Overview

Navigating the mortgage landscape can be daunting, especially when faced with various lending options. Private mortgage lenders stand out from traditional lenders primarily due to their regulatory flexibility and speed of approval. This unique approach allows them to cater to your specific financial situation and provide quicker access to funds when you need it most.

Imagine being able to secure a loan in just a few days, rather than waiting weeks as you would with a conventional bank. This streamlined process can be a game-changer for families looking for timely financial solutions. However, it’s essential to weigh both the advantages and drawbacks of each option.

While private lenders offer rapid approvals, traditional banks come with their own set of benefits, such as established reputations and potentially lower interest rates. We understand how challenging it can be to choose the right path, and we’re here to support you every step of the way. By considering your unique needs, you can make an informed decision that aligns with your family’s financial goals.

Introduction

Navigating the mortgage landscape can be overwhelming, especially as private mortgage lenders gain popularity as alternatives to traditional banks. We know how challenging this can be. These independent financiers offer unique advantages, such as:

- Rapid approval processes

- Tailored loan options, catering to those with unconventional financial profiles

However, with the allure of flexibility comes the need to understand potential risks and trade-offs. How can you, as a borrower, effectively weigh the benefits of private lending against the reliability of conventional options? We’re here to support you every step of the way as you find the best fit for your financial needs.

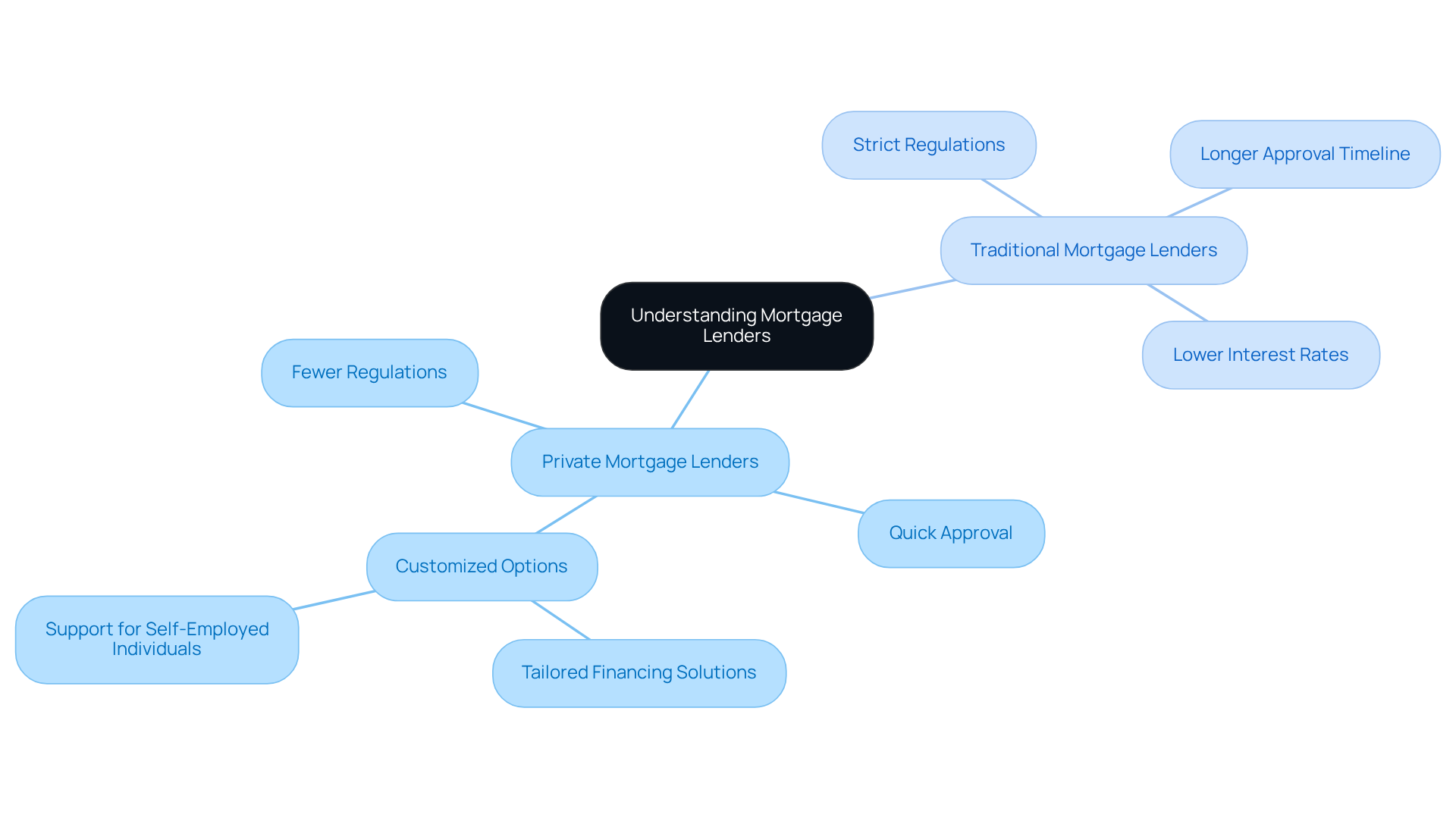

Understanding Private and Traditional Mortgage Lenders

Private mortgage lenders, which include individuals and specialized firms, operate with fewer regulatory restrictions than conventional banks. This flexibility allows private mortgage lenders to cater to niche markets, particularly individuals with unique financial circumstances or those in need of quick approval processes. On the other hand, conventional mortgage providers, such as banks and credit unions, adhere to strict federal regulations, resulting in a longer approval timeline. However, they often offer lower interest rates due to their established credibility and resources.

We understand how challenging it can be to navigate the mortgage landscape, especially with current trends showing a growing preference for independent mortgage financing. Many borrowers are increasingly turning to private mortgage lenders as conventional lending standards tighten. For instance, individual financiers are being recognized for their ability to provide tailored funding solutions, which can be particularly advantageous in competitive real estate markets. This shift is evident in the fact that independent financiers can often approve loans and disburse funds within days, contrasting sharply with the weeks or even months required by traditional lenders.

Moreover, private mortgage lenders excel at meeting the needs of self-employed individuals and those with less-than-perfect credit by offering customized loan options that may not be available through traditional banks. F5 Mortgage exemplifies this client-focused approach by connecting clients with top realtors in their area, ensuring a seamless home buying experience. They work with over two dozen prominent financial institutions to secure the best mortgage offers and provide access to various down payment assistance programs, enhancing home buying opportunities for families looking to upgrade their homes. With 5-star reviews from satisfied clients, F5 Mortgage showcases exceptional customer satisfaction.

As the mortgage landscape continues to evolve, understanding these distinctions is crucial for individuals seeking the most suitable financing options for their unique circumstances. We’re here to support you every step of the way, empowering you to make for your family’s future.

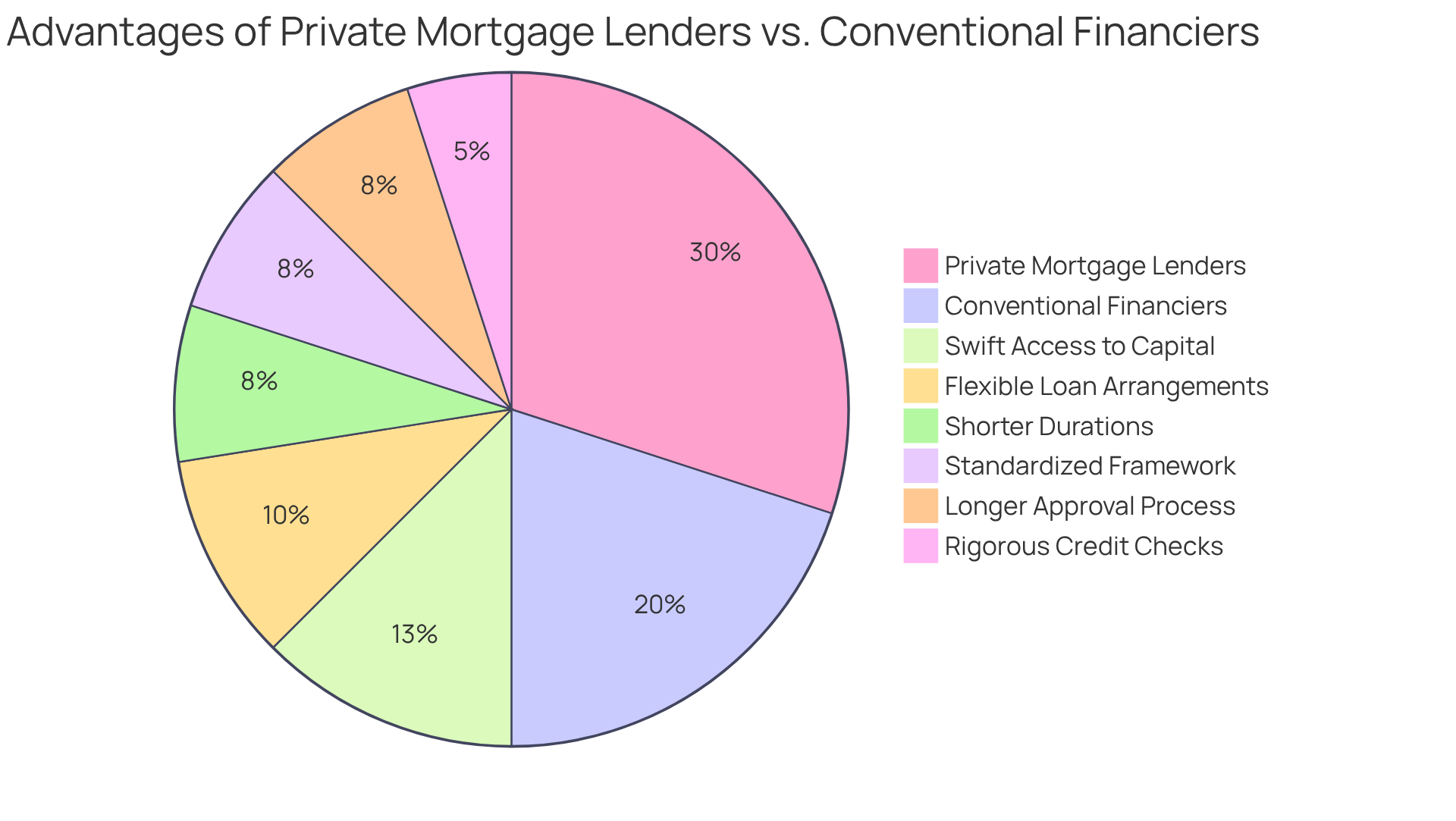

Comparing Loan Structures and Approval Processes

Private mortgage lenders are increasingly recognized for their flexible loan arrangements, which provide shorter durations and various repayment alternatives. This is especially beneficial for individuals who need swift access to capital. For example, F5 Mortgage stands out by leveraging technology to provide ultra-competitive mortgage rates while ensuring a no-pressure service experience for clients. We know how challenging this can be, and F5 Mortgage is committed to exceptional service, having garnered 5-star reviews on platforms like Google and Zillow. Clients often praise the team’s expertise and support throughout the loan process.

In contrast, conventional financiers typically follow a more standardized loan framework, defined by fixed terms and interest rates. Their approval processes can stretch over several weeks due to extensive documentation and rigorous credit checks. This clear contrast highlights the importance for individuals seeking loans to assess their urgency and financial circumstances when choosing between private mortgage lenders and conventional lending options.

As the lending environment evolves, the speed and adaptability offered by companies like F5 Mortgage are becoming increasingly attractive. This is especially true for those wanting to navigate the complexities of home financing effectively. With the U.S. market for non-bank credit approaching $2 trillion, the is evident as they gain market share from conventional banks. This shift makes them a feasible choice for many clients.

Ultimately, we’re here to support you every step of the way in finding the right mortgage solution that fits your needs.

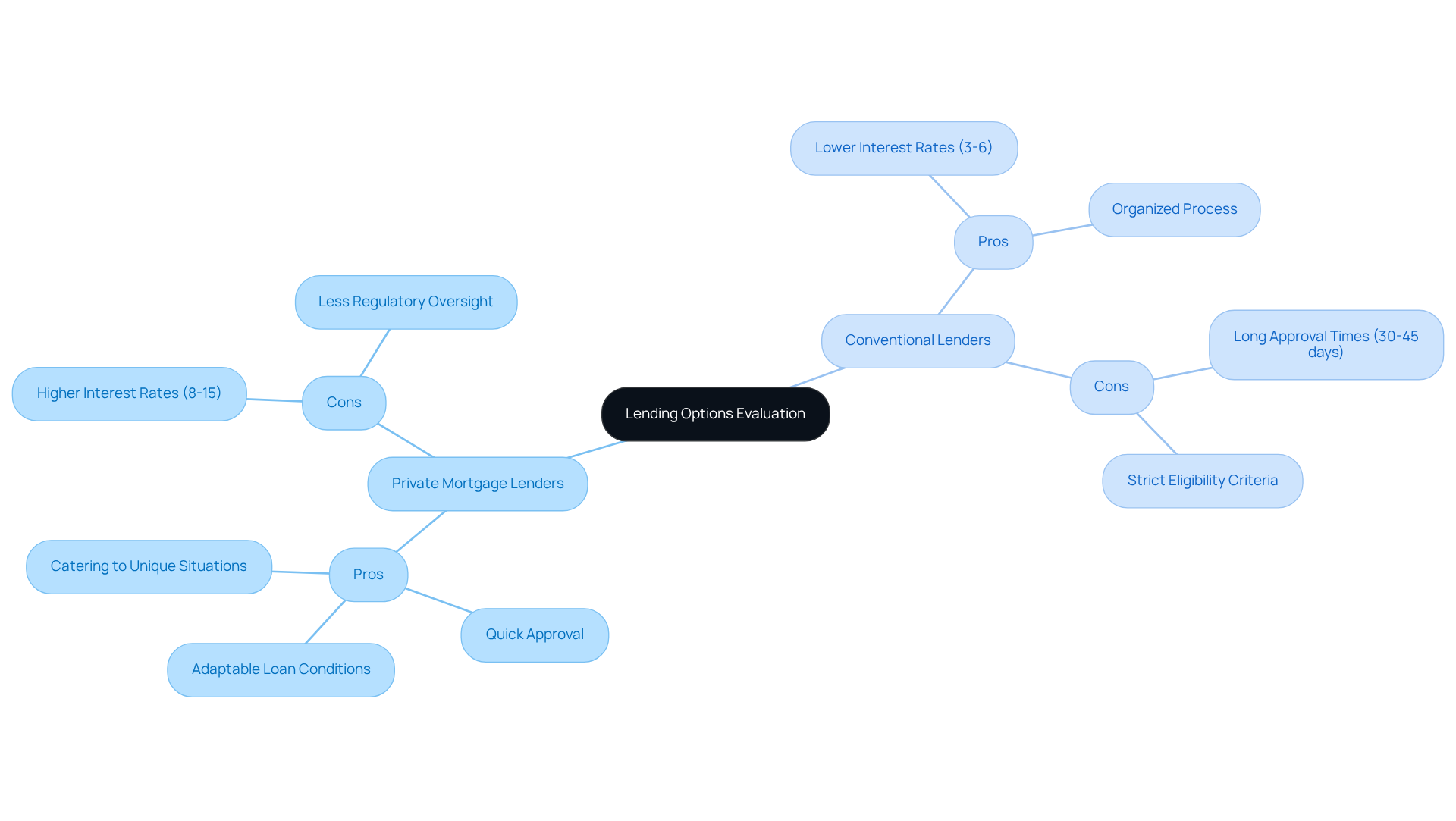

Evaluating the Pros and Cons of Each Lending Option

When assessing individual mortgage providers, it’s important to recognize the significant benefits they offer, such as quick approval times, adaptable loan conditions, and the ability to cater to unique financial situations. For instance, private mortgage lenders often authorize loans in just a few days, making them an appealing choice for those who need rapid access to funds. However, we know how challenging it can be to weigh these benefits against potential trade-offs, like higher interest rates that typically range from 8% to 15%, and less regulatory oversight, which can increase the risk of unfavorable lending practices.

In contrast, conventional lenders usually provide lower interest rates and a more organized lending process, giving clients a sense of security. Their rates often range from 3% to 6%, depending on market conditions and applicant qualifications. Yet, the —often taking 30 to 45 days—along with strict eligibility criteria, can pose significant drawbacks for individuals seeking immediate financing.

Financial analysts caution that while personal lending can be a viable option for those unable to secure standard loans, it carries inherent risks. For example, individuals seeking loans may face quick foreclosure if they miss payments, as non-traditional lenders can act swiftly compared to conventional banks. Additionally, the lack of consumer safeguards in personal lending can strain personal relationships, especially in cases of intrafamily loans.

Ultimately, understanding the advantages and disadvantages of each lending option is crucial for making informed decisions that align with your financial goals. By considering the adaptability and speed of private mortgage lenders alongside the reliability and lower costs of conventional institutions, you can select the optimal route for your specific circumstances. Remember, we’re here to support you every step of the way.

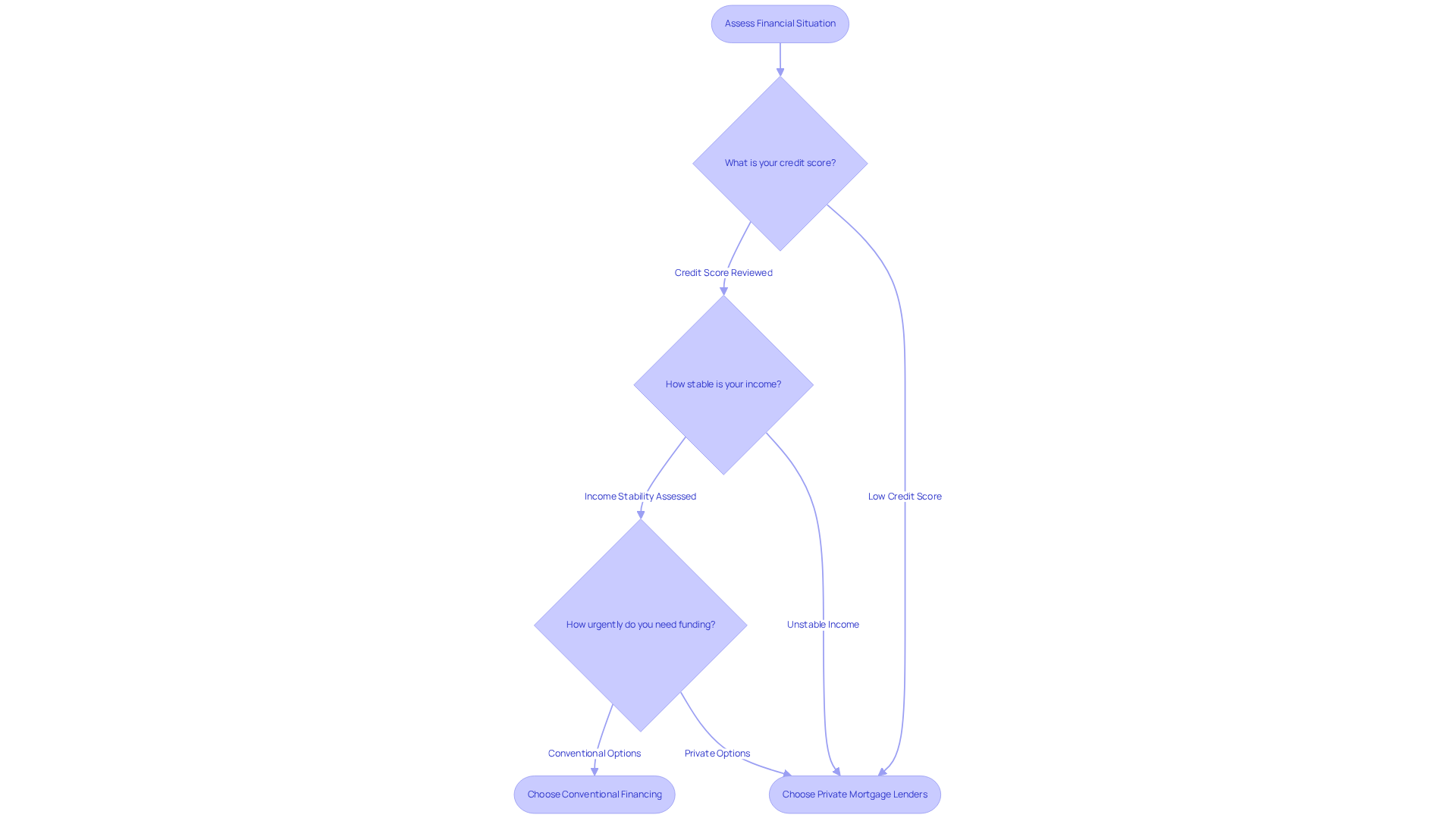

Determining the Right Lender for Your Financial Situation

Choosing the right financing source can feel overwhelming, but it all starts with understanding your financial situation. Take a moment to review your credit score, assess your income stability, and consider how urgently you need funding. If you have a strong credit history and a stable income, conventional financing options often come with lower interest rates and better terms. However, if your financial profile is a bit unconventional or if you need quick access to funds, private mortgage lenders can offer more flexibility and support.

It’s crucial to grasp the long-term implications of loan terms and interest rates as you make your decision. For instance, a recent analysis revealed that 78.9% of mortgages were issued to super-prime clients, underscoring the significance of credit scores in securing favorable lending options. When exploring Adjustable Rate Mortgages (ARMs), keep in mind that they usually start with lower initial rates compared to fixed-rate mortgages, which can make your monthly payments more manageable. Plus, caps on interest rate hikes provide a safety net, protecting you from significant payment increases.

Ultimately, your choice of lender should align with your financial goals and your comfort level with associated risks. This ensures a well-informed and strategic approach to mortgage financing. Seeking insights from mortgage consultants, like Alyssa Alberton at F5 Mortgage, can be incredibly beneficial. She offers valuable perspectives on assessing financial stability and navigating the complexities of mortgage financing. With her expertise in and self-employed clients, you’ll receive personalized guidance that suits your unique financial situation.

Take the first step toward securing the right mortgage for you. Apply online or give us a call. Our caring team at F5 Mortgage is here to help you every step of the way! Apply For Your Adjustable Rate Loan Today!

Conclusion

Private mortgage lenders and traditional lenders each offer unique advantages that cater to different borrower needs. We understand how navigating the mortgage landscape can feel overwhelming, and recognizing these distinctions is essential. Private lenders provide flexibility and quick access to funds, while traditional lenders deliver lower interest rates and structured processes. It’s crucial to assess your personal financial circumstances before making a decision.

This article highlights key differences between these two types of lenders, focusing on the speed and adaptability of private mortgage lenders, especially for those with unconventional financial profiles or urgent funding needs. In contrast, traditional lenders maintain a more regulated approach, which, while potentially slower, offers a sense of security and lower costs. Understanding the pros and cons of each option is vital for making informed choices that align with your financial goals.

Ultimately, the decision on which lender to choose should be guided by a thorough evaluation of your financial situation, urgency for funds, and the long-term implications of loan terms. Engaging with mortgage consultants can provide valuable insights, ensuring that you select the most suitable financing option for your unique circumstances. We’re here to support you every step of the way. Taking proactive steps toward understanding these lending options can empower you to secure the best mortgage solution for your future.

Frequently Asked Questions

What are private mortgage lenders?

Private mortgage lenders include individuals and specialized firms that operate with fewer regulatory restrictions than traditional banks, allowing them to cater to niche markets and individuals with unique financial circumstances.

How do private mortgage lenders differ from traditional mortgage lenders?

Private mortgage lenders offer more flexibility and quicker approval processes, while traditional mortgage lenders, such as banks and credit unions, adhere to strict federal regulations, resulting in longer approval timelines but often lower interest rates.

Why are more borrowers turning to private mortgage lenders?

Many borrowers are increasingly turning to private mortgage lenders due to tightening conventional lending standards, seeking tailored funding solutions and quicker access to loans, especially in competitive real estate markets.

Who benefits most from private mortgage lenders?

Private mortgage lenders are particularly beneficial for self-employed individuals and those with less-than-perfect credit, as they offer customized loan options that may not be available through traditional banks.

How does F5 Mortgage assist clients in the mortgage process?

F5 Mortgage connects clients with top realtors in their area, works with over two dozen financial institutions to secure the best mortgage offers, and provides access to various down payment assistance programs to enhance home buying opportunities.

What is the customer satisfaction level like for F5 Mortgage?

F5 Mortgage has received 5-star reviews from satisfied clients, indicating exceptional customer satisfaction in their services.

Why is it important to understand the differences between private and traditional mortgage lenders?

Understanding these distinctions is crucial for individuals seeking the most suitable financing options for their unique circumstances, empowering them to make informed decisions for their family’s future.