Overview

This article is dedicated to supporting families as they navigate the complexities of managing a $350,000 mortgage payment. We understand how challenging this can be, and it’s important to start with the basics of mortgages. By grasping these fundamentals, families can calculate their monthly payments effectively, while also considering additional costs that may arise.

Regularly reviewing your financial situation is crucial. This ongoing assessment empowers families with the knowledge they need to make informed decisions. We’re here to support you every step of the way, ensuring that you can maintain financial stability and peace of mind.

Introduction

Understanding the complexities of a $350,000 mortgage payment can feel daunting for many families. We know how challenging this can be, especially with rising housing costs and fluctuating interest rates. Mastering the art of mortgage management is essential for long-term financial stability. This guide delves into practical steps and insights that empower families to navigate their mortgage payments effectively.

From grasping the fundamental components of their loan to recognizing additional hidden costs that can impact their budget, we’re here to support you every step of the way. How can families not only survive but thrive in the face of such financial obligations? Together, we can explore the answers.

Understand Mortgage Basics and Payment Structure

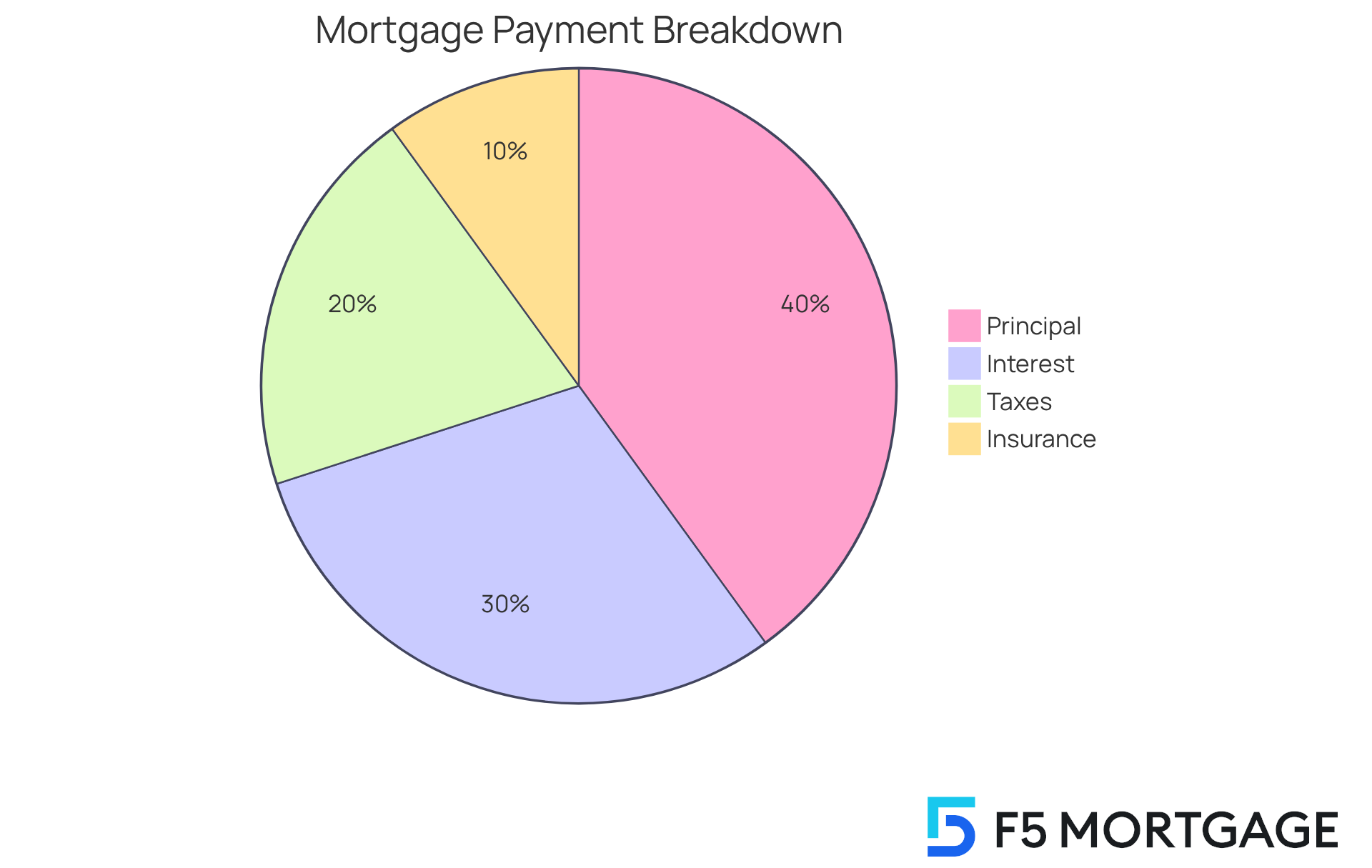

To efficiently handle your 350,000 mortgage payment, we understand how crucial it is to comprehend the basic elements that constitute your monthly responsibility. A home loan is a financial product specifically designed for acquiring real estate, usually repaid over a term of 15 to 30 years. Let’s break down the primary components of a mortgage payment:

- Principal: This is the original amount borrowed, which reduces over time as you make payments.

- Interest: The cost of borrowing the principal, calculated as a percentage of the remaining loan balance.

- Taxes: Property taxes included in your monthly charge, contributing to local funding for schools, roads, and public services.

- Insurance: Homeowners insurance safeguards your property, while private loan insurance (PMI) may be necessary if your down deposit is less than 20%.

In 2025, the national median housing cost for conventional loan applicants was reported at $2,112, reflecting ongoing trends in the real estate market. Understanding these elements clarifies their impact on your overall monthly payment, particularly the 350,000 mortgage payment, and equips you for efficient loan management. A clear understanding of your loan structure, particularly the 350,000 mortgage payment, is essential for making informed decisions and achieving long-term financial stability.

When evaluating your loan term length, consider the benefits of longer versus shorter terms. An extended duration can help maintain your regular expenses at a reduced level, allowing for extra funds for home enhancement tasks or increasing your savings. On the other hand, a shorter term means you’ll pay off your loan sooner, pay less in interest, and can build equity in your home faster. For instance, if you possess a loan of $400,000 at a 4% interest rate, the equivalent 350,000 mortgage payment would be roughly $1,909. Including projected property taxes of $300 and homeowners insurance of $100 would raise your overall cost to approximately $2,309. Using loan calculators can assist you in estimating these costs according to your particular circumstances, ensuring you are well-prepared for your financial obligations.

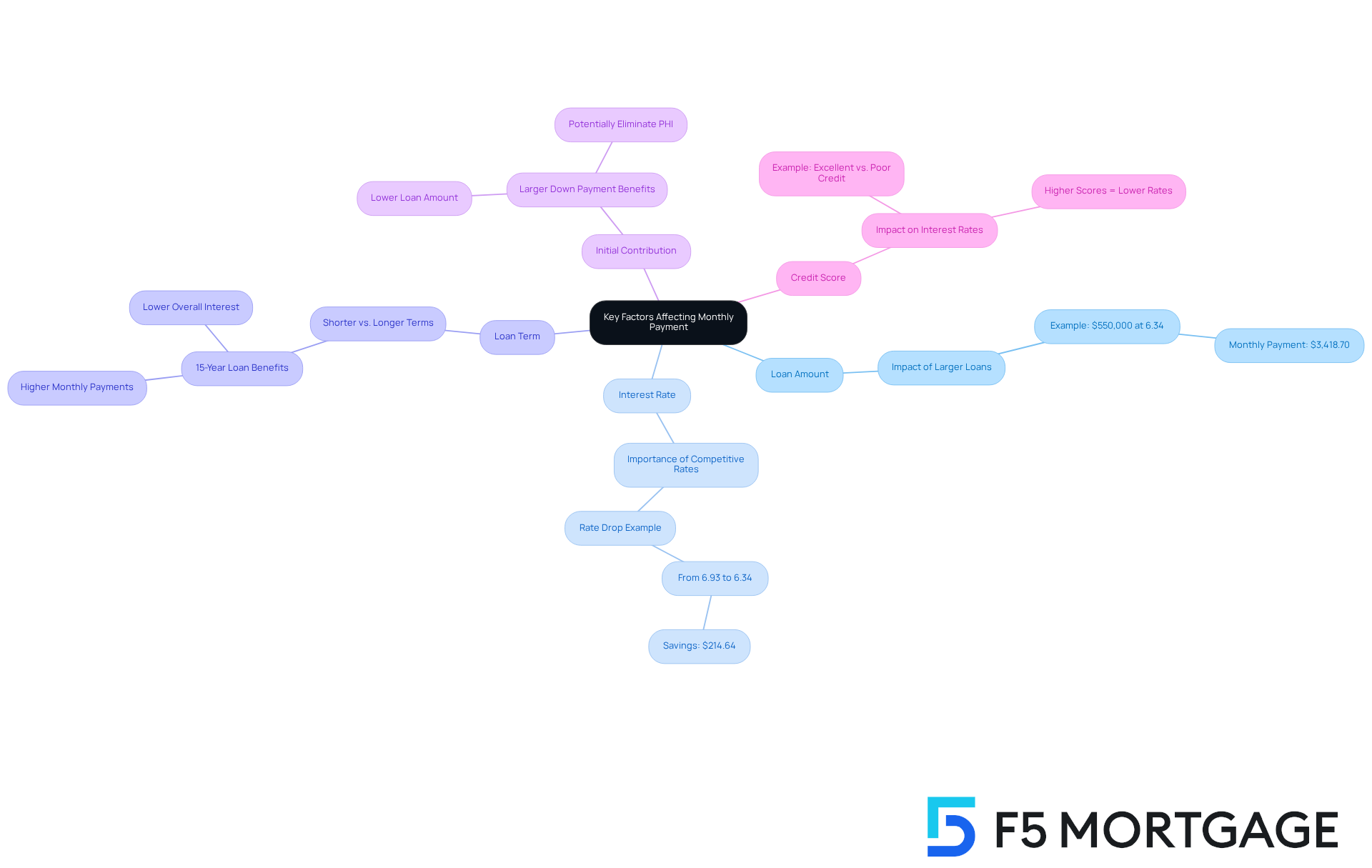

Identify Key Factors Affecting Your Monthly Payment

Navigating the world of mortgages can feel overwhelming, but understanding a few key factors can significantly ease your 350,000 mortgage payment.

-

Loan Amount: We know how challenging it can be when the loan amount is larger, leading to higher monthly payments. For instance, a $550,000 mortgage payment at the current average rate of 6.34% results in a payment of roughly $3,418.70. This illustrates how the size of your loan, particularly a 350,000 mortgage payment, directly influences affordability.

-

Interest Rate: Lowering your interest rate can make a substantial difference in your costs. Imagine if the rate drops from 6.93% to 6.34%; your payment could decrease by $214.64. This highlights the importance of comparing competitive rates to find the best fit for your budget.

-

Loan Term: Choosing a shorter loan term may mean higher monthly installments, but it often leads to reduced overall interest expenses. A 15-year loan, while costlier each month, allows homeowners to pay off their homes more quickly and save on interest over time.

-

Initial Contribution: Making a larger initial contribution can lower your loan amount and potentially eliminate private housing insurance (PHI), which further reduces your monthly costs. This approach is especially beneficial for families aiming to maximize their budget.

-

Credit Score: A higher credit score can open doors to better interest rates, significantly impacting your payment. For example, individuals with excellent credit ratings often secure rates much lower than those with poor credit. This underscores the importance of enhancing your financial profile before applying for a loan.

By understanding these factors, you can make informed decisions that align with your financial goals. We’re here to support you every step of the way, ensuring a more manageable loan experience.

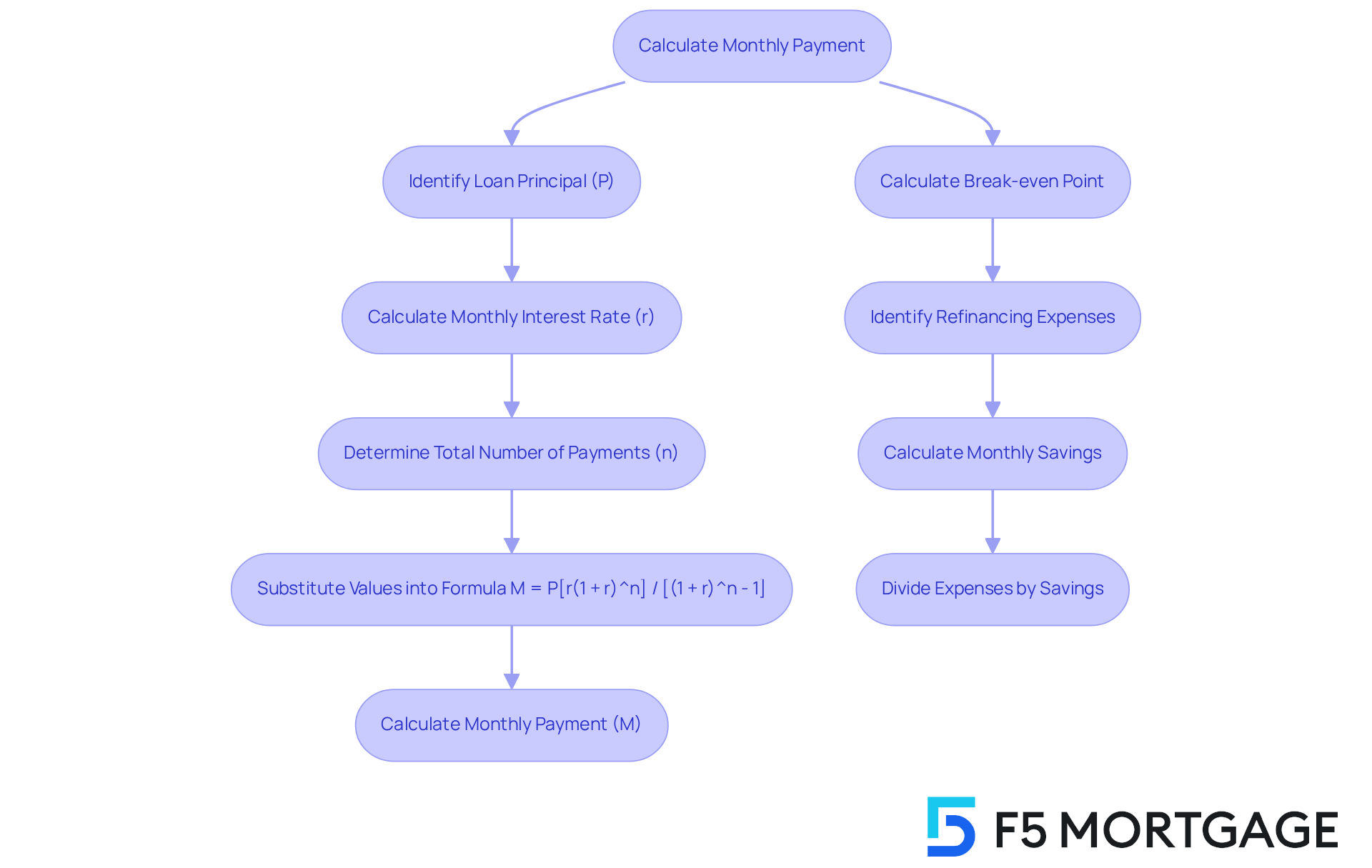

Calculate Your Monthly Payment Using the Formula

Understanding your monthly mortgage payment is an important step in managing your finances. To help you navigate this, we can use the following formula:

M = P[r(1 + r)^n] / [(1 + r)^n – 1]

Where:

- M = Total monthly mortgage payment

- P = Loan principal (amount borrowed)

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in months)

Let’s consider an example: If you have a loan of $350,000 at an interest rate of 4% over 30 years, here’s how it breaks down:

- P = 350,000

- r = 0.04 / 12 = 0.00333

- n = 30 * 12 = 360

Substituting these values into the formula gives you a monthly payment of approximately $1,670. This calculation is crucial for understanding your financial obligations, and it helps you plan your budget effectively.

Additionally, if you’re thinking about refinancing, knowing your break-even point can be essential. Start by determining your refinancing expenses, which include all closing fees and charges. Then, calculate your monthly savings by subtracting your new payment from your current one. To find out how long it will take to reach equilibrium, divide your refinancing expenses by your monthly savings. For example, if your refinancing expenses are $4,000 and your monthly savings are $100, your break-even point would be 40 months.

This insight is vital for families considering refinancing options with F5 Mortgage. We understand how challenging this process can be, and we’re here to support you every step of the way, ensuring you stay in your home long enough to truly benefit from the savings.

Consider Additional Costs Beyond the Mortgage Payment

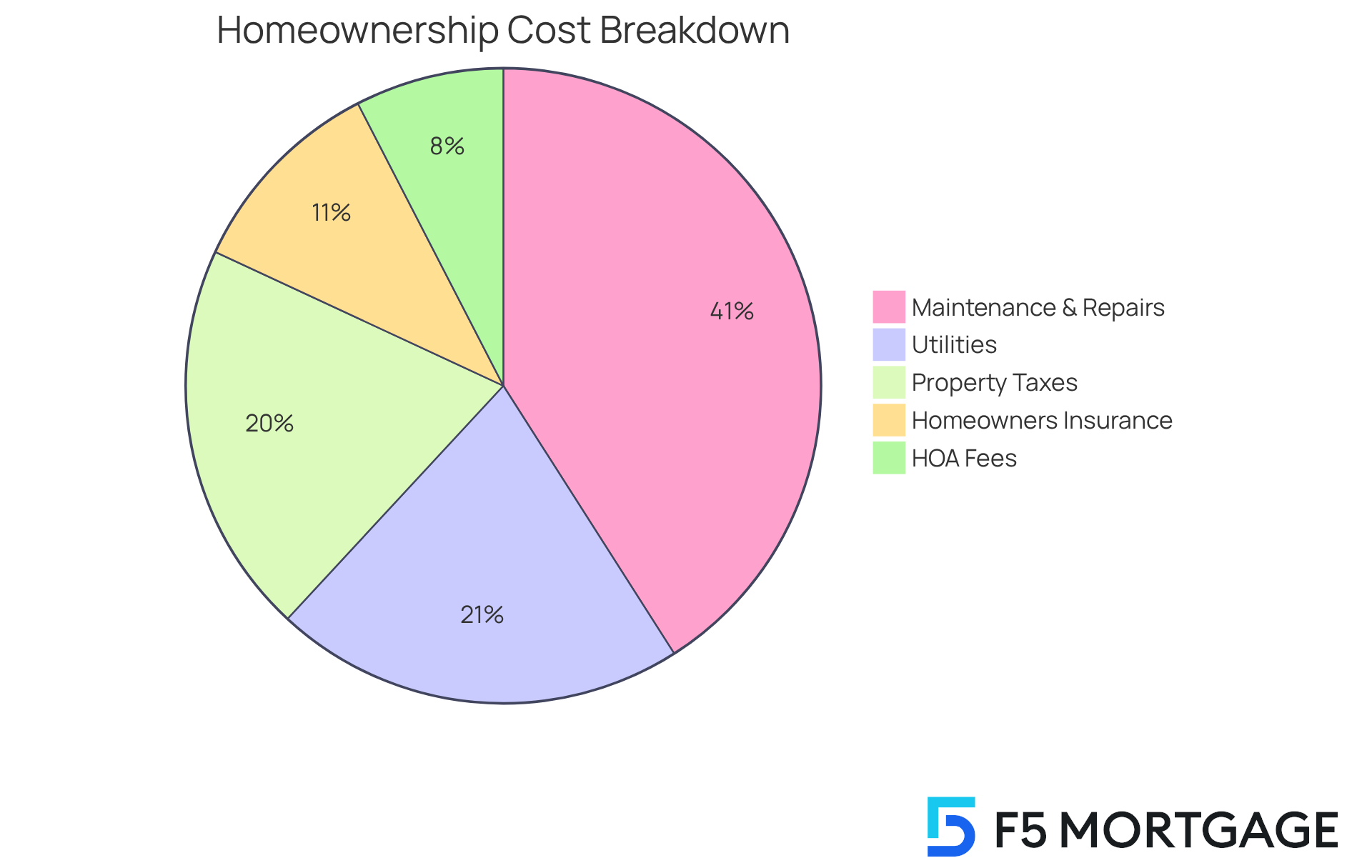

When managing a 350,000 mortgage payment, we know how challenging it can be for families to navigate additional costs that significantly impact their overall budget. Here are some key expenses to consider:

-

Property Taxes: These can vary widely depending on your location and property value. For instance, states like New Jersey have some of the highest property taxes, averaging $10,485 annually, while West Virginia boasts the lowest at just $1,063. Understanding these differences can help you plan better.

-

Homeowners Insurance: This essential coverage protects your home and belongings. In 2025, the average price of homeowners insurance is anticipated to be around $2,267. This reflects rising premiums due to factors like volatile weather patterns, which have resulted in increased expenses in many regions. It’s important to factor this into your budget.

-

Maintenance and Repairs: Regular upkeep is crucial for preserving your home’s value. Home upkeep expenses average over $8,800 each year, making it the largest concealed outlay for homeowners. Typical maintenance tasks include lawn care, pest control, seasonal HVAC tune-ups, and cleaning gutters. It’s wise to budget 1-2% of your home’s value each year for maintenance and repairs, ensuring your home remains a safe haven for your family.

-

Utilities: Monthly expenses for electricity, water, gas, and internet can add up quickly. In 2025, homeowners are expected to spend an average of $4,494 annually on utilities, with many reporting increases in their utility bills. Staying informed about these costs can help you avoid surprises.

-

HOA Fees: If your residence is part of a homeowners association, be ready for extra regular fees, which can cover amenities and upkeep of shared areas. The median monthly condo or HOA fee in 2024 was $135, emphasizing the potential extra expenses of homeownership.

By thoroughly considering these expenses, families can develop a more precise budget that includes their 350,000 mortgage payment. This proactive approach aids in the avoidance of unforeseen financial pressures, ensuring a smoother homeownership experience. Additionally, the national average for hidden homeownership costs is approximately $17,500 annually, underscoring the importance of comprehensive budgeting. Remember, we’re here to support you every step of the way as you navigate these essential financial decisions.

Review and Adjust Your Payment Based on Personal Finances

To keep your mortgage payment manageable, we understand how essential it is to regularly evaluate your financial situation:

-

Assess Your Budget: We know how challenging it can be to balance your income and expenses. Consistently tracking these can help you determine if your 350,000 mortgage payment comfortably fits within your overall budget. Planning for home loan costs, including a 350,000 mortgage payment, is often one of the biggest regular expenses for families, and being aware of this can ease some of that burden.

-

Think About Refinancing: If interest rates have dropped or your credit score has improved, refinancing your loan could significantly reduce your regular costs. Considering the current favorable loan rates in Colorado, now is a wonderful time to explore refinancing options with F5 Mortgage. This could not only lower your monthly payments but also provide access to funds for home enhancements or to establish an emergency reserve. Just remember, it’s important to be aware of potential costs associated with refinancing, such as fees for recasting a loan, which can impact your overall savings.

-

Make Extra Payments: Whenever possible, consider making additional payments towards the principal. This strategy not only reduces the overall interest paid on a 350,000 mortgage payment but can also shorten the loan term, leading to substantial long-term savings. Every little bit helps!

-

Seek Professional Advice: Consulting with a loan broker or financial advisor can offer insights tailored to your specific situation. They can assist you in exploring refinancing choices and recognizing the best approaches for managing your loan effectively.

By actively managing your mortgage payment and adapting to life changes, you can maintain financial stability and work towards your homeownership goals. Remember, we’re here to support you every step of the way.

Conclusion

Understanding how to effectively manage a $350,000 mortgage payment is crucial for families seeking financial stability. We know how challenging this can be, but grasping the intricacies of mortgage structures—like principal, interest, taxes, and insurance—can empower you to make informed decisions that align with your financial goals. This knowledge lays the groundwork for successful long-term management of your mortgage obligations.

Key insights, such as the impact of loan amount, interest rates, loan terms, initial contributions, and credit scores, play a vital role in determining the overall cost of a mortgage. Additionally, recognizing the hidden expenses of homeownership—like property taxes, insurance, maintenance, and utilities—enables families to create a comprehensive budget that accommodates their $350,000 mortgage payment and prevents unexpected financial strain.

Ultimately, proactive financial management and regular evaluation of your mortgage situation can lead to significant savings and a more secure financial future. We encourage families to continuously assess their budgets, consider refinancing options, and seek professional advice to navigate their mortgage journey effectively. By taking these steps, you can not only manage your mortgage payments but also build a brighter financial future for yourself and your loved ones.

Frequently Asked Questions

What are the main components of a mortgage payment?

The main components of a mortgage payment include principal, interest, taxes, and insurance. Principal is the original amount borrowed, interest is the cost of borrowing calculated as a percentage of the remaining loan balance, taxes refer to property taxes included in the monthly charge, and insurance includes homeowners insurance and possibly private mortgage insurance (PMI) if the down payment is less than 20%.

How does the loan amount affect my monthly payment?

The loan amount directly influences the size of your monthly payments. For example, a $550,000 mortgage at the current average interest rate of 6.34% results in a payment of approximately $3,418.70, demonstrating that larger loan amounts lead to higher monthly payments.

How does the interest rate impact my mortgage payment?

Lowering your interest rate can significantly reduce your monthly payment. For instance, if the interest rate drops from 6.93% to 6.34%, your payment could decrease by $214.64, highlighting the importance of comparing rates to find the best option for your budget.

What is the difference between a shorter and longer loan term?

A shorter loan term typically results in higher monthly payments but allows homeowners to pay off their homes more quickly and save on overall interest expenses. Conversely, a longer loan term can lower monthly payments, providing more flexibility in budgeting but may lead to paying more interest over time.

How can an initial contribution affect my mortgage payment?

Making a larger initial contribution can lower your loan amount, which may eliminate the need for private mortgage insurance (PMI), thereby reducing your monthly costs. This strategy can be particularly beneficial for families looking to maximize their budget.

Why is my credit score important when applying for a mortgage?

A higher credit score can lead to better interest rates, which significantly impacts your monthly payment. Individuals with excellent credit ratings often secure lower rates compared to those with poor credit, making it crucial to enhance your financial profile before applying for a loan.

What was the national median housing cost for conventional loan applicants in 2025?

In 2025, the national median housing cost for conventional loan applicants was reported at $2,112, reflecting ongoing trends in the real estate market.

How can I estimate my mortgage costs?

You can use loan calculators to estimate your mortgage costs based on your specific circumstances, including loan amount, interest rate, term length, property taxes, and insurance, ensuring you are well-prepared for your financial obligations.