Introduction

Homeowners often find themselves at a crossroads when it comes to financing major expenses, whether it’s a home renovation or education costs. We know how challenging this can be. A Home Equity Line of Credit (HELOC) offers a flexible solution, allowing families in Maryland to tap into their home’s equity and access funds as needed.

However, navigating the intricacies of HELOC rates can feel daunting. With varying factors like credit scores and market conditions influencing what lenders offer, it’s easy to feel overwhelmed. How can families ensure they secure the best rates while avoiding potential pitfalls in this financial landscape?

In this article, we’re here to support you every step of the way, guiding you through the process with understanding and expert advice.

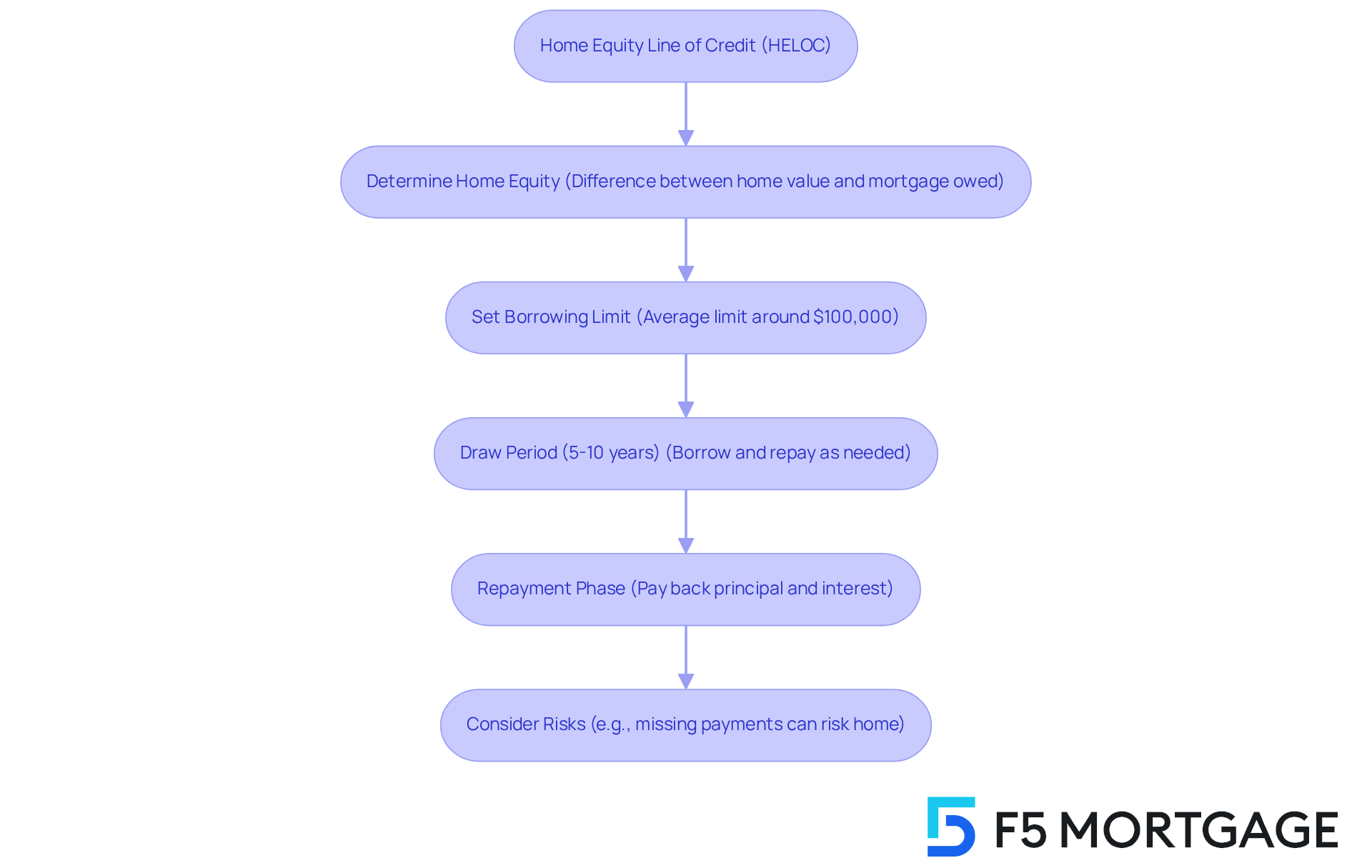

Define Home Equity Lines of Credit (HELOCs)

A Home Equity Line of Credit (HELOC) can be a lifeline for homeowners, allowing them to tap into the equity of their home. This equity is simply the difference between what your home is worth and what you still owe on your mortgage. Think of a HELOC like a credit card for your home; it lets you borrow money as you need it, up to a set limit. In Maryland, families can expect that HELOC rates Maryland will allow for an average borrowing limit of around $100,000 by 2025, providing significant access to funds for various needs.

Typically, HELOCs come with a draw period of 5 to 10 years. During this time, you can borrow and repay as needed. After this period, the repayment phase kicks in, where you’ll start paying back both the principal and interest. This structure offers families the flexibility to manage significant expenses, like home improvements or education costs, without the stress of a lump-sum loan. For example, imagine using a HELOC to cover your child’s college tuition, allowing you to spread out payments over time instead of facing a hefty upfront cost.

Financial advisors often highlight the advantages of HELOCs, especially the HELOC rates Maryland, which can be lower compared to other borrowing options. This makes them an attractive choice for families managing expenses. As one expert puts it, “HELOCs provide homeowners with the flexibility to manage their finances effectively, especially during major life events or unexpected expenses.”

However, it’s essential to be aware of the risks involved with HELOCs. Missing payments could put your home at risk, as it serves as collateral. To maximize the benefits of a HELOC, consider securing your mortgage terms with F5 Mortgage. This can protect you from market fluctuations during the processing period. Additionally, it’s wise to shop around with different lenders to compare rates, fees, and terms, ensuring you find the best fit for your needs. F5 Mortgage offers competitive pricing and personalized support, making it a great choice for families looking to leverage their home equity.

This flexibility, combined with the ability to access home equity, makes HELOCs a valuable resource for families seeking financial solutions. Keep in mind that the HELOC rates in Maryland typically vary by provider, currently ranging from about 6.15% to 8.65%, depending on the financial institution.

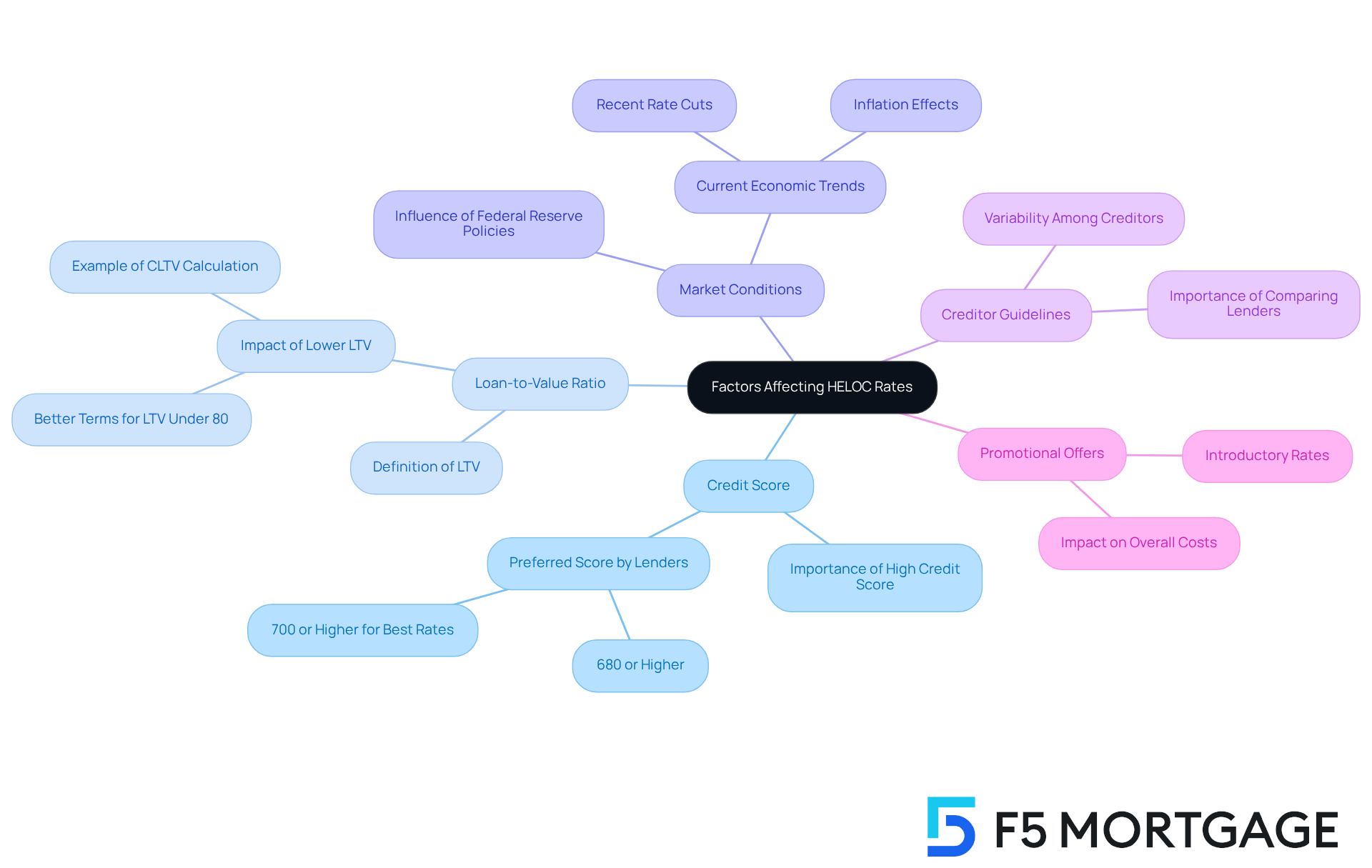

Explore Factors Affecting HELOC Rates

Understanding the factors that influence HELOC rates can feel overwhelming, especially for families navigating their financial options. In Maryland, several key elements play a significant role in determining HELOC rates, and we’re here to help you make sense of them.

Credit Score: Your credit score is a crucial factor. Generally, a higher score leads to lower interest rates. Lenders view borrowers with strong credit histories as less risky, which means they’re more likely to offer favorable terms. Keeping your credit score at 680 or above is essential for securing good HELOC terms, with many lenders favoring scores of 700 or higher. We know how challenging it can be to maintain a strong credit score, but it’s worth the effort.

Loan-to-Value Ratio (LTV): The loan-to-value ratio compares your loan amount to your property’s assessed value. A lower LTV indicates more equity in your home, which can lead to better terms. For instance, if your home is worth $500,000 and you have a $300,000 loan, pursuing a $120,000 HELOC would give you a CLTV of 84%. Borrowers with LTV ratios under 80% often receive the best deals. This is a great opportunity to leverage your home’s value.

Market Conditions: Economic factors, such as the Federal Reserve’s interest policies and inflation, significantly impact lending costs. Recent reductions by the Fed have started to lower home equity expenses, which can directly affect your loan terms. As the prime interest rate shifts, HELOC costs often adjust accordingly. Staying informed about these changes can empower you to make better financial decisions.

Creditor Guidelines: Different creditors have varying criteria and pricing frameworks. This makes it essential for you to compare options to find the most favorable terms. Some financial institutions may offer better conditions based on their assessment of your economic profile, including your credit score and debt-to-income ratio. We encourage you to shop around and find the best fit for your needs.

Promotional Offers: Some lenders provide introductory rates that are lower for a limited time, which can be a great way to minimize initial costs. These offers can significantly impact the overall affordability of a home equity line of credit, especially if you’re planning renovations or consolidating debts. It’s worth exploring these options to see how they can benefit you.

By understanding these factors, you can make informed choices when considering a line of credit. We’re here to support you every step of the way, ensuring you utilize your equity efficiently.

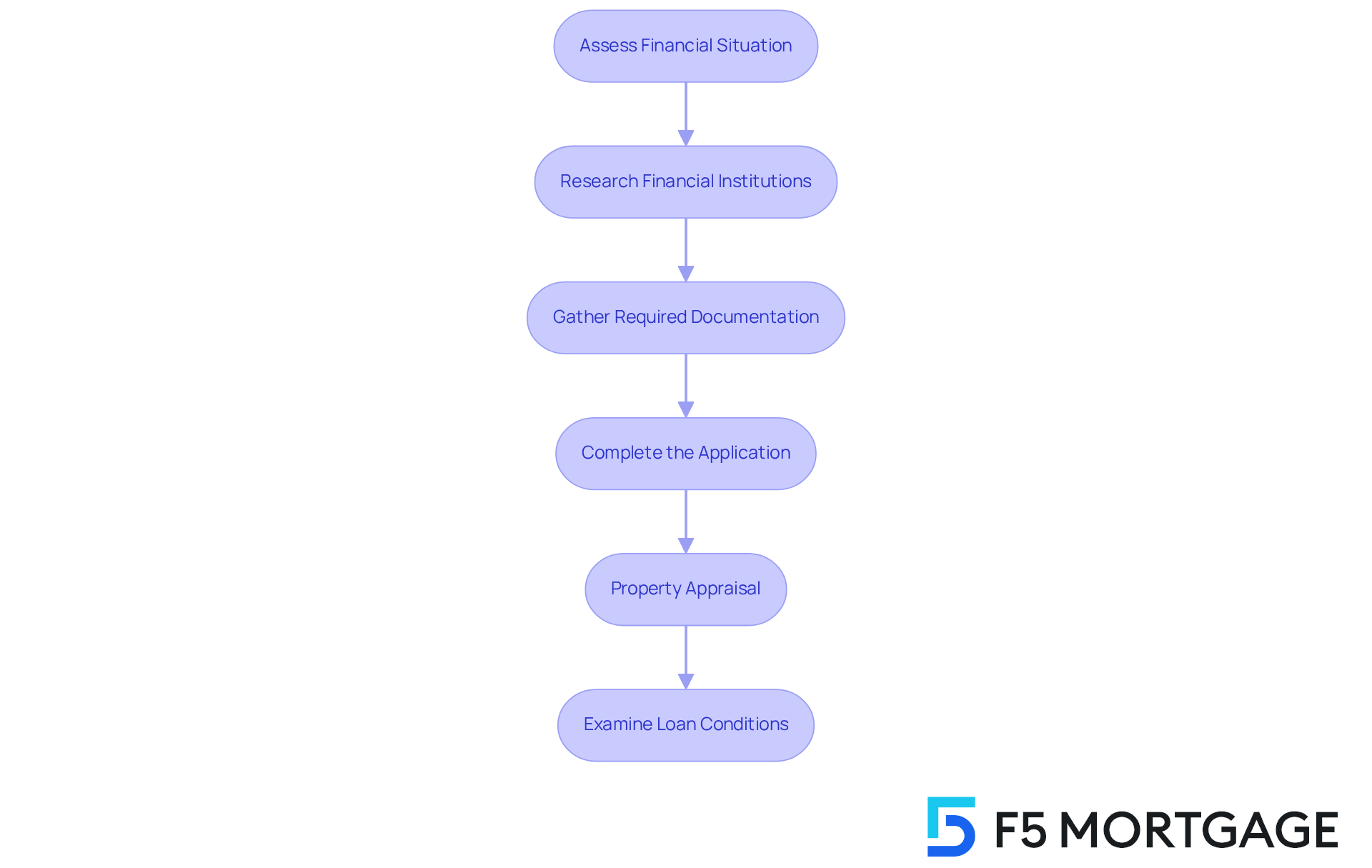

Guide to Applying for a HELOC

Applying for a Home Equity Line of Credit (HELOC) can feel overwhelming, but breaking it down into manageable steps can make the process smoother and increase your chances of approval. We know how challenging this can be, so let’s walk through it together.

Assess Your Financial Situation: Start by taking a close look at your credit score, debt-to-income (DTI) ratio, and the equity in your home. Most lenders prefer a DTI under 43% and an LTV ratio of 80% or less. Understanding these factors can significantly impact your eligibility and the HELOC rates in Maryland that you might qualify for.

Research Financial Institutions: It’s important to compare different providers to find the best HELOC rates in Maryland and terms. Look for institutions that offer competitive HELOC rates in Maryland, low fees, and flexible repayment plans. Engaging with various lenders can reveal better offers tailored to your financial situation.

Gather Required Documentation: Prepare the necessary documents to support your application. Common requirements include proof of income, such as pay stubs and tax returns, current mortgage statements, and property-related information like appraisals and tax assessments. Having these documents ready shows your seriousness and financial preparedness to lenders.

Complete the Application: Fill out the application form carefully, ensuring all information is accurate. Be ready for a hard credit inquiry, which might temporarily affect your credit score. Providing thorough and precise information can help speed up the approval process.

Property Appraisal: The lender may need an appraisal to assess your home’s current market value, which will determine your borrowing limit. On average, a home appraisal costs around $357, and this step is vital for establishing the equity available for your HELOC.

Examine Loan Conditions: Once approved, take the time to review the loan conditions, including HELOC rates in Maryland, as well as fees and repayment schedules. Understanding these details is crucial to avoid unexpected issues later on, especially regarding fluctuating interest costs and potential prepayment penalties. Don’t hesitate to ask questions if anything is unclear before signing the agreement.

By following these steps and being well-prepared, families can navigate the HELOC application process more effectively. Remember, we’re here to support you every step of the way, helping you make informed decisions that align with your financial goals.

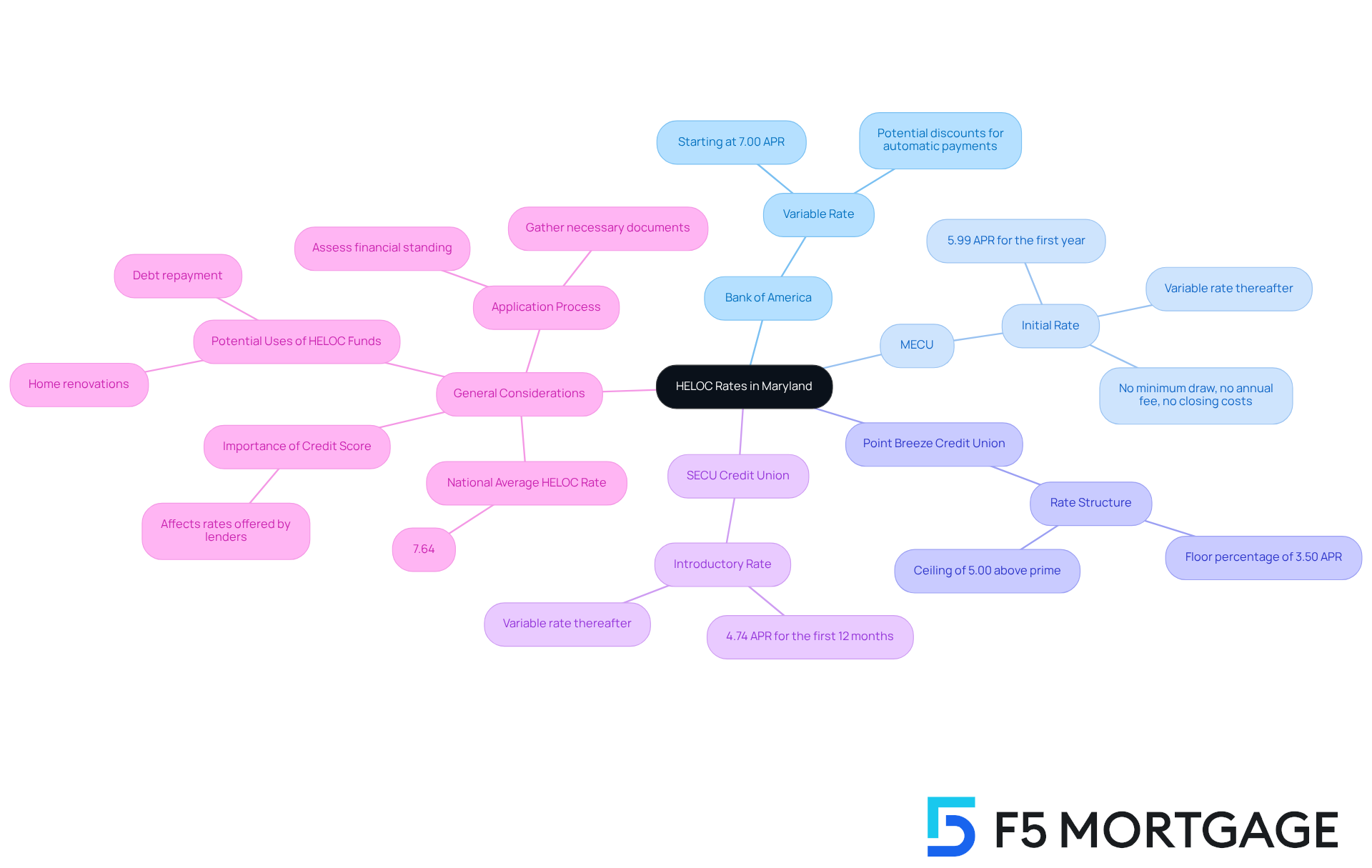

Compare Current HELOC Rates in Maryland

As of November 2025, families in Maryland exploring heloc rates maryland will find a variety of options among lenders. Understanding these differences can be crucial in making the right choice for your financial needs. Here are some notable current rates:

- Bank of America: Offers variable rates starting around 7.00% APR, with potential discounts available for automatic payments.

- MECU: Provides an appealing initial rate of 5.99% APR for the first year, transitioning to a variable rate afterward. Plus, MECU has no minimum draw, no annual fee, and no closing costs, making it a great option for many borrowers.

- Point Breeze Credit Union: Lists a floor percentage of 3.50% APR, with a ceiling of 5.00% above the prime value at the time of application.

- SECU Credit Union: Offers an introductory rate of 4.74% APR for the first 12 months, followed by a variable rate.

When evaluating these figures, it’s essential to consider not just the APR but also any related charges, like closing costs or annual fees. These can significantly impact the total cost of borrowing. We know how challenging this can be, and keeping a high credit score is crucial for securing favorable HELOC rates in Maryland, as it directly affects the rates lenders offer.

Currently, the national average home equity line of credit rate stands at 7.64%. This serves as a helpful benchmark for assessing the rates listed above. For families seeking a HELOC, understanding these nuances is vital. There are potential tax benefits when using this credit for home renovations, and it can also be a smart option for debt repayment.

Moreover, being aware of the application process for a HELOC is critical. This knowledge empowers potential borrowers to navigate their options effectively. Remember, we’re here to support you every step of the way as you explore these financial opportunities.

Conclusion

A Home Equity Line of Credit (HELOC) can be a valuable resource for families, offering them the chance to tap into their home equity for various needs. We understand how important it is to make informed decisions, especially when it comes to finances. This guide has shed light on the essential aspects of HELOCs, from their structure to the application process, ensuring families in Maryland feel empowered to navigate their options.

Throughout this article, we’ve explored the critical factors that influence HELOC rates, such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

By understanding how these elements interact, families can position themselves to secure favorable borrowing terms. Remember, comparing current HELOC rates in Maryland is crucial; shopping around can lead to the best options available.

Ultimately, leveraging a HELOC can provide families with the financial flexibility they need during significant life events or unexpected expenses. As you consider this option, staying informed and proactive in your financial planning will empower you to make choices that enhance your overall financial health and well-being. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against the equity in their home, which is the difference between the home’s value and the remaining mortgage balance. It functions similarly to a credit card, letting you borrow money as needed up to a set limit.

What is the average borrowing limit for HELOCs in Maryland by 2025?

Families in Maryland can expect an average borrowing limit of around $100,000 for HELOCs by 2025.

How long is the draw period for a HELOC?

The draw period for a HELOC typically lasts between 5 to 10 years, during which you can borrow and repay as needed.

What happens after the draw period ends?

After the draw period, the repayment phase begins, requiring you to start paying back both the principal and interest.

What are some common uses for a HELOC?

HELOCs can be used for various expenses, such as home improvements or education costs, allowing homeowners to manage significant expenses without a lump-sum loan.

Why are HELOCs considered an attractive borrowing option?

HELOCs often have lower rates compared to other borrowing options, making them appealing for families managing expenses.

What risks are associated with HELOCs?

Missing payments on a HELOC can put your home at risk since the home serves as collateral for the loan.

How can homeowners protect themselves when using a HELOC?

Homeowners can protect themselves by securing favorable mortgage terms and shopping around with different lenders to compare rates, fees, and terms.

What are the current HELOC rates in Maryland?

HELOC rates in Maryland typically range from about 6.15% to 8.65%, depending on the financial institution.