Introduction

Navigating the complexities of a $300,000 mortgage over 30 years can feel overwhelming for families. We know how challenging this can be, especially when faced with a myriad of terms and calculations that seem daunting. But understanding essential mortgage concepts and the factors that influence monthly payments can truly empower you to make informed decisions that align with your financial goals.

What if there were straightforward strategies to not only manage but also reduce these payments effectively? Imagine the relief of knowing you can thrive financially while securing your family’s future. This guide delves into key mortgage terms, calculation methods, and actionable tips designed to transform your home financing experience. We’re here to support you every step of the way.

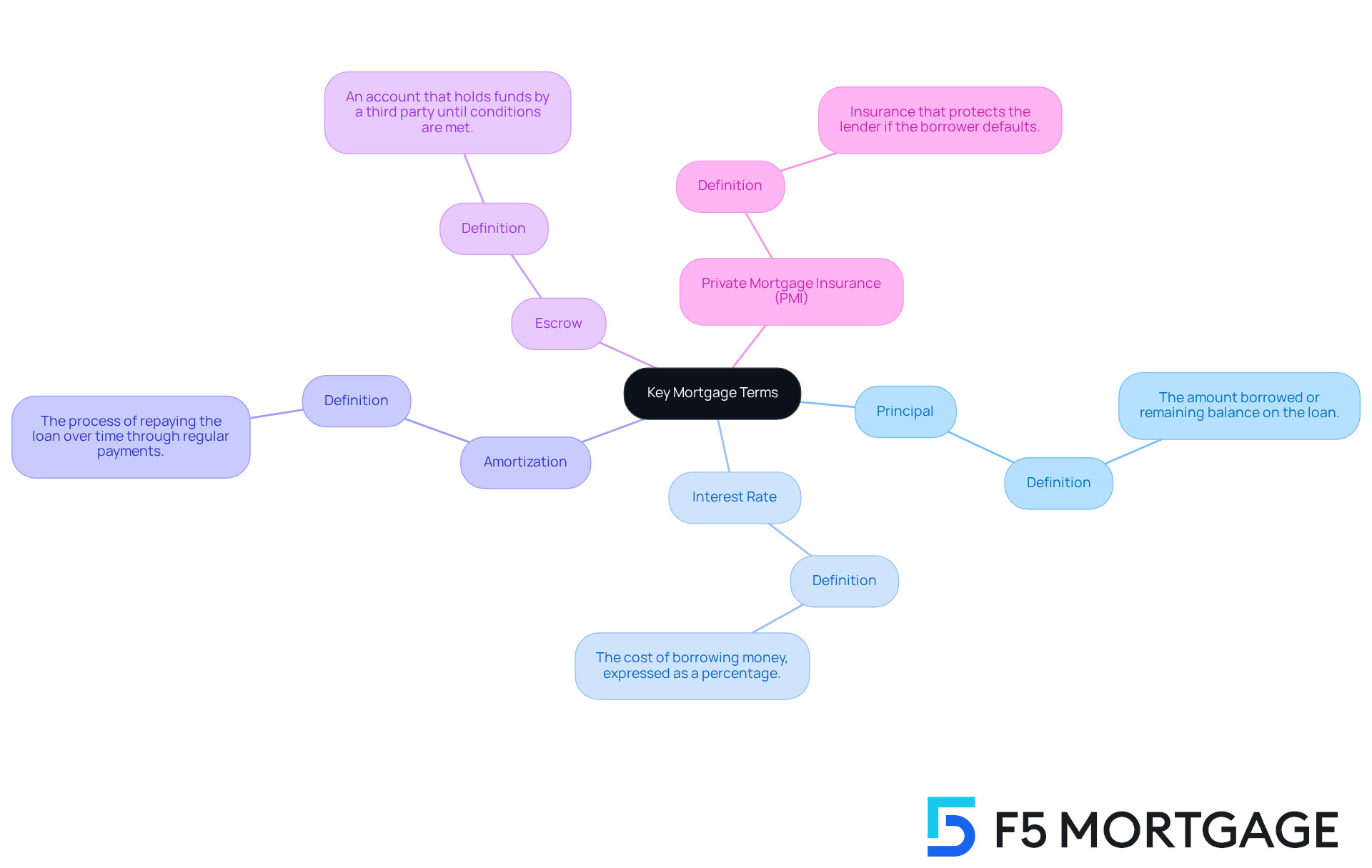

Define Key Mortgage Terms and Concepts

Navigating the home buying process can feel overwhelming, but understanding key terms can make a world of difference for families. Here are some essential concepts that can help you feel more confident:

- Principal: This is the amount you borrow or the remaining balance on your loan. It’s the foundation of your mortgage.

- Interest Rate: Think of this as the cost of borrowing money, shown as a percentage of what you’ve borrowed. It significantly affects your monthly payments.

- Amortization: This refers to how you repay your loan over time through regular payments. It helps you see how your loan balance decreases.

- Escrow: An escrow account holds funds by a third party until certain conditions are met. It’s often used for property taxes and insurance, ensuring these payments are made on time.

- Private Mortgage Insurance (PMI): This insurance protects the lender if you default on your loan. It’s usually required if your down payment is less than 20%, which can add to your monthly costs.

We know how challenging this can be, but getting familiar with these terms will not only improve your conversations with lenders but also help you understand your loan documents better. As financing specialists emphasize, grasping these concepts is vital for making informed decisions and navigating the complexities of home funding. Remember, we’re here to support you every step of the way.

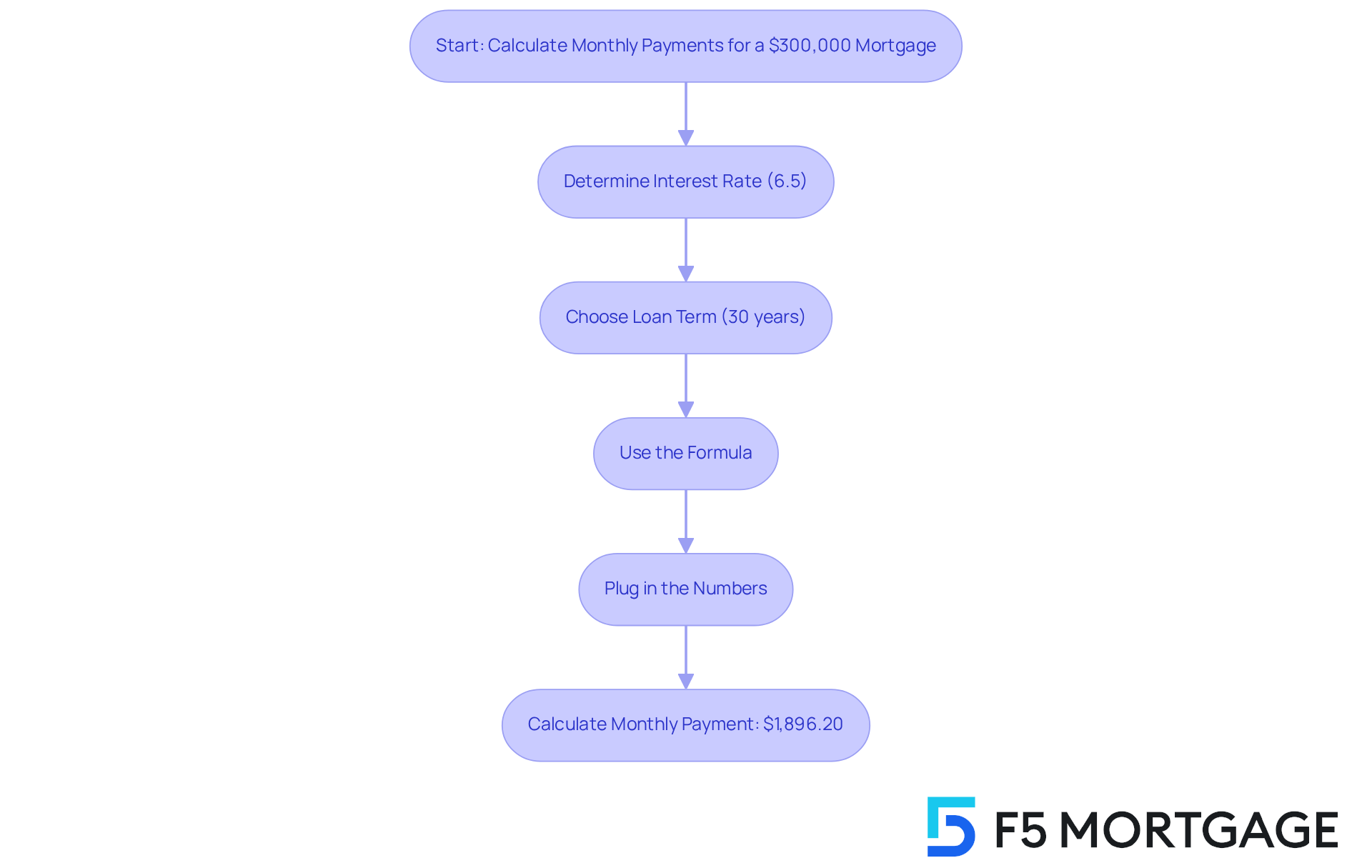

Calculate Monthly Payments for a $300,000 Mortgage

Calculating the $300,000 mortgage payment over 30 years can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down together.

Determine the Interest Rate: For this example, we’ll assume a fixed interest rate of 6.5%.

Choose the Loan Term: A common choice is a 30-year term, which many families find manageable.

Use the Formula: The formula for calculating monthly mortgage payments is:

M = P × (r(1 + r)^n) / ((1 + r)^n - 1)

Where:

- M = total monthly mortgage payment

- P = principal loan amount ($300,000)

- r = monthly interest rate (annual rate divided by 12 months)

- n = number of payments (loan term in months)

- Plug in the Numbers:

- Monthly interest rate = 6.5% / 100 / 12 = 0.00541667

- Number of payments = 30 years × 12 months/year = 360

So, we calculate:

M = 300000 × (0.00541667(1 + 0.00541667)^{360}) / ((1 + 0.00541667)^{360} - 1)

After crunching the numbers, the monthly payment comes out to approximately $1,896.20.

Understanding this calculation is essential for families to grasp their financial responsibilities and effectively plan their budgets. With the current average monthly loan cost for U.S. homebuyers at around $2,259, families can stay within their financial limits by budgeting for a $300,000 mortgage payment over 30 years.

We know how challenging this can be, and financial consultants often recommend that families assess their entire financial situation, including income and expenses, when determining how much they can afford for housing costs. Generally, a household income of $60,000 to $90,000 annually is needed to afford a $300,000 mortgage payment over 30 years for purchasing a home. Plus, putting down at least 20% ($60,000) can help avoid private mortgage insurance.

Don’t forget to factor in property taxes and homeowners insurance as part of your overall mortgage payment. This ensures you have a complete understanding of your financial commitments.

Additionally, understanding home equity requirements is crucial. Many lenders require homeowners to maintain at least an 80% home-to-value ratio. This means you should have paid down at least 20% of your initial loan amount, or your home must have appreciated in value. A maximum debt-to-income (DTI) ratio of 43% is typically necessary for home financing, which can influence the competitiveness of interest rates.

Families should also explore down payment assistance programs available through F5 Mortgage. For instance, the MyHome Assistance Program in California offers up to 3% of the home’s purchase price, while the My Choice Texas Home program provides up to 5% for down payment and closing assistance. These resources can significantly ease the financial burden for families looking to upgrade their homes.

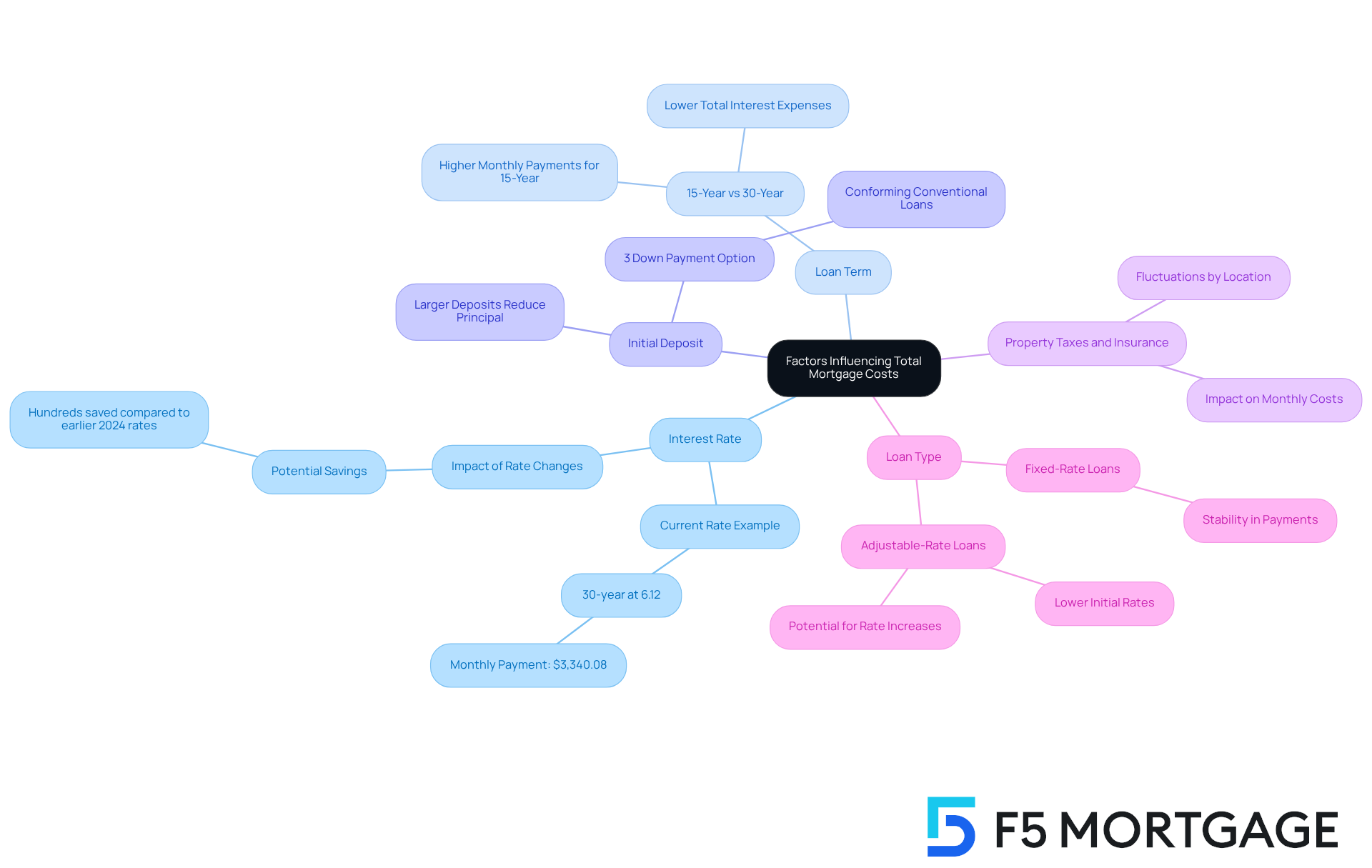

Explore Factors Influencing Total Mortgage Costs

Several factors significantly influence the total cost of your mortgage, and we know how challenging this can be:

Interest Rate: A lower interest rate can dramatically decrease your monthly payment and the total interest paid over the loan’s duration. For instance, a 30-year financing option at 6.12% results in a recurring charge of roughly $3,340.08 for a $550,000 borrowing. This example shows how current rates can lead to significant savings compared to previous rates in 2024.

Loan Term: Shorter loan durations, like 15 years, generally involve higher monthly costs but reduced total interest expenses. This can be beneficial for families aiming to settle their loan quicker and save on interest over time.

Initial Deposit: The amount of your initial deposit plays a crucial role in determining your loan installments. A larger initial deposit decreases the principal sum borrowed, which can reduce regular installments and eliminate private loan insurance (PMI). For example, securing a loan with only a 3% down deposit is achievable through conforming, conventional financing, enhancing homeownership accessibility.

Property Taxes and Insurance: These expenses can fluctuate greatly depending on location and property value, affecting your overall monthly cost. It’s essential to factor these into your budget when considering a home loan.

Loan Type: Various types of financing, such as fixed-rate versus adjustable-rate options, have differing effects on your payment structure and long-term expenses. Fixed-rate loans ensure stability, while adjustable-rate loans may provide lower initial rates but can vary over time.

Understanding these factors empowers families to make informed decisions that can lead to significant savings over time. Especially in a market where home prices have risen by approximately 50% since the start of the decade, it’s crucial to navigate this landscape wisely.

With F5 Mortgage, we’re here to support you every step of the way. You can attain homeownership with outstanding service and competitive rates, ensuring a seamless and supportive experience throughout the financing process.

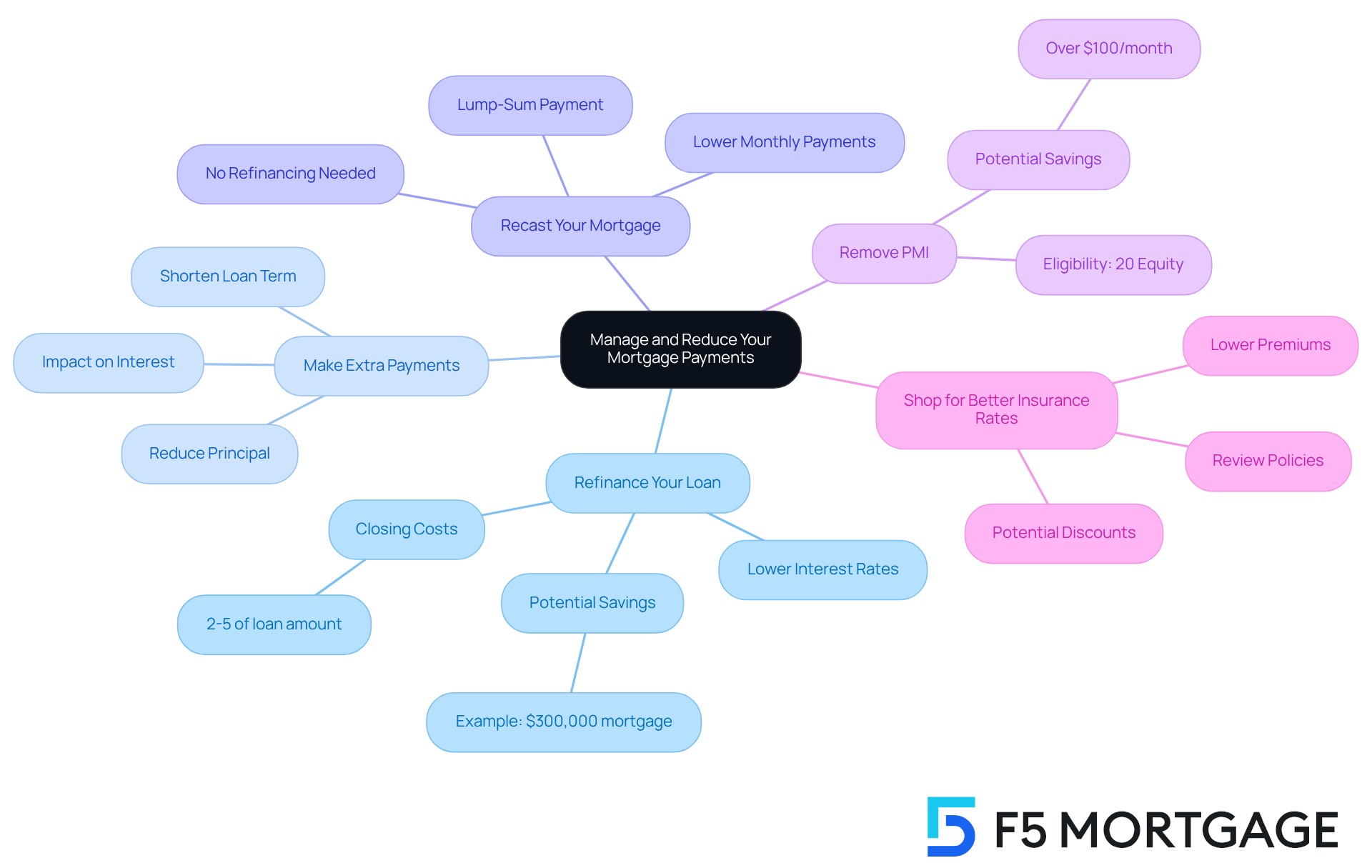

Manage and Reduce Your Mortgage Payments Effectively

Managing your mortgage payments can feel overwhelming, but there are effective strategies that can help ease your burden. We know how challenging this can be, and we’re here to support you every step of the way.

Refinance Your Loan: If interest rates have dropped since you took out your loan, refinancing might be a smart move. Imagine refinancing a $300,000 mortgage payment over 30 years at a lower rate – this could save families hundreds of dollars each month, making a real difference in your budget.

Make Extra Payments: Contributing a little extra towards your principal can lead to significant savings. Even small additional payments can reduce the total interest paid over the life of the loan and shorten your repayment term. It’s a simple step that can have a big impact on your financial future.

Recast Your Mortgage: If you receive a windfall, like a bonus or inheritance, consider making a lump-sum contribution towards your principal. This can lower your monthly payments without the hassle of refinancing, giving you more breathing room in your budget.

Remove PMI: If your home equity exceeds 20%, you might be eligible to cancel private mortgage insurance (PMI). This could lower your monthly expenses by over $100 – a substantial saving that can improve your cash flow.

Shop for Better Insurance Rates: Don’t forget to review your homeowners insurance. Comparing policies can lead to lower premiums, further reducing your overall monthly costs. Many families overlook potential discounts that could save them money.

By implementing these strategies, you can take control of your mortgage payments, leading to greater financial stability and peace of mind. Remember, you’re not alone in this journey; there are options available to help you thrive.

Conclusion

Understanding the complexities of a $300,000 mortgage payment over 30 years is essential for families striving for financial stability. We know how challenging this can be, but grasping key mortgage terms and concepts can help you navigate the home buying process with confidence. This knowledge lays the groundwork for making informed decisions that can significantly impact your long-term financial health.

Throughout this article, we discussed essential components like:

- Calculating monthly payments

- Recognizing factors that influence total mortgage costs

- Exploring strategies to manage and reduce payments

Understanding how interest rates, loan terms, and initial deposits affect mortgage payments allows families to plan better and potentially save thousands over the life of their loan. Additionally, practical strategies such as:

- Refinancing

- Making extra payments

- Removing PMI

can empower you to take control of your financial commitments.

Ultimately, the journey to homeownership doesn’t have to be daunting. By leveraging the insights provided and actively seeking assistance through available programs, you can navigate the complexities of mortgage payments with greater ease. Embracing these strategies can lead to a more secure financial future, ensuring that the dream of homeownership becomes a reality without undue stress.

Frequently Asked Questions

What is the principal in a mortgage?

The principal is the amount you borrow or the remaining balance on your loan. It serves as the foundation of your mortgage.

How does the interest rate affect my mortgage?

The interest rate is the cost of borrowing money, expressed as a percentage of the amount borrowed. It significantly impacts your monthly payments.

What does amortization mean in the context of a mortgage?

Amortization refers to the process of repaying your loan over time through regular payments, which allows you to see how your loan balance decreases.

What is an escrow account?

An escrow account is a fund held by a third party until certain conditions are met, often used for property taxes and insurance to ensure timely payments.

What is Private Mortgage Insurance (PMI)?

PMI is insurance that protects the lender if you default on your loan. It is typically required if your down payment is less than 20%, which can increase your monthly costs.

Why is it important to understand these mortgage terms?

Understanding these terms can improve your conversations with lenders and help you better comprehend your loan documents, aiding in informed decision-making during the home buying process.