Overview

Navigating the down payment process for conventional loans can feel overwhelming, and we understand how challenging this can be. It’s important to know that down payments can vary significantly based on factors like your credit score, the type of financing, and the property itself. For eligible buyers, the minimum down payment can be as low as 3%. This flexibility can open doors to homeownership.

Larger down payments can offer additional benefits, such as:

- Avoiding private mortgage insurance (PMI)

- Securing lower interest rates

These advantages not only make homeownership more attainable but also provide long-term financial relief. We’re here to support you every step of the way as you explore your options and find the best path forward.

Remember, understanding your down payment options is a crucial step in your home-buying journey. Take the time to assess your financial situation and consider what works best for you. With the right information and support, you can make informed decisions that lead to a brighter future in your new home.

Introduction

Navigating the world of home financing can feel overwhelming, especially when it comes to understanding conventional loan down payments. We know how challenging this can be. With the average down payment projected to rise to 18.6% by 2025, it’s essential for prospective buyers to grasp the intricacies of this financial commitment.

This article will explore the key elements of conventional loan down payments, highlighting the benefits of strategic contributions while debunking common misconceptions. As you consider your options, the pressing question remains: how can you effectively balance initial costs with long-term financial health?

Define Conventional Loan Down Payments

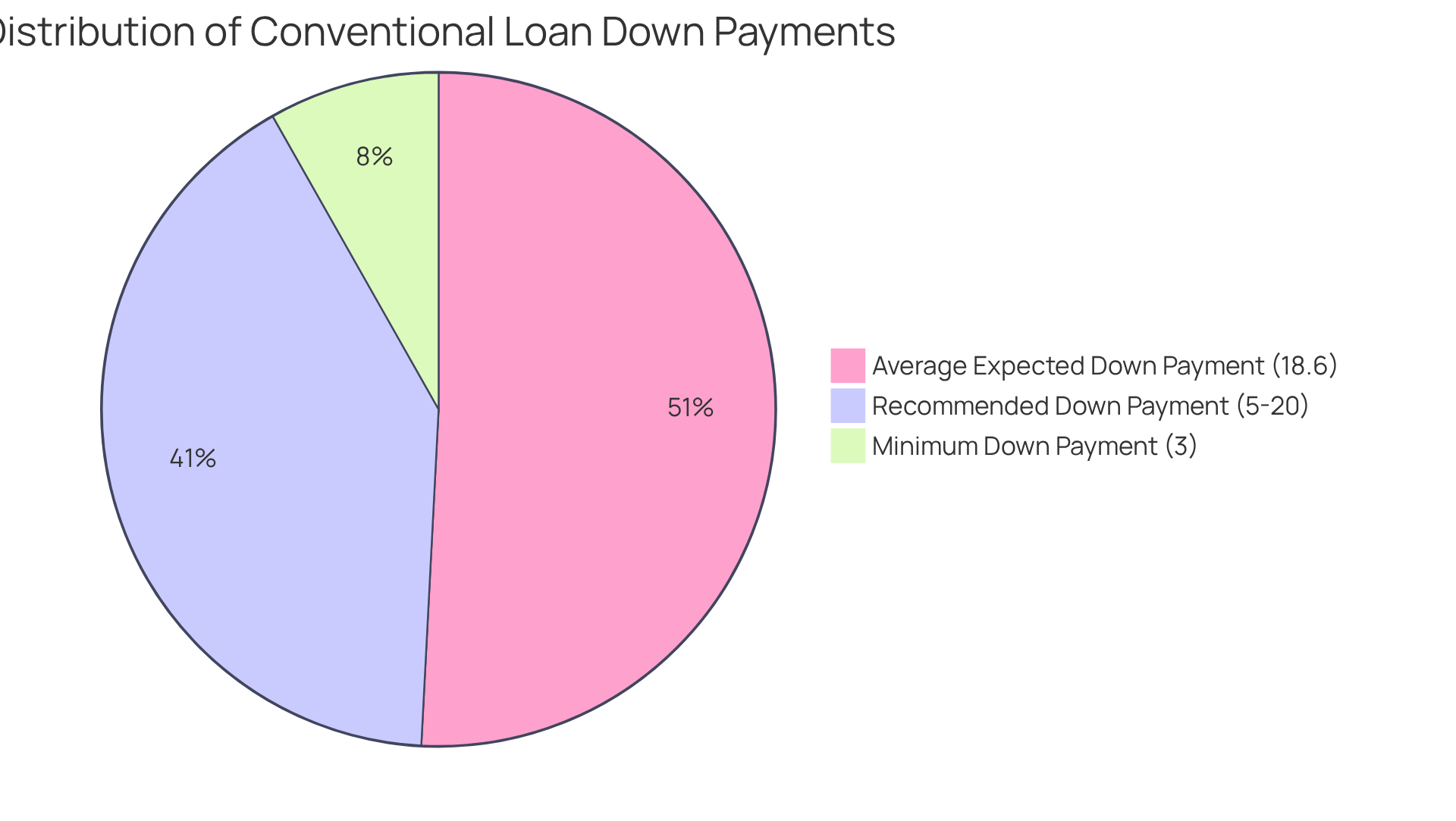

A conventional loan down payment represents the initial cash contribution made by a borrower when purchasing a home, typically expressed as a percentage of the home’s purchase price. For eligible buyers, the minimum down deposit can be as low as 3%. However, many lenders suggest that a conventional loan down payment between 5% and 20% can help avoid private mortgage insurance (PMI), which can add to monthly expenses.

As we look ahead to 2025, the average conventional loan down payment is expected to be around 18.6%, translating to approximately $67,500. This reflects a significant increase from previous years and highlights the rising home prices, as well as the careful financial planning required for prospective buyers.

The impact of the conventional loan down payment on mortgage terms is substantial; a larger conventional loan down payment can lead to lower interest rates and reduced monthly payments, making homeownership more attainable over time. For instance, making a 20% conventional loan down payment not only decreases the loan amount but also helps borrowers avoid PMI, resulting in long-term savings.

Experts suggest that while a larger initial contribution is beneficial, it’s also essential for buyers to consider their overall financial strategy, particularly in relation to the conventional loan down payment. Lower initial costs may allow for savings to be allocated toward future home improvements or investments, as noted by industry analysts.

Real-world examples illustrate this variability:

- In high-cost areas like San Francisco, buyers often make a conventional loan down payment of 26.4%.

- Regions like Virginia Beach may see averages for a conventional loan down payment as low as 3%.

Understanding these dynamics is key to navigating the mortgage landscape effectively. We know how challenging this can be, and we’re here to support you every step of the way.

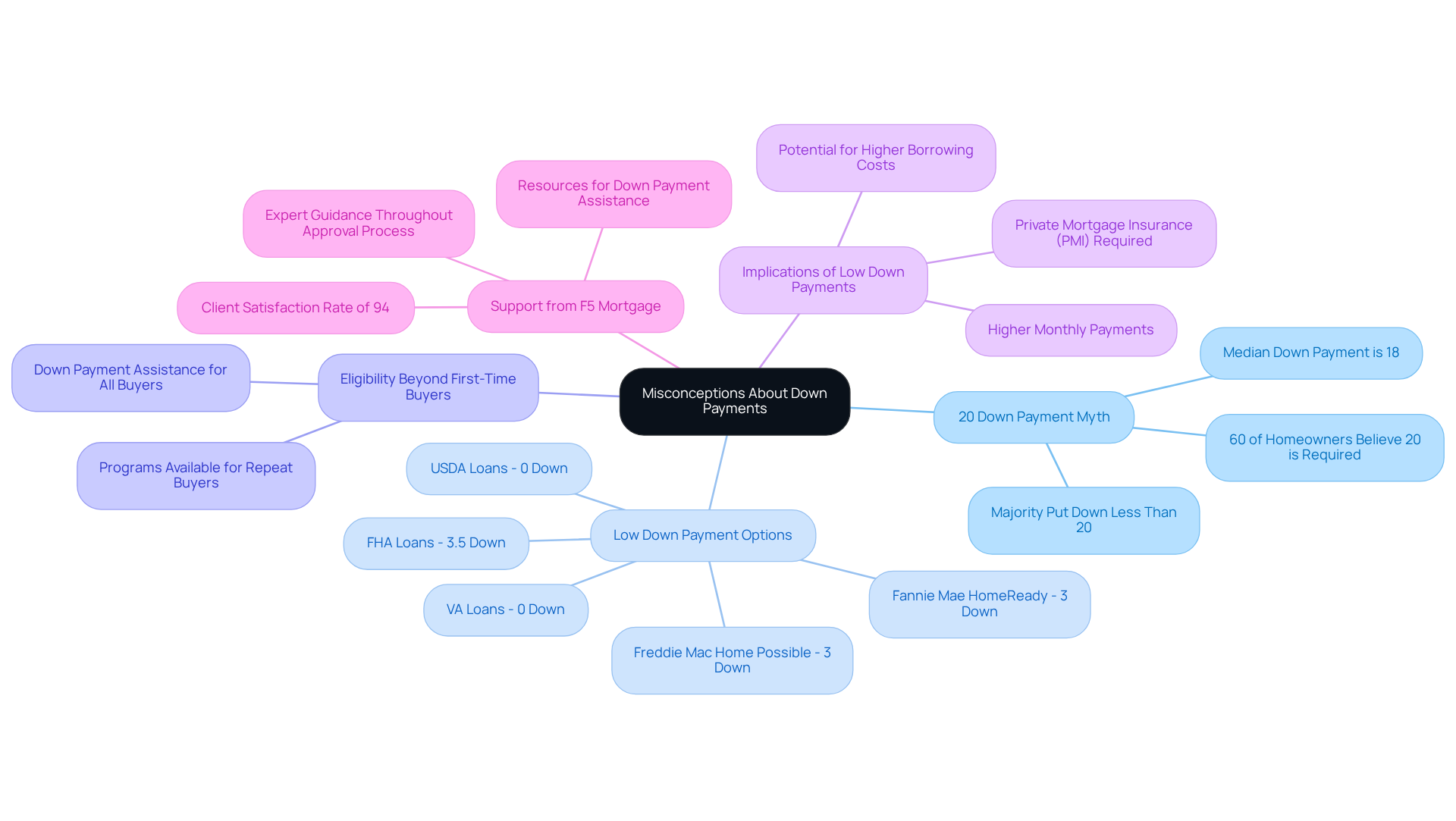

Clarify Common Misconceptions About Down Payments

One of the most common misconceptions we encounter is the belief that a 20% conventional loan down payment is necessary for all conventional loans. In reality, many lenders offer options with initial contributions as low as 3%. For instance, programs like Fannie Mae HomeReady and Freddie Mac Home Possible allow contributions of just 3%.

Additionally, some people think that only first-time homebuyers can qualify for low initial cost programs, but that’s not the case; there are numerous programs available for repeat buyers as well. It’s important to understand that while lower initial contributions, such as a conventional loan down payment, can make homeownership more attainable, they may lead to higher monthly mortgage payments due to borrowing more from the lender.

Moreover, when the conventional loan down payment is less than 20%, private mortgage insurance (PMI) is typically required, which can increase the overall cost of the mortgage. By recognizing these misconceptions, potential buyers can feel more confident in their ability to secure financing and pursue homeownership. As expert Channel states, “most people put down notably less,” highlighting the flexibility available in the mortgage process.

At F5 Mortgage, we truly care about our clients’ needs. We provide support throughout the approval process and highlight various down payment assistance programs that enhance home buying opportunities. Our clients consistently express their satisfaction, as reflected in testimonials praising our team’s expertise and unwavering support throughout their mortgage journey.

Explore Factors Influencing Down Payment Amounts

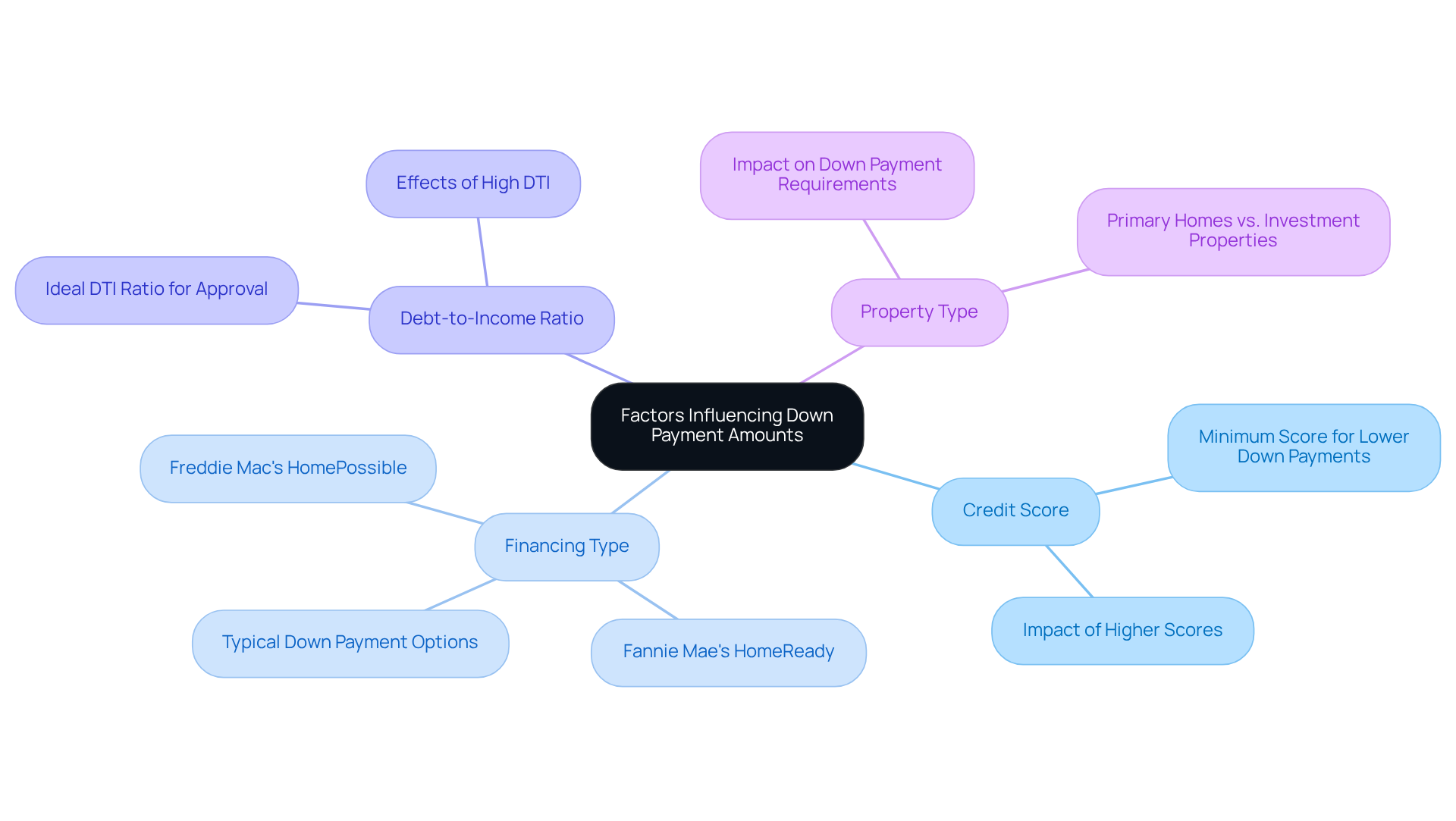

When considering a conventional loan, several important factors can influence the down payment you may need to make:

-

Credit Score: We understand how important your credit score is. A higher credit score can open the door to lower down payment options. For instance, if your score exceeds 620, you might qualify for programs that allow contributions as low as 3%. On the other hand, if your score is lower, you may face higher upfront costs, which can be concerning.

-

Financing Type: Different traditional financing programs, such as Fannie Mae’s HomeReady and Freddie Mac’s HomePossible, offer varying deposit structures. These programs are designed to assist first-time homebuyers and individuals with lower incomes, often permitting deposits as low as 3% if certain income thresholds are met. This can be a great relief for many families.

-

Debt-to-Income Ratio: Lenders will look at your debt-to-income (DTI) ratio, which ideally should be below 43% for conventional financing approval. A lower DTI can improve your chances of securing a loan with a more favorable upfront cost requirement, easing some of the financial pressure.

-

Property Type: The type of property you wish to purchase also matters. For example, primary homes usually have lower initial deposit requirements compared to investment properties, which may demand larger upfront costs. Understanding this can help you plan better.

Grasping these factors is crucial as you prepare financially for your property acquisition. We know how challenging this can be, but by being informed, you can make choices that align with your financial goals. Remember, we’re here to support you every step of the way.

Calculate Your Required Down Payment

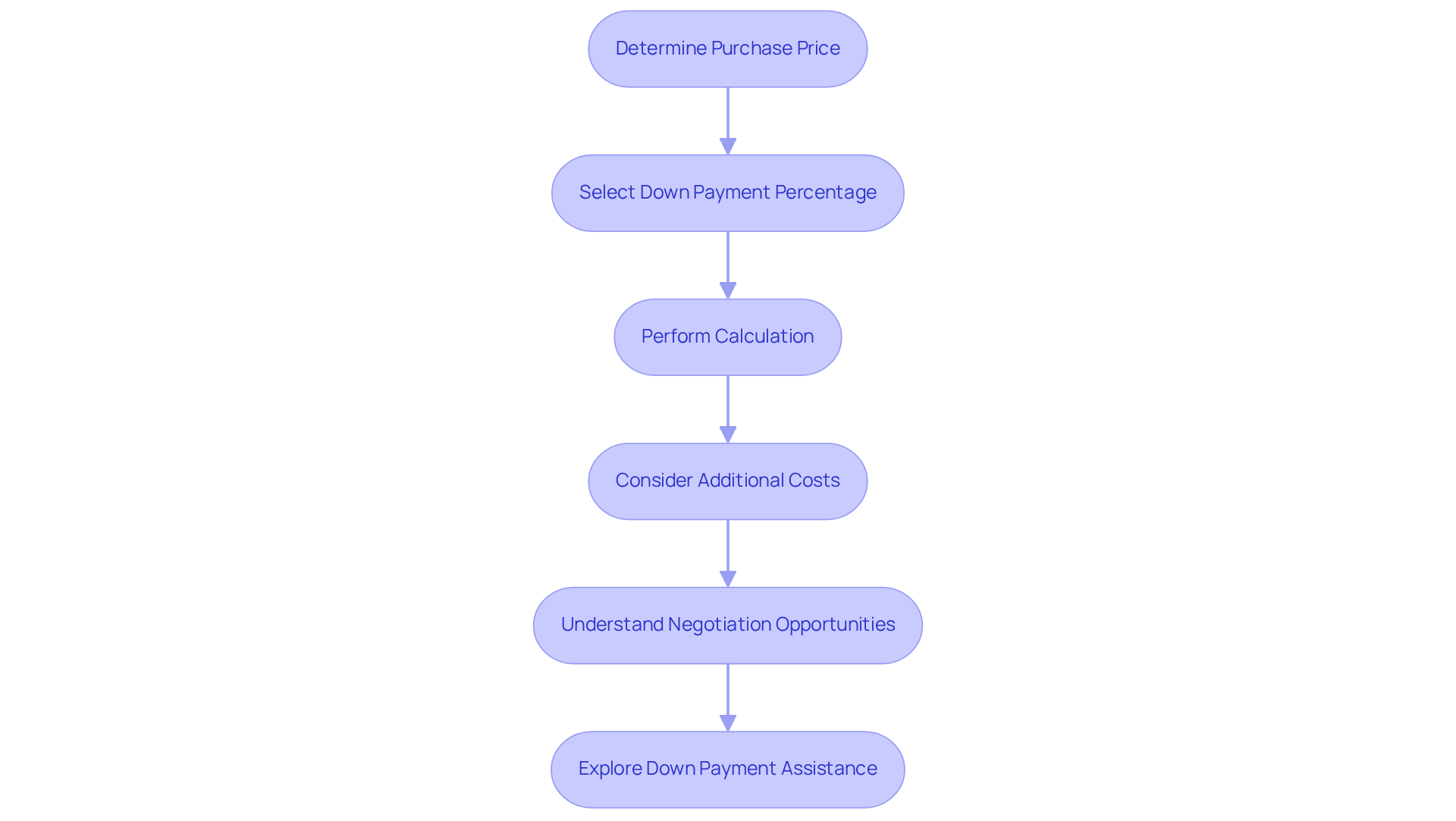

Calculating your required down payment for a conventional loan down payment can feel overwhelming, but we’re here to support you every step of the way. Follow these steps to make the process clearer:

-

Determine the Purchase Price: Start by identifying the total cost of the property you wish to buy. For context, the median sale price of a home in the U.S. in January 2025 was $362,000.

-

Select Your Down Payment for a Conventional Loan: Based on your unique financial situation and lender requirements, choose a down payment percentage for your conventional loan that feels right for you—options typically include 3%, 5%, or 20%. First-time purchasers usually provide a median deposit of 9%, while repeat purchasers contribute a median deposit of 18%. We know how challenging this can be, so take your time to assess what works best for you.

-

Perform the Calculation: Multiply the purchase price by your chosen down deposit percentage. For instance, if the home costs $300,000 and you opt for a 5% down payment:

- $300,000 x 0.05 = $15,000. If you choose a 20% down payment, the calculation would be:

- $300,000 x 0.20 = $60,000. Making a larger initial contribution as a conventional loan down payment can help you avoid private mortgage insurance (PMI), which is required when a buyer puts down less than 20% of the home’s purchase price.

-

Consider Additional Costs: Remember to account for other expenses such as closing fees and potential PMI if your down deposit is less than 20%. PMI can add an average of $125 to $375 to your monthly expenses, which can impact your overall affordability.

-

Understand Negotiation Opportunities: As you prepare for your purchase, consider that you can negotiate with the seller for repairs or upgrades before finalizing the deal. This can be a strategic move to ensure the residence meets your needs without incurring additional expenses later.

-

Explore Down Payment Assistance: Don’t forget to look into down payment assistance programs available through F5 Mortgage. These programs can provide valuable support and potentially reduce your upfront costs. They may have specific eligibility criteria and benefits that can significantly impact your financial planning.

By following this comprehensive approach, you can gain a clearer understanding of the total upfront costs associated with purchasing your home. This way, you can feel well-prepared for the financial commitment ahead.

Conclusion

Mastering the conventional loan down payment process is essential for prospective homebuyers who may feel overwhelmed by the complexities of mortgage financing. We understand how challenging this can be, and knowing the various down payment options—from a minimum of 3% to the ideal range of 5% to 20%—empowers you to make informed decisions that can significantly impact your long-term financial health. This knowledge not only facilitates access to homeownership but also helps you avoid additional costs like private mortgage insurance (PMI).

Key insights throughout this article highlight the importance of factors such as credit scores, debt-to-income ratios, and property types in determining the required down payment. By debunking common misconceptions, such as the necessity of a 20% down payment for all conventional loans, we clarify the flexible options available to both first-time and repeat buyers. By grasping these concepts, you can better prepare for the financial commitment of purchasing a home.

Ultimately, taking the time to understand and calculate the required down payment can lead to more favorable mortgage terms and a smoother home buying experience. Engaging with down payment assistance programs and seeking expert guidance can further enhance your opportunities as an aspiring homeowner. The journey to homeownership may seem daunting, but with the right knowledge and support, it becomes a more achievable goal, paving the way for a brighter financial future.

Frequently Asked Questions

What is a conventional loan down payment?

A conventional loan down payment is the initial cash contribution made by a borrower when purchasing a home, typically expressed as a percentage of the home’s purchase price.

What is the minimum down payment for a conventional loan?

For eligible buyers, the minimum down payment can be as low as 3%.

How does the size of a down payment affect private mortgage insurance (PMI)?

A conventional loan down payment between 5% and 20% can help avoid private mortgage insurance (PMI), which adds to monthly expenses.

What is the expected average conventional loan down payment in 2025?

The average conventional loan down payment is expected to be around 18.6%, translating to approximately $67,500.

How does a larger down payment impact mortgage terms?

A larger conventional loan down payment can lead to lower interest rates and reduced monthly payments, making homeownership more attainable over time.

What are the benefits of making a 20% down payment?

Making a 20% down payment decreases the loan amount and helps borrowers avoid PMI, resulting in long-term savings.

Should buyers consider their overall financial strategy when deciding on a down payment?

Yes, buyers should consider their overall financial strategy, as lower initial costs may allow for savings to be allocated toward future home improvements or investments.

What are some examples of conventional loan down payment percentages in different regions?

In high-cost areas like San Francisco, buyers often make a down payment of 26.4%, while regions like Virginia Beach may see averages as low as 3%.