Overview

Max seller concessions in VA loans provide a valuable opportunity for property owners to contribute up to 4% of the home’s purchase price. This support helps cover essential expenses like closing costs, making homeownership more attainable for veterans and active-duty service members. We understand how challenging this can be, and these concessions can significantly alleviate financial burdens.

By enabling buyers to save thousands at closing, they can redirect funds toward other important expenses. This not only enhances their overall purchasing power but also empowers them to make informed decisions about their financial future. We’re here to support you every step of the way as you navigate this journey.

Introduction

Understanding the intricacies of VA loans can be daunting. We know how challenging this can be, especially when it comes to the financial relief offered through seller concessions. These contributions from property owners not only alleviate upfront costs but also empower veterans and active-duty service members to achieve homeownership with greater ease.

As the housing market evolves, the potential for maximizing these concessions raises a critical question: how can buyers effectively leverage these benefits to navigate the complexities of home buying? This article delves into the mechanics of seller concessions, their limits, and the strategies that can help families make informed decisions while securing their dream homes. We’re here to support you every step of the way.

Define Seller Concessions in VA Loans

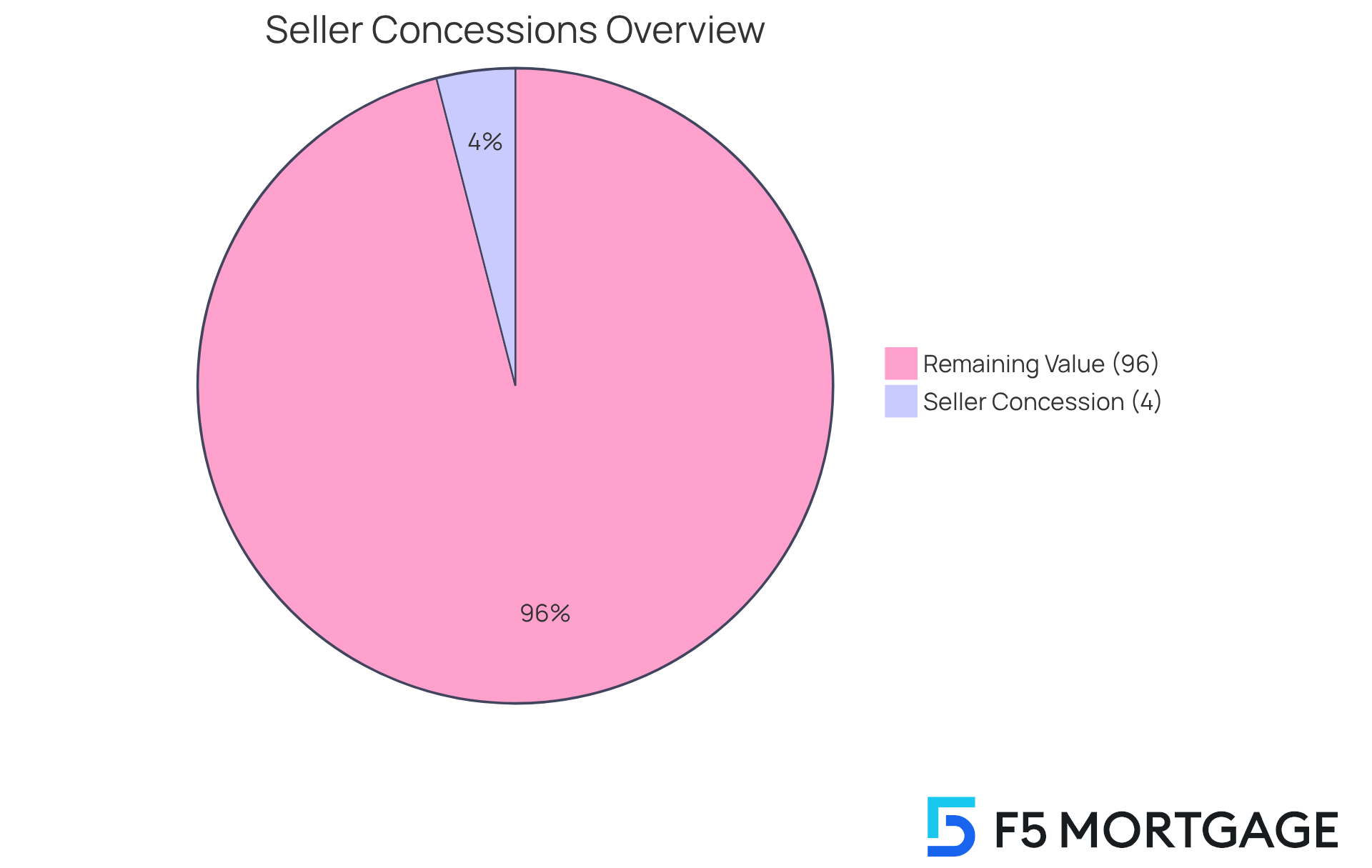

When considering VA loans, it’s important to understand how financial contributions from property owners can ease the burden of home buying. These contributions help cover various expenses, such as closing costs, prepaid property taxes, and other fees typically incurred by buyers. By allowing max seller concessions va of up to 4% of the home’s purchase price, these allowances significantly lessen the financial pressure on veterans and active-duty service members, making homeownership more achievable.

For instance, if a property is appraised at $300,000, the financial contributions could amount to $12,000. This can cover essential costs like the VA funding fee and homeowners insurance, which might otherwise hinder a buyer’s ability to close the deal. Looking ahead to 2025, it’s estimated that about 9.9% of VA loan buyers will take advantage of these vendor incentives, reflecting a growing trend among veterans who want to maximize their savings during the home purchasing journey.

Experts emphasize that utilizing max seller concessions va can provide substantial financial relief, enabling buyers to allocate funds toward moving expenses or home improvements. As Chaley McVay, a Redfin Premier real estate agent, noted, ‘With max seller concessions va allowing property owners to contribute up to 4% of the purchase price toward expenses like the VA funding fee and prepaid taxes, buyers can save thousands at closing.’

Understanding the nuances of vendor allowances is crucial for veterans navigating the complexities of homeownership. In a market where various factors can influence a seller’s willingness to offer these allowances, knowing your options can empower you to make informed decisions. We know how challenging this can be, and we’re here to every step of the way.

Explain How Seller Concessions Work in VA Financing

In VA financing, vendor concessions play a vital role in easing the financial burden on homebuyers by covering various expenses. These can include closing costs, loan origination charges, and even the VA funding fee. Importantly, the max seller concessions VA allow for no limit on how much the seller can contribute toward closing costs in a VA loan, offering substantial financial flexibility for buyers. Sellers can agree to cover these expenses as part of the purchase agreement, significantly reducing the buyer’s out-of-pocket costs.

For instance, when purchasing a home priced at $300,000, the max seller concessions VA allow the seller to contribute up to 4% of the sale price, which amounts to $12,000. This contribution can be strategically used to offset necessary expenses, making homeownership more affordable for buyers.

Real-world examples illustrate the impact of vendor concessions. Take Dennis, a buyer who successfully negotiated for the seller to cover all closing costs and an additional $8,000 to pay off an auto loan. This arrangement not only eliminates closing costs but also lowers Dennis’s debt-to-income ratio, making it easier for him to qualify for the VA loan. Such compromises, like max seller concessions VA, can save buyers thousands in initial costs, allowing them to transition into homeownership more smoothly.

Expert insights highlight that while vendor concessions are not mandatory, they can be a significant advantage in negotiations, especially in a competitive market. Sellers may also purchase discount points to lower the buyer’s interest rate, further enhancing affordability. Understanding the potential for can empower buyers to make informed choices, leading to a more accessible home-buying experience. We know how challenging this process can be, and we’re here to support you every step of the way.

Clarify the VA Seller Concession Limits and Rules

Navigating the world of home buying can feel overwhelming, especially when it comes to understanding vendor concessions. The VA establishes clear limits on max seller concessions VA, capping them at 4% of the home’s fair value or sale price, whichever is lower. For example, if a home is valued at $300,000, the maximum contribution from the vendor can reach $12,000. However, if the sale price exceeds the appraised value, the contributor’s involvement must comply with the max seller concessions VA and align with the lower appraisal.

It’s important to remember that max seller concessions VA cannot be applied to costs that are not permitted under VA guidelines, such as the agent’s commission. Additionally, seller-funded temporary interest rate buydowns are considered max seller concessions VA and must be included in the total four percent. Understanding these limits is crucial for purchasers, as it empowers them to negotiate their purchase agreements effectively without exceeding the max seller concessions VA.

In the current market, around 60% of vendors in San Diego are offering incentives for purchasers, creating a favorable environment for negotiations. As Doug Nunnery, a broker with Round Table Realty, points out, “Most purchasers don’t realize that negotiating for vendor allowances is even a possibility. But they can oftentimes make the difference between buyers qualifying for their loan or not.” This insight underscores the importance of utilizing seller agreements to enhance financial flexibility.

Moreover, families can maximize their purchasing power by exploring the benefits of VA loans, such as no down payment and refinancing options like the VA Interest Rate Reduction Refinance Loan and VA cash-out refinance through F5 Mortgage. We’re here to support you every step of the way as you navigate the complexities of home buying.

Highlight the Benefits of Seller Concessions for Homebuyers

Max seller concessions va offer significant benefits for homebuyers using VA loans. We know how challenging the home-buying process can be, and these allowances can greatly reduce the associated with purchasing a home. For instance, a family looking to buy a $400,000 residence could benefit from vendor incentives that cover closing costs, potentially saving thousands of dollars at settlement. This financial relief allows families to redirect funds toward other essential expenses, such as moving costs or necessary home improvements.

Moreover, adjustments from vendors improve cash flow management for buyers. By alleviating the immediate financial burden, families can allocate their resources more effectively, ensuring they can manage ongoing expenses without strain. In a competitive housing market, these incentives also serve as a compelling motivator, making home purchases more appealing to prospective buyers. In fact, in the first quarter of 2025, nearly 44.4% of homeowners provided incentives, highlighting a trend that can greatly assist families facing the challenges of homeownership.

Additionally, families can explore various down payment assistance programs available through F5 Mortgage. For example:

- The MyHome Assistance Program in California offers up to 3% of the home’s purchase price.

- The My Choice Texas Home program provides up to 5% for down payment and closing assistance.

- In Florida, initiatives like the Florida Assist Second Mortgage Program can provide up to $10,000 to help with initial expenses.

These programs not only enhance home buying opportunities but also align with F5 Mortgage’s commitment to exceptional customer satisfaction, as evidenced by clients who have praised the team’s unwavering support throughout their home financing journey.

Ultimately, understanding and utilizing vendor allowances, along with accessible down payment support programs, can empower families to make informed decisions. This knowledge aids a smoother transition into homeownership while alleviating financial burdens. As noted by VA Loan Help, max seller concessions va can serve as a powerful tool to reduce closing costs and make homeownership more attainable.

Guide on Negotiating Seller Concessions Effectively

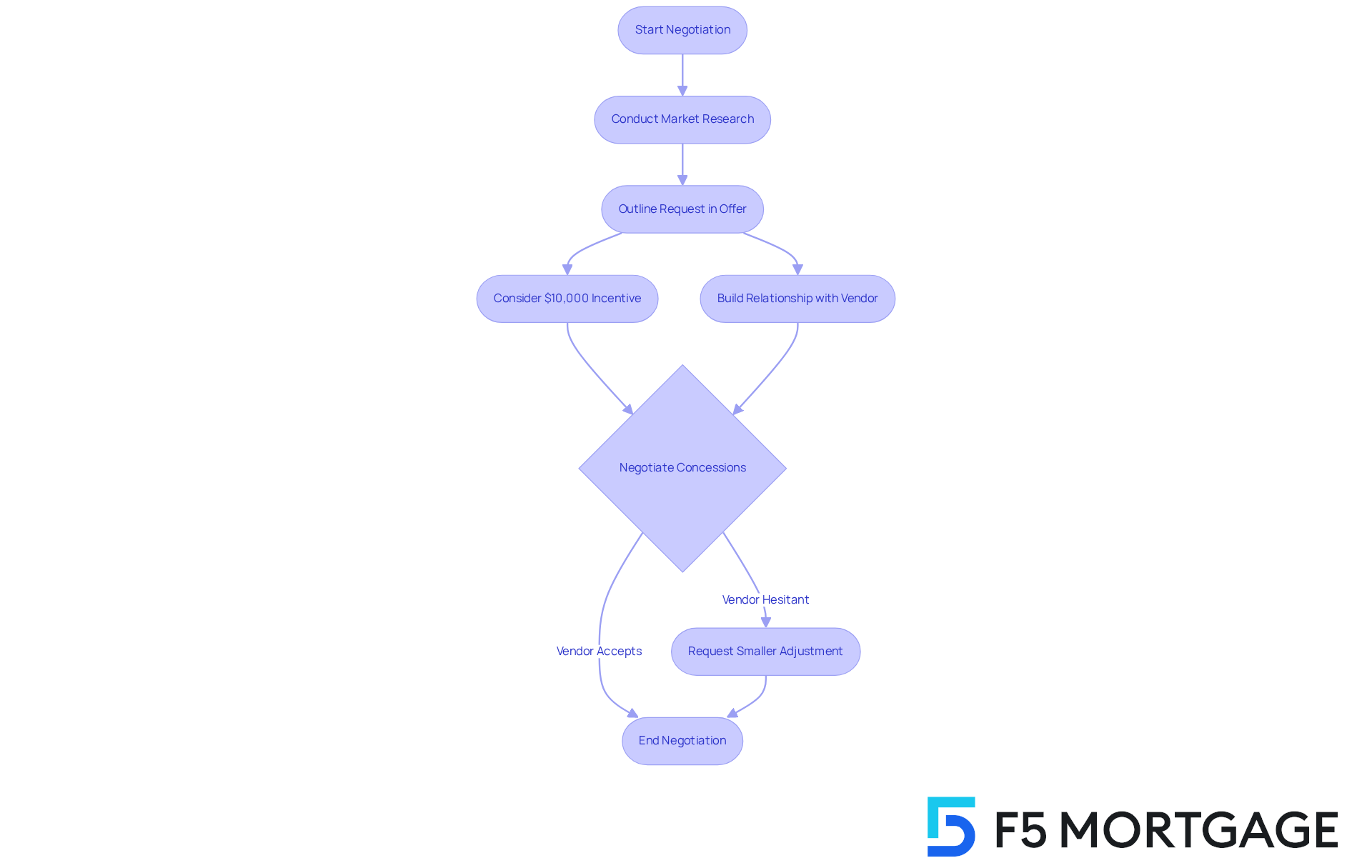

When it comes to negotiating vendor allowances, we know how challenging this can be for homebuyers. To start, it’s essential to conduct thorough research on the local real estate market. Understanding typical vendor allowance practices can make a significant difference. Did you know that nearly 45% of U.S. home transactions in Q1 2025 included vendor incentives? This is an increase from just above 39% the previous year, highlighting a .

As you prepare to present your offer, clearly outline your request for adjustments in the purchase agreement. Specify the amount and the expenses you wish to cover. For instance, a $10,000 buyer incentive can lead to instant savings at closing. Alternatively, a $10,000 price decrease lowers the purchase price to $590,000, which could impact loan approval based on market value assessments.

Building a connection with the vendor or their representative can also be beneficial. A positive relationship often leads to more favorable negotiations. Remember, being open to compromise is key. If the vendor is hesitant to meet your full request, consider negotiating for a smaller adjustment that still provides financial relief.

Real estate professionals often recommend starting with rate buy-downs. Sellers typically prefer this approach over outright price reductions. By employing these strategies, homebuyers can enhance their chances of securing max seller concessions va during their VA loan negotiations. We’re here to support you every step of the way as you navigate this process.

Conclusion

Max seller concessions in VA loans serve as a vital financial resource for veterans and active-duty service members, making the journey to homeownership much smoother. By enabling sellers to contribute up to 4% of the home’s purchase price toward closing costs and other expenses, these concessions help buyers tackle the housing market’s complexities with increased confidence and less financial worry.

Throughout the article, we explore the mechanics of seller concessions, the specific limits established by the VA, and the real benefits they offer to homebuyers. Real-world examples illustrate how these contributions can ease upfront costs, while expert advice highlights the importance of understanding and negotiating these allowances effectively. With more sellers providing incentives, the environment for VA loan buyers is becoming increasingly supportive.

Ultimately, utilizing max seller concessions can greatly enhance the home-buying experience. Families can concentrate on settling into their new homes instead of being burdened by financial concerns. By engaging with knowledgeable professionals and actively negotiating, significant savings can be unlocked, making homeownership not only achievable but also a more fulfilling journey. Embracing this information empowers potential buyers to make informed choices, paving the way for a brighter future in their new homes.

Frequently Asked Questions

What are seller concessions in VA loans?

Seller concessions in VA loans refer to financial contributions made by property owners to help cover various expenses incurred by buyers, such as closing costs, prepaid property taxes, and other fees. These concessions can significantly reduce the financial burden on veterans and active-duty service members when purchasing a home.

How much can sellers contribute in VA loans?

Sellers can contribute up to 4% of the home’s purchase price in VA loans. For example, if a property is appraised at $300,000, the maximum seller concession would amount to $12,000.

What expenses can seller concessions cover?

Seller concessions can cover essential costs such as the VA funding fee, homeowners insurance, closing costs, and loan origination charges, making homeownership more affordable for buyers.

How do seller concessions benefit VA loan buyers?

Seller concessions provide substantial financial relief, allowing buyers to allocate funds toward moving expenses or home improvements, ultimately making the home-buying process more manageable.

Are seller concessions mandatory in VA financing?

No, seller concessions are not mandatory. However, they can be a significant advantage in negotiations, especially in a competitive market, helping buyers save on initial costs.

Can sellers contribute to lowering the buyer’s interest rate?

Yes, sellers can purchase discount points to lower the buyer’s interest rate, further enhancing affordability in the home-buying process.

What is the trend regarding the use of seller concessions among VA loan buyers?

It is estimated that about 9.9% of VA loan buyers will take advantage of seller concessions by 2025, indicating a growing trend among veterans looking to maximize their savings during the home purchasing journey.