Overview

Current HELOC rates can feel overwhelming, especially when considering factors such as credit score, loan-to-value ratio, economic conditions, market competition, and the type of HELOC. We know how challenging this can be for families looking to upgrade their homes.

Understanding these elements is crucial. By grasping how these factors influence rates, families can make informed decisions that lead to securing favorable terms. In a market where homeowners enjoy substantial equity due to rising real estate values, this knowledge empowers you.

Take a moment to reflect: What does this mean for your family? It means that with the right information, you can navigate the complexities of HELOCs with confidence. We’re here to support you every step of the way as you explore your options.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially when it comes to Home Equity Lines of Credit (HELOCs). We understand how challenging this can be for families looking to upgrade their homes. That’s why grasping the current HELOC rates and the factors that influence them is so important.

This article explores the benefits of HELOCs, the economic conditions impacting interest rates, and the application process. Our goal is to empower you to make informed financial decisions. But with so many options available, how can you ensure that your family secures the best rates while effectively leveraging your home equity? We’re here to support you every step of the way.

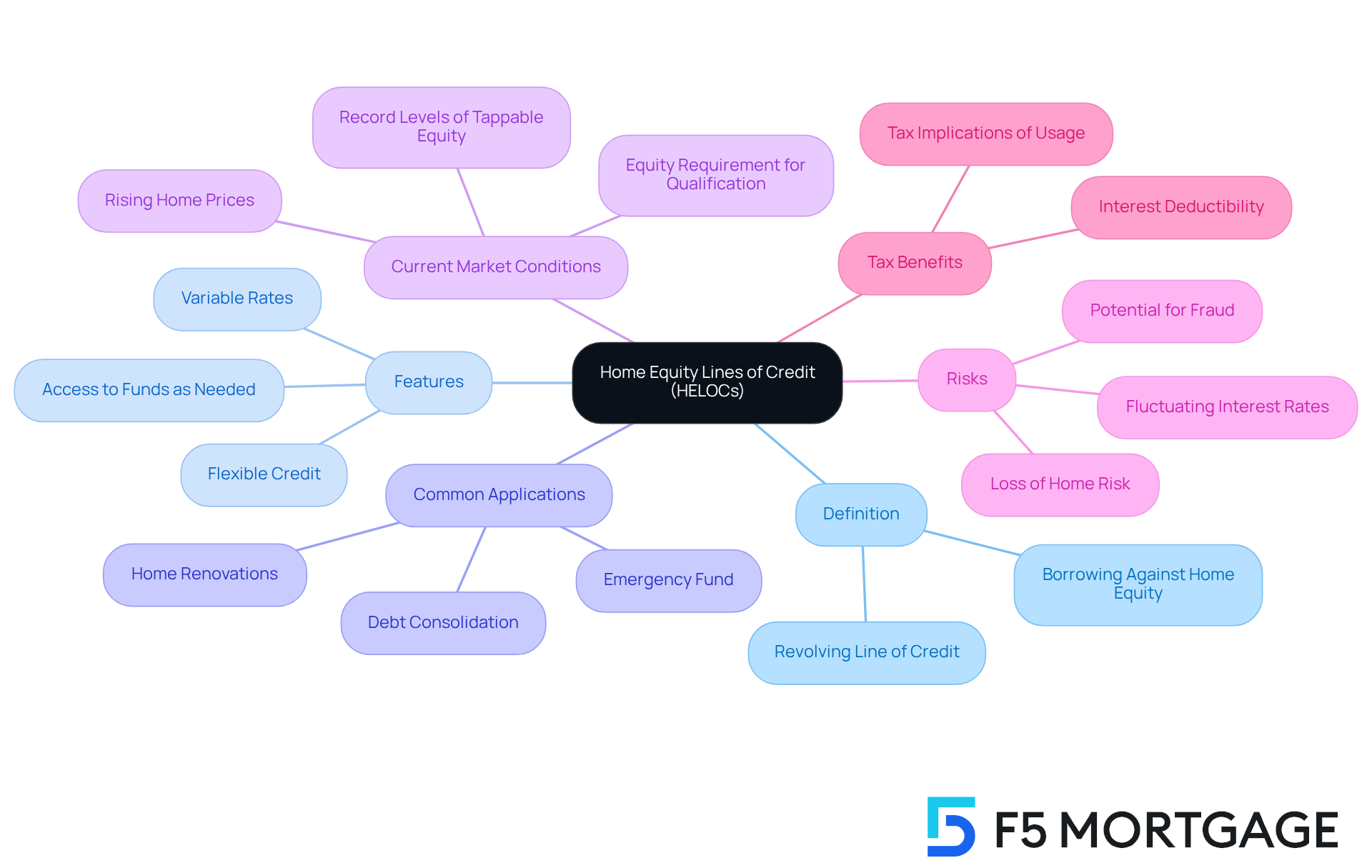

Define Home Equity Lines of Credit (HELOCs)

A Home Equity Line of Credit (HELOC) offers homeowners a flexible, revolving line of credit, allowing them to borrow against the equity in their property. This equity is simply the difference between the home’s current market value and the outstanding mortgage balance. Much like a credit card, a HELOC enables borrowers to access funds as needed, up to a predetermined limit, and only incur charges on the amount they use. Typically, HELOCs have a current HELOC rate that comes with variable rates, which can fluctuate during both the draw and repayment periods, influenced by market conditions. Therefore, it’s vital for borrowers to stay informed about how these rates may change over time, especially in the context of adjustable-rate mortgages (ARMs), which have introductory rates and interest adjustment caps that can affect overall borrowing costs.

Families considering a home equity line of credit should take a moment to evaluate their financial situation and think about how they might use these funds. Common applications include:

- Home renovations, which can enhance both the enjoyment and value of the property

- Debt consolidation, providing a strategic way to manage existing financial obligations

For instance, property owners might tap into a HELOC to fund a kitchen renovation or expand a deck, thus increasing their home’s market appeal.

Professional insights highlight that the current HELOC rate reflects the favorable conditions for securing a home equity line of credit, as many homeowners now possess substantial equity—averaging nearly $150,000—thanks to rising real estate values. This financial product not only provides immediate access to funds but also grants ongoing financial flexibility. However, it’s important to recognize the risks associated with HELOCs, including the possibility of losing one’s home if payments are not kept up. Additionally, interest paid on a line of credit may be tax-deductible if used for property improvements, which is a significant consideration for homeowners. Lenders typically require a minimum of 15 to 20 percent equity in the property for qualification, a factor families should carefully consider when exploring this option. Understanding the refinancing process in California can also empower families to make informed decisions about effectively accessing their home equity.

Explore Factors Influencing HELOC Rates

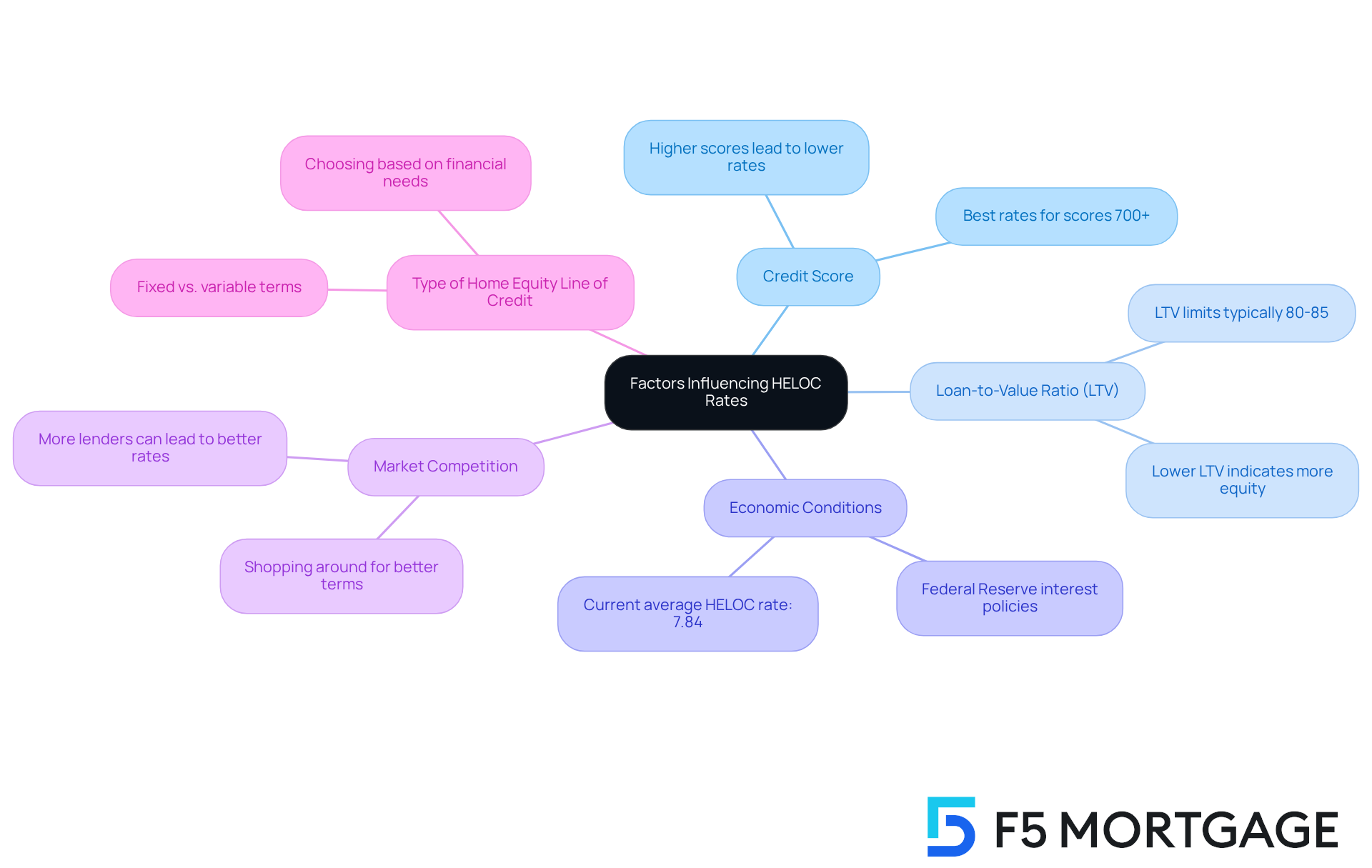

Several key factors significantly influence HELOC rates, which are essential for families considering this financing option:

- Credit Score: We know how challenging it can be to navigate credit scores. A higher credit score typically results in lower interest rates. Lenders perceive borrowers with strong credit histories as less risky, which can lead to more favorable terms. For instance, borrowers with a credit score of 700 or higher may qualify for the best introductory rates.

- Loan-to-Value Ratio (LTV): Understanding the loan-to-value ratio is crucial. This ratio compares the amount of the loan to the appraised value of the property. In 2025, lenders generally restrict total property loans to a maximum of 80 to 85 percent of a property’s value. A lower LTV signifies greater equity in the home, frequently leading to improved terms.

- Economic Conditions: Broader economic factors, such as the Federal Reserve’s interest policies, play a crucial role in determining lending costs. For example, recent reductions in federal interest levels have led to a current HELOC rate that has resulted in lower home equity line of credit costs, with the average currently around 7.84%. However, if the Fed raises interest levels, home equity line rates may also rise, affecting borrowing expenses.

- Market Competition: We encourage families to shop around. The quantity of lenders providing HELOCs and their corresponding terms can greatly affect charges. Comparing offers can help secure the best deal, as competition among lenders often leads to more favorable terms.

- Type of Home Equity Line of Credit: It’s important to understand the options available. Some home equity lines offer fixed terms for an initial period, while others have variable terms that can change over time. Knowing these options is vital for families to choose the right product that aligns with their financial needs and goals.

By taking these elements into account, families can make knowledgeable choices when looking into home equity line options, ensuring they obtain the most favorable conditions for their financial circumstances. We’re here to support you every step of the way.

Navigate the HELOC Application Process and Secure the Best Rates

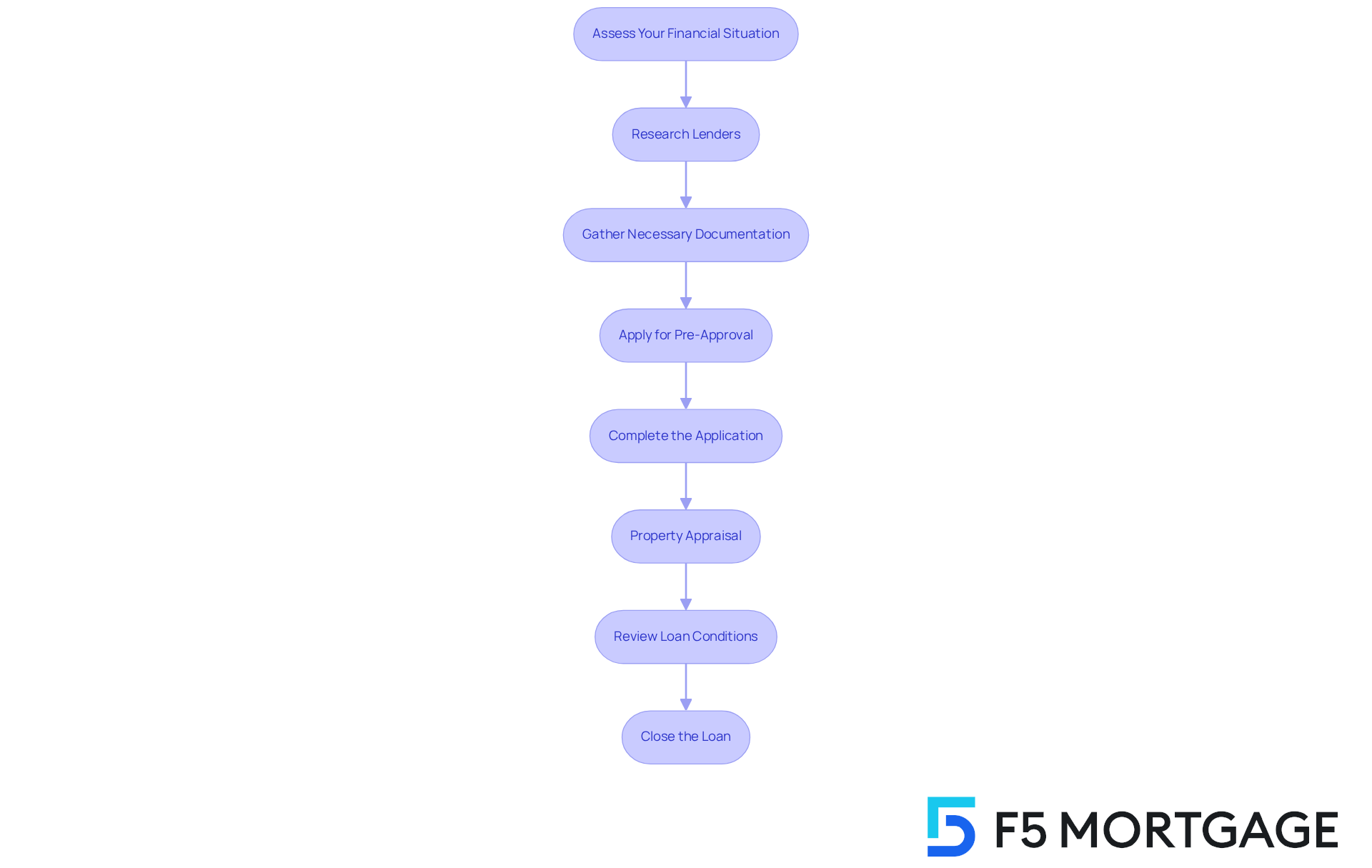

Navigating the HELOC application process can feel overwhelming, but with the right steps, families can secure the current HELOC rate and the support they need. Here’s how you can approach this journey:

-

Assess Your Financial Situation: Start by reviewing your credit score, income, and existing debts. Understanding your borrowing capacity is crucial. A solid credit score, ideally above 640, can open doors to better terms.

-

Research Lenders: Take the time to compare various lenders and their HELOC offerings. Look for competitive pricing, favorable conditions, and customer feedback to find the best fit for your needs. Remember, online lenders often offer faster approvals and potentially lower fees compared to traditional banks.

-

Gather Necessary Documentation: Prepare essential documents like proof of income (W-2s, pay stubs), tax returns, and details about your current mortgage. Having these ready can make the application process smoother and faster.

-

Apply for Pre-Approval: Many lenders offer pre-approval, which helps you understand how much you can borrow and at what cost. This step can significantly streamline your search for the right loan.

-

Complete the Application: When filling out the lender’s application form, ensure all required information is accurate. Responding promptly to lender inquiries can further speed up the process.

-

Property Appraisal: Be prepared for a property appraisal that the lender may require to determine your asset’s current market value. This assessment will play a key role in your loan-to-value (LTV) ratio and borrowing limits.

-

Review Loan Conditions: Once you receive approval, take the time to thoroughly review the loan conditions, including interest rates, fees, and repayment options. Understanding these details is essential before signing any agreements.

-

Close the Loan: After agreeing to the terms, finalize the loan. This is when the funds become available for your use, providing you with the flexibility for home improvements or other expenses.

By following these steps, families can enhance their chances of obtaining favorable HELOC terms considering the current HELOC rate while ensuring a smooth application process. We know how challenging this can be, but remember, we’re here to support you every step of the way.

Compare HELOCs with Alternative Financing Options

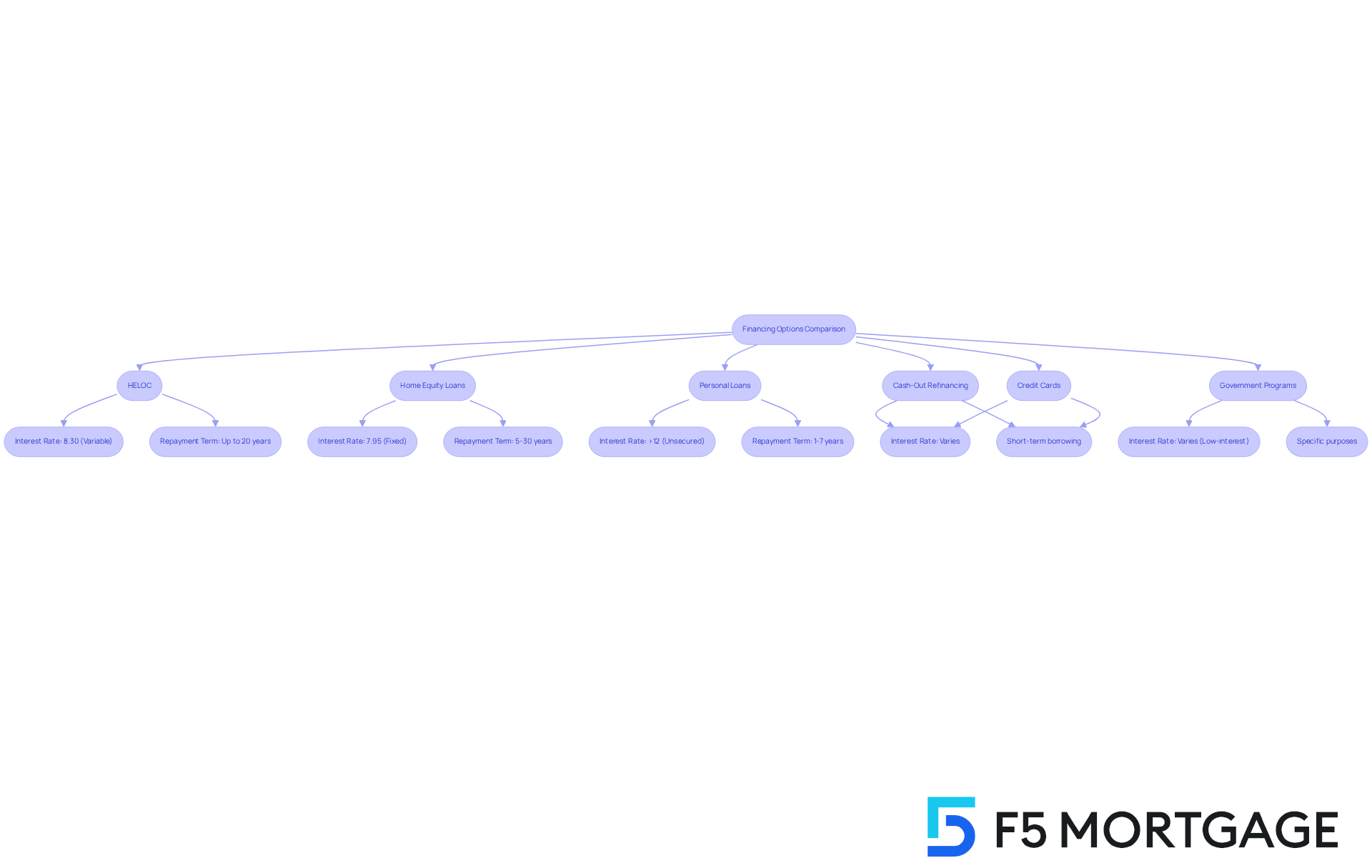

When evaluating financing options, we understand that families face important decisions. It’s essential to carefully compare HELOCs with several alternatives to find the best fit for your needs:

-

Home Equity Loans: These loans provide a lump sum at a fixed interest rate, making them ideal for those who need a specific amount for a project. With a typical borrowing cost around 7.95%, equity loans offer consistent payments over a duration of 5 to 30 years. This can be advantageous for long-term financial planning. Additionally, costs on equity loans might be tax-deductible if the funds are used for qualifying property enhancements, potentially saving families money.

-

Personal Loans: While generally having higher charges than HELOCs, personal loans are unsecured and do not require property equity. They are suitable for smaller amounts or when home equity is insufficient. The typical personal loan cost exceeds 12%, and repayment terms usually range from 1 to 7 years, making them a quick option for families in need of urgent funds, especially when considering the current HELOC rate.

-

Cash-Out Refinancing: This option allows you to replace your existing mortgage with a new one for a larger amount, giving you access to cash. It can be particularly beneficial if current mortgage interest rates are lower than your existing rate, potentially resulting in reduced monthly payments.

-

Credit Cards: While convenient for minor expenses, credit cards often come with higher charges than HELOCs, making them less suitable for larger financing needs. They are best utilized for short-term borrowing, as the average credit card interest rate can exceed 20%.

-

Government Programs: Various government initiatives offer low-interest loans for specific purposes, such as home improvements. We encourage families to explore these options, as they may provide favorable terms if they qualify.

It’s crucial to recognize that both HELOCs and home equity loans are secured by the borrower’s residence. This means that failing to make payments can lead to foreclosure. By understanding the distinctions between these financing options, including the underwriting processes for home equity loans—which involve income verification, home appraisal, title search, and credit score checks—families can choose the solution that best aligns with their financial circumstances and goals. We’re here to support you every step of the way.

Conclusion

Understanding the dynamics of Home Equity Lines of Credit (HELOCs) is essential for families looking to upgrade their homes or manage their finances more effectively. By leveraging the equity in their properties, homeowners can access flexible funding options that cater to various needs, from renovations to debt consolidation. We know how challenging it can be to navigate financial decisions, and staying informed about current HELOC rates and the factors influencing them is crucial. These rates directly impact the affordability of borrowing, making knowledge a powerful tool.

Throughout this article, we’ve highlighted key factors such as:

- Credit scores

- Loan-to-value ratios

- Economic conditions

- Market competition

Each of these elements plays a significant role in determining HELOC rates. Additionally, we’ve broken down the application process into manageable steps, empowering families to approach this financial option with confidence. By comparing HELOCs with alternative financing solutions, families can make informed choices that align with their financial goals and circumstances.

As we conclude, navigating the world of HELOCs requires careful consideration and research. Families are encouraged to assess their financial situations, explore various lending options, and understand the implications of their choices. By doing so, they can not only secure the best possible rates but also unlock the potential of their home equity to enhance their living spaces and overall financial health. The journey of home improvement and financial empowerment begins with informed decisions—taking the first step today can lead to a brighter, more secure future.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a flexible, revolving line of credit that allows homeowners to borrow against the equity in their property, which is the difference between the home’s current market value and the outstanding mortgage balance.

How does a HELOC work?

Similar to a credit card, a HELOC enables borrowers to access funds as needed, up to a predetermined limit, and only incur charges on the amount they use. It typically has variable interest rates that can fluctuate during both the draw and repayment periods.

What are common uses for a HELOC?

Common applications for a HELOC include home renovations, which can enhance the property’s enjoyment and value, and debt consolidation, providing a strategic way to manage existing financial obligations.

What factors influence the current HELOC rate?

The current HELOC rate is influenced by market conditions and can fluctuate during the draw and repayment periods. Borrowers should stay informed about potential changes in these rates.

What are the risks associated with a HELOC?

The risks include the possibility of losing one’s home if payments are not maintained. It’s important for borrowers to understand these risks before proceeding with a HELOC.

Can the interest paid on a HELOC be tax-deductible?

Yes, the interest paid on a HELOC may be tax-deductible if the funds are used for property improvements.

What equity is typically required to qualify for a HELOC?

Lenders typically require a minimum of 15 to 20 percent equity in the property for qualification.

Why is it important to understand the refinancing process in California when considering a HELOC?

Understanding the refinancing process can empower families to make informed decisions about effectively accessing their home equity and managing their financial options.