Overview

Are you feeling uncertain about how HELOC (Home Equity Line of Credit) interest rates work? We understand how challenging it can be to navigate financial decisions, especially when it comes to your home. This article delves into the intricacies of HELOC interest rates, which are primarily variable and influenced by factors such as the prime interest rate and personal credit scores.

Currently, these rates average around 8.12%, making them a competitive option for financing home renovations or consolidating debt. By exploring this information, we hope to empower you with the knowledge you need to make informed choices. Remember, we’re here to support you every step of the way as you consider your financial options.

Introduction

Understanding the nuances of Home Equity Lines of Credit (HELOCs) is essential for homeowners seeking financial flexibility. We know how challenging it can be to navigate these options. As property values rise and mortgage balances decrease, tapping into home equity can provide a lifeline for major expenses, from renovations to education costs.

However, the variable nature of HELOC interest rates can create uncertainty. Many homeowners wonder how these rates are determined and what implications they hold for their financial future.

What should you consider when navigating this complex landscape of borrowing against your own equity? We’re here to support you every step of the way.

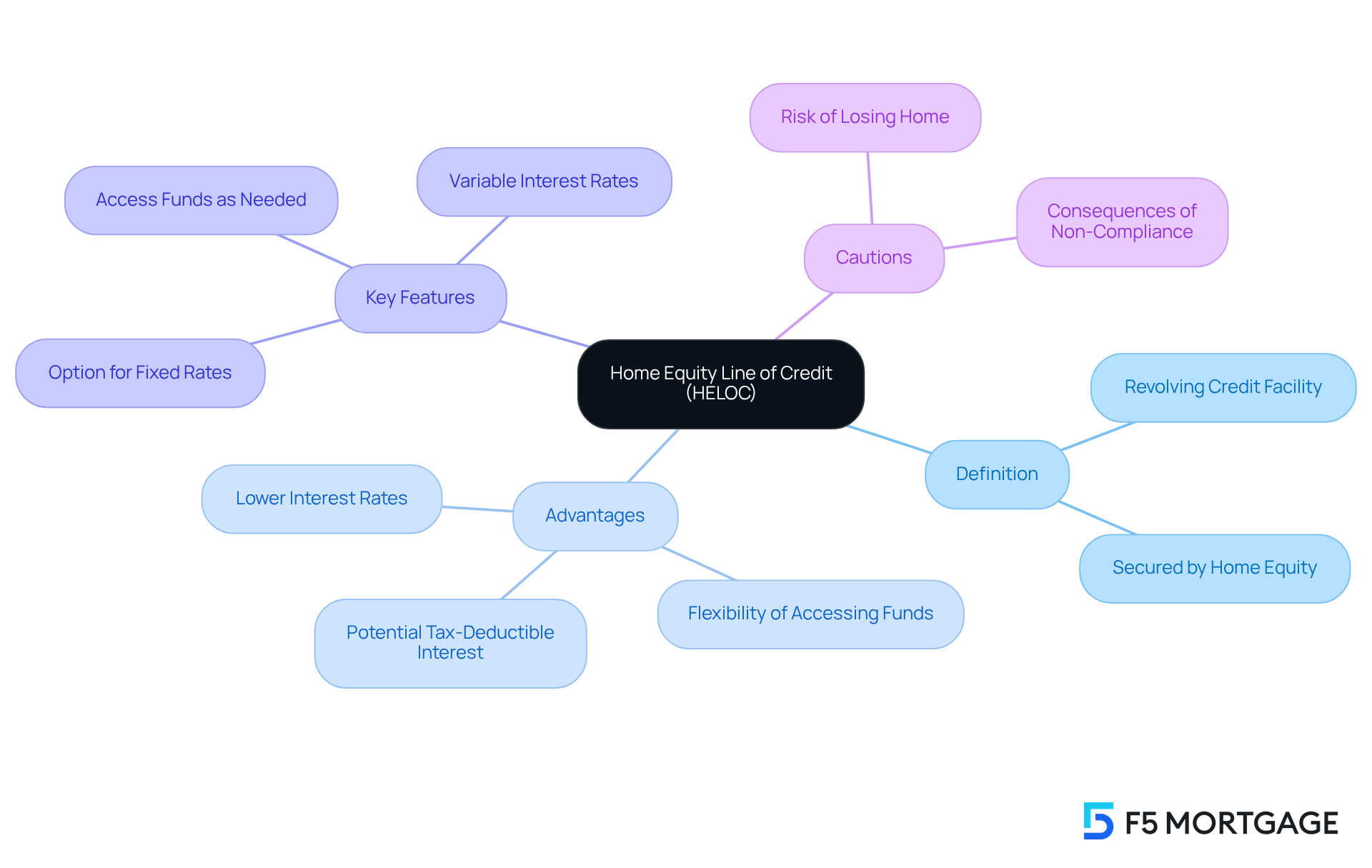

Define Home Equity Line of Credit (HELOC)

A (HELOC) is a revolving credit facility secured by the equity in your residence. We understand how challenging it can be to navigate , especially when it comes to your home. As you pay down your mortgage and your property appreciates in value, you build equity that can be borrowed against. Unlike a , which provides a lump sum, a HELOC allows you to access funds as needed, much like a credit card. This flexibility makes it a compelling choice for homeowners looking to finance significant expenses, such as renovations or education costs, while only paying interest on the amount you use.

In 2025, many homeowners are turning to , and it’s easy to see why. They offer advantages like and the ability to borrow against the equity you’ve built in your home. Presently, the is around 8.25 percent, making it a competitive option for financing. Key features of HELOCs include:

- Variable interest rates

- The option to switch to fixed rates

- when used for

However, it’s essential to be cautious. Failing to meet your obligations on a line of credit can have serious consequences, including the risk of losing your home. As financial analyst Stephen Kates wisely notes, “A line of credit secured by property .” This makes it a strategic option for managing expenses while utilizing your equity. Remember, we’re here to support you every step of the way as you explore your financial options.

Explain How HELOCs Work

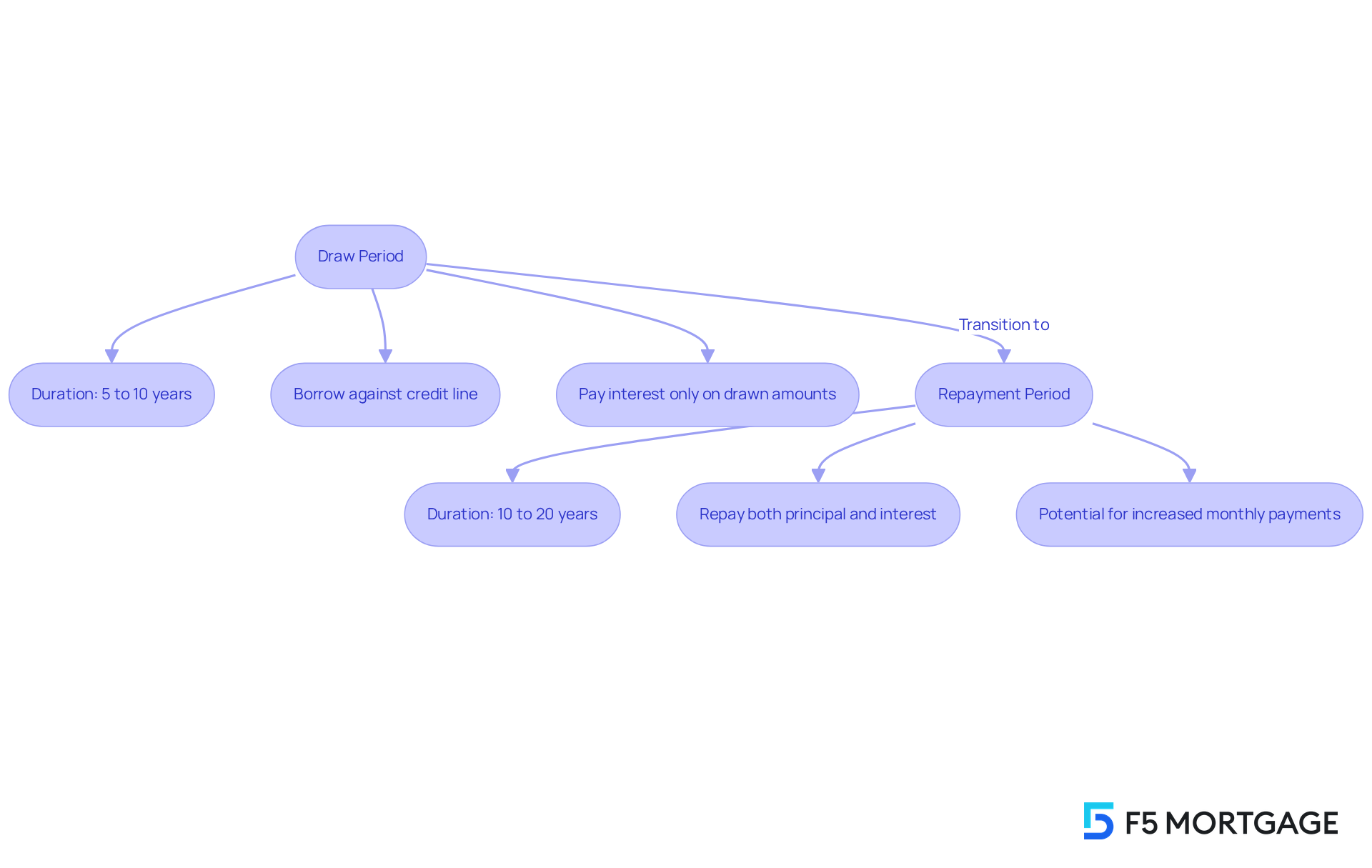

HELOCs, or Lines of Credit, operate in two main phases: the and the . We understand how important it is to effectively, so let’s break this down together.

During the draw period, which typically lasts 5 to 10 years, you can borrow against your credit line up to a predetermined limit. This means you only pay interest on the amount you draw, making it a cost-effective option for managing your expenses. It’s a helpful tool when you need extra funds for home improvements or .

After the draw period ends, the repayment period begins, usually lasting 10 to 20 years. During this time, you will start repaying both the principal and interest. It’s essential to be prepared, as this can lead to significantly higher monthly payments. We know how challenging this can be, and is crucial for effective .

Additionally, it’s important to note that the often has . This means your payments can change based on market conditions, which can add to your financial considerations. We’re here to support you every step of the way as you navigate these decisions.

Discuss the Interest Rates Associated with HELOCs

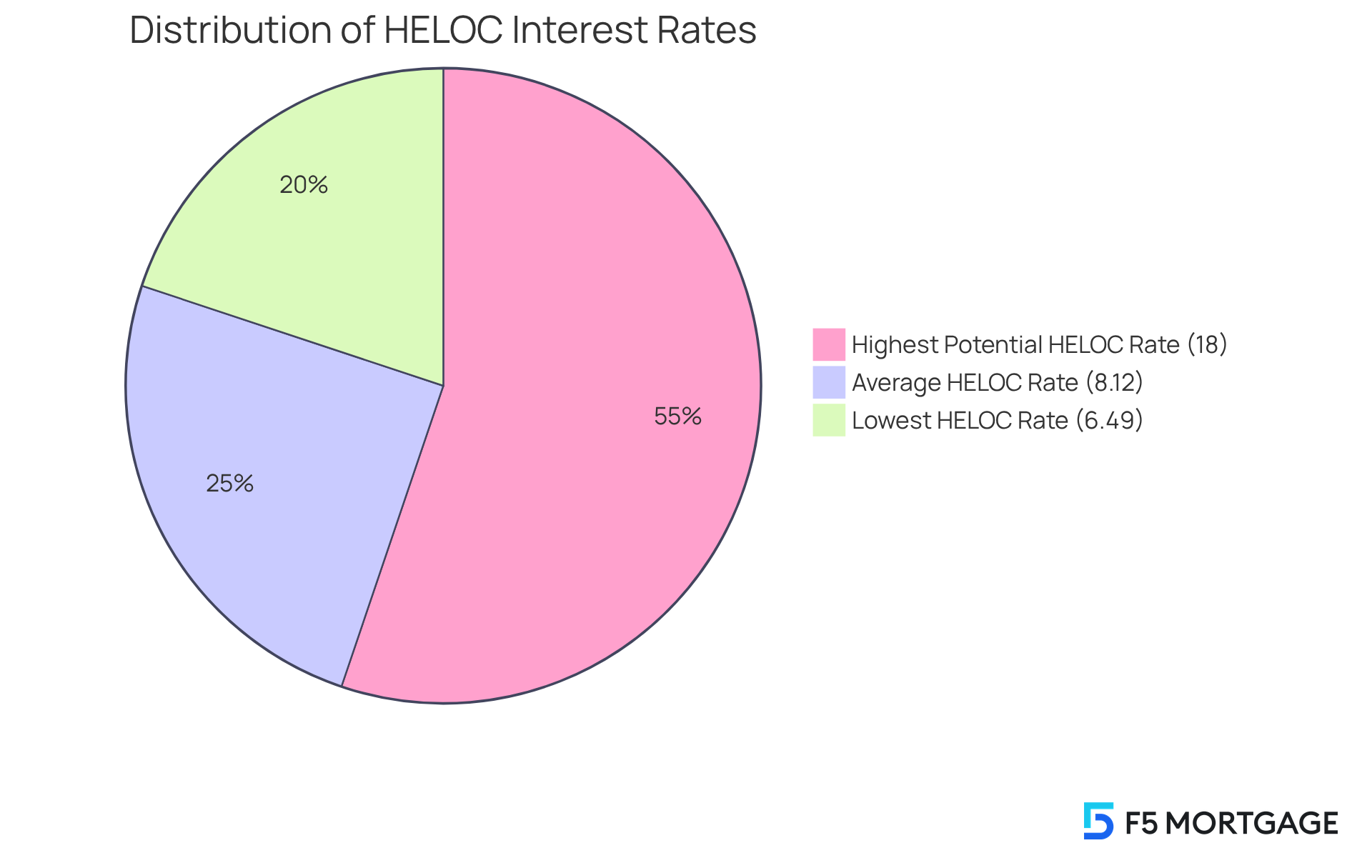

Navigating the can feel overwhelming, but understanding the can empower you. These interest levels are primarily variable and influenced by important elements like the prime interest rate, , and the amount of equity you hold in your home. Lenders typically set the HELOC interest rate as a margin above the prime rate, which is currently at 7.50%, and this often serves as the benchmark for rates. For instance, if a lender adds a 1% margin, you might see an interest rate around 8.50%.

As of July 2025, the average HELOC interest rate is hovering around 8.12%. However, it’s essential to recognize that the heloc interest rate can fluctuate significantly based on individual circumstances, ranging from nearly 7% to as high as 18%, depending on your creditworthiness and lender policies. We know how challenging this can be, as these dynamics directly affect your monthly payments and the overall cost of borrowing.

We encourage homeowners to to secure the most . This proactive approach can lead to over time. Additionally, with the , now is a great time to investigate home equity line of credit alternatives while keeping a low primary mortgage rate.

Importantly, FourLeaf Credit Union is currently offering a HELOC interest rate of 6.49% for the first 12 months on amounts up to $500,000, showcasing the available in the market. Furthermore, did you know that the if used for IRS-eligible repairs and renovations? This adds another layer of financial benefit for homeowners, and we’re here to support you every step of the way.

Identify Common Uses for a HELOC

Homeowners often turn to Home Equity Lines of Credit (HELOCs) for a variety of reasons, with being among the most common. We understand how important it is to manage unexpected costs, and the inherent allows you to borrow only what you need, when you need it. This makes it an ideal solution for tackling . For instance, if you’re planning a kitchen remodel, you can draw funds incrementally throughout the project instead of securing a large lump sum loan. This adaptability not only supports effective financial planning but also helps that come with renovations.

To qualify for a HELOC, lenders typically require homeowners to have at least 15-20% equity in their homes. We know that many property owners are opting for renovations rather than purchasing new homes, with renovations costing on average $49,000 less than buying a new property. Additionally, expanding an existing home is $79,000 more affordable. It’s encouraging to see that 60% of millennial homeowners and 56% of Gen Z homeowners plan to remodel or renovate this year, reflecting a growing trend towards enhancing their current living spaces.

Moreover, HELOCs can be a strategic tool for debt consolidation, allowing homeowners to combine high-interest debts into a single, lower-interest payment. With the at approximately 7.8%, this option can be a cost-effective choice for many families. This approach not only simplifies financial management but also contributes to overall financial stability. However, it’s essential to recognize that using a HELOC comes with risks, as it leverages the property as collateral, which could lead to foreclosure if the loan is not repaid. By , homeowners can effectively fund renovations and manage unexpected expenses, making HELOCs a versatile financial resource that we’re here to support you with every step of the way.

Conclusion

A Home Equity Line of Credit (HELOC) offers homeowners a flexible financial solution by allowing them to borrow against the equity in their homes. This unique credit facility not only provides access to funds as needed but also comes with competitive interest rates. This makes it an attractive option for managing significant expenses. Understanding how HELOCs function, particularly the draw and repayment phases, is crucial for effective financial planning and ensuring responsible borrowing.

We know how challenging financial decisions can be. Throughout the article, we presented key insights regarding the workings of HELOCs, including the variable interest rates influenced by factors like the prime interest rate and personal credit scores. The potential uses of HELOCs, such as home renovations and debt consolidation, highlight their versatility as a financial tool. Additionally, the importance of comparing offers from various lenders to secure favorable terms was emphasized. This can lead to significant savings over time.

Ultimately, understanding HELOCs empowers homeowners to make informed financial decisions. By leveraging the equity built in their homes, individuals can effectively manage unexpected costs and enhance their living spaces. As the landscape of interest rates continues to evolve, exploring HELOC options can unlock valuable opportunities for financial growth and stability. We’re here to support you every step of the way as you navigate these important choices.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a revolving credit facility secured by the equity in your residence, allowing you to borrow against the equity you have built in your home.

How does a HELOC differ from a conventional equity loan?

Unlike a conventional equity loan, which provides a lump sum, a HELOC allows you to access funds as needed, similar to a credit card, meaning you only pay interest on the amount you use.

What are some advantages of using a HELOC?

Advantages of a HELOC include lower interest rates compared to personal loans, the ability to borrow against your home equity, and potential tax-deductible interest when used for home improvements.

What is the current interest rate for HELOCs?

The current interest rate for HELOCs is around 8.25 percent.

What are the key features of a HELOC?

Key features of HELOCs include variable interest rates, the option to switch to fixed rates, and the potential for tax-deductible interest when used for home improvements.

What should homeowners be cautious about when using a HELOC?

Homeowners should be cautious as failing to meet obligations on a line of credit can lead to serious consequences, including the risk of losing their home.

How can a HELOC provide flexibility for managing expenses?

A HELOC provides greater flexibility regarding when and how much you withdraw, making it a strategic option for managing expenses while utilizing your home equity.