Overview

Managing a $150,000 mortgage payment over 30 years can feel overwhelming, but we’re here to support you every step of the way. This article will guide you through understanding the components of your mortgage, calculating payments, and exploring effective repayment strategies. We know how challenging this can be, especially when considering elements like principal, interest rates, taxes, and insurance.

By grasping these key components, you can make informed financial decisions that suit your family’s needs. We’ll also discuss helpful methods such as making extra payments or refinancing, which can significantly reduce your overall costs. These strategies are designed to empower you, enabling you to take control of your financial future.

As you navigate this journey, remember that you are not alone. With the right knowledge and support, you can successfully manage your mortgage and achieve peace of mind. Let’s explore these options together, so you can feel confident in your choices.

Introduction

Navigating the complexities of a $150,000 mortgage payment over 30 years can feel overwhelming, especially as families contend with rising costs and fluctuating interest rates. We understand how challenging this can be. By breaking down the essential components of mortgage payments—such as principal, interest, taxes, and insurance—you can gain clarity and confidence in managing your finances.

However, with so many variables at play, including interest rate changes and the potential impact of extra payments, how can you effectively navigate this complex landscape? We’re here to support you every step of the way, helping you achieve financial stability and potentially save thousands.

Understand the Basics of Mortgage Payments

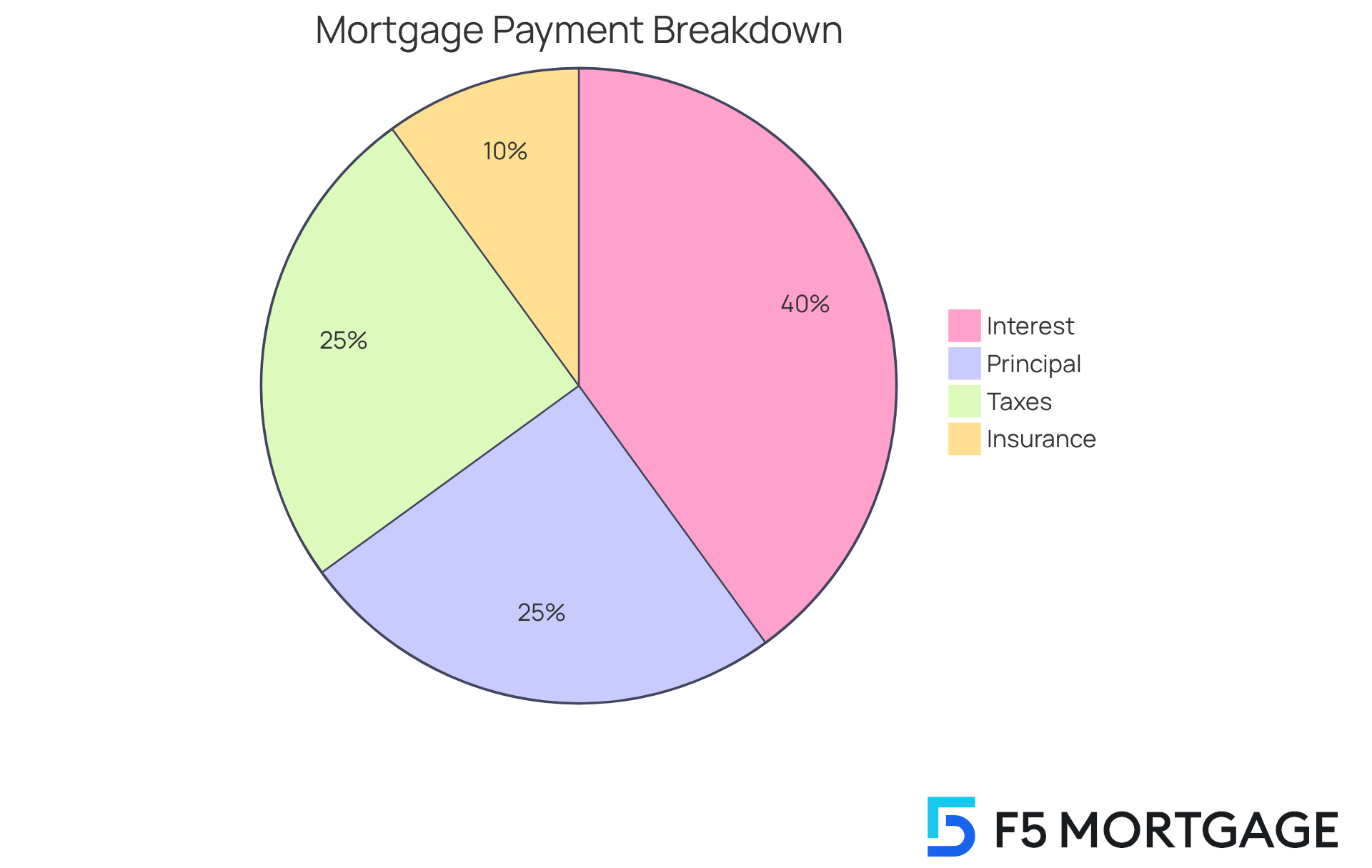

To master your $150,000 mortgage payment over 30 years, it’s essential to understand the key components that constitute your monthly payment. We know how challenging this can be, but breaking it down can help ease your worries.

-

Principal: This is the original loan amount you borrowed. For a $150,000 mortgage payment over 30 years, this serves as your starting point. Knowing this helps you understand the foundation of your mortgage.

-

Interest: This represents the cost of borrowing the principal, expressed as a percentage. As of 2025, the average interest percentage for a 30-year fixed mortgage is approximately 6.58%. This rate can significantly influence your regular installment and the overall sum paid throughout the duration of the loan. Understanding how interest works can empower you to make better financial choices.

-

Taxes: Property taxes are generally incorporated in your monthly fee and can differ significantly depending on your location. For instance, property owners in regions such as Washington, D.C., have experienced their housing costs rise considerably, with average expenses growing from $1,600 in 2014 to $3,700 in 2024, indicating a 132% rise. This highlights the financial pressures faced by homeowners and underscores the importance of understanding these costs.

-

Insurance: Homeowners insurance protects your property and is generally required by lenders. If your initial contribution is below 20%, you might also have to cover the cost of private insurance for loans. Being aware of these requirements can help you prepare better.

Grasping these elements is essential for determining your overall charge each month. For instance, with a 6.58% interest rate, the regular cost for a $150,000 mortgage payment over 30 years might be approximately $1,000, which includes principal, interest, taxes, and insurance. Moreover, it’s essential to investigate local property taxes and insurance expenses when calculating your monthly costs, as these can differ greatly by area. This knowledge enables you to make informed choices about your loan options and manage your finances effectively. As financial consultant Sarah DeFlorio observes, ‘Comprehending the components of your loan cost is crucial for efficient financial planning.’ Remember, we’re here to support you every step of the way.

Apply the Mortgage Payment Formula

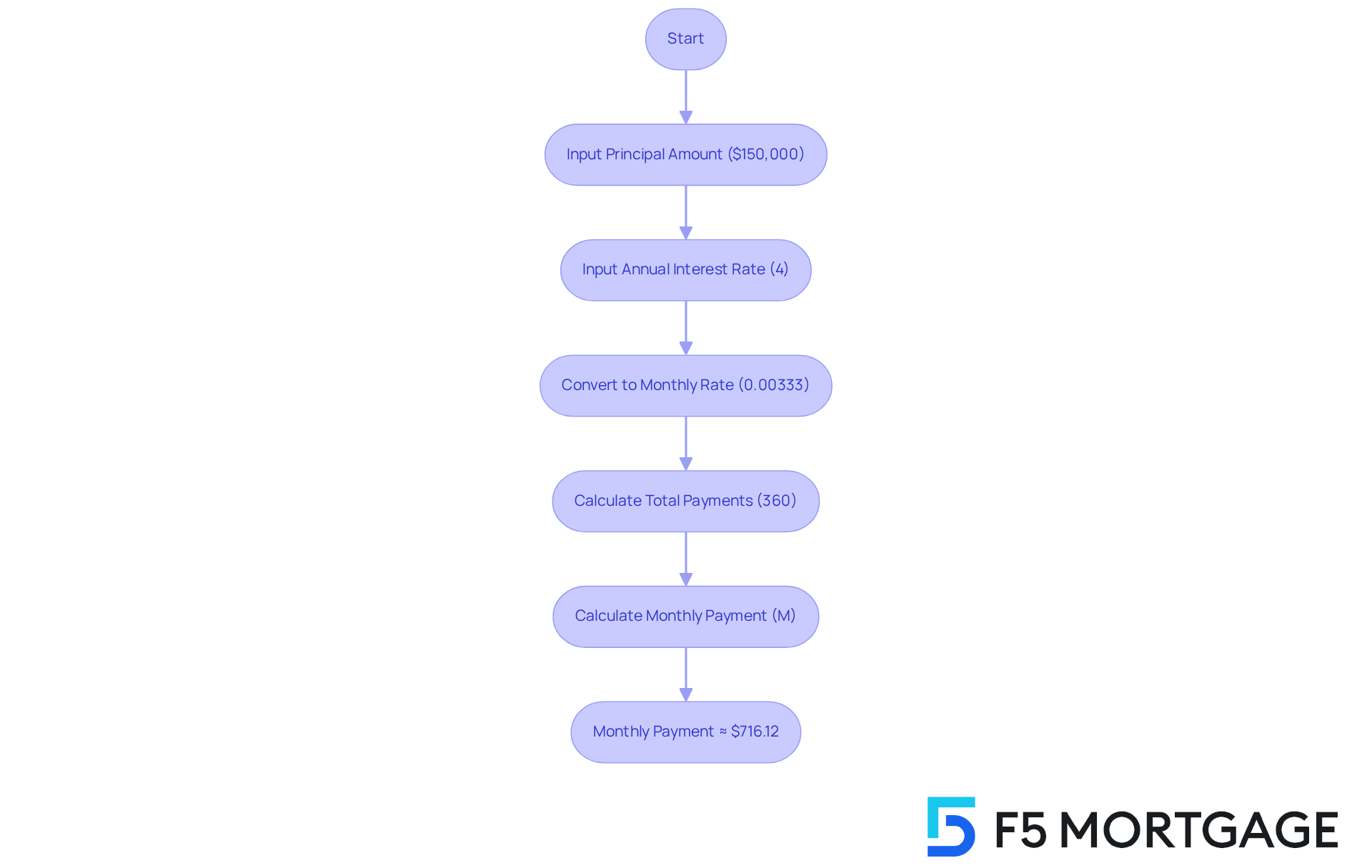

To determine your monthly mortgage payment, you can utilize the following formula:

M = P × (r(1 + r)^n) / ((1 + r)^n – 1)

Where:

- M = total monthly mortgage payment

- P = principal loan amount ($150,000)

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in months, e.g., 30 years = 360 months)

Example Calculation:

- Assume an interest percentage of 4% (0.04 annual value).

- Transform the yearly rate to a per month rate: 0.04 / 12 = 0.00333.

- Calculate the total amount of installments: 30 years × 12 months = 360.

- Substitute these values into the formula:

- M = 150,000 × (0.00333(1 + 0.00333)^360) / ((1 + 0.00333)^360 – 1)

- M ≈ $716.12.

Therefore, your recurring charge would be around $716.12, not including taxes and insurance.

Impact of Interest Rate Changes:

In 2025, fluctuations in interest rates can significantly affect your mortgage payments. For example, a $150,000 mortgage payment over 30 years at a 6% interest rate yields a monthly payment of around $899.33, whereas at 9%, it increases to roughly $1,207.85. Understanding these variations is crucial for budgeting and financial planning. We know how challenging it can be to navigate these changes, and being informed helps you make the best decisions for your family.

Understanding Debt-to-Income Ratio and Refinancing Options:

A maximum of a 43% DTI ratio is usually required for home loans, whether acquiring a traditional mortgage or refinancing an existing one. An improved DTI can result in more competitive loan prices, which is something we’re here to support you with. If you’re considering refinancing, F5 Mortgage offers various options tailored to your needs, including conventional loans, FHA loans, and VA loans, each with unique benefits and eligibility requirements. For example, FHA loans are accessible to homeowners with lower credit scores and have less stringent DTI requirements. Furthermore, F5 Mortgage offers adaptable loan prices and outstanding client support, guaranteeing a seamless refinancing experience.

Financial Expert Insights:

Experts emphasize the importance of calculating mortgage payments accurately, as this helps potential homeowners assess affordability and make informed decisions. Using loan calculators can further assist in identifying the best rates and comprehending the total expense of financing. Remember, we’re here to support you every step of the way.

Incorporate Extra Payments to Reduce Loan Duration

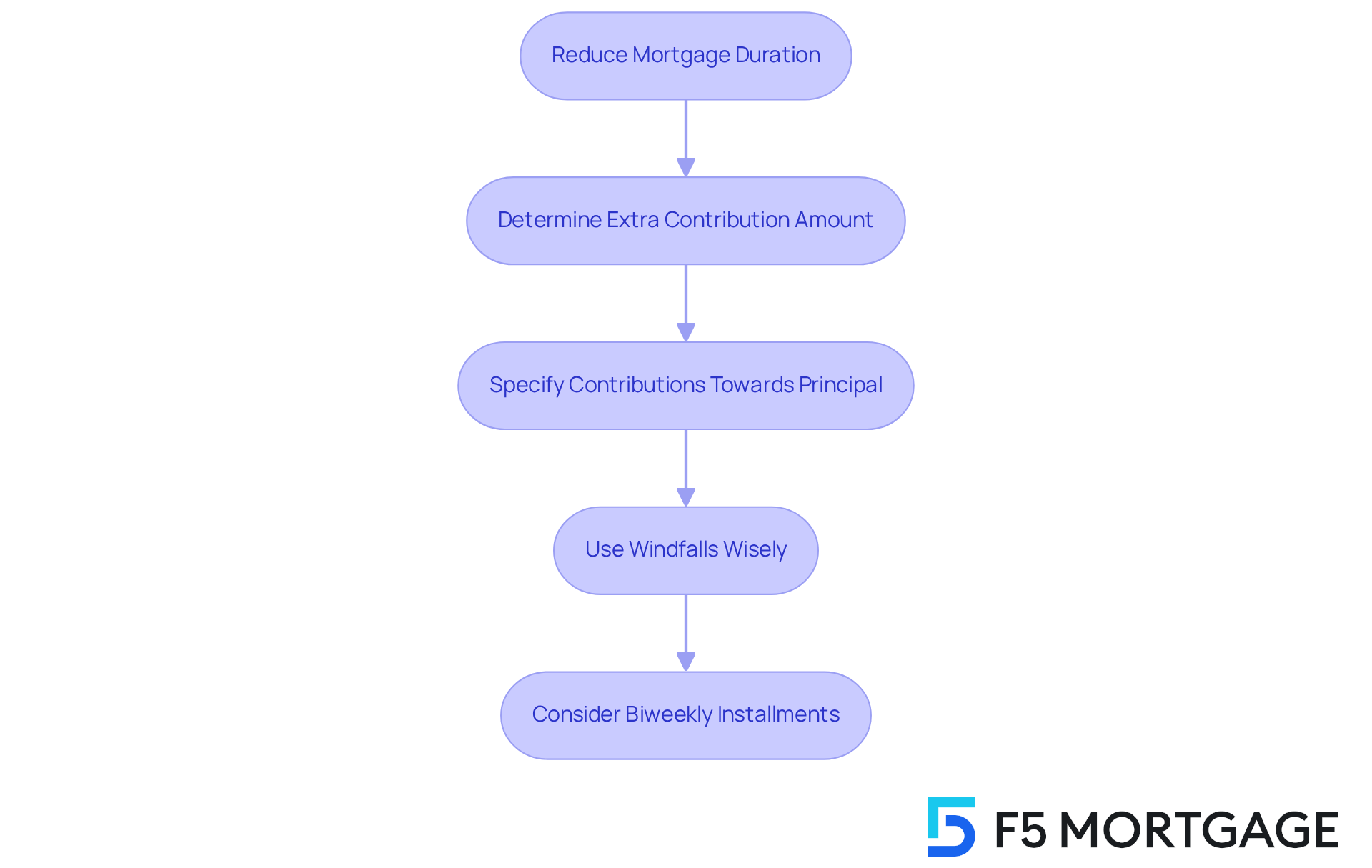

To efficiently shorten your mortgage term and save on interest, consider making additional contributions. We know how challenging this can be, but here’s a structured approach to help you navigate this path:

- Determine Your Extra Contribution Amount: Assess how much additional contribution you can comfortably make each month. Even an extra $100 can lead to substantial savings over time.

- Specify Additional Contributions Towards Principal: Ensure that any extra contributions are applied directly to the principal balance. This strategy decreases the total interest paid throughout the loan’s life.

- Use Windfalls Wisely: Allocate bonuses, tax refunds, or unexpected income towards your mortgage. Such contributions can significantly lower your principal and interest obligations.

- Consider Biweekly Installments: Choose biweekly installments instead of those made each month. This method results in one additional payment each year, effectively shortening your loan term.

Example Impact:

Imagine contributing an extra $100 monthly on a $150,000 mortgage at a 4% interest rate. You could pay off your mortgage approximately 5 years earlier, saving thousands in interest. Given the present economic situation, with loan rates hitting peaks of 7.79% in 2023, this method not only speeds up your journey to homeownership but also improves your financial stability over time. As financial planner Jane Doe mentions, ‘Making additional contributions is one of the most effective strategies to tackle increasing interest costs and attain financial independence sooner.’ We’re here to support you every step of the way.

Explore Factors Influencing Your Mortgage Payment

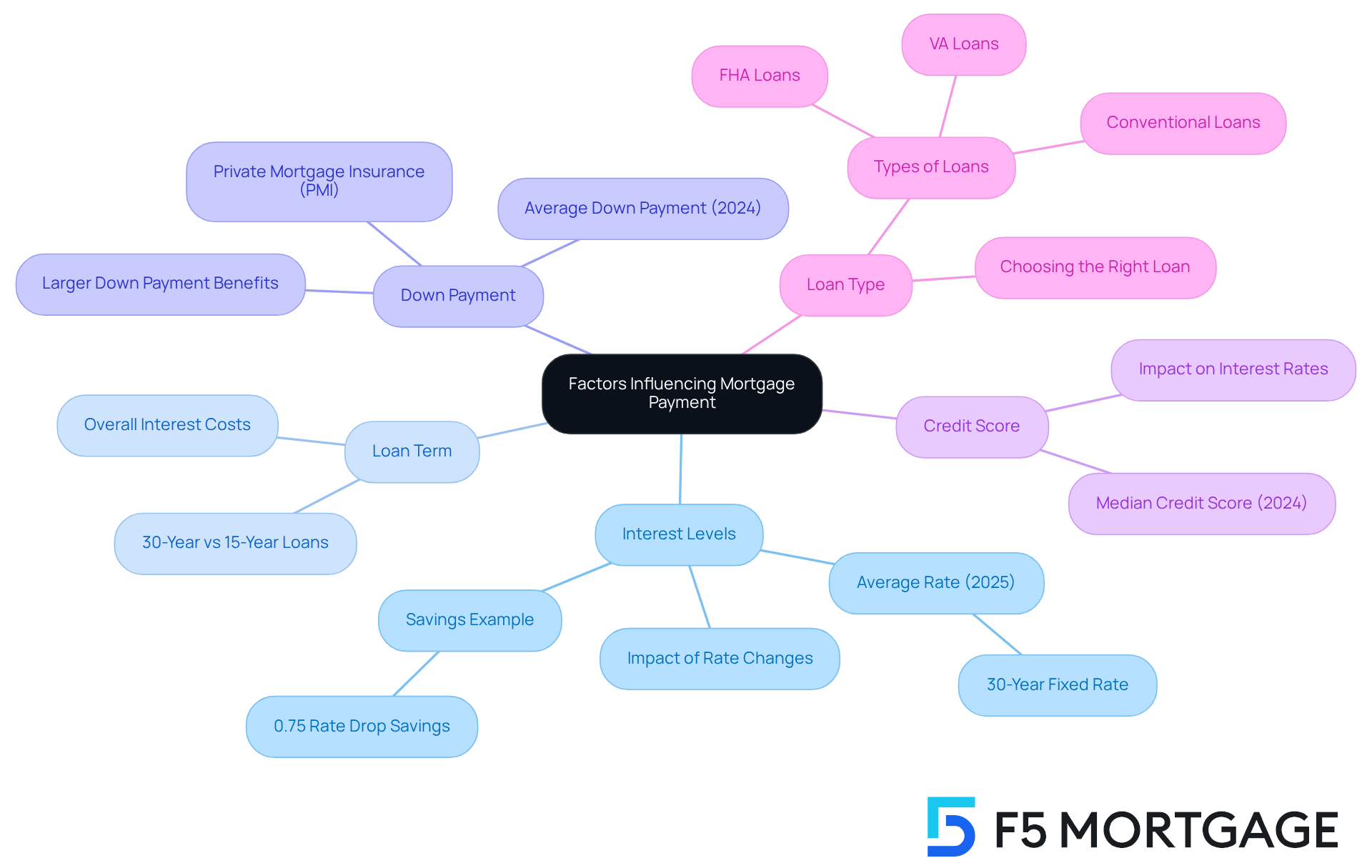

Several key factors influence your mortgage payment:

-

Interest Levels: We know how challenging it can be to navigate mortgage costs. Variations in interest levels can significantly affect your monthly payment. For instance, a decline of 0.75% in loan costs can help borrowers save around $750 in interest each year for every $100,000 borrowed. As of early 2025, the average cost for a 30-year fixed loan is approximately 6.8%. Understanding how these rates impact your expenses is essential, especially with a $150,000 mortgage payment over 30 years, since 80% of current loans have rates under 5%.

-

Loan Term: The length of your loan can greatly influence your recurring charge. A $150,000 mortgage payment for 30 years generally leads to reduced installment amounts compared to a 15-year loan, but it also results in greater overall interest expenses throughout the financing term. At F5 Mortgage, we offer customizable loan options to help you find the best fit for your financial goals.

-

Down Payment: Contributing a larger initial sum can be a smart strategy. It decreases the principal amount of your mortgage, which can lower your recurring costs and eliminate private mortgage insurance (PMI), further reducing your expenses. Our personalized support at F5 Mortgage can guide you through this process, ensuring you make informed decisions.

-

Credit Score: Your credit score plays a crucial role in determining the interest percentage you qualify for. Higher credit scores typically result in better rates, which can significantly reduce your monthly costs. As of 2024, the median credit score among new loan borrowers is 781, indicating a strong credit environment.

-

Loan Type: Different loan categories, including FHA, VA, and conventional loans, have varying requirements and repayment structures. Understanding these differences can help you choose the best option for your financial situation. At F5 Mortgage, we’re here to empower you with the knowledge needed to navigate these choices effectively.

By grasping these factors, you can navigate your mortgage options more effectively and make informed decisions to strategically manage your $150,000 mortgage payment over 30 years. As millennials and Gen Z increasingly enter the housing market, understanding these dynamics becomes even more crucial for families looking to upgrade their homes. For a quick pre-qualification process and to learn more about how F5 Mortgage can assist you, reach out to our team today—we’re here to support you every step of the way.

Conclusion

Mastering a $150,000 mortgage payment over 30 years can feel overwhelming, but understanding the various components that shape your monthly expenses can make a significant difference. By breaking down elements such as principal, interest, taxes, and insurance, you can gain clarity on your financial obligations. This foundational knowledge empowers you to navigate the complexities of mortgage payments effectively.

We know how challenging this can be, which is why it’s essential to accurately calculate your monthly payments using established formulas. Consider the impact of fluctuating interest rates on your overall costs and explore strategies for reducing loan duration through extra payments. Additionally, understanding factors like loan terms, down payments, and credit scores can significantly influence your mortgage affordability and long-term financial health.

Ultimately, being well-informed about mortgage payment dynamics is crucial for your financial stability and planning. We’re here to support you every step of the way. We encourage you to explore your options, utilize available resources, and consider strategies such as refinancing or making additional contributions to your principal. By taking these proactive steps, you can enhance your financial well-being and confidently work towards achieving your homeownership goals.

Frequently Asked Questions

What are the key components of a mortgage payment?

The key components of a mortgage payment include principal, interest, taxes, and insurance.

What is the principal in a mortgage?

The principal is the original loan amount you borrowed. For a $150,000 mortgage over 30 years, this serves as the starting point for your payment calculations.

How does interest affect mortgage payments?

Interest represents the cost of borrowing the principal, expressed as a percentage. As of 2025, the average interest rate for a 30-year fixed mortgage is approximately 6.58%, which can significantly influence your monthly installment and the total amount paid over the loan’s duration.

How do property taxes impact my mortgage payment?

Property taxes are typically included in your monthly mortgage payment and can vary widely based on location. For example, property owners in Washington, D.C., have seen average housing costs rise from $1,600 in 2014 to $3,700 in 2024.

What is homeowners insurance and why is it important?

Homeowners insurance protects your property and is usually required by lenders. If your down payment is less than 20%, you may also need to pay for private mortgage insurance. Understanding these insurance requirements helps you prepare financially.

How much might a $150,000 mortgage payment be per month?

With a 6.58% interest rate, the estimated monthly cost for a $150,000 mortgage payment over 30 years is approximately $1,000, which includes principal, interest, taxes, and insurance.

Why is it important to understand the components of a mortgage payment?

Understanding the components of your mortgage payment is crucial for effective financial planning, as it helps you make informed choices about loan options and manage your finances better.