Overview

This article serves as a compassionate guide for those navigating the FHA loan application process. We understand how overwhelming this journey can feel, and we’re here to support you every step of the way. By focusing on the necessary preparations and documentation, we aim to empower potential homebuyers in their quest for homeownership.

To begin, it’s crucial to grasp the eligibility criteria. Knowing what qualifies you for an FHA loan can ease some of the uncertainty. Next, gathering the required documents is essential. We know how challenging this can be, but having everything in order can significantly smooth the process.

Additionally, we address common issues that many applicants face. By troubleshooting these challenges, you can navigate the application more successfully. Remember, each step you take enhances your likelihood of approval, bringing you closer to your dream of homeownership.

Introduction

Navigating the path to homeownership can often feel overwhelming, especially for first-time buyers and those with limited financial means. We understand how challenging this can be. FHA loans, backed by the Federal Housing Administration, present a unique opportunity to make homeownership more accessible. With lower down payment requirements and flexible eligibility criteria, these loans can help open doors that once seemed closed.

However, the application process can be fraught with challenges. Many potential homeowners find themselves wondering: what are the essential steps to successfully secure an FHA loan, and how can common pitfalls be avoided? This guide aims to demystify the FHA loan application process, equipping you with the knowledge and tools necessary to turn your homeownership dreams into reality. We’re here to support you every step of the way.

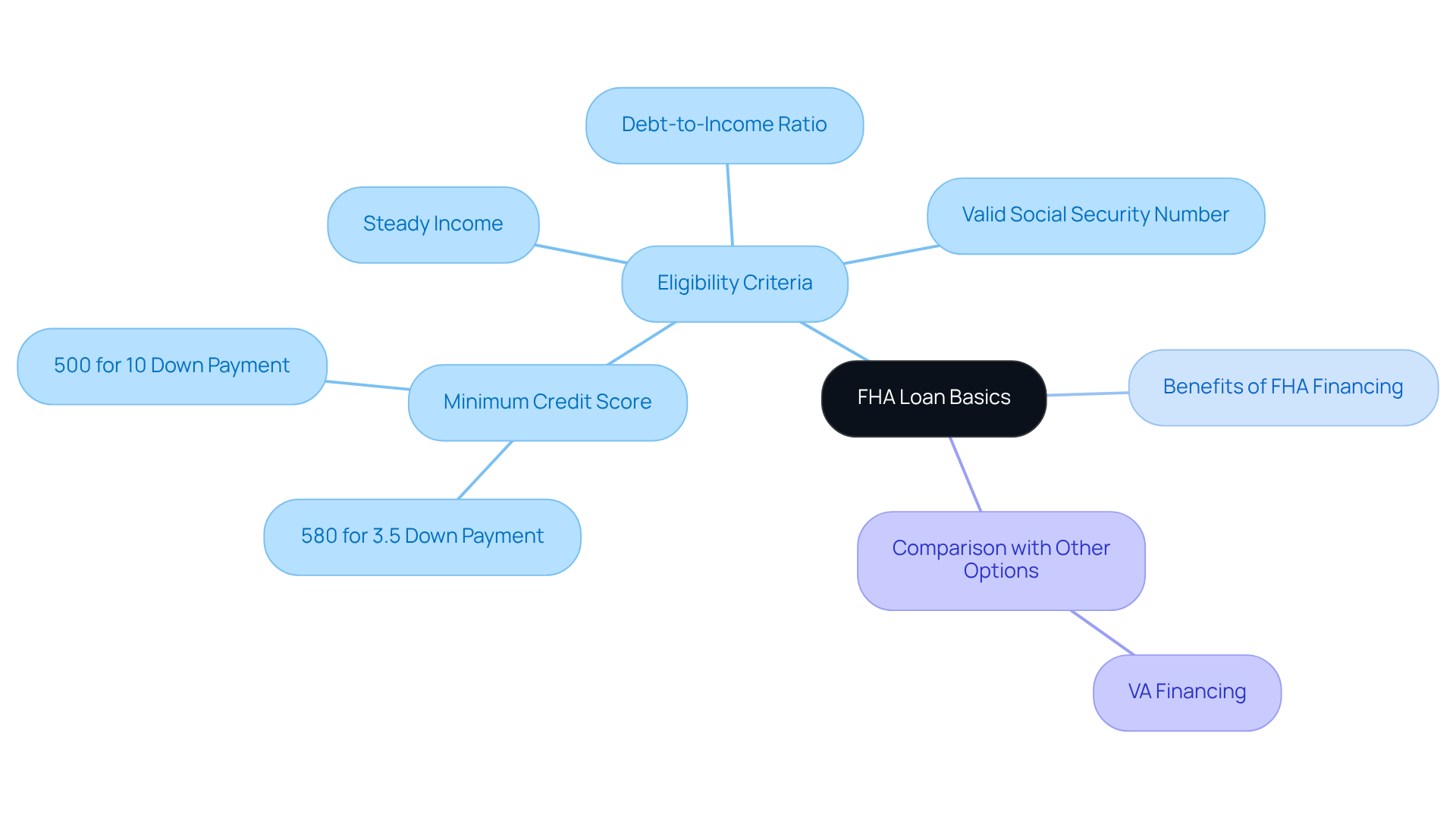

Understand FHA Loan Basics and Eligibility Criteria

FHA mortgages, backed by the Federal Housing Administration, are designed to help lower-income and first-time homebuyers like you secure financing with minimal down payment options. We understand how daunting this process can feel, especially when you’re trying to make your dream of homeownership a reality.

These financial products typically require a minimum credit score of 580 for a 3.5% down payment, or a score of 500 for a 10% down payment. This makes them attainable for many families looking to improve their living situations. To qualify, you’ll also need to show a steady income, maintain a manageable debt-to-income ratio, and possess a valid Social Security number.

Understanding these fundamentals is crucial for completing the FHA loan application. It will empower you to evaluate your eligibility and prepare for the FHA loan application process. As you weigh the benefits of FHA financing against other options, like VA financing, remember: we’re here to support you every step of the way.

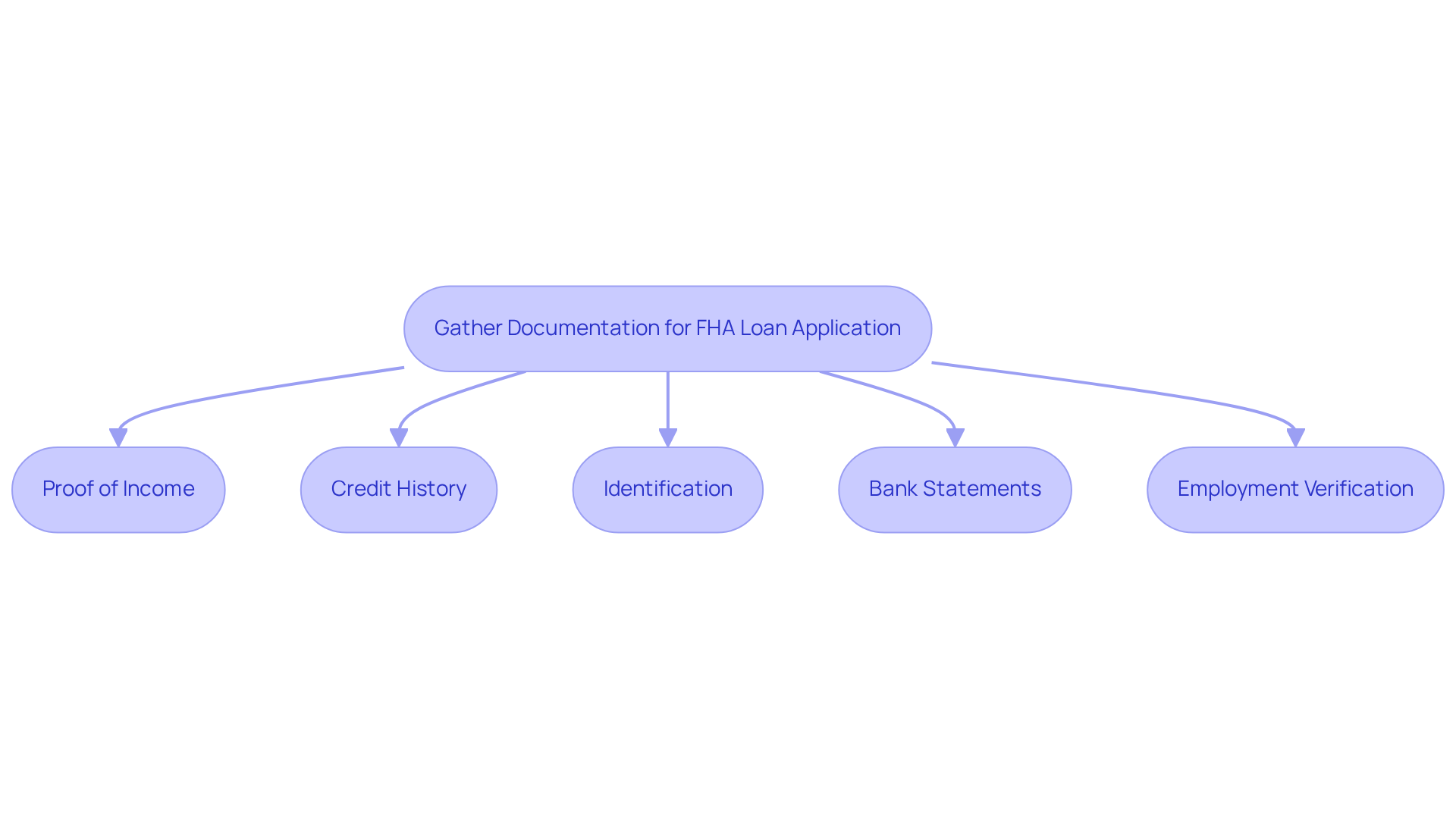

Gather Required Documentation for Your Application

Before you begin your journey toward securing an FHA loan application, it’s essential to gather a few important documents. We understand how overwhelming this process can feel, but having everything ready will help ease your mind.

- Proof of Income: You’ll need recent pay stubs, W-2 forms, and tax returns for the last two years. This documentation showcases your financial stability.

- Credit History: While your lender will check your credit rating, it’s wise to review your credit report for any discrepancies. A good credit score is vital, especially if you’re aiming for a favorable debt-to-income (DTI) ratio, ideally below 43% to qualify for competitive mortgage rates.

- Identification: Make sure to have a valid government-issued ID and your Social Security number handy.

- Bank Statements: Recent statements from all your bank accounts will help verify your assets.

- Employment Verification: A letter from your employer confirming your position and salary may also be required.

Having these documents ready will facilitate a smoother FHA loan application process. Remember, understanding your DTI ratio can empower you in exploring refinancing options available through F5 Mortgage, including conventional, FHA, and VA mortgages. We’re here to support you every step of the way, helping you choose the most suitable type for your financial circumstances.

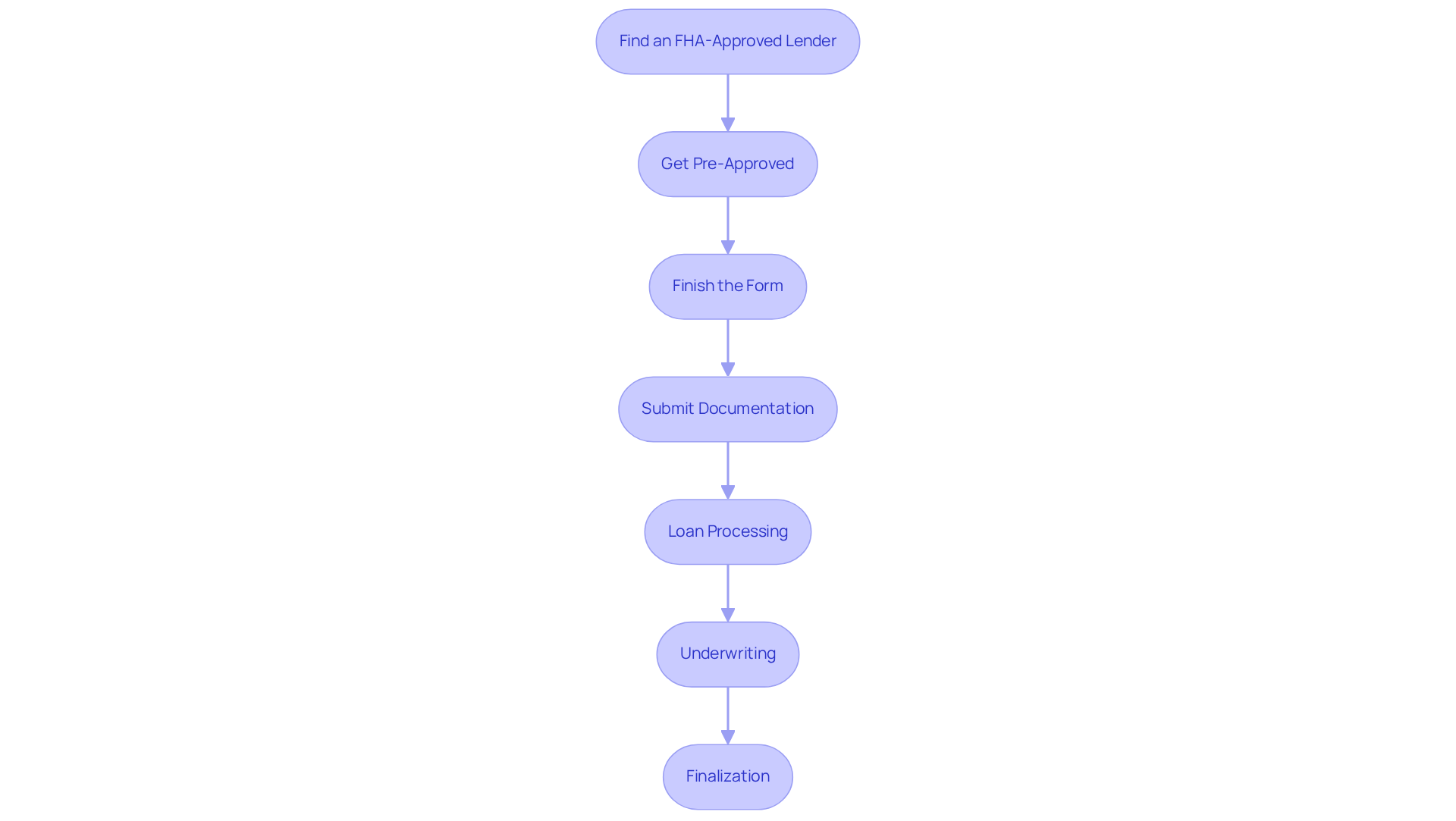

Navigate the FHA Loan Application Process Step-by-Step

To successfully apply for an FHA loan with F5 Mortgage, follow these essential steps:

-

Find an FHA-Approved Lender: We know how important it is to find the right support. Start by researching and selecting a lender approved by the FHA. A comprehensive list of approved lenders can be found on the HUD website, which includes local banks, national banks, and online mortgage companies.

-

Get Pre-Approved: Submit your financial information to the lender for pre-approval. This step is crucial as it provides insight into how much you can borrow and helps you understand your budget. Statistics indicate that borrowers who obtain pre-approval have a considerably greater likelihood of securing advantageous financing terms. With FHA options providing down payment requirements as low as 3.5% for credit scores of 580 or higher, it’s a step worth taking. At F5 Mortgage, we leverage user-friendly technology to simplify this process, ensuring you feel guided rather than pushed.

-

Finish the Form: Fill out the FHA loan application, ensuring you provide all necessary information about your financial situation, including income, debts, and assets. We’re here to help you through this.

-

Submit Documentation: Gather and submit required documentation to your lender. This generally encompasses personal identification, income verification, and property details, which are crucial for the lender to handle your request effectively.

-

Loan Processing: Once your request is submitted, the lender will begin processing it. This stage usually takes between 30 to 45 days, during which your information will be verified, and your creditworthiness assessed. It’s important to acknowledge that FHA mortgages necessitate upfront and annual mortgage insurance premiums (MIP) for the duration of the financing in most instances.

-

Underwriting: An underwriter will assess your submission and documentation to ensure you meet FHA guidelines. This step is essential, as it dictates your eligibility for the financial assistance.

-

Finalization: If your request is approved, you will proceed to the closing stage. Here, you will sign the final paperwork and officially obtain your funds, allowing you to proceed with your home purchase.

Real-world examples illustrate that many borrowers successfully navigate this process by staying organized and responsive to lender requests. By adhering to these steps with the assistance of F5 Mortgage, you can simplify your FHA financing process and enhance your likelihood of attaining homeownership. Remember, we’re here to support you every step of the way.

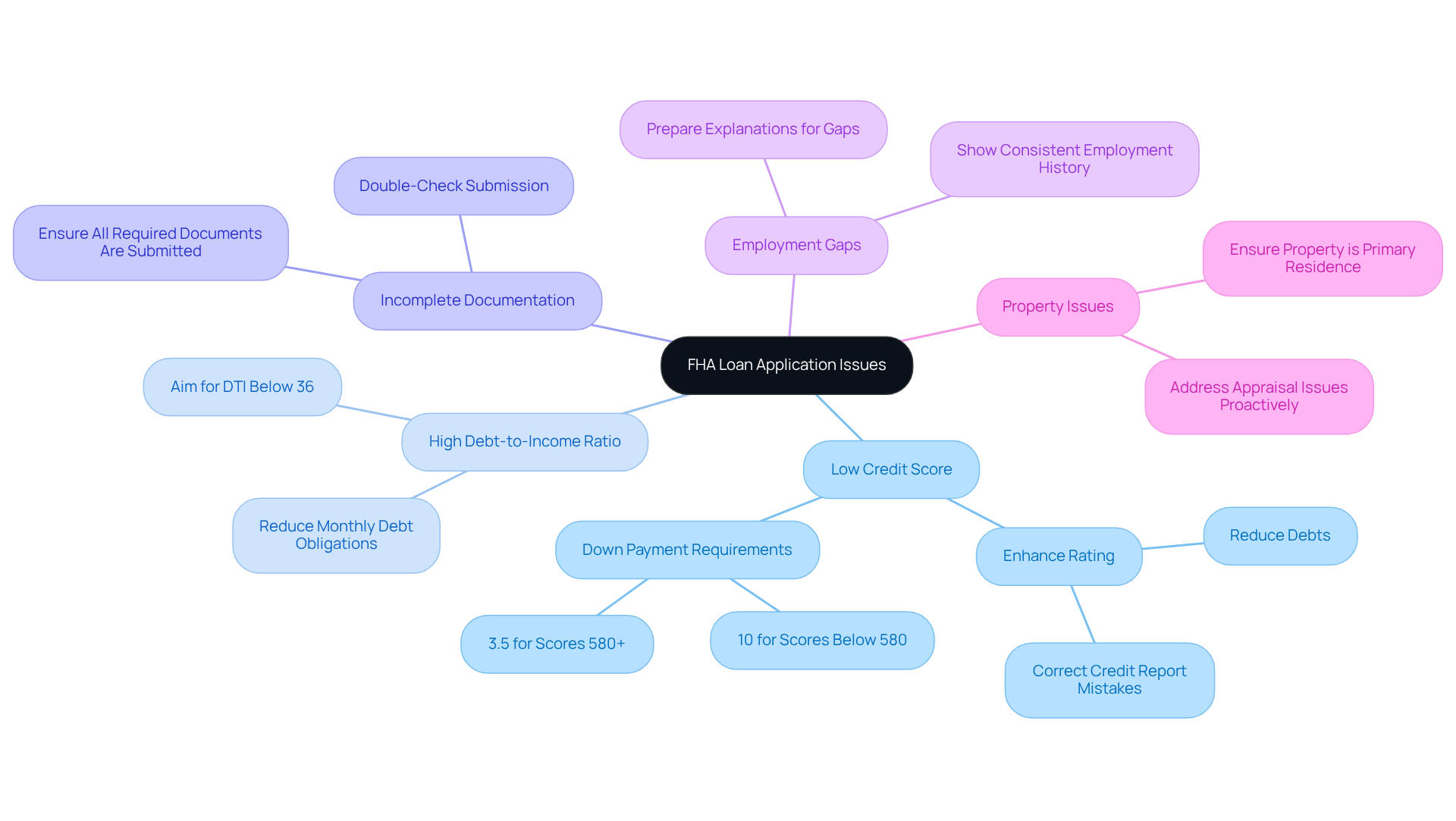

Troubleshoot Common FHA Loan Application Issues

Navigating the FHA loan application process can be daunting, and we recognize how challenging it can be. Common issues applicants face can significantly impact approval rates. Here’s how to troubleshoot them effectively:

-

Low Credit Score: A credit score below the required threshold can hinder your chances of approval. To enhance your rating, focus on reducing debts and correcting any mistakes on your credit report. For FHA financing, scores as low as 500 are permissible, but a score of 580 or above allows for a minimum down payment of just 3.5%. If your score is under 580, you’ll need to provide a 10% down payment instead, which is crucial to understand.

-

High Debt-to-Income Ratio: If your debt-to-income (DTI) ratio exceeds 43%, it’s essential to reduce your monthly debt obligations before applying. A favorable DTI ratio is below 36%, which can improve your eligibility for FHA financing. However, it’s important to remember that higher ratios may still qualify for a mortgage with additional criteria.

-

Incomplete Documentation: To avoid delays in the approval process, ensure that all required documents are submitted. Double-check your submission for completeness, as missing information can lead to complications.

-

Employment Gaps: If you have gaps in your employment history, be prepared to explain them to your lender. Consistent employment is crucial for approval, and lenders will want to understand any interruptions in your work history.

-

Property Issues: The property must be a primary residence and meet FHA standards. If any issues are identified during the appraisal, address them proactively before closing. Ensuring that the property is compliant can help mitigate potential problems and streamline the approval process.

By addressing these common challenges, you can enhance your chances of a successful FHA loan application and navigate the FHA loan application process with greater confidence. Remember, we’re here to support you every step of the way.

Conclusion

Mastering the FHA loan application process is a crucial step for those dreaming of homeownership with the help of affordable financing options. We understand how overwhelming this can feel, but by grasping the core elements of FHA loans—including eligibility criteria, required documentation, and a step-by-step navigation of the application—you can empower yourself to make informed decisions and enhance your chances of securing a mortgage.

In this guide, we’ve shared key insights that can help you along the way. For instance:

- Maintaining a good credit score

- Managing your debt-to-income ratio

- Ensuring all necessary documents are in order

These factors can make a significant difference. If you encounter common issues like low credit scores or incomplete documentation, remember that troubleshooting these challenges proactively can greatly improve your chances of a successful application. By following these steps, you can simplify your journey toward homeownership.

Ultimately, the FHA loan application process opens doors for first-time homebuyers and those with lower incomes to enter the housing market. With the right knowledge and preparation, the dream of owning a home is within reach. We encourage you to stay informed and proactive in this endeavor, as the benefits of FHA financing can lead to a brighter future for you and your family.

Frequently Asked Questions

What is an FHA loan?

An FHA loan is a mortgage backed by the Federal Housing Administration, designed to help lower-income and first-time homebuyers secure financing with minimal down payment options.

Who can benefit from FHA loans?

FHA loans are particularly beneficial for lower-income families and first-time homebuyers looking to improve their living situations.

What are the credit score requirements for an FHA loan?

To qualify for an FHA loan, you typically need a minimum credit score of 580 for a 3.5% down payment or a score of 500 for a 10% down payment.

What other criteria must be met to qualify for an FHA loan?

In addition to credit score requirements, you must show a steady income, maintain a manageable debt-to-income ratio, and possess a valid Social Security number.

Why is it important to understand FHA loan basics?

Understanding FHA loan basics is crucial for completing the loan application process, evaluating your eligibility, and preparing for the application.

How does FHA financing compare to other options like VA financing?

While the article mentions weighing the benefits of FHA financing against other options like VA financing, it does not provide specific comparisons. It encourages readers to consider their options and seek support during the process.