Introduction

Navigating the complexities of a $300,000 mortgage can feel overwhelming for many prospective homeowners. We understand how daunting it is to face the myriad of costs and factors that influence monthly payments. By breaking down essential components like interest rates, property taxes, and insurance, you can gain a clearer understanding of your financial commitments.

However, with fluctuating interest rates and varying local tax laws, how can you ensure you’re making the most informed decisions about your mortgage options? It’s crucial to recognize these challenges, and we’re here to support you every step of the way. Let’s explore how you can take control of your mortgage journey.

Defining a $300,000 Mortgage: Key Components and Costs

Navigating a house payment on 300k can feel overwhelming, but understanding its essential components can ease your journey toward homeownership. The principal amount is the sum you borrow, while the interest represents the cost of borrowing, typically shown as a percentage. Most loans come with terms of 15 or 30 years; while longer terms may lower your monthly payments, they can also lead to higher overall interest costs over time.

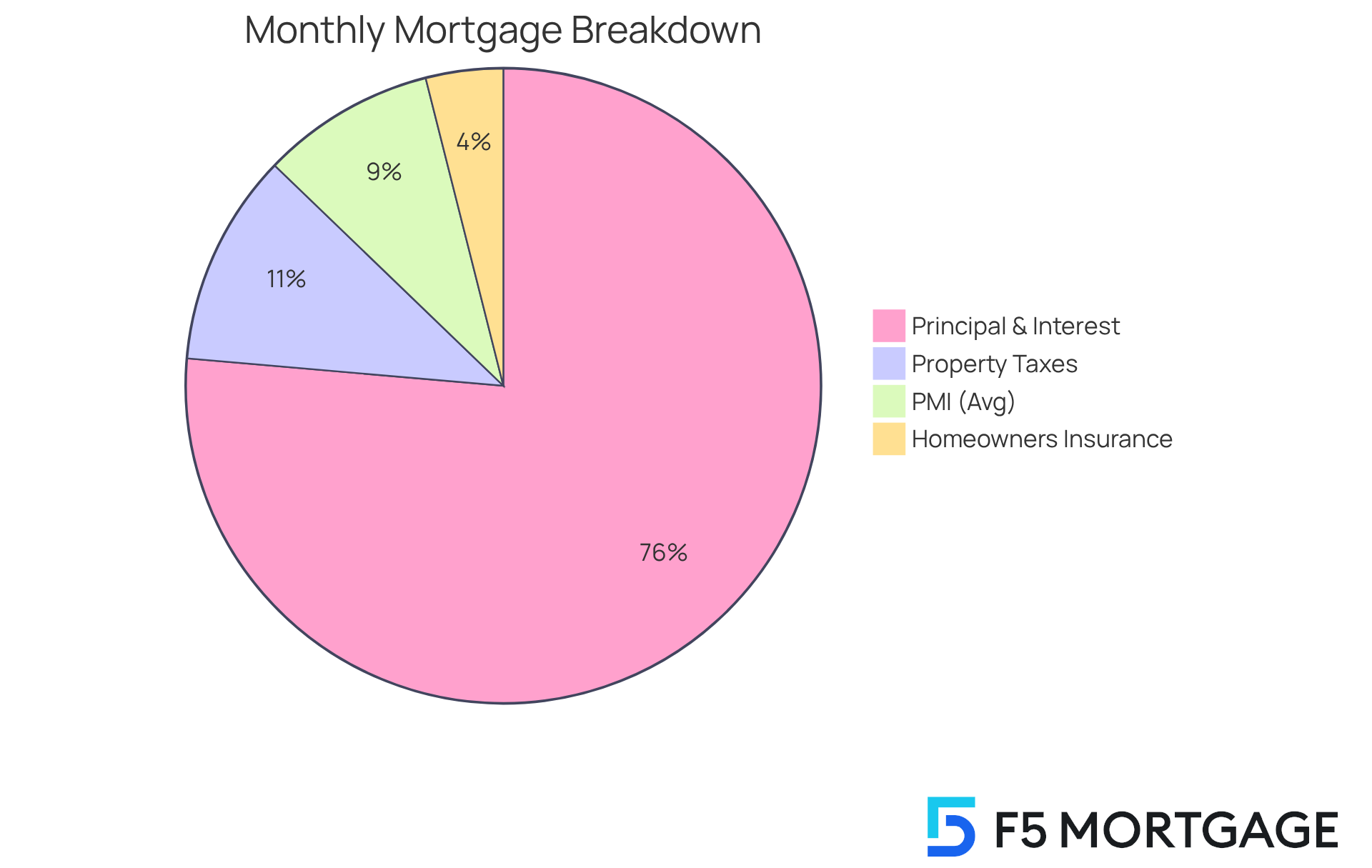

As we look ahead to 2025, the average interest rate for a 30-year fixed mortgage hovers around 6.7%. At this rate, the house payment on 300k would result in monthly payments of about $1,940 for principal and interest. But that’s not all – property taxes are another significant expense. In the U.S., the average effective property tax rate is about 1.1%, which translates to roughly $3,300 a year for a $300,000 home, or about $275 each month.

Homeowners insurance is also a crucial cost, averaging around $1,200 annually, which adds about $100 to your monthly expenses. If your down payment is less than 20%, you might need private mortgage insurance (PMI), which typically costs between 0.3% to 1.5% of the original loan amount each year. For a $300,000 loan, this could mean an additional $75 to $375 each month.

When considering these factors, it’s important to remember that the house payment on 300k can range from approximately $2,390 to $2,715, depending on property taxes, insurance, and PMI. Understanding the loan approval process is crucial; getting approved means a lender sees you as a suitable candidate for financing based on your financial situation, which can influence your loan options and overall financial plan.

We know how challenging this can be, but grasping these components is vital for accurately assessing your financial commitments. By doing so, you can make informed decisions throughout the home buying process, ensuring you feel confident every step of the way.

Factors Influencing Monthly Payments on a $300,000 Mortgage

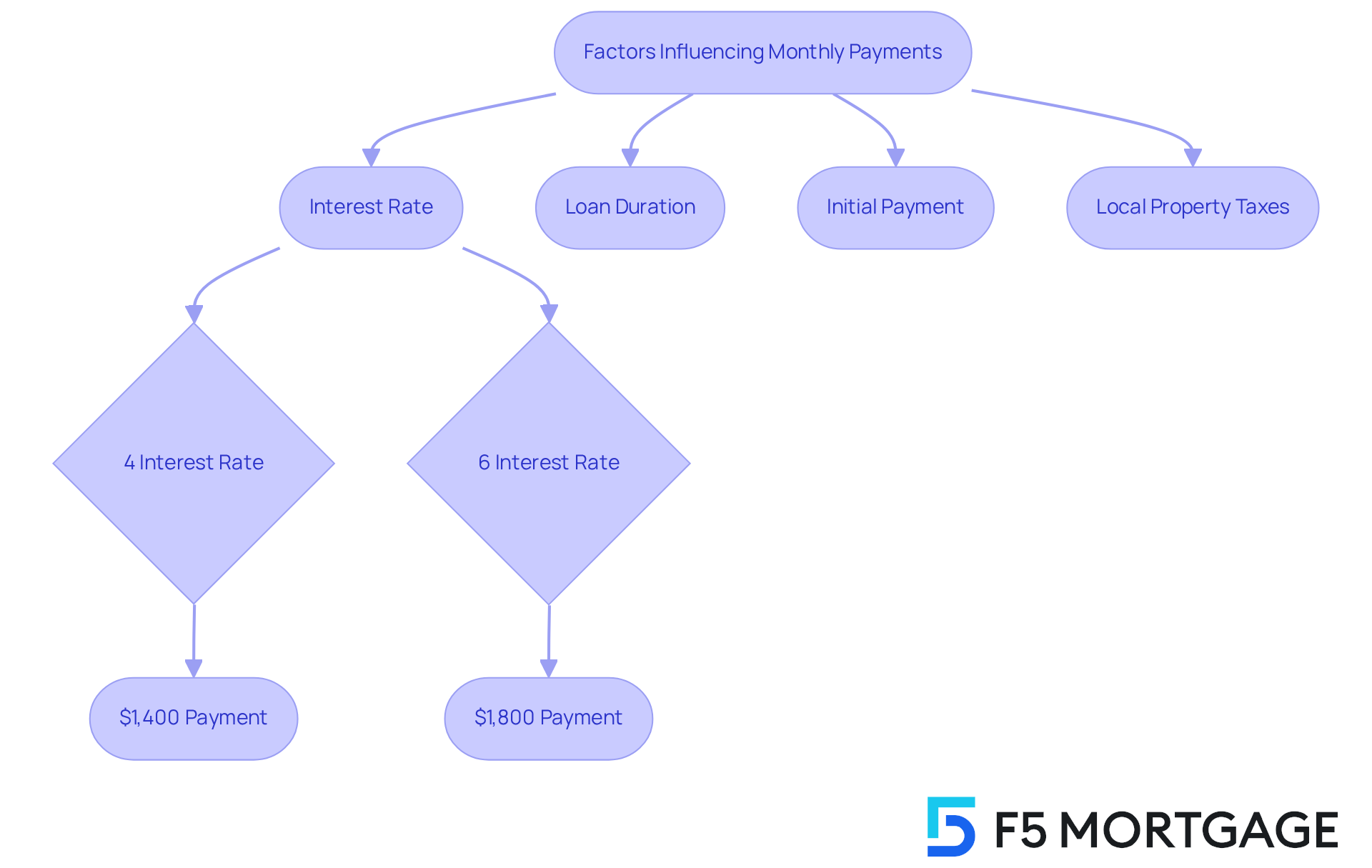

When it comes to the house payment on 300k, several key factors come into play. We know how challenging this can be, and understanding these elements can make a significant difference in your financial journey. The interest rate, loan duration, initial payment, and local property taxes all contribute to your monthly costs.

- A lower interest rate can greatly reduce your monthly payments. For instance, if you secure a 30-year fixed loan at a 4% interest rate with a 20% down payment, your house payment on 300k would be approximately $1,400.

- However, if the interest rate rises to 6%, the house payment on 300k could increase to approximately $1,800. This illustrates just how much interest rates can impact home loan affordability.

Additionally, local property tax rates can vary widely, further affecting your overall expenses. It’s essential to grasp these dynamics, as they empower you to make informed decisions about your loan options and financial commitments. Remember, we’re here to support you every step of the way.

Understanding Affordability: Income and Costs Associated with a $300,000 Mortgage

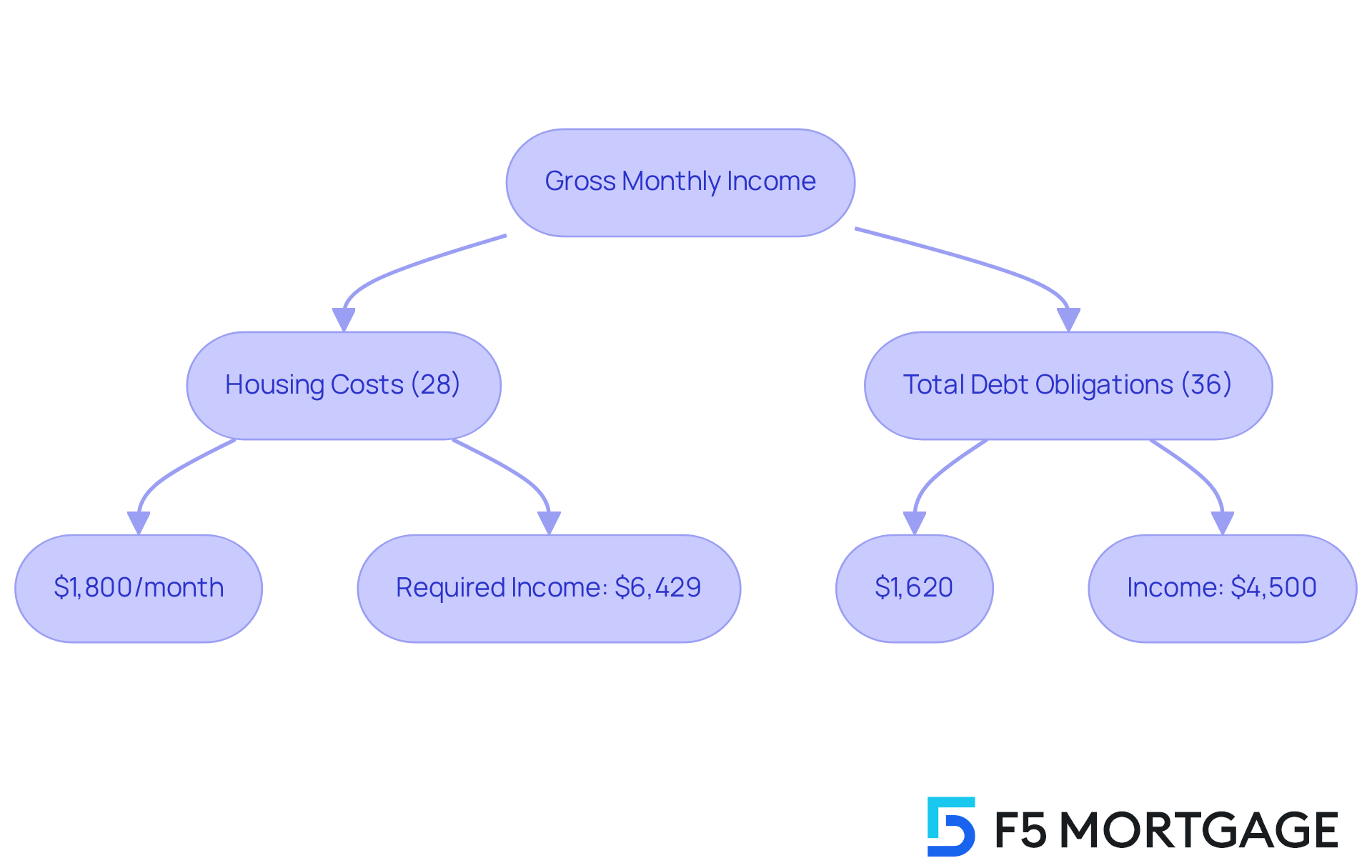

Understanding the house payment on 300k can feel overwhelming, but we’re here to support you every step of the way. Typically, lenders use the 28/36 rule, which suggests that no more than 28% of your gross income should go toward housing costs, while total debt obligations shouldn’t exceed 36%. For instance, if you’re looking at a loan where the house payment on 300k is estimated to be around $1,800 per month, you’d need a gross monthly income of at least $6,429. This guideline is a valuable resource for potential homeowners, helping you assess your financial capacity and the income needed to manage loan obligations alongside other debts.

As we look ahead to 2025, it’s important to note that many lenders may allow higher debt-to-income (DTI) ratios, especially for those with strong credit histories or larger down payments. Understanding these ratios is crucial, as they significantly impact your loan eligibility and interest rates. For example, a household earning a gross monthly income of $4,500 could afford total debt payments of about $1,620 under the 28/36 rule. This highlights the importance of budgeting and financial planning in your home-buying journey.

Real-life examples show that while the 28/36 rule offers a solid framework, everyone’s situation is unique. We know how challenging this can be, so it’s essential for homebuyers to consider their individual financial circumstances, including credit scores and existing debts. By doing so, you can make informed choices about your financing options, ensuring a smoother path to homeownership.

Navigating Mortgage Options: The Role of Independent Brokers in Securing a $300,000 Mortgage

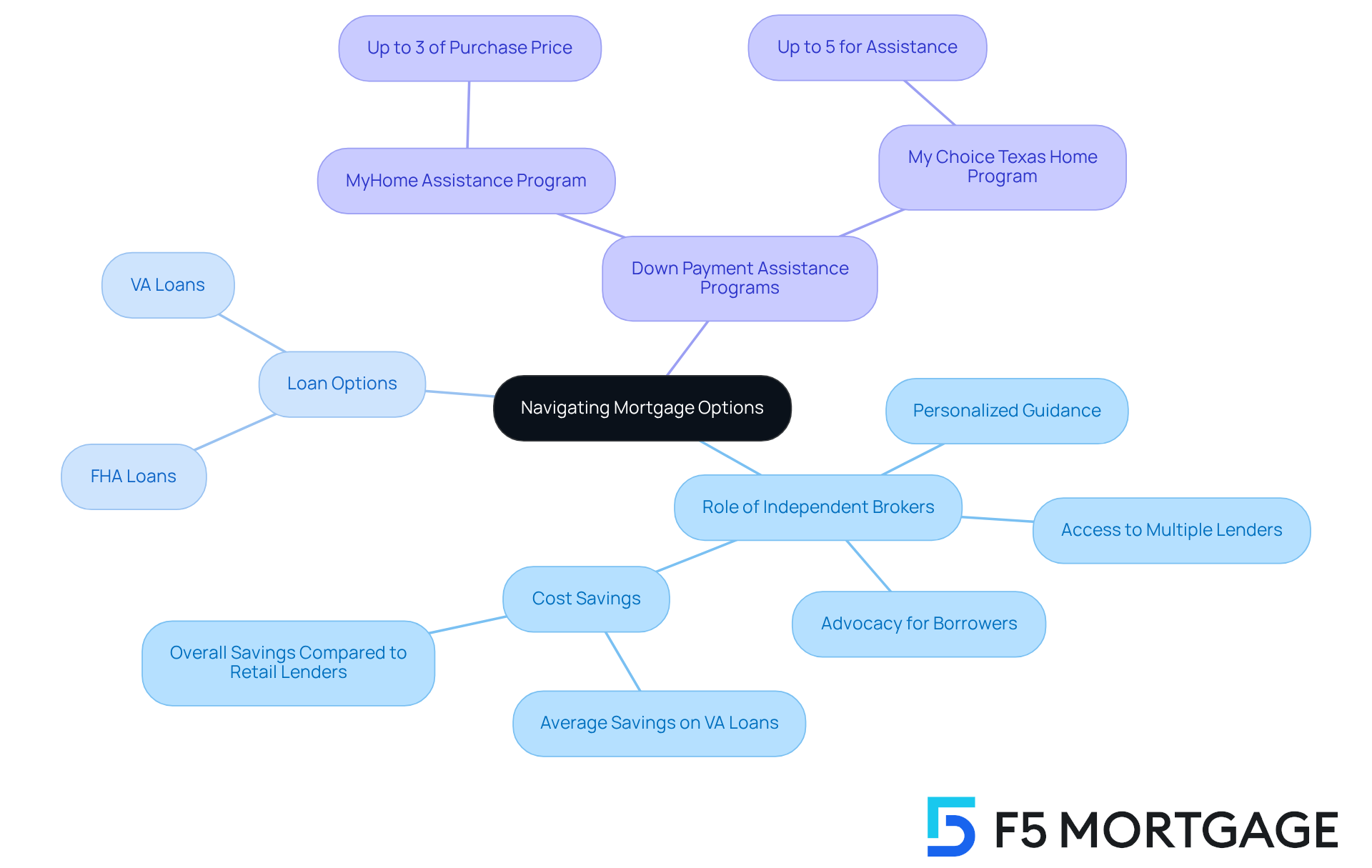

Securing a mortgage can feel overwhelming, especially when dealing with a house payment on 300k, but independent mortgage brokers are here to help. They provide personalized guidance and access to a wide range of loan options tailored to your unique needs. Unlike traditional lenders, brokers work on your behalf, leveraging their relationships with multiple lenders to find the best rates and terms for you.

This support is especially beneficial for families facing unique financial situations or those in search of specialized loan products. For example, an independent broker can assist you in navigating FHA or VA loans, which may offer favorable terms for eligible borrowers.

Additionally, F5 Mortgage offers various down payment assistance programs designed to ease your financial burden. The following programs are available:

- MyHome Assistance Program in California provides up to 3% of the home’s purchase price.

- My Choice Texas Home program offers up to 5% for down payment and closing assistance.

These options can make a significant difference in your home-buying journey.

By simplifying the mortgage process and advocating for your best interests, independent brokers enhance your overall experience, making it less daunting and more accessible. We know how challenging this can be, and clients have expressed their satisfaction with F5 Mortgage, highlighting the exceptional support they received throughout the process. This truly underscores the value of working with independent brokers who prioritize your needs.

Conclusion

Understanding the complexities of house payments on a $300,000 mortgage is crucial for anyone looking to buy a home. We know how challenging this can be, and by grasping the various components – like principal, interest rates, property taxes, and insurance – you can better prepare for the financial commitments that come with homeownership.

Throughout this discussion, we’ve highlighted key elements that affect your monthly payments. For instance, interest rates play a significant role, and local property tax rates can vary widely. It’s also important to assess your personal financial situation using guidelines like the 28/36 rule. Remember, you’re not alone in this journey; independent mortgage brokers can offer valuable expertise to simplify the mortgage process and provide tailored solutions that meet your unique needs.

Ultimately, gaining a comprehensive understanding of these factors empowers you to make informed decisions. We encourage you to seek professional guidance when necessary. As you embark on your journey toward homeownership, being proactive and educated about your mortgage options will pave the way for a smoother and more confident experience in securing that $300,000 mortgage.

Frequently Asked Questions

What is the principal amount in a mortgage?

The principal amount is the sum you borrow when taking out a mortgage.

How is the interest on a mortgage defined?

The interest represents the cost of borrowing, typically expressed as a percentage of the loan amount.

What are the common terms for mortgage loans?

Most mortgage loans come with terms of either 15 or 30 years.

How does the length of the mortgage term affect monthly payments?

Longer terms may lower your monthly payments but can lead to higher overall interest costs over time.

What is the average interest rate for a 30-year fixed mortgage as of 2025?

The average interest rate is around 6.7%.

How much would the monthly payments be for a $300,000 mortgage at this interest rate?

Monthly payments for principal and interest would be about $1,940.

What additional costs should be considered when calculating house payments?

Additional costs include property taxes, homeowners insurance, and potentially private mortgage insurance (PMI).

What is the average effective property tax rate in the U.S.?

The average effective property tax rate is about 1.1%.

How much would property taxes cost annually for a $300,000 home?

Property taxes would cost roughly $3,300 a year, or about $275 each month.

What is the average cost of homeowners insurance?

Homeowners insurance averages around $1,200 annually, adding about $100 to monthly expenses.

What is private mortgage insurance (PMI) and when is it needed?

PMI is required if your down payment is less than 20%, and it typically costs between 0.3% to 1.5% of the original loan amount each year.

How much could PMI add to the monthly payment for a $300,000 loan?

PMI could add an additional $75 to $375 each month.

What is the total estimated monthly payment range for a $300,000 mortgage?

The total estimated monthly payment can range from approximately $2,390 to $2,715, depending on property taxes, insurance, and PMI.

Why is understanding the loan approval process important?

Understanding the loan approval process is crucial because it indicates whether a lender sees you as a suitable candidate for financing, which can influence your loan options and overall financial plan.