Overview

Understanding the importance of credit scores can be a crucial step in your journey toward homeownership, especially when it comes to FHA loan approval requirements. We know how challenging this can be, and it’s essential to recognize that a minimum credit score of 580 is typically necessary to qualify for low down payment options. This requirement can feel daunting, but it’s important to remember that your credit score plays a significant role in determining your loan terms, including interest rates and insurance premiums.

Moreover, it’s worth noting that lender requirements can vary widely. Some lenders may necessitate a higher score to offer better borrowing conditions, which can add to the complexity of the process. However, understanding these nuances can empower you to take proactive steps toward improving your credit score, which may open up more favorable options for you.

As you navigate this journey, remember that we’re here to support you every step of the way. By focusing on your credit score and its impact on your loan approval, you can make informed decisions that align with your financial goals. Take heart, and know that with the right information and guidance, you can successfully manage your credit and enhance your chances of securing the home you desire.

Introduction

Understanding the intricacies of FHA loans is crucial for many aspiring homeowners, especially those from low- to moderate-income backgrounds. We know how challenging this can be, and that’s why FHA loans—with their flexible down payment options and accessible eligibility criteria—have become a lifeline for over 793,000 buyers in 2024 alone. However, the relationship between credit scores and FHA loan approval can be complex. Many potential borrowers wonder: how much does a credit score truly impact their chances of securing a mortgage?

In this article, we’re here to support you every step of the way as we delve into the essential credit score requirements for FHA loans. We will explore both the opportunities and challenges that come with navigating this vital aspect of home financing. Our aim is to empower you with the knowledge needed to make informed decisions.

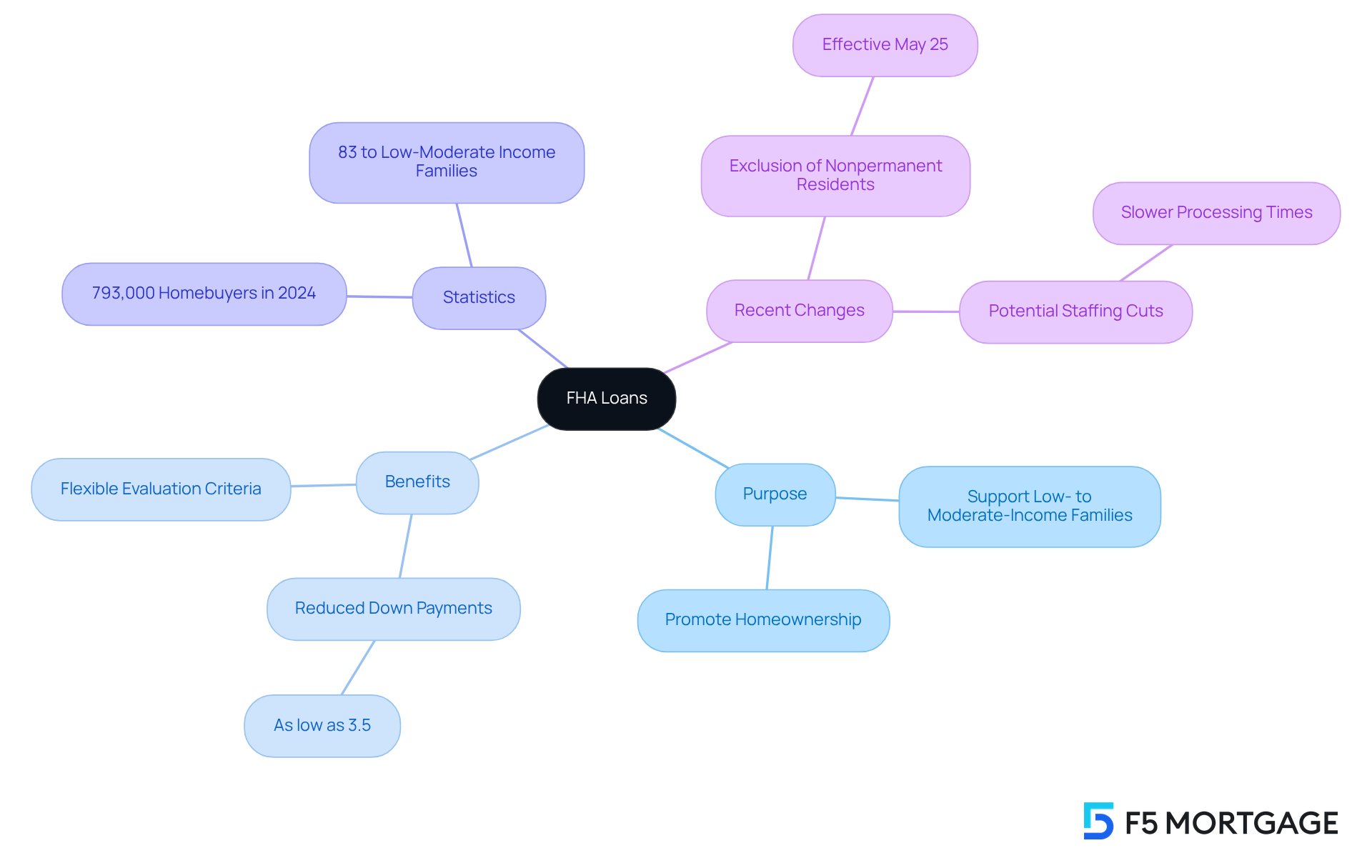

Define FHA Loans and Their Purpose

FHA mortgages, or Federal Housing Administration mortgages, are here to support low- to moderate-income families on their journey to homeownership. Established in 1934, these government-backed financial products aim to make home purchasing more attainable by offering reduced down payment standards and more flexible evaluation criteria compared to traditional options. For first-time homebuyers, [FHA financing](https://f5mortgage.com/loan-programs/fha-loans) is particularly beneficial, allowing down payments as low as 3.5% for individuals with a credit score for FHA loan of 580 or higher. This accessibility has made FHA financing a favored choice for families eager to buy their first home or refinance an existing mortgage.

In 2024, FHA financing opened doors for over 793,000 homebuyers and property owners, highlighting its vital role in promoting homeownership. An impressive 83% of FHA mortgages were issued to low- to moderate-income families, showcasing the program’s effectiveness in aiding those who may struggle to qualify for conventional financing options. Success stories abound, like those from the MSHDA First-Generation Down Payment Assistance Program, illustrating how these financial resources have empowered families to achieve their homeownership dreams, paving the way for stability and wealth accumulation.

However, recent changes in eligibility criteria, particularly the exclusion of nonpermanent residents from FHA financing starting May 25, have raised concerns about access for certain groups. Despite this, the commitment to support first-time homebuyers remains steadfast, with various programs and resources available to improve their chances of securing a mortgage. As industry experts affirm, FHA financing continues to be an essential resource for families navigating the complexities of home buying. We know how challenging this can be, and we encourage you to consider FHA financing as a toward investing in your future.

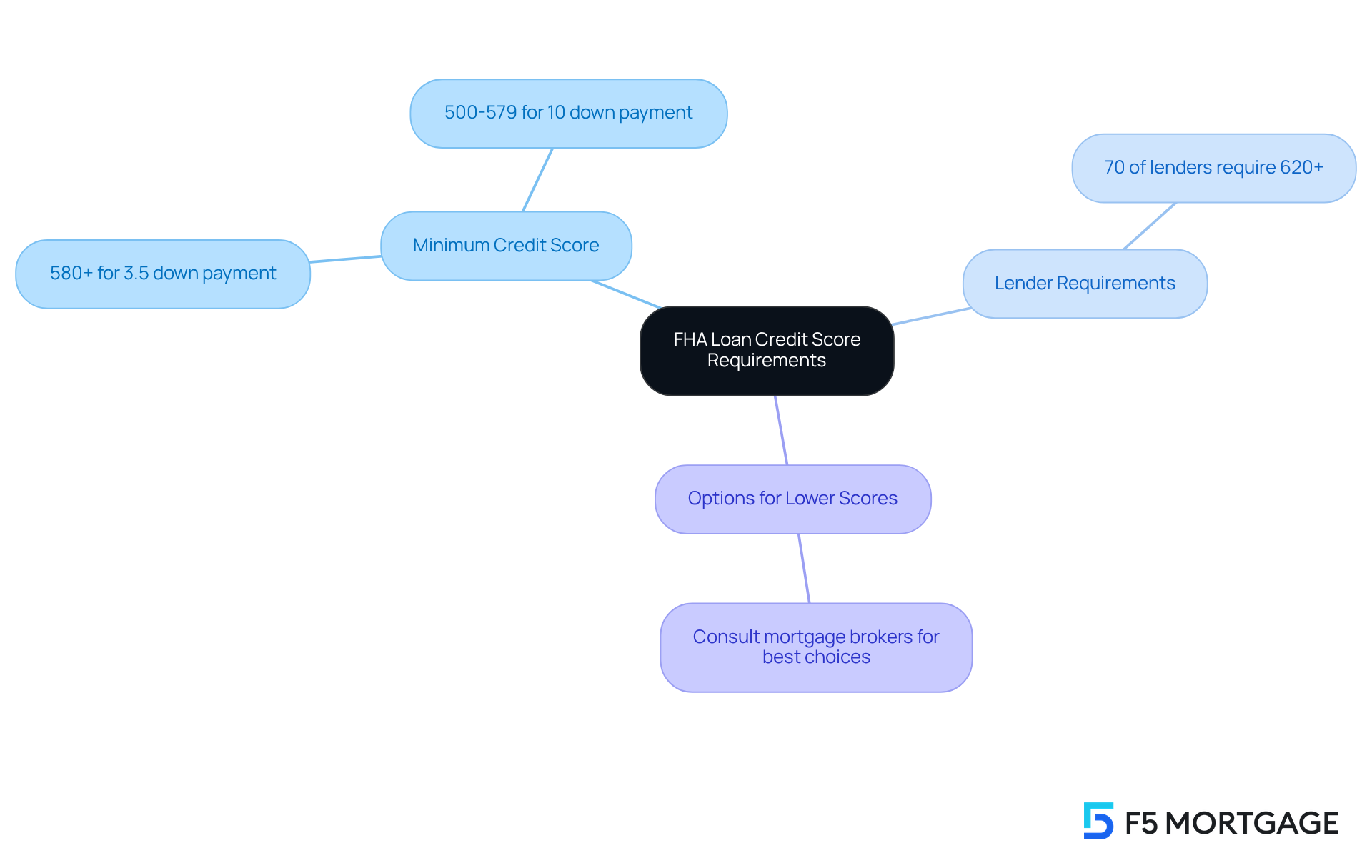

Outline Credit Score Requirements for FHA Loan Approval

Navigating the world of FHA mortgages can feel overwhelming, especially when it comes to understanding eligibility requirements. We know how challenging this can be, and we’re here to support you every step of the way. To qualify for an FHA mortgage, applicants typically need a minimum credit score for FHA loan of 580 to take advantage of the low down payment option of just 3.5%. If your rating falls between 500 and 579, don’t lose hope! FHA loans are still an option, though they do require a larger down payment of at least 10%. This flexibility allows individuals with lower financial ratings to pursue their dreams of homeownership.

However, it’s important to recognize that while the FHA establishes these minimum standards, the credit score for FHA loan may still be subject to stricter criteria set by many lenders. In fact, around 70% of lenders might require a credit score for FHA loan to be 620 or above for approval. This variability in lender standards highlights the importance of exploring multiple lending options. Consulting with knowledgeable mortgage brokers can help you identify the best choices available to you.

Real-world examples show that many borrowers with varying ratings have successfully secured FHA financing. This demonstrates the program’s accessibility for those facing financial challenges. Ultimately, understanding how your down payment requirements and lender expectations is crucial for potential FHA applicants. Remember, you’re not alone in this process, and there are resources available to help you find the right path to homeownership.

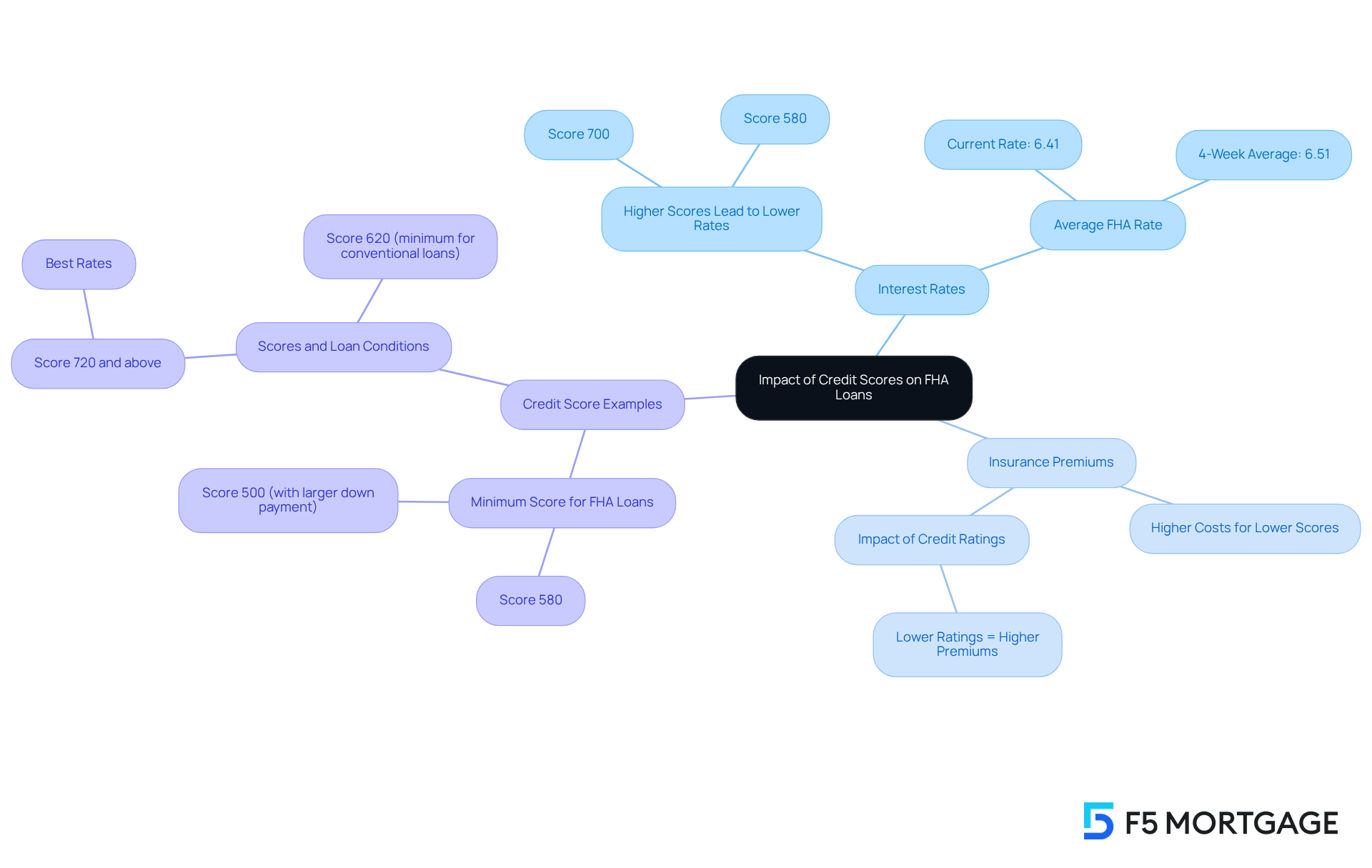

Explain the Impact of Credit Scores on FHA Loan Terms

The credit score for FHA loan plays a significant role in determining the conditions of an FHA mortgage, including interest rates and insurance premiums. We understand how overwhelming this can be, especially when it comes to your financial future. Typically, individuals with better financial ratings can obtain , leading to substantial savings over the life of the loan. For instance, a borrower with a rating of 700 may secure a more favorable rate compared to someone with a rating of 580.

Moreover, FHA loans require mortgage insurance, which can also vary based on financial ratings. Borrowers with lower ratings may face higher insurance costs, adding to their monthly payments. As Peter Warden wisely notes, “Your financial rating greatly affects the interest rate you’ll obtain on your mortgage.” This highlights the importance of maintaining a favorable financial rating, especially for those looking to minimize borrowing costs.

Recent trends show that FHA rates currently average around 6.41%, reflecting a slight decrease of 0.15% over the past week. Meanwhile, the 4-week average FHA rate stands at 6.51%. This underscores the significance of proactive financial management in securing better borrowing conditions. Remember, a credit score for FHA loan can be as low as 580, making these loans a viable option for many families facing challenges with their credit ratings. We’re here to support you every step of the way as you navigate this process.

Conclusion

Understanding the intricacies of FHA loans and their credit score requirements is crucial for those navigating the home buying process. We know how challenging this can be, and the central message here emphasizes that FHA loans serve as a vital resource for low- to moderate-income families. They provide accessible financing options, fostering homeownership and stability. By outlining the credit score thresholds and their implications, potential borrowers can better prepare themselves for the journey ahead.

The article highlights key aspects, such as the minimum credit score requirements for FHA loans. For scores of 580 and above, you can secure a down payment as low as 3.5%. However, it’s important to note that lender standards can vary, and many may require higher scores for approval. Furthermore, the impact of credit scores on loan terms—including interest rates and insurance premiums—underscores the importance of maintaining a favorable financial rating to secure better borrowing conditions.

Ultimately, the significance of understanding credit scores in relation to FHA loans cannot be overstated. By equipping yourself with knowledge about the requirements and potential challenges, you can take proactive steps toward achieving your homeownership dreams. Embracing FHA financing as a viable option opens doors to stability and wealth accumulation for many families. We’re here to support you every step of the way.

Frequently Asked Questions

What are FHA loans and their purpose?

FHA loans, or Federal Housing Administration mortgages, are designed to support low- to moderate-income families in achieving homeownership. They aim to make home purchasing more attainable by offering reduced down payment requirements and flexible evaluation criteria compared to traditional financing options.

What are the benefits of FHA loans for first-time homebuyers?

FHA loans are particularly beneficial for first-time homebuyers, allowing down payments as low as 3.5% for individuals with a credit score of 580 or higher. This accessibility has made FHA financing a popular choice for families looking to buy their first home or refinance an existing mortgage.

How many homebuyers utilized FHA financing in 2024?

In 2024, FHA financing helped over 793,000 homebuyers and property owners, highlighting its significant role in promoting homeownership.

What percentage of FHA mortgages were issued to low- to moderate-income families?

An impressive 83% of FHA mortgages were issued to low- to moderate-income families, demonstrating the program’s effectiveness in assisting those who may have difficulty qualifying for conventional financing.

What recent changes have affected FHA loan eligibility?

Recent changes in eligibility criteria, effective May 25, have excluded nonpermanent residents from FHA financing, raising concerns about access for certain groups.

What resources are available for first-time homebuyers seeking FHA financing?

Various programs and resources are available to support first-time homebuyers in improving their chances of securing an FHA mortgage, despite recent changes in eligibility criteria.

Why is FHA financing considered an essential resource for families?

FHA financing is viewed as an essential resource for families navigating the complexities of home buying, as it helps make homeownership more accessible and supports families in achieving stability and wealth accumulation.