Overview

Navigating the world of mortgages can be daunting, and we understand how challenging this can be for families. In this article, we compare mortgage recasting and refinancing, two options that can significantly impact your financial situation.

- Recasting typically offers lower costs and allows you to retain your original loan terms, which can be a comforting choice for many homeowners.

- On the other hand, refinancing may provide access to lower interest rates and cash-out options, giving you more financial flexibility.

Ultimately, the decision between recasting and refinancing depends on your unique financial circumstances and goals. We’re here to support you every step of the way as you consider which option aligns best with your needs. By weighing the benefits of each approach, you can make an informed choice that brings you peace of mind.

Introduction

In a world where mortgage rates fluctuate and financial stability is paramount, we know how challenging it can be for homeowners to make informed decisions. As families face the choice between recasting and refinancing their mortgages, both options promise potential savings and relief from monthly financial strains. However, it’s important to recognize that these strategies cater to different needs and circumstances.

As you navigate these pivotal decisions, you may wonder: which strategy truly aligns with your financial goals? By exploring the nuances of each option, you can uncover the best path forward in your quest for a more manageable mortgage. We’re here to support you every step of the way, ensuring you find the solution that works best for your family’s unique situation.

Define Mortgage Recasting and Refinancing

Mortgage recasting is a thoughtful financial strategy that allows borrowers to make a lump-sum payment toward the principal of their mortgage. This step leads to a recalibration of monthly payments based on the reduced principal balance, enabling homeowners to retain their current financing terms and interest while enjoying lower monthly payments. On the other hand, restructuring means replacing the existing mortgage with a new financial agreement, which may come with different conditions, interest rates, and possibly a new duration. Many property owners seek to lower their interest rates, change their financing options, or tap into the equity of their homes.

In 2025, many homeowners are weighing the options of recast vs refinance as a viable alternative to restructuring, particularly in a fluctuating interest rate environment. This trend highlights a growing awareness of the benefits of keeping favorable loan terms while still achieving lower monthly payments. Real-life stories show that those who have recast their mortgages often experience significant savings without the complexities associated with mortgage restructuring.

Ultimately, the choice between recast vs refinance depends on individual financial circumstances and goals. While recasting can offer immediate relief in monthly payments, restructuring might present opportunities for long-term savings and access to additional funds. Understanding these options is vital for families who want to make informed decisions about their mortgage strategies. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Evaluate the Pros and Cons of Each Option

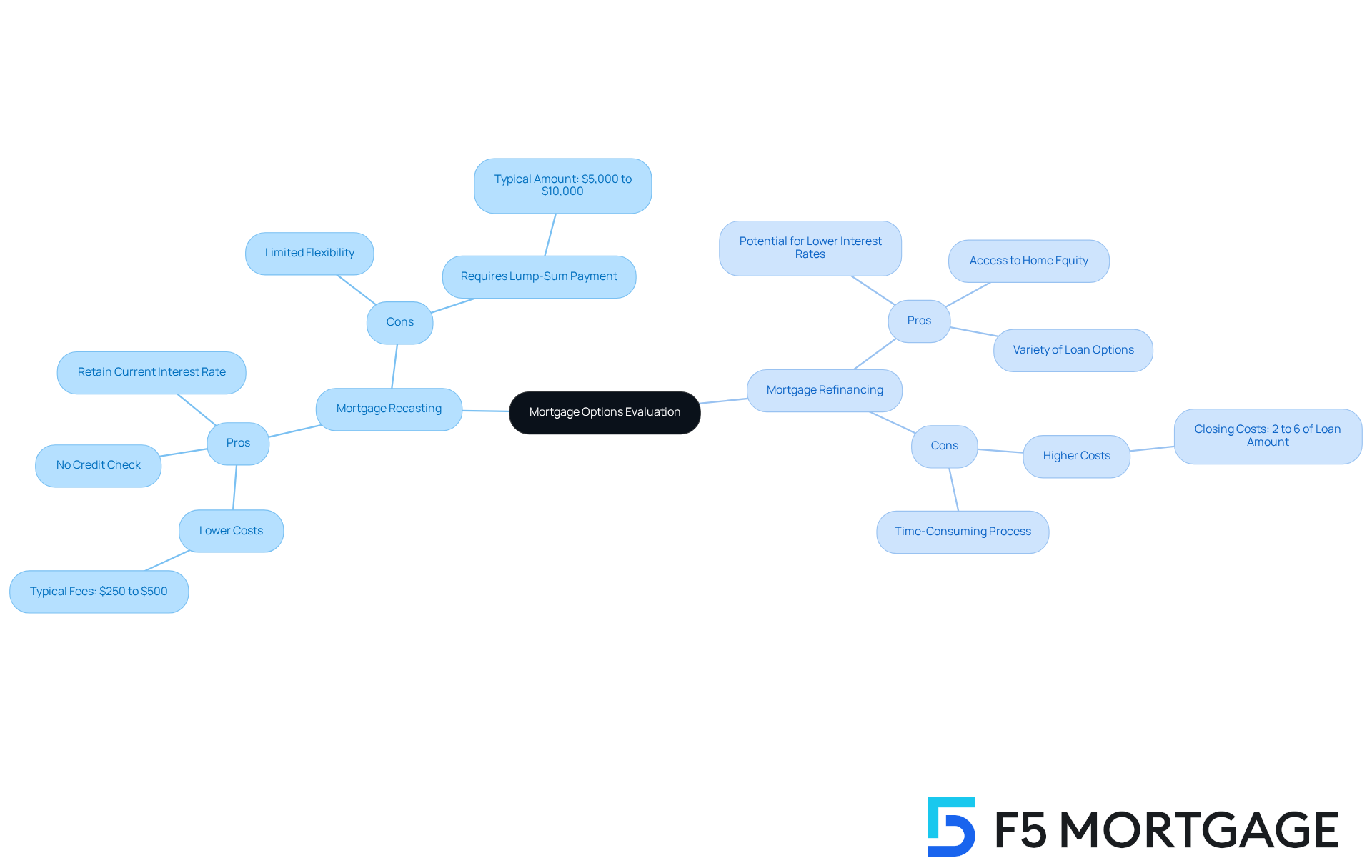

Pros of Mortgage Recasting:

- Lower Costs: Recasting typically incurs minimal fees, ranging from $250 to $500. This is significantly less than the costs involved in recast vs refinance, which can amount to between 2% and 6% of the loan amount. We understand that every dollar counts, and this option might ease some financial pressure.

- No Credit Check: Unlike refinancing, recasting does not require a credit check. This makes it accessible for homeowners who may have less-than-perfect credit histories, allowing them to explore their options without added stress.

- Retain Current Interest Rate: Homeowners can keep their existing interest rate, which is particularly beneficial if market rates have risen since the original mortgage was secured. This stability can provide peace of mind in uncertain times.

Cons of Mortgage Recasting:

- Limited Flexibility: Recasting does not permit changes to loan terms or provide access to additional funds. This limitation may restrict financial options, and we recognize how important flexibility can be in managing your finances.

- Requires Lump-Sum Payment: A significant cash amount, typically between $5,000 to $10,000, is necessary to initiate a recast. For some homeowners, this may not be feasible, and we empathize with the challenges of gathering such funds.

Pros of Mortgage Refinancing:

- Potential for Lower Interest Rates: Refinancing can secure a lower interest rate, which may reduce monthly payments and the total interest paid over the loan’s life. For example, restructuring from a 7% rate to a 5% rate can lead to substantial savings, helping families breathe a little easier financially.

- Access to Home Equity: Homeowners can tap into their home equity through cash-out loans, providing funds for renovations or debt consolidation. In Colorado, options like FHA mortgages are especially beneficial for individuals with lower credit ratings, offering more accessible restructuring alternatives.

- Variety of Loan Options: Colorado residents can choose from numerous options for loan modification, including conventional loans, FHA loans, VA loans, and streamline refinance loans. Each option is tailored to different financial circumstances and needs. At F5 Mortgage, we’re here to support you in navigating these choices effectively.

Cons of Mortgage Refinancing:

- Higher Costs: The closing costs associated with refinancing can be significant, often deterring homeowners with tight budgets. These expenses typically range from 2% to 6% of the borrowed sum, and we know how quickly these costs can add up.

- Time-Consuming Process: Refinancing often involves a lengthy application process, including credit assessments and appraisals. This can delay access to funds and new financing terms, and we understand how frustrating this waiting period can be.

Identify Situations Favoring Recasting or Refinancing

Identify Situations Favoring Recasting or Refinancing

Situations Favoring Mortgage Recasting:

- Homeowners with Extra Cash: We understand that receiving a windfall, like an inheritance or a bonus, can be both exciting and overwhelming. If you’re looking to lower your monthly payments without altering your loan terms, recasting might be the perfect solution for you.

- Stable Interest Levels: In times when interest levels are stable or even rising, preserving your current rate through recasting can be a smart move to consider.

Situations Favoring Mortgage Refinancing:

- Lower Interest Rates Available: With current mortgage rates around 6.5%, significantly lower than the peaks of over 7% seen earlier, homeowners with existing higher-rate mortgages can achieve substantial savings through refinancing. Even a decrease of just 0.5% can make a meaningful difference, especially for those with debts exceeding 7%.

- Need for Cash: If you’re looking to tap into your equity for home improvements or other expenses, cash-out options can be incredibly beneficial. This allows you to access your home’s value while potentially securing better financing terms.

- Desire for Different Loan Terms: If you’re considering switching from an adjustable-rate mortgage to a fixed-rate mortgage, obtaining a new loan is necessary. At F5 Mortgage, we offer a variety of loan options for modification, including conventional, FHA, VA, and streamlined loans, tailored to meet your unique needs and financial situation.

- Personal Financial Evaluation: As Yoon suggests, whether restructuring your loan is a good idea truly depends on your individual financial circumstances. We encourage you to assess your options thoroughly, especially given the current trends that favor restructuring for those with higher existing rates. F5 Mortgage is here to help you evaluate these choices and determine the best path forward.

In summary, the decision of recast vs refinance hinges on your personal financial situation and the prevailing market conditions. We know that mortgage restructuring can be both stressful and rewarding, depending on when it’s completed and the environment in which it’s carried out, as highlighted by Matt Richardson.

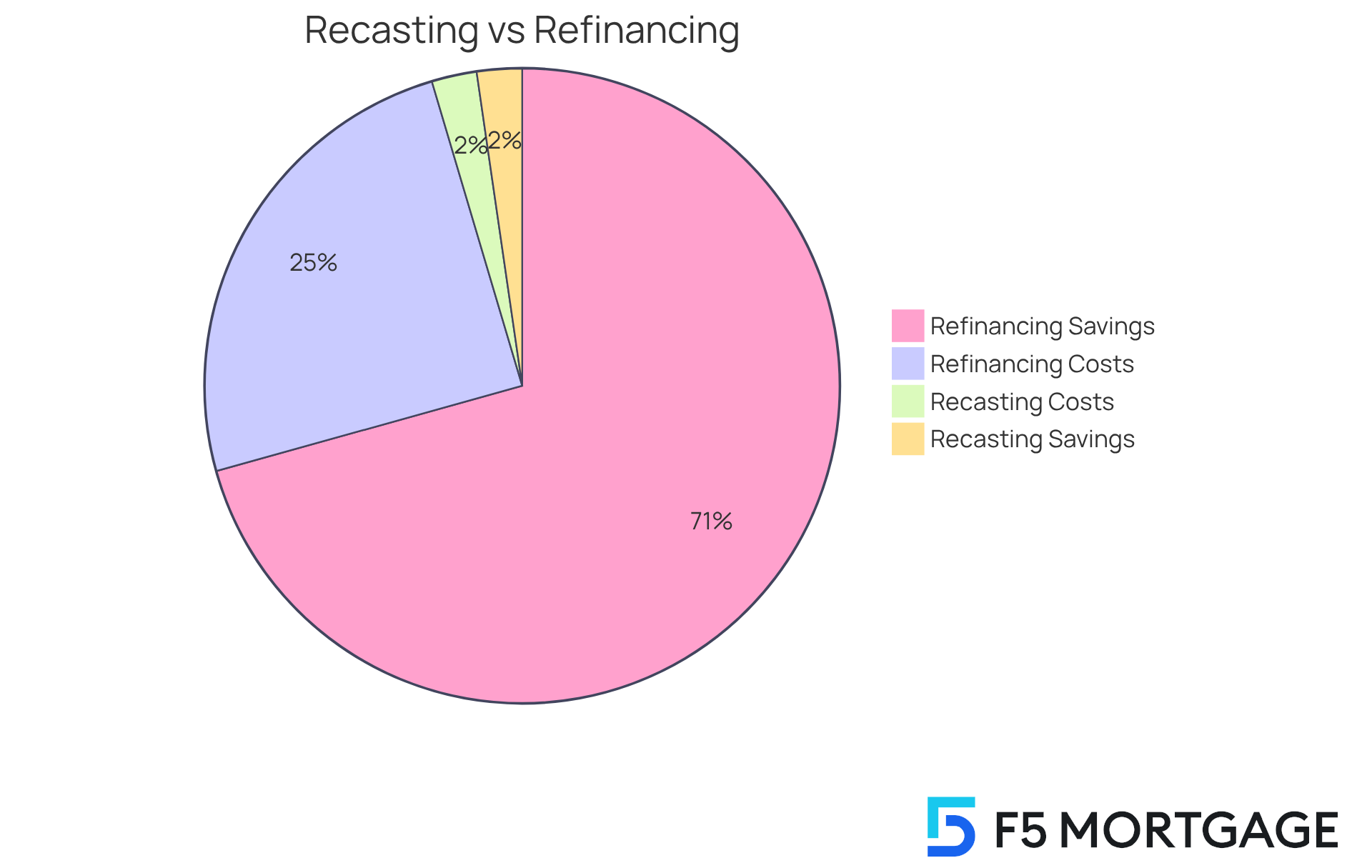

Compare Costs and Savings of Recasting vs. Refinancing

Cost Comparison:

-

Recasting Costs: We understand that navigating financial options can be daunting. Generally, recasting costs range from $150 to $500. The absence of closing costs or appraisal fees makes this a more affordable option for homeowners seeking immediate relief.

-

Refinancing Expenses: On the other hand, restructuring can involve costs ranging from 2% to 5% of the borrowed amount. These expenses include closing costs, appraisal fees, and other associated charges, which can accumulate significantly. It’s important to be aware of these factors as you consider your options in the context of recast vs refinance.

Savings Potential:

-

Recasting Savings: By making a lump-sum payment, homeowners can lower their monthly payments and save on interest over the remaining loan term without changing the interest rate. This approach can be particularly beneficial for those who have substantial funds available and wish to reduce their monthly financial burden. We know how important it is to ease financial stress.

-

Refinancing Savings: Homeowners may save thousands over the duration of their loan by obtaining a lower interest percentage through refinancing. For instance, a decrease of only 1% in interest can lead to significant savings on a 30-year mortgage, especially for individuals who previously secured higher percentages. This can be a game-changer for many families.

Example Scenario:

Consider a homeowner with a $300,000 mortgage at a 4% interest rate. If they opt for recasting with a $50,000 lump-sum payment, they could significantly lower their monthly payment without incurring high costs. Alternatively, refinancing to a new loan at 3% could provide even greater long-term savings, depending on the new loan terms and associated costs. This highlights the importance of evaluating both options, including recast vs refinance, to determine the best financial strategy for your family. Remember, we’re here to support you every step of the way.

Conclusion

Choosing between mortgage recasting and refinancing is a significant financial decision that can greatly impact your family’s financial health. We understand how challenging this can be. Each option offers distinct advantages and considerations, making it essential for homeowners to evaluate their personal circumstances and long-term goals with care.

- Recasting allows for lower monthly payments while retaining existing loan terms.

- On the other hand, refinancing can provide opportunities for lower interest rates and access to home equity.

In this article, we’ve explored the pros and cons of both strategies in detail.

- Recasting often incurs lower costs and does not require a credit check, making it an appealing option for those with extra cash who wish to reduce their monthly obligations.

- Conversely, refinancing can unlock substantial savings over time, especially for homeowners with higher interest rates, and provides flexibility through various loan options.

Ultimately, the decision hinges on your individual financial situation and current market conditions. We encourage you to assess your needs thoughtfully and consider consulting with a financial advisor to determine the best course of action for your family. Understanding the implications of recasting versus refinancing is crucial in navigating the mortgage landscape effectively. By doing so, you can make informed choices that align with your financial aspirations.

Frequently Asked Questions

What is mortgage recasting?

Mortgage recasting is a financial strategy that allows borrowers to make a lump-sum payment toward the principal of their mortgage, which leads to a recalibration of monthly payments based on the reduced principal balance while retaining the current financing terms and interest.

How does mortgage refinancing differ from recasting?

Mortgage refinancing involves replacing the existing mortgage with a new financial agreement, which may come with different conditions, interest rates, and possibly a new duration, whereas recasting keeps the same loan terms but adjusts the monthly payments.

Why are homeowners considering recasting or refinancing in 2025?

Homeowners are weighing recast vs refinance options as viable alternatives to restructuring, particularly in a fluctuating interest rate environment, to keep favorable loan terms while achieving lower monthly payments.

What are some benefits of mortgage recasting?

Recasting can offer immediate relief in monthly payments and allows homeowners to save money without the complexities associated with mortgage restructuring.

What factors should homeowners consider when choosing between recasting and refinancing?

The choice between recasting and refinancing depends on individual financial circumstances and goals, such as the desire for immediate payment relief or long-term savings and access to additional funds.

How can homeowners get support in making mortgage decisions?

Homeowners can seek support from financial advisors or mortgage professionals who can guide them through the process and help them make informed decisions about their mortgage strategies.