Overview

Navigating the world of mortgages can feel overwhelming, but we’re here to support you every step of the way. This article explores the various types of mortgages available to homebuyers, including:

- Fixed-rate mortgages

- Adjustable-rate mortgages

- FHA mortgages

- VA mortgages

- Jumbo mortgages

Each option is designed to meet diverse financial needs, ensuring there’s something for everyone.

Understanding these mortgage types is essential. We know how challenging this can be, but being informed empowers you to make decisions that best suit your family’s financial situation. By grasping the nuances of each mortgage type and the application process, you can enhance your home financing experience.

As you read through the options, remember that you’re not alone in this journey. Many families face similar concerns, and knowing the right path can make all the difference. Take the time to explore these choices, and feel confident in your ability to choose the mortgage that aligns with your goals.

Introduction

Navigating the world of mortgages can feel like wandering through a labyrinth. We understand how overwhelming it can be, especially with the myriad of options available to homebuyers today. Understanding the various types of mortgages is crucial, as it empowers you to make informed decisions that can significantly impact your financial future. Yet, with so many choices—from fixed-rate to government-backed loans—how can you determine the best fit for your unique circumstances?

This article delves into the essentials of mortgage types, application processes, and the value of personalized consultations. We’re here to support you every step of the way, offering insights that will help you conquer your home financing journey with confidence.

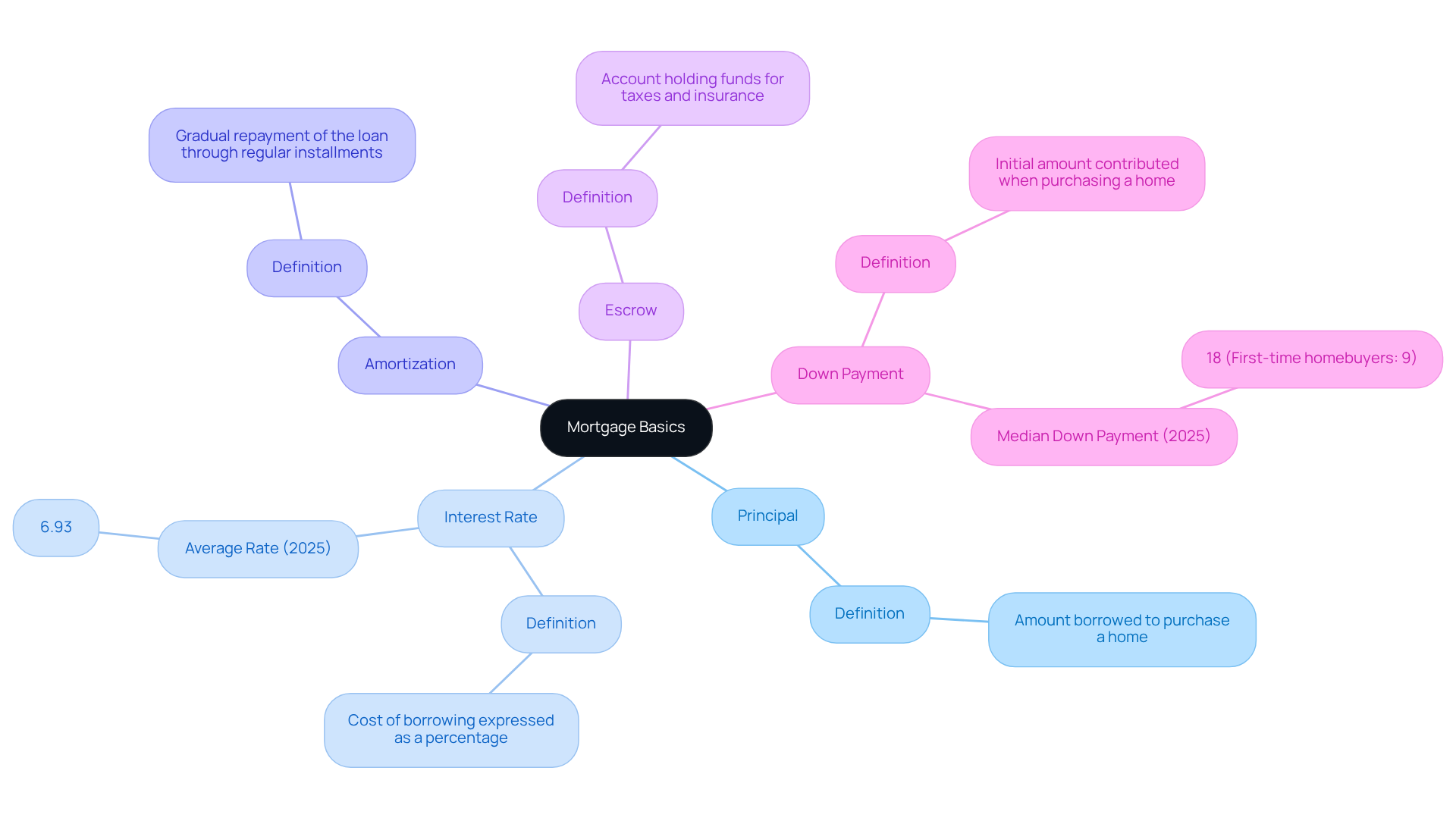

Define Mortgage Basics and Key Terminology

A home loan is a financial product designed to help you acquire real estate, with the property itself serving as security. We understand how daunting the mortgage landscape can be, so grasping key terms is essential for navigating this process with confidence:

- Principal: This is the amount you borrow to purchase your home.

- Interest Rate: This represents the cost of borrowing, shown as a percentage, which can significantly affect your monthly payments. As we look ahead to 2025, the average interest rate for a 30-year fixed mortgage is around 6.93%.

- Amortization: This refers to the gradual repayment of your loan through regular installments, which typically include both principal and interest.

- Escrow: An escrow account holds funds until specific conditions are met, often for property taxes and insurance, ensuring these obligations are fulfilled on time.

- Down Payment: This is the initial amount you contribute when purchasing a home, generally a percentage of the purchase price. In 2025, the median down payment in the U.S. is about 18%, while first-time homebuyers average around 9%.

Understanding these types of mortgage not only empowers you to make informed decisions but also helps you navigate the complexities of loan financing with assurance. For instance, knowing the difference between fixed-rate and adjustable-rate loans and understanding the various types of mortgage can significantly influence your long-term financial strategy, especially in a market where over 5.35 million home sales are expected in 2025. By familiarizing yourself with these concepts, you can enhance your negotiation skills and ultimately enjoy a more favorable financing experience. We’re here to support you every step of the way.

Explore Various Types of Mortgages Available

Homebuyers have access to various types of mortgage, each tailored to meet specific financial needs. We understand how overwhelming this process can be, and we’re here to support you every step of the way.

-

Fixed-Rate Mortgages: These loans offer a stable interest rate and consistent monthly payments, making them ideal for long-term budgeting. About 75% of home purchasers choose fixed-interest loans because of their reliability and protection against interest changes. If you seek consistency, transitioning from an adjustable-rate mortgage to a fixed-rate one can secure a lower interest, providing you with peace of mind.

-

Adjustable-Rate Mortgages (ARMs): With ARMs, interest levels can change periodically based on market conditions. While they often start with lower initial costs, it’s important for borrowers to prepare for potential increases over time. This type of mortgage can be beneficial for those planning to sell or refinance before rates adjust, allowing for lower monthly expenses in the short term.

-

FHA Financing: Backed by the Federal Housing Administration, FHA financing is designed for first-time homebuyers, especially those with lower credit scores and smaller upfront costs. These financial aids generally require an initial contribution as low as 3.5%, making homeownership more attainable for many families.

-

VA Financing: Exclusively available to veterans and active-duty military personnel, VA financing offers significant advantages, including no down payment and no private mortgage insurance (PMI). This makes it an attractive option for eligible borrowers looking to maximize their purchasing power.

-

Jumbo Mortgages: These financial products exceed the conforming limits set by Fannie Mae and Freddie Mac, making them suitable for high-value properties. Jumbo loans often come with stricter credit requirements and higher interest rates, reflecting the increased risk to lenders.

Understanding the types of mortgage available enables you to select the most suitable choice for your financial circumstances. Additionally, flexible refinancing alternatives empower homeowners to adjust their loan conditions as their financial needs evolve. At F5 Finance, we are dedicated to transforming the home loan experience by utilizing technology to offer highly competitive prices and personalized assistance, ensuring a hassle-free property purchasing journey. Unlike traditional financial institutions that may rely on hard sales tactics and biased information, we prioritize transparency and client empowerment.

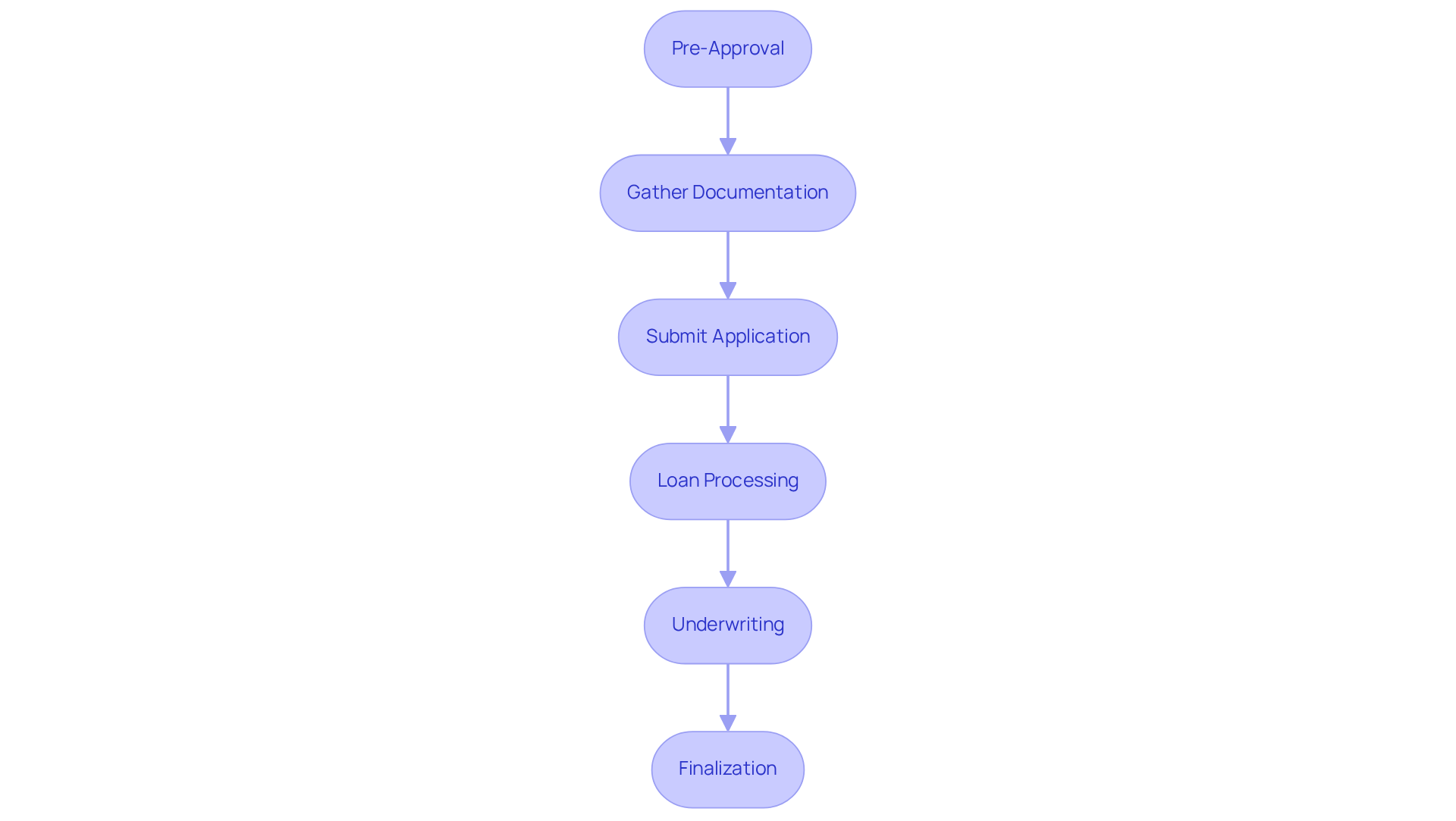

Understand the Mortgage Application Process and Requirements

The mortgage application process consists of several essential steps that can significantly impact your home buying experience. We know how challenging this can be, but understanding these steps can help ease your journey.

-

Pre-Approval: Securing pre-approval from a lender is a crucial first step before you start house hunting. This process helps you understand how much you can borrow, giving you a competitive edge in the market. Knowing your budget can alleviate some of the stress associated with home buying.

-

Gather Documentation: Prepare to provide necessary documentation, including proof of income, tax returns, credit history, and details about your debts and assets. Lenders typically require a credit score of at least 620 for pre-approval, with higher scores often leading to better rates. Gathering these documents may seem daunting, but we’re here to support you every step of the way.

-

Submit Application: Complete the mortgage application form with your lender, ensuring all required documentation is included. This step is vital for a smooth processing experience. Taking this step with confidence can set a positive tone for the rest of the process.

-

Loan Processing: Once your application is submitted, the lender will review it, verify your information, and assess your creditworthiness. This stage can take around 10 days, so plan accordingly. Patience is key here, and understanding the timeline can help ease any worries.

-

Underwriting: An underwriter will evaluate the risk of lending to you, ensuring that you meet all necessary requirements. This step is crucial in assessing your eligibility for the financial assistance. Remember, this is a standard part of the process, and it’s designed to protect you as a borrower.

-

Finalization: If your application is approved, you will attend a closing meeting to sign the final documents and complete the financing. Most mortgages at F5 Mortgage close in less than three weeks, making the process efficient. This final step is exciting, as it brings you closer to your new home.

Grasping these steps not only simplifies your loan application but also readies you for what to anticipate, boosting your confidence as you proceed through the home purchasing process. You’re not alone in this journey, and with the right knowledge, you can navigate it successfully.

Recognize the Value of Personalized Mortgage Consultations

Personalized mortgage consultations offer a multitude of advantages that can significantly enhance your home financing experience.

-

Tailored Advice: We understand that every financial situation is unique. A mortgage broker will evaluate your specific circumstances and recommend the types of mortgage that are most suitable and tailored to your needs. This personalized approach ensures you are matched with products that align with your long-term goals. Clients like Ruth Vest have praised F5 Mortgage for their expertise and customer service, noting how the team worked diligently to meet their needs.

-

Access to Various Lenders: We know how important it is to have choices. Brokers partner with a wide range of lenders, providing you access to an expanded selection of types of mortgage options and favorable terms. This variety is particularly beneficial in a market where affordability is a growing concern for many homebuyers. Testimonials from satisfied clients, such as Artie Kamarhie, highlight the team’s ability to secure amazing rates and provide detailed guidance throughout the process.

-

Simplified Process: Navigating the complexities of loan applications can be daunting. A knowledgeable broker will streamline this process for you, assisting with paperwork and negotiations, which can alleviate stress and confusion. The educational resources provided by F5 Mortgage, including comprehensive home buyer’s guides, empower you to make informed decisions. Joe Simms noted how Jeff and his team made the process easy and worry-free, ensuring that every step was clearly understood.

-

Ongoing Support: We believe that support should not end after closing. Brokers offer constant assistance throughout the loan process, ensuring you stay informed and assured in your choices. This relationship extends beyond the initial transaction, fostering trust and long-term engagement. Clients like Marqis Lamar have expressed gratitude for the patience and educational support received from F5 Mortgage, feeling like family throughout the process.

Acknowledging the importance of personalized consultations can lead to a more successful and fulfilling financing experience. In fact, 94% of clients who engaged with F5 Mortgage reported satisfaction with their broker services, highlighting the effectiveness of tailored advice in achieving favorable outcomes. As the mortgage landscape evolves in 2025, the role of brokers in assisting first-time homebuyers and families looking to upgrade remains crucial, ensuring you navigate the complexities of financing with ease.

Conclusion

Navigating the mortgage landscape can feel overwhelming, but we understand how important it is to find the right path for your unique needs. This article has shed light on essential mortgage basics, from key terms like principal and interest rates to the various types of mortgages available, including fixed-rate, adjustable-rate, FHA, VA, and jumbo loans. Each option comes with its own set of features and benefits, empowering you to select the best fit for your financial situation.

We’ve discussed the significance of the mortgage application process, which includes vital steps like pre-approval and gathering necessary documentation. Personalized mortgage consultations stand out as a tremendous advantage. These consultations not only offer tailored advice but also simplify the application process and provide ongoing support, ensuring a seamless experience for you as a buyer. The importance of grasping these elements cannot be overstated, especially as the mortgage market continues to evolve in 2025.

As you embark on this significant financial commitment, it’s crucial to leverage the knowledge and resources at your disposal. Engaging with mortgage professionals can greatly enhance your home buying experience, providing clarity and confidence as you navigate the complexities of financing. Embrace this journey with the right information and support, and take the next step towards securing a home that fulfills both your current needs and future aspirations.

Frequently Asked Questions

What is a home loan?

A home loan is a financial product designed to help you acquire real estate, with the property itself serving as security.

What is the principal in a mortgage?

The principal is the amount you borrow to purchase your home.

What does the interest rate represent?

The interest rate represents the cost of borrowing, shown as a percentage, which can significantly affect your monthly payments.

What is the average interest rate for a 30-year fixed mortgage in 2025?

The average interest rate for a 30-year fixed mortgage in 2025 is around 6.93%.

What does amortization mean in the context of a mortgage?

Amortization refers to the gradual repayment of your loan through regular installments, which typically include both principal and interest.

What is an escrow account?

An escrow account holds funds until specific conditions are met, often for property taxes and insurance, ensuring these obligations are fulfilled on time.

What is a down payment?

A down payment is the initial amount you contribute when purchasing a home, generally a percentage of the purchase price.

What is the median down payment in the U.S. in 2025?

In 2025, the median down payment in the U.S. is about 18%, while first-time homebuyers average around 9%.

Why is it important to understand different types of mortgages?

Understanding different types of mortgages empowers you to make informed decisions and navigate the complexities of loan financing, which can significantly influence your long-term financial strategy.

How many home sales are expected in 2025?

Over 5.35 million home sales are expected in 2025.