Overview

This article is dedicated to helping families navigate the often daunting task of negotiating closing costs during a home upgrade. We understand how challenging this process can be, and it’s crucial to grasp the various components of closing costs. By preparing through research and developing a solid strategy, families can feel empowered to tackle this financial hurdle.

Moreover, employing effective negotiation techniques can lead to better financial outcomes. We’re here to support you every step of the way, equipping you with the knowledge needed to approach this complex process with confidence. Let’s explore how you can turn this challenge into an opportunity for growth and savings.

Introduction

Understanding the intricacies of closing costs is essential for families embarking on the journey of upgrading their homes. These often-overlooked fees can significantly impact your overall financial picture. From loan origination to appraisal and title insurance, the details can feel overwhelming. We know how challenging this can be.

As families prepare to negotiate these expenses, they face the dual challenge of comprehending what these costs entail and mastering the art of negotiation. How can you effectively navigate this complex landscape? It’s crucial to ensure that you aren’t overpaying for your dream home.

We’re here to support you every step of the way, helping you to understand these costs and empowering you to secure the best possible deal.

Understand Closing Costs: Definition and Components

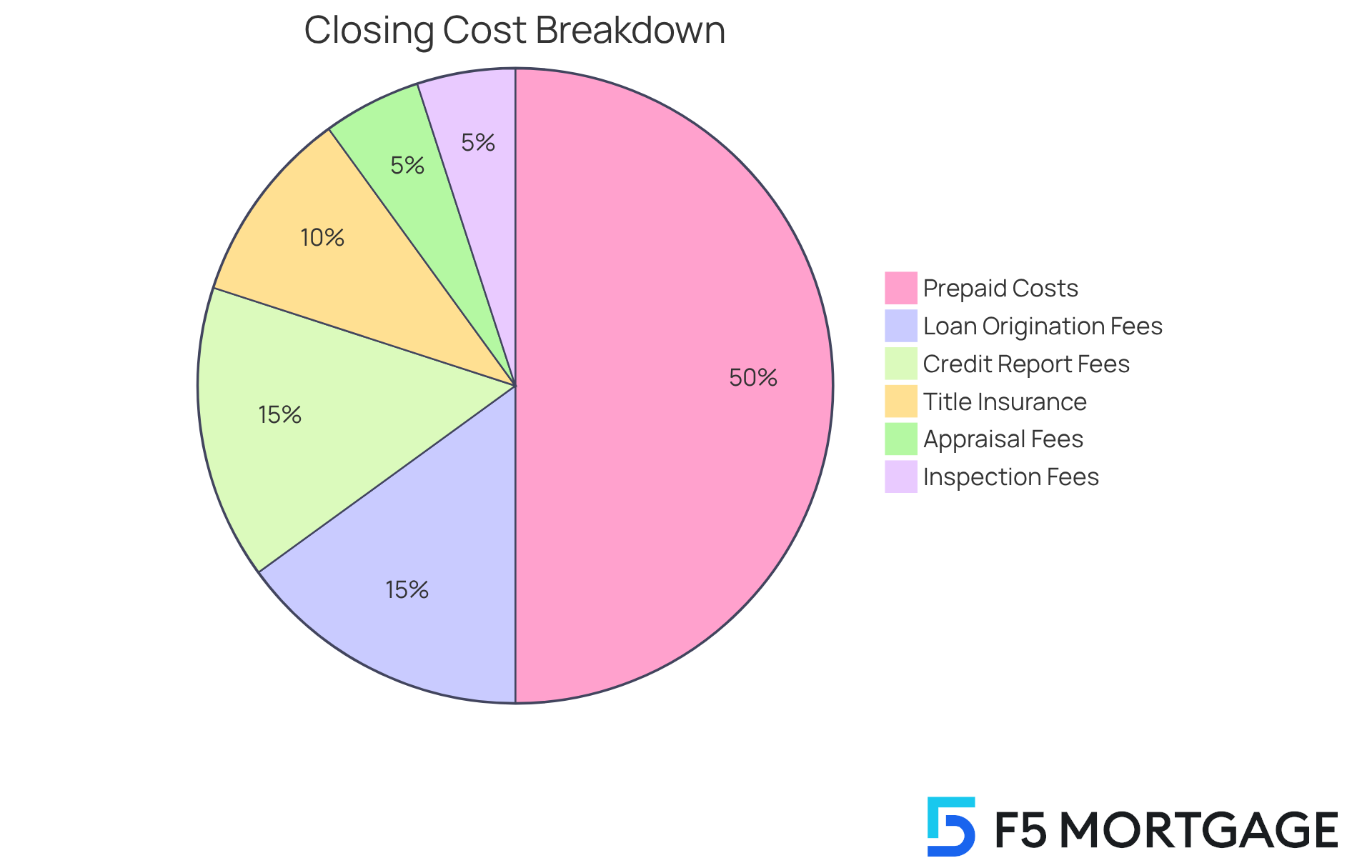

Closing fees can feel overwhelming, but understanding them is crucial for families who are negotiating closing costs in the mortgage process. These charges and expenses related to completing a mortgage typically range from 2% to 5% of the loan amount. Knowing what these costs entail can help you plan better for your financial future.

- Loan Origination Fees are one of the first costs you might encounter. Charged by the lender for processing the loan, these fees usually fall between 0.5% and 1.5% of the loan amount.

- Then there are Appraisal Fees, which assess the property’s value and generally range from $300 to $500, depending on your location and property type.

- Title Insurance is another important cost, safeguarding you against potential conflicts regarding property ownership. Its expenses can vary from 0.5% to 1% of the loan amount.

- Don’t forget about Inspection Fees, which evaluate the home’s condition and can differ based on the property itself.

- Additionally, there are Prepaid Costs, like property taxes and homeowners insurance, as well as Credit Report Fees, typically around $35, necessary for assessing your creditworthiness.

We know how challenging this can be, but understanding these elements helps families predict the overall expenses related to negotiating closing costs for their home improvement. This understanding enables improved financial planning. Moreover, determining your break-even point can illuminate how long it will take to recover these expenses through savings in monthly payments or interest rates. For instance, if your refinancing expenses amount to $4,000 and your monthly savings are $100, your break-even point would be 40 months ($4,000 / $100 = 40 months).

This knowledge is crucial for families considering refinancing options like rate-and-term loans, which can significantly reduce monthly mortgage payments. We’re here to support you every step of the way as you explore your options.

Prepare for Negotiation: Research and Strategy Development

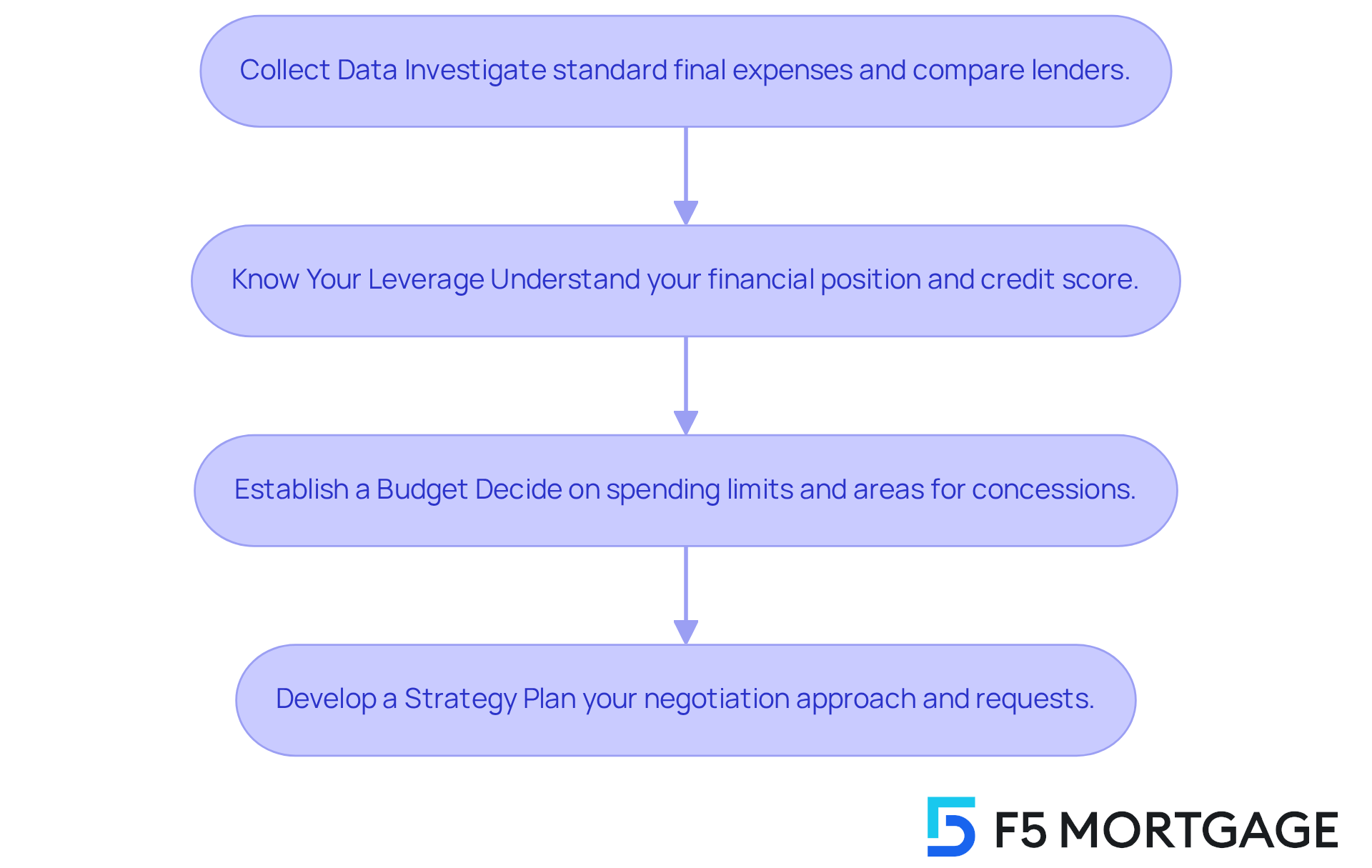

Preparing for negotiating closing costs can feel overwhelming, but with the right steps, families can approach this process with confidence.

-

First, collect data. Investigate standard final expenses in your region and compare them among various lenders. Websites like Zillow or Bankrate can provide valuable insights. Additionally, consider working with F5 Mortgage, which offers competitive rates and personalized service tailored to your needs.

-

Next, know your leverage. Understanding your financial position, including your credit score and down payment, is crucial, as these factors can significantly influence your negotiation power.

-

Establish a budget. Decide how much you are prepared to spend on final expenses and identify areas where you can make concessions. This clarity will empower you during negotiations.

-

Finally, develop a strategy. Think about your negotiation approach—whether it’s asking for a specific reduction or requesting that certain fees be waived altogether.

By being well-prepared and considering options like F5 Mortgage, families can confidently and clearly navigate the process of negotiating closing costs. Remember, we’re here to support you every step of the way.

Negotiate Effectively: Techniques for Reducing Closing Costs

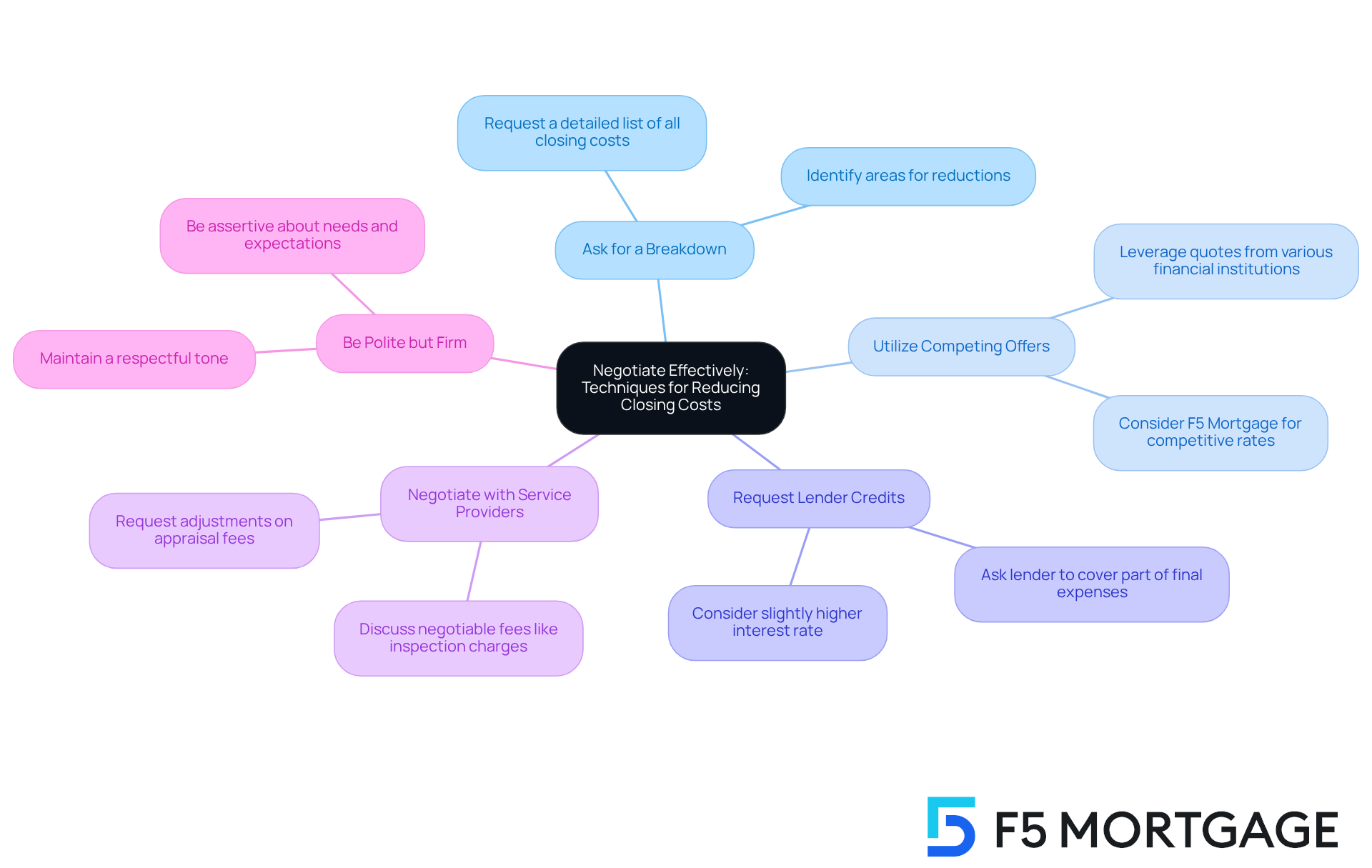

When negotiating closing costs, we know how challenging this can be, but there are several techniques you can use to ease the process:

- Ask for a Breakdown: Request a detailed list of all closing costs. This will help you identify areas where reductions can be made, giving you more control over your expenses.

- Utilize Competing Offers: If you have quotes from various financial institutions, consider using them as leverage. This can lead to improved terms with your chosen provider. F5 Mortgage, for instance, offers competitive rates and personalized service, making it a strong option for your mortgage needs.

- Request Lender Credits: You can ask the lender to cover part of the final expenses in exchange for a slightly higher interest rate. This option can alleviate some of the upfront costs.

- Negotiate with Service Providers: Remember that some fees, such as inspection or appraisal charges, may be negotiable with the service providers. Don’t hesitate to ask for adjustments.

- Be Polite but Firm: It’s important to maintain a respectful tone while being assertive about your needs and expectations. This balance can lead to more favorable outcomes.

Implementing these techniques can lead to significant savings when negotiating closing costs, and we’re here to support you every step of the way.

Overcome Challenges: Troubleshooting Common Negotiation Issues

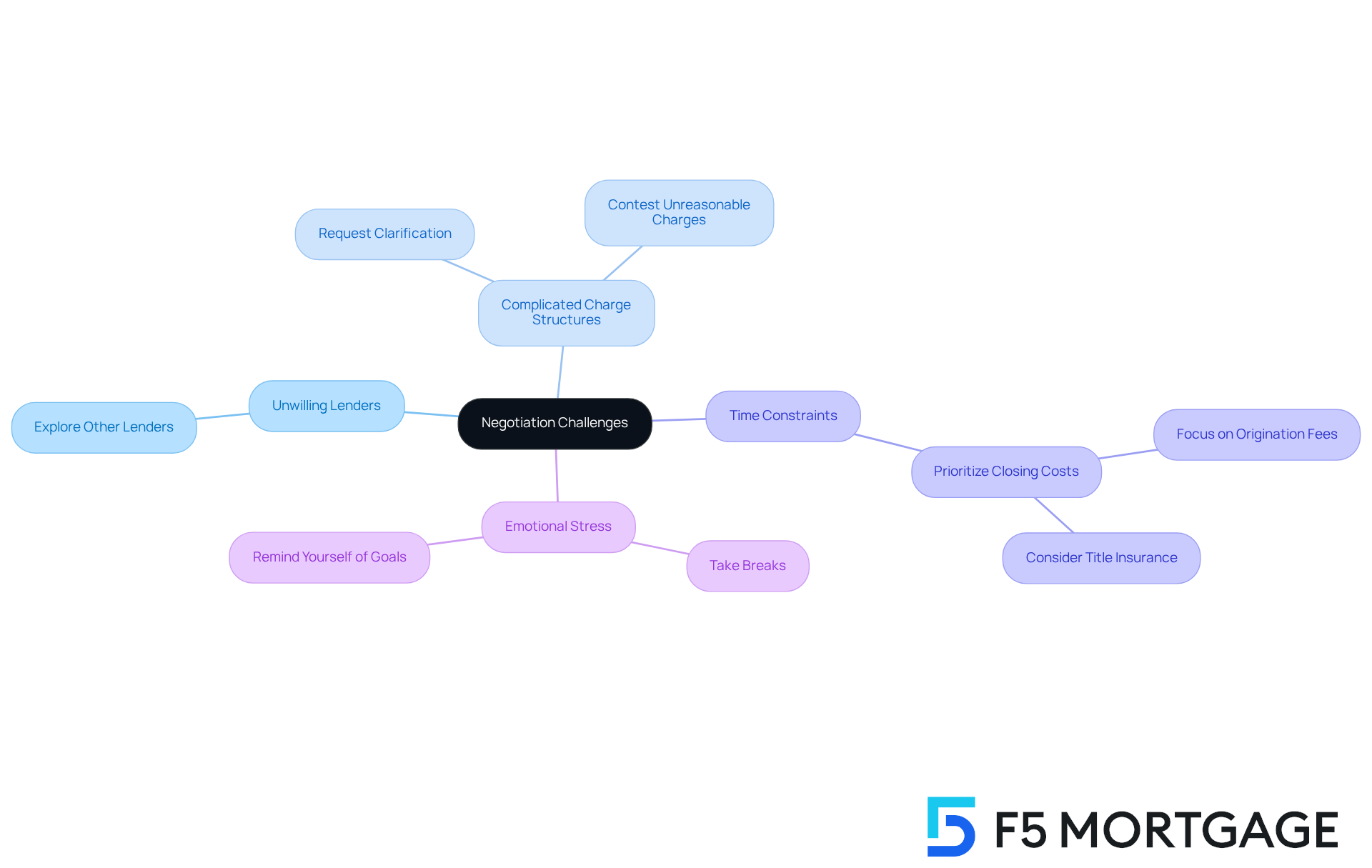

Families often encounter various challenges during negotiations, and it’s important to recognize them.

- Unwilling Lenders can pose a significant hurdle; if a lender is resistant to negotiation, consider exploring other lenders who may be more flexible.

- Complicated Charge Structures can also be confusing. If costs seem unclear, don’t hesitate to request clarification and contest any charges that appear unreasonable or unjustified.

- Time constraints can add pressure to the process. If time is limited, prioritize negotiating closing costs, such as origination fees or title insurance, first.

- Additionally, we know that Emotional Stress can arise during negotiations. Remember, it’s okay to take breaks as needed and remind yourself of your goals.

By anticipating these challenges and having strategies in place, families can navigate the negotiation process more effectively. We’re here to support you every step of the way, empowering you to achieve the best outcomes.

Conclusion

Understanding and mastering the art of negotiating closing costs is essential for families looking to upgrade their homes. We know how challenging this can be, but by grasping the various components of these costs and employing effective negotiation strategies, families can significantly reduce their financial burden and make informed decisions during the mortgage process.

Key insights from the article highlight the importance of thorough preparation. This includes:

- Researching standard fees

- Knowing your financial leverage

- Developing a clear negotiation strategy

Techniques such as:

- Requesting detailed cost breakdowns

- Leveraging competing offers

- Negotiating with service providers

can lead to substantial savings. Additionally, being aware of common challenges, such as unwilling lenders and complicated charge structures, allows families to navigate potential obstacles with confidence.

Ultimately, the ability to negotiate closing costs effectively not only enhances financial outcomes but also empowers families to achieve their homeownership goals. By taking proactive steps and utilizing available resources, families can ensure a smoother and more beneficial home upgrade experience. Embracing these strategies is vital for anyone looking to make the most of their investment in real estate. We’re here to support you every step of the way.

Frequently Asked Questions

What are closing costs in the mortgage process?

Closing costs are charges and expenses related to completing a mortgage, typically ranging from 2% to 5% of the loan amount.

What are Loan Origination Fees?

Loan Origination Fees are charges from the lender for processing the loan, usually falling between 0.5% and 1.5% of the loan amount.

How much do Appraisal Fees typically cost?

Appraisal Fees, which assess the property’s value, generally range from $300 to $500, depending on location and property type.

What is Title Insurance, and what does it cost?

Title Insurance safeguards against potential conflicts regarding property ownership, with expenses varying from 0.5% to 1% of the loan amount.

What are Inspection Fees?

Inspection Fees evaluate the home’s condition and can differ based on the property itself.

What are Prepaid Costs in relation to closing costs?

Prepaid Costs include expenses like property taxes and homeowners insurance that are paid upfront during the closing process.

What is the typical cost for Credit Report Fees?

Credit Report Fees, necessary for assessing creditworthiness, are typically around $35.

How can understanding closing costs help with financial planning?

Understanding closing costs helps families predict overall expenses related to negotiating these costs, enabling improved financial planning.

What is a break-even point in the context of refinancing?

The break-even point is the time it takes to recover refinancing expenses through savings in monthly payments or interest rates. For example, if refinancing expenses are $4,000 and monthly savings are $100, the break-even point would be 40 months.

Why is knowledge of closing costs important for families considering refinancing?

Knowledge of closing costs is crucial for families considering refinancing options, such as rate-and-term loans, which can significantly reduce monthly mortgage payments.