Overview

This article is here to support you as you navigate the complexities of managing a $250,000 mortgage payment. We know how challenging this can be, which is why we outline the key components, calculation methods, and additional costs involved. Understanding PITI—Principal, Interest, Taxes, and Insurance—is essential. By assessing your financial readiness and budgeting for extra expenses, you can make informed decisions that help avoid financial strain.

As prospective homeowners, it’s important to recognize the emotional weight this journey carries. We’re here to guide you through it. Start by familiarizing yourself with the elements of your mortgage. This knowledge empowers you to tackle the challenges ahead with confidence. Remember, you’re not alone in this process; many families have walked this path before you.

In conclusion, take the time to evaluate your financial situation and prepare for the journey ahead. With the right understanding and support, you can manage your mortgage effectively and create a stable future for your family. We’re here to support you every step of the way.

Introduction

Navigating the complexities of mortgage payments can feel overwhelming for many prospective homeowners. We know how challenging this can be. A typical mortgage installment includes essential elements like principal, interest, taxes, and insurance, making it vital to understand these components for effective financial planning. But beyond just grasping the basics, how can you truly master the intricacies of a $250,000 mortgage payment? How can you ensure that you are financially prepared for homeownership?

This article delves into key steps, calculations, and hidden costs that can significantly impact your journey to owning a home. We’re here to support you every step of the way, empowering you to make informed decisions and avoid common pitfalls. Together, we can navigate this path with confidence.

Explore the Basics of Mortgage Payments

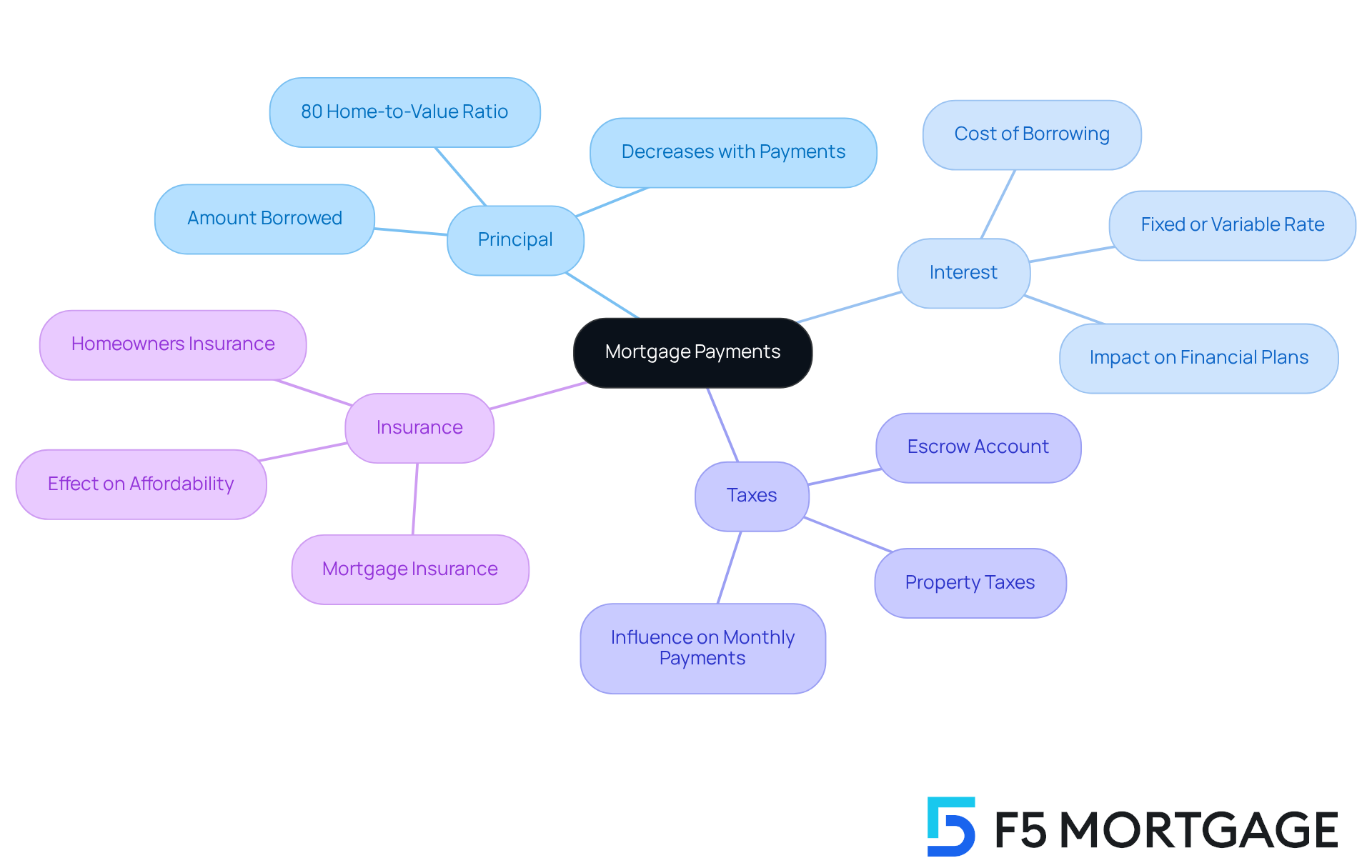

Navigating the world of mortgages can feel overwhelming, but understanding the key components can make a significant difference. A mortgage installment typically consists of four main components, often referred to as PITI: Principal, Interest, Taxes, and Insurance. Knowing how these elements interact with home equity and debt-to-income (DTI) ratios is essential for homeowners like you.

Principal: This is the amount borrowed from the lender. Each payment decreases the principal balance of the debt, which is crucial for meeting the 80% home-to-value financing ratio that many lenders require. We understand how important it is to keep track of this balance as you work towards homeownership.

Interest: This represents the cost of borrowing the money, expressed as a percentage of the loan amount. The interest rate can be fixed or variable, impacting the overall cost of your mortgage. It’s important to consider how this will affect your long-term financial plans.

Taxes: Property taxes are typically included in your regular contributions and are held in an escrow account until they are due. These taxes can influence your overall monthly payment, and we know how vital it is to factor them into your DTI calculations.

Insurance: Homeowners insurance protects against damages to your residence, while mortgage insurance may be necessary for loans with less than a 20% deposit. This insurance can also affect the affordability of your monthly payments.

By grasping these components, you can better anticipate your monthly obligations and budget accordingly. Remember, keeping a DTI ratio of no more than 43% is essential for securing competitive financing rates. A healthier DTI can lead to more favorable terms, making your journey to homeownership smoother. We’re here to support you every step of the way as you take this important financial step.

Calculate Your Monthly Payment for a $250,000 Mortgage

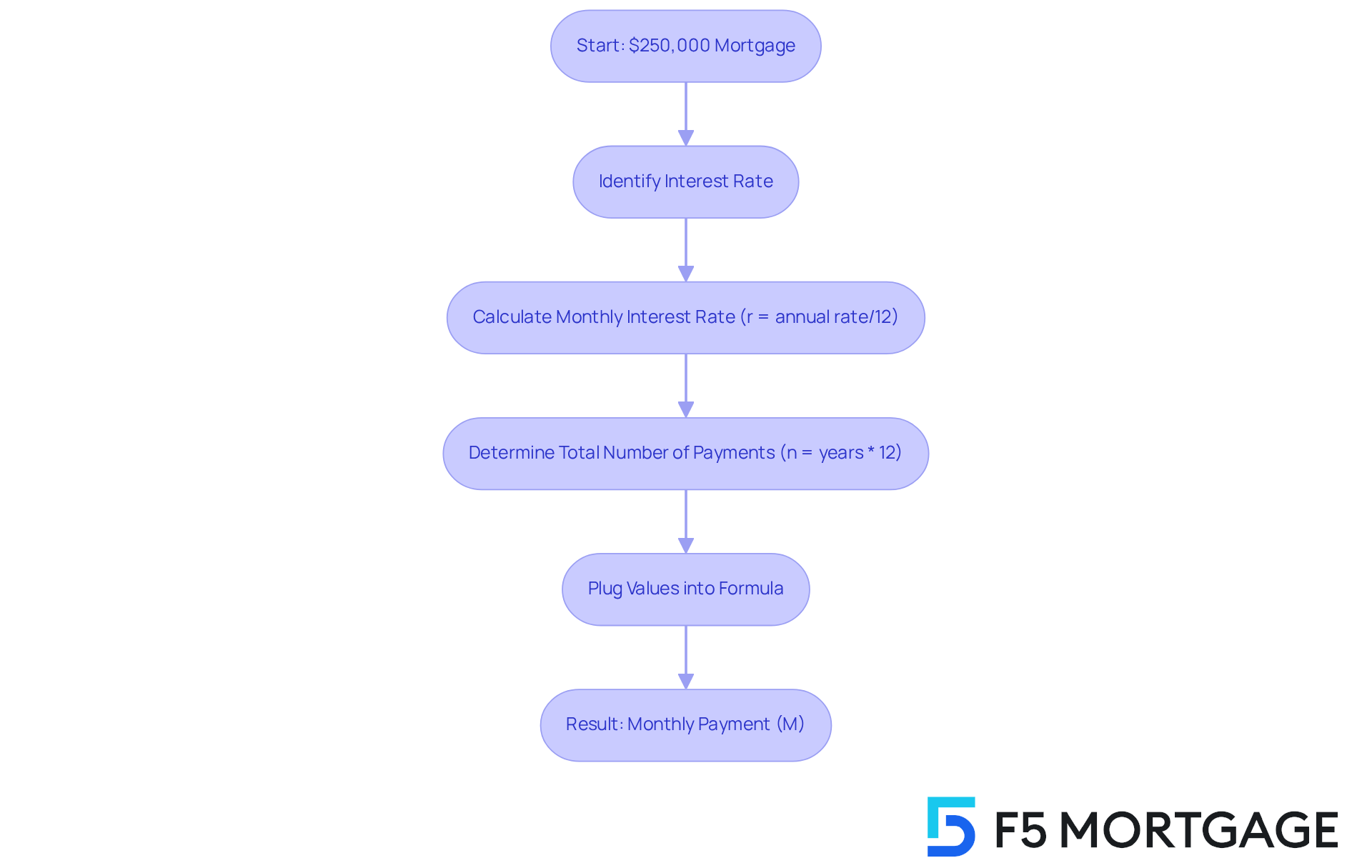

When considering a mortgage, understanding your monthly payment is crucial. For a $250,000 mortgage, you can use this formula to determine your payment:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

In this formula:

- M is your total monthly mortgage payment.

- P represents the borrowed amount associated with the $250,000 mortgage payment.

- r stands for the interest rate per month (annual rate divided by 12).

- n is the total number of installments, or the loan term in months.

Let’s break it down together. For example, if you have a 30-year fixed mortgage with an interest rate of 4%, your monthly interest rate would be calculated as 0.04/12, which equals approximately 0.00333. The total number of payments over 30 years would be 30 multiplied by 12, resulting in 360 payments. Plugging these values into the formula gives us:

M = 250,000[0.00333(1 + 0.00333)^360] / [(1 + 0.00333)^360 - 1]

After calculating, you would find that your monthly payment is roughly $1,193.54. We understand how daunting this process can be, and grasping these calculations is essential for prospective buyers. It helps clarify your financial responsibilities each month, empowering you to make informed decisions about your future.

Understand Additional Costs Beyond Monthly Payments

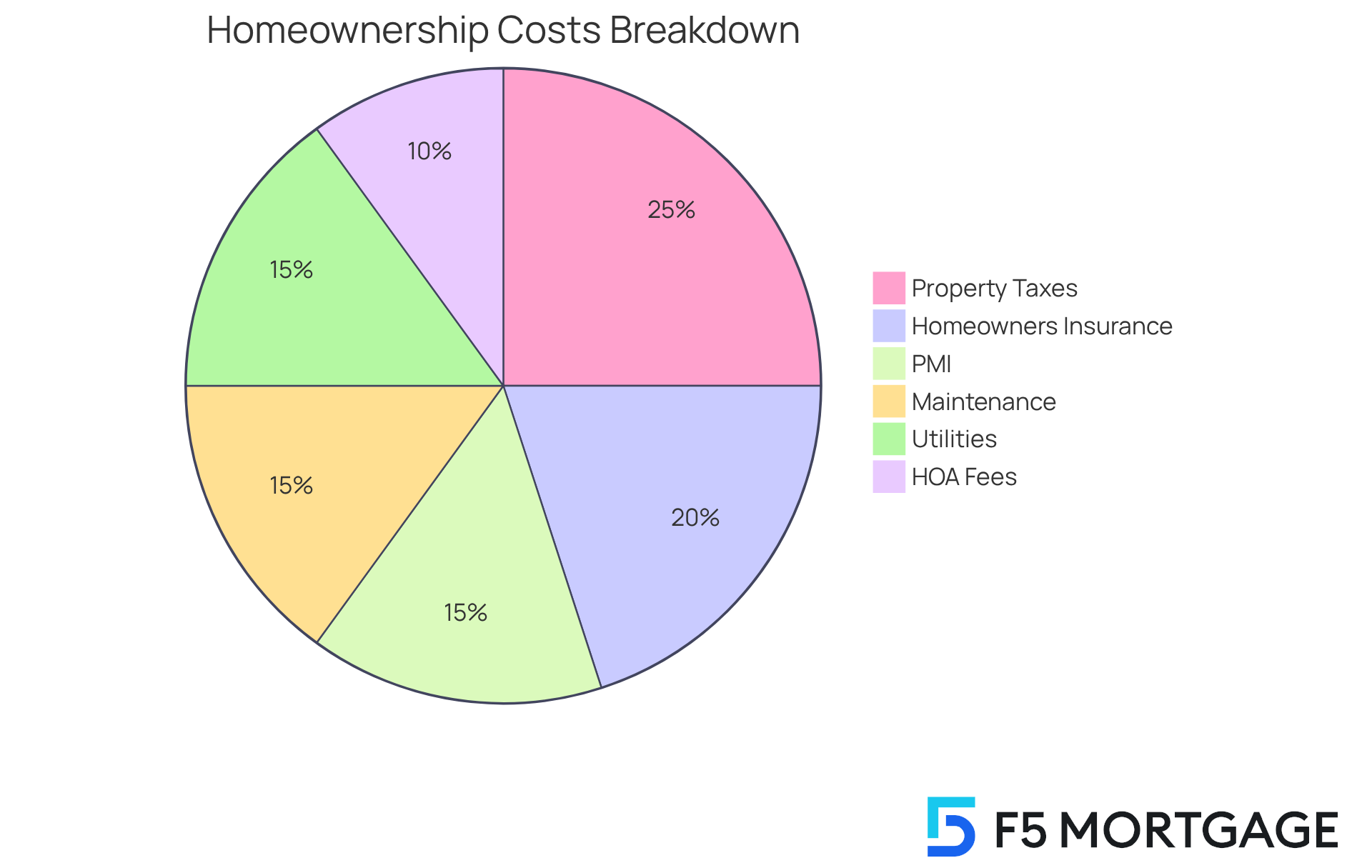

When it comes to homeownership, being aware of the costs beyond the monthly mortgage payment is essential. We understand how overwhelming this can feel, so let’s explore some key expenses together:

- Property Taxes: These are assessed by local governments and can vary widely based on location. It’s important to factor these into your budget.

- Homeowners Insurance: This protects your home and belongings from damage or theft, offering peace of mind.

- Private Mortgage Insurance (PMI): If your down payment is less than 20%, PMI is required and adds to your monthly costs. Knowing this ahead of time can help you plan better.

- Maintenance and Repairs: Regular upkeep is necessary to maintain your property’s value. Think of it as an investment in your home’s future.

- Utilities: Monthly bills for electricity, water, gas, and internet can add up, so it’s wise to keep track of these expenses.

- Homeowners Association (HOA) Fees: If applicable, these fees cover community maintenance and amenities, contributing to your overall living experience.

By understanding these additional costs, you can budget more effectively and avoid financial strain. Remember, we’re here to support you every step of the way.

Assess Your Financial Readiness for a $250,000 Mortgage

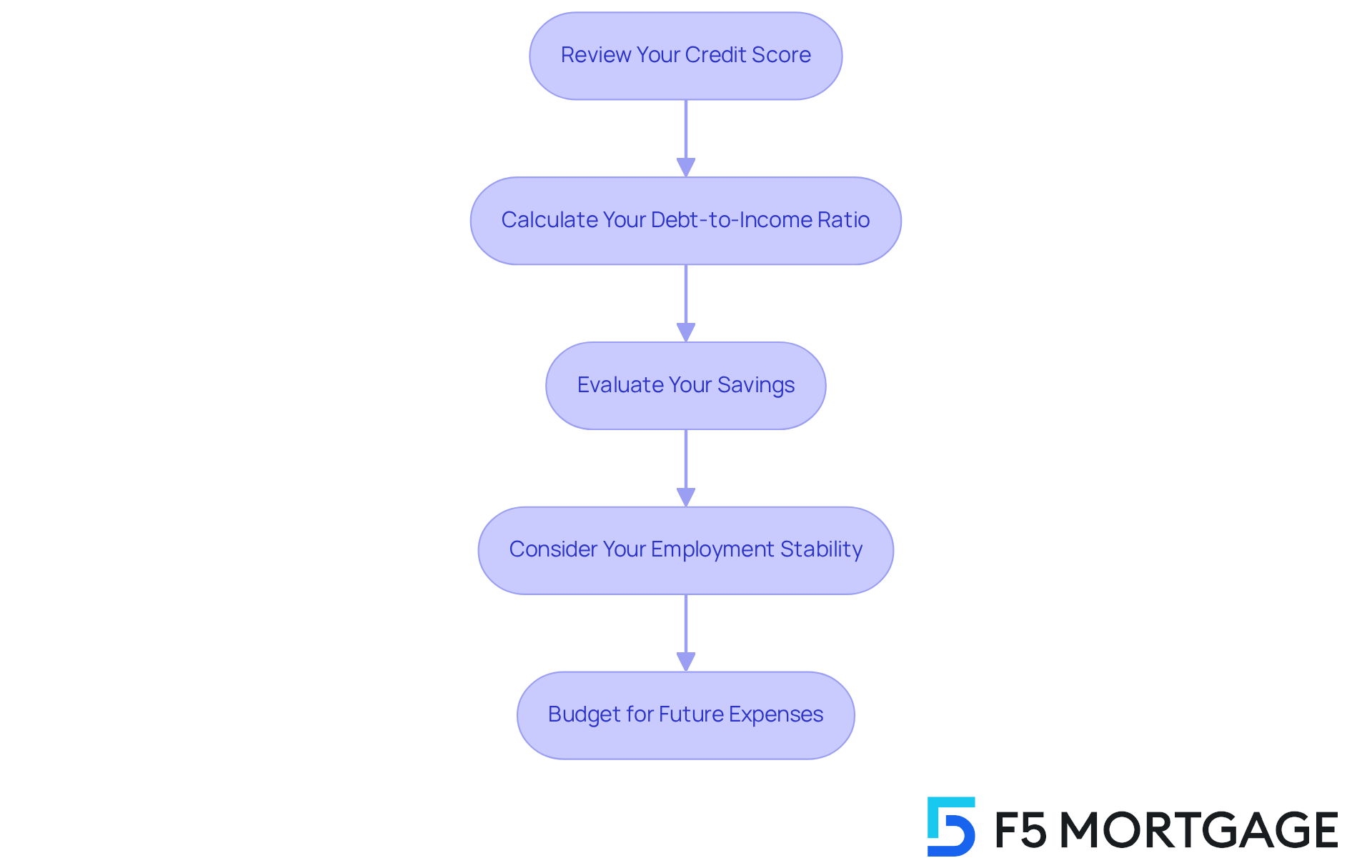

Assessing your financial readiness involves several key steps that can help you feel more confident in your journey to homeownership:

Review Your Credit Score: A higher credit score can lead to better interest rates. If you’re aiming for traditional financing, a score of 620 or above is a good target. Remember, the most favorable loan rates with a conventional option are accessible to individuals with a minimum of a 740 FICO score.

Calculate Your Debt-to-Income Ratio (DTI): We know how challenging it can be to manage finances, and lenders typically prefer a DTI of 43% or lower. This ratio compares your monthly debt obligations to your gross monthly income. A better DTI can lead to more competitive mortgage rates, making it crucial for homebuyers to understand and manage this ratio effectively.

Evaluate Your Savings: Ensure you have sufficient funds for a down deposit, which usually ranges from 3-20% of the home price, along with extra money for closing costs and reserves. Having this financial cushion can provide peace of mind.

Consider Your Employment Stability: A steady job history can reassure lenders of your ability to make payments. We’re here to support you every step of the way, so consider how your job stability impacts your financial readiness.

Budget for Future Expenses: It’s important to factor in potential increases in property taxes, insurance, and maintenance costs. Planning for these future expenses can help you avoid surprises down the road.

By thoroughly assessing these factors, potential homeowners can determine if they are financially prepared to take on a 250,000 mortgage payment. Additionally, exploring refinancing options with F5 Mortgage, such as conventional loans, FHA loans, and VA loans, can provide flexible solutions tailored to your financial situation, empowering you to achieve your dream of homeownership.

Conclusion

Mastering a $250,000 mortgage payment can feel overwhelming, but we know how important it is to understand the various financial components involved. By breaking down the essential elements—Principal, Interest, Taxes, and Insurance—homeowners can gain clarity on their monthly obligations. This foundational knowledge not only aids in budgeting but also empowers prospective buyers to navigate the complexities of home financing with greater confidence.

It’s crucial to accurately calculate monthly payments while recognizing additional costs beyond the basic mortgage payment. Understanding property taxes, homeowners insurance, and potential PMI can significantly impact overall affordability. Moreover, assessing your financial readiness through credit scores, debt-to-income ratios, and employment stability equips you to make informed decisions. We’re here to support you every step of the way, ensuring you are well-prepared for the responsibilities of homeownership.

Ultimately, taking the time to master these aspects of mortgage payments is essential for achieving financial stability and success in homeownership. By being proactive in budgeting and planning for additional costs, you can pave the way for a smoother transition into your new financial commitment. Embracing these strategies not only enhances your financial literacy but also propels you toward the dream of owning a home.

Frequently Asked Questions

What are the main components of a mortgage payment?

The main components of a mortgage payment are Principal, Interest, Taxes, and Insurance, often referred to as PITI.

What is the principal in a mortgage payment?

The principal is the amount borrowed from the lender. Each payment reduces the principal balance, which is important for maintaining the required 80% home-to-value financing ratio.

How does interest affect mortgage payments?

Interest represents the cost of borrowing money and is expressed as a percentage of the loan amount. The interest rate can be fixed or variable, affecting the overall cost of the mortgage.

What role do taxes play in mortgage payments?

Property taxes are typically included in monthly mortgage payments and are held in an escrow account until due. They can influence the overall monthly payment and should be factored into debt-to-income (DTI) calculations.

What types of insurance are associated with mortgages?

Homeowners insurance protects against damages to the home, while mortgage insurance may be required for loans with less than a 20% down payment. Both can affect the affordability of monthly payments.

Why is understanding these components important for homeowners?

Understanding these components helps homeowners anticipate their monthly obligations and budget accordingly, making the journey to homeownership smoother.

What is a healthy debt-to-income (DTI) ratio for securing financing?

A healthy DTI ratio is no more than 43%, which is essential for securing competitive financing rates and favorable terms.