Overview

Navigating a $350,000 mortgage payment can feel overwhelming, but we’re here to support you every step of the way. This article serves as a comprehensive guide, breaking down essential components like principal, interest, taxes, and insurance (PITI). Understanding these elements is crucial, as they directly influence your mortgage payment.

We know how challenging it can be to grasp factors like interest rates, borrowing terms, and down payments. It’s important to calculate total costs, including additional expenses such as property taxes and insurance. By doing so, you can make informed financial decisions that pave the way for successful homeownership.

Ultimately, our goal is to empower you with the knowledge you need to navigate this process confidently. Remember, understanding your mortgage is not just about numbers; it’s about securing a home for you and your family.

Introduction

Navigating the complexities of a $350,000 mortgage payment can feel overwhelming for many homeowners. We understand how challenging this can be. It’s essential to grasp the intricate components—such as principal, interest, taxes, and insurance—alongside the various factors that influence monthly costs. This understanding is crucial for making informed financial decisions.

As you seek to balance affordability with your financial goals, you may find yourself grappling with questions about how to effectively manage these payments and what hidden costs might arise.

This guide aims to demystify the mortgage payment process, empowering you with the essential knowledge and strategies needed to take control of your financial future. We’re here to support you every step of the way.

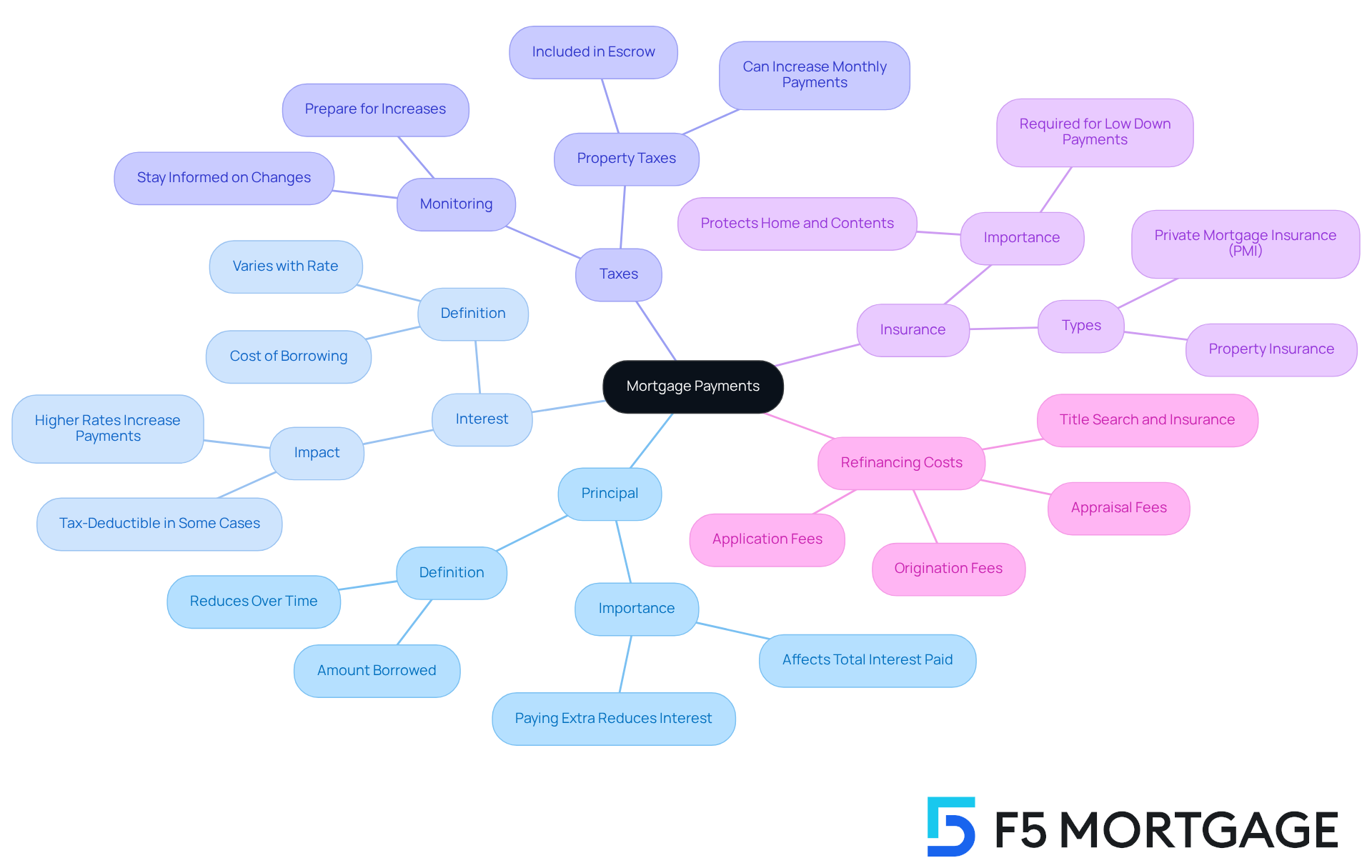

Understand the Basics of Mortgage Payments

A loan installment consists of four crucial elements: principal, interest, taxes, and insurance, collectively referred to as PITI. We understand that navigating these components can feel overwhelming. The principal represents the amount borrowed to purchase your home, while interest is the cost incurred for borrowing that amount. Grasping these components is essential for effective loan management. For instance, in the initial years of a loan, a considerable share of your contribution is directed towards interest instead of principal due to the amortization schedule, which details how contributions are divided over time.

To illustrate, imagine a mortgage of $240,000 at a 3.5% interest rate, where the monthly charge amounts to approximately $1,077.71. At first, a large portion of this disbursement addresses interest, but as your loan matures, more of your payment will go towards decreasing the principal balance. This shift is vital for homeowners aiming to pay off their loans faster and save on interest costs.

Furthermore, staying updated on property taxes and insurance is crucial, as these can lead to variations in your monthly costs. For example, if property taxes increase, your escrow contributions may grow, affecting your total mortgage cost. If you are contemplating refinancing, it’s essential to understand the related closing expenses. These can encompass:

- Application charges ranging from $75 to $500

- Origination fees between 0.5% and 1.5% of the borrowed amount

- Appraisal fees typically between $300 and $500

- Title search and insurance costs between 0.5% and 1% of the borrowed amount

Determining your break-even point after refinancing can assist you in figuring out how long it will take to recover these expenses through savings in monthly contributions. By grasping the significance of PITI and monitoring these components, you can make informed decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

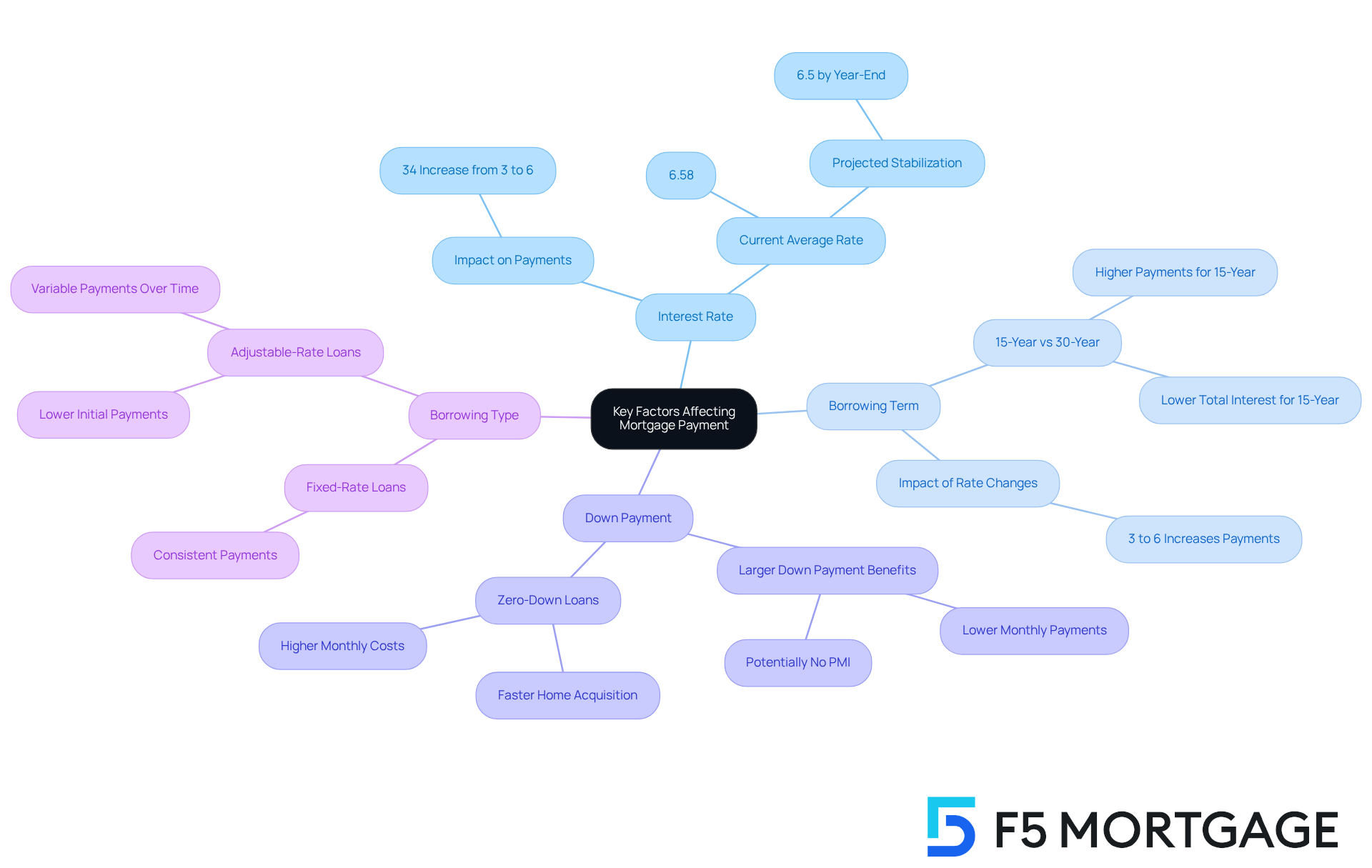

Identify Key Factors Affecting Your Mortgage Payment

Several key factors significantly influence your 350k mortgage payment, and at F5 Mortgage, we understand how overwhelming this process can feel. We are dedicated to helping you navigate these with exceptional service and competitive rates:

-

Interest Rate: This is the percentage charged on the loan amount. Currently, average loan rates hover around 6.58%, with projections suggesting they may stabilize around 6.5% by year-end. A lower interest rate can dramatically decrease your 350k mortgage payment, making it essential to shop around for the best rates. At F5 Mortgage, we offer flexible mortgage rates tailored to your needs, ensuring you can own your dream home faster.

-

Borrowing Term: The period during which you pay back the amount typically spans from 15 to 30 years. Shorter borrowing periods, like 15 years, frequently involve elevated installments but lead to reduced interest paid throughout the duration of the credit. For example, an increase in borrowing rates from 3% to 6% can elevate a homebuyer’s average recurring cost by 34%. This highlights the significance of understanding how financing terms influence the total expenses related to a 350k mortgage payment. Furthermore, 15-year loans usually result in a higher monthly payment, like a 350k mortgage payment, compared to 30-year loans, which is essential for budgeting. Our financing specialists at F5 Mortgage can custom-tailor a solution that meets your goals.

-

Down Payment: The initial amount you pay upfront can significantly affect your loan. A larger initial deposit decreases the borrowed amount, which can reduce your regular expenses and possibly eliminate private housing insurance (PMI), further minimizing your overall costs. However, it’s important to consider the trade-offs associated with zero-down loans, which may lead to a 350k mortgage payment that enables faster home acquisitions but could involve higher monthly costs or loan insurance. F5 Mortgage provides personalized support to help you understand these options.

-

Borrowing Type: Various borrowing types, like fixed-rate and adjustable-rate home loans, provide differing degrees of cost stability and total expense. Fixed-rate financing offers consistent payments, while an adjustable-rate home financing might start with a lower 350k mortgage payment but can vary over time, impacting long-term affordability. At F5 Mortgage, we equip you with the knowledge to select the appropriate financing option for your financial situation.

Comprehending these elements is vital for making informed choices when seeking a 350k mortgage payment. We know how challenging this can be, and as financing experts highlight, preserving a strong credit score—typically above 670—and understanding market trends can also result in improved terms and reduced interest rates, ultimately affecting your recurring expenses. With F5 Mortgage, you can anticipate a smooth experience as we assist you through the financing process, with no obligation or concealed expenses, and the capability to get pre-qualified within 10 minutes.

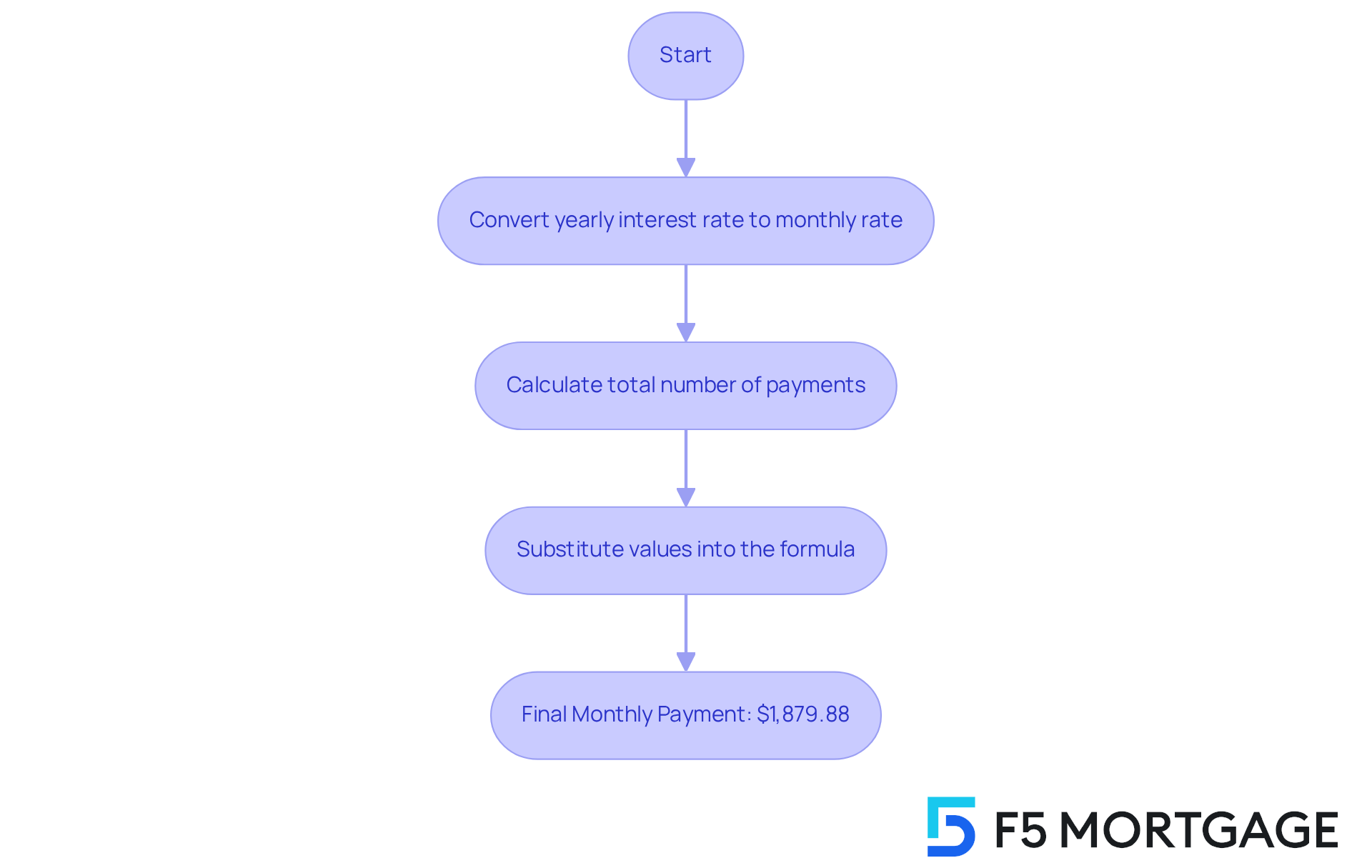

Calculate Your Monthly Payment Using the Formula

Understanding your monthly mortgage payment can feel overwhelming, but we’re here to support you every step of the way. To simplify this process, you can use the following formula:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

Where:

- M = total monthly mortgage payment

- P = principal loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in months)

Let’s take a closer look with an example: Imagine you’re considering a $350,000 mortgage at a 5% interest rate over 30 years. Here’s how you can break it down:

- First, convert the yearly interest rate to a monthly rate: 5% / 100 / 12 = 0.004167.

- Next, calculate the total number of payments: 30 years x 12 months = 360 payments.

- Now, substitute these values into the formula:

M = 350000[0.004167(1 + 0.004167)^360] / [(1 + 0.004167)^360 - 1] = $1,879.88.

This calculation provides a clear estimate of your monthly payment, not including taxes and insurance. We know how challenging this can be, but understanding this formula empowers homeowners to assess their financial commitments accurately. Financial specialists suggest that using such calculations can lead to significant savings over the life of the loan, especially when comparing different lending options. For instance, even a slight reduction in interest rates can greatly lower your monthly payments.

As we look ahead to 2025, with average loan rates expected to be around 6.95%, being informed about your payment calculations will help you make more confident financial decisions. Remember, you’re not alone in this journey; we’re here to help you navigate these important choices.

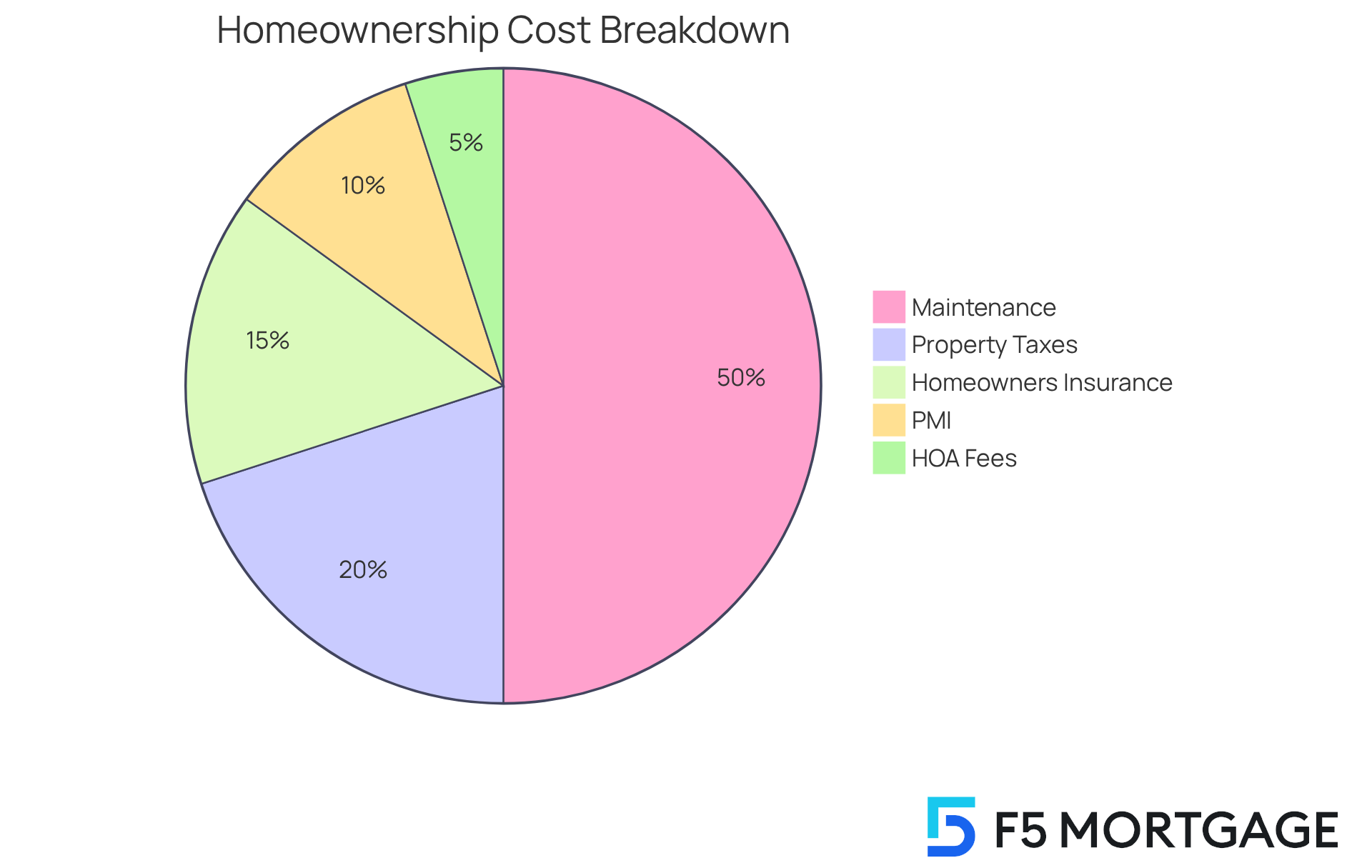

Consider Additional Costs Beyond the Monthly Payment

When budgeting for a 350k mortgage payment, it’s essential to consider additional costs that can significantly shape your financial landscape. We understand how overwhelming this process can be, and we’re here to support you every step of the way. These costs include:

-

Property Taxes: Typically assessed annually, property taxes can vary greatly depending on your location. In 2024, homeowners in states like California and New Jersey faced some of the highest median ownership expenses, reaching as much as $3,181 in D.C. alone. Understanding your local tax rates is crucial for precise budgeting, especially as ownership expenses have increased by 26% since 2019.

-

Homeowners Insurance: Required by lenders, homeowners insurance protects your property against damages and liabilities. The average annual cost for this insurance has risen significantly, with premiums increasing by 70% since late 2019. In 2025, the average homeowner now pays nearly $2,370 annually for insurance, reflecting the growing financial burden on families.

-

Private Mortgage Insurance (PMI): If your down payment is below 20%, you may be required to pay PMI, which adds to your monthly expenses. This cost can vary, but it’s an important consideration for those with smaller down payments.

-

Homeowners Association (HOA) Fees: If your home is within a community managed by an HOA, you may encounter recurring or annual charges. In 2024, the median monthly condo or HOA fee was $135, with households with a loan paying a lower median fee of $120 compared to $184 for those without.

-

Maintenance and Repairs: Budgeting for ongoing maintenance and unexpected repairs is vital for long-term homeownership. Home maintenance costs average around $8,808 annually, and according to Bankrate’s 2025 Homeowner Regrets Survey, 42% of homeowners report that maintenance and unforeseen expenses were more costly than they had anticipated.

By accounting for these additional costs, you can better prepare for the financial responsibilities of owning a home, such as managing a 350k mortgage payment. This proactive approach ensures a smoother transition into homeownership, allowing you to focus on creating lasting memories in your new space.

Evaluate Your Financial Readiness for a $350,000 Mortgage

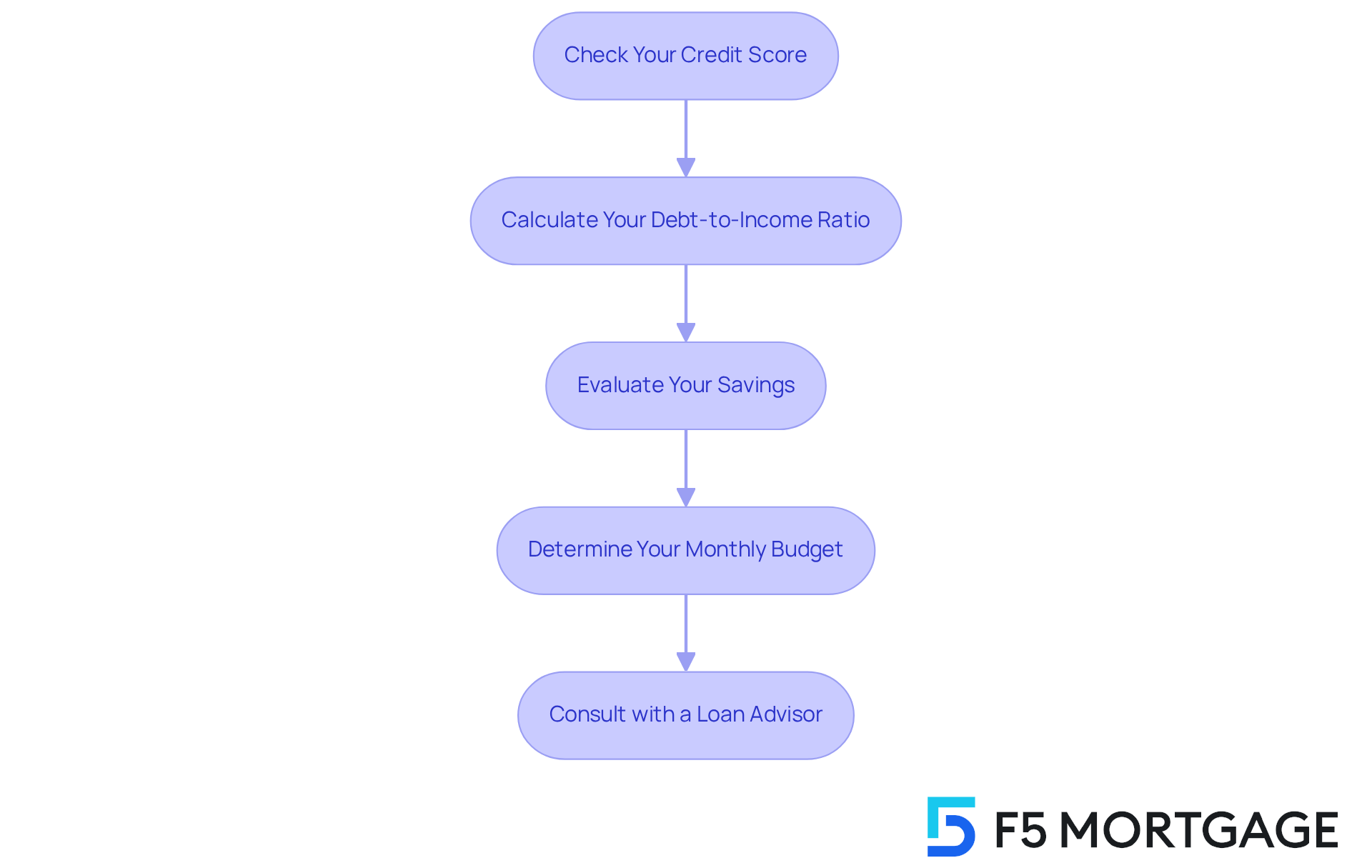

To assess your financial readiness for a $350,000 mortgage, let’s walk through these essential steps together:

-

Check Your Credit Score: We know how important a strong credit score is for securing favorable loan rates. Aim for a score above 700, as this can significantly reduce your interest costs over the life of the loan. Improving your credit score from fair (580-669) to very good (740-799) could save you over $39,000 over the lifetime of your balances.

-

Calculate Your Debt-to-Income Ratio (DTI): Lenders generally prefer a DTI below 43%. This ratio assesses your monthly debt obligations in relation to your gross monthly income, helping lenders evaluate your capacity to handle extra loan installments.

-

Evaluate Your Savings: Make sure you have adequate savings for a deposit, ideally 20%, to avoid private mortgage insurance (PMI). Additionally, consider exploring down payment assistance programs available in California, which can provide valuable support for homebuyers. If you’re self-employed, understanding how bank statement loans work can be beneficial. These loans allow for income calculation based on your business cash flow over 12 or 24 months of bank statements, demonstrating your financial stability.

-

Determine Your Monthly Budget: Establish how much you can comfortably set aside for housing each month. Don’t forget to consider loan installments, property taxes, insurance, and maintenance expenses.

-

Consult with a Loan Advisor: Working with a loan advisor can offer you personalized guidance based on your financial circumstances. They can assist you in navigating the intricacies of the loan process efficiently and provide insights on keeping your credit utilization rate below 30% to limit the effects of high balances on your credit score.

By thoroughly evaluating these aspects, including understanding the options available through bank statement loans and down payment assistance programs, you can make informed decisions about pursuing a 350k mortgage payment. Remember, we’re here to support you every step of the way, positioning you for a successful home buying experience.

Conclusion

Mastering a $350,000 mortgage payment can feel overwhelming, but we’re here to support you every step of the way. By understanding the essential components—principal, interest, taxes, and insurance—you can navigate the complexities of mortgage payments with greater confidence. This guide highlights the importance of being well-informed about your loan structure, payment calculations, and the additional costs that come with homeownership.

We know how challenging this can be. Throughout the article, we shared key insights on how interest rates, borrowing terms, down payments, and loan types significantly impact your mortgage payment. By grasping these elements, along with maintaining a healthy credit score and evaluating your financial readiness, you can make more informed decisions. Additionally, budgeting for property taxes, insurance, and maintenance costs is crucial to ensure that you are prepared for the financial responsibilities that accompany a mortgage.

Ultimately, taking a proactive approach to managing a $350,000 mortgage payment not only facilitates smoother homeownership but also empowers you to make strategic financial decisions. By leveraging the tips and insights provided, you can navigate your mortgage journey with clarity and confidence, setting yourself up for long-term success in achieving your homeownership dreams.

Frequently Asked Questions

What are the four components of a mortgage payment?

The four components of a mortgage payment are principal, interest, taxes, and insurance, collectively referred to as PITI.

What does the principal in a mortgage represent?

The principal represents the amount borrowed to purchase your home.

How does interest affect mortgage payments?

Interest is the cost incurred for borrowing the principal amount. In the initial years of a loan, a significant portion of the payment goes towards interest rather than reducing the principal balance.

How does the amortization schedule work?

The amortization schedule details how your contributions to the mortgage payment are divided over time, with more of the payment going towards interest in the early years and gradually shifting towards the principal.

What is an example of a mortgage payment calculation?

For a mortgage of $240,000 at a 3.5% interest rate, the monthly payment is approximately $1,077.71, with a larger portion initially going towards interest.

Why is it important to stay updated on property taxes and insurance?

Staying updated on property taxes and insurance is crucial because changes can lead to variations in your monthly mortgage costs, affecting your overall payment.

What are the typical closing costs associated with refinancing?

Typical closing costs can include application charges ($75 to $500), origination fees (0.5% to 1.5% of the borrowed amount), appraisal fees ($300 to $500), and title search and insurance costs (0.5% to 1% of the borrowed amount).

What is the significance of determining a break-even point after refinancing?

Determining your break-even point helps you figure out how long it will take to recover refinancing expenses through savings in monthly payments.

What factors influence a $350,000 mortgage payment?

Key factors include the interest rate, borrowing term, down payment, and borrowing type.

How does the interest rate affect mortgage payments?

A lower interest rate can significantly decrease your mortgage payment, making it essential to shop around for the best rates.

What is the impact of the borrowing term on mortgage payments?

The borrowing term typically spans from 15 to 30 years; shorter terms usually result in higher monthly payments but lower total interest paid over the life of the loan.

How does the down payment affect mortgage costs?

A larger down payment reduces the borrowed amount, which can lower monthly payments and potentially eliminate private mortgage insurance (PMI).

What are the differences between fixed-rate and adjustable-rate loans?

Fixed-rate loans offer consistent payments, while adjustable-rate loans may start with lower payments but can vary over time, affecting long-term affordability.

Why is maintaining a strong credit score important for mortgage terms?

A strong credit score, typically above 670, can lead to improved terms and reduced interest rates, ultimately lowering recurring expenses.