Overview

This article offers essential strategies and insights for managing a $200,000 mortgage payment effectively. We understand how challenging this can be, and it’s crucial to grasp the various components of your loan, including interest rates and refinancing options. By breaking down the essential elements—principal, interest, taxes, and insurance (PITI)—we aim to provide clarity and support.

We want to empower you with practical strategies. Consider the following actions:

- Making extra payments

- Shopping around for better rates

These actions can significantly reduce your monthly costs and help you navigate your financial responsibilities with confidence. Remember, we’re here to support you every step of the way as you work towards financial stability.

Introduction

Navigating the intricacies of a $200,000 mortgage payment can feel like wandering through a maze of financial terms and choices. We understand how overwhelming this can be, especially with factors like loan duration, interest rates, and initial contributions playing crucial roles. Many prospective homeowners find themselves grappling with how to make informed decisions that will impact their futures.

In this article, we’ll explore essential strategies and insights designed to empower you in managing your mortgage payments effectively. By doing so, you could save significant amounts over time, easing some of the financial burdens you may face. However, with so many options available, how can you ensure you are making the best financial decisions for your future? We’re here to support you every step of the way.

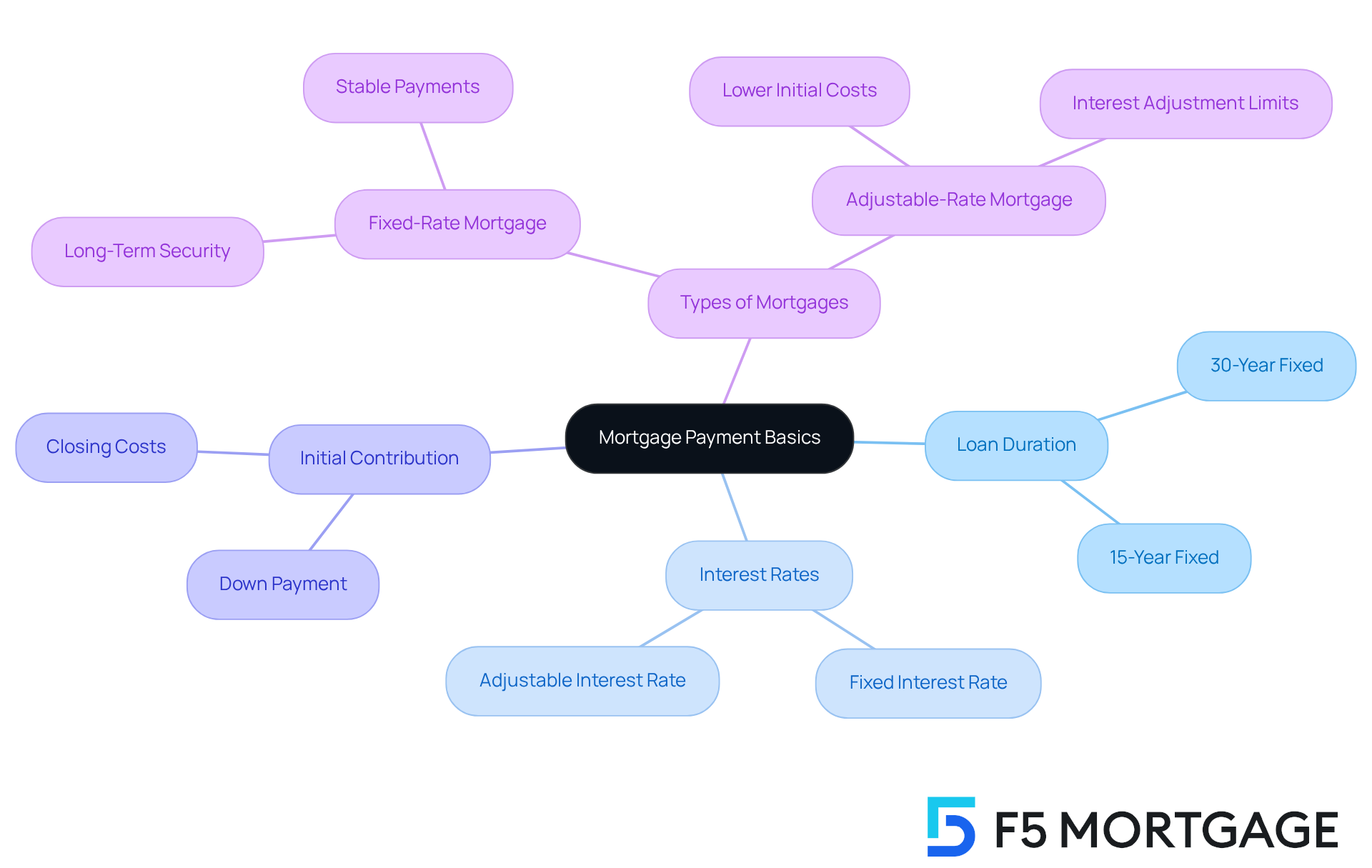

Explore the Basics of a $200,000 Mortgage Payment

When considering a 200k mortgage payment, it’s essential to understand the key components involved, including the loan duration, interest percentage, and initial contribution. For instance, if you secure a 30-year fixed-interest loan at a 6% rate, your 200k mortgage payment would amount to approximately $1,199, excluding taxes and insurance. We know how overwhelming this process can feel, especially when exploring various options.

One alternative worth considering is an adjustable-rate mortgage (ARM). ARMs often come with lower initial costs, making them appealing for those who plan to pay off their mortgage quickly or refinance within a few years. During the introductory phase, the initial interest rate is set, but it will adjust according to market conditions, typically every six months. To protect you from significant increases, these loans also include interest adjustment limits.

Understanding these choices is crucial as you prepare for the financial responsibilities of homeownership. It empowers you to budget effectively for your monthly expenses. Additionally, it’s important to consider how your credit rating and financial history can impact the interest rate you receive, which directly affects your monthly payment amount. Remember, we’re here to support you every step of the way as you navigate these decisions.

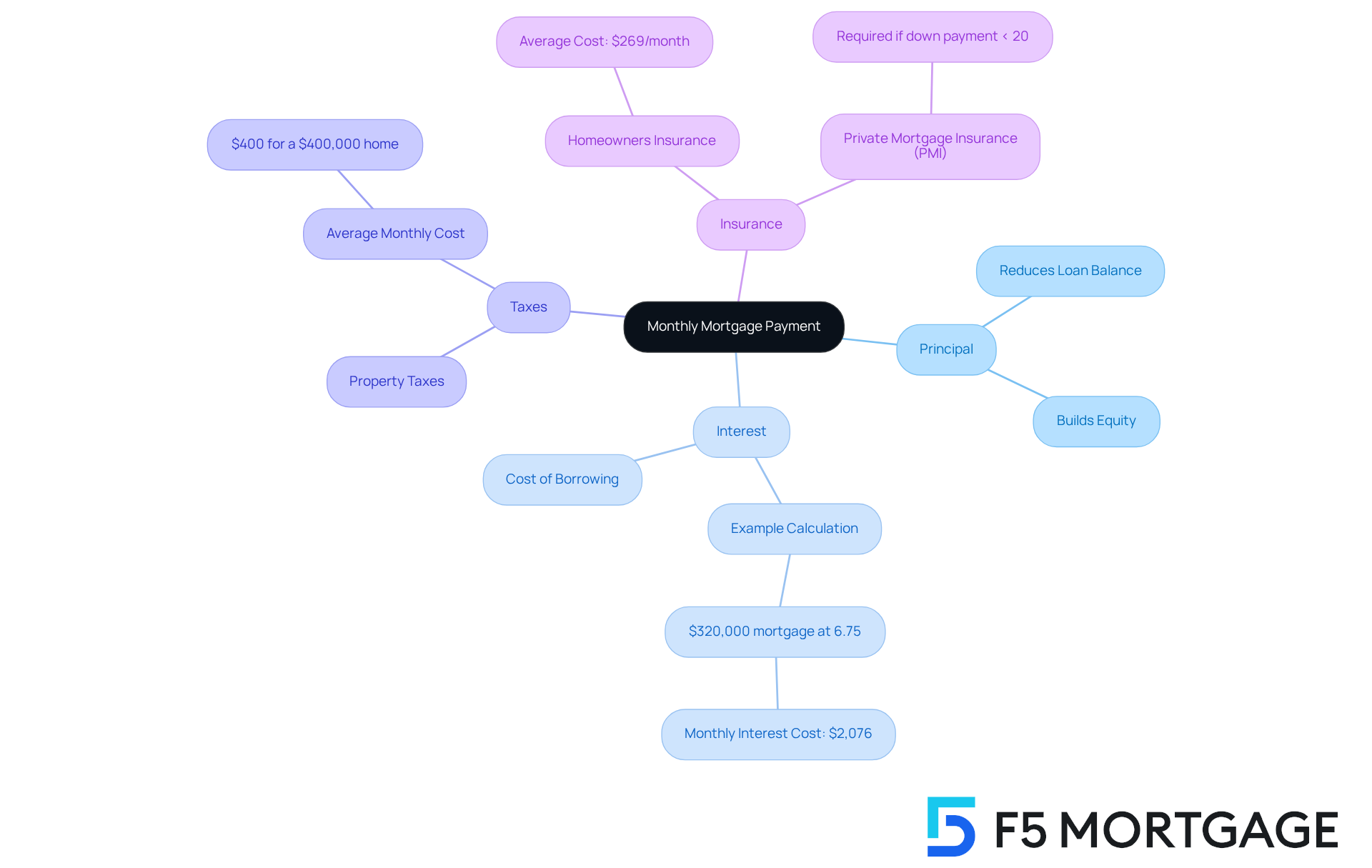

Break Down the Components of Your Monthly Mortgage Payment

Your regular loan installment consists of several essential elements, collectively referred to as PITI: Principal, Interest, Taxes, and Insurance. Understanding these components can feel overwhelming, but we’re here to support you every step of the way.

- Principal: This segment of your contribution directly lowers the loan balance, adding to your equity in the home over time. It’s a crucial part of building your financial future.

- Interest: This represents the cost of borrowing, calculated as a percentage of the remaining loan balance. For example, on a $320,000 mortgage with a 6.75 percent interest, the interest cost each month would be roughly $2,076. Knowing this helps you plan your finances better.

- Taxes: Property taxes are usually incorporated in your monthly contribution and are retained in an escrow account until they are due. For a $400,000 home, property taxes can average around $400 per month, depending on local rates. Understanding these costs can prevent surprises down the road.

- Insurance: Homeowners insurance protects your property, and if your initial contribution is less than 20%, you may also need to pay for private mortgage insurance (PMI). In 2025, a significant percentage of homeowners are expected to pay PMI, reflecting the common practice of securing additional coverage when equity is low. The average homeowners insurance estimate for a $400,000 home is approximately $269 per month. This coverage is vital for your peace of mind.

Comprehending these elements is essential, as each influences your total compensation and future financial strategy. Lenders consider PITI when deciding on loan approvals, making it essential for borrowers to grasp how these elements influence their financial obligations. For instance, understanding how property taxes and homeowners insurance premiums can vary over time can assist you in anticipating changes in your obligations, ensuring you stay ready for any adjustments in your budget. As Taylor Freitas observes, maximum PITI signifies the highest regular housing expense you can manage based on your DTI ratio, income, and other debt responsibilities. We know how challenging this can be, but with the right knowledge, you can navigate these waters confidently.

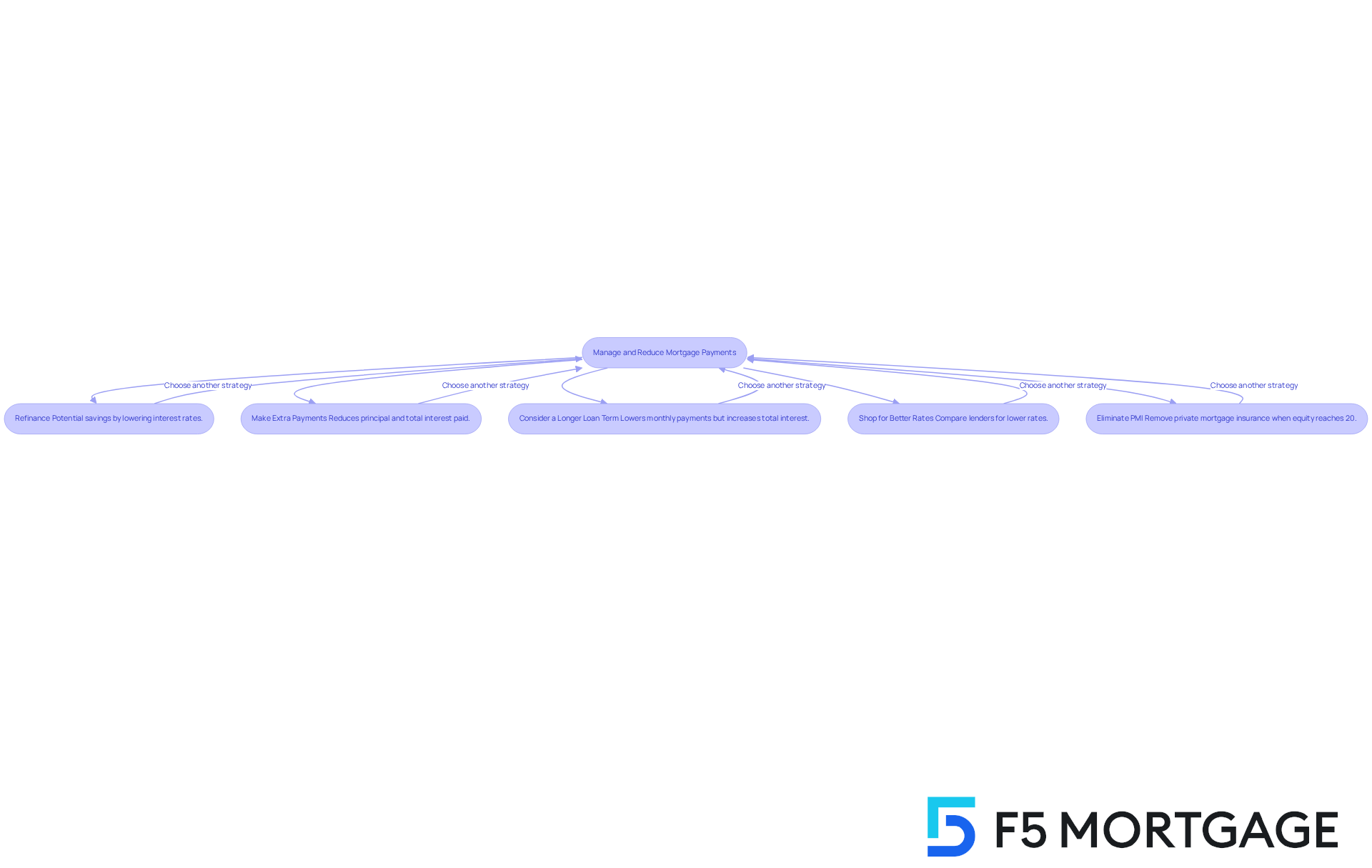

Implement Strategies to Manage and Reduce Your Mortgage Payments

Managing your 200k mortgage payment can be a daunting task, but there are effective strategies that can help you navigate this process with greater ease and potentially reduce your monthly costs.

-

Refinance: With interest rates fluctuating, refinancing your mortgage may offer significant savings. In 2025, many homeowners are finding opportunities to refinance, especially as rates hover around 6.5%. For instance, if your rate drops from 7.25% to 6.5%, you could save approximately $200 each month on a $400,000 loan.

-

Make Extra Payments: Contributing additional funds toward your principal can lead to substantial savings in interest over time, while also shortening your loan term. Homeowners who adopt this approach often notice a significant decrease in the total interest paid, providing a sense of relief.

-

Consider a Longer Loan Term: While extending your loan term can lower your monthly payments, it may also increase your total interest costs. This strategy can offer immediate financial relief, making it easier to manage your monthly expenses associated with a 200k mortgage payment.

-

Shop for Better Rates: Regularly comparing loan rates from different lenders is essential. With nearly 60% of active loans currently below 4%, there are opportunities to secure better deals that can enhance your financial situation.

-

Eliminate PMI: If your equity reaches 20%, you can request the removal of private mortgage insurance (PMI). This step can significantly lower your monthly payments, adding to your financial flexibility.

By embracing these strategies, you can achieve meaningful savings and greater financial freedom. We understand how challenging this process can be, and we’re here to support you every step of the way, making your financing journey more manageable and less stressful.

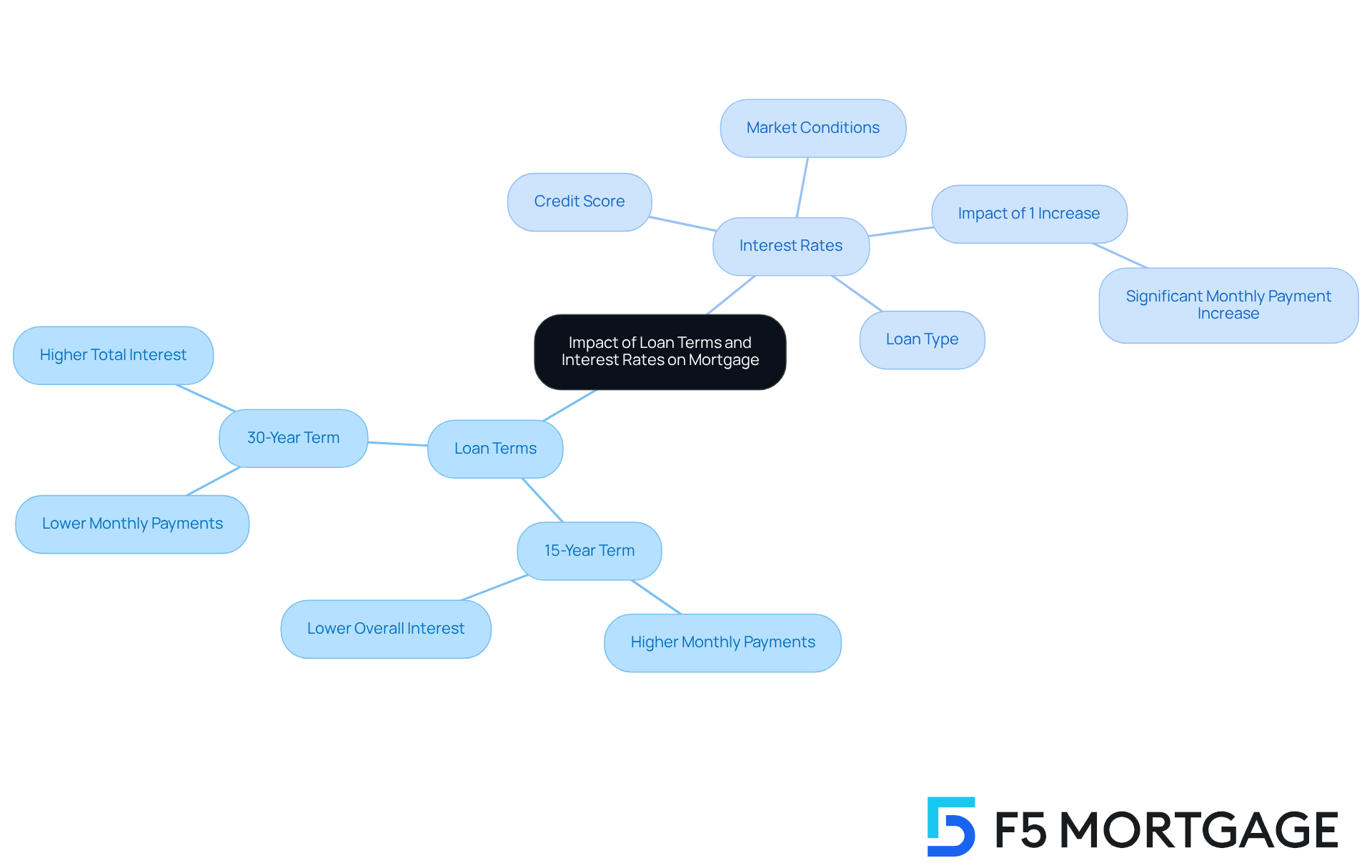

Understand the Impact of Loan Terms and Interest Rates on Your Mortgage

Understanding loan terms and interest rates is essential for effectively managing your costs related to a 200k mortgage payment. We know how challenging this can be, especially when faced with choices that impact your financial future. Generally, opting for shorter loan durations, like 15 years, means higher regular payments but leads to lower overall interest expenses throughout the loan’s life. On the other hand, longer durations, such as 30 years, offer reduced monthly installments but come with higher total interest costs.

Your interest rate is influenced by several factors, including your credit score, current market conditions, and the specific type of loan you choose. Even a small increase of just 1% in interest can significantly raise your monthly payment, potentially adding hundreds of dollars to your budget. As of mid-2025, the average rate for a 30-year fixed loan is around 6.84%, while the 15-year fixed rate is approximately 5.97%.

Grasping these dynamics is crucial for making informed choices about your loan, allowing you to select an option that aligns with your financial goals. Furthermore, obtaining approval from a lender indicates that, based on your financial information, you are a good candidate for a mortgage. This approval typically includes an estimate of your loan amount, interest rate, and potential monthly payment, like a 200k mortgage payment, which can guide you as you navigate the home buying process. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of a $200,000 mortgage payment is vital for any prospective homeowner. We know how challenging this can be. This article emphasizes the importance of grasping essential components such as loan duration, interest rates, and the overall financial implications of homeownership. By familiarizing yourself with these elements, you can better prepare for the responsibilities that accompany mortgage payments, ensuring a smoother journey toward homeownership.

Key insights discussed throughout the article include the breakdown of monthly payments into principal, interest, taxes, and insurance (PITI). Additionally, various strategies to manage and potentially reduce mortgage payments were explored. These include:

- Refinancing

- Making extra payments

- Shopping for better rates

Understanding how loan terms and interest rates impact overall costs is crucial; even minor fluctuations can lead to significant changes in your monthly obligations.

Ultimately, the significance of being informed cannot be overstated. By actively engaging with the factors that influence mortgage payments, you can make educated decisions that align with your financial goals. Embracing these strategies and insights empowers you to navigate your mortgage journey with confidence, leading to greater financial stability and peace of mind. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is the estimated monthly payment for a $200,000 mortgage with a 30-year fixed interest loan at a 6% rate?

The estimated monthly payment would be approximately $1,199, excluding taxes and insurance.

What are the key components to consider when taking out a mortgage?

The key components include the loan duration, interest percentage, and initial contribution.

What is an adjustable-rate mortgage (ARM)?

An adjustable-rate mortgage (ARM) is a type of loan that often has lower initial costs and features an interest rate that adjusts according to market conditions, typically every six months after an introductory phase.

Who might benefit from choosing an ARM?

An ARM may be appealing for those who plan to pay off their mortgage quickly or refinance within a few years.

How does a borrower’s credit rating affect their mortgage?

A borrower’s credit rating and financial history can impact the interest rate they receive, which directly affects their monthly payment amount.

Why is it important to understand mortgage options?

Understanding mortgage options is crucial for budgeting effectively for monthly expenses and preparing for the financial responsibilities of homeownership.