Overview

Maximizing your savings with a mortgage calculator by making extra payments can be a game changer. By inputting those additional contributions, you can significantly reduce the overall interest paid and shorten the duration of your loan.

We understand how daunting this process can feel, but even small extra payments—like $155 a month—can save you tens of thousands of dollars in interest over time. This demonstrates just how effective the calculator can be in your financial planning and decision-making.

Think about it: every little bit counts. Imagine the relief of knowing that you’re taking control of your mortgage and securing a brighter financial future for your family. We’re here to support you every step of the way as you navigate these important decisions. The mortgage calculator is not just a tool; it’s a pathway to empowerment and peace of mind.

Introduction

Navigating the complexities of mortgage financing can often feel daunting. We understand how challenging this can be, especially when it comes to making informed financial decisions that could save you thousands over the life of your loan. Mortgage calculators are invaluable tools that empower homeowners to estimate monthly payments and see how additional contributions can make a difference. But how can you effectively use these calculators to maximize your savings and simplify the refinancing process?

In this article, we’ll explore the powerful benefits of using a mortgage calculator for extra payments. We’ll provide practical insights and strategies designed to help you achieve significant long-term financial gains, ensuring that you feel supported every step of the way.

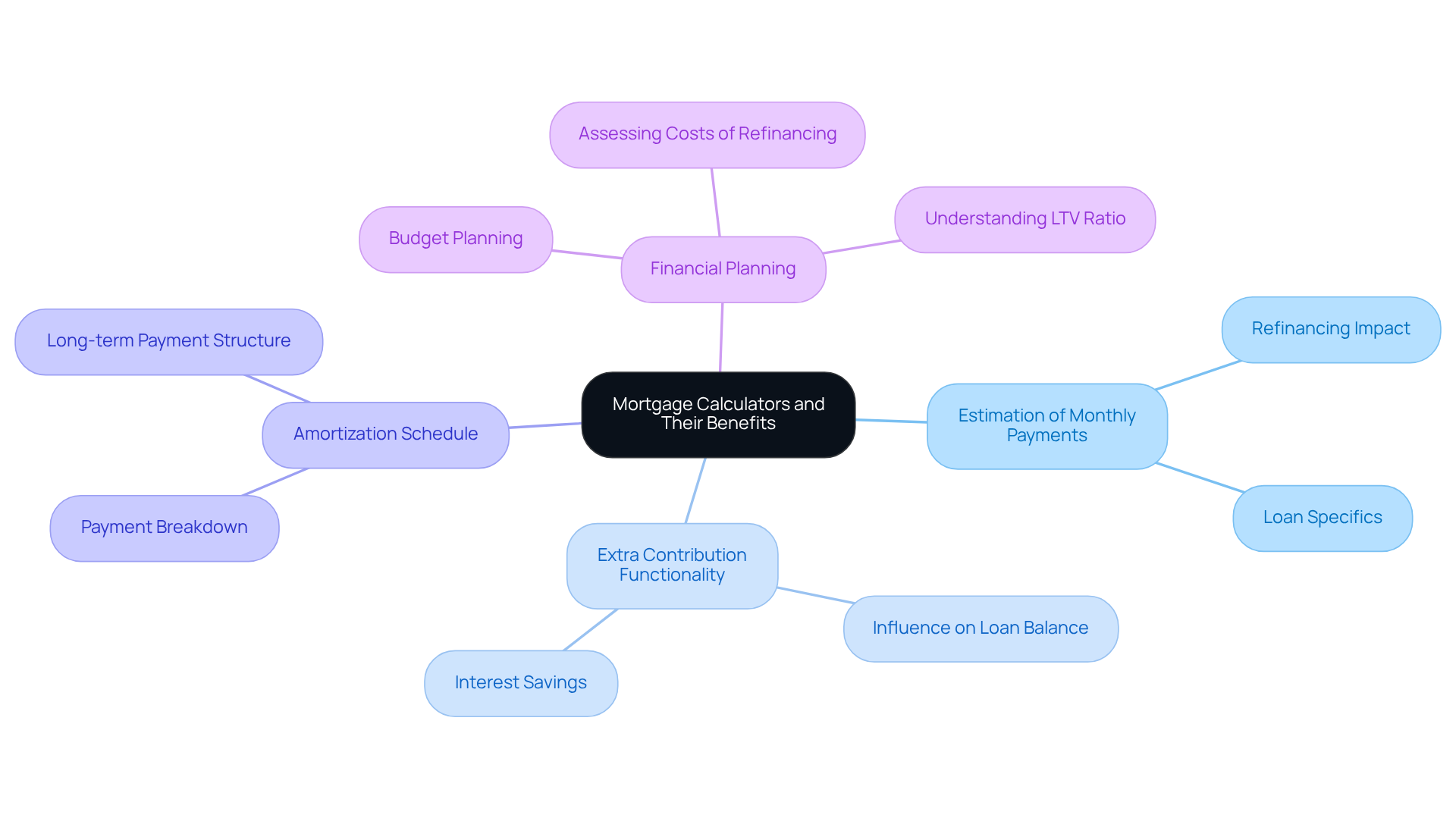

Understand Mortgage Calculators and Their Benefits

Home financing calculators are essential tools that help borrowers estimate their monthly costs based on several factors, including the amount borrowed, interest rate, and financing duration. They also allow users to input additional contributions through a mortgage calculator extra payment, which can significantly reduce the overall interest paid throughout the borrowing period. By understanding how to use these calculators, homeowners can make informed decisions about their loan costs, potentially saving thousands of dollars—especially when considering refinancing options to eliminate private mortgage insurance (PMI).

Benefits of Using a Mortgage Calculator:

- Estimation of Monthly Payments: Quickly calculate what your monthly mortgage payment will be based on your loan details, including potential changes from refinancing.

- Extra Contribution Functionality in the Mortgage Calculator Extra Payment: Input additional contributions to see how they influence your loan balance and interest savings, particularly useful if you refinance to a lower loan-to-value (LTV) ratio.

- Amortization Schedule: View a breakdown of how your payments are applied over time, helping you understand the impact of using a mortgage calculator extra payment on your loan and how refinancing can alter your payment structure.

- Financial Planning: Use the calculator to plan your budget and make informed decisions about refinancing or purchasing a home, including assessing the costs associated with refinancing and calculating your break-even point.

In addition to these benefits, we know how challenging the refinancing process can be. It involves exploring alternatives, submitting an application, undergoing an appraisal, and completing underwriting before finalizing the new loan. If you have significant expenses like medical bills or education costs, a cash-out refinance may be an option for accessing additional funds while potentially lowering your LTV ratio.

Looking ahead, in 2025, the new conforming borrowing limit is set at $806,500, broadening opportunities for homebuyers. This change underscores the importance of utilizing loan calculators to evaluate affordability and prepare for upcoming financial obligations. For instance, a family considering a home purchase can utilize a mortgage calculator extra payment to compare the costs of various funding scenarios, including the effects of making additional payments. This proactive approach not only aids in budgeting but also enhances overall .

As Nicholas Hiersche, President of The Mortgage Calculator, notes, “Our asset-based non-QM loans are designed to unlock financing for borrowers who have long been underserved by conventional lending practices.” This highlights the necessity for borrowers to explore different funding options and understand their implications through tools like loan calculators. By leveraging these resources, families can navigate the complexities of home financing with greater confidence and clarity.

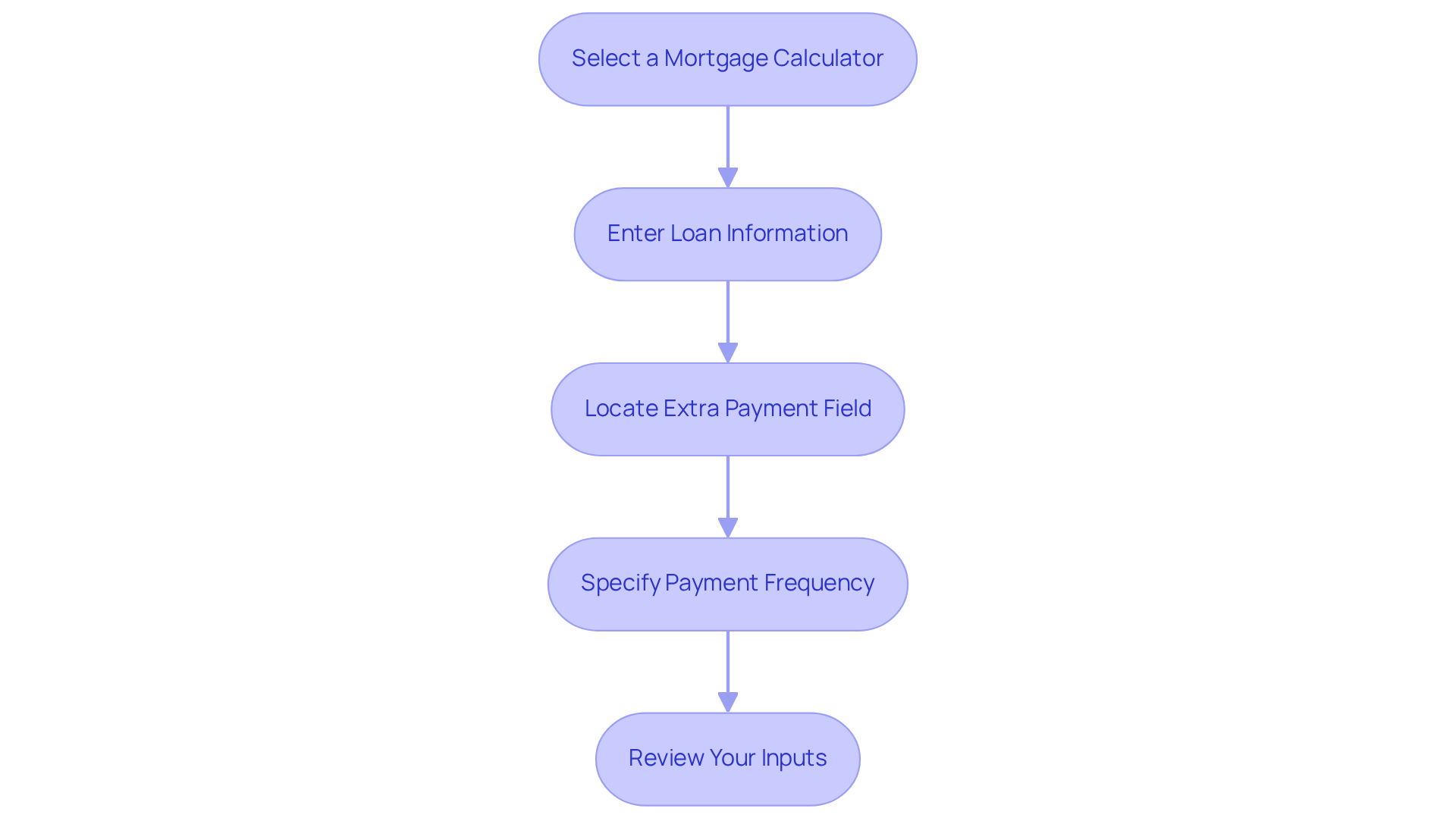

Input Extra Payment Details into the Calculator

To effectively input extra payment details into a mortgage calculator, let’s walk through these steps together:

- Select a mortgage calculator extra payment: Choose a trustworthy mortgage calculator that offers an additional contribution option. like Bankrate and U.S. Bank are excellent choices that can help you feel confident in your decisions.

- Enter Loan Information: Input essential details such as your loan amount, interest rate, and loan term. Remember, accurate data is crucial for precise calculations, and we know how important this is for your financial peace of mind.

- Locate the mortgage calculator extra payment field by finding the section labeled ‘Extra Payment’ or ‘Additional Payment.’ Here, you will enter the amount you plan to pay in addition each month or as a one-time payment. This step is vital for maximizing your savings with a mortgage calculator extra payment.

- Specify Payment Frequency: Indicate how often you plan to make these extra payments—monthly, bi-weekly, etc. This frequency can significantly impact your overall savings, and understanding this can empower you to make informed choices.

- Review Your Inputs: Carefully double-check all entered information to ensure accuracy before proceeding to the calculation. Taking this moment to review can lead to better outcomes.

Using a mortgage calculator extra payment can effectively lead to significant savings. For example, making an extra contribution of just $155 a month can save borrowers over $43,000 in interest and significantly reduce the loan duration. We understand that navigating finances can be daunting, but many borrowers find clarity and insights through these tools. In 2025, some of the top loan calculators for additional contributions will feature comprehensive amortization schedules and adjustable input options, enabling users to visualize their savings over time.

Additionally, consider improving your credit score by checking your credit report for errors and paying down existing debts. These approaches can greatly influence your loan conditions and overall financial well-being. Remember, we’re here to support you every step of the way, ensuring that making additional contributions aligns with your long-term objectives.

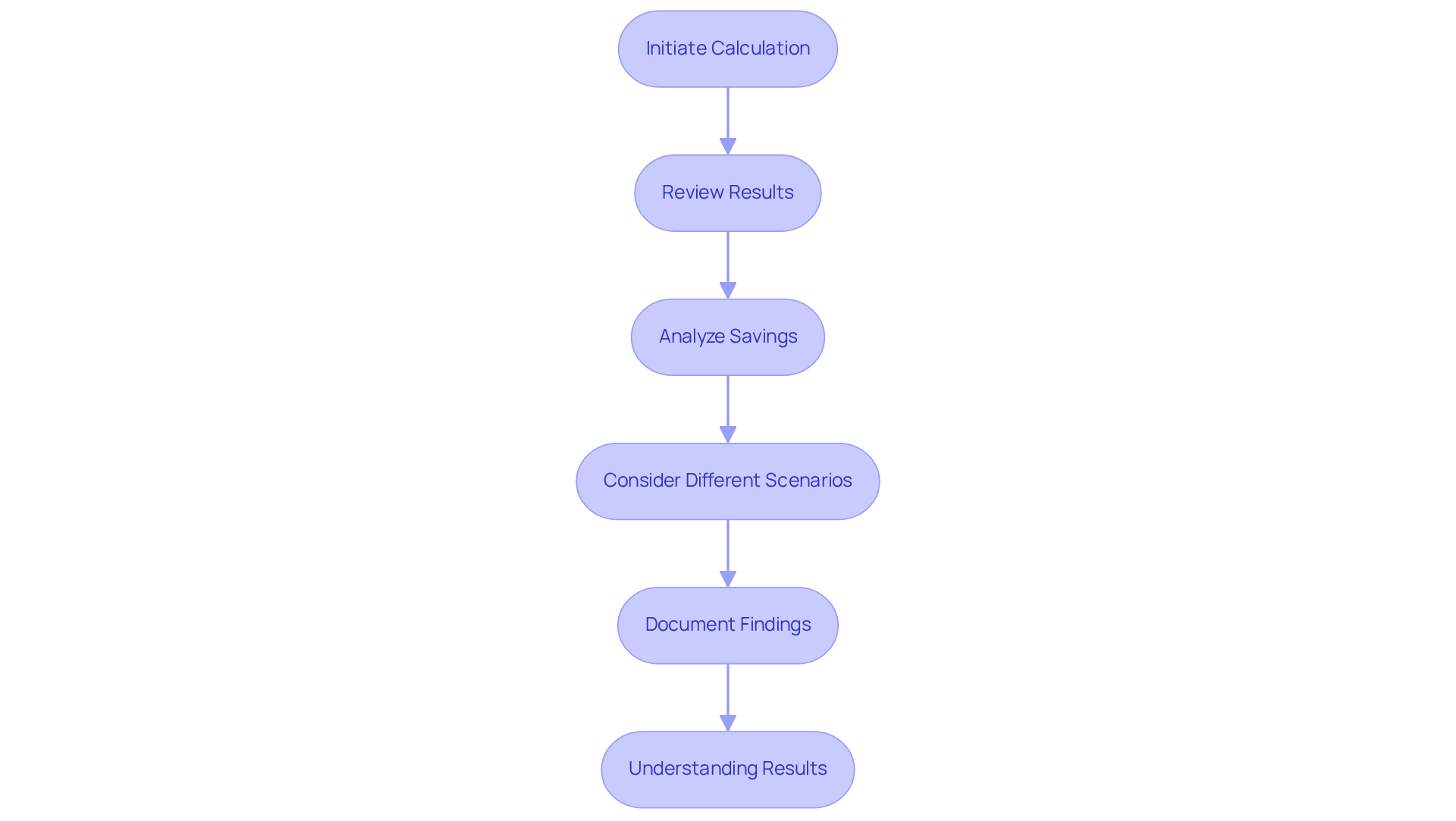

Calculate Potential Savings from Extra Payments

To calculate your potential savings from making extra mortgage payments, let’s walk through these steps together:

- Initiate the Calculation: Begin by clicking the ‘Calculate’ button. This will generate results based on your input, helping you see the impact of your efforts.

- Review the Results: The calculator will display your new monthly amount, total interest saved, and the revised payoff date. Take a moment to pay close attention to these figures; they reveal how your additional contributions can make a real difference in your financial journey.

- Analyze the Savings: Look closely at the section detailing the total interest saved over the life of the loan. This amount often serves as a powerful motivation to consider making further contributions. Regular additional investments can save you tens of thousands of dollars in interest. For example, making two extra contributions annually on a $400,000 loan at a 3.5% interest rate could save you approximately $41,000 and shorten your loan term by five years.

- Consider Different Scenarios: Feel free to experiment with various additional sums to see their effects on your savings. For instance, rounding up a monthly payment of $2,450 to $2,500 adds an extra $600 toward the loan each year. Compare the impact of a one-time payment against a monthly extra payment to discover which option benefits you more.

- Document Your Findings: Keep a record of your calculations for future reference, especially if you plan to discuss these figures with your loan broker or financial advisor. This documentation can clarify your financial strategy and goals.

Understanding the results from your can significantly influence your decision-making. Even small adjustments, like adding $50 or $100 to your monthly contribution, can noticeably lower the principal balance and lead to substantial long-term savings. By leveraging these insights, you can take proactive steps toward achieving financial freedom and homeownership sooner. Remember to ensure that any extra payments are applied directly to the principal balance to maximize your savings. We’re here to support you every step of the way.

Explore Additional Resources and Tips for Effective Use

To maximize the effectiveness of using a mortgage calculator, we understand how important it is to have the right resources and tips at your fingertips:

- Educational Articles: We know how challenging this can be, so reading articles on mortgage strategies from reputable financial websites can deepen your understanding of mortgage management.

- Consult with a Mortgage Broker: Engaging with a professional, like those at F5 Mortgage, can provide personalized advice tailored to your financial situation. Our team is here to support you every step of the way, ensuring you find a financing option that aligns with your long-term financial goals. As Matt Schulz, chief consumer finance analyst, wisely notes, “While rates are important, they’re not everything. Work with a who can help you find a loan product that fits your long-term financial goals.”

- Utilize Online Tools: Explore various online tools, including a mortgage calculator extra payment, that offer functionalities such as amortization schedules and payment frequency adjustments. At F5 Mortgage, we utilize technology to provide user-friendly tools, such as a mortgage calculator extra payment, that help you understand your loan choices more effectively. Remember, for every $100,000 borrowed, shopping around could save you more than $24,000 over 30 years, according to National Mortgage Professional.

- Stay Informed on Market Trends: It’s essential to keep an eye on interest rates and market conditions, as these can influence your loan decisions and potential savings. Homebuyers in 2025 are facing increasing home prices and heightened loan rates near 7%, making it crucial to stay informed. F5 Mortgage is dedicated to revitalizing the lending process, guaranteeing you access to competitive rates without the inconvenience of aggressive sales tactics.

- Join Online Forums: Engaging in conversations with fellow homeowners or prospective buyers can provide valuable insights and advice related to loans and savings tactics. A recent analysis from LendingTree highlights that borrowers can save an average of $80,024 over the life of a 30-year fixed-rate mortgage by selecting the best available offer. At F5 Mortgage, we empower our clients with the knowledge and support needed to navigate down payment assistance programs, enhancing home buying opportunities.

Conclusion

Maximizing savings through a mortgage calculator, especially with extra payments, is a thoughtful strategy for homeowners looking to ease their financial burden. By utilizing these calculators, you can gain a clearer picture of your loan obligations and see how additional contributions can significantly affect both your interest payments and the duration of your loan.

In this article, we shared valuable insights on effectively using mortgage calculators. From estimating monthly payments to analyzing potential savings from extra contributions, these tools empower you to make informed decisions. The step-by-step guidance on entering extra payment details and the importance of reviewing results highlight how small changes can lead to meaningful long-term benefits. Additionally, exploring various resources, like consulting with mortgage brokers and staying updated on market trends, can enhance your overall financial strategy.

Ultimately, the importance of understanding and using a mortgage calculator cannot be overstated. It serves not just as a tool for immediate calculations but as a gateway to greater financial literacy and empowerment. By taking proactive steps, such as making extra payments and utilizing available resources, you can navigate the complexities of your mortgage with confidence. Embracing these strategies can pave the way for financial freedom and a more secure future in homeownership.

Frequently Asked Questions

What is the purpose of mortgage calculators?

Mortgage calculators are tools that help borrowers estimate their monthly mortgage costs based on factors such as the amount borrowed, interest rate, and financing duration.

How can extra contributions affect my mortgage?

By using the mortgage calculator’s extra payment functionality, users can input additional contributions to see how they influence the loan balance and overall interest savings, particularly when refinancing to a lower loan-to-value (LTV) ratio.

What information can I obtain from an amortization schedule?

An amortization schedule provides a breakdown of how your payments are applied over time, helping you understand the impact of extra payments on your loan and how refinancing can change your payment structure.

How can I use a mortgage calculator for financial planning?

A mortgage calculator can help you plan your budget, assess refinancing costs, and calculate your break-even point, enabling informed decisions about refinancing or purchasing a home.

What challenges are associated with the refinancing process?

The refinancing process can be challenging as it involves exploring alternatives, submitting an application, undergoing an appraisal, and completing underwriting before finalizing a new loan.

What is a cash-out refinance?

A cash-out refinance is an option that allows borrowers to access additional funds while potentially lowering their LTV ratio, which can be beneficial for covering significant expenses like medical bills or education costs.

What is the new conforming borrowing limit set for 2025?

The new conforming borrowing limit set for 2025 is $806,500, which broadens opportunities for homebuyers.

How can mortgage calculators enhance financial literacy?

By allowing users to compare costs of various funding scenarios and assess the effects of making additional payments, mortgage calculators help in budgeting and improve overall financial literacy.

What is the significance of exploring different funding options?

Exploring different funding options is essential for borrowers to understand their implications and make informed financing decisions, especially for those underserved by conventional lending practices.