Overview

Navigating a $150,000 mortgage payment can feel overwhelming for families. We understand how challenging this can be, and that’s why it’s essential to take proactive steps. First, it’s important to grasp the different types of mortgages available. This knowledge can empower you to make informed decisions that suit your unique situation.

Next, calculating key financial metrics like GDS (Gross Debt Service) and TDS (Total Debt Service) ratios is crucial. These figures help you understand your financial landscape better, ensuring you’re not stretching your budget too thin. By knowing where you stand financially, you can approach your mortgage with confidence.

Additionally, exploring personalized financing solutions can make all the difference. Every family’s financial situation is unique, and tailored options can help align your mortgage strategy with your homeownership goals. Remember, we’re here to support you every step of the way as you navigate these important decisions.

Introduction

Navigating the complexities of a mortgage can be particularly daunting for high-income families, especially when faced with a substantial payment like $150,000. We understand how challenging this can be.

Understanding the intricacies of mortgage types, credit scores, and essential financial metrics such as GDS and TDS ratios can empower families to make informed decisions that align with their financial aspirations.

However, with so many options and potential pitfalls, how can families ensure they are making the best choices for their unique situations?

This article delves into essential steps and strategies that can help families master their mortgage payments and achieve greater financial stability. We’re here to support you every step of the way.

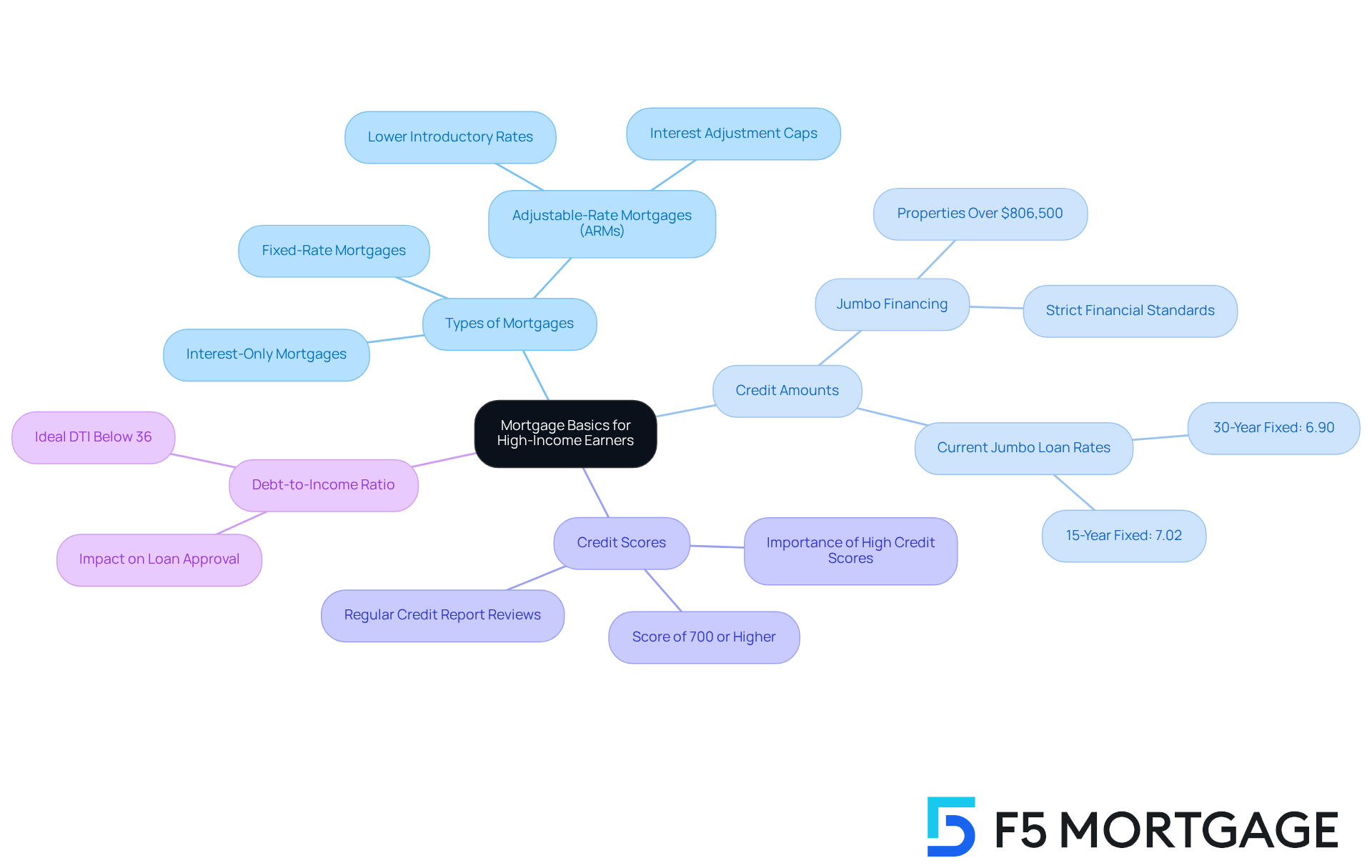

Explore Mortgage Basics for High-Income Earners

High-income earners often find themselves navigating a more intricate financial landscape, which can significantly affect their loan options. We understand how challenging this can be, and knowing some key concepts can help ease the process:

- Types of Mortgages: Familiarize yourself with various mortgage types, such as fixed-rate, adjustable-rate, and interest-only mortgages. Each option presents distinct advantages and disadvantages, depending on your financial strategy and long-term goals. For example, adjustable-rate mortgages (ARMs) offer lower introductory rates, making them suitable for those planning to pay off their mortgage quickly or refinance in a few years. However, it’s crucial to be aware of the potential for rate adjustments and the importance of interest adjustment caps that protect borrowers from significant increases.

- Credit Amounts: Your income plays a crucial role in determining the maximum credit amount you can qualify for, especially when considering , which is designed for properties exceeding conforming credit limits. In 2025, jumbo mortgages generally serve properties valued over $806,500, necessitating borrowers to fulfill strict financial standards. Present jumbo loan rates average 6.90% for 30-year fixed terms and 7.02% for 15-year fixed terms, which are important to consider when planning your financing.

- Credit Scores: Keeping an outstanding credit score is essential for obtaining advantageous loan rates. High-income earners should regularly review their credit reports for inaccuracies and take proactive steps to enhance their scores. A score of 700 or higher is often necessary for the best terms, and we’re here to support you every step of the way in achieving that.

- Debt-to-Income Ratio: This ratio is a critical factor in assessing your borrowing capacity. Aim for a debt-to-income (DTI) ratio below 36% to enhance your chances of loan approval and access to better rates.

By mastering these fundamentals, families can effectively navigate the home loan landscape. We know how important it is to align your choices with your financial aspirations, and with the right knowledge, you can ensure a smoother home financing experience.

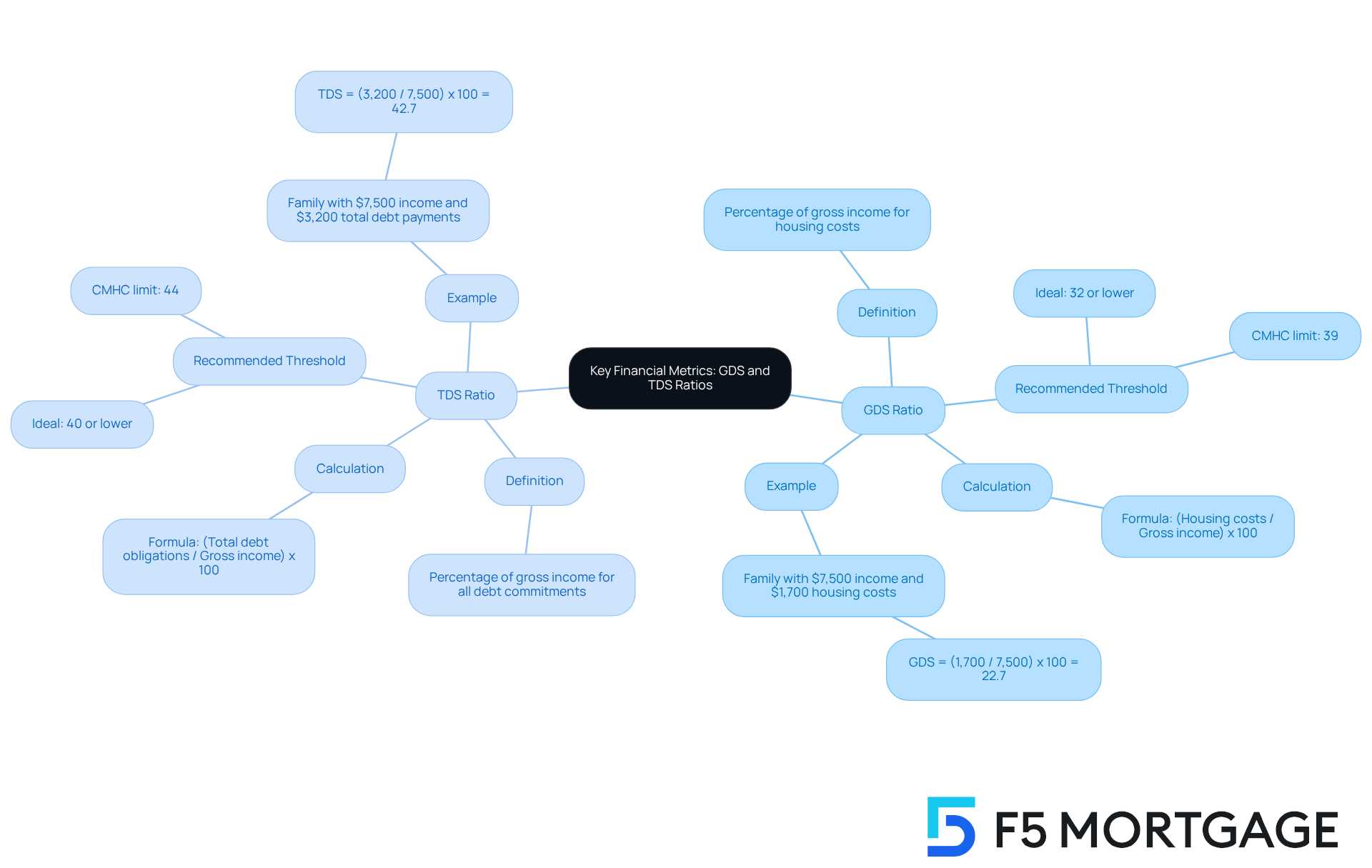

Analyze Key Financial Metrics: GDS and TDS Ratios

Understanding the is essential for families as they navigate their financing options. We know how challenging this can be, and grasping these concepts can empower you to make informed decisions.

- GDS Ratio: This ratio represents the percentage of your gross income allocated to housing costs, which include mortgage payments, property taxes, and heating expenses. Generally, a GDS ratio of 32% or lower is recommended to ensure your housing remains affordable.

- TDS Ratio: This broader measure considers all debt commitments, including housing expenses, car loans, and credit card payments. Ideally, you should aim for a TDS ratio at or below 40% to maintain financial stability.

- GDS Calculation: (Housing costs per month / Gross income per month) x 100.

- TDS Calculation: (Total debt obligations / Gross income) x 100.

For instance, let’s consider a family with a gross income of $7,500 and total housing costs of $1,700 each month. Their GDS would be calculated as (1,700 / 7,500) x 100, resulting in a GDS of 22.7%, which is well within the recommended limit. However, if their total monthly debt payments amount to $3,200, the TDS would be (3,200 / 7,500) x 100, yielding a TDS of 42.7%, which exceeds the ideal threshold.

As of 2025, the average TDS ratio for Canadian families hovers around 38%, reflecting the financial pressures many face. Financial specialists recommend that families target a GDS below 32% and a TDS below 40% to improve their chances of loan approval and keep debt levels manageable. By carefully analyzing these ratios, families can make informed choices about their mortgage options, including the implications of a 150k mortgage payment, and avoid unnecessary financial strain.

It’s crucial to understand these ratios, as many lenders require homeowners to maintain at least an 80% home-to-value ratio, meaning you need to have reduced at least 20% of your initial amount or your property must have appreciated in value. Additionally, a maximum of a 43% DTI ratio is usually required for home loans, referring to the relationship between existing debt and income. An improved DTI can lead to more competitive loan rates.

If you find yourself with a high TDS ratio, consider strategies such as reducing current debts or increasing your initial deposit. These steps can significantly impact your ability to secure a loan, and remember, we’re here to support you every step of the way.

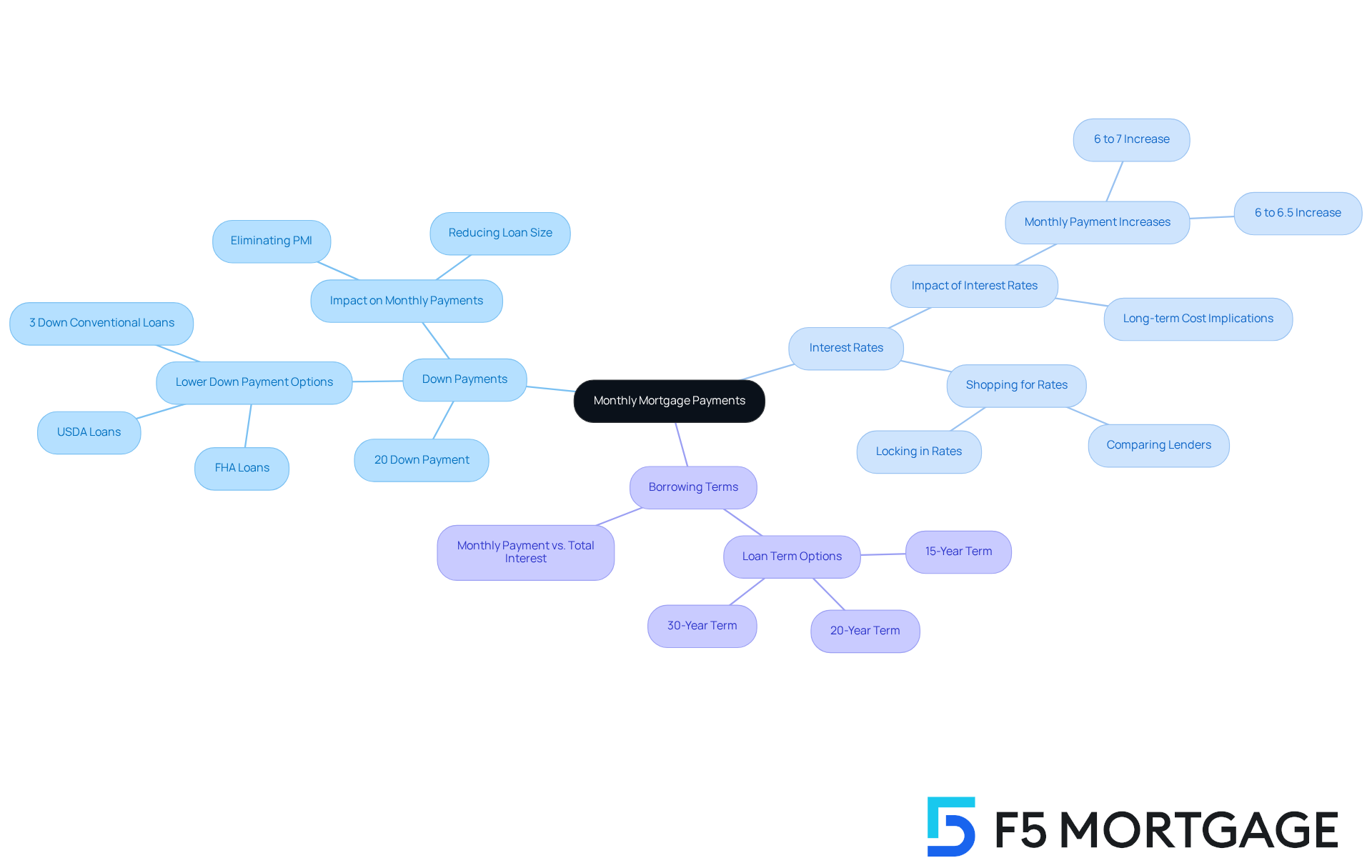

Calculate Monthly Payments: Down Payments and Interest Rates

Calculating your monthly mortgage payment can feel overwhelming, but we’re here to guide you through it. Several key factors play a role in determining what you’ll pay each month.

- Down Payment: A larger down payment can significantly reduce your principal loan amount, which in turn lowers your monthly payments. Aiming for at least 20% not only helps you save on monthly costs but also allows you to avoid private mortgage insurance (PMI). However, we understand that first-time buyers often opt for lower initial contributions, such as FHA financing, to keep cash reserves for other expenses. If you purchased your home with a conventional loan and put down less than 20%, refinancing might be an option to eliminate PMI, especially considering the rising home values in California.

- Interest Rates: The interest rate you secure is crucial to your monthly charge. For instance, at a 6% interest rate, the mortgage payment for a $150,000 mortgage would cost approximately $2,398 per month. If the rate rises to 7%, that payment increases to around $2,661—a difference of $263 each month. Even a slight increase from 6% to 6.5% raises your payment from about $2,398 to around $2,529. It’s wise to shop around for competitive rates, and locking in a favorable rate can lead to significant savings over time. Remember, a 1% increase in interest rates can raise your monthly costs by about $263, adding up to over $31,500 more over a 30-year mortgage.

- Borrowing Term: Typical borrowing terms include 15, 20, or 30 years. While shorter terms often mean higher monthly payments, they can save you money on overall interest in the long run. Conversely, longer terms can help keep your monthly costs lower, freeing up funds for home improvements or savings. Understanding these options empowers families to choose a that aligns with their financial goals.

Formula for Monthly Payment: To calculate your monthly payment, you can use the following formula:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

Where:

- M = total monthly mortgage payment

- P = principal loan amount

- r = monthly interest rate (annual rate / 12)

- n = number of payments (loan term in months)

For example, if you take out a $150,000 mortgage at a 4% interest rate over 30 years, your monthly payment would be approximately $716.12. By grasping these calculations, you can better prepare for your commitments related to the $150,000 mortgage payment and make informed financial choices. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

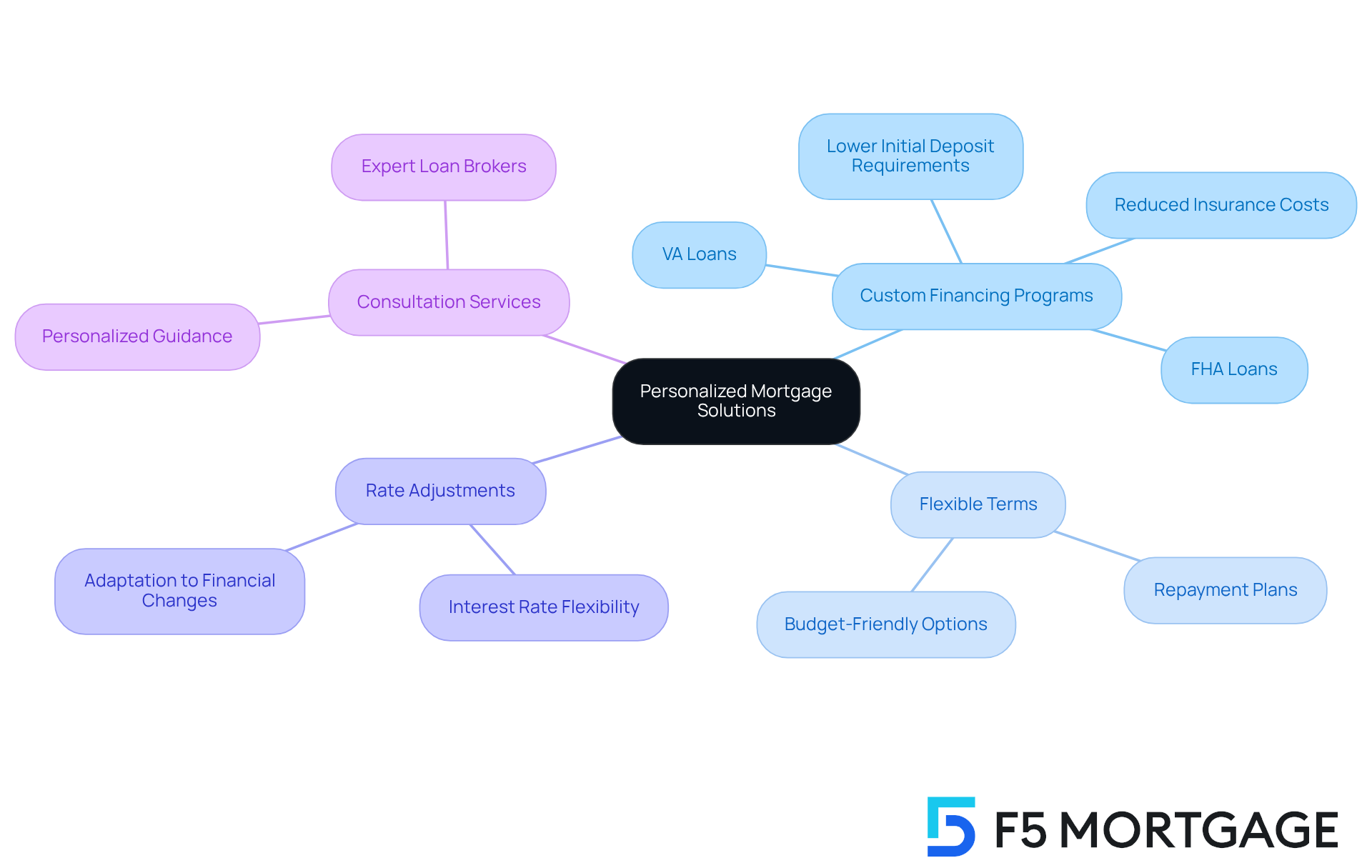

Understand the Impact of Personalized Mortgage Solutions

Personalized mortgage solutions provide families with tailored options that resonate with their unique financial situations, ultimately enhancing their homebuying journey.

- Custom Financing Programs: We understand that every family has different needs. Families can explore a variety of financing options designed just for them. For example, FHA loans are particularly beneficial for first-time buyers, while VA loans offer favorable terms for veterans. These programs often feature lower initial deposit requirements and reduced insurance costs, making homeownership more attainable for many.

- Flexible Terms: It’s essential to find lenders who offer flexible repayment terms. This flexibility allows families to select a plan that fits their budget and lifestyle, ensuring that loan payments remain manageable over time.

- Rate Adjustments: Some lenders provide options to adjust interest rates based on changing financial circumstances. This feature can be incredibly beneficial, enabling families to adapt their loan to their evolving financial situation, potentially saving them money in the long run.

- Consultation Services: Working with loan brokers who offer can greatly assist families. These professionals guide clients through the many options available, helping them identify the best fit for their financial situation and goals.

By understanding the impact of these personalized solutions, families can make informed decisions that enhance their mortgage experience and contribute to their financial stability. We know how challenging this can be, but we’re here to support you every step of the way.

Conclusion

Mastering a $150,000 mortgage payment is a journey that requires a clear understanding of the financial landscape, especially for high-income earners. We know how challenging this can be, but by familiarizing yourself with various mortgage types, credit requirements, and essential financial ratios, you can navigate your options more effectively. Maintaining a healthy credit score, understanding debt-to-income ratios, and calculating monthly payments are vital. These elements are crucial in ensuring that families not only qualify for loans but also secure favorable terms that align with their financial goals.

In this guide, we highlighted key concepts such as GDS and TDS ratios as vital metrics for assessing financial health and loan eligibility. Additionally, we explored the impact of down payments and interest rates on monthly payments, emphasizing how even minor adjustments can lead to significant differences in overall costs. Personalized mortgage solutions emerged as a valuable resource, offering families tailored options that cater to their unique financial situations, enhancing their homebuying experience.

Understanding the intricacies of mortgage payments is essential for families aiming to achieve homeownership without compromising their financial stability. By leveraging the insights shared in this article, you can take proactive steps toward mastering your mortgage payments. Consider consulting with financial professionals to further tailor your mortgage strategy to your specific needs. Embrace the knowledge gained here, and remember, we’re here to support you every step of the way.

Frequently Asked Questions

What types of mortgages should high-income earners consider?

High-income earners should familiarize themselves with various mortgage types, including fixed-rate, adjustable-rate, and interest-only mortgages. Each type has distinct advantages and disadvantages based on financial strategies and long-term goals.

What is an adjustable-rate mortgage (ARM)?

An adjustable-rate mortgage (ARM) offers lower introductory rates, making it suitable for those planning to pay off their mortgage quickly or refinance in a few years. However, borrowers should be aware of potential rate adjustments and the importance of interest adjustment caps to protect against significant increases.

How does income affect the maximum credit amount for a mortgage?

Your income is crucial in determining the maximum credit amount you can qualify for, especially for jumbo financing, which is designed for properties exceeding conforming credit limits. In 2025, jumbo mortgages generally serve properties valued over $806,500 and require borrowers to meet strict financial standards.

What are the current jumbo loan rates?

As of now, jumbo loan rates average 6.90% for 30-year fixed terms and 7.02% for 15-year fixed terms.

Why is maintaining a good credit score important for high-income earners?

Maintaining an outstanding credit score is essential for obtaining advantageous loan rates. A score of 700 or higher is often necessary to secure the best terms on loans.

How can high-income earners improve their credit scores?

High-income earners should regularly review their credit reports for inaccuracies and take proactive steps to enhance their scores to secure better loan terms.

What is the ideal debt-to-income (DTI) ratio for securing a mortgage?

An ideal debt-to-income (DTI) ratio is below 36%, which can enhance the chances of loan approval and access to better rates.

How can understanding mortgage basics help high-income earners?

By mastering mortgage fundamentals, high-income earners can effectively navigate the home loan landscape and align their choices with their financial aspirations, ensuring a smoother home financing experience.