Overview

Navigating the mortgage pre-approval process can feel daunting for many prospective homebuyers. We understand how challenging this can be, and that’s why this step is so essential. It involves a thorough evaluation of your financial status, helping you determine your borrowing capacity and enhancing your negotiating power.

By seeking pre-approval, you not only clarify your budgeting but also accelerate the closing process. This can provide you with a competitive edge in the housing market, making it a vital step in your home purchasing journey. Remember, we’re here to support you every step of the way, empowering you to make informed decisions for your family’s future.

Introduction

Navigating the path to homeownership often begins with a critical yet sometimes overlooked step: the mortgage pre-approval process. We know how challenging this can be, and this essential procedure not only clarifies how much a lender is willing to offer but also equips potential buyers with the confidence needed to make competitive offers in a bustling real estate market. Yet, many are left wondering—what exactly sets pre-approval apart from pre-qualification? Understanding these nuances can be the key to unlocking a smoother, more successful home-buying journey.

We’re here to support you every step of the way.

Understand Mortgage Pre-Approval

The mortgage pre approval process is a crucial step in your journey towards homeownership. It’s a process where a financial institution evaluates your economic status to determine how much they are willing to lend you for purchasing a home. This involves a thorough look at your credit history, income, debts, and assets, along with your Debt-to-Income (DTI) ratio. Ideally, your DTI should be below 43% for mortgages, as a better DTI can lead to more competitive mortgage rates. Understanding this can empower you in your financial evaluation.

Unlike pre-qualification, which gives you a rough estimate, the mortgage pre approval process provides a . This not only gives you a clearer picture of your budget but also strengthens your position when making an offer on a home. We know how challenging this can be, and having that clarity can make a significant difference.

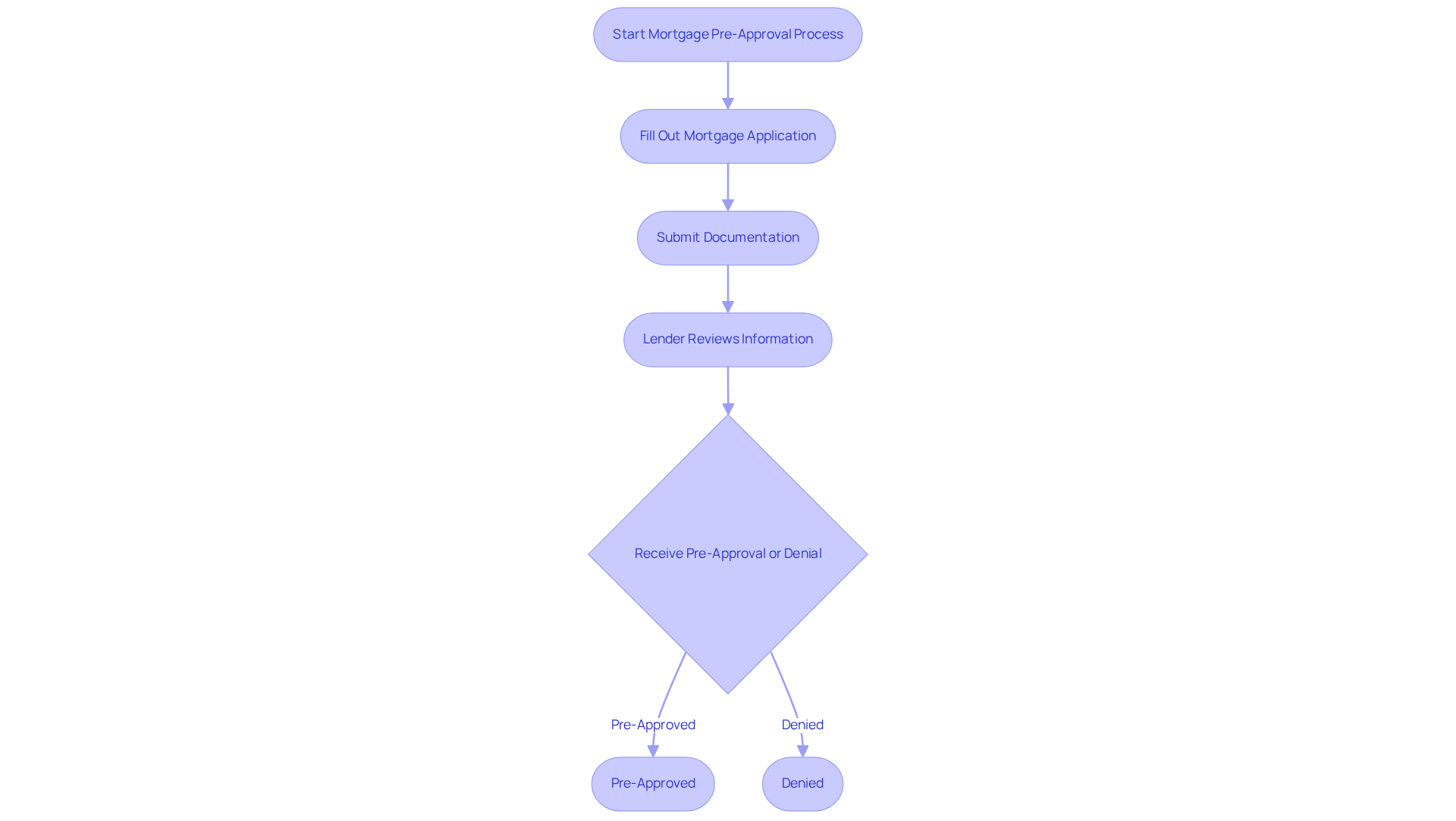

To begin the mortgage pre approval process, you’ll typically fill out a mortgage application and submit the necessary documentation. The lender will review this information to assess your eligibility for financing. If you’re also considering refinancing options, F5 Mortgage is here to help. We offer a variety of loans tailored for Colorado residents, including:

- Conventional loans

- FHA loans

- VA loans

Each of these options comes with specific DTI requirements and benefits that can assist you in securing a favorable mortgage rate. Remember, we’re here to support you every step of the way.

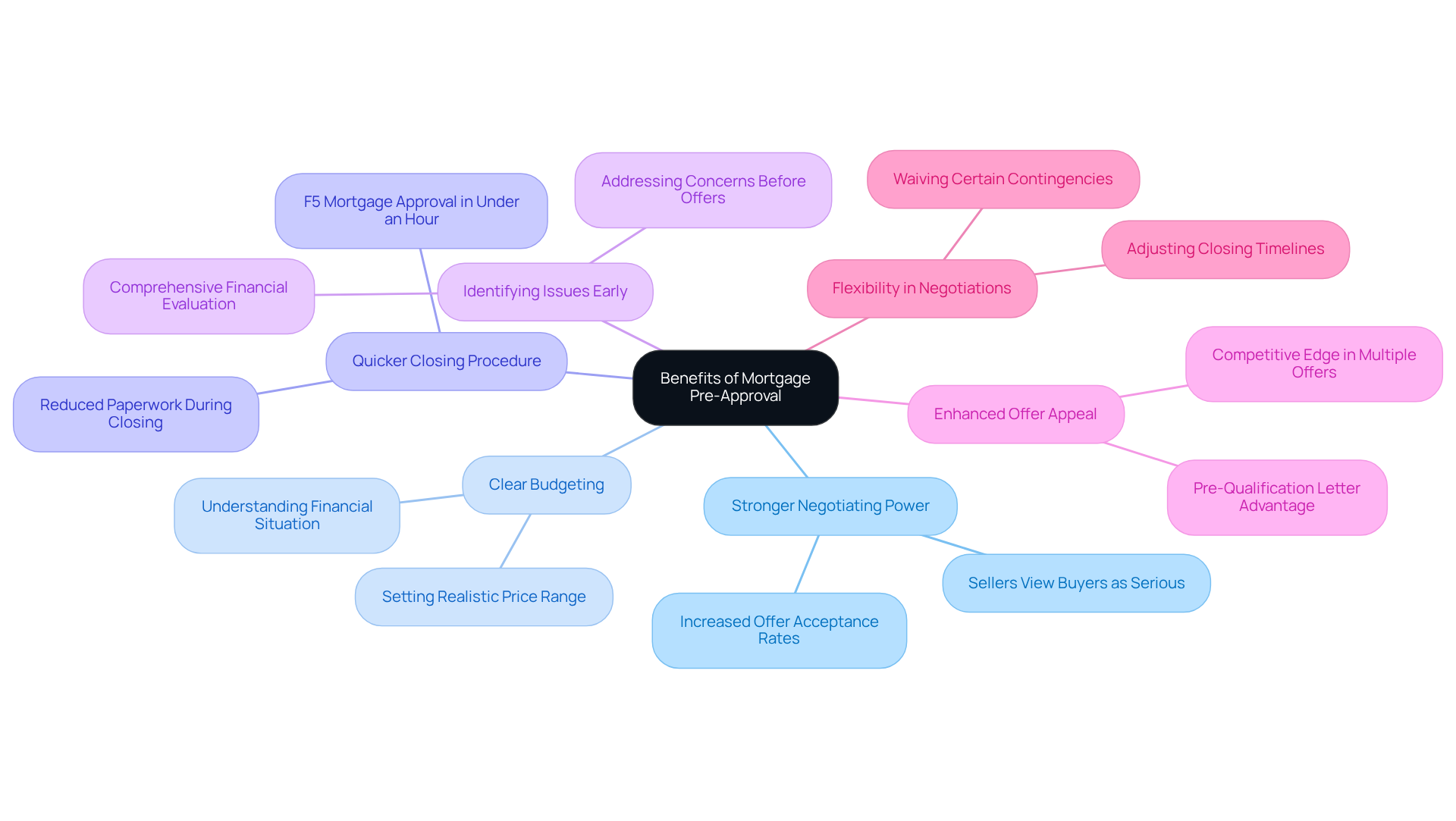

Recognize the Benefits of Pre-Approval

Obtaining a mortgage pre approval process offers several significant advantages, especially when working with F5 Mortgage, which is dedicated to revolutionizing the mortgage experience through transparency and technology.

- Stronger Negotiating Power: We understand how important it is for you to feel secure in your homebuying journey. Sellers are more inclined to consider offers from buyers who have completed the mortgage pre approval process, viewing them as serious and financially stable. This perception can lead to more favorable negotiations, allowing you to negotiate terms and contingencies with greater confidence.

- Clear Budgeting: We know how challenging it can be to navigate your financial landscape. Pre-approval provides a comprehensive understanding of your financial situation, helping you establish a realistic price range. This clarity enables you to focus on homes that suit your budget, simplifying your search.

- Quicker Closing Procedure: In today’s fast-paced market, timing is everything. With much of the required paperwork finalized during initial approval, the closing phase can be greatly accelerated once you locate a home. F5 Mortgage guarantees approval within an hour, highlighting our commitment to that prioritizes your needs.

- Identifying Issues Early: We’re here to support you every step of the way. The initial approval phase includes a comprehensive evaluation of your financial details, which can reveal potential issues early on. Addressing these concerns before making an offer minimizes the risk of complications later in the transaction, ensuring a smoother homebuying experience.

- Enhanced Offer Appeal: A pre-qualification letter signals to sellers that you are a serious buyer, making your offer more appealing compared to those from non-pre-qualified buyers. This advantage is especially crucial in competitive markets where multiple offers may be on the table.

- Flexibility in Negotiations: Being pre-approved empowers you to negotiate better terms, such as adjusting closing timelines or waiving certain contingencies, which can further strengthen your position in negotiations.

In summary, the mortgage pre approval process not only clarifies your budget but also boosts your negotiating power, making it a vital step in . With F5 Mortgage, you can expect a technology-driven, consumer-centric approach that ensures competitive rates and exceptional service, all without the hard sales tactics often employed by traditional lenders.

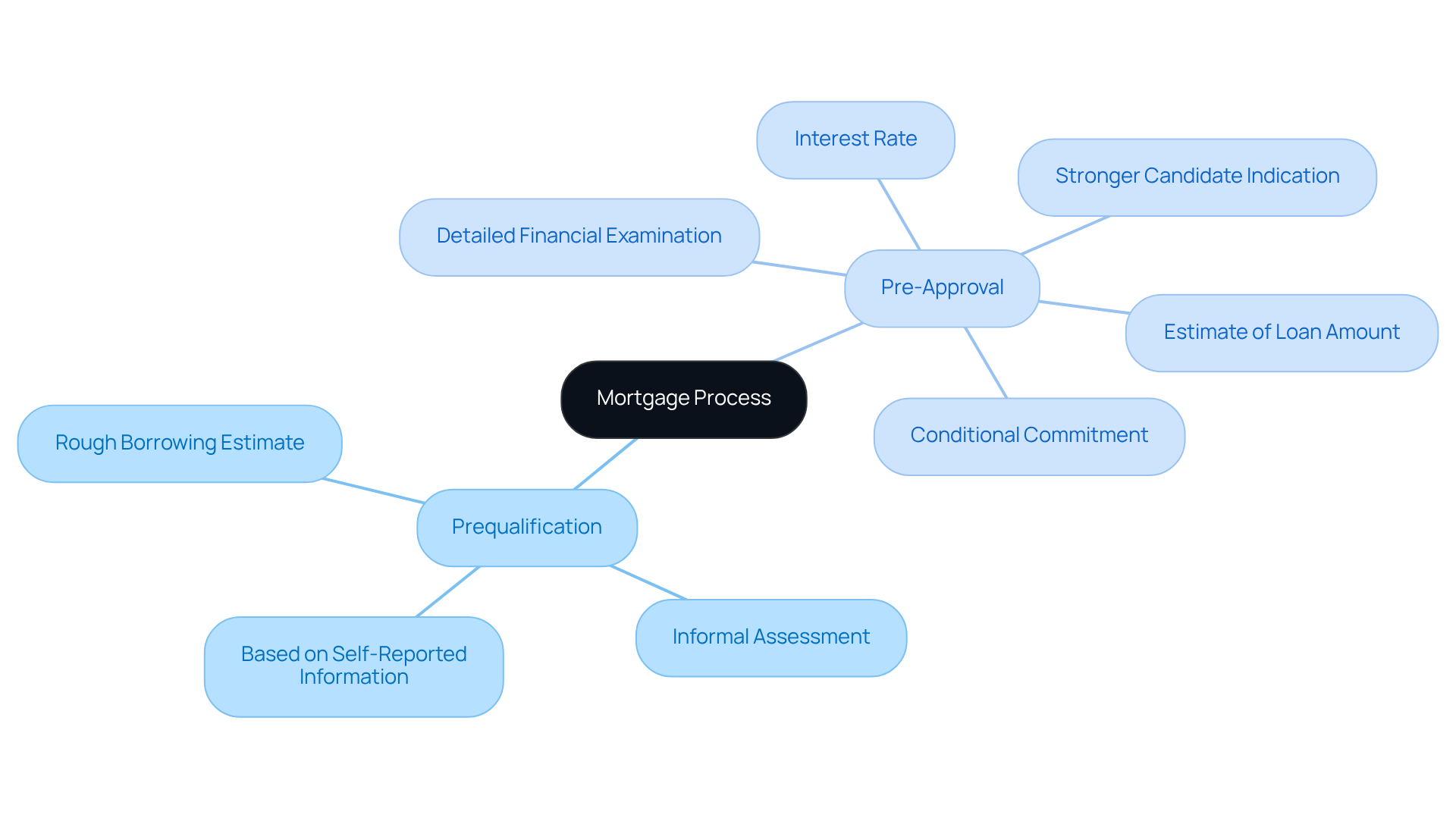

Differentiate Between Pre-Approval and Prequalification

Navigating the mortgage process can feel overwhelming, but understanding the [mortgage pre approval process](https://f5mortgage.com/understanding-loan-commitment-letters-key-components-and-importance) and the difference between pre-approval and prequalification is a crucial first step. Let’s break it down together:

- Prequalification: Think of this as a friendly chat about your financial situation. It’s an informal assessment, often based on the information you provide yourself. While it gives you a rough estimate of what you might borrow, it doesn’t dig deep into your financial documents.

- Mortgage pre approval process: This is when the situation becomes more serious. The mortgage pre approval process involves a detailed examination of your financial history and creditworthiness. It’s a financial institution’s way of indicating that, based on the information you’ve shared, you’re a strong candidate in the mortgage pre approval process. Typically, this process includes an estimate of your loan amount, interest rate, and potential monthly payment. Importantly, the mortgage pre approval process leads to a conditional commitment from the financial institution, which is vital in understanding your borrowing capacity.

We know how challenging this can be, but we’re here to support you every step of the way. Understanding these terms empowers you to make as you move forward in your journey to homeownership.

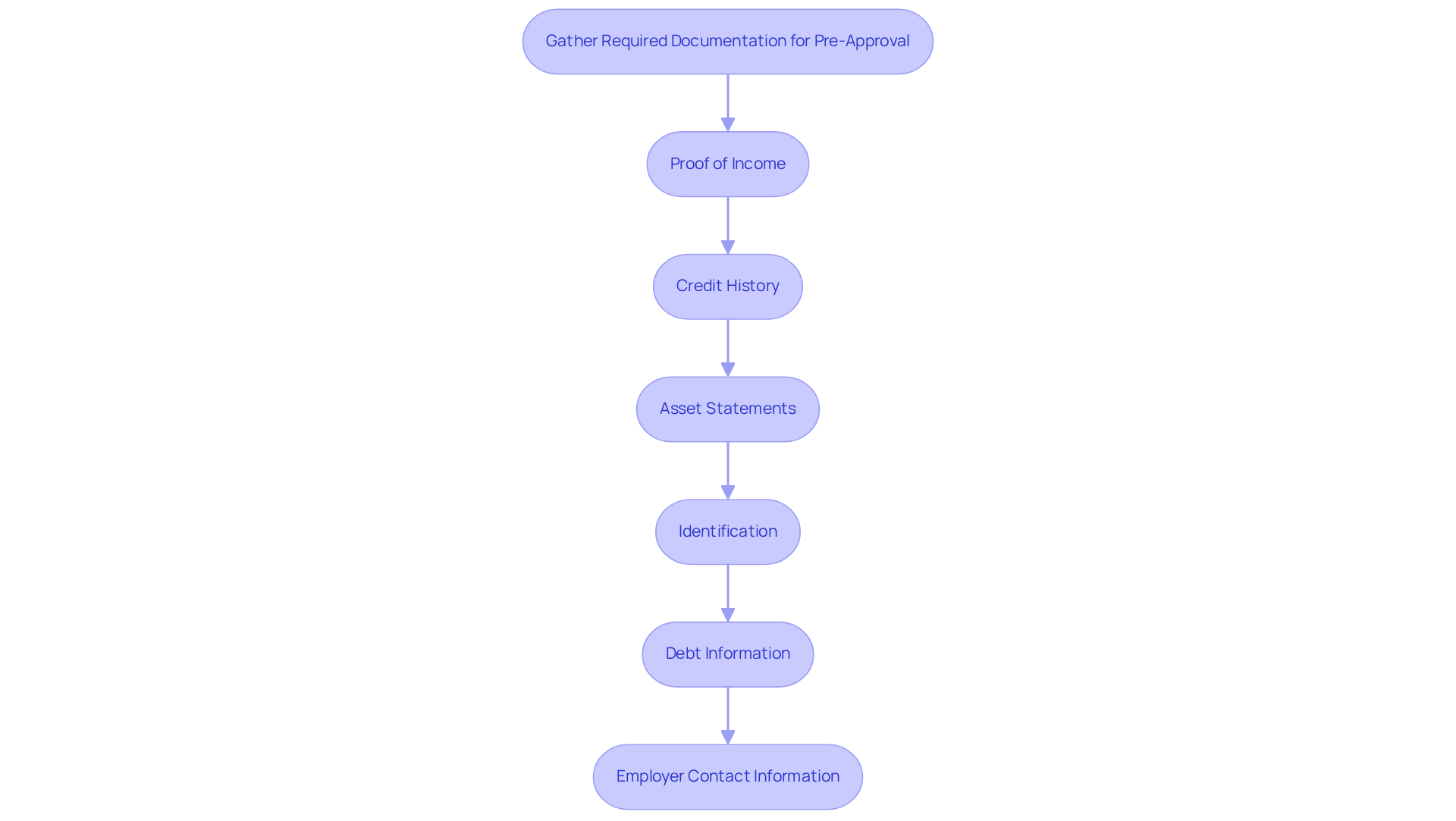

Gather Required Documentation for Pre-Approval

Securing a mortgage pre-approval can feel overwhelming, but gathering the right documents can make the process smoother and more manageable. Here’s a helpful checklist to guide you through:

- Proof of Income: Start by including recent pay stubs, W-2 forms, or tax returns if you’re self-employed. These documents are essential for financial institutions to assess your earning potential. If you’re self-employed, you may also need to provide profit and loss statements and tax returns from the last two years.

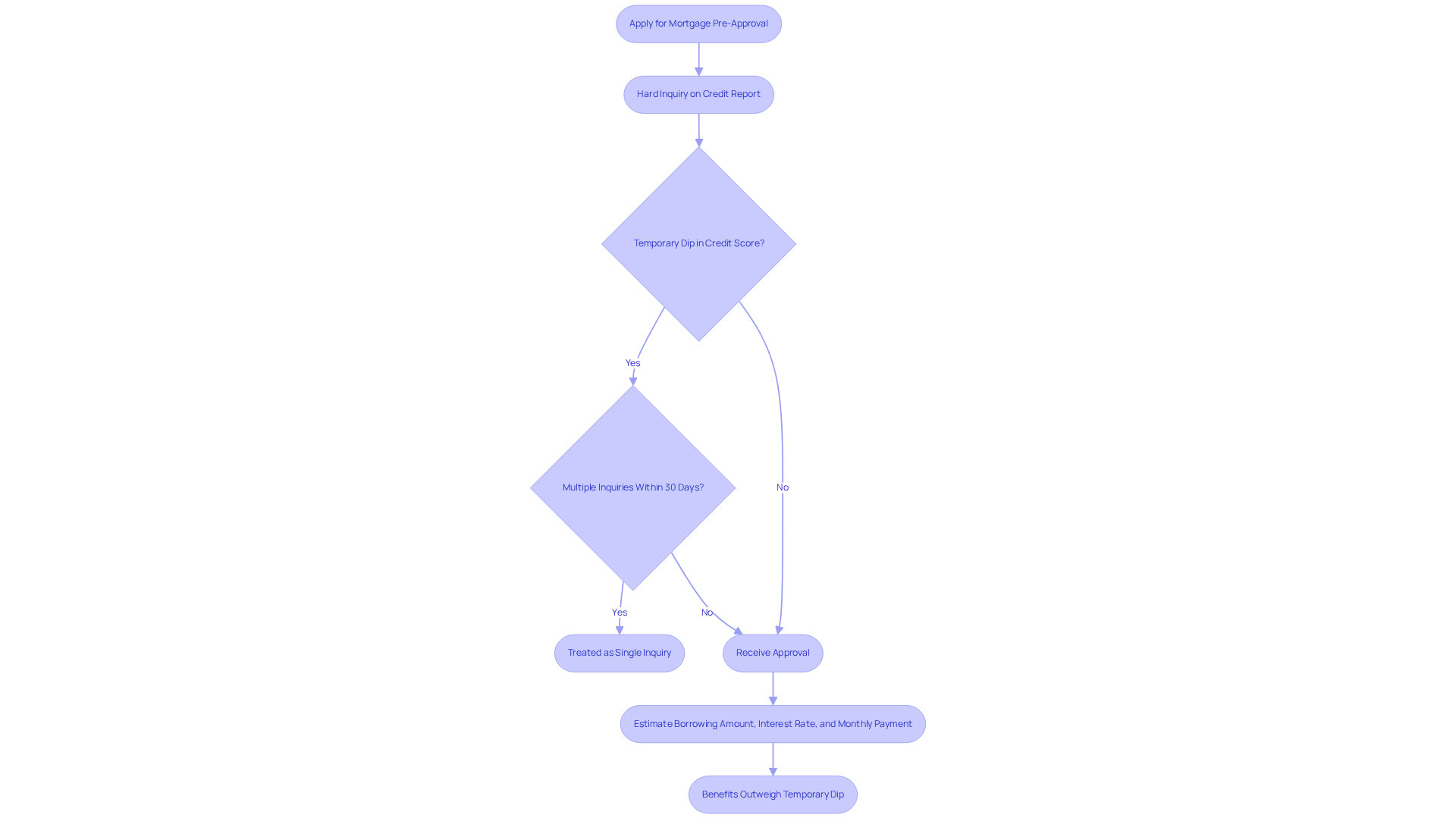

- Credit History: It’s important to authorize the financial institution to access your credit report, as this is crucial for evaluating your creditworthiness. Just a heads up, this process might cause a temporary dip in your credit score due to a hard inquiry.

- Asset Statements: Collect your bank statements and investment account statements. These will help verify your savings and assets, showcasing your financial health.

- Identification: A government-issued ID, like a driver’s license or passport, is necessary to confirm your identity.

- Debt Information: Be sure to detail any existing debts, including credit cards, student loans, and other financial obligations. Lenders will look at your debt-to-income ratio (DTI) to determine your borrowing capacity. Typically, a maximum DTI ratio of 43% is required for home loans, and a better DTI can lead to more competitive mortgage rates. Understanding your DTI is crucial, as it directly impacts your .

- Employer Contact Information: Lastly, provide your employer’s contact details and two years’ worth of mailing addresses to assist in verification.

Keeping these documents organized and easily accessible can significantly speed up the preliminary approval phase. Mortgage experts emphasize that thorough preparation not only accelerates the process but also enhances your credibility as a borrower. In fact, a well-prepared candidate can often obtain preliminary approval in less than an hour, allowing for quick responses in a competitive market. Remember, the initial approval process usually takes a few business days after all necessary information is submitted, and approval letters typically remain valid for 30 to 90 days.

If you’re considering refinancing, F5 Mortgage offers various options tailored to your needs, including conventional loans, FHA loans, and VA loans, each with different DTI requirements. We know how challenging this can be, and we’re here to support you every step of the way.

Establish a Timeline for Pre-Approval

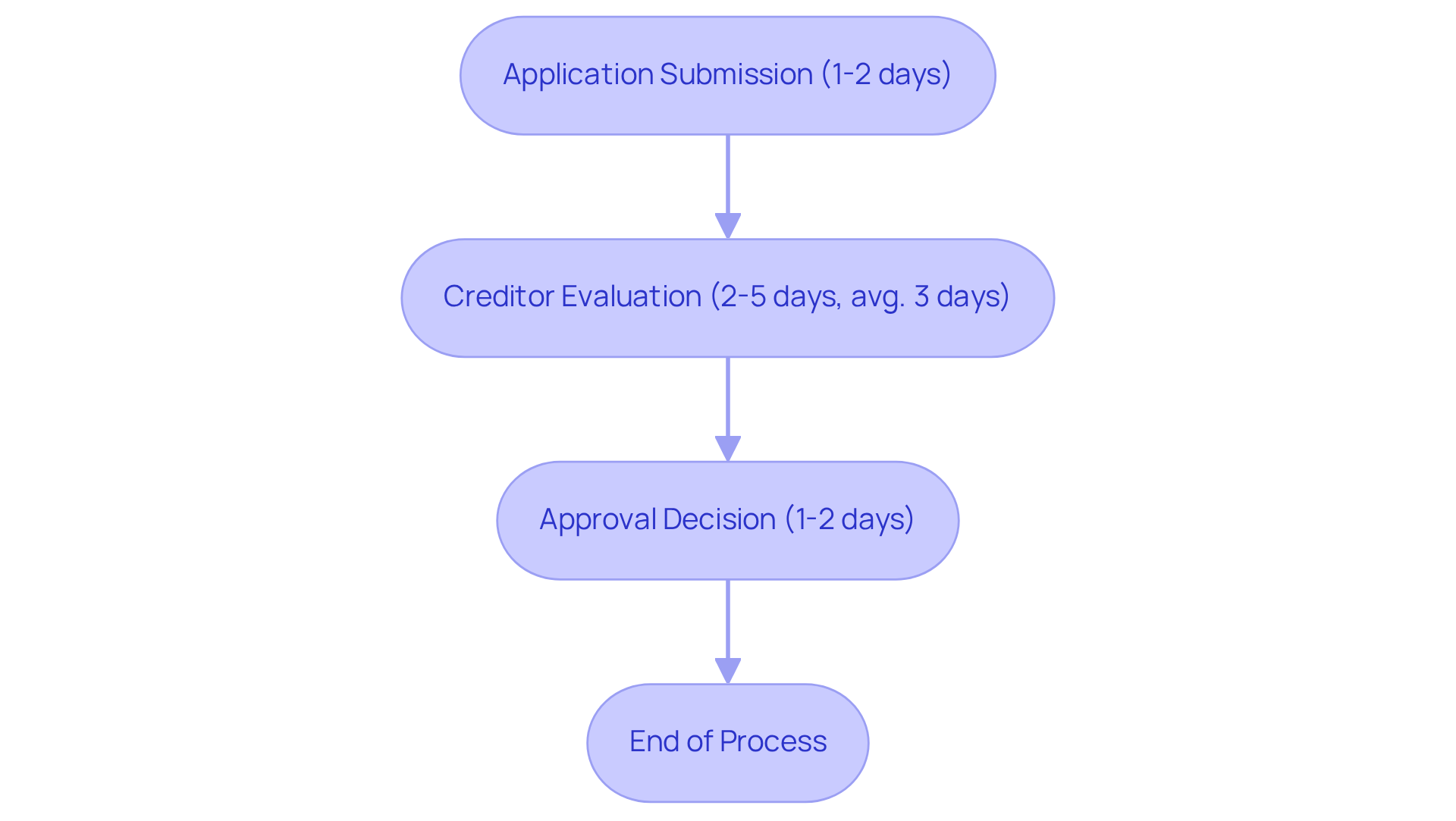

Navigating the mortgage pre approval process can feel daunting, but we’re here to support you every step of the way. Generally, the process follows these essential steps:

- Application Submission: Completing and submitting your application along with necessary documentation typically takes 1-2 days.

- Creditor Evaluation: Next, anticipate the creditor to assess your application and documents within 2-5 days. Lenders often complete their review in an average of 3 days, showcasing their efficiency.

- Approval Decision: Once your application is accepted, the financial institution typically provides an approval letter within 1-2 days.

In total, the mortgage pre approval process can take about one week, depending on the lender’s efficiency and the thoroughness of your documentation. We know how challenging this can be, and that’s why F5 Mortgage employs to guarantee approval in under an hour. This ensures a stress-free and streamlined experience, which is crucial in competitive markets where timely decisions can make all the difference.

For instance, a recent case study highlighted how F5 Mortgage assisted a South African couple in securing a property investment in London. By offering a customized financing solution that featured rapid approval, they were able to act quickly in a competitive market. As Mrs. P, a satisfied client, expressed, “This bespoke solution successfully allowed us to achieve our objectives while maintaining the financial flexibility we needed for future opportunities.

Assess the Impact of Pre-Approval on Your Credit Score

Understanding what to expect during the mortgage pre-approval process can help alleviate the daunting feeling of applying for mortgage pre-approval. When you take this step, the financial institution will conduct a hard inquiry on your credit report. While this might by a few points, don’t worry too much. If you make multiple inquiries within a short time—typically 30 days—credit scoring models often treat them as a single inquiry, which minimizes the impact on your score.

Receiving an approval is a positive sign. It means the lender has reviewed your financial information and believes you are a strong candidate for a mortgage. This mortgage pre-approval process typically gives you an estimate of your borrowing amount, interest rate, and potential monthly payment. We know how challenging this can be, but the benefits of the mortgage pre-approval process—like securing a loan and possibly obtaining better interest rates—often outweigh the temporary dip in your credit score.

Remember, you’re not alone in this journey. We’re here to support you every step of the way as you navigate the mortgage process.

Plan Your Next Steps After Pre-Approval

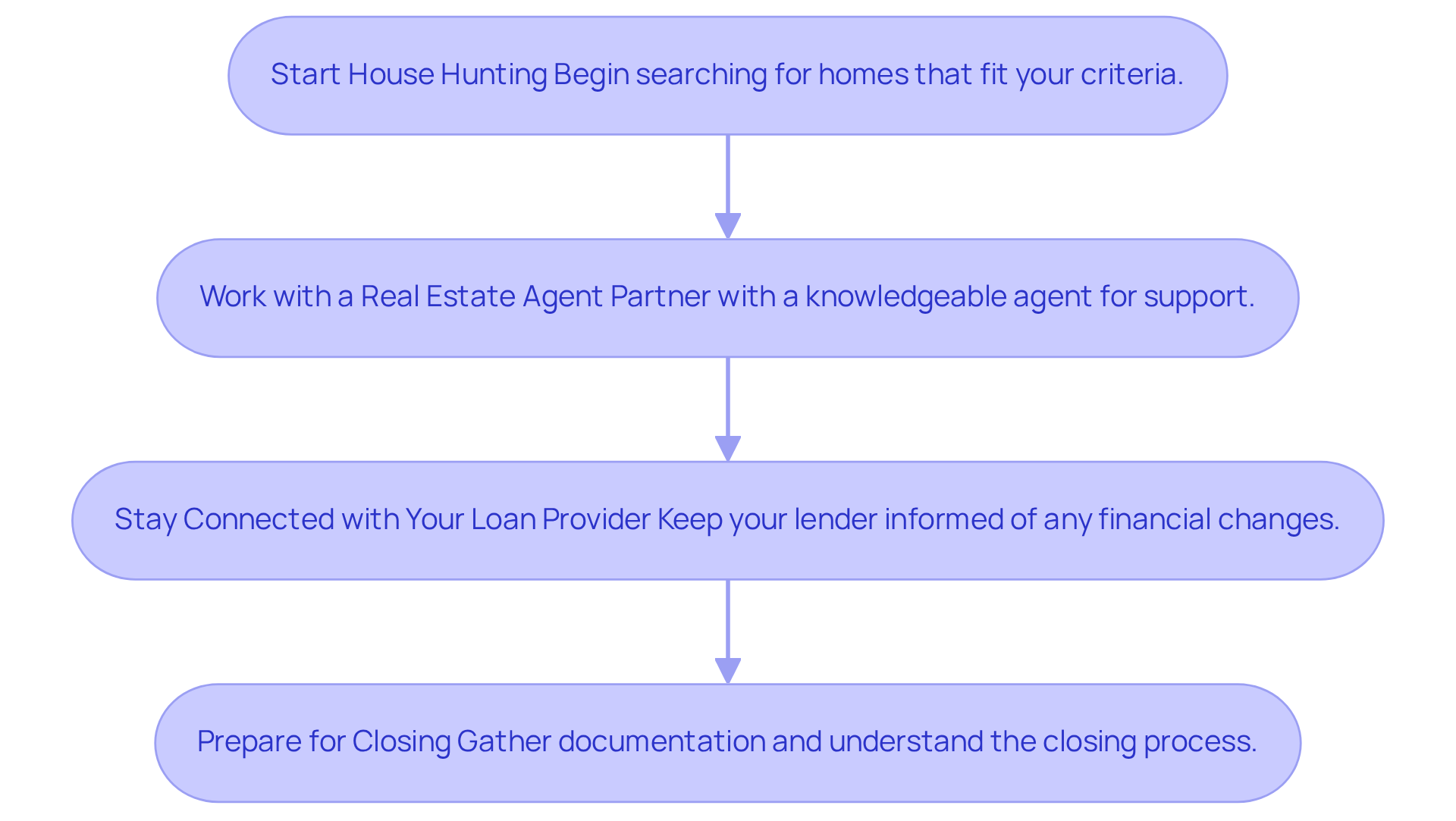

Once you have received your mortgage pre approval process, we know how exciting yet overwhelming this journey can feel. Here are some caring next steps to guide you:

- Start House Hunting: With a clear budget in mind, begin searching for homes that fit your criteria. This is a significant step, and we’re here to support you every step of the way.

- Work with a Real Estate Agent: Partner with a who can help you find suitable properties and negotiate offers. Having someone by your side can make a world of difference.

- Stay Connected with Your Loan Provider: Keep your loan provider informed of any changes in your financial situation and inquire about securing your interest rate. Open communication is key to a smooth process.

- Prepare for Closing: Familiarize yourself with the closing process and gather any additional documentation your lender may require. Understanding what to expect can ease your concerns.

By following these steps, you can ensure a smooth transition through the mortgage pre approval process to homeownership, making this journey less daunting and more fulfilling.

Conclusion

The mortgage pre-approval process is a crucial stepping stone for prospective homeowners, providing clarity and confidence as you embark on your home-buying journey. We understand how challenging this can be, and by grasping this process, you can navigate your financial landscape more effectively, ensuring you are well-prepared to make informed decisions about purchasing a home.

Throughout this article, we’ve highlighted several key points:

- The difference between pre-approval and prequalification

- The essential documentation you’ll need for a smooth application

- The overall timeline for securing pre-approval

Additionally, the advantages of obtaining a mortgage pre-approval—like enhanced negotiating power and quicker closing procedures—underscore its significance in today’s competitive real estate market.

Ultimately, embracing the mortgage pre-approval process not only simplifies your path to homeownership but also empowers you to approach your home search with assurance. As you prepare to take the next steps, such as house hunting and collaborating with real estate professionals, the knowledge gained from understanding pre-approval will be invaluable. We’re here to support you every step of the way, and taking action now can lead to a more successful and fulfilling home-buying experience.

Frequently Asked Questions

What is the mortgage pre-approval process?

The mortgage pre-approval process is when a financial institution evaluates your economic status, including your credit history, income, debts, and assets, to determine how much they are willing to lend you for purchasing a home.

How does pre-approval differ from pre-qualification?

Unlike pre-qualification, which provides a rough estimate of how much you might be able to borrow, mortgage pre-approval offers a conditional commitment from the lender, giving you a clearer picture of your budget and strengthening your position when making an offer on a home.

What are the necessary steps to begin the mortgage pre-approval process?

To start the mortgage pre-approval process, you typically need to fill out a mortgage application and submit the required documentation, which the lender will review to assess your eligibility for financing.

What types of loans does F5 Mortgage offer for Colorado residents?

F5 Mortgage offers various loans tailored for Colorado residents, including conventional loans, FHA loans, and VA loans, each with specific Debt-to-Income (DTI) requirements and benefits.

What are the benefits of obtaining a mortgage pre-approval?

The benefits include stronger negotiating power with sellers, clear budgeting for your home search, quicker closing procedures, early identification of potential issues, enhanced appeal of your offer, and greater flexibility in negotiations.

How does pre-approval enhance negotiating power?

Sellers are more inclined to consider offers from buyers who have completed the mortgage pre-approval process, viewing them as serious and financially stable, which can lead to more favorable negotiations.

How does pre-approval help with budgeting?

Pre-approval provides a comprehensive understanding of your financial situation, helping you establish a realistic price range and focus on homes that fit your budget.

What is the impact of pre-approval on the closing process?

With much of the required paperwork finalized during initial approval, the closing phase can be significantly accelerated once you find a home, leading to a quicker closing procedure.

How does pre-approval identify issues early in the process?

The initial approval phase includes a thorough evaluation of your financial details, which can reveal potential issues early on, allowing you to address them before making an offer and minimizing complications later.

What approach does F5 Mortgage take in the pre-approval process?

F5 Mortgage emphasizes a technology-driven, consumer-centric approach that ensures competitive rates and exceptional service, prioritizing your needs without the hard sales tactics often used by traditional lenders.