Overview

Navigating the process of PMI insurance removal can feel overwhelming, but we’re here to support you every step of the way. To successfully remove PMI insurance from your mortgage, it’s essential to:

- Achieve at least 20% equity in your home

- Maintain a solid transaction record

- Formally request cancellation from your lender

Understanding these requirements is crucial, as it can lead to significant monthly savings, ranging from $150 to $250. Imagine what you could do with that extra money! By grasping the PMI removal process, you can take control of your finances and make informed decisions that benefit your family.

We know how challenging this can be, but with the right knowledge and steps, you can navigate this journey effectively. Don’t hesitate to reach out and take action today; your financial peace of mind is worth it.

Introduction

Navigating the complexities of homeownership can be daunting, especially when it comes to understanding the nuances of Private Mortgage Insurance (PMI). For many homeowners, particularly those who made a down payment of less than 20%, PMI can significantly inflate monthly mortgage payments. This often creates a financial strain that feels unending.

However, there is hope. With the right knowledge and proactive steps, it is possible to eliminate this expense and unlock substantial savings. We know how challenging this can be, but by taking control of your financial future, you can pave the way for a more secure homeownership experience.

What challenges must homeowners overcome to successfully remove PMI? And how can you take charge of your financial destiny? We’re here to support you every step of the way.

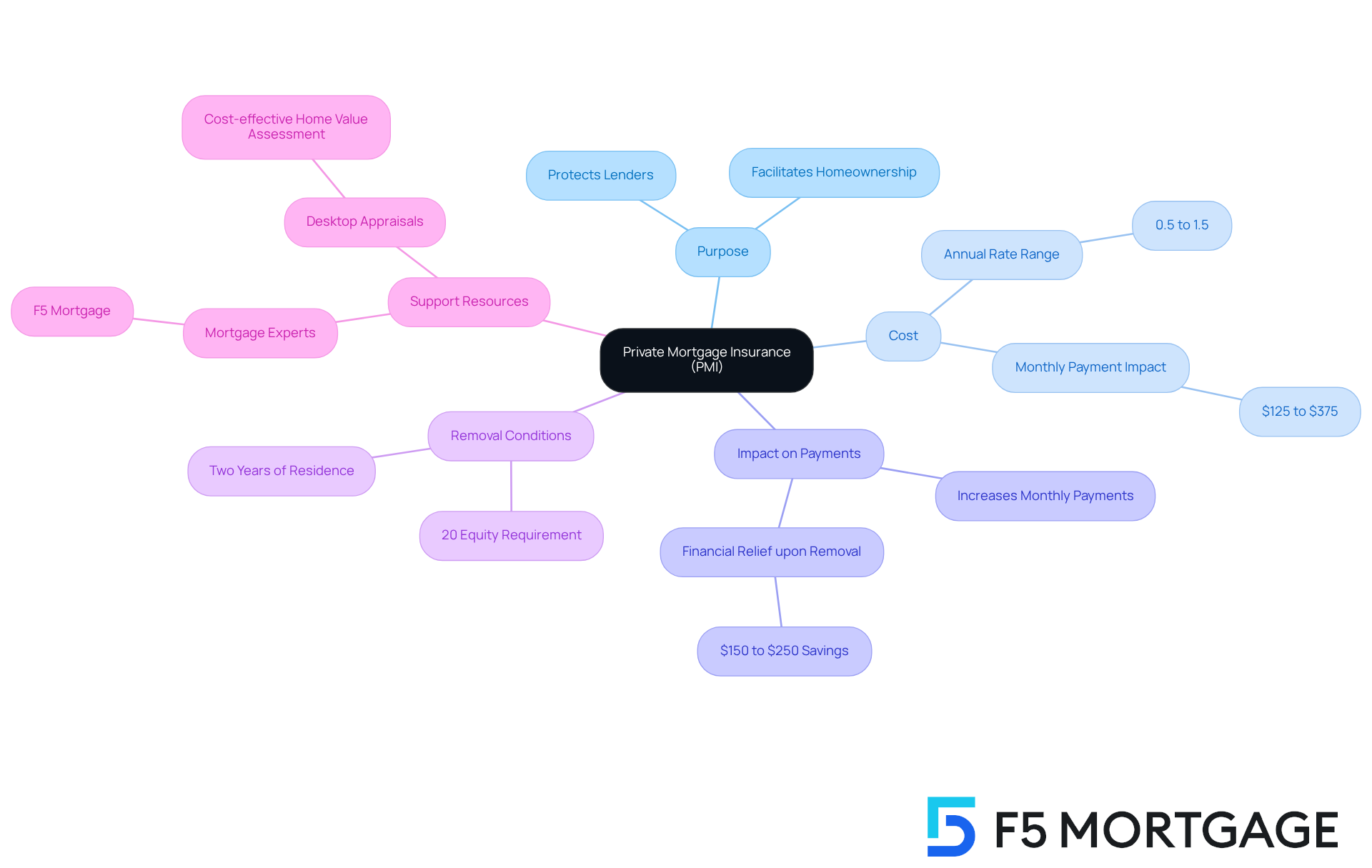

Understand Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is a crucial aspect of conventional loans for those who make a deposit of less than 20%. We understand how overwhelming this can feel, but PMI serves as a safety net for lenders, protecting them in case of borrower default. For homeowners, grasping the implications of PMI is vital, as it can significantly impact monthly mortgage payments.

Typically, PMI costs range from 0.5% to 1.5% of the original loan amount each year, which gets included in your monthly mortgage charge. For example, on a $400,000 home with a $300,000 mortgage, PMI could add between $125 to $375 to your monthly payment, depending on the rate applied. It’s important to remember that PMI benefits the lender, not the homeowner. By understanding the terms and conditions related to PMI insurance removal, you can take proactive steps toward its removal.

If you have built at least 20% equity in your home, you may qualify for PMI insurance removal, which could potentially save you between $150 to $250 each month. This financial relief can be significant, especially in today’s economic climate where rising costs are a concern. Engaging with a mortgage expert at F5 Mortgage can provide clarity on PMI and assist you in navigating your options effectively.

We’re here to support you every step of the way. Our commitment to transparency, combined with advanced technology, ensures you receive competitive rates and personalized support. This empowers you to make informed decisions that align with your financial goals.

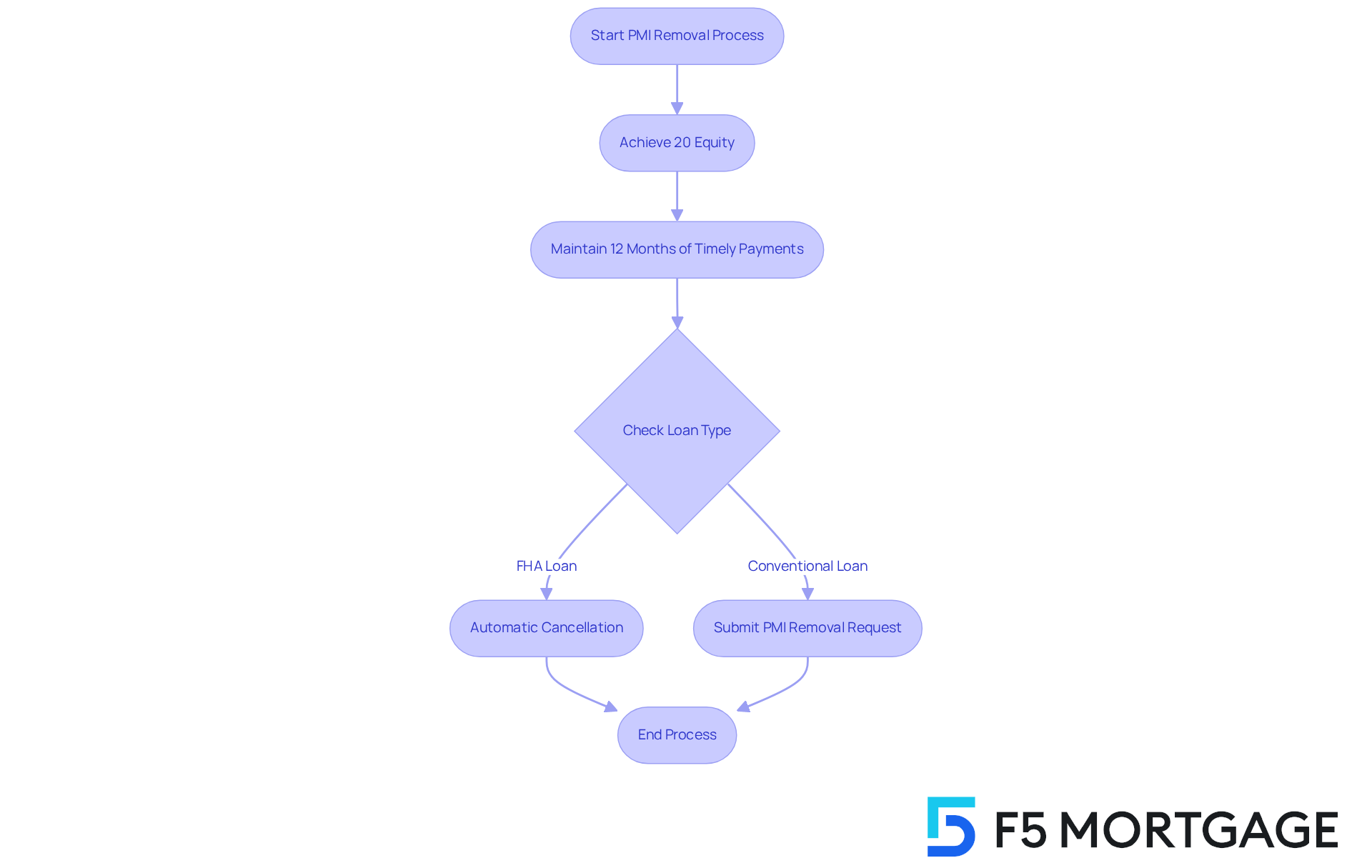

Identify Conditions for PMI Removal

We know how challenging it can be to navigate the world of mortgage insurance, but understanding how to successfully achieve PMI insurance removal can lead to significant savings for you and your family. Here’s what you need to know:

-

Achieving 20% Equity: You can start your PMI cancellation request once your mortgage balance falls below 80% of your property’s initial value. This milestone is often reached through consistent loan contributions or a rise in property value. If you’re in Colorado, learning about the refinancing process can help you leverage your home equity effectively, especially in a rising market.

-

Transaction Record: Lenders typically require a solid transaction record, which means having at least 12 consecutive months of timely contributions before they consider your PMI removal request. Staying current on your loan is essential, highlighting the importance of maintaining good financial habits.

-

Loan Type: The ability to eliminate PMI can vary depending on the type of loan you have. For example, FHA loans have unique regulations regarding mortgage insurance compared to conventional loans, where PMI insurance removal is typically necessary if the down payment is below 20%.

-

Automatic cancellation happens when lenders are obligated to facilitate PMI insurance removal once your principal balance reaches 78% of the original property value, as long as you are current on your payments.

-

To proceed with PMI insurance removal, you must formally request it from your lender. This may involve submitting paperwork or obtaining a new appraisal to confirm your property’s current market value. Understanding how much equity you have is crucial, as it can impact your mortgage rates. A cost-effective option is to request a desktop appraisal, which typically costs between $150 and $200.

By understanding these requirements, you can take proactive steps to reduce your monthly expenses and potentially save between $150 to $250 each month by eliminating PMI. We’re here to support you every step of the way as you work towards achieving your financial goals.

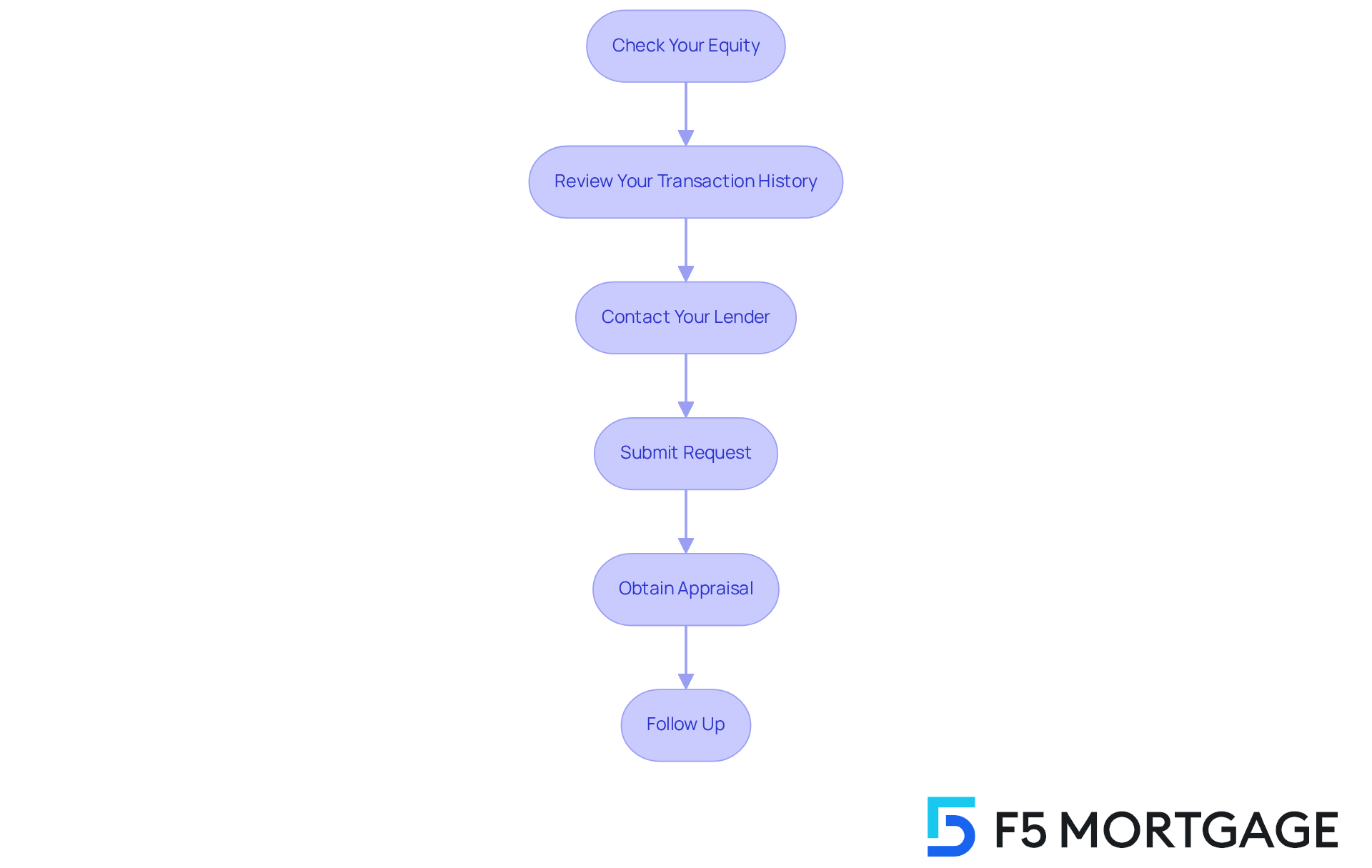

Implement Steps to Remove PMI

While PMI insurance removal can feel daunting, we’re here to support you every step of the way. Follow these simple steps to navigate the process with confidence:

-

Check Your Equity: Start by calculating your loan-to-value (LTV) ratio. This is done by dividing your remaining mortgage balance by the current appraised value of your property. If your LTV is below 80%, you may qualify for PMI insurance removal. For instance, if your mortgage balance is $160,000 and your home is appraised at $200,000, your LTV is 80%, making you eligible to request PMI cancellation.

-

Review Your Transaction History: It’s important to ensure you have a solid transaction record. Lenders typically require that you have no dues 30 days overdue in the past 12 months. A clean record can make a significant difference in processing your request.

-

Contact your lender to learn about their specific process for PMI insurance removal. They may require a written request or a specific form to initiate the cancellation, so it’s good to ask what you need.

-

Submit a request for PMI insurance removal by preparing and including necessary documentation such as proof of equity and your payment history. This step is crucial in moving forward.

-

Obtain an Appraisal (if necessary): Some lenders may need a new appraisal to verify your property’s current value. Be prepared to cover the appraisal cost, typically ranging from $300 to $500. This investment can be worthwhile in the long run.

-

Follow Up: After submitting your request, don’t hesitate to follow up with your lender. This ensures the process is progressing and helps address any additional requirements they may have. Keeping detailed records of all communications is essential for tracking your request.

We understand how challenging this can be, but with these steps, you can take control of the situation and work towards removing PMI.

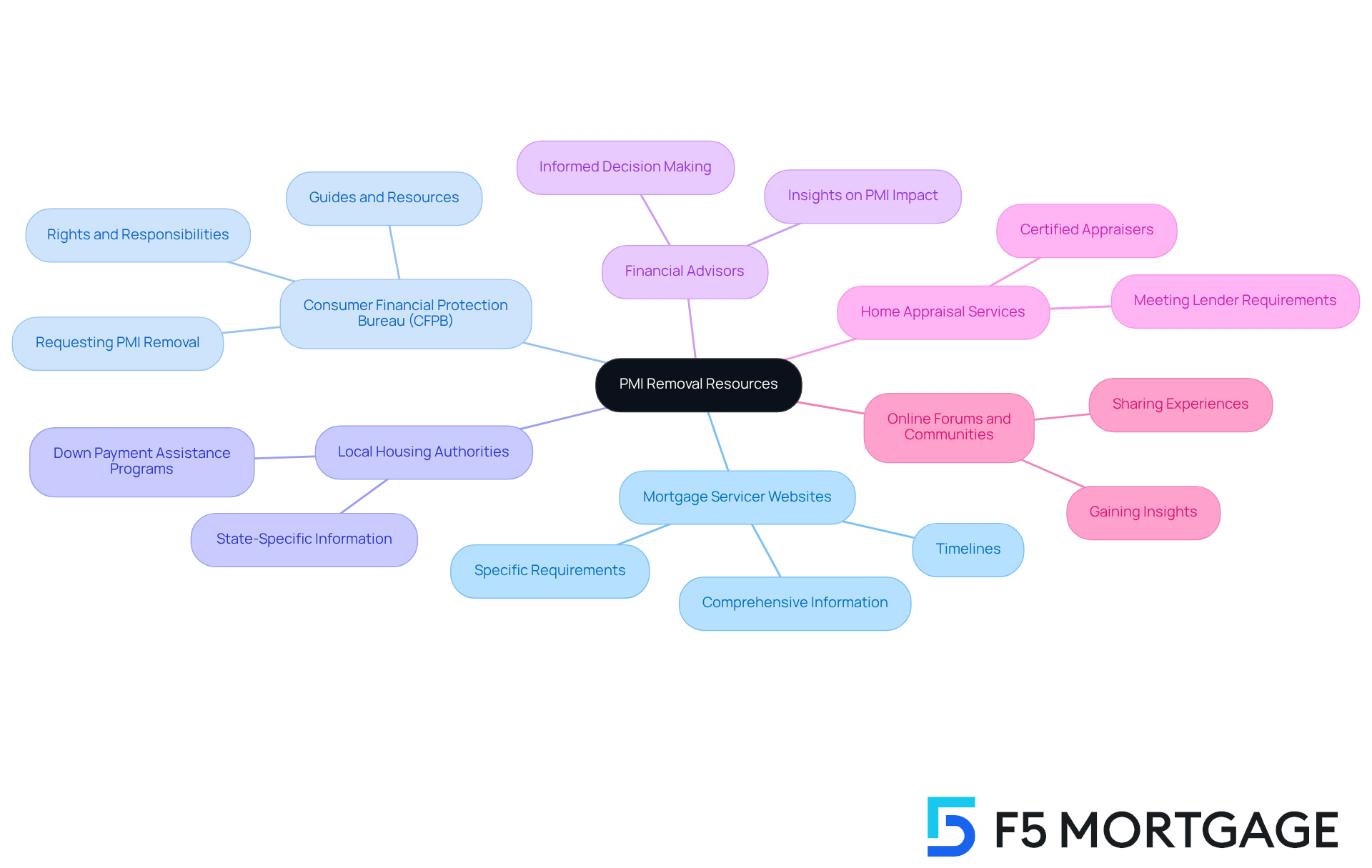

Access Resources and Support for PMI Removal

If you’re a homeowner looking for PMI insurance removal, you’re not alone in this endeavor. Many families face this challenge, but there are various resources and support options available to help you through the process:

- Mortgage Servicer Websites: Many lenders provide comprehensive information on their websites regarding the PMI removal process, including specific requirements and timelines. This can be a great first step in understanding what to expect.

- Consumer Financial Protection Bureau (CFPB): The CFPB offers valuable resources and guides about PMI, outlining your rights and responsibilities when it comes to cancellation. Importantly, you can request PMI insurance removal once your mortgage principal balance reaches 80% of your home’s original value.

- Local Housing Authorities: These organizations can assist you with state-specific information and resources, including potential down payment assistance programs that may support your homeownership journey.

- Financial Advisors: Consulting with a financial advisor can provide insights on how PMI removal impacts your overall financial health, ensuring you make informed decisions for your future.

- Home Appraisal Services: If an appraisal is necessary for PMI cancellation, you can find certified appraisers through local directories or online platforms, ensuring you meet your lender’s requirements.

- Online Forums and Communities: Engaging with online communities, such as Reddit or mortgage-specific forums, allows you to share experiences and gain insights from others who have successfully navigated the PMI removal process.

By utilizing these resources, you can effectively manage the PMI insurance removal process and enhance your financial well-being. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding the process of removing Private Mortgage Insurance (PMI) is essential for homeowners seeking to alleviate their financial burdens. We know how challenging this can be, as PMI can significantly impact monthly mortgage payments. However, by achieving the necessary equity in your home and following specific steps, you can successfully eliminate this cost. The journey to PMI removal not only leads to potential monthly savings but also enhances your overall financial health.

Key insights include:

- The importance of reaching at least 20% equity

- Maintaining a clean payment history

- Understanding the unique requirements based on loan types

Homeowners must take proactive measures, such as calculating their loan-to-value ratio and engaging with their lenders to initiate the removal process. Utilizing available resources, from mortgage servicer websites to financial advisors, can further empower you to navigate this journey effectively.

In conclusion, removing PMI is not merely a financial strategy; it is a pathway to greater financial freedom and stability. We’re here to support you every step of the way. Homeowners are encouraged to take the necessary steps towards PMI removal, leveraging available resources and support to enhance their financial well-being. By understanding and acting on these insights, you can reclaim your financial future and enjoy the benefits of reduced monthly payments.

Frequently Asked Questions

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance (PMI) is insurance required for conventional loans when a borrower makes a down payment of less than 20%. It protects lenders in case of borrower default.

How does PMI affect monthly mortgage payments?

PMI can significantly impact monthly mortgage payments, adding costs that typically range from 0.5% to 1.5% of the original loan amount each year. For example, on a $400,000 home with a $300,000 mortgage, PMI could add between $125 to $375 to the monthly payment.

Who benefits from PMI?

PMI primarily benefits the lender, as it provides protection against borrower default. Homeowners do not receive direct benefits from PMI.

When can PMI be removed?

PMI can be removed if a homeowner has built at least 20% equity in their home. This could potentially save homeowners between $150 to $250 each month.

How can a mortgage expert assist with PMI?

A mortgage expert can provide clarity on PMI, assist in navigating options for its removal, and help homeowners understand the terms and conditions related to PMI.

What is the role of F5 Mortgage in relation to PMI?

F5 Mortgage offers support and transparency regarding PMI, utilizing advanced technology to ensure competitive rates and personalized assistance, helping homeowners make informed financial decisions.