Overview

Securing a $15,000 loan for home upgrades can feel overwhelming, but we’re here to support you every step of the way. Understanding key financial concepts, preparing necessary documentation, and selecting the right lender are crucial to your success. We know how challenging this can be, and that’s why we’ve outlined essential steps to guide you.

- Start by checking your credit score. This is an important first step that can significantly impact your loan approval.

- Next, gather your financial documents; having everything ready will make the process smoother.

- Finally, take the time to compare lender options. A structured approach can truly enhance your chances of securing the loan you need.

Remember, you’re not alone in this journey. By following these steps, you empower yourself to make informed decisions that can lead to a successful loan application.

Introduction

Navigating the world of personal loans can feel overwhelming, especially for families eager to upgrade their homes. We understand how challenging this can be. With the average personal loan amount around $15,000, grasping the intricacies of borrowing is crucial for making informed financial decisions. This guide aims to demystify key concepts and terminology while outlining actionable steps that can enhance your chances of securing that loan.

What challenges might arise during the application process? We’re here to support you every step of the way, helping families prepare effectively to overcome them.

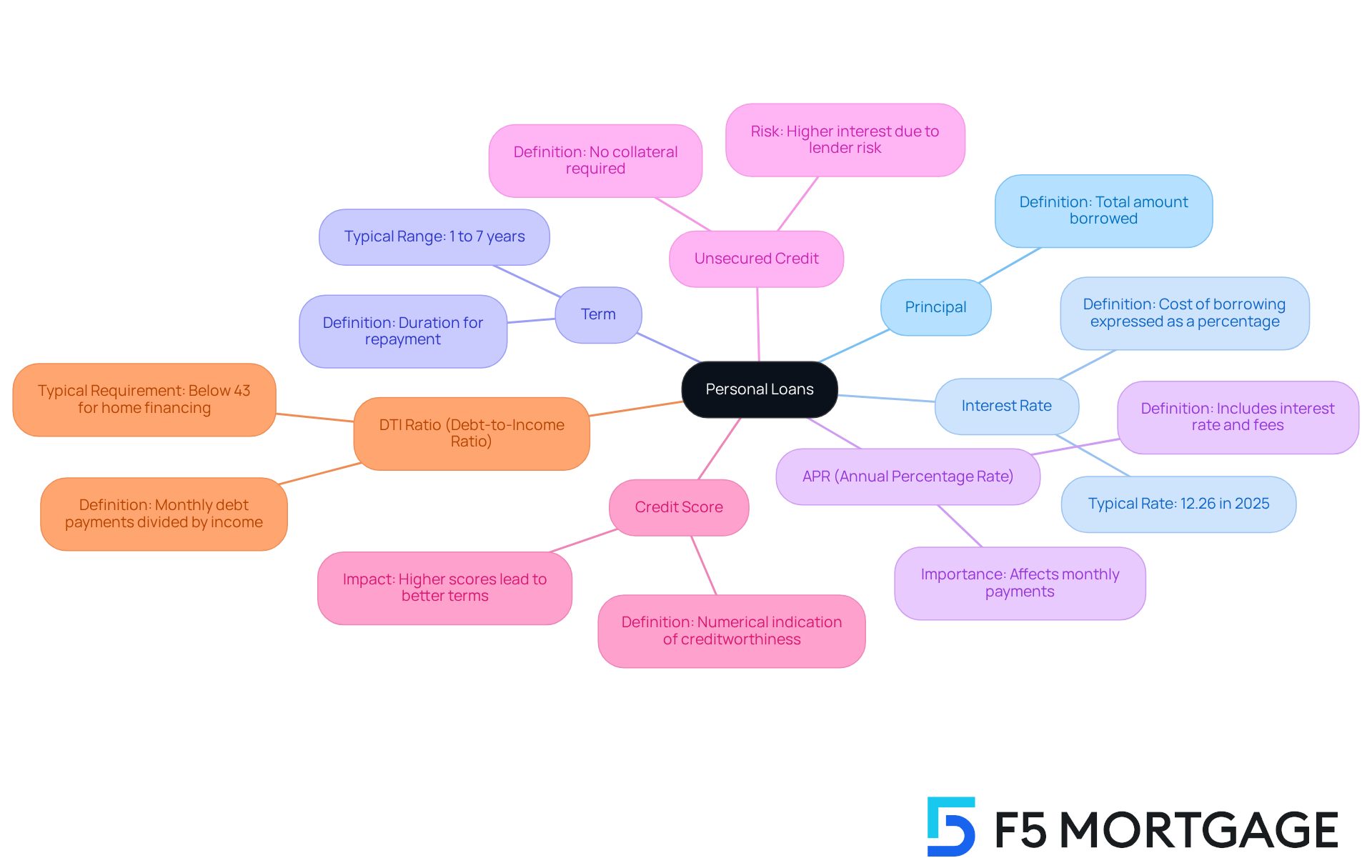

Understand Personal Loans: Key Concepts and Terminology

Before starting the application process for financing, we know how challenging it can be to comprehend key terms related to personal credit. Familiarity with these concepts will empower you to make informed decisions as you navigate your options:

- Principal: This is the total amount of money you borrow, which forms the basis for calculating interest.

- Interest Rate: Expressed as a percentage of the principal, this represents the cost of borrowing money. In 2025, typical personal borrowing costs remain around 12.26%, yet can differ greatly depending on creditworthiness and provider.

- Term: This refers to the duration over which you will repay the debt, typically ranging from one to seven years. Shorter terms frequently result in reduced interest levels, making them more economical.

- APR (Annual Percentage Rate): This figure includes the interest rate along with any related fees, providing a more comprehensive view of the total expense. Understanding APR is vital, as it directly impacts your monthly payments and overall financial commitment.

- Unsecured Credit: This kind of credit does not require collateral, meaning you won’t need to pledge assets like your home or car. However, unsecured financing often carries higher interest charges because of the heightened risk for lenders.

- Credit Score: A numerical indication of your creditworthiness, this score is essential in assessing your eligibility for financing and the interest terms you may obtain. Higher scores generally result in improved terms; for example, borrowers with scores exceeding 700 frequently qualify for considerably lower terms.

- Debt-to-Income (DTI) Ratio: A maximum of a 43% DTI ratio is typically necessary for home financing, whether obtaining a traditional mortgage or refinancing an existing one. A better DTI can lead to more competitive mortgage rates. For families in Colorado, understanding DTI is essential, especially when considering refinancing options. F5 Mortgage provides a range of refinancing options, including conventional mortgages, FHA products, and VA programs, each with distinct DTI requirements and advantages.

By understanding these terms, you will be better prepared to assess your borrowing options and make decisions that align with your monetary objectives. We’re here to support you every step of the way.

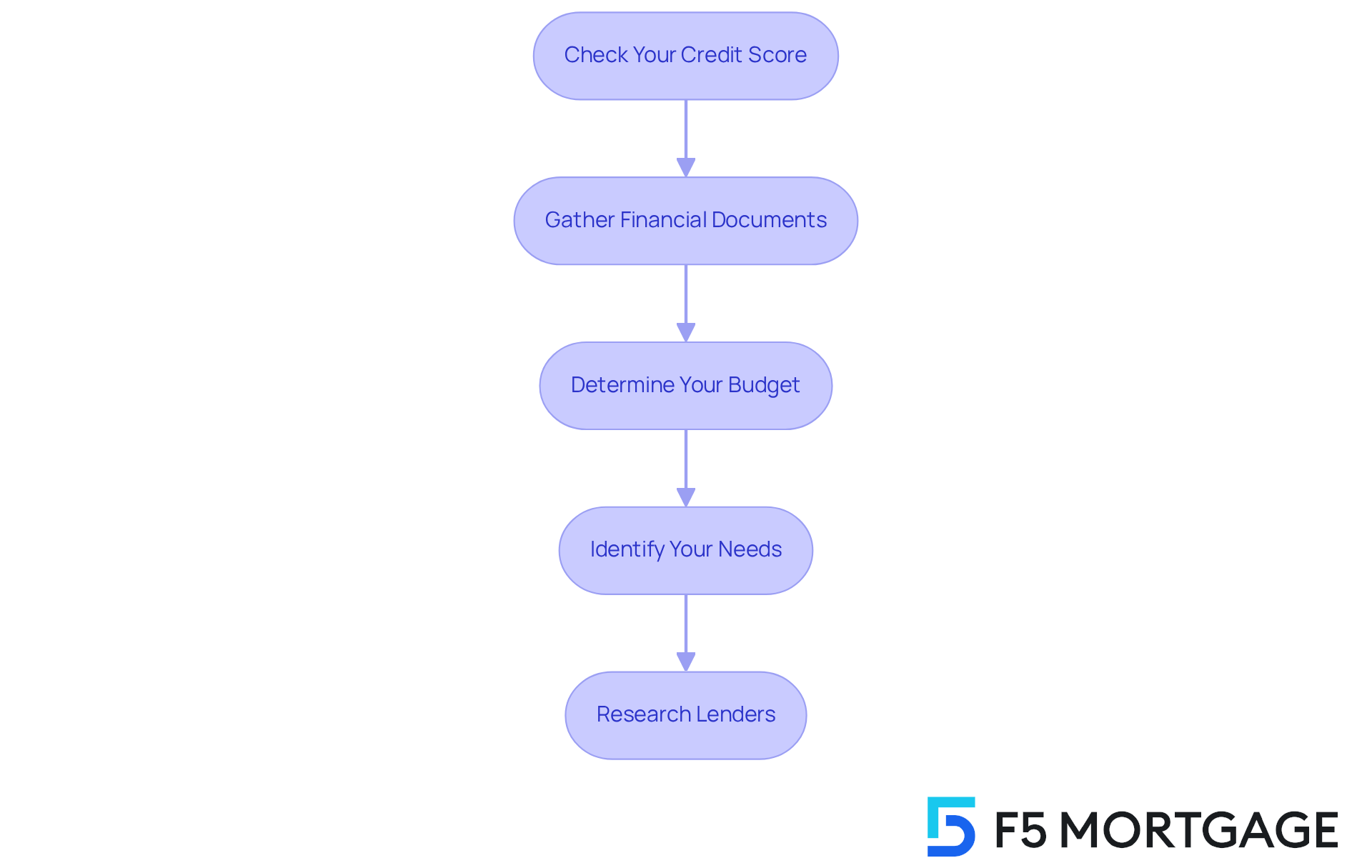

Prepare for Your Loan Application: Essential Steps

To effectively prepare for your 15k loan application, we understand how overwhelming this process can feel. Here are some essential steps to guide you:

-

Check Your Credit Score: Start by obtaining a copy of your credit report and checking your score. Aiming for a score of 650 or higher significantly enhances your chances of approval, as approximately 71% of consumers have good or better credit scores. We know how important this is for your financial future.

-

Gather Financial Documents: Compile the necessary documents, including:

- Recent pay stubs

- Tax returns from the last two years

- Bank statements

- Proof of identity (e.g., driver’s license, Social Security card)

Having everything ready can ease your mind and streamline the process.

-

Determine Your Budget: Assess how much you can afford to borrow and repay monthly. Use a mortgage calculator to estimate your potential payments, ensuring that your budget matches your economic capabilities. It’s crucial to know your limits as you navigate this journey.

-

Identify Your Needs: Clearly articulate the purpose of the financial assistance, whether for home improvements or debt consolidation. This clarity aids financial institutions in comprehending your monetary objectives and intentions. Remember, understanding your needs is the first step toward achieving them.

-

Research Lenders: Explore lenders that provide personal financing with advantageous conditions and terms. Comparing at least three options allows you to find the best fit for your specific needs, ensuring you secure the most advantageous deal. We’re here to support you every step of the way.

By adhering to these steps, you can improve your likelihood of obtaining a 15k loan that meets your family’s requirements. Enjoy the competitive offers and customized solutions provided by F5 Mortgage, and take comfort in knowing that you are making informed decisions for your future.

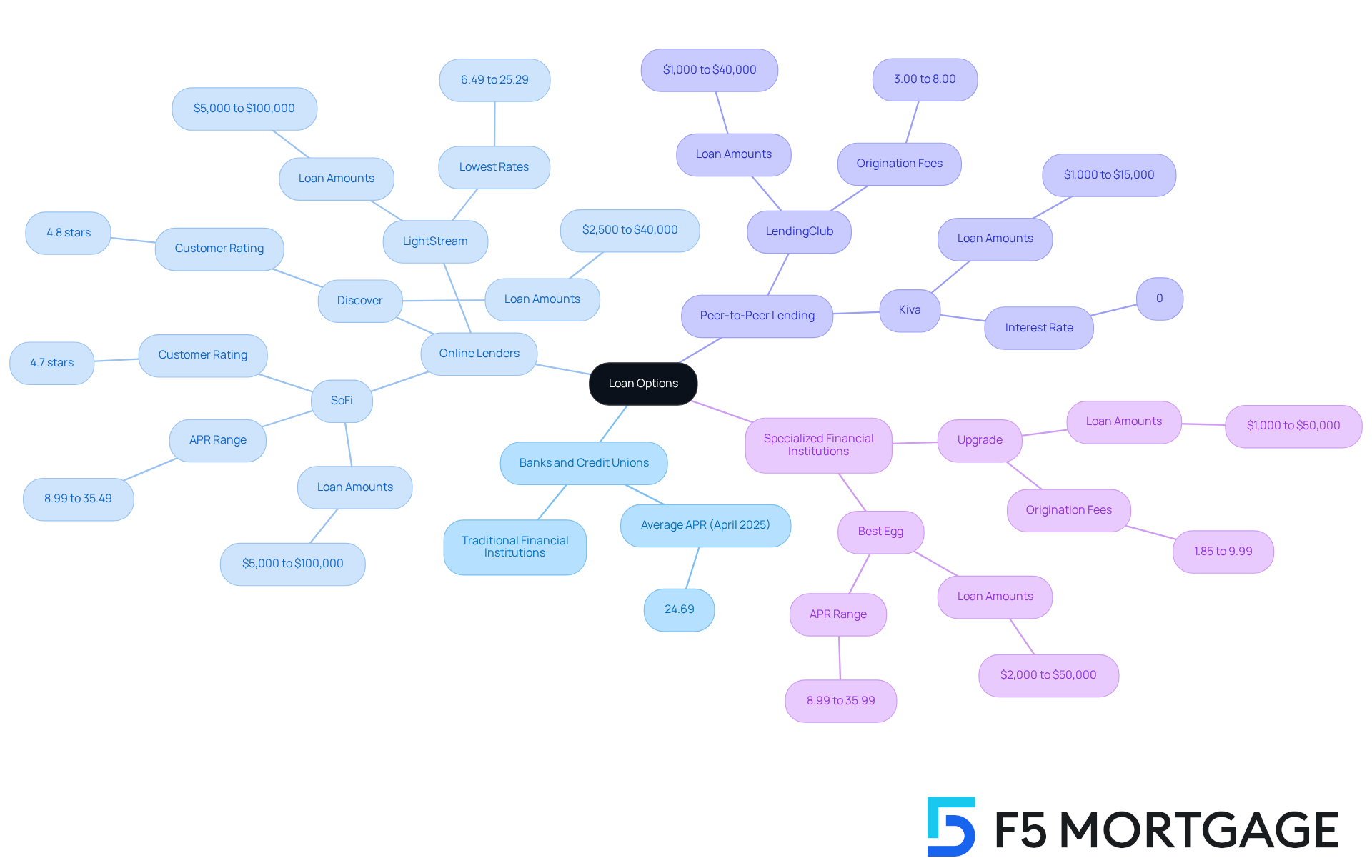

Explore Loan Options: Where to Find a $15,000 Loan

When considering a 15k loan, we know how challenging this decision can be. Let’s explore some options that may help you find the right fit for your needs:

-

Banks and Credit Unions: Traditional financial institutions often offer competitive rates and favorable terms. It’s a good idea to consult your local bank or credit union for personal financing options that may suit you. The average APR across all tiers in April 2025 was 24.69%, which can help you gauge what to expect.

-

Online Lenders: Numerous online platforms, like SoFi, LightStream, and Discover, provide quick access to personal loans. These websites make it easy to compare prices and terms, helping you discover the best offer. For instance, Discover has a customer service rating of 4 out of 5, indicating a strong reputation among borrowers.

-

Peer-to-Peer Lending: Platforms such as LendingClub connect borrowers with private investors, often leading to lower interest rates compared to conventional sources. However, it’s important to remember that investments in peer-to-peer lending are not FDIC insured, which poses a risk for investors.

-

Specialized Financial Institutions: Certain institutions focus on specific demographics or loan purposes, such as home improvement loans. Investigating financial institutions that cater to your specific needs can yield advantageous choices. For example, Upgrade charges origination fees between 1.85% and 9.99%, which is a critical factor to consider when evaluating your options.

Before applying, ensure you read reviews and assess the lender’s reputation to make an informed decision. As monetary specialists point out, ‘Personal credit options have several benefits, such as a stable interest rate, a set duration, and consistent payments,’ which can offer stability in your budgeting. Remember, we’re here to support you every step of the way.

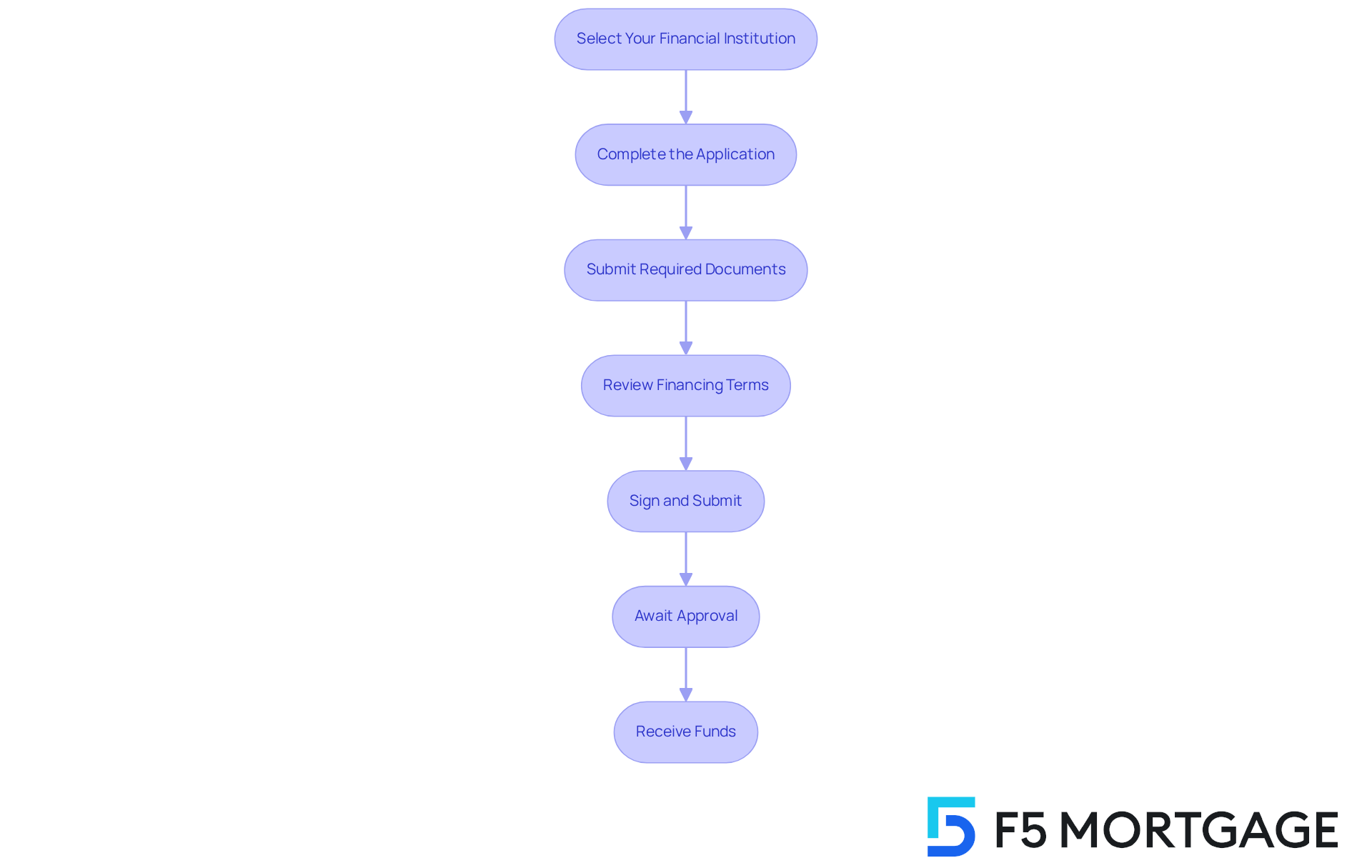

Apply for Your Loan: Step-by-Step Application Process

Securing your 15k loan can feel overwhelming, but we’re here to support you every step of the way. Follow these essential steps to make the process smoother:

-

Select Your Financial Institution: We know how important it is to find the right provider. Investigate different options to discover one that offers the best conditions for your financial situation. Consider factors like interest rates, fees, and customer service. According to LendingTree, comparing various financial institutions is crucial for finding the best loan proposal.

-

Complete the Application: Take your time to accurately fill out the lender’s application form. Ensuring all personal and financial information is correct will help facilitate a smoother process.

-

Submit Required Documents: Gather necessary financial documents, such as proof of income and identification. This step is crucial to avoid any delays in processing your application.

-

Review Financing Terms: Carefully examine the agreement, focusing on the interest rate, repayment schedule, and any associated fees. Financial experts emphasize the importance of fully understanding these terms to avoid surprises later. As J.D. Power notes, personal financing can be a critical financial lifeline, so knowing what you’re agreeing to is essential.

-

Sign and Submit: Once you feel comfortable with the terms, sign the agreement and submit your application.

-

Await Approval: The lender will review your application, which may take from a few hours to several days. Be prepared for potential requests for additional information during this period.

-

Receive Funds: Upon approval, funds are generally transferred directly to your bank account, often within one business day. This allows you to access your financial assistance quickly.

Statistics show that families who follow a structured method for credit applications have higher completion rates. In fact, 47.6% of LendingTree users intend to pay down debt through personal financing. This structured approach is crucial for a successful outcome.

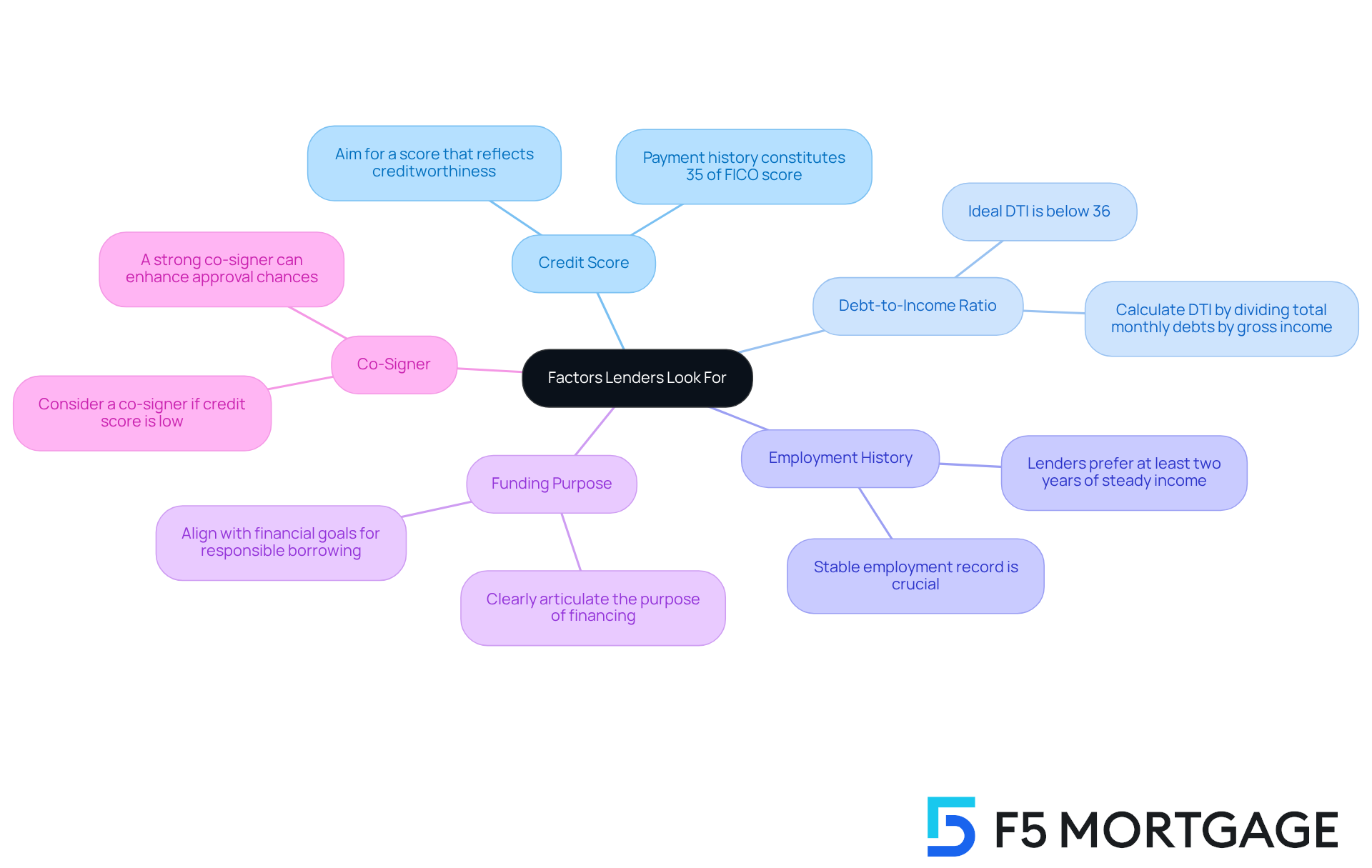

Improve Your Approval Chances: What Lenders Look For

To enhance your chances of securing a loan, we know how crucial it is to understand the key factors that lenders evaluate:

-

Credit Score: A strong credit score is essential, as it reflects your creditworthiness. Aim to improve your score by reducing outstanding debts and consistently making on-time payments. Remember, payment history constitutes 35% of your FICO score, so timely payments are critical.

-

Debt-to-Income Ratio (DTI): Lenders typically prefer a DTI ratio below 36%. To calculate your DTI, divide your total monthly debt payments by your gross monthly income. For instance, if your monthly obligations amount to $2,000 and your gross income is $6,000, your DTI would be around 33%, which is advantageous for approval.

-

Employment History: A stable employment record can significantly bolster your application. Lenders usually seek a minimum of two years of steady income, which demonstrates dependability and economic stability.

-

Funding Purpose: Clearly articulating the purpose of your financing can strengthen your application. Lenders favor borrowers who have a well-defined plan that aligns with their financial goals, indicating responsible borrowing.

-

Co-Signer: If your credit score is not ideal, consider enlisting a trusted individual to co-sign your financing. A co-signer with a strong credit profile can enhance your chances of approval, as they share the responsibility for repayment.

By addressing these factors, you can present a compelling application that increases your likelihood of securing the 15k loan necessary for your home upgrade. We’re here to support you every step of the way.

Conclusion

Securing a $15,000 loan for home upgrades is a significant financial decision, and we understand how challenging this can be. It requires careful consideration and preparation. By grasping key loan concepts, preparing adequately for the application process, and knowing where to find the best lending options, families can navigate this journey with confidence. The insights provided throughout this article emphasize the importance of being informed and organized, ultimately leading to a successful loan acquisition.

Key steps include:

- Checking your credit score

- Gathering necessary financial documents

- Researching various lenders to find the most favorable terms

Understanding what lenders look for—such as creditworthiness, debt-to-income ratios, and employment history—can greatly enhance your likelihood of approval. Each of these aspects plays a crucial role in not only securing the loan but also ensuring that it aligns with your financial goals.

As families consider their options for financing home improvements, it is essential to approach the process with diligence and clarity. By taking the time to educate yourselves on personal loans and following the outlined steps, you can make informed decisions that will benefit your financial future. Embracing this proactive approach will not only simplify the loan application process but also empower you to achieve your home renovation aspirations with confidence.

Frequently Asked Questions

What is a personal loan?

A personal loan is a type of financing where you borrow a specific amount of money, which you will repay over a set period, typically with interest.

What are the key terms related to personal loans?

Key terms include:

- Principal: The total amount borrowed.

- Interest Rate: The cost of borrowing, expressed as a percentage of the principal.

- Term: The duration over which the debt is repaid, usually between one to seven years.

- APR (Annual Percentage Rate): The total cost of borrowing, including the interest rate and any fees.

- Unsecured Credit: Credit that does not require collateral.

- Credit Score: A numerical representation of your creditworthiness.

- Debt-to-Income (DTI) Ratio: A measure of your monthly debt payments compared to your income.

What is the typical interest rate for personal loans in 2025?

The typical interest rate for personal loans in 2025 is around 12.26%, but it can vary based on creditworthiness and the lender.

How can I prepare for a personal loan application?

To prepare for a personal loan application, you should:

- Check your credit score.

- Gather necessary financial documents (e.g., pay stubs, tax returns, bank statements, proof of identity).

- Determine your budget for borrowing and repayment.

- Clearly identify your needs for the loan.

- Research and compare lenders.

What credit score is recommended for loan approval?

A credit score of 650 or higher is recommended to enhance your chances of loan approval, as around 71% of consumers have good or better credit scores.

Why is understanding the Debt-to-Income (DTI) ratio important?

Understanding your DTI ratio is important because it helps lenders assess your ability to manage monthly payments. A lower DTI can lead to more competitive mortgage rates and better loan terms.

What documents do I need to gather for a loan application?

You need to gather:

- Recent pay stubs

- Tax returns from the last two years

- Bank statements

- Proof of identity (e.g., driver’s license, Social Security card)

How can I identify my needs for a loan?

You can identify your needs by clearly articulating the purpose of the financial assistance, such as for home improvements or debt consolidation, which helps lenders understand your financial objectives.

How many lenders should I research when applying for a personal loan?

It is advisable to compare at least three lenders to find the best conditions and terms that suit your specific needs.