Overview

Navigating HELOC refinance rates can feel overwhelming for families, and we understand how challenging this process can be. This article serves as a comprehensive guide, shedding light on the key factors that influence your refinancing journey. By focusing on essential elements such as credit scores, loan-to-value ratios, and market conditions, we aim to equip you with the knowledge needed to make informed financial decisions.

Imagine the relief of potentially saving money by refinancing high-interest debt. This guide not only highlights those savings but also empowers you with actionable steps to take control of your financial future. We’re here to support you every step of the way, ensuring you feel confident in your choices.

As you explore this guide, remember that you are not alone in this journey. Many families face similar challenges, and understanding these factors can lead to a brighter financial outlook. Let’s work together to navigate this process, making it as smooth and beneficial as possible.

Introduction

Homeowners are increasingly recognizing the potential of Home Equity Lines of Credit (HELOCs) as a flexible financial tool in an ever-changing economic landscape. We know how challenging it can be to navigate these financial waters, especially with average refinance rates hovering around 8.36% in 2025. Families now have opportunities to consolidate debt or fund significant home improvements, but the path can often feel daunting.

What factors truly determine the best time to refinance? How can families secure the most favorable terms? These are common questions that many face. This guide aims to demystify the process and equip you with the knowledge to make informed financial decisions that align with your unique circumstances. We’re here to support you every step of the way.

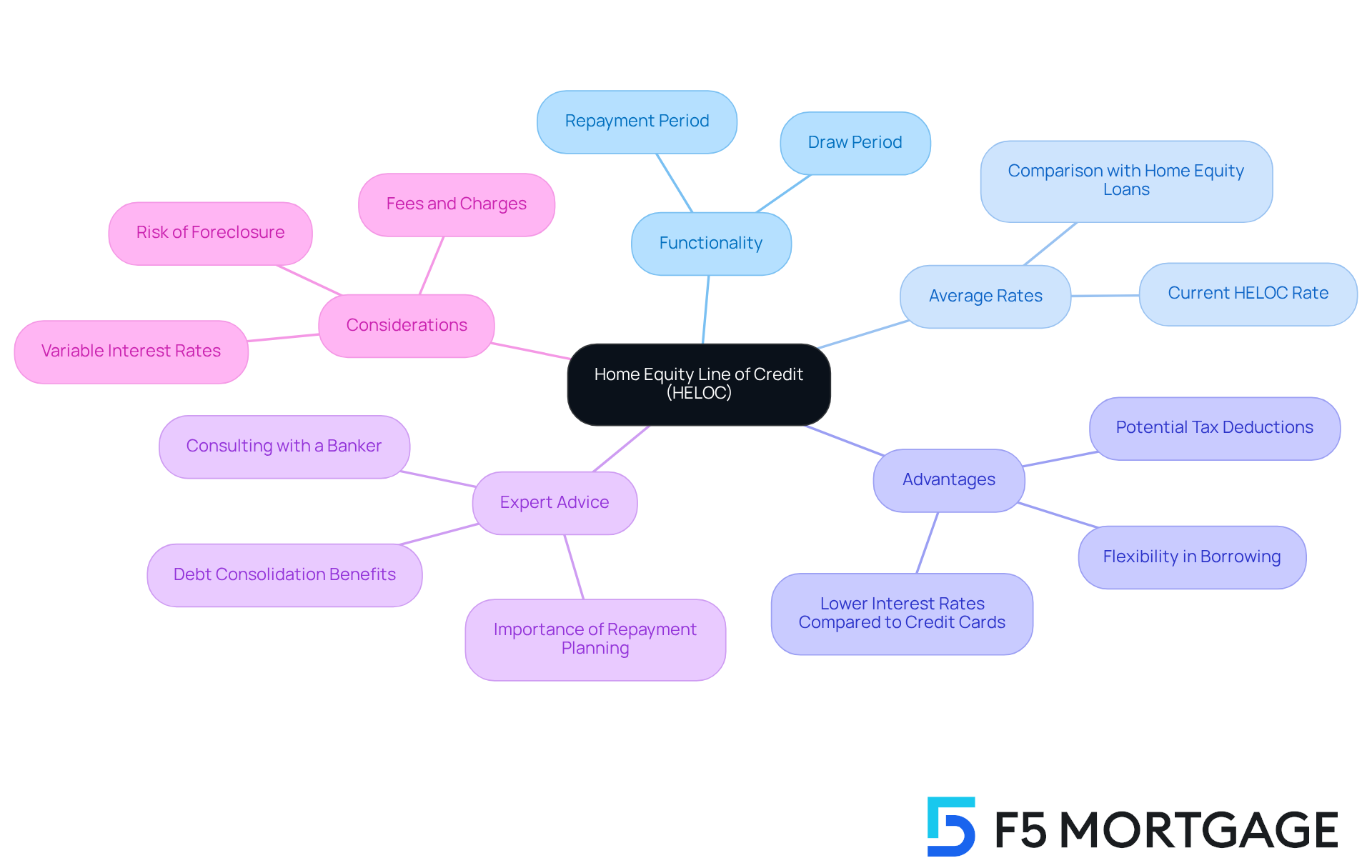

Understand Home Equity Lines of Credit (HELOCs)

A Home Equity Line of Credit (HELOC) can be a valuable resource for homeowners looking to tap into the equity they have built in their homes. Unlike traditional loans that provide a lump sum, a HELOC functions much like a credit card, allowing you to draw funds as needed. This flexibility is essential, especially when unexpected expenses arise. However, it’s important to understand the terms, including the draw period—when you can access funds—and the repayment period—when you start paying back the principal.

As we look to 2025, the average HELOC refinance rates are around 8.36%, which is slightly lower than the 8.41% for home equity loans. This makes HELOCs an attractive option for families wanting to consolidate debt or invest in home improvements. Financial experts emphasize the importance of using a HELOC wisely. For instance, Jordan Banning, a certified financial advisor, notes that refinancing high-interest credit card debt with a HELOC can lead to significant savings—potentially around $6,000 a year for a $50,000 balance—especially considering that credit card rates can exceed 21%.

Recent trends show a rising interest in HELOCs as homeowners take advantage of record levels of tappable equity. Many families are using HELOCs for various purposes, such as funding major renovations or consolidating high-interest debt. Imagine a family using a HELOC to pay off credit card bills, reducing their monthly payments and regaining financial stability.

The flexibility of HELOCs allows families to access funds when they need them, making them a practical choice for managing unforeseen expenses. However, it’s crucial to approach this borrowing method with a solid repayment plan, as failing to make payments can lead to foreclosure. Additionally, families should be aware that interest on HELOCs used for non-home improvement purposes is not tax-deductible. Mark Anderson, a senior loan officer, points out that HELOC refinance rates are closely tied to Federal Reserve policies, indicating that potential rate reductions could benefit borrowers soon.

Families considering refinancing options should also explore cash-out refinancing, which allows them to access their home equity while potentially lowering their interest costs. This can be particularly advantageous in today’s market, where decreasing mortgage rates offer opportunities for financial relief. We understand how challenging financial decisions can be, so it’s essential to assess your needs carefully and consult with a banker to find the best HELOC options available. We’re here to support you every step of the way.

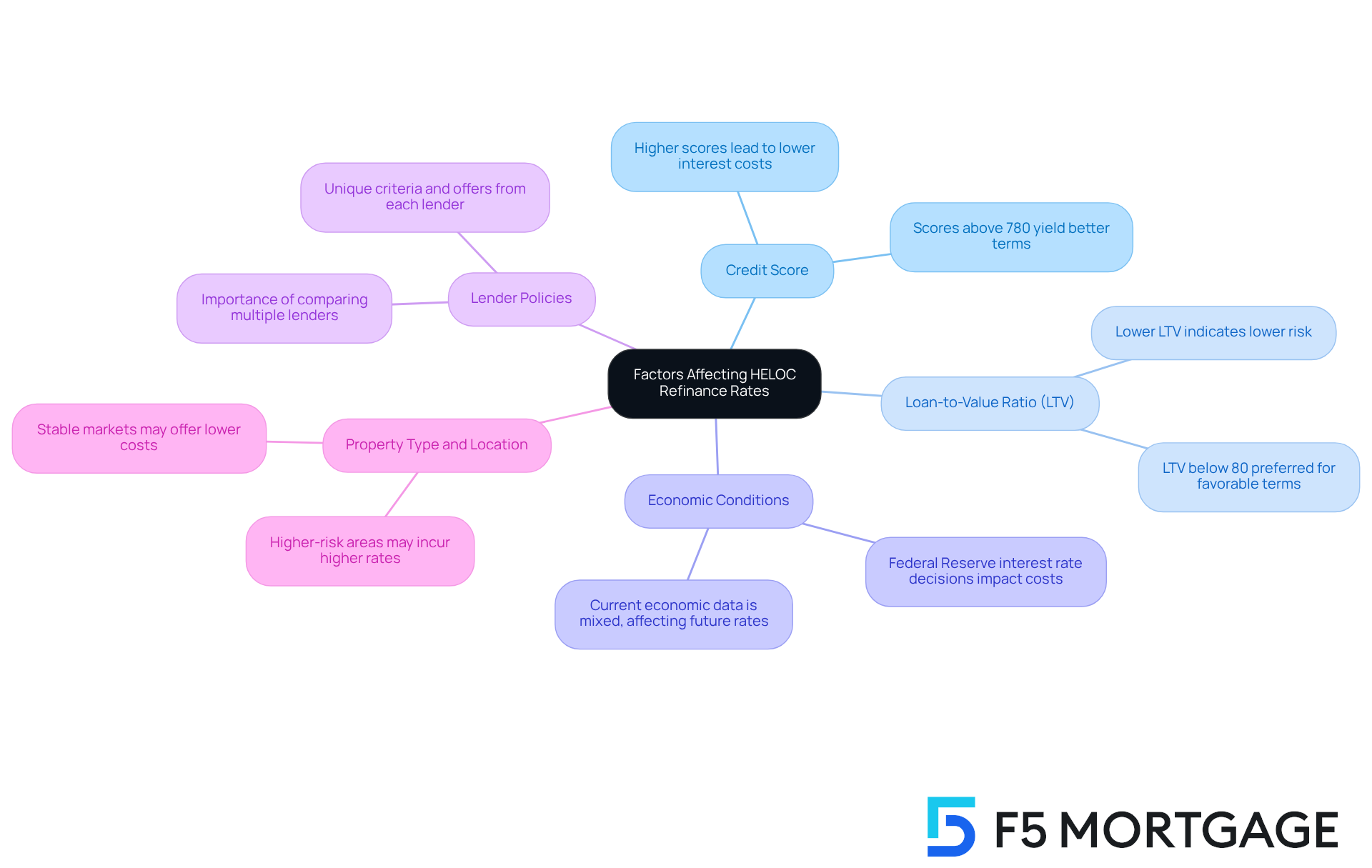

Identify Factors Affecting HELOC Refinance Rates

Several key factors significantly influence the HELOC refinance rates, and understanding them can help you navigate this process with confidence.

-

Credit Score: We know how challenging it can be to manage your credit score, but a higher score typically results in reduced interest costs. Lenders view borrowers with solid credit histories as less risky. For example, borrowers with scores exceeding 780 can obtain more advantageous terms, while those with lower scores might encounter increased costs.

-

Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the appraised value of your home and plays a crucial role in determining costs. A lower LTV often results in better refinancing options, indicating a lower risk for lenders. In 2025, households with LTVs below 80% are more likely to obtain favorable terms.

-

Economic Conditions: Broader market trends, especially the Federal Reserve’s interest level decisions, can influence overall borrowing expenses. As of late 2025, expectations of possible reductions may further affect the HELOC refinance rates. This could be a favorable moment for families to consider the benefits of HELOC refinance rates.

-

Lender Policies: Each lender has unique criteria and offers, making it essential for you to shop around. Differences in policies can lead to notable discrepancies in costs and conditions, so it’s wise to compare various lenders to find the best fit for your situation.

-

Property Type and Location: The kind of property you own and its geographical placement can also influence costs. Properties in higher-risk areas may incur higher rates, while those in stable markets could benefit from lower costs.

By understanding these factors, you can better prepare for negotiations with lenders. We’re here to support you every step of the way as you work towards securing more favorable refinancing conditions and maximizing your home equity.

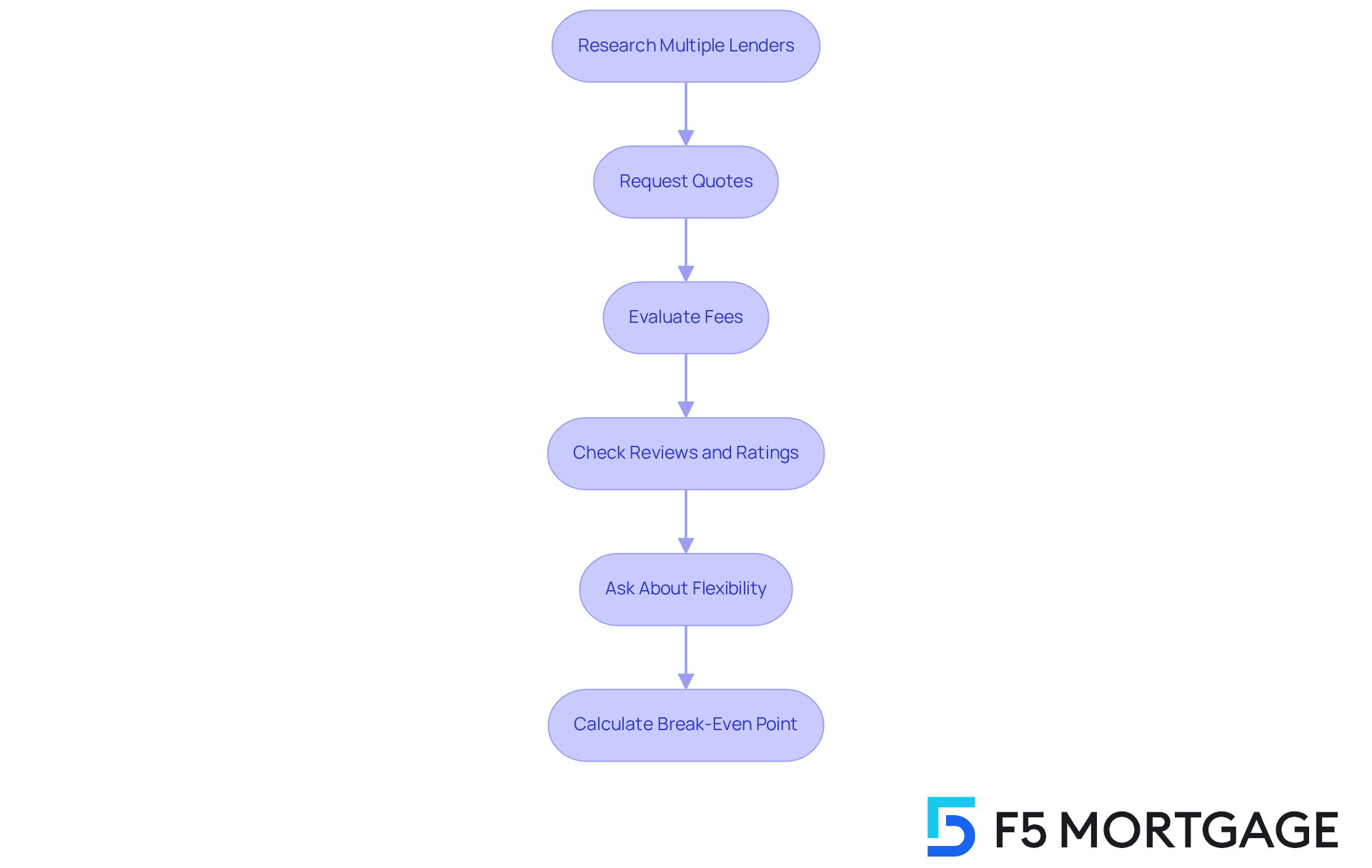

Compare Lenders and Their Offers

When comparing lenders for HELOC refinance rates, we understand how challenging this process can be for families. Following these essential steps can help you navigate the process with confidence:

-

Research Multiple Lenders: Explore options from banks, credit unions, and online lenders. Each may offer differing prices and terms, so consider collaborating with F5 Mortgage for attractive pricing and customized assistance.

-

Request Quotes: Obtain quotes from at least three lenders to effectively compare interest percentages, fees, and terms. This step is crucial to ensure you find the best deal.

-

Evaluate Fees: Scrutinize closing costs, which typically range from $50 to $75, annual fees, and any additional charges. Mortgage refinance closing expenses can encompass:

- Application fees ($75 to $500)

- Origination charges (0.5% to 1.5% of the loan amount)

- Credit report costs (around $35)

- Appraisal charges ($300 to $500)

- Title search and title insurance (0.5% to 1% of the loan amount)

- Discount points (1% of the loan amount for a 0.25% interest reduction)

- Attorney fees ($500 or more)

- Survey fees ($150 to $400)

Some lenders may promote no closing costs but make up for it with increased fees.

-

Check Reviews and Ratings: Investigate customer reviews and ratings to assess the lender’s reputation and quality of service. Understanding others’ experiences can provide valuable insights.

-

Ask About Flexibility: Inquire about the lender’s policies regarding rate adjustments, repayment options, and any penalties for early repayment. Knowing your options can empower you in making a decision.

To calculate your break-even point, follow these three steps: Determine loan costs, calculate your monthly savings, and divide your loan costs by your monthly savings. By diligently comparing lenders, families can secure favorable terms that align with their financial objectives.

With the average closing costs for HELOC refinance rates varying significantly, understanding these rates can lead to substantial savings. For example, some lenders may provide competitive terms around 7.84% as of mid-October 2025, while others may present figures as low as 6.15% or as high as 8.65%. Furthermore, mortgage brokers stress the significance of assessing proposals considering both interest percentages and total loan expenses, helping households make knowledgeable choices.

Successful negotiations have been reported by families who leveraged their creditworthiness and existing equity to secure better terms, highlighting the potential for favorable outcomes in the refinancing process. Remember, families should also be aware of the potential for rising interest rates during the loan period, which can impact repayment costs. We’re here to support you every step of the way.

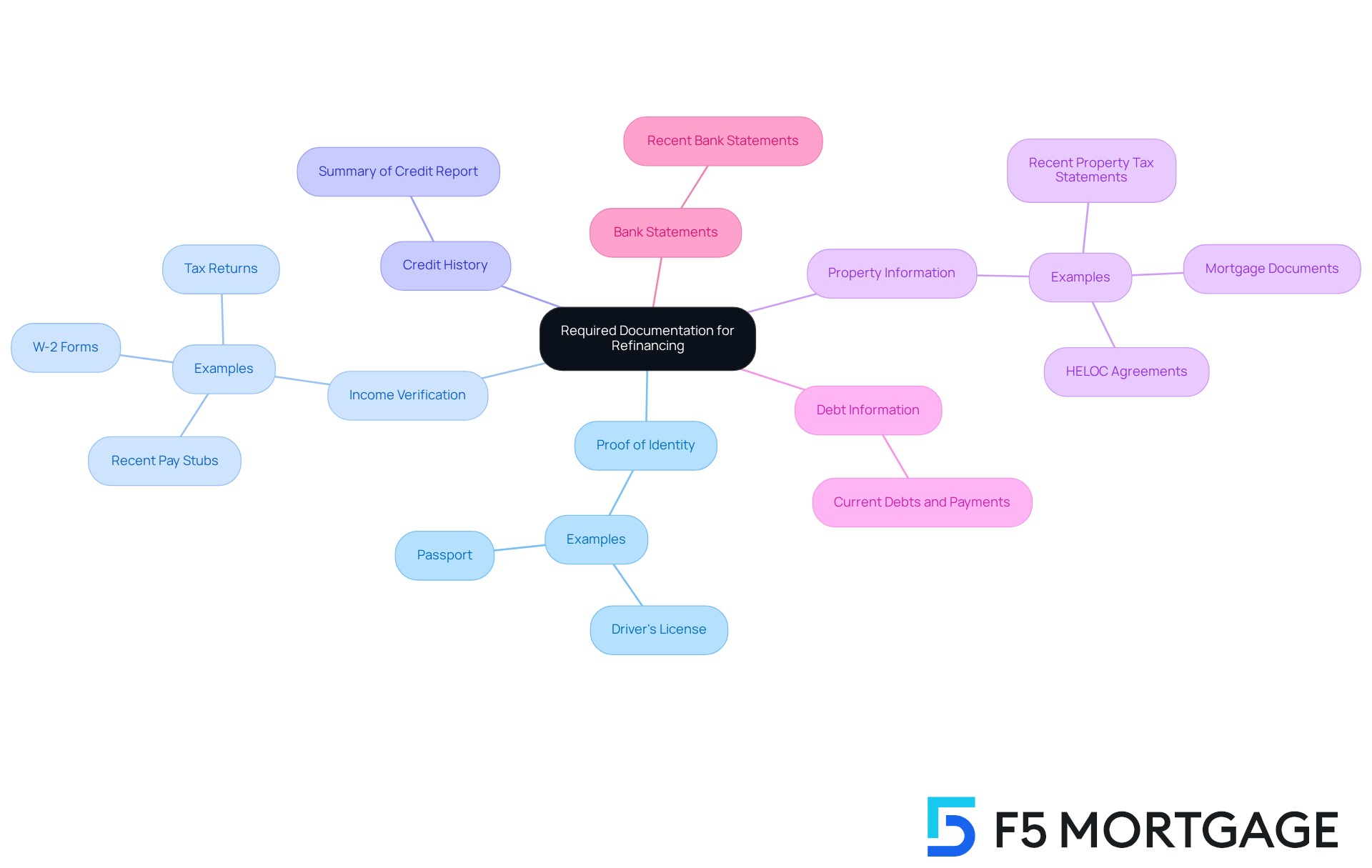

Prepare Required Documentation for Refinancing

To successfully refinance your HELOC, we know how crucial it is to gather the right documentation. Here’s what you’ll need:

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is essential for verification.

- Income Verification: Recent pay stubs, W-2 forms, or tax returns are necessary to demonstrate your income stability.

- Credit History: While lenders will pull your credit report, having a summary of your credit history can provide additional context.

- Property Information: Gather recent property tax statements, mortgage documents, and any current home equity line of credit agreements to present a complete picture of your property status.

- Debt Information: Prepare a list of current debts and monthly payments to help assess your debt-to-income ratio, which is critical for loan approval.

- Bank Statements: Recent bank statements will verify your assets and savings, showcasing your financial health.

Preparing these documents will not only simplify the loan process but also improve your likelihood of approval. We’re here to support you every step of the way as you navigate the intricacies of home equity line of credit restructuring.

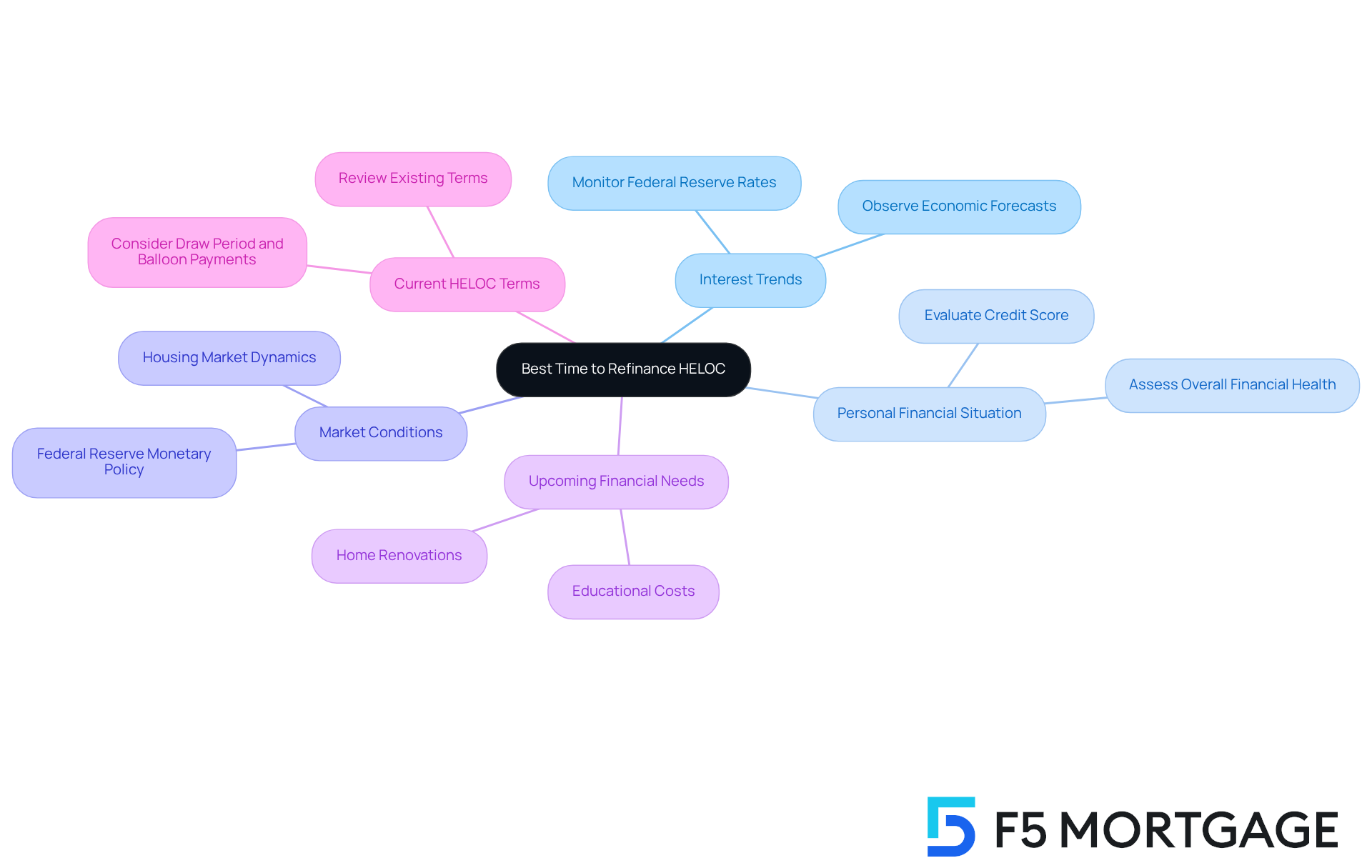

Determine the Best Time to Refinance Your HELOC

To determine the optimal time for refinancing your HELOC, we understand that families face several important factors to consider:

-

Interest Trends: Staying informed about current interest levels and economic forecasts is crucial. With the Federal Reserve’s recent reductions, you may find potential for further declines. Observing these trends closely can be beneficial for your financial decisions.

-

Personal Financial Situation: It’s essential to evaluate your credit score and overall financial health. If your credit has improved since your last home equity line of credit, you may qualify for better terms, enhancing your loan options.

-

Market Conditions: Keeping an eye on housing market dynamics and the Federal Reserve’s monetary policy is vital, as these elements significantly influence borrowing costs. For instance, the recent drop in HELOC refinance rates presents a favorable opportunity for loan restructuring.

-

Upcoming Financial Needs: If you anticipate significant expenses, such as home renovations or educational costs, timing your refinance to align with these needs can be advantageous. This strategic approach helps ensure you have access to funds when necessary, without incurring unnecessary costs.

-

Current Home Equity Line of Credit Terms: Reviewing the conditions of your existing line of credit is important. If you are nearing the end of your draw period or facing a balloon payment, refinancing may be a prudent step to avoid potential financial strain.

By thoughtfully evaluating these factors, families can strategically time their HELOC refinance rates to maximize their benefits. We’re here to support you every step of the way, ensuring you make informed decisions that align with your financial goals.

Conclusion

A Home Equity Line of Credit (HELOC) serves as a flexible financial tool for families, allowing them to tap into their home equity. This access can help manage expenses and achieve important financial goals. We understand that navigating the intricacies of HELOC refinance rates is essential for homeowners aiming to make informed borrowing decisions.

In this guide, we’ve explored key factors that influence HELOC refinance rates, such as:

- Credit scores

- Loan-to-value ratios

- Economic conditions

- Lender policies

- Property specifics

By understanding these elements and comparing various lenders, families can find favorable terms that meet their financial needs. Moreover, gathering the necessary documentation and timing the refinance strategically can further enhance the benefits of a HELOC.

Ultimately, leveraging a HELOC can significantly impact financial stability. We encourage families to take proactive steps:

- Explore current HELOC offers

- Assess their financial situations

- Consult with lending professionals who can guide them through this process

By doing so, they can unlock the full potential of their home equity and pave the way for a more secure financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a financial product that allows homeowners to borrow against the equity in their homes, functioning similarly to a credit card by enabling access to funds as needed.

How does a HELOC differ from a traditional loan?

Unlike traditional loans that provide a lump sum, a HELOC allows for flexible withdrawals of funds during a draw period and requires repayment during a subsequent repayment period.

What are the current average HELOC refinance rates?

As of 2025, the average HELOC refinance rates are approximately 8.36%, which is slightly lower than the 8.41% for home equity loans.

What are some common uses for HELOCs?

Homeowners commonly use HELOCs for consolidating high-interest debt, funding major renovations, or managing unexpected expenses.

What should homeowners be cautious about when using a HELOC?

Homeowners should have a solid repayment plan, as failing to make payments can result in foreclosure. Additionally, interest on HELOCs used for non-home improvement purposes is not tax-deductible.

What factors can affect HELOC refinance rates?

Key factors include credit score, loan-to-value ratio (LTV), economic conditions, lender policies, and the property type and location.

How does credit score impact HELOC refinance rates?

A higher credit score typically leads to lower interest costs, as lenders view borrowers with solid credit histories as less risky.

What is the significance of the loan-to-value ratio (LTV)?

The LTV ratio compares the loan amount to the appraised value of the home, with lower LTVs generally resulting in better refinancing options.

How do economic conditions influence HELOC refinance rates?

Broader market trends, particularly decisions made by the Federal Reserve regarding interest rates, can significantly impact overall borrowing expenses.

Why is it important to compare lenders when considering a HELOC?

Each lender has unique criteria and offers, leading to potential discrepancies in costs and conditions, making it essential to shop around for the best fit.