Overview

FHA loan limits in Florida play a vital role for first-time buyers. These limits determine the maximum amount that can be borrowed, and they vary significantly by county. In many areas, the limits start at $402,500, while high-cost regions like Monroe County can reach as high as $1,000,000.

We understand how challenging navigating these figures can be. Knowing these limits is essential for establishing realistic budgets and effectively navigating the competitive housing market. By grasping this information, you empower yourself to make informed financial decisions.

Remember, we’re here to support you every step of the way. Understanding FHA loan limits can make a significant difference in your home-buying journey.

Introduction

Understanding the intricacies of FHA loan limits is essential for first-time homebuyers navigating Florida’s competitive housing market. We know how challenging this can be, and these government-backed loans offer significant advantages. With lower down payments and flexible credit requirements, they make homeownership more attainable for many families.

However, varying loan limits across counties can create challenges for buyers aiming to find a home within their financial reach. It’s important to recognize these hurdles as you embark on your journey. How can you leverage this knowledge to make informed decisions? By understanding the landscape, you can better secure your dream property amidst rising prices and competitive bidding.

We’re here to support you every step of the way, empowering you to navigate these complexities with confidence.

Define FHA Loans and Their Importance for Homebuyers

FHA mortgages, or Federal Housing Administration mortgages, are government-supported financing options designed to help lower-income and first-time homebuyers secure the funds they need. We know how challenging this can be, and that’s why these loans are significant—they offer several advantages that can make a real difference:

- Lower Down Payments: FHA loans typically require a down payment of just 3.5%, which makes homeownership more accessible. With F5 Mortgage, you might even be eligible to purchase a home with as little as 3% down, or potentially 0% down for . This greatly alleviates the financial strain of acquiring a home.

- Flexible Credit Requirements: If you have a credit score as low as 580, you can qualify for these loans. This flexibility is especially beneficial for those with limited credit history, as we understand that everyone’s journey is different.

- Competitive Interest Rates: FHA mortgages frequently offer lower interest rates compared to traditional options, which can decrease your total borrowing expenses.

These features, combined with the diverse range of financing programs provided by F5 Mortgage—covering both standard and nontraditional options—make FHA mortgages an appealing choice. We’re here to support you every step of the way as you navigate the housing market without the burden of significant upfront expenses.

Explore FHA Loan Limits in Florida by County

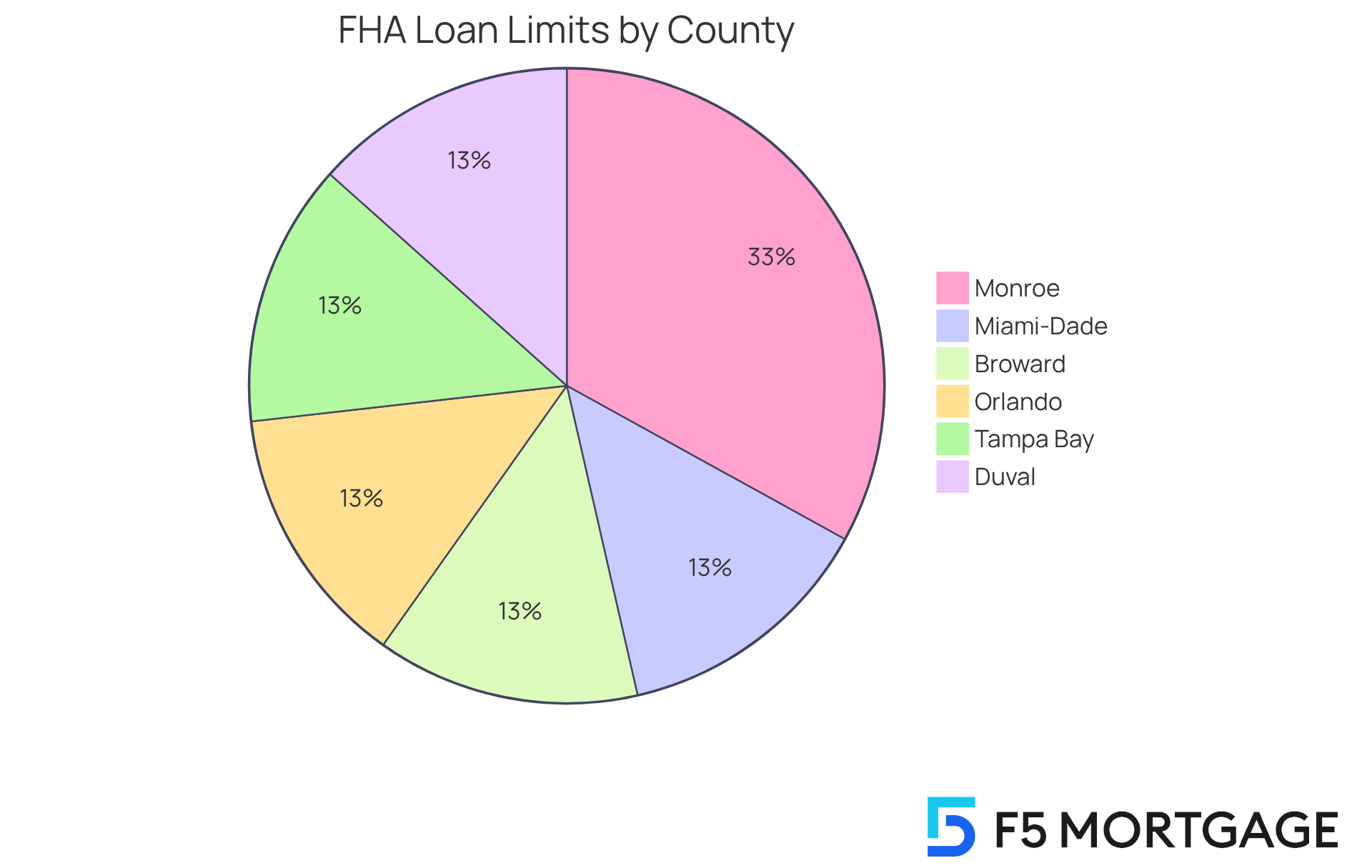

In Florida, FHA loan limits are established by county, and they can differ significantly based on local housing market conditions. As of 2025, the general loan limits for FHA loans in several counties are as follows:

- Miami-Dade County: $402,500

- Broward County: $402,500

- Orlando County: $402,500

- Tampa Bay Area: $402,500

- Duval County: $402,500

However, in counties with higher housing costs, like Monroe County, limits can reach up to $1,000,000. This increase in FHA loan limits is a response to the ongoing rise in property values, providing first-time buyers with enhanced purchasing power. For instance, in areas such as Miami-Dade, understanding the FHA loan limits is crucial, as these limits directly influence the affordability of homes and the financing options available to prospective buyers.

We know how challenging this can be, and real estate specialists emphasize the importance of verifying specific restrictions for your desired areas. These numbers can significantly impact your ability to secure a home. With the current at 6.10%, navigating these limits effectively can empower you to make informed decisions in a competitive housing market. Remember, we’re here to support you every step of the way.

Outline FHA Loan Requirements for First-Time Buyers

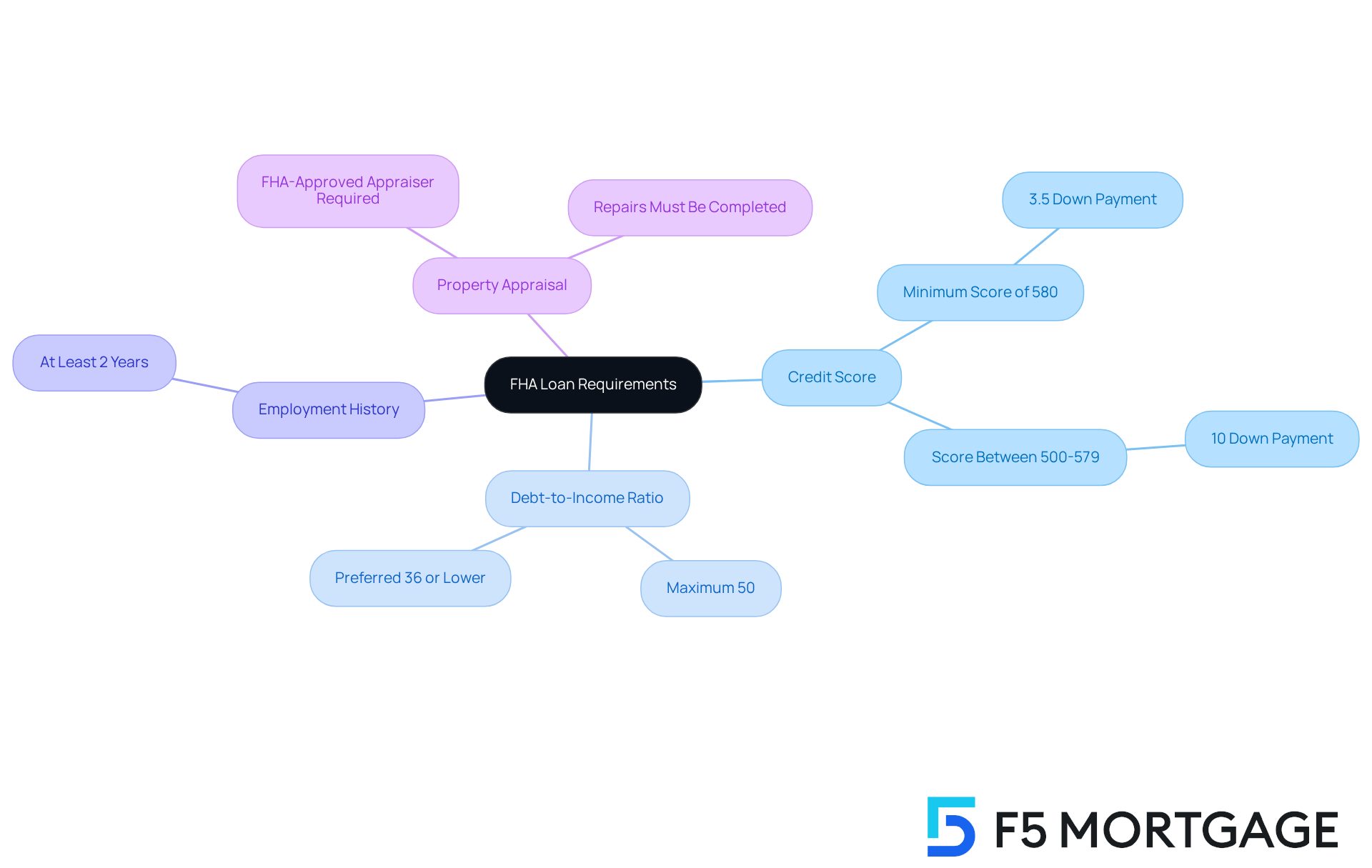

To qualify for an FHA loan, first-time buyers must meet several key requirements:

- Credit Score: A minimum score of 580 is necessary for a down payment of 3.5%. For those with scores between 500 and 579, a 10% down payment is required. This flexibility allows many individuals with reasonable credit to access home financing. FHA financing options are available for individuals with lower credit scores, as they permit a minimum credit score as low as 500 with a 10% down payment.

- Debt-to-Income Ratio: Generally, your total monthly debts should not exceed 50% of your gross monthly income. This is more lenient compared to traditional financing options that usually limit this ratio at 36%. Furthermore, many lenders necessitate homeowners to uphold at least an 80% home-to-value ratio, indicating they have reduced at least 20% of their initial amount or their property has appreciated in value. A better DTI can lead to more competitive mortgage rates.

- Employment History: A steady employment history for at least two years is preferred, demonstrating financial stability and reliability to lenders.

- Property Appraisal: The property must be appraised by an FHA-approved appraiser to ensure it meets safety and livability standards. If an FHA appraiser finds required repairs, they must be finished before the financing can move to closing.

Understanding these requirements is essential for first-time buyers to prepare their finances and documentation accordingly. We know how challenging this can be, but many successful FHA financing requests have been made by first-time buyers with limited savings, enabling them to acquire properties with as little as . For instance, a borrower with a 580 credit score and $15,000 saved can potentially purchase a $300,000 home with an FHA mortgage.

In 2025, the average credit score of FHA applicants is expected to reflect the program’s accessibility, with many borrowers qualifying despite having scores in the mid-500s. Mortgage experts stress that although credit scores hold significance, they are not the only determinant in qualifying for an FHA mortgage. This makes FHA financing a viable choice for those who may not fulfill the stricter requirements of conventional options. Additionally, FHA mortgages incur an upfront Mortgage Insurance Premium (MIP) of 2.25% of the mortgage’s value, which cannot be canceled, along with an ongoing annual premium.

Moreover, prospective property purchasers should investigate down payment aid initiatives accessible through F5 Mortgage, such as the MyHome Assistance Program in California, which offers up to 3% of the property’s purchase price, or the My Choice Texas program, which provides up to 5% for down payment and closing support.

Analyze the Impact of FHA Loan Limits on Home Buying Decisions

The FHA loan limits Florida significantly influence the purchasing decisions of first-time buyers. Understanding these limits is crucial for establishing realistic budgets, helping buyers avoid properties that exceed their financial capabilities. This knowledge ensures they remain within their means, which is a vital step in the homebuying journey.

In high-demand areas, buyers often compete for properties priced within the FHA limit. This competition can drive up property values, making it essential for buyers to act promptly and strategically. We know how challenging this can be, but being informed can empower you to navigate this competitive landscape.

When a desired home exceeds the FHA funding limit, becomes necessary. While this may complicate the purchasing process, it also opens the door to various solutions that could work for you. By understanding these factors, first-time buyers can better navigate the housing market, making informed decisions that align with their financial goals.

As a reference, the baseline FHA loan limit for 2025 is set at $524,225 for single-family homes. This reflects an increase from previous years, enhancing borrowing power and allowing buyers to consider a wider range of homes. We’re here to support you every step of the way as you embark on this exciting journey.

Conclusion

Understanding FHA loan limits is essential for first-time homebuyers in Florida. These limits play a critical role in determining affordability and financing options. We know how challenging this can be, but FHA loans offer a pathway to homeownership by providing lower down payment requirements, flexible credit criteria, and competitive interest rates. This makes it more attainable for individuals who may otherwise face barriers in the housing market.

Throughout this article, we shared key insights regarding the specific FHA loan limits across various Florida counties. These limits can significantly influence your purchasing decisions. We also covered the eligibility requirements for FHA loans, emphasizing the program’s accessibility for those with varying credit scores and financial situations. Understanding how these limits impact budgeting and competition among buyers is crucial, especially in a dynamic housing market.

Ultimately, grasping FHA loan limits and requirements empowers you to make informed decisions that align with your financial goals. As the housing landscape continues to evolve, staying updated on these limits and exploring available financing options can enhance your homebuying experience. For those embarking on this journey, remember that leveraging the resources and support available can pave the way to successful homeownership. We’re here to support you every step of the way.

Frequently Asked Questions

What are FHA loans?

FHA loans, or Federal Housing Administration mortgages, are government-supported financing options designed to assist lower-income and first-time homebuyers in securing the funds needed for homeownership.

Why are FHA loans important for homebuyers?

FHA loans are significant because they offer advantages such as lower down payments, flexible credit requirements, and competitive interest rates, making homeownership more accessible.

What is the typical down payment required for FHA loans?

FHA loans typically require a down payment of just 3.5%. However, with certain financing options from F5 Mortgage, you may be eligible to purchase a home with as little as 3% down or even 0% down.

What are the credit requirements for FHA loans?

You can qualify for FHA loans with a credit score as low as 580, which is beneficial for individuals with limited credit history.

How do FHA loans compare to traditional loans in terms of interest rates?

FHA mortgages often offer lower interest rates compared to traditional loan options, which can help reduce total borrowing expenses.

What types of financing programs are available through F5 Mortgage?

F5 Mortgage provides a diverse range of financing programs, including both standard and nontraditional options, to support homebuyers in navigating the housing market.