Overview

This article serves as a caring step-by-step guide for families eager to master the home pre-approval process. We understand how overwhelming this journey can feel, and we emphasize the importance of organization and preparation in securing a mortgage. By gathering your financial documents and completing the pre-approval application accurately, you can take significant strides toward homeownership.

After receiving your pre-approval, knowing the next steps is crucial. This knowledge positions your family as strong contenders in the housing market, ready to make informed decisions. Remember, we’re here to support you every step of the way, ensuring you feel empowered and confident throughout this process.

Let’s embark on this journey together, transforming challenges into opportunities for success in your home-buying experience.

Introduction

Navigating the complexities of home buying can often feel daunting. We know how challenging it can be, especially when it comes to securing a mortgage. Understanding the pre-approval process is essential for families looking to make informed decisions. It positions you as a serious buyer in a competitive market.

What if the key to unlocking the door to your dream home lies not just in finding the right property, but in mastering the pre-approval steps? These steps can significantly enhance your negotiating power. We’re here to support you every step of the way.

Understand Mortgage Pre-Approval

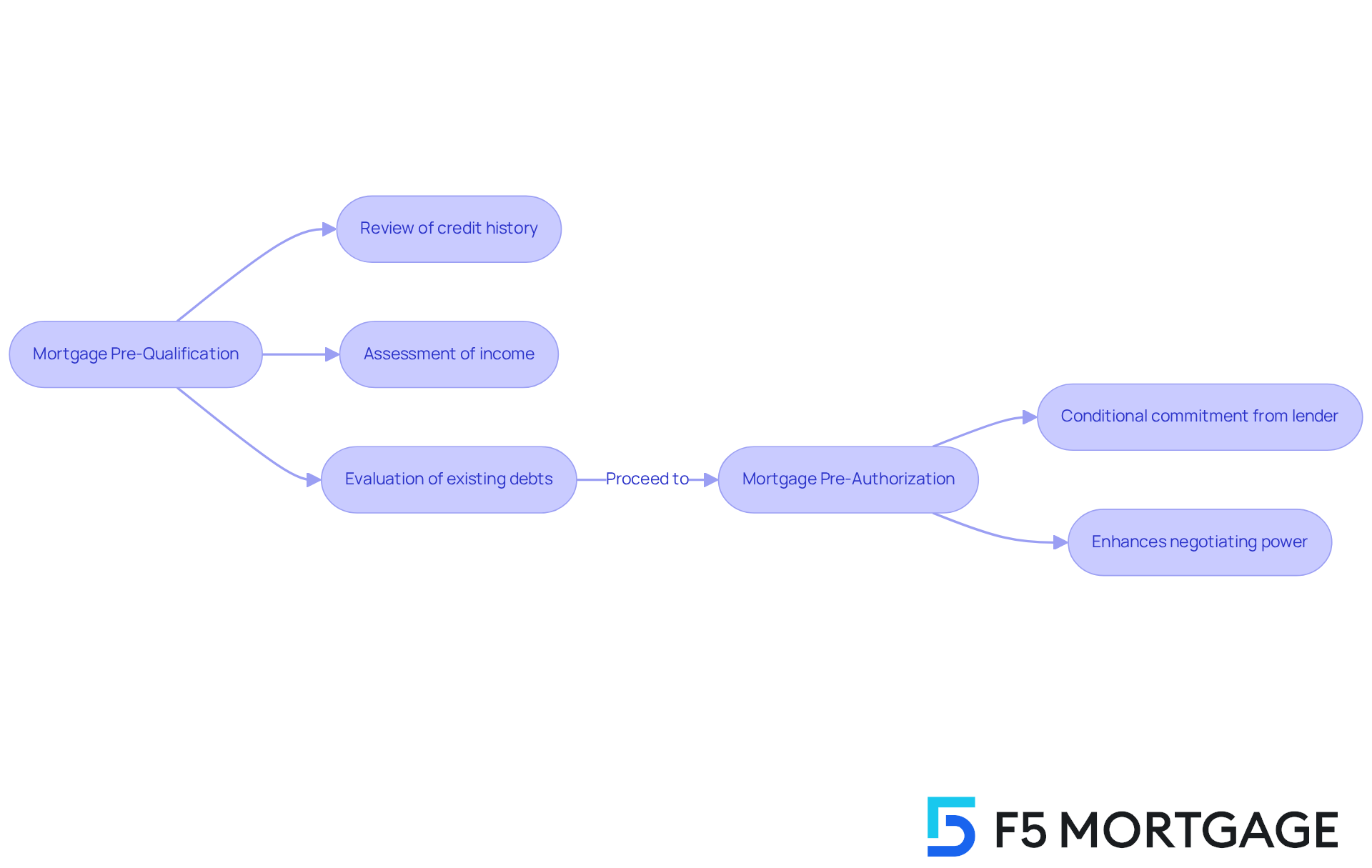

Navigating the home buying journey can feel overwhelming, and mortgage pre-qualification is a crucial step in this process. Here, a financial institution assesses your economic circumstances to determine how much they are willing to lend for your new home. This assessment includes a careful review of your credit history, income, and existing debts.

While pre-qualification provides a rough estimate of your borrowing potential, pre-authorization offers a more precise evaluation. This process includes a conditional commitment from the lender, which can significantly enhance your negotiating power when making an offer on a home. Sellers often prefer buyers with home pre-approval, as it indicates seriousness and readiness.

We know how challenging this can be, but obtaining advance authorization not only clarifies your budget but also positions you as a strong contender in a competitive market. This step can greatly increase your chances of securing your desired property. We’re here to support you every step of the way, ensuring you feel confident and informed throughout your home buying experience.

Prepare Your Financial Documents

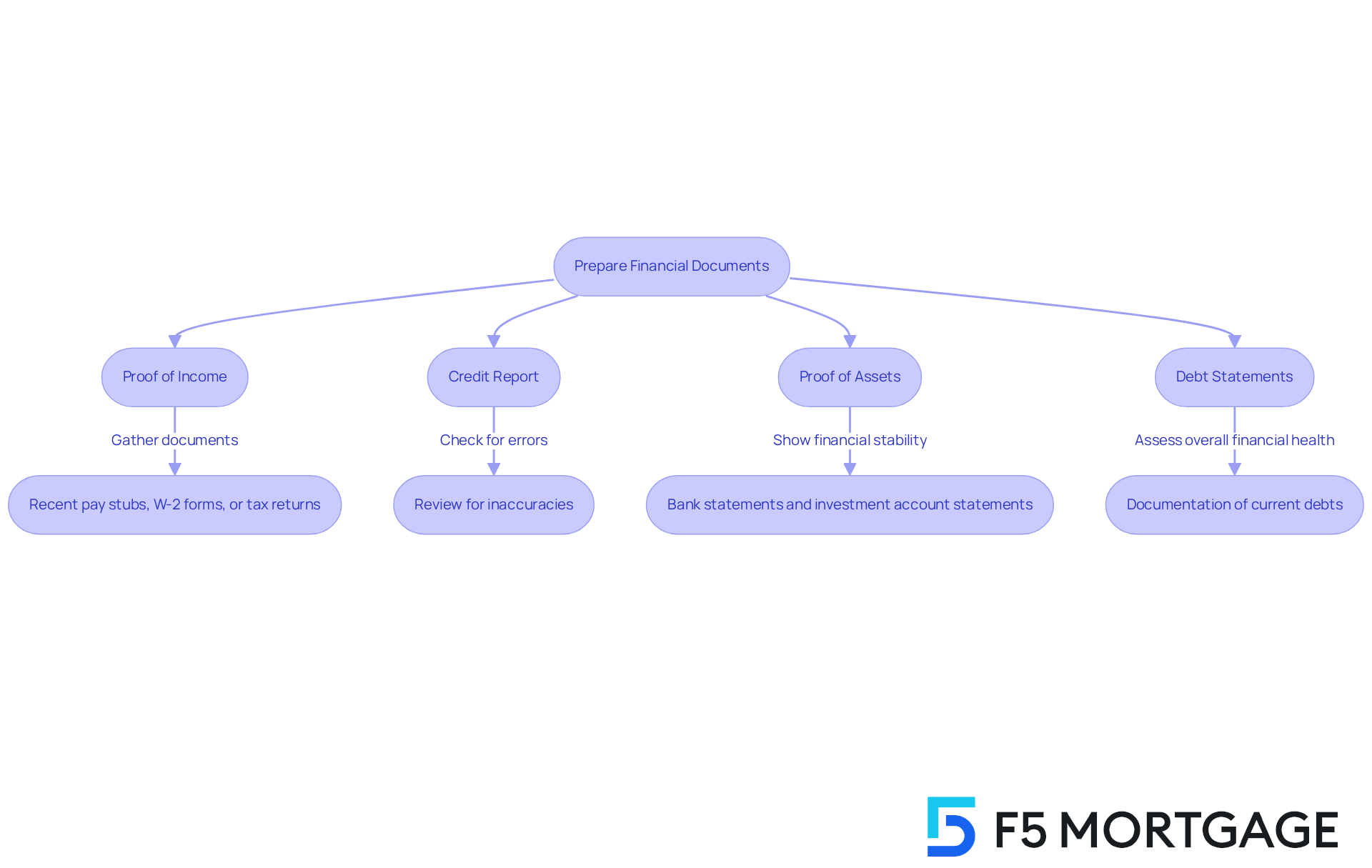

Securing home pre approval for a mortgage can feel overwhelming, but gathering several key financial documents can make this process smoother. This preparation not only speeds up your application but also shows financial institutions that you are ready. Here’s what you typically need:

- Proof of Income: Recent pay stubs, W-2 forms, or tax returns for those who are self-employed are essential to verify your income.

- Credit Report: While lenders will obtain your credit report, reviewing it beforehand allows you to identify and correct any inaccuracies that could impact your approval.

- Proof of Assets: Bank statements and investment account statements are vital to demonstrate your financial stability and ability to manage mortgage payments.

- Debt Statements: Documentation of current debts, like credit cards or loans, helps creditors assess your overall financial health.

We understand how challenging this can be. Statistics show that being organized with your documents can significantly reduce the time it takes for mortgage applications. Many applicants find themselves approved in as little as two days when everything is in order. Clarity and completeness of these documents are often the keys to achieving successful home pre approval. A well-structured checklist can guide you in gathering the necessary information, ensuring that nothing is overlooked.

Mortgage brokers emphasize that having these documents organized not only simplifies the home pre approval application process but also builds trust with creditors regarding your financial responsibility. By carefully arranging your financial documents, you place yourself in a favorable position with potential lenders, paving the way for a smoother home buying experience. Remember, we’re here to support you every step of the way.

Complete the Pre-Approval Application

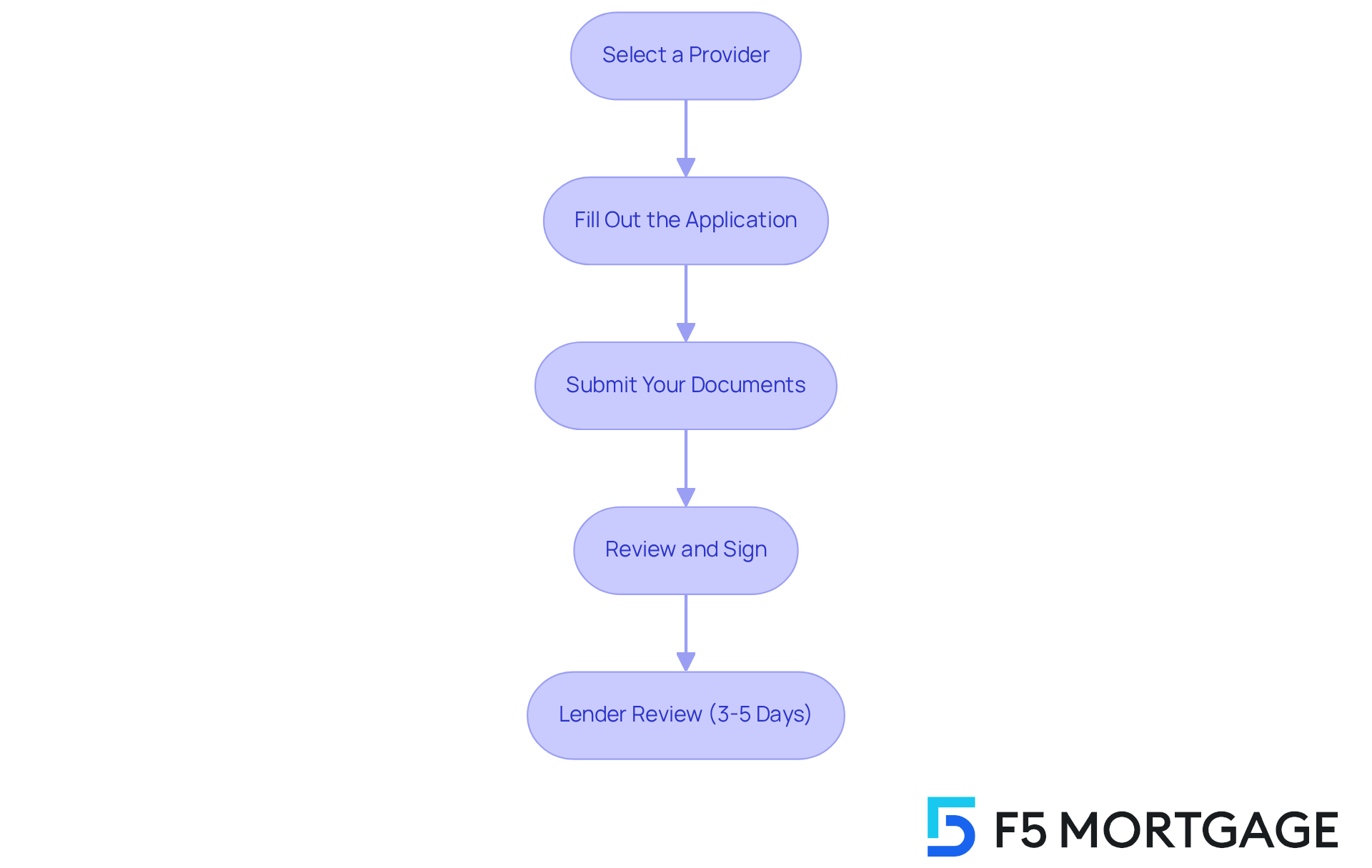

Once your monetary documents are organized, you can confidently move forward with the home pre-approval application. We know how challenging this can be, so here’s a streamlined approach to ensure a smooth process:

-

Select a Provider: Conduct thorough research to find an institution that offers competitive rates and terms suited to your monetary situation. Look for financial institutions with strong reputations and positive customer feedback. Remember, this choice is crucial for your peace of mind.

-

Fill Out the Application: Accurately complete the application by providing personal details, employment history, income, and debts. Honesty is essential here; any discrepancies can lead to delays in processing, which we want to avoid.

-

Submit Your Documents: Attach all necessary financial documents, including proof of income and asset statements. Ensuring completeness will help avoid unnecessary holdups, allowing you to move forward with confidence.

-

Review and Sign: Before submitting, take a moment to carefully review your application for accuracy. Once you are satisfied, sign and submit it to the financial institution. This step is important for ensuring everything is in order.

After submission, lenders typically take a few days to review your application and documents. This timeframe can vary, but being prepared with accurate information can expedite the process. For families, having a home pre-approval letter not only enhances your stance in a competitive housing market but also assists in defining your budget. This makes the home shopping experience more targeted and efficient, helping you find the perfect place to call home.

Know the Next Steps After Pre-Approval

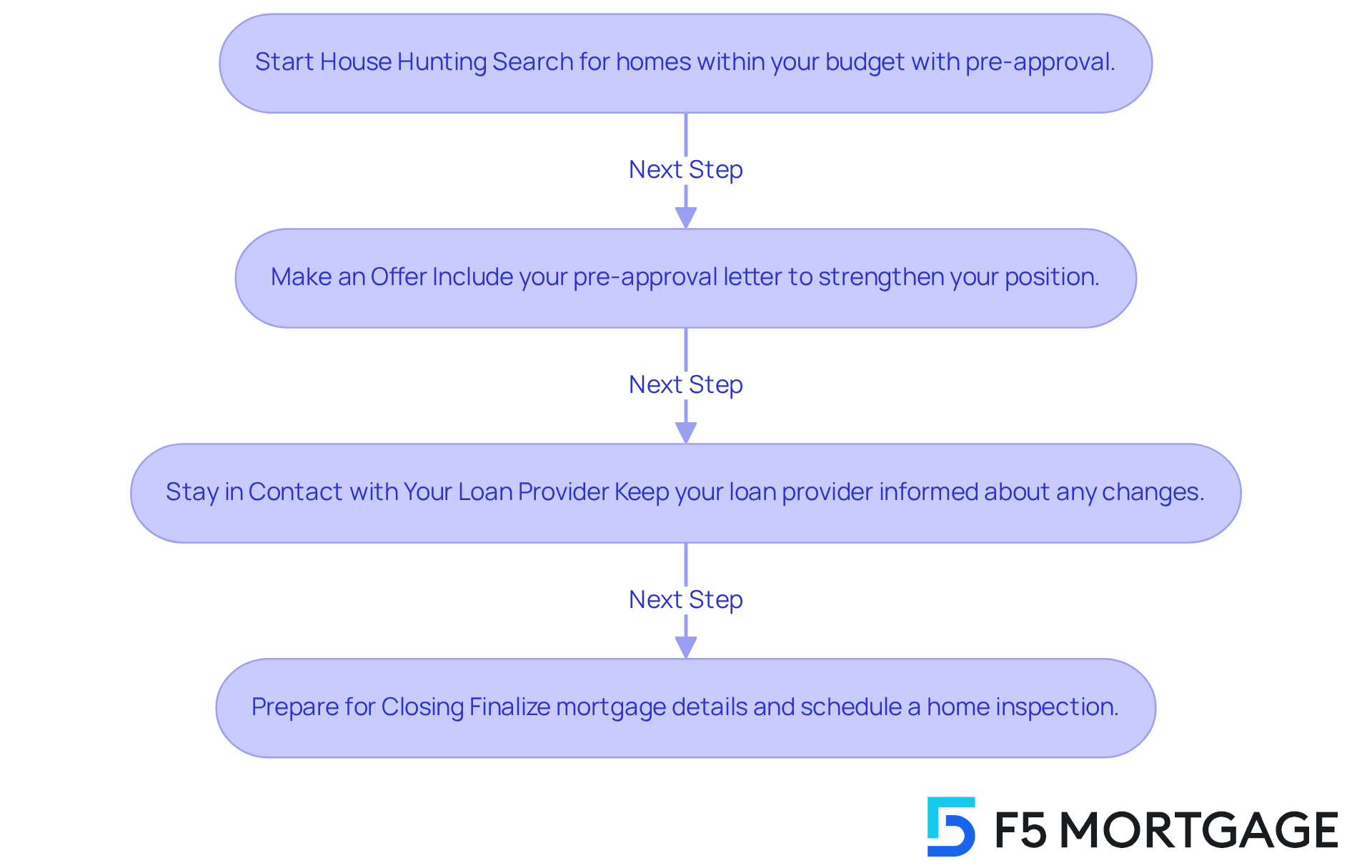

After receiving your pre-approval letter, we know how exciting and overwhelming this journey can be. Here are some steps to help you navigate the process:

- Start House Hunting: With your home pre-approval in hand, you can confidently search for homes within your budget. Our devoted team at F5 Mortgage is here to assist you during this journey, ensuring you discover the ideal home.

- Make an Offer: When you find a home you love, making an offer is the next step. Including your pre-approval letter will strengthen your position. Our loan officer and Account Manager will work closely with you and your realtor to help get your offer accepted and streamline the process.

- Stay in Contact with Your Loan Provider: It’s essential to keep your loan provider informed about any changes in your financial circumstances. Responding quickly to any requests for further information is crucial for a smooth transaction.

- Prepare for Closing: Once your offer is accepted, collaborate with your lender to finalize the mortgage details and prepare for closing. This includes scheduling a home inspection and reviewing closing costs. Our team is committed to ensuring that you feel supported and informed every step of the way.

By following these steps and utilizing the knowledge of F5 Mortgage, you can navigate the home purchasing journey smoothly and confidently. We’re here to support you with outstanding customer satisfaction and possible down payment assistance options. For instance, many of our clients have shared their positive experiences, highlighting how our team made the process easier and more enjoyable. Additionally, programs like FL Assist and MI Home Loan can provide significant financial support, making homeownership more accessible.

Conclusion

Navigating the home buying process can feel overwhelming. We understand how challenging this can be, but mastering home pre-approval is essential for families eager to secure their dream home. This guide has shed light on the significance of mortgage pre-approval, emphasizing that it not only clarifies your budget but also strengthens your negotiating power in a competitive market. By approaching this process with knowledge and preparedness, families can position themselves as serious contenders when making offers on homes.

Key steps to consider include:

- Gathering crucial financial documents

- Accurately completing the pre-approval application

- Knowing what to do after receiving pre-approval

Each of these components plays a vital role in ensuring a smooth and efficient home buying experience. The importance of organization and clear communication with lenders cannot be overstated; it significantly impacts the speed and success of your application process.

Ultimately, the journey to homeownership is a significant milestone for families, and being well-prepared can make all the difference. By taking proactive steps toward securing mortgage pre-approval, families can confidently embark on their house-hunting adventure, knowing they have the support and resources necessary to navigate this important transition. Embrace the process, stay informed, and take action to turn the dream of homeownership into a reality.

Frequently Asked Questions

What is mortgage pre-approval?

Mortgage pre-approval is a process where a financial institution assesses your economic circumstances, including credit history, income, and existing debts, to determine how much they are willing to lend for your new home.

How does pre-qualification differ from pre-approval?

Pre-qualification provides a rough estimate of your borrowing potential, while pre-approval offers a more precise evaluation with a conditional commitment from the lender.

Why is pre-approval important in the home buying process?

Pre-approval enhances your negotiating power when making an offer on a home and indicates to sellers that you are a serious and ready buyer.

How can obtaining pre-approval benefit me in a competitive market?

Obtaining pre-approval clarifies your budget and positions you as a strong contender, increasing your chances of securing your desired property.

What factors are considered during the mortgage pre-approval process?

The pre-approval process considers your credit history, income, and existing debts to assess your borrowing capacity.