Overview

We know how important it is to understand the loan-to-value (LTV) ratio. This crucial financial metric compares your mortgage amount to the property’s appraised value. It can significantly influence your mortgage options and costs.

A lower LTV ratio can lead to better loan terms, such as lower interest rates and the possibility of avoiding private mortgage insurance (PMI). This can make a substantial difference in your monthly payments and overall financial health.

By managing your LTV ratio effectively, you can position yourself for more favorable loan conditions. We’re here to support you every step of the way as you navigate this important aspect of home financing.

Introduction

Understanding the loan-to-value (LTV) ratio is crucial for anyone navigating the mortgage landscape. We know how challenging this can be, as this ratio serves as a key indicator of financial health and lending risk. It not only influences interest rates and mortgage insurance requirements but also plays a pivotal role in determining the types of financing available to borrowers.

However, many individuals remain unaware of how to effectively manage and improve their LTV. This leaves them vulnerable to higher costs and less favorable loan terms. We’re here to support you every step of the way.

What strategies can be employed to optimize this critical financial measure and unlock better mortgage options? Let’s explore this together.

Define the Loan-to-Value Ratio and Its Importance

The loan-to-value ratio is an essential financial measure that compares the amount of a mortgage to the appraised value of the property being acquired. It is determined by dividing the amount borrowed by the property’s value and representing it as a percentage. For example, if you buy a house worth $200,000 and obtain financing for $160,000, your LTV proportion would be 80% (160,000 ÷ 200,000 = 0.80).

Understanding the loan-to-value ratio measurement is vital because it serves as a risk assessment tool for lenders. We understand how challenging this can be, as a high loan-to-value ratio signifies increased risk, which can result in higher interest rates or even rejection of the application. For instance, traditional financing usually necessitates a loan-to-value ratio of 97% or lower, whereas striving for a loan-to-value ratio of 80% or less can help borrowers avoid private mortgage insurance (PMI). Conversely, a lower loan-to-value ratio measurement often leads to more favorable loan terms, including reduced interest rates and the potential elimination of PMI.

In 2025, average loan-to-value ratios for home purchases reflect a trend towards lower ratios, as buyers increasingly recognize the benefits of larger down payments. This change not only improves their chances of loan approval but also sets them up for better interest rates. F5 Mortgage offers competitive rates and personalized service, making it an excellent choice for families looking to upgrade their homes. Additionally, down payment assistance programs available through F5 Mortgage, such as FL Assist and the Florida Homeownership Loan Program, can provide up to $10,000 to help with down payments or closing costs, further enhancing home buying opportunities.

Experts highlight that managing the loan-to-value ratio is essential for borrowers, as it directly impacts their financial responsibilities and overall lending experience. Many lenders require a maximum loan-to-value ratio measurement between 80% and 90% for home equity loans and lines of credit, which is an important consideration for those looking to leverage their home equity.

By comprehending and enhancing their loan-to-value ratio measurement, borrowers can navigate the loan landscape more efficiently and secure better financing options. As Tim Maxwell, a personal finance writer, advises, “Leverage expert advice to see if you can save thousands of dollars.

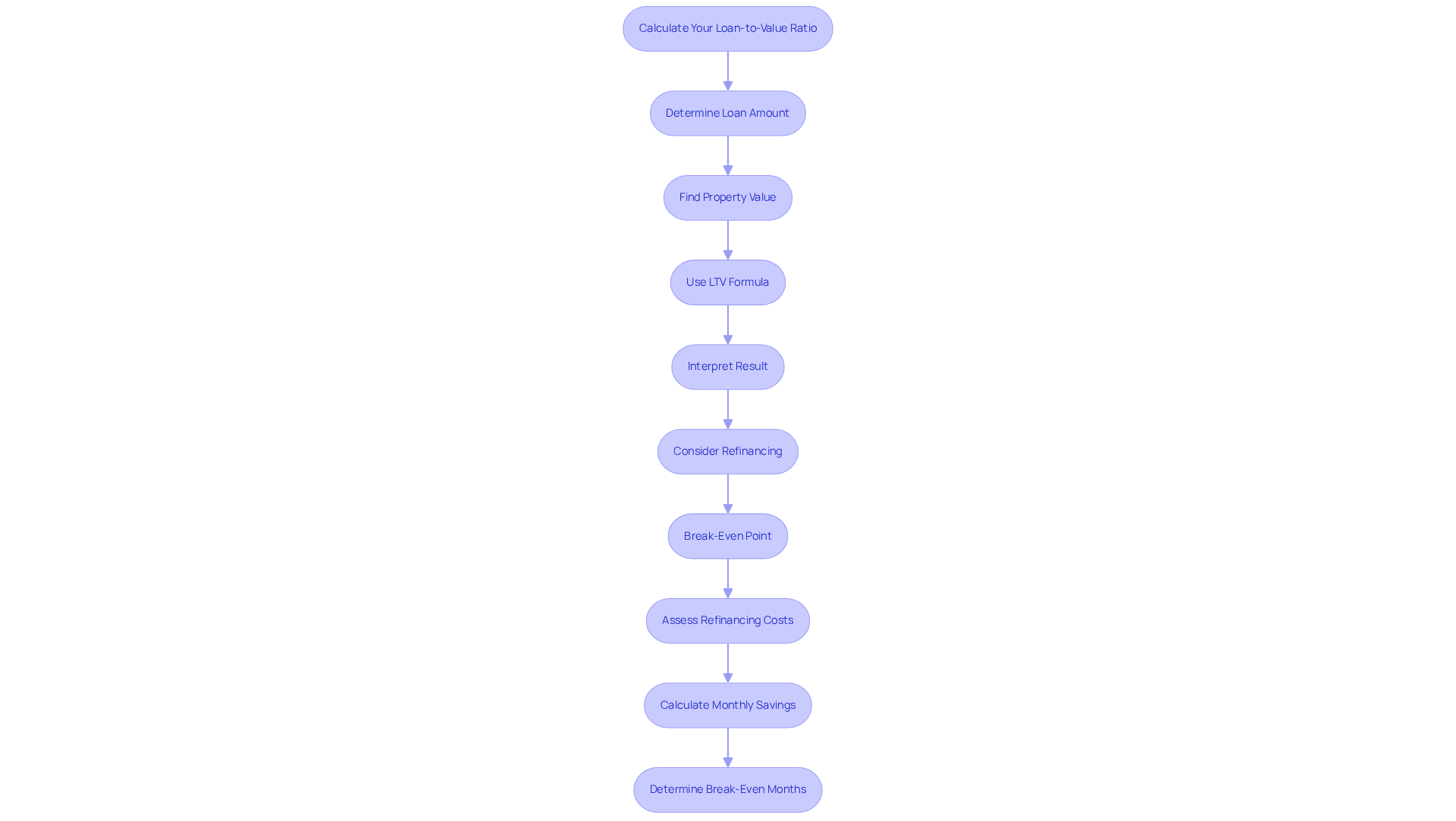

Calculate Your Loan-to-Value Ratio: Step-by-Step Guide

Understanding your loan-to-value ratio is crucial for navigating your financing options. Let’s walk through the steps together to determine your LTV:

-

Determine the Loan Amount: Start by identifying the total sum you plan to borrow, which includes the principal of the loan.

-

Find the Property Value: Obtain the appraised value of the property. This can be done through a professional appraisal or by using the purchase price if it is lower than the appraised value.

-

Use the LTV Formula: Apply the formula:

LTV = (Loan Amount ÷ Property Value) × 100

For instance, if your loan amount is $180,000 and the property value is $225,000, the calculation would be:

LTV = (180,000 ÷ 225,000) × 100 = 80%

-

Interpret the Result: An LTV of 80% means you are borrowing 80% of the property’s value. This is typically beneficial for securing better loan conditions. Maintaining an LTV of 80% or lower can also eliminate the need for private mortgage insurance (PMI), significantly reducing your monthly payments.

We know how challenging it can be to navigate financial decisions, and understanding how to compute your loan-to-value ratio empowers you to make informed choices about your loan. This ensures you can access the best financing options available to you. Additionally, improving your credit score can enhance your mortgage opportunities. Consider ordering a copy of your credit report to check for errors, pay down existing debts, and use credit wisely to improve your financial standing. It’s also important to note that FHA mortgages allow for a loan-to-value ratio of 96.5%, while VA options can provide up to 100% financing. However, be cautious of high loan-to-value ratio levels, as they can increase the risk of being underwater on your loan if property values decline.

Moreover, calculating your break-even point when refinancing can further enhance your financing strategy. To determine your break-even point, follow these steps:

- Assess your refinancing costs, including all closing fees and expenses.

- Calculate your monthly savings by subtracting your new monthly payment from your current one.

- Divide your refinancing costs by your monthly savings to find out how many months it will take to break even.

For example, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months. This understanding is crucial for ensuring that refinancing aligns with your financial situation. We’re here to support you every step of the way.

Understand the Impact of LTV on Mortgage Options and Costs

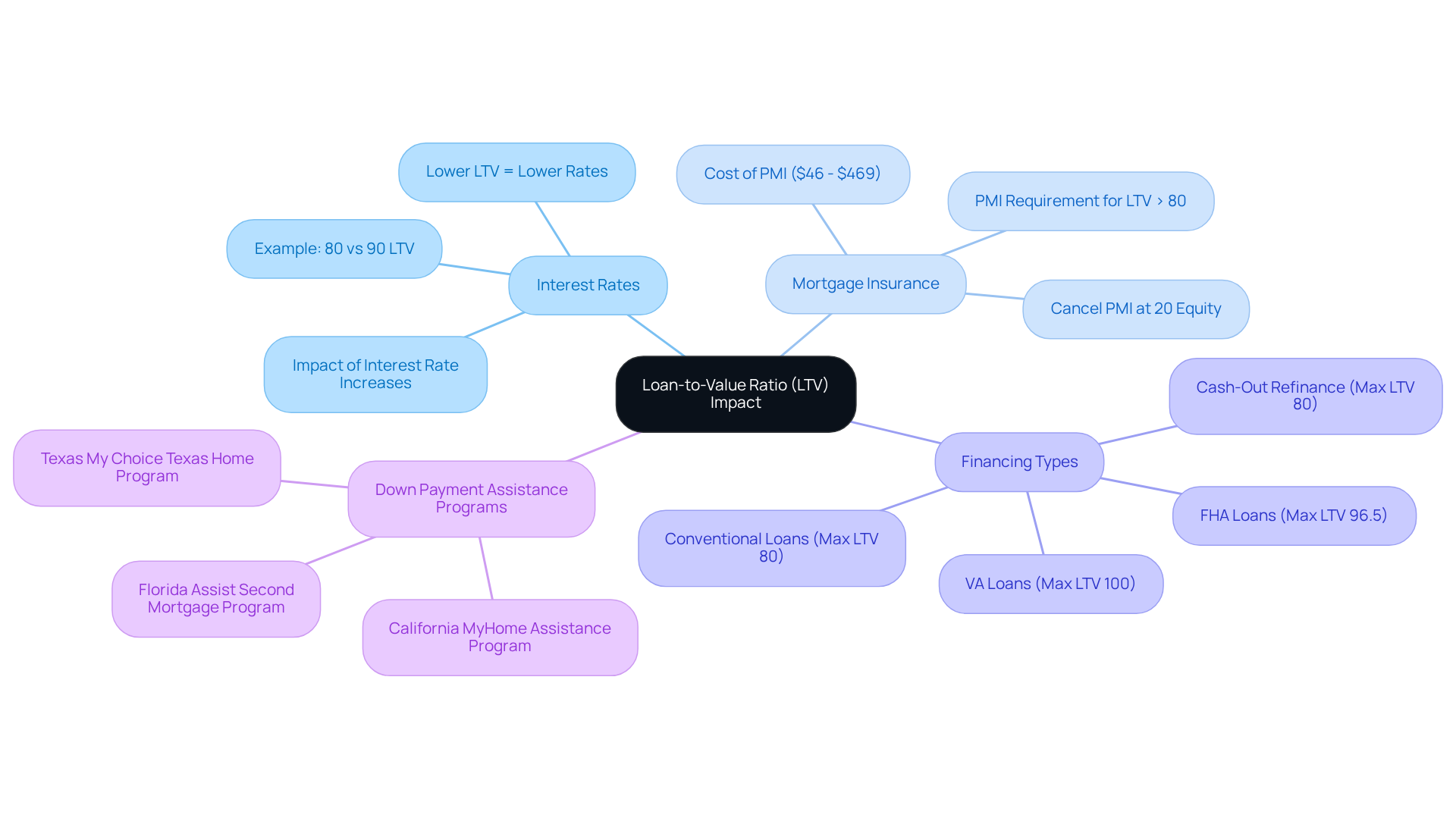

Understanding the loan-to-value ratio is crucial for navigating the complexities of mortgage financing, and we recognize how challenging this can be. The LTV ratio significantly impacts several key aspects of your mortgage journey:

-

Interest Rates: Lenders often offer lower interest rates for lower LTV ratios. For example, if your loan-to-value ratio is 80% or lower, you may qualify for better rates compared to a loan-to-value ratio of 90%, which could lead to higher borrowing costs.

-

Mortgage Insurance: If your loan-to-value ratio exceeds 80%, you may be required to obtain private mortgage insurance (PMI), which can add between $46 and $469 to your monthly payment. By reducing your loan-to-value ratio, you can avoid this expense. Once you reach 20% equity in your home, you can cancel PMI, further enhancing your financial situation.

A lower loan-to-value ratio can improve your chances of financing approval. It signals to lenders that your loan-to-value ratio is more favorable, showing you have more equity in the property and are less likely to default. This is especially important in a high-interest environment.

- Financing Types: Different financing programs come with specific loan-to-value ratio requirements. For instance, FHA loans may allow a higher loan-to-value ratio (up to 96.5%), while conventional loans often favor lower loan-to-value ratios for better terms. Additionally, cash-out refinances typically have a maximum loan-to-value ratio of 80%.

To help you manage your loan costs, F5 Mortgage offers various down payment assistance programs tailored to your needs. In California, the MyHome Assistance Program provides up to 3% of the home’s purchase price. In Texas, the My Choice Texas Home program offers a 30-year, low-interest-rate loan along with up to 5% for down payment and closing assistance. Florida residents can benefit from programs like the Florida Assist Second Mortgage Program, which provides up to $10,000 for upfront costs.

By comprehending these effects, you can better plan your financing request and potentially save thousands throughout your credit duration. Notably, F5 Mortgage prides itself on a fast and efficient closing process, with most loans closing in less than three weeks. Once your application is approved, securing your loan rates can protect you from market fluctuations during the processing period, further simplifying your financing experience. We’re here to support you every step of the way.

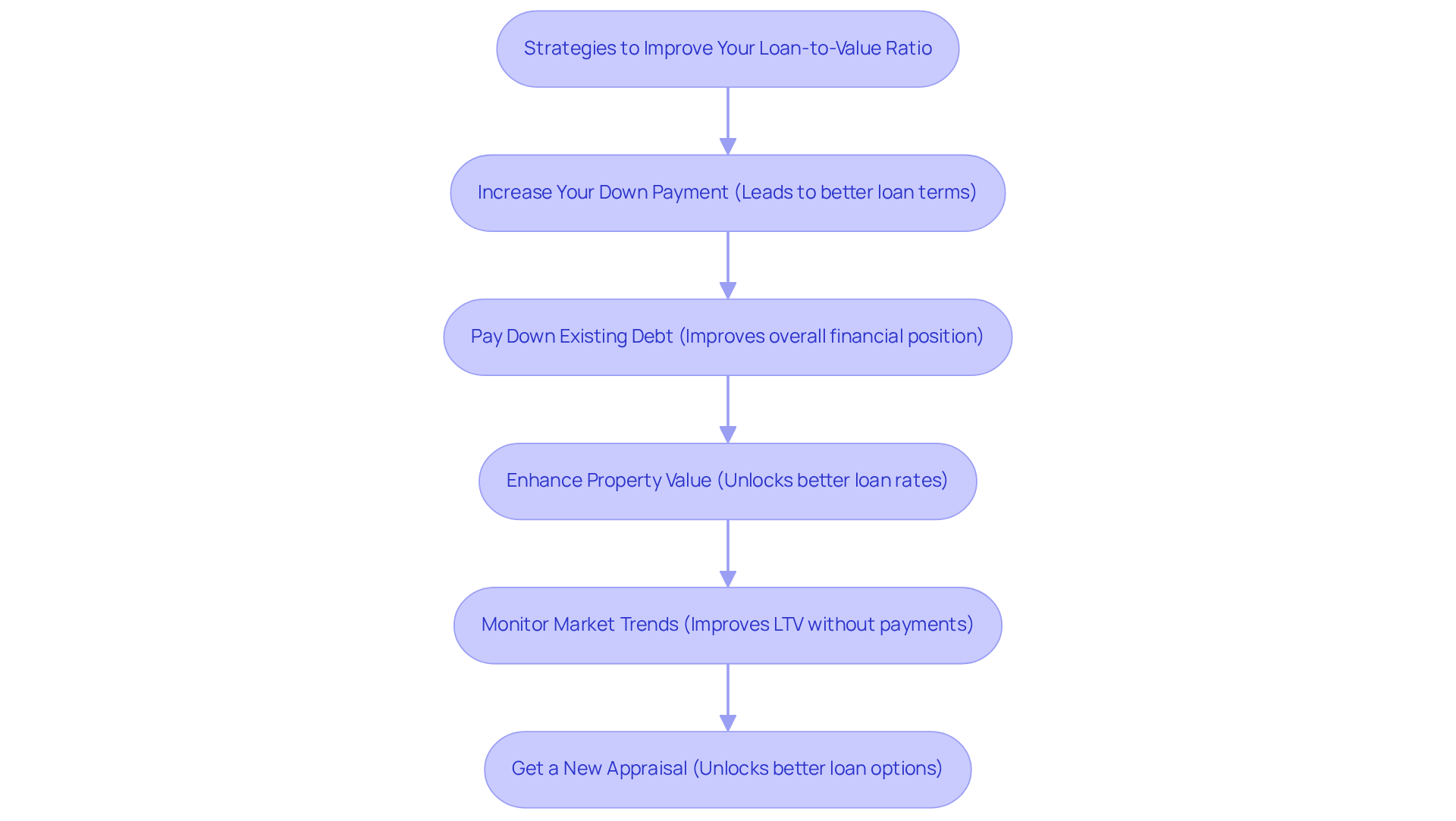

Manage and Improve Your Loan-to-Value Ratio Effectively

Improving your loan-to-value ratio can significantly enhance your financing options and reduce expenses. We know how challenging navigating the mortgage process can be, so here are some effective strategies to consider:

-

Increase Your Down Payment: One of the most direct ways to lower your LTV is by increasing your down payment. A larger down payment decreases the loan amount in relation to the property’s value, positively affecting the loan-to-value ratio, which can lead to better loan terms. For instance, with the typical down payment now at 18.6% or $67,500, aiming for a higher percentage can yield substantial savings over time.

-

Pay Down Existing Debt: If you already own a home, consider making additional payments on your loan. Reducing the principal balance not only improves your LTV but also strengthens your overall financial position. Every little bit helps, and we’re here to support you every step of the way.

-

Enhance Property Value: Investing in home improvements can increase your property’s appraised value. This approach is especially effective during refinancing, as a higher appraisal can reduce your loan-to-value ratio, which can qualify you for more advantageous loan rates. At F5 Mortgage, we leverage technology to help you navigate these improvements and understand their impact on your financing options.

-

Monitor Market Trends: Stay informed about the real estate market. If property values in your area are on the rise, your LTV may improve without any additional payments. For example, in 2025, many regions are experiencing significant home value increases, which can positively impact your loan-to-value ratio.

-

Get a New Appraisal: If you suspect that your property’s value has increased, consider obtaining a new appraisal. An increased appraised value will directly reduce your loan-to-value ratio, potentially unlocking better loan options. F5 Mortgage is dedicated to offering a clear and hassle-free financing process, ensuring you have access to the best rates available.

By actively overseeing your loan-to-value ratio, you can position yourself for enhanced loan options and save money in the long term. Real-life examples show that homeowners who strategically increase their down payments often secure better financing terms, reinforcing the importance of this approach in today’s competitive market. Furthermore, for self-employed borrowers, comprehending how bank statement financing operates can be essential. These loans allow for income calculation based on bank statements rather than traditional documentation, which can be beneficial in improving your loan-to-value ratio and enhancing your overall mortgage options. As noted by Aly J. Yale, “Median down payments have now risen year over year for 12 months in a row,” emphasizing the trend towards larger down payments and their impact on the loan-to-value ratio.

Conclusion

Understanding the loan-to-value ratio (LTV) is crucial for anyone navigating the mortgage landscape. We know how challenging this can be. This financial metric not only reflects the relationship between the borrowed amount and the property’s value but also serves as a critical indicator of risk for lenders. By mastering the LTV, borrowers can secure more favorable mortgage options, lower interest rates, and potentially avoid costly private mortgage insurance (PMI).

The article outlines several key points regarding the importance of LTV in mortgage financing. It explains how a lower LTV can lead to better loan terms and the necessity of calculating it accurately. We’re here to support you every step of the way, and we want to share strategies for improving your LTV. From increasing down payments to enhancing property values, each approach offers a pathway to better financing opportunities. Additionally, it highlights how different mortgage programs have varying LTV requirements, which can significantly impact your borrowing experience.

In conclusion, actively managing and improving the loan-to-value ratio is essential for anyone looking to optimize their mortgage options. By taking informed steps to enhance your LTV, you can save thousands of dollars over the life of your loans. As the real estate market evolves, staying proactive and informed about LTV can empower you to make smarter financial decisions. Ultimately, this leads to a more secure and beneficial homeownership experience.

Frequently Asked Questions

What is the loan-to-value (LTV) ratio?

The loan-to-value ratio is a financial measure that compares the amount of a mortgage to the appraised value of the property being acquired. It is calculated by dividing the amount borrowed by the property’s value and expressing it as a percentage.

How is the LTV ratio calculated?

The LTV ratio is calculated by dividing the amount borrowed by the property’s appraised value. For example, if a house is worth $200,000 and the financing obtained is $160,000, the LTV ratio would be 80% (160,000 ÷ 200,000 = 0.80).

Why is the LTV ratio important for lenders?

The LTV ratio serves as a risk assessment tool for lenders. A high LTV ratio indicates increased risk, which may result in higher interest rates or rejection of the loan application.

What LTV ratio is typically required for traditional financing?

Traditional financing usually requires a loan-to-value ratio of 97% or lower. Striving for an LTV ratio of 80% or less can help borrowers avoid private mortgage insurance (PMI).

How does a lower LTV ratio benefit borrowers?

A lower LTV ratio often leads to more favorable loan terms, including reduced interest rates and the potential elimination of private mortgage insurance (PMI).

What trends are being observed in average LTV ratios for home purchases?

In 2025, average loan-to-value ratios for home purchases are reflecting a trend towards lower ratios, as buyers are increasingly recognizing the benefits of making larger down payments, which improves their chances of loan approval and better interest rates.

What assistance programs are available for down payments?

F5 Mortgage offers down payment assistance programs, such as FL Assist and the Florida Homeownership Loan Program, which can provide up to $10,000 to help with down payments or closing costs.

What is the recommended LTV ratio for home equity loans?

Many lenders require a maximum loan-to-value ratio measurement between 80% and 90% for home equity loans and lines of credit.

How can borrowers improve their LTV ratio?

Borrowers can enhance their loan-to-value ratio by making larger down payments, which can help them navigate the loan landscape more efficiently and secure better financing options.