Overview

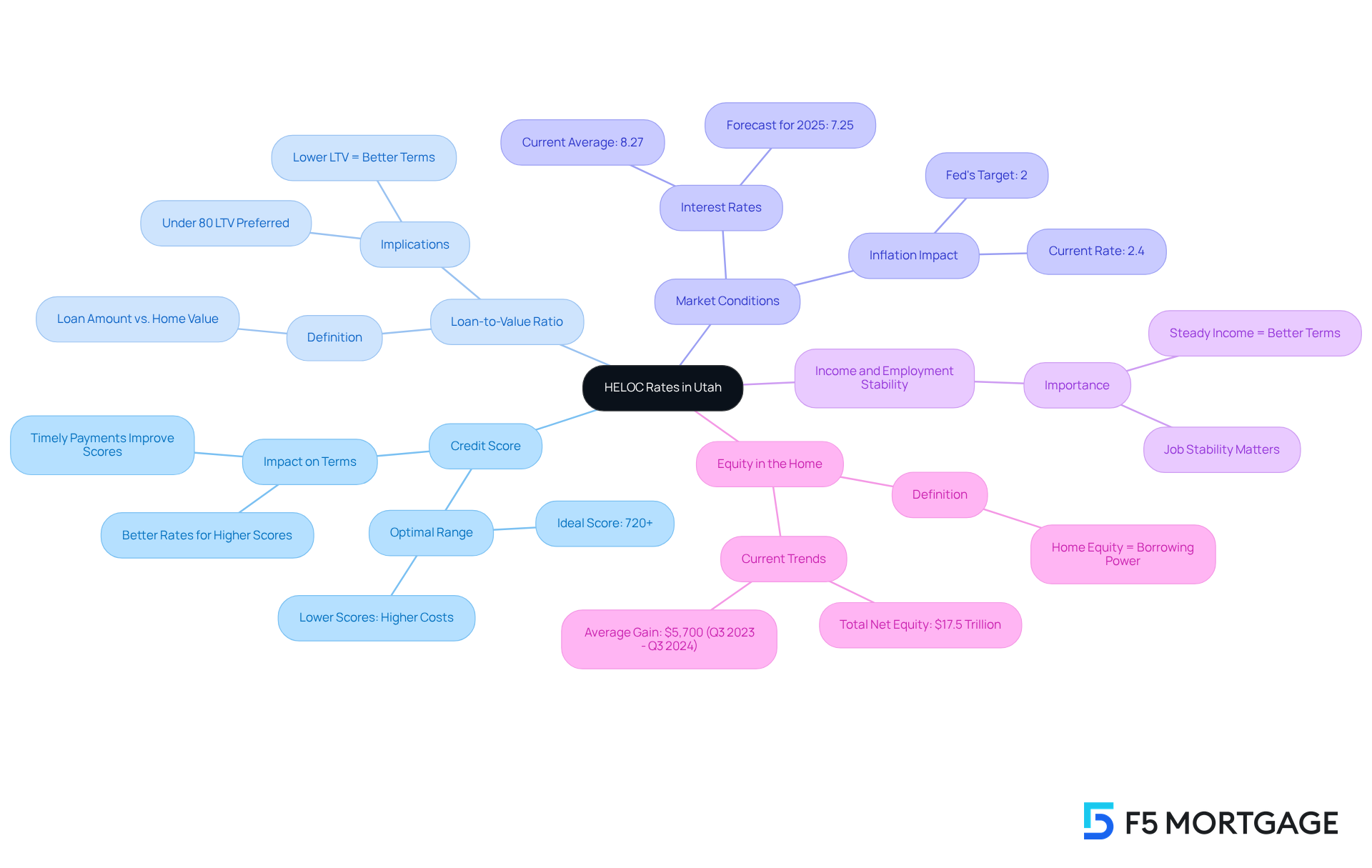

Navigating HELOC rates in Utah can feel overwhelming, but understanding the key factors at play can empower you. Your credit score, loan-to-value ratio, market conditions, income stability, and the equity in your home all play significant roles in determining your options. We know how challenging this can be, especially as you strive to make informed borrowing decisions.

As we look ahead, the current economic climate presents favorable rates that may average around 7.25% in 2025. This makes HELOCs a cost-effective option for accessing your home equity. By recognizing these factors, you can take control of your financial future and make choices that best suit your needs.

Remember, we’re here to support you every step of the way. Understanding these elements not only helps you navigate the complexities of borrowing but also empowers you to seize opportunities that can enhance your financial well-being. Take the time to explore your options and consider how a HELOC might fit into your plans.

Introduction

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) is essential for homeowners in Utah, especially in a thriving real estate market where equity is on the rise. We know how challenging this can be, but with the potential for significant financial benefits—like lower interest rates compared to credit cards and possible tax deductions—HELOCs can be a powerful tool for managing expenses or funding home improvements.

However, navigating the factors that influence HELOC rates can present challenges. Elements such as credit scores, market conditions, and loan-to-value ratios can feel overwhelming. We’re here to support you every step of the way.

How can homeowners effectively leverage their equity while minimizing risks and ensuring favorable terms in this evolving financial landscape? Let’s explore this together.

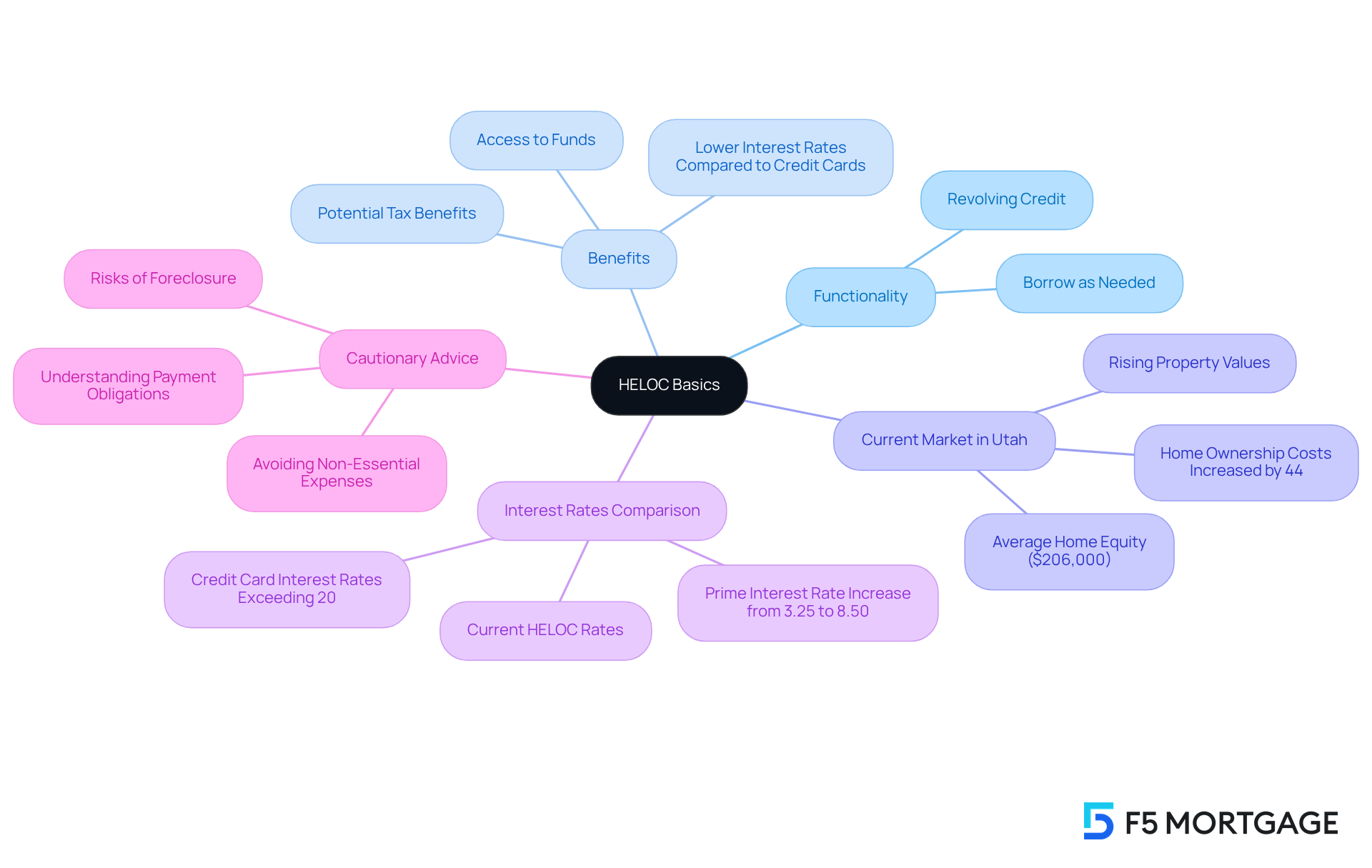

Explore the Basics of HELOCs and Their Importance in Utah

A Home Equity Line of Credit (HELOC) is a revolving line of credit backed by the equity in your residence. Unlike a conventional equity loan, which offers a lump sum, a line of credit against property allows you to borrow as needed, much like a credit card. This flexibility makes HELOC rates Utah an appealing option for families seeking to finance home improvements, consolidate debt, or manage unexpected expenses.

In Utah’s dynamic real estate market, where property values have been steadily rising, many homeowners find themselves with significant equity—averaging around $206,000—that can be accessed through HELOC rates Utah. This financial tool not only provides access to funds but also offers potential tax benefits, as the interest paid on a HELOC may be tax-deductible when used for renovations.

Moreover, HELOC rates Utah can be considerably lower than credit card interest rates, which exceeded 20% as of June 2024. This makes these loans a cost-effective option for debt consolidation. We understand how overwhelming financial decisions can be, and experts suggest rather than unnecessary expenses to maximize your financial advantages.

However, it’s crucial to proceed with caution. Missing payments on a HELOC can lead to foreclosure, similar to mortgage defaults. We know how challenging this can be, so understanding these fundamentals is vital for making informed decisions about utilizing home equity, particularly in light of the current HELOC rates in Utah. We’re here to support you every step of the way as you navigate these important choices.

Analyze Key Factors Affecting HELOC Rates in Utah

Understanding the factors that influence HELOC rates in Utah can feel overwhelming, but we’re here to support you every step of the way. Several key elements play a significant role in shaping HELOC rates in Utah, and recognizing them can empower you to make informed decisions.

- Credit Score: Your is a crucial factor. Lenders typically offer more favorable terms to those with higher scores, ideally 720 or above. Maintaining a strong credit score is vital, as it can significantly lower your borrowing costs and open doors to better options.

- Loan-to-Value (LTV) Ratio: This ratio compares your loan amount to your home’s appraised value. A lower LTV ratio usually means reduced costs, reflecting less risk for lenders. For example, if your LTV ratio is under 80%, you may qualify for improved terms, showcasing your lower risk profile.

- Market conditions, including the prime interest rate and inflation, can significantly affect HELOC rates in Utah. Following recent Federal Reserve actions to lower interest rates, HELOC rates in Utah are expected to average 7.25% in 2025, marking the lowest point in three years. This trend presents a favorable opportunity for homeowners to consider borrowing against their equity. Keep an eye on the upcoming Federal Reserve meeting on July 29, 2025, as it may further influence these rates.

- Income and Employment Stability: Lenders look closely at your income and job stability to assess your repayment ability. A steady income can lead to more advantageous terms, reassuring lenders of your capacity to repay the loan.

- Equity in the Home: The equity you’ve built in your property directly affects how much you can borrow and the rates available to you. With total net residential equity exceeding $17.5 trillion, many homeowners are well-positioned to leverage this equity for home improvements or other financial needs. Notably, mortgage-holding property owners gained an average of $5,700 in equity between Q3 2023 and Q3 2024, highlighting the potential for accessing significant funds.

By grasping these elements, you can better equip yourself to negotiate and secure the most beneficial credit terms available. We encourage you to compare offers from your current mortgage lenders and other competitors to ensure you are getting the best possible rates. Remember, we’re here to help you navigate this process with confidence.

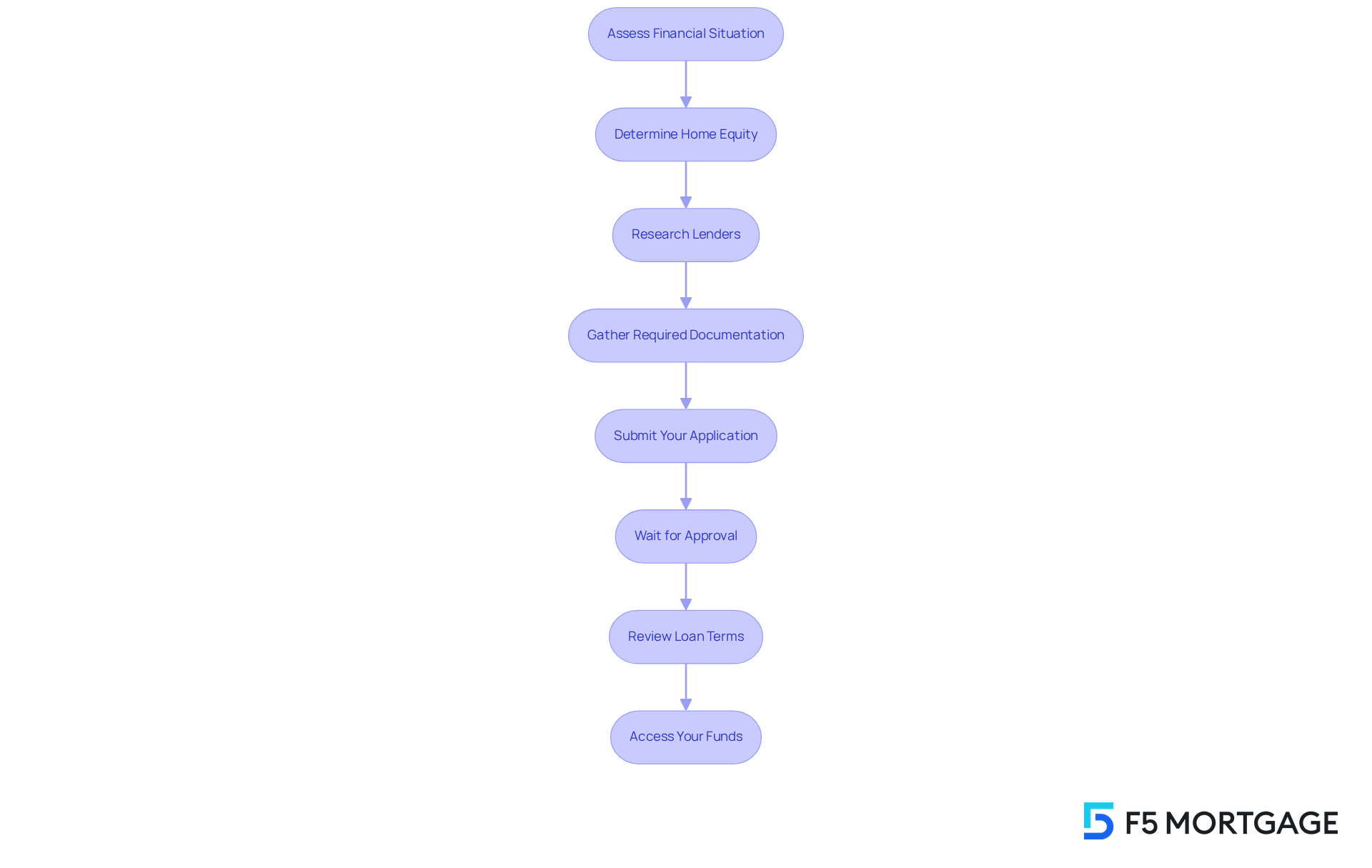

Understand the Application Process for HELOCs in Utah

Applying for a [Home Equity Line of Credit](https://f5mortgage.com/securing-a-home-equity-line-of-credit-with-bad-credit-steps-to-success) (HELOC) in Utah can feel overwhelming, especially when considering the [heloc rates utah](https://f5mortgage.com/7-heloc-without-appraisal-options-for-quick-financing), but we’re here to support you every step of the way. By following these essential steps, you can navigate the process more smoothly and feel empowered to make informed decisions.

- Assess Your Financial Situation: Start by evaluating your credit score, income, and existing debts. A credit score of 680 or above is usually necessary for home equity line approval, so understanding where you stand can help you gauge your borrowing capacity.

- Determine Your Home Equity: Calculate your home’s current market value and subtract any outstanding mortgage balance. This will help you ascertain your . Homeowners with a minimum of 15% equity typically qualify for a home equity line of credit, giving you options for financial flexibility.

- Research Lenders: Take the time to compare different lenders to find the best offers and conditions. Focus on those specializing in HELOCs and those with a strong reputation in Utah, particularly regarding heloc rates utah, ensuring you choose a partner you can trust.

- Gather Required Documentation: Prepare necessary documents, including proof of income, tax returns, and details about your existing mortgage. For lines of credit under $250,000, an official appraisal is typically not required, which can simplify the process for you.

- Submit Your Application: Once you’re ready, complete the application process with your chosen lender, ensuring all required documentation is included. Approval times can vary, but many lenders offer initial decisions within two weeks if documents are submitted promptly.

- Wait for Approval: Your lender will review your application and assess your creditworthiness. This process may take anywhere from a few days to several weeks, depending on the lender’s workload and the appraisal process. We understand this waiting period can be stressful, but patience is key.

- Review Loan Terms: If granted, take the time to thoroughly analyze the conditions of the home equity line of credit. Pay attention to interest percentages, fees, and repayment choices before signing any contracts. The typical home equity line of credit interest rate, reflecting HELOC rates in Utah, is currently 8.27%, which is lower than personal loan rates of approximately 12% and credit card rates of about 21%.

- Access Your Funds: Once everything is settled, you can start withdrawing from your line of credit as needed. This offers you the flexibility to make home enhancements or address other monetary needs.

By following these steps, you can streamline the HELOC application process and enhance your chances of securing favorable terms. Remember, we know how challenging this can be, and we’re here to help you navigate it with confidence.

Conclusion

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) is essential for homeowners in Utah who are looking to leverage their property equity effectively. We know how challenging this can be, and by exploring the fundamental aspects of HELOCs—such as their flexibility, potential tax benefits, and cost-effectiveness compared to other credit options—homeowners can make informed financial decisions that truly align with their needs.

Key factors influencing HELOC rates in Utah include:

- Credit scores

- Loan-to-value ratios

- Market conditions

- Income stability

- The equity homeowners have built in their properties

Recognizing how these elements interact can empower you to negotiate better terms and maximize the financial advantages of your home equity. Furthermore, understanding the application process helps streamline efforts in securing a HELOC, ensuring that you are well-prepared to navigate this financial landscape.

Ultimately, accessing a HELOC can provide significant opportunities for:

- Funding home improvements

- Managing unexpected expenses

- Consolidating debt

We encourage you to stay informed about current HELOC rates in Utah and market trends, as this knowledge is vital for making sound financial choices. Taking proactive steps today can lead to a more secure financial future, allowing you to make the most of the equity built in your home.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit backed by the equity in your home, allowing you to borrow as needed, similar to a credit card, rather than receiving a lump sum like a conventional equity loan.

Why are HELOCs considered appealing options for families in Utah?

HELOCs are appealing because they provide flexibility for financing home improvements, consolidating debt, or managing unexpected expenses, especially in Utah’s rising real estate market.

How much equity do homeowners in Utah typically have access to through HELOCs?

Homeowners in Utah typically have access to significant equity, averaging around $206,000.

Are there any tax benefits associated with HELOCs?

Yes, the interest paid on a HELOC may be tax-deductible when the funds are used for renovations.

How do HELOC rates compare to credit card interest rates in Utah?

HELOC rates in Utah can be considerably lower than credit card interest rates, which exceeded 20% as of June 2024, making HELOCs a cost-effective option for debt consolidation.

What should homeowners be cautious about when using a HELOC?

Homeowners should be cautious because missing payments on a HELOC can lead to foreclosure, similar to defaults on a mortgage.

Why is it important to understand the fundamentals of HELOCs?

Understanding the fundamentals of HELOCs is vital for making informed financial decisions about utilizing home equity, especially in light of current HELOC rates in Utah.