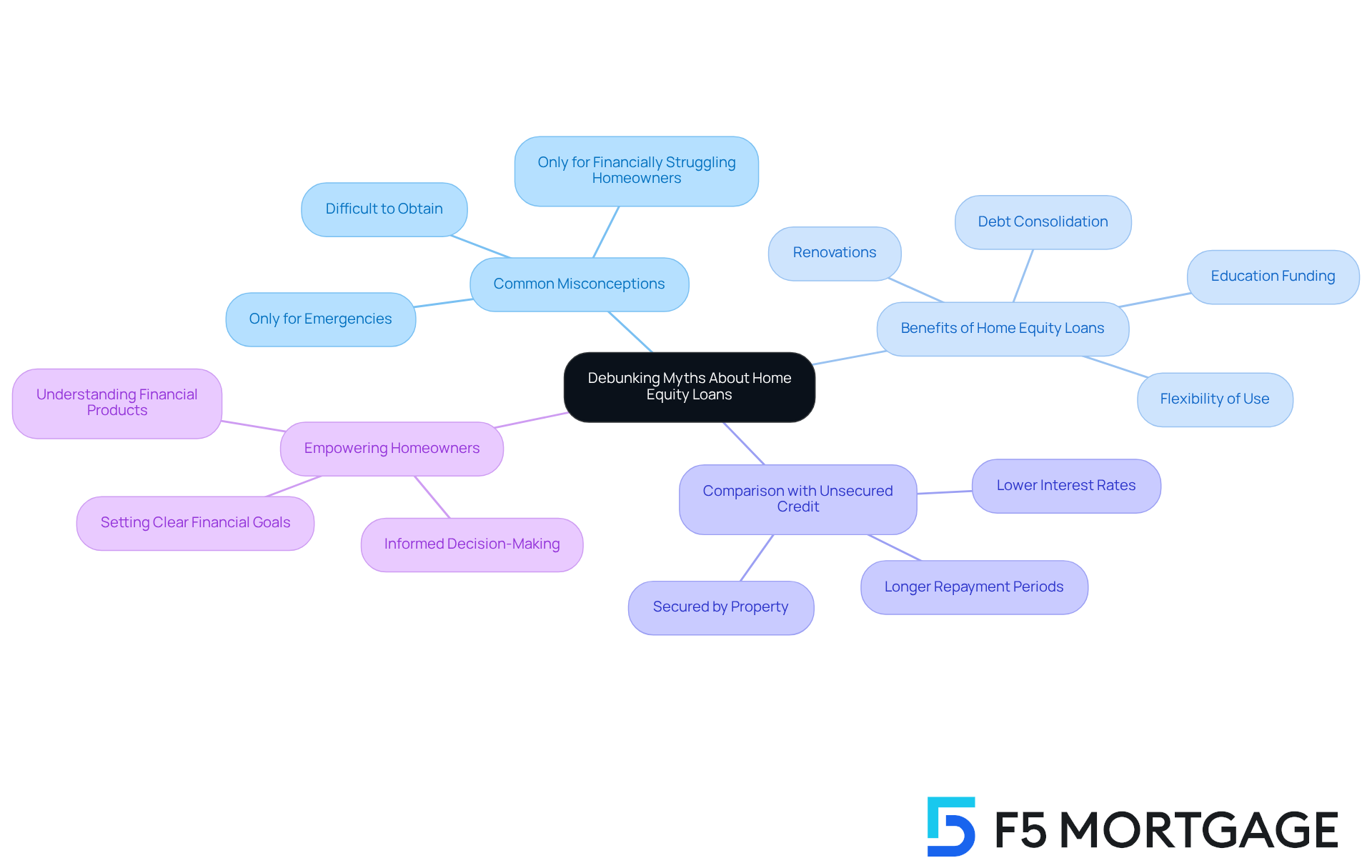

Debunking Myths About Home Equity Loans

Many property owners mistakenly believe that residential financing options are only for emergencies, and this is a common viewpoint. This misunderstanding can prevent them from taking advantage of a valuable financial tool. In truth, property value loans offer a range of benefits beyond immediate needs. They can help with renovations, consolidate high-interest debt, or even fund education. With the average property value hovering around $330,000, homeowners have significant assets at their disposal for various purposes.

While interest rates for property-backed loans can differ, they often present a more favorable option compared to unsecured credit, which currently averages over 20%. This is largely due to the security provided by the property, making these financing options a more economical choice for many families. For instance, someone might use a property-based credit to cover medical expenses or start a business, showcasing the flexibility these loans can offer.

It’s crucial to dispel the myths surrounding residential financing, especially regarding how hard it is to get a home equity loan, so that property owners can make informed financial decisions. Financial consultants emphasize that understanding the true nature of these financial products can open up opportunities for homeowners from all walks of life. This knowledge empowers them to use their residential assets wisely and responsibly.

We know how challenging navigating these options can be, particularly when considering how hard it is to get a home equity loan, but we’re here to support you every step of the way. Consider exploring how property value loans can work for you.

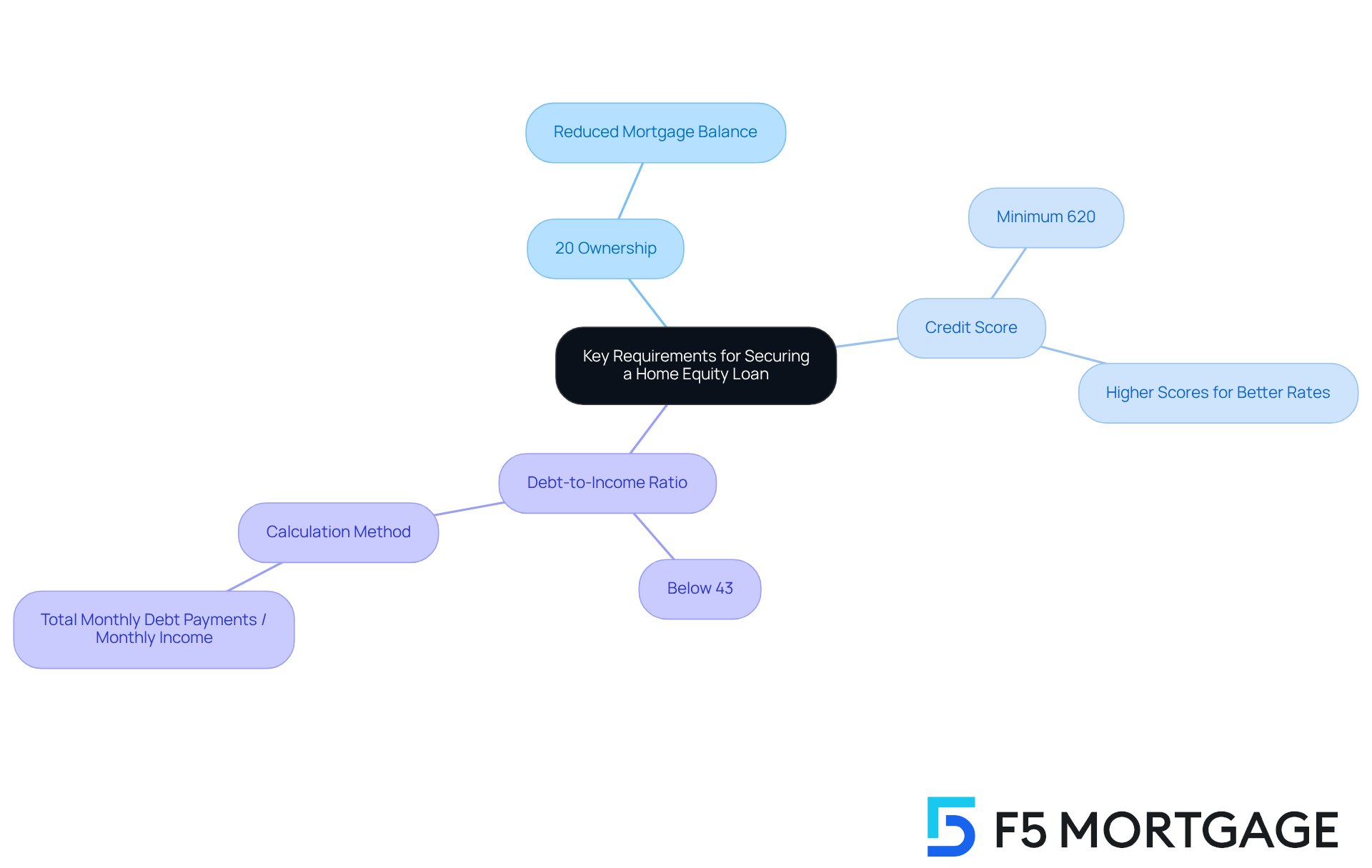

Key Requirements for Securing a Home Equity Loan

Navigating the world of property financing can feel overwhelming, especially when considering how hard it is to get a home equity loan. To secure a property value financing, there are some essential criteria that borrowers typically need to meet. Most lenders look for at least 20% ownership in the property. This means that as a property owner, you should ideally have reduced your mortgage balance significantly.

A credit score of at least 620 is generally necessary, but if your score is higher, you may qualify for more favorable rates. Additionally, lenders will assess your debt-to-income (DTI) ratio, which should ideally stay below 43%. These criteria are in place to ensure that you have the financial stability needed to repay the debt. This not only protects you as a homeowner but also safeguards the lender from potential financial difficulties.

We’re here to support you every step of the way as you consider these important factors. Understanding these requirements can empower you to take the next steps toward securing your financing, including evaluating how hard it is to get a home equity loan.

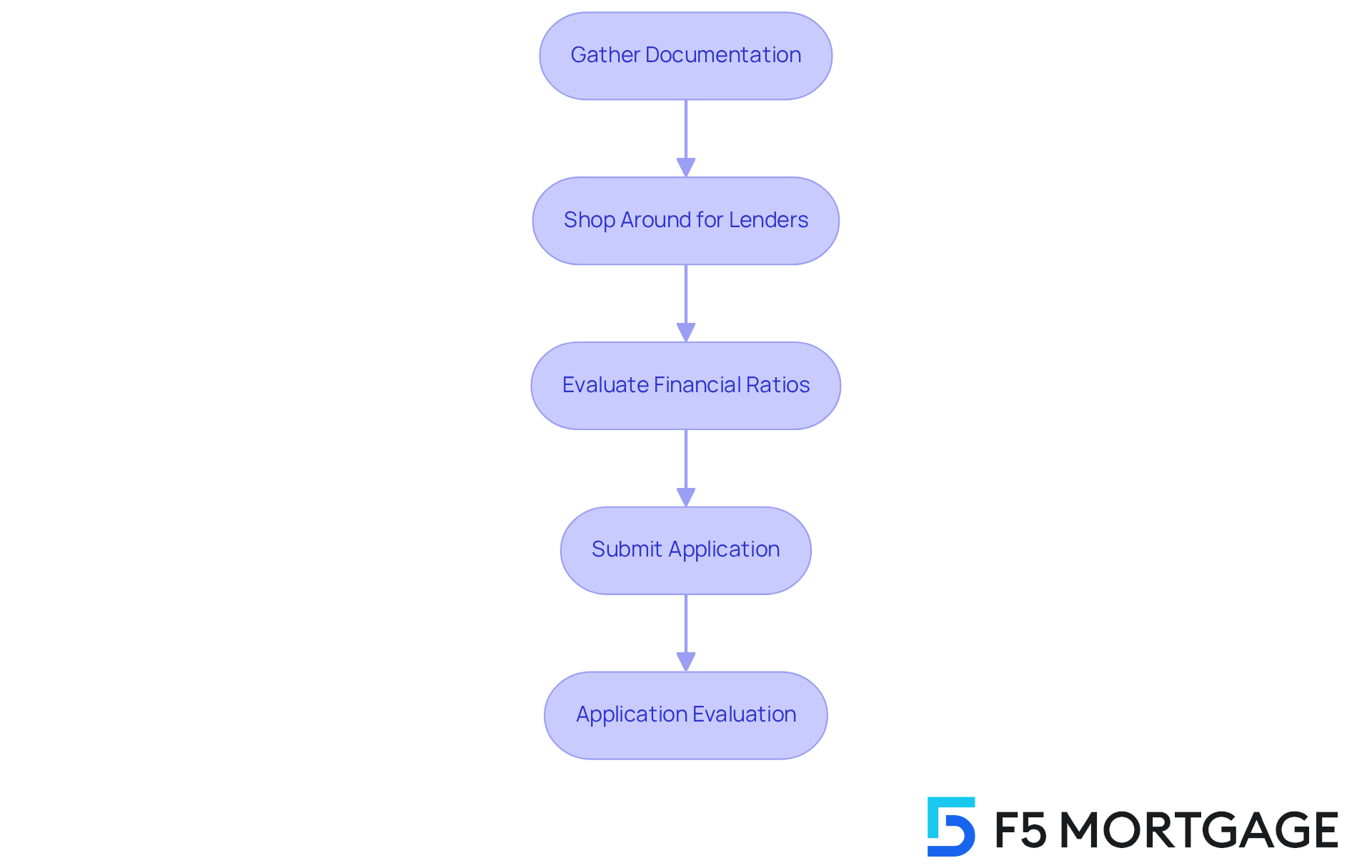

Navigating the Application Process for Home Equity Loans

Navigating the application process for property financing can feel overwhelming, but with the right preparation, it doesn’t have to be. We know how challenging this can be, so let’s break it down together. Start by gathering essential documentation, like proof of income, recent tax returns, and details about existing debts. This paperwork is crucial, as it helps lenders assess your financial situation and ability to repay the loan. Remember, having organized documents can significantly streamline the process.

Next, take the time to shop around for lenders. Comparing rates and terms can make a big difference. With property equity borrowing rates currently averaging under 8%, now is a great time to secure favorable lending conditions. Many lenders, such as F5 Mortgage, require property owners to maintain a minimum 80% value-to-equity ratio. This means you should have reduced at least 20% of your initial borrowing amount or that your home has appreciated in value. Additionally, a maximum 43% debt-to-income (DTI) ratio is typically needed for mortgages. A better DTI can lead to more competitive mortgage rates, so it’s essential to evaluate your financial standing.

Residential property financing options often feature fixed interest rates, which can help with budgeting-especially beneficial for families looking to enhance their homes. Once you’ve chosen a lender, you’ll submit an application that will be evaluated alongside your credit history and a property appraisal. The entire process can vary in duration, taking anywhere from a few weeks to a couple of months, depending on the lender’s requirements and the complexity of your application.

As an independent broker, F5 Mortgage uses user-friendly technology to simplify this process, ensuring a stress-free experience. Mortgage professionals emphasize the importance of being proactive and organized. “Having all necessary documentation ready can make a significant difference in the speed and efficiency of your application,” they note. By understanding the necessary documentation and taking the time to compare lenders, you can enhance your chances of a smooth and efficient application experience. In summary, being well-prepared and informed can lead to a successful property financing application. We’re here to support you every step of the way.

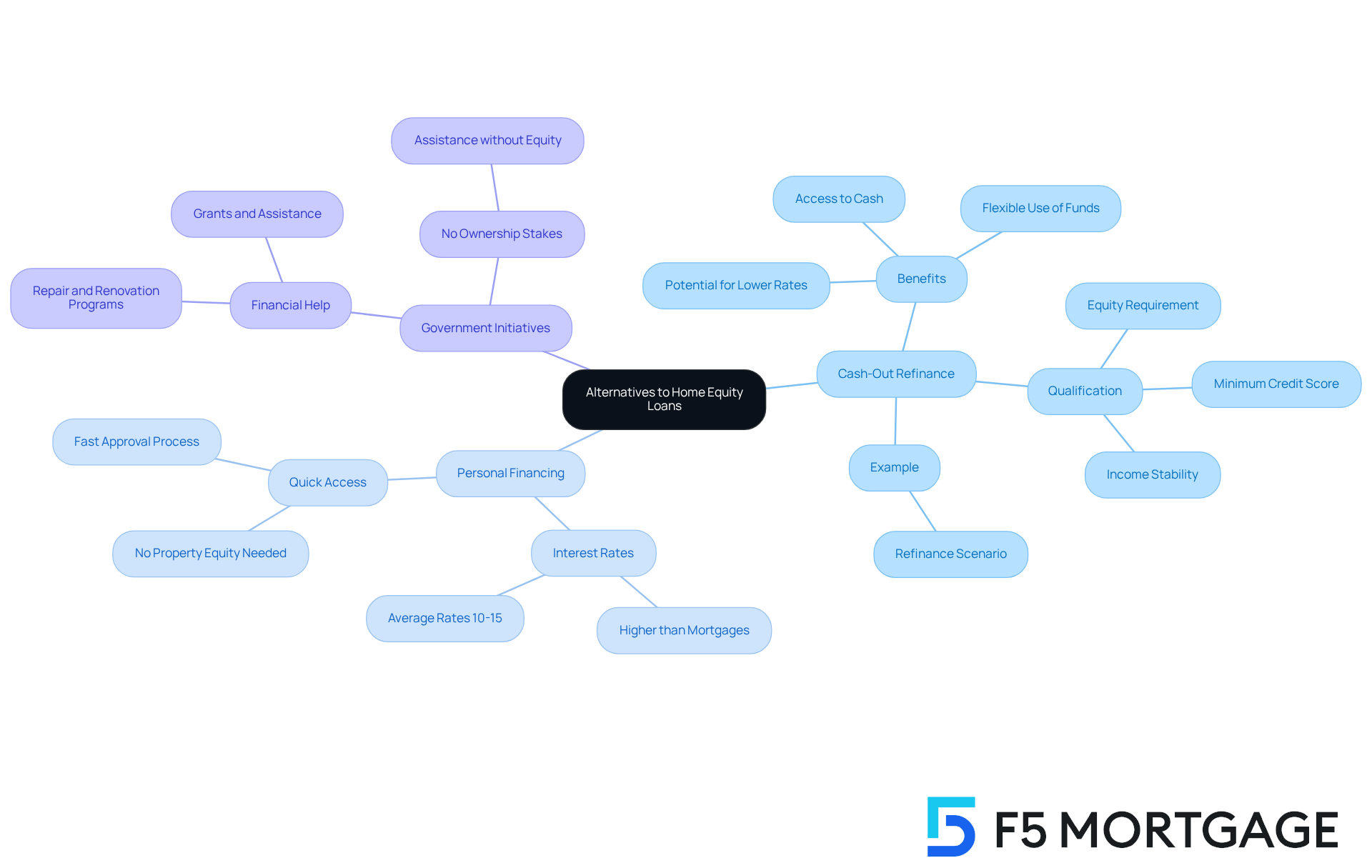

Exploring Alternatives When Home Equity Loans Are Unavailable

When home equity loans aren’t an option, property owners often wonder how hard is it to get a home equity loan. But don’t worry-there are several alternatives to consider that might just fit your needs. One prominent choice is a cash-out refinance. This option allows you to refinance your existing mortgage for more than what you owe, giving you the difference in cash. Imagine having instant funds at your disposal while also negotiating new mortgage terms! For instance, if you have a mortgage balance of $100,000 on a home valued at $300,000, you could potentially refinance for up to $240,000, accessing $140,000 in cash after settling your current mortgage.

Financial advisors often highlight the benefits of cash-out refinancing. It can be easier to qualify for than many expect, especially if you have a steady income and sufficient equity. In 2025, cash-out refinance options remain attractive, with average rates for a 30-year fixed-rate mortgage around 6.30%. While these rates might be a bit higher than conventional refinancing alternatives, the ability to obtain funds for renovations or debt consolidation can outweigh the costs.

On the other hand, personal financing is another option, though it typically comes with higher interest rates. These loans can provide quick access to funds without needing to tap into your property’s value, making them a viable choice for homeowners facing immediate financial demands. For example, personal borrowing rates can average around 10% to 15%, which is considerably higher than mortgage rates that often range from 6% to 8%.

Additionally, you might want to explore government initiatives designed to assist with repairs or renovations. These programs can offer financial help without requiring ownership stakes. Understanding these alternatives empowers you to make informed decisions about how hard it is to get a home equity loan that best suit your financial situation, even when traditional options aren’t feasible. Remember, we’re here to support you every step of the way!

Conclusion

Understanding the complexities of home equity loans is vital for homeowners who want to make the most of their property’s value. We know how challenging this can be, especially when many think these loans are only for emergencies. In reality, they can be used for a variety of purposes, from funding renovations to consolidating debt. By clearing up common misconceptions and recognizing the broader applications of home equity loans, you can discover valuable financial opportunities that might have otherwise slipped by.

This article outlines the key requirements for securing a home equity loan. You’ll need at least 20% equity in your property and a credit score of 620 or higher. Being organized during the application process is crucial – gathering necessary documentation and comparing lenders can help you find the best rates. If traditional home equity loans seem daunting, don’t worry! Alternatives like cash-out refinancing and personal loans can also be viable options.

Ultimately, understanding the realities of home equity loans and their alternatives empowers you to make informed financial decisions. As the landscape of property financing evolves, staying updated on eligibility criteria and application processes is essential. We’re here to support you every step of the way, encouraging you to explore these financing options thoughtfully. This way, you can effectively utilize your assets to achieve your financial goals.

Frequently Asked Questions

What are home equity loans commonly misunderstood to be used for?

Many property owners mistakenly believe that home equity loans are only for emergencies, which can prevent them from utilizing this valuable financial tool for various purposes.

What are some benefits of home equity loans beyond emergencies?

Home equity loans can be used for renovations, consolidating high-interest debt, funding education, covering medical expenses, or starting a business.

How does the average property value affect home equity loans?

With the average property value around $330,000, homeowners have significant assets available to leverage for various financial needs.

How do interest rates for home equity loans compare to unsecured credit?

Interest rates for home equity loans are often more favorable than unsecured credit, which averages over 20%, due to the security provided by the property.

What is the importance of dispelling myths about home equity loans?

Dispelling myths is crucial as it helps property owners understand the true nature of these financial products, enabling them to make informed financial decisions and take advantage of the opportunities available.

What challenges do homeowners face when considering home equity loans?

Homeowners often find it challenging to navigate the options available and may believe that obtaining a home equity loan is difficult, which can deter them from exploring this financing option.

How can homeowners learn more about home equity loans?

Homeowners are encouraged to seek support and explore how home equity loans can work for their specific financial situations.