Overview

This article offers caring, step-by-step guidance for homeowners looking to navigate the refinancing process with confidence. We understand how challenging this can be, and our goal is to help you effectively use a home refinance calculator to evaluate potential savings and costs associated with refinancing.

By accurately entering your mortgage details, you can uncover important metrics such as monthly savings and break-even points. We’re here to support you every step of the way, providing examples of typical savings and costs involved in this journey. With this information, you can make informed decisions that align with your financial goals.

Introduction

Navigating the intricacies of mortgage refinancing can often feel overwhelming. We understand how daunting it can be, especially with the myriad of options and calculations involved. A home refinance calculator emerges as an essential tool, offering homeowners the chance to uncover potential savings and make informed financial decisions. However, the challenge remains: how can you effectively utilize this calculator to maximize benefits while avoiding common pitfalls?

This guide provides a comprehensive, step-by-step approach to mastering the home refinance calculator. We’re here to support you every step of the way, ensuring that the path to financial clarity and savings is both accessible and straightforward.

Understand the Purpose of a Home Refinance Calculator

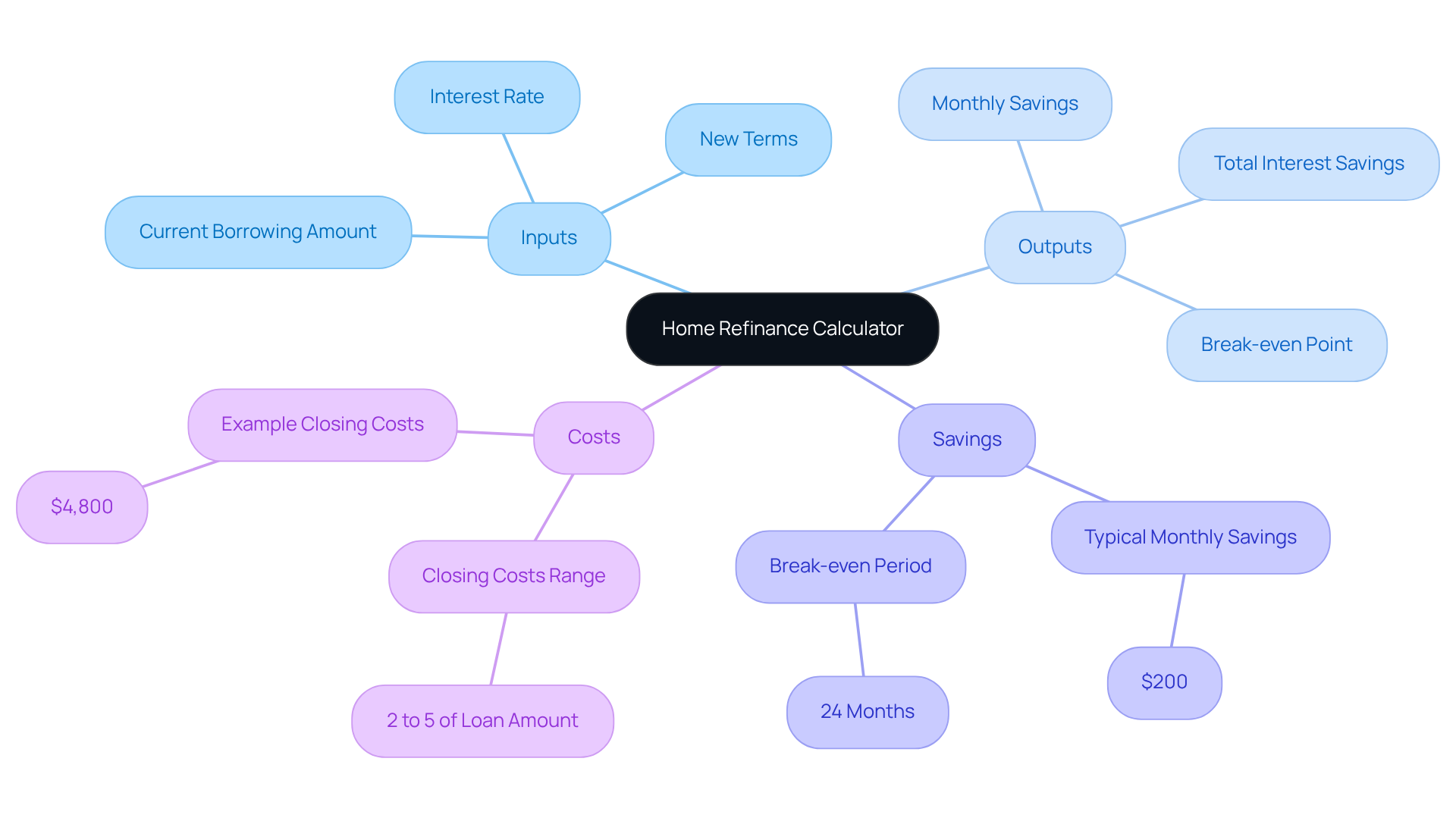

A home refinance calculator serves as a vital resource for homeowners navigating the complexities of mortgage adjustments. By simply entering details like the current borrowing amount, interest rate, and proposed new terms into a home refinance calculator, you can uncover potential monthly savings, total interest savings over the life of the loan, and the break-even point for recouping costs associated with the new financing.

Imagine this: homeowners who utilize these calculators often discover that restructuring their loans can lead to significant savings—typically around $200 each month. Understanding these metrics is crucial for making informed decisions when using a home refinance calculator. It empowers you to assess whether a lower interest rate or a different term could substantially enhance your monthly payments and overall financial well-being.

Specifically, the break-even point generally hovers around 24 months when factoring in $4,800 in closing costs and $200 in monthly savings. In California, the costs tied to finalizing a mortgage refinance usually range from 2% to 5% of the loan amount. For instance, if your new loan amount is $300,000, you can expect to pay between $6,000 and $15,000 in closing fees. This includes application fees, origination fees, appraisal fees, and more—all critical factors to weigh in your loan modification decision.

At F5 Mortgage, we understand how challenging this process can be. We’re here to support you every step of the way, helping you navigate these costs and the intricacies of refinancing. Together, we can ensure that your choices align with your financial goals.

Follow Step-by-Step Instructions to Use the Calculator

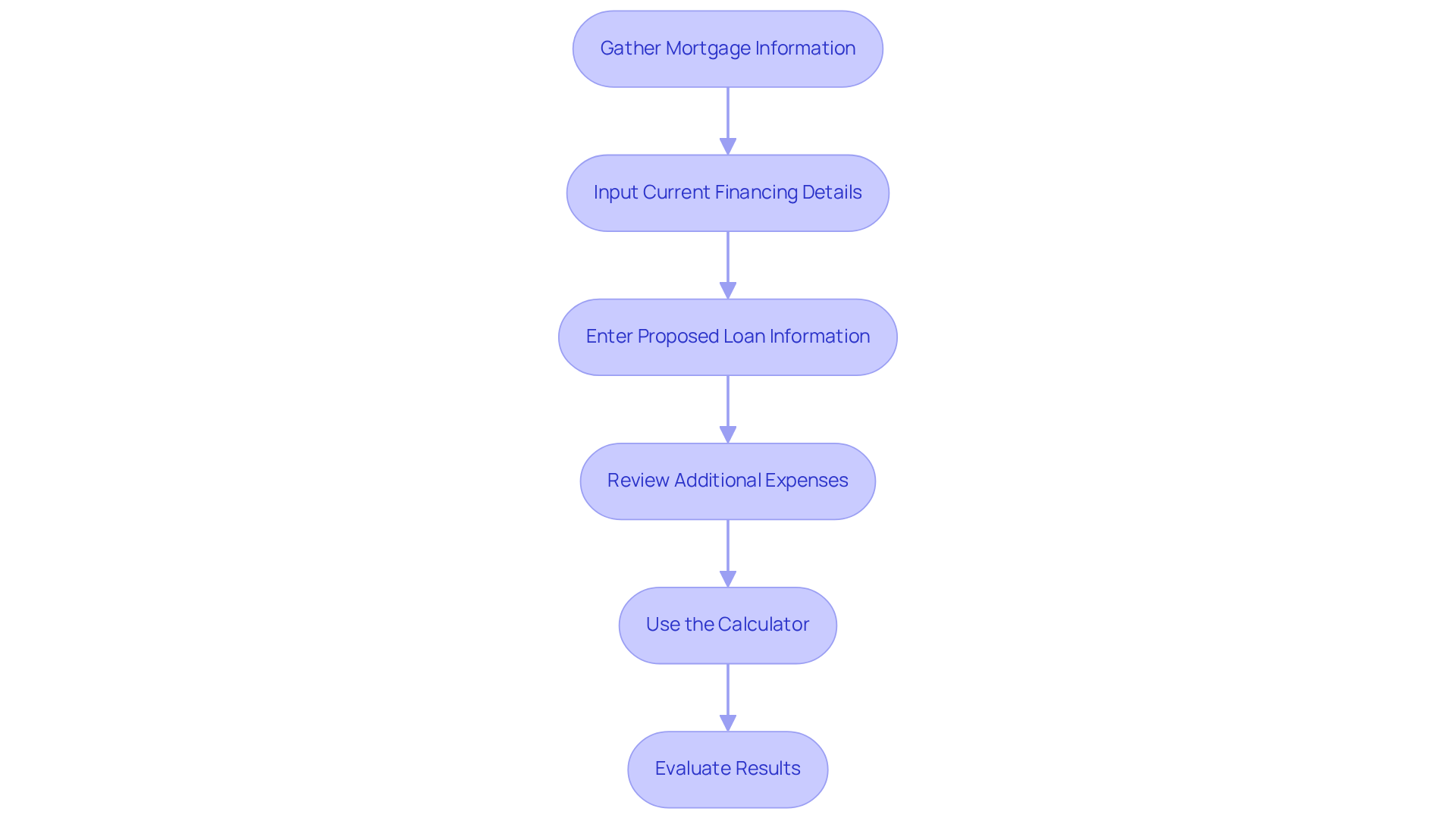

To effectively utilize a home refinance calculator, follow these steps:

-

Gather Your Current Mortgage Information: We understand how important it is to have all your details in one place. Begin by collecting your current mortgage statement. Key details include your current balance, interest rate, and remaining term.

-

Input Current Financing Details: Enter your existing borrowing amount, interest rate, and remaining term into the tool. This information is vital for accurate calculations, and we know how overwhelming this can feel.

-

Enter Proposed Loan Information: Input the new loan amount you are considering, the expected interest rate, and the desired loan term. If you plan to take cash out, include that amount as well. Remember, this is about finding the best option for you and your family.

-

Review Additional Expenses: Some calculators allow you to enter closing fees related to refinancing. Incorporating these expenses offers a thorough perspective on your possible savings. Typical mortgage refinance closing expenses include:

- Application charges (between $75 to $500)

- Origination fees (0.5% to 1.5% of the loan amount)

- Appraisal fees (around $300 to $500)

- Title search and insurance (0.5% to 1% of the loan amount)

Projected closing expenses for loan restructuring are frequently established at approximately $3,000 when using a home refinance calculator. We know that every dollar counts.

-

Use a home refinance calculator to determine your potential savings. To calculate and analyze results, use the home refinance calculator by clicking the calculate button to view your results. Examine the estimated monthly payment, total interest savings, and break-even point. To calculate your break-even point, determine your loan adjustment expenses (including all closing fees), calculate your monthly savings by subtracting your new monthly payment from your current one, and divide your loan adjustment expenses by your monthly savings. This analysis will help you assess whether refinancing is a viable option for your financial situation.

It’s common for homeowners to overlook closing expenses or fail to refresh their existing mortgage details correctly. Financial professionals emphasize the importance of gathering complete and accurate mortgage information to ensure reliable results. For instance, Joel Kan from the Mortgage Bankers Association advises homeowners to know their credit status and shop around for the best rates.

Additionally, it’s crucial to compare costs and negotiate with lenders, as advised by the Federal Trade Commission. In Colorado, homeowners have various options for mortgage modification, including conventional loans, FHA loans, VA loans, and streamlined refinance loans, which can cater to different financial situations.

Examples of homeowners successfully using refinance calculators illustrate their effectiveness. Many individuals have shared considerable savings by correctly entering their mortgage information and examining the outcomes, resulting in knowledgeable choices about loan adjustments. Remember, the loan modification procedure usually requires around 30 days from application to funding, so plan accordingly. We’re here to support you every step of the way.

Troubleshoot Common Issues and FAQs

When using a home refinance calculator, we understand how challenging it can be to navigate potential problems. Here are solutions to frequently asked questions to help you feel more confident in your decisions:

-

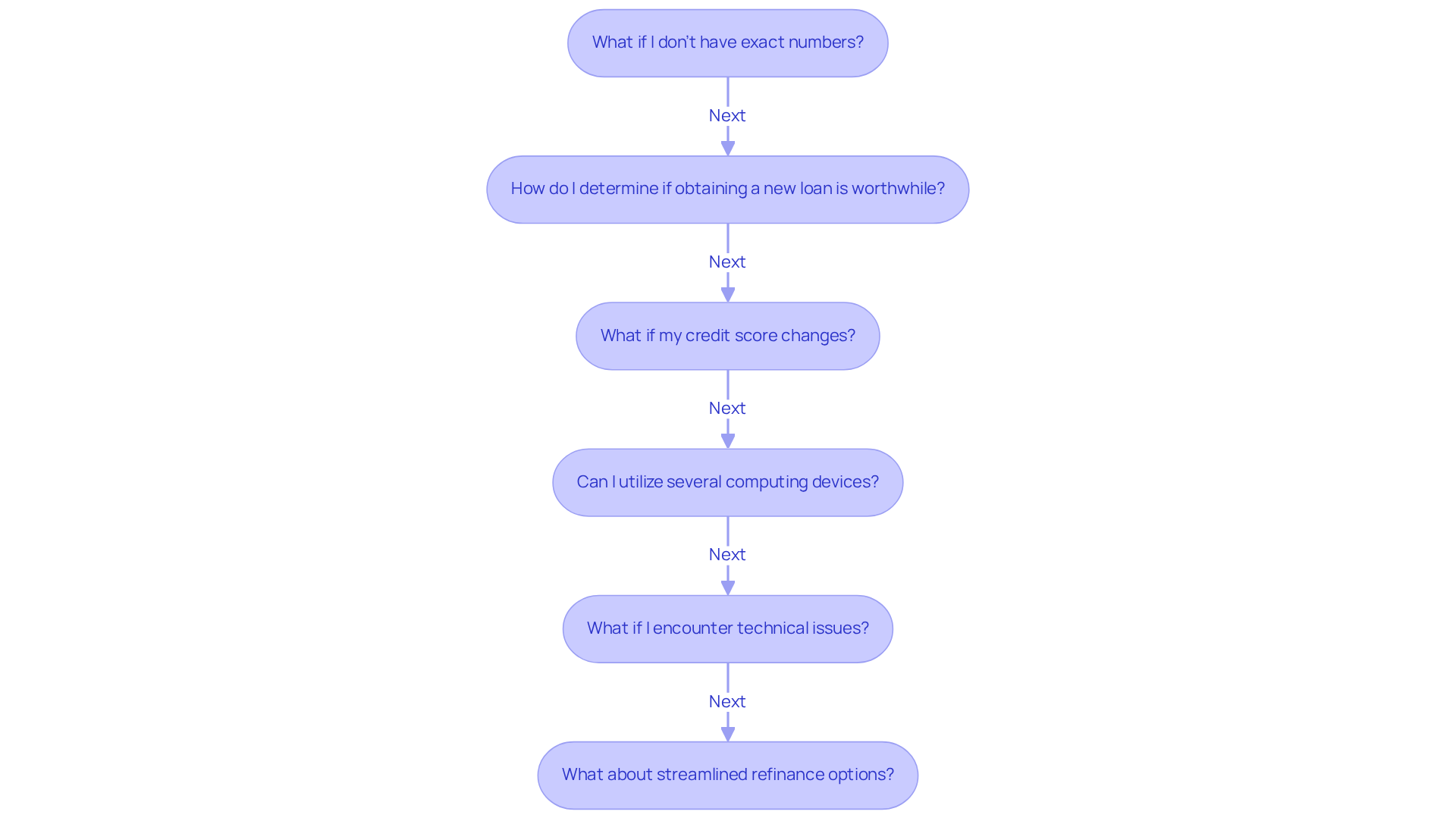

What if I don’t have exact numbers? Estimating your current mortgage details is completely acceptable. For more precise results, we recommend referring to your latest mortgage statement, which typically includes your remaining balance, interest rate, and monthly payment.

-

How do I determine if obtaining a new loan is worthwhile? The break-even point indicated by the home refinance calculator is crucial. If you plan to stay in your residence after this time, adjusting your mortgage could lead to significant savings. For instance, a reduction in your interest rate from 7.25% to 6.5% on a $400,000 loan could save you approximately $200 monthly. Additionally, understanding the detailed breakdown of mortgage refinance closing costs, such as application fees, origination fees, and appraisal fees, can help you assess the overall financial impact of refinancing.

-

What if my credit score changes? Changes in your credit score can impact the interest rate you qualify for. If your score increases, re-run the home refinance calculator with the updated figure to evaluate possible savings. Conversely, a decrease in your score may lead to higher rates, so it’s essential to stay informed. For FHA refinance loans, for example, a minimum credit score of 580 is typically required, while conventional loans may necessitate a score of at least 740 for the best rates.

-

Can I utilize several computing devices? Absolutely! Utilizing a home refinance calculator along with different tools can provide a more complete perspective on your refinancing choices. Each device may include various features or assumptions, assisting you in making a more informed choice.

-

What if I encounter technical issues? If the home refinance calculator is not functioning correctly, you should try refreshing the page or switching to a different browser. Should problems persist, consult the website’s support section for further assistance.

-

What about streamlined refinance options? If you currently have an FHA loan, consider the streamlined refinance option. This allows you to lower your interest rate with less documentation and a faster process.

By addressing these common concerns, homeowners can navigate the loan modification process more effectively and make informed decisions that align with their financial goals. As specialists often mention, millions of borrowers could save considerably if they think about restructuring their loans, especially as interest rates fluctuate. Understanding the detailed breakdown of mortgage refinance closing costs and calculating your break-even point can further enhance your refinancing strategy. We’re here to support you every step of the way.

Conclusion

Utilizing a home refinance calculator is a vital step for homeowners who want to optimize their mortgage terms and potentially save money. We understand how overwhelming this process can feel, but by learning how to input the necessary information and interpret the results, you can make informed decisions that align with your financial goals. This guide offers a comprehensive overview of the calculator’s purpose, a step-by-step process for using it effectively, and common troubleshooting tips to enhance your experience.

Key insights include:

- The importance of accurately gathering your current mortgage details

- Recognizing the potential for significant monthly savings

- Understanding how closing costs can impact your refinancing decisions

We also emphasize the value of:

- Knowing your break-even point

- Exploring the various refinancing options available

Ultimately, mastering the home refinance calculator is not just about crunching numbers; it’s about taking control of your financial future. As interest rates fluctuate and personal circumstances change, leveraging this tool can lead to substantial savings and improved financial well-being. We encourage you to explore your refinancing options and consult professionals when needed, ensuring that your decisions are well-informed and beneficial in the long run.

Frequently Asked Questions

What is the purpose of a home refinance calculator?

A home refinance calculator helps homeowners evaluate mortgage adjustments by providing insights into potential monthly savings, total interest savings over the loan’s life, and the break-even point for recouping refinancing costs.

How do you use a home refinance calculator?

To use a home refinance calculator, you enter details such as the current borrowing amount, interest rate, and proposed new terms. The calculator then provides information on savings and costs associated with refinancing.

What kind of savings can homeowners expect from refinancing?

Homeowners who use refinance calculators often find that restructuring their loans can lead to significant savings, typically around $200 each month.

What is the break-even point for refinancing?

The break-even point for recouping costs associated with refinancing generally hovers around 24 months when considering $4,800 in closing costs and $200 in monthly savings.

What are the typical closing costs for refinancing in California?

In California, closing costs for finalizing a mortgage refinance usually range from 2% to 5% of the loan amount. For a new loan amount of $300,000, this equates to approximately $6,000 to $15,000 in fees.

What types of fees are included in the closing costs for refinancing?

Closing costs can include application fees, origination fees, appraisal fees, and other related expenses that are important to consider when deciding on loan modifications.

How can F5 Mortgage assist homeowners with refinancing?

F5 Mortgage offers support to homeowners throughout the refinancing process, helping them navigate costs and the complexities of refinancing to ensure their choices align with their financial goals.