Overview

This article is here to support first-time homebuyers in Florida as they embark on the journey of homeownership. We know how challenging this can be, and using a mortgage calculator can be a valuable tool in estimating your monthly mortgage costs. By understanding how to navigate this process, you can feel more confident in your decisions.

To effectively use a mortgage calculator, it’s essential to consider key inputs such as:

- Loan amount

- Interest rate

- Down payment

These factors play a significant role in determining your monthly payments. We encourage you to take your time and explore these details, as they can greatly impact your financial planning.

As you interpret the results, remember that you’re not alone. There are additional resources available to help you understand your options and support your journey toward homeownership. We’re here to guide you every step of the way, ensuring you have the information you need to make informed decisions.

With the right tools and support, you can navigate the homebuying process with confidence. Let’s take this important step together, and empower yourself with knowledge that will lead you to your dream home.

Introduction

Navigating the complexities of home financing can feel overwhelming for first-time homebuyers, especially in a lively market like Florida. We understand how challenging this can be. That’s where the mortgage calculator becomes an essential ally, providing clarity on potential monthly payments and overall loan costs. Yet, the real challenge is in effectively using these calculators and interpreting the results to make informed decisions.

How can you harness the power of mortgage calculators to simplify your homebuying journey and secure the best financial outcomes? We’re here to support you every step of the way.

Understand the Basics of Mortgage Calculators

Mortgage calculators, such as the mortgage calculator Florida, are digital tools designed to help prospective homebuyers like you estimate your monthly mortgage costs. By inputting various details, such as the amount borrowed, interest rate, term of the agreement, and down payment, you can gain a clearer understanding of what to expect. We know how challenging this can be, so let’s break it down:

- Loan Amount: This is the total amount you borrow to purchase your home.

- Interest Rate: This percentage is charged on your loan and can be fixed or variable. For example, adjustable-rate mortgages (ARMs) often start with lower introductory rates for an initial period. After that, the rate adjusts to market conditions, usually every six months. This adjustment can significantly impact your . Thankfully, there are limits on how much the interest can increase, providing some protection against sudden cost rises.

- Loan Term: This refers to the duration over which you will repay the loan, commonly 15 or 30 years.

- Down Payment: This is your initial payment when buying the home, typically expressed as a percentage of the purchase price.

By familiarizing yourself with these terms, including the implications of choosing a fixed or variable interest rate, you can use the mortgage calculator Florida more effectively. This will help you assess your financial situation and determine what you can afford. ARMs may be particularly suitable if you plan to pay off your loan quickly, sell your home, or refinance within a few years. Remember, we’re here to support you every step of the way.

Access and Navigate a Mortgage Calculator

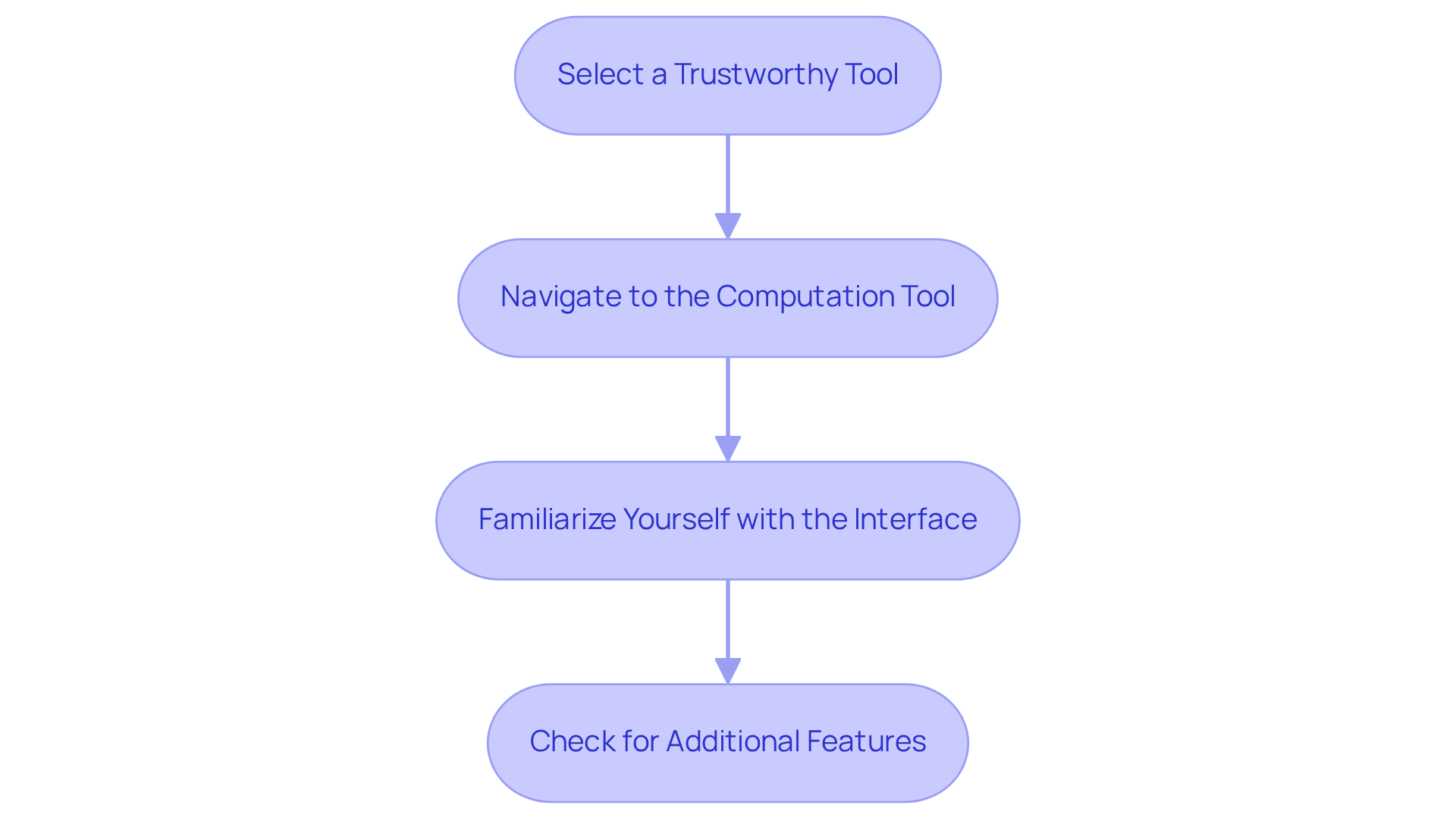

Accessing a mortgage calculator Florida can feel overwhelming, but we’re here to support you every step of the way. Follow these simple steps to make the process easier:

- Select a Trustworthy Tool: We know how important it is to find reliable resources. Websites like Bankrate, NerdWallet, and SmartAsset offer free . Choose one that best fits your needs and offers peace of mind.

- Navigate to the Computation Tool: Once you’re on the website, look for the mortgage calculator Florida section. This is often located in the financial tools or resources menu, making it easier for you to find.

- Familiarize Yourself with the Interface: Take a moment to explore the layout. Most devices will have input areas for the loan amount, interest rate, loan term, and down payment. Understanding this will help you feel more confident as you proceed.

- Check for Additional Features: Some calculators may provide advanced options, such as including property taxes, homeowners insurance, and PMI (Private Mortgage Insurance). Familiarizing yourself with these features can lead to a more comprehensive estimate, giving you a clearer picture of your potential mortgage.

Input Essential Information for Accurate Calculations

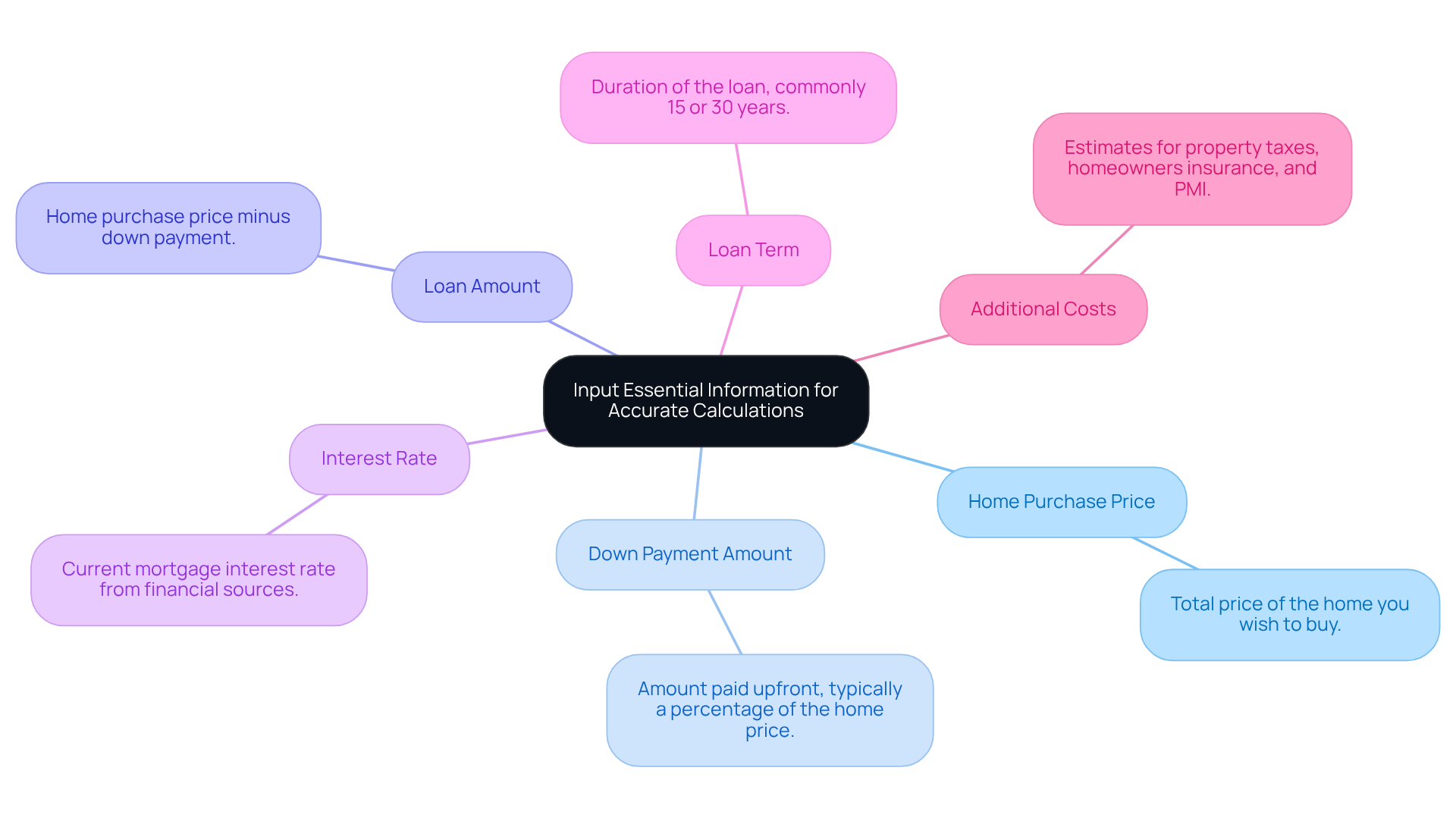

To achieve accurate calculations, it’s essential to input the following information into the mortgage calculator:

- Home Purchase Price: This is the total price of the home you wish to buy. We know how significant this decision is for you.

- Down Payment Amount: Specify how much you plan to pay upfront. Typically, this is a percentage of the home price, and it can greatly impact your loan.

- Loan Amount: Usually, this is the home purchase price minus the down payment. Some mortgage calculator Florida options will calculate this automatically for you, easing the process.

- Interest Rate: Input the current mortgage interest rate. You can find this information on financial news websites or lender websites. Staying informed is key.

- Loan Term: Select the duration of the loan, commonly 15 or 30 years. Choosing the right term can make a difference in your monthly payments.

- Additional Costs: If applicable, include estimates for property taxes, homeowners insurance, and PMI. This will give you a more accurate monthly payment estimate, helping you plan better.

Additionally, keep in mind that approval letters generally expire after 90 days. If you haven’t submitted a proposal within that timeframe, consider renewing your approval before utilizing the tool. We’re here to support you every step of the way, ensuring you are ready to proceed with your home purchase.

Interpret Mortgage Calculator Results Effectively

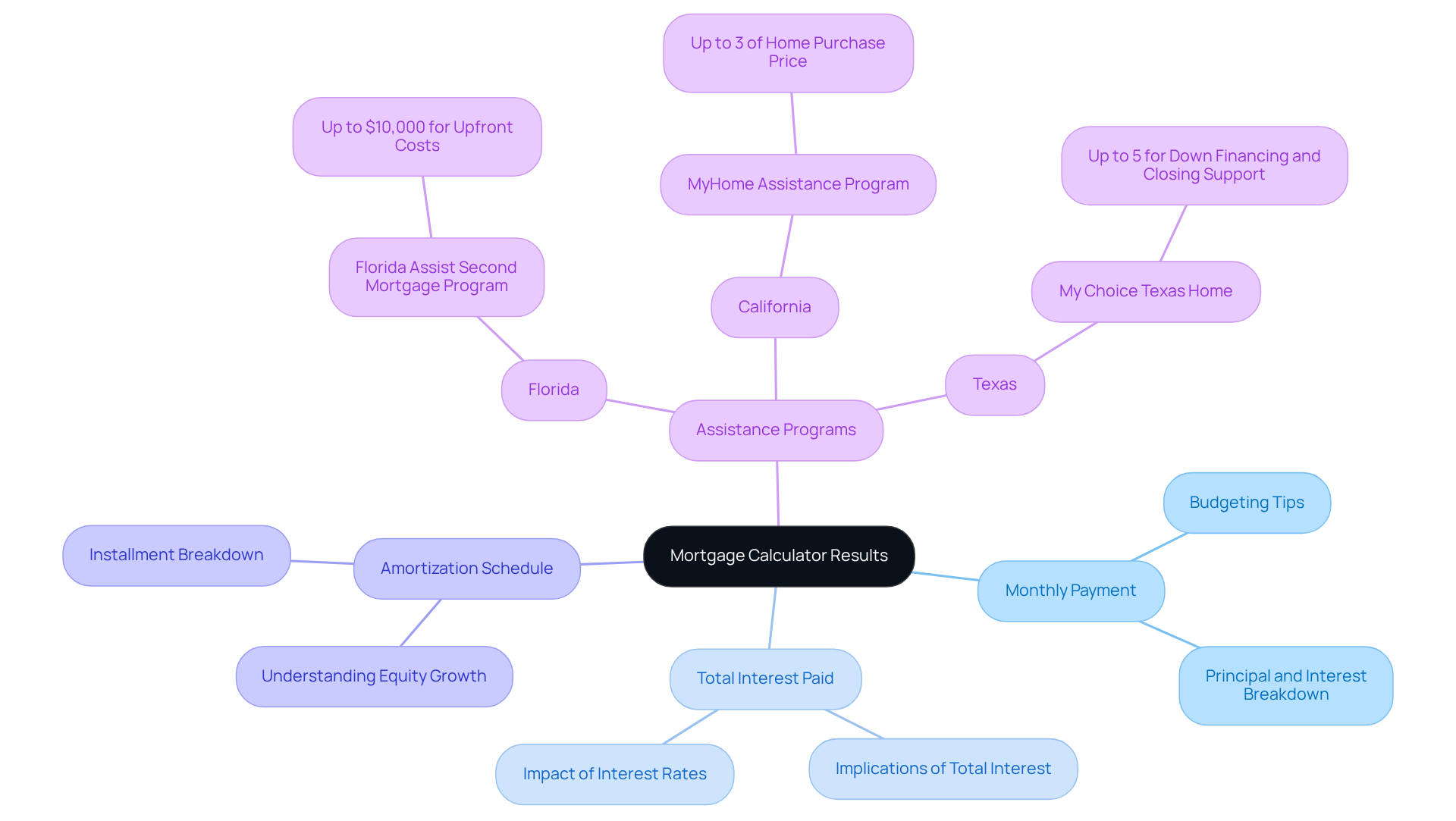

Once you input your information, the mortgage calculator Florida will generate results that can be incredibly helpful in your journey toward homeownership. Typically, these results include:

- Monthly Payment: This is the amount you will pay each month, encompassing both principal and interest. Understanding this figure is crucial for budgeting effectively.

- Total Interest Paid: This shows how much interest you will pay over the life of the loan. Remember, a lower interest rate can significantly reduce this amount.

- Amortization Schedule: Some calculators provide a detailed summary of installments over time, indicating how much is allocated to principal versus interest. This insight can help you see how your equity in the home will grow.

Along with these calculations, it’s essential to consider assistance programs for upfront costs that can make homeownership more attainable. For instance, Florida offers several programs, including the Florida Assist Second Mortgage Program, which provides up to $10,000 for upfront costs. If you’re also exploring options in California or Texas, programs like the MyHome Assistance Program, which offers up to 3% of the home’s purchase price, and My Choice Texas Home, which provides up to 5% for down financing and closing support, can be significant resources.

We know how challenging this can be, so review these results carefully. If the monthly cost exceeds your budget, consider adjusting the loan amount, down payment, or loan term to find a more manageable option. We’re here to .

Explore Additional Resources and Tips for First-Time Homebuyers

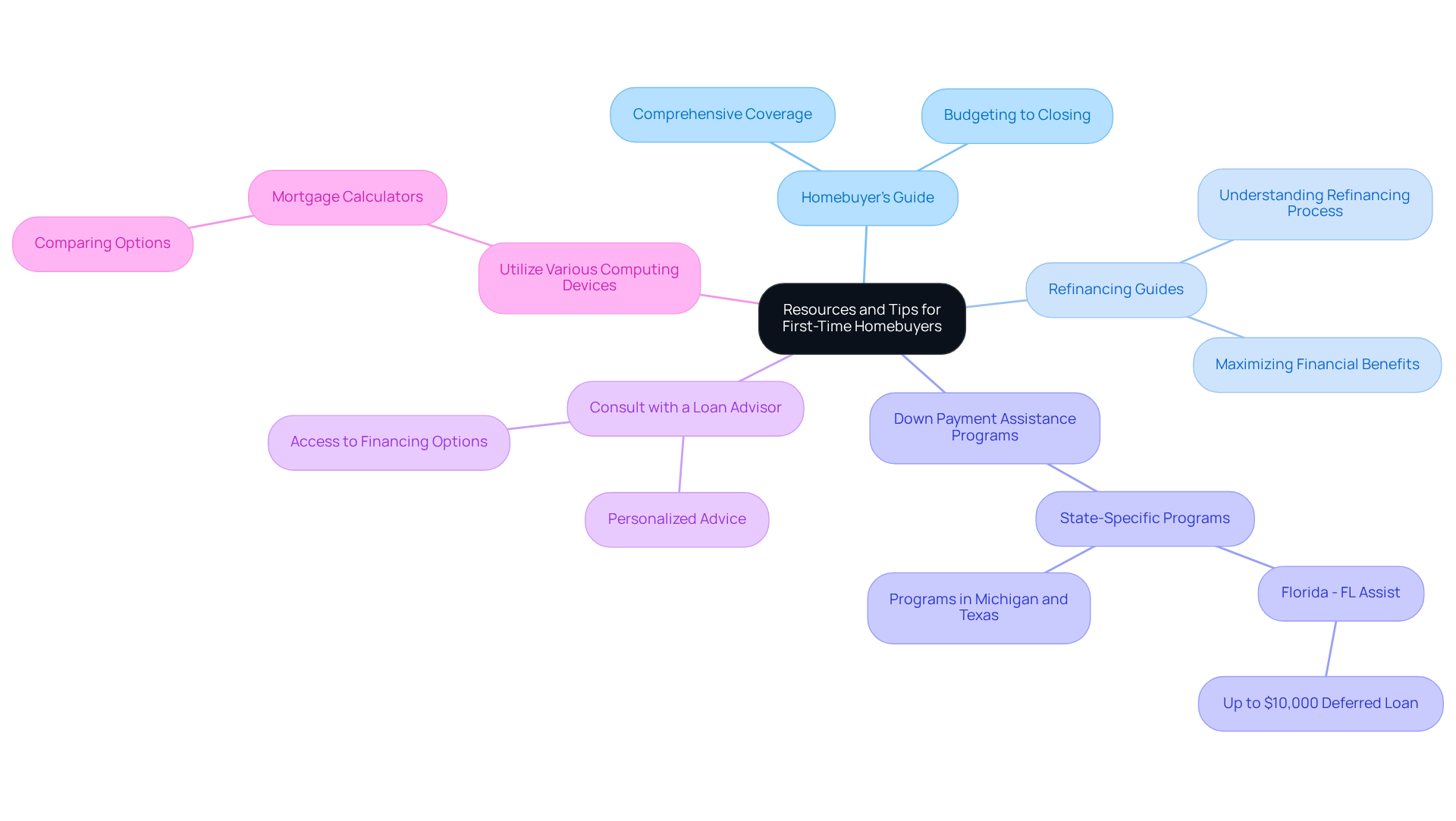

To further assist you in your homebuying journey, we know how challenging this can be, so consider these helpful resources and tips:

- Homebuyer’s Guide: F5 Mortgage offers a comprehensive homebuyer’s guide that covers everything from budgeting to closing. This ensures you have the knowledge needed to navigate the process smoothly.

- Refinancing Guides: If you’re considering refinancing in the future, familiarize yourself with the refinancing process and options available to maximize your financial benefits.

- Down Payment Assistance Programs: Research state-specific programs that can help with down payments, especially if you’re a first-time buyer. For instance, Florida presents various programs such as FL Assist, which offers up to $10,000 as a deferred second loan, facilitating homeownership. Programs in Michigan and Texas also provide substantial assistance, showcasing F5 Mortgage’s commitment to enhancing home buying opportunities. As one satisfied client noted, “F5 Mortgage made the process so much easier with their guidance on these programs!”

- Consult with a Loan Advisor: Engaging with can provide personalized advice and access to a wider range of financing options, ensuring you find the best fit for your needs.

- Utilize Various Computing Devices: Different computing devices may produce slightly different outcomes. Use several mortgage calculator Florida options to compare and ensure you’re getting a well-rounded view of your potential mortgage costs. Our clients have expressed high satisfaction with our tools and support, with one client stating, “The calculators were incredibly helpful in understanding my options!

Conclusion

Understanding how to effectively use a mortgage calculator is crucial for first-time homebuyers in Florida. We know how challenging this can be, and by mastering this tool, prospective buyers can gain clarity on their financial commitments, making the journey to homeownership feel less daunting. The mortgage calculator empowers users to input essential details, allowing for a tailored estimate of monthly payments and total costs associated with their loan.

Familiarizing oneself with key mortgage terms, such as:

- Loan amount

- Interest rates

- Down payment

is essential. It’s important to accurately input information to achieve reliable calculations and interpret results to make informed decisions. Additionally, there are assistance programs available that can alleviate upfront costs, ensuring that more individuals can realize their dream of owning a home.

Utilizing a mortgage calculator not only simplifies the homebuying process but also equips first-time buyers with the knowledge needed to navigate their financial landscape. Engaging with additional resources, consulting with experts, and taking advantage of financial assistance programs can further enhance the homebuying experience. Empowerment through education and informed decision-making is key to achieving homeownership. We encourage prospective buyers to embrace these tools and insights as they embark on their journey.

Frequently Asked Questions

What is a mortgage calculator?

A mortgage calculator is a digital tool that helps prospective homebuyers estimate their monthly mortgage costs by inputting details such as the loan amount, interest rate, loan term, and down payment.

What key terms should I understand when using a mortgage calculator?

Key terms include: – Loan Amount: The total amount borrowed to purchase a home. – Interest Rate: The percentage charged on the loan, which can be fixed or variable. – Loan Term: The duration over which the loan will be repaid, commonly 15 or 30 years. – Down Payment: The initial payment expressed as a percentage of the purchase price.

How does the interest rate affect my mortgage payments?

The interest rate affects your monthly payments significantly. Fixed rates remain the same, while variable rates (like those in adjustable-rate mortgages) can change, impacting your costs, especially after an initial period.

What are the steps to access and navigate a mortgage calculator?

To access a mortgage calculator: 1. Select a trustworthy tool from websites like Bankrate, NerdWallet, or SmartAsset. 2. Navigate to the mortgage calculator section on the website. 3. Familiarize yourself with the interface, noting where to input the loan amount, interest rate, loan term, and down payment. 4. Check for additional features that may include property taxes, homeowners insurance, and PMI for a more comprehensive estimate.

Are there any features I should look for in a mortgage calculator?

Look for features that allow you to include property taxes, homeowners insurance, and Private Mortgage Insurance (PMI) for a more accurate and comprehensive estimate of your potential mortgage costs.