Overview

This article aims to help you understand Fixed Rate HELOCs (Home Equity Lines of Credit) by outlining their benefits, application process, and common misconceptions.

We know how challenging navigating financial options can be, and we’re here to support you every step of the way.

Fixed Rate HELOCs offer predictable payments and provide access to your home equity for various financial needs.

By debunking myths about their use and flexibility, we emphasize their value as a financial tool for homeowners.

This understanding can empower you to make informed decisions about your financial future.

Introduction

Navigating the world of home financing can feel like traversing a maze of options and variables. We understand how overwhelming this can be, especially when it comes to leveraging home equity. Among these options, a fixed rate HELOC stands out as a strategic tool. It offers homeowners the ability to borrow against their property’s equity with the assurance of stable monthly payments.

In this article, we will explore the multifaceted benefits of fixed rate HELOCs. We will outline the application process while dispelling common myths that may cloud your understanding. With so many misconceptions in the air, we want to help you confidently determine if a fixed rate HELOC is the right choice for your financial journey.

Define Fixed Rate HELOCs and Their Purpose

A is a valuable loan option for property owners, as it allows them to at a consistent . Unlike traditional HELOCs, which often come with fluctuating interest rates, a [fixed rate HELOC](https://f5mortgage.com/7-key-benefits-of-fixed-rate-helo-cs-for-homeowners) ensures . This predictability can be incredibly comforting for those navigating .

Imagine wanting to renovate your home, consolidate debt, or make a significant purchase. A fixed rate heloc can be especially beneficial in these situations, providing you’ve built in your home. Often, borrowers find that they can secure compared to unsecured loans, making long-term HELOCs an appealing choice.

As we look toward 2025, the average interest rate for a is around 8.27%. This reflects a competitive option for those wishing to utilize their property equity effectively. We understand how challenging it can be to make financial decisions, and we’re here to in exploring your options.

Explore Benefits of Fixed Rate HELOCs

- Predictable Payments: We understand how important it is for families to manage their budgets effectively. provide the advantage of knowing your monthly payments in advance, which is crucial for . This predictability can be a lifeline for families facing tight financial situations, allowing them to plan their expenses without the stress of fluctuating rates.

- : Homeowners can tap into their property’s equity through a Constant Interest HELOC without needing to refinance their entire mortgage. This flexibility empowers them to access funds for various needs while keeping intact, giving them peace of mind.

- : Standard HELOCs typically offer lower interest rates compared to personal loans or credit cards, making them a more economical borrowing option. This can lead to significant savings over time, especially when larger amounts are withdrawn against home equity, easing financial burdens.

- : The interest paid on a set interest might be tax-deductible, depending on how the funds are used. This potential tax relief can enhance the financial benefits of this borrowing option, providing families with additional support.

- The funds from a fixed rate HELOC can be used for a variety of purposes, such as home renovations, educational expenses, or consolidating higher-interest debt. This versatility makes it an invaluable striving to improve their financial situation.

- : At F5 Mortgage, we are dedicated to providing throughout the refinancing process. Our caring team is committed to ensuring that families receive the guidance they need to make informed financial decisions, streamlining the process and enhancing your overall experience. We know how challenging this can be, and we’re here to support you every step of the way.

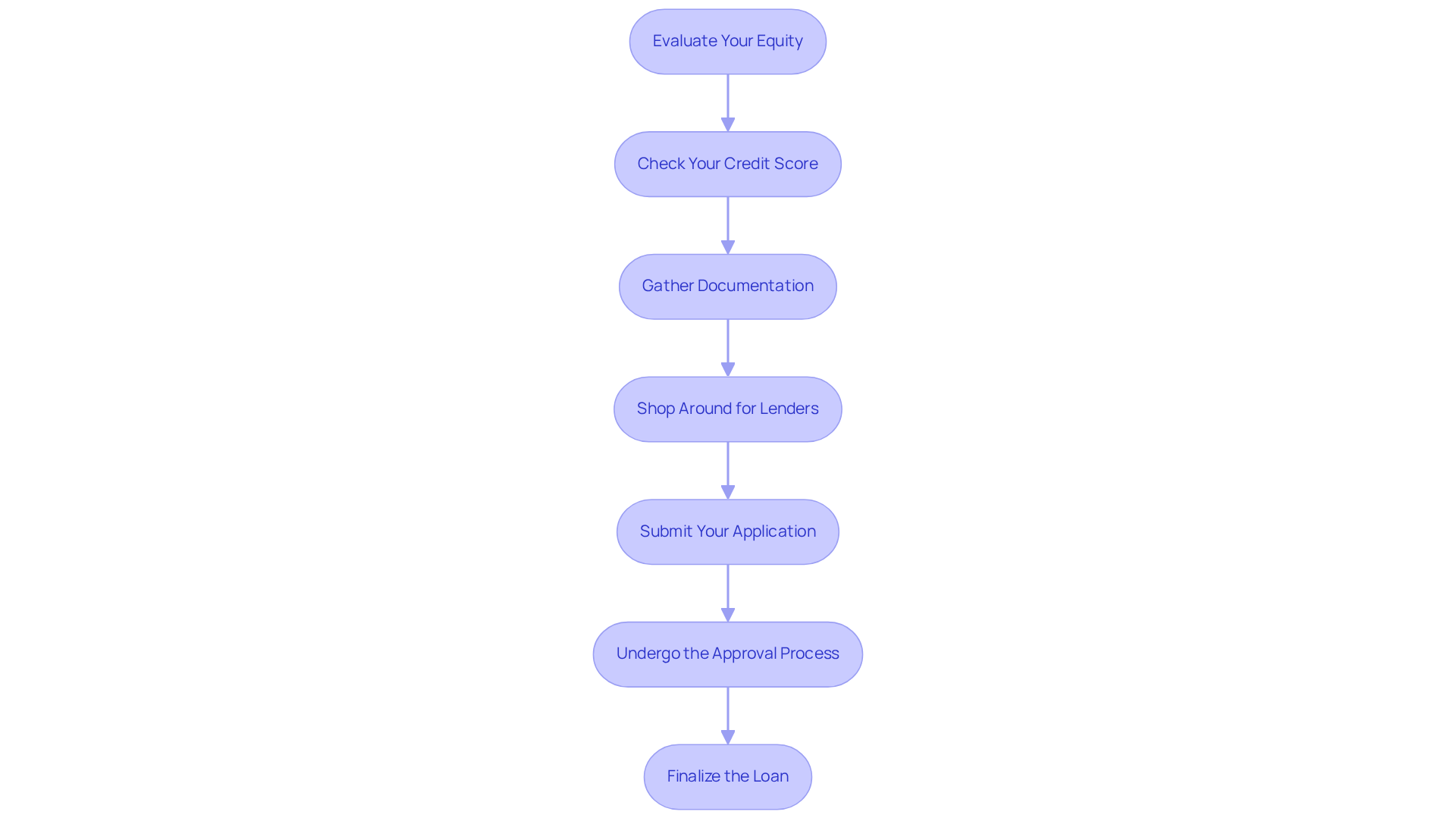

Outline the Application Process for Fixed Rate HELOCs

- : We understand that can feel overwhelming. Start by subtracting your outstanding mortgage balance from your residence’s current market value. For instance, if your property is appraised at $400,000 and you owe $150,000, you have $250,000 in equity. This equity can be a valuable resource for a , helping you achieve your financial goals.

- Check your : A solid credit score is crucial for securing favorable terms on a . We encourage you to review your credit report for accuracy and correct any discrepancies. To enhance your creditworthiness, order a copy of your credit report to check for errors. Consider paying down existing debts to lower your debt-to-income ratio, and remember to use credit wisely by avoiding large purchases and making timely payments.

- Gather Documentation: Preparing essential documents can alleviate stress during the . Compile proof of income, tax returns, and details about your existing mortgage. This preparation will help you feel more organized and ready.

- : Exploring various lenders can be a key step in finding the best rates and terms for your situation. As an independent broker, , ensuring you have access to competitive options tailored to your financial needs.

- Submit Your Application: When you’re ready, complete the application with your chosen lender. Be sure to include all required documentation to avoid any delays—this step can make a significant difference in your experience.

- Undergo the : We know how important this stage is. The lender will evaluate your application and assess your creditworthiness. They will determine the amount you can borrow based on your equity and financial profile, providing you with clarity on your options.

- : Once approved, you’ll complete the loan terms and close the HELOC. This step grants you access to your funds, which can be used for renovations or other financial needs. Remember, we’re here to support you every step of the way.

Clarify Common Misconceptions and FAQs About Fixed Rate HELOCs

- Myth: Unchanging Interest HELOCs are the Same as : While it’s true that both involve borrowing against property equity, Unchanging Interest HELOCs offer greater . Unlike conventional mortgages, which have set payment plans, empower homeowners to access funds as needed, making them a versatile financial resource.

- Myth: You Can Only Use HELOC Funds for Property Enhancements: Many people believe that funds from a can only be used for property renovations. However, the reality is that these funds can serve a multitude of purposes. Homeowners often tap into these resources for education expenses, debt consolidation, or even unexpected medical bills, showcasing the true flexibility of this borrowing option.

- FAQ: What Happens if I Sell My Home? When you decide to sell your home, it’s important to remember that the outstanding balance on your must be settled at closing. This process is similar to any other mortgage, ensuring that the lender is repaid before the property changes ownership.

- FAQ: Is it possible to change a variable interest home equity line of credit to a constant interest rate? Many lenders offer the option to . However, this can vary by lender and may involve additional charges. It’s always a good idea to check with your lender for specific terms and conditions that apply to your situation.

- FAQ: Are There Charges Linked to a Locked Interest Home Equity Line of Credit? Yes, there can be , including closing costs, annual fees, or penalties for early repayment. As of mid-June, the average home equity line of credit rate is 8.27 percent, which is crucial to consider when evaluating these fees. We encourage homeowners to carefully review the terms and conditions to understand all potential costs before proceeding. Additionally, it’s worth noting that a quarter-point rate drop on a $100,000 HELOC could save almost $21 a month, highlighting the financial implications of HELOC rates.

Conclusion

A fixed rate HELOC is more than just a financial tool; it’s a pathway for homeowners to tap into their property equity with the comfort of consistent interest rates. This dependable borrowing option not only aids in effective financial planning but also opens up a world of funding possibilities. For many individuals, it stands out as a preferred choice to enhance their financial well-being.

Throughout this article, we’ve explored the many benefits of fixed rate HELOCs. They offer predictable payments, access to equity without the hassle of refinancing, lower interest charges, and even potential tax advantages. We’ve also outlined the application process, highlighting the importance of:

- Evaluating your equity

- Checking credit scores

- Gathering necessary documentation

- Comparing lenders

By addressing common myths and misconceptions, we aim to clarify the true nature and flexibility of fixed rate HELOCs.

Understanding these advantages and processes is vital for homeowners who want to make informed financial decisions. We know how challenging this can be, and by dispelling myths and emphasizing the benefits, we hope to encourage you to consider fixed rate HELOCs as viable options for funding home improvements, consolidating debt, or managing unexpected expenses. Taking that first step towards utilizing this financial resource can lead to greater financial freedom and security. We’re here to support you every step of the way.

Frequently Asked Questions

What is a fixed rate HELOC?

A fixed rate HELOC is a loan option that allows property owners to borrow against their residential equity at a consistent interest rate, providing predictable monthly payments.

How does a fixed rate HELOC differ from a traditional HELOC?

Unlike traditional HELOCs, which often have fluctuating interest rates, a fixed rate HELOC ensures that the interest rate remains constant, offering more predictability in monthly payments.

What are some common uses for a fixed rate HELOC?

A fixed rate HELOC can be used for various purposes, including home renovations, debt consolidation, or making significant purchases.

What are the potential benefits of using a fixed rate HELOC?

Borrowers may secure lower interest rates compared to unsecured loans, making long-term HELOCs an appealing choice for accessing home equity.

What is the average interest rate for a fixed rate HELOC in 2025?

The average interest rate for a Steady Equity Line of Credit in 2025 is around 8.27%.