Overview

Navigating Home Equity Line of Credit (HELOC) rates can feel overwhelming for families in Pennsylvania. We understand how challenging this process can be, and that’s why this article serves as your comprehensive guide. It helps you grasp the essentials of HELOCs, identifies the factors that influence rates, and encourages you to compare options from multiple lenders.

As you embark on this journey, we’re here to support you every step of the way. You’ll find insights into the application process, empowering you with the knowledge and strategies needed to secure favorable financial terms. Together, we can make this experience more manageable and less stressful for your family.

Introduction

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) can truly empower families to make informed financial decisions that enhance their economic stability. We know how challenging navigating these options can be. This guide delves into the essential elements of HELOCs, highlighting the benefits of leveraging home equity for renovations and debt consolidation. Additionally, we will discuss the critical factors that influence interest rates in Pennsylvania.

However, with so many variables at play—such as credit scores, loan-to-value ratios, and fluctuating market conditions—how can families ensure they secure the best possible terms for their HELOC? We’re here to support you every step of the way, helping you find clarity and confidence in your financial journey.

Understand Home Equity Lines of Credit (HELOCs)

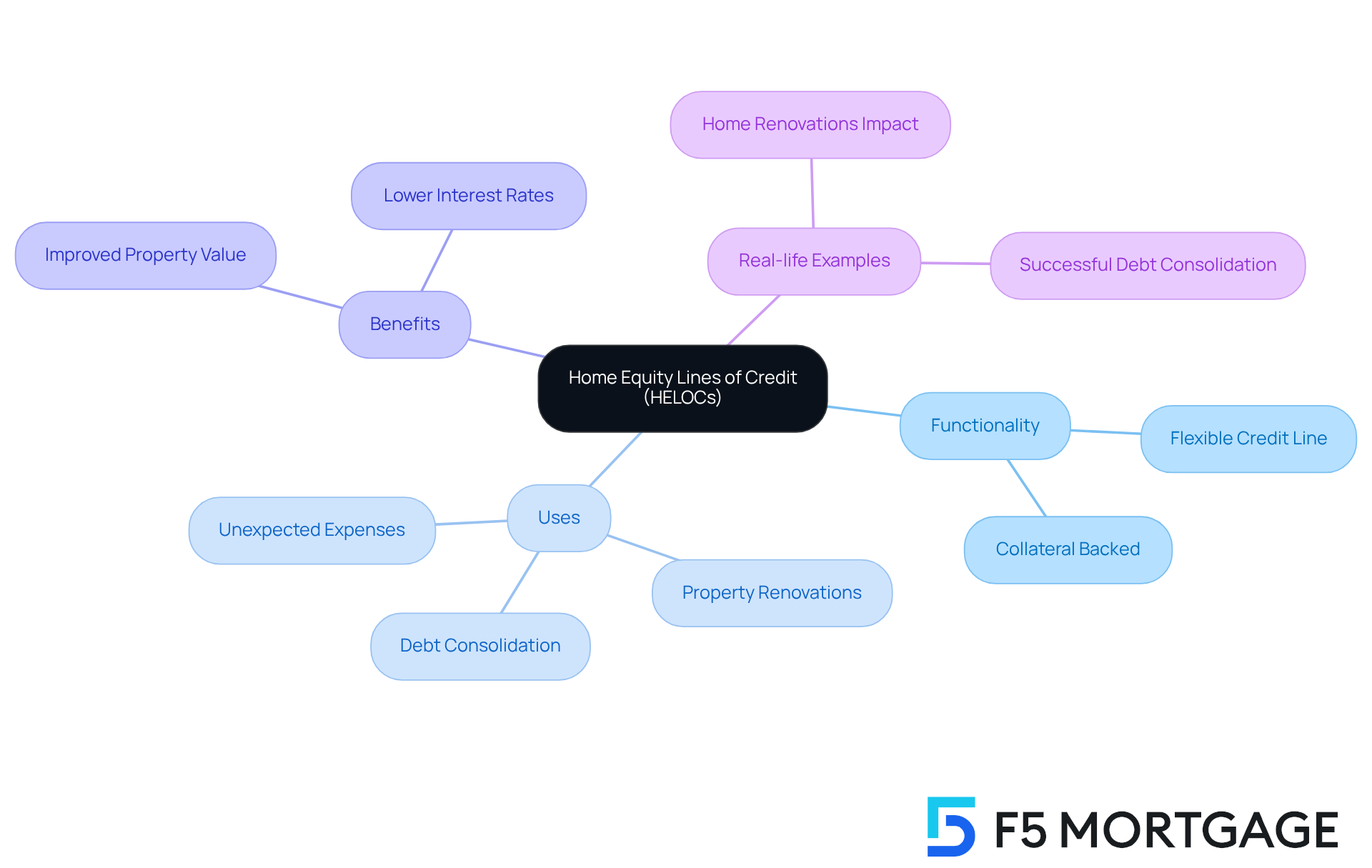

A Home Equity Line of Credit (HELOC) is a flexible, revolving credit line that allows property owners to borrow against the equity in their homes. Unlike a traditional equity loan, which provides a lump sum, a HELOC enables you to access funds as needed, up to a predetermined limit. Your residence backs this credit line, serving as collateral. Understanding how a home equity line of credit works is essential, as it can be used for various purposes, such as property renovations, debt consolidation, or managing unexpected expenses. Key terms to familiarize yourself with include the draw period, the timeframe during which you can borrow, and the repayment period, when you must begin repaying the borrowed amount.

The benefits of using a line of credit for property renovations are significant. Homeowners can tap into their equity to fund upgrades that not only improve their living spaces but also potentially boost the property’s market value. For example, the average borrowing amount for a home equity line of credit in 2025 is projected to be around $121,613, providing ample resources for substantial renovations. Financial advisors often recommend HELOCs for property enhancements, noting that the current HELOC rates PA can provide a cost-effective way to secure funds at lower interest rates compared to personal loans or credit cards.

Real-life examples reveal how families have successfully utilized HELOCs for debt consolidation. By merging high-interest debts into a single, lower-interest HELOC, homeowners can streamline their finances and lower monthly payments. This strategy has become increasingly popular as property owners look to leverage their equity amidst rising property values. As of 2025, homeowners have gained an average of nearly $150,000 in equity, which makes HELOC rates PA an appealing choice for those seeking financial flexibility. We know how challenging navigating these options can be, and we’re here to support you every step of the way.

Identify Factors Influencing HELOC Rates

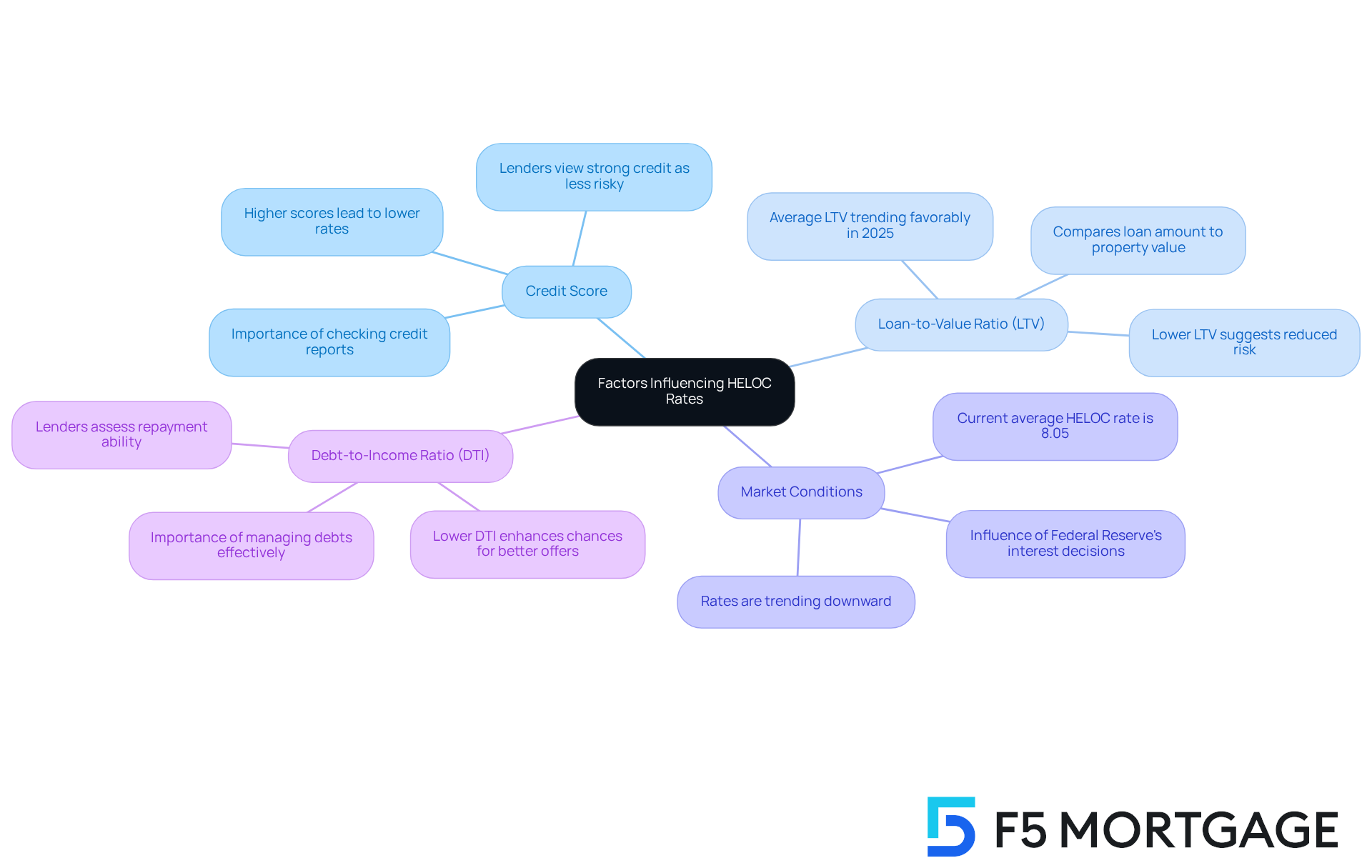

Several factors significantly influence the heloc rates pa on home equity lines of credit (HELOCs), and understanding them can make a world of difference for families seeking financial stability.

-

Credit Score: We know how challenging it can be to maintain a good credit score, but a higher score generally leads to lower interest rates. Lenders view borrowers with strong credit histories as less risky. Financial analysts emphasize that focusing on your credit score is crucial for securing favorable HELOC rates PA.

-

Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the assessed value of your property, and it plays a vital role in determining costs. A lower LTV suggests reduced risk for lenders, often resulting in better terms for borrowers. In 2025, the average LTV for HELOCs is trending favorably, which means families can enhance their financial standing by increasing their home equity through renovations or strategic investments, especially considering the heloc rates pa.

-

Market Conditions: Economic factors, especially the Federal Reserve’s interest decisions, can influence overall lending costs. Recent trends indicate that heloc rates pa are currently averaging around 8.05%. This decline may present a favorable opportunity for families to apply.

-

Debt-to-Income Ratio (DTI): Lenders evaluate your DTI to assess your ability to repay the loan. A lower DTI can enhance your chances of securing a beneficial offer, making it essential for families to manage their debts effectively.

By comprehending these elements, families can create actionable plans to improve their financial situations before applying for a home equity line of credit. This proactive approach can potentially lead to better conditions and offers, empowering families to take control of their financial futures.

Compare HELOC Rates from Multiple Lenders

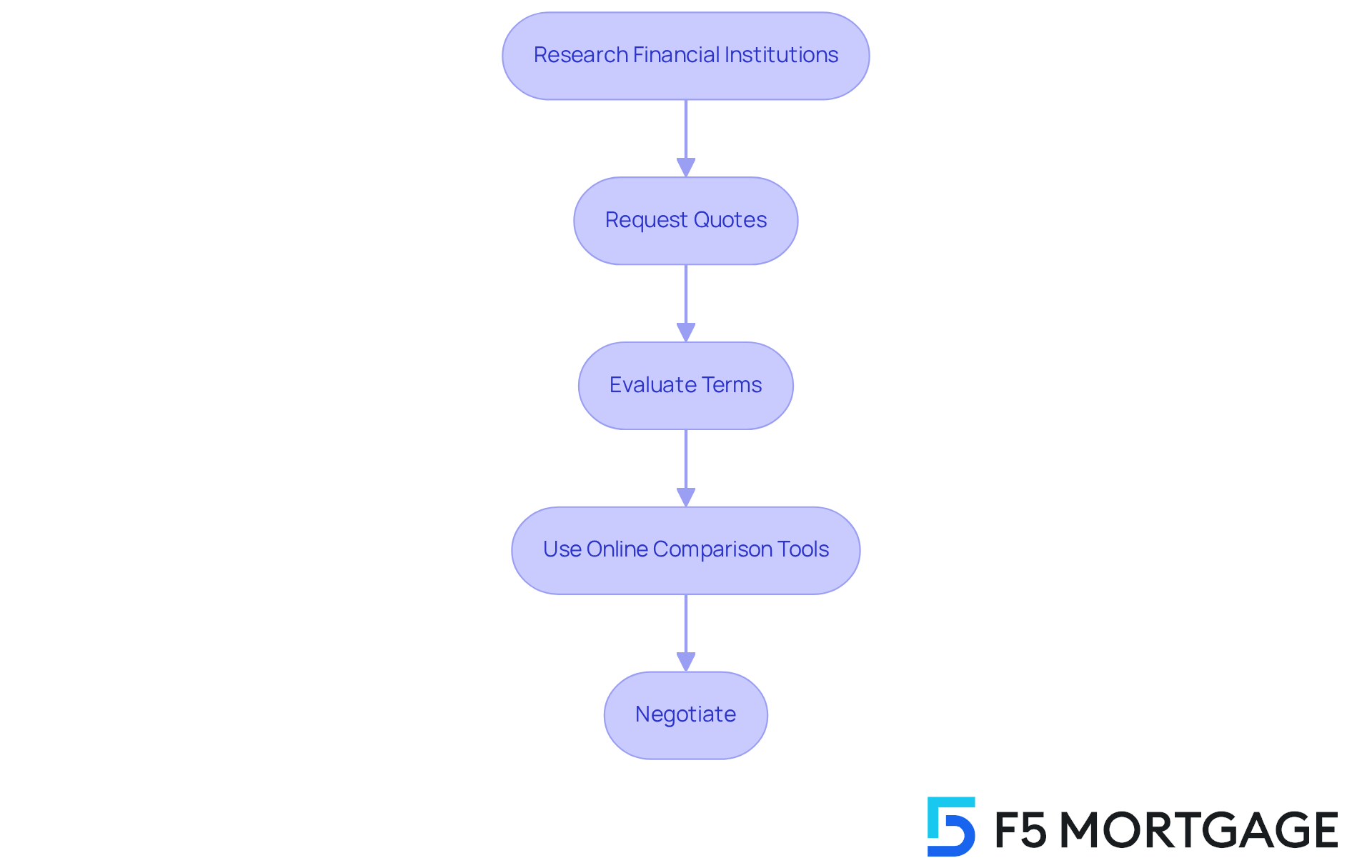

To secure the best HELOC rates, we know how important it is for families to follow these essential steps:

-

Research Financial Institutions: Start by identifying a variety of sources, including banks, credit unions, and online options. Each creditor may offer different prices and conditions, so an extensive search is essential to find the best fit for your needs.

-

Request Quotes: Reach out to various financial institutions to acquire estimates for HELOC terms. It’s crucial to provide the same information to each creditor to ensure accurate comparisons.

-

Evaluate Terms: Look beyond just the interest figure. Consider additional factors such as fees, repayment terms, and the flexibility of the draw period. Some lenders may offer appealing terms but come with higher fees that could affect your total expenses. Remember, the interest on a HELOC may be tax-deductible if utilized for renovations, which can lead to potential savings. Keeping a low debt-to-income ratio (DTI) is also essential, as a maximum DTI of 43% is generally necessary for home loans, which can impact the terms you obtain.

-

Use Online Comparison Tools: Leverage websites like Bankrate or NerdWallet to quickly compare rates from different financial institutions, making the process more efficient and less overwhelming.

-

Negotiate: Don’t hesitate to discuss terms with financial institutions. If you receive a competitive offer from one lender, share it with others to see if they can match or improve upon it. F5 Mortgage can help you evaluate your choices and ensure you comprehend the effects of your DTI on your mortgage terms.

Moreover, exploring the refinancing alternatives accessible in Colorado can offer additional opportunities to obtain favorable terms. By diligently comparing HELOC rates and terms, families can make informed choices that align with their financial goals, ensuring they secure the most advantageous home equity line of credit options available. We’re here to support you every step of the way.

Navigate the HELOC Application Process

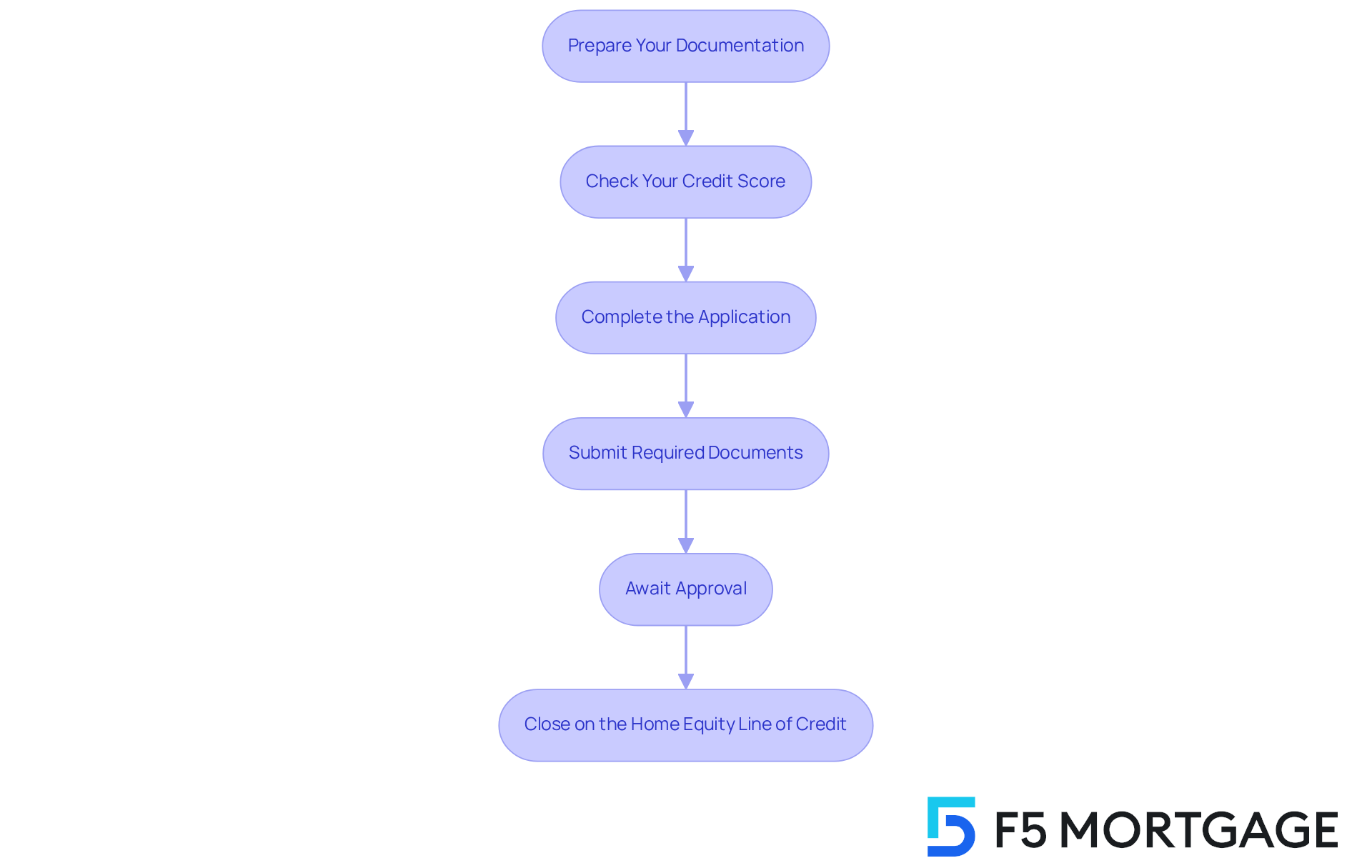

Successfully navigating the home equity line of credit application process can feel overwhelming, but with careful preparation and attention to detail, you can make it smoother. Here are the essential steps we recommend for families:

- Prepare Your Documentation: Start by gathering necessary documents such as proof of income (pay stubs, tax returns), credit reports, and details about your existing mortgage. Having these ready can significantly streamline the process and alleviate stress.

- Check Your Credit Score: Before applying, take a moment to review your credit score. A score of 620 or higher is generally favorable for HELOC approval. Addressing any issues beforehand can prevent unexpected roadblocks and give you peace of mind.

- Complete the Application: Fill out the application form from your selected financial institution thoroughly and accurately. Incomplete applications are a common cause of delays, so ensure all information is correct to avoid frustration.

- Submit Required Documents: Along with your application, submit all necessary documentation, including proof of identity, income verification, and property details. Organizing these documents in advance can help avoid processing delays and make the experience less daunting.

- Await Approval: After submission, the financial institution will review your application and may request additional information. This review process typically takes a few days to weeks, depending on the lender and the completeness of your application, so be patient during this time.

- Close on the Home Equity Line of Credit: Once approved, you’ll need to sign closing documents. After closing, you can access your funds as needed, typically within a few weeks, giving you the flexibility to manage your finances.

Real-life examples show that families who prepare their documentation meticulously often experience smoother approvals. For instance, one family organized their pay stubs and tax returns ahead of time, which allowed them to receive approval within two weeks, significantly faster than the average timeline of 30 days.

Mortgage experts stress that missing or incomplete documents are the main reasons for delays in the home equity line of credit process. As one specialist pointed out, “Gathering and uploading documents swiftly will certainly accelerate the process of home equity lines of credit.” By following these steps and being proactive, families can navigate the HELOC application process with confidence and efficiency, knowing that we’re here to support you every step of the way.

Conclusion

Mastering Home Equity Lines of Credit (HELOCs) in Pennsylvania can truly empower families to leverage their home equity for various financial needs. We understand how challenging this can be, but by grasping how HELOCs operate and recognizing the advantages they offer, homeowners can make informed decisions that align with their financial goals. The flexibility of accessing funds as needed, combined with potentially lower interest rates compared to traditional loans, makes HELOCs an appealing option for many families.

Throughout this guide, we’ve shared key insights regarding the factors that influence HELOC rates, such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

Additionally, we’ve outlined practical steps for comparing rates from multiple lenders and navigating the application process. By being proactive and well-prepared, families can enhance their chances of securing favorable terms and making the most of their home equity.

Ultimately, understanding and effectively utilizing HELOCs can significantly contribute to financial stability and growth. We encourage families to take charge of their financial futures by exploring current HELOC rates, evaluating their options, and seeking professional guidance when necessary. With the right knowledge and resources, accessing the benefits of a HELOC can lead to improved financial flexibility and the realization of home improvement dreams or debt consolidation strategies. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a flexible, revolving credit line that allows property owners to borrow against the equity in their homes, enabling access to funds as needed, up to a predetermined limit.

How does a HELOC differ from a traditional equity loan?

Unlike a traditional equity loan, which provides a lump sum, a HELOC allows homeowners to withdraw funds as needed, making it a more flexible option.

What serves as collateral for a HELOC?

The homeowner’s residence serves as collateral for the HELOC.

What are the key terms to understand when considering a HELOC?

Key terms include the draw period, which is the timeframe during which you can borrow, and the repayment period, when you must begin repaying the borrowed amount.

What are some common uses for a HELOC?

A HELOC can be used for various purposes, such as property renovations, debt consolidation, or managing unexpected expenses.

What are the benefits of using a HELOC for property renovations?

Homeowners can tap into their equity to fund upgrades that improve their living spaces and potentially boost the property’s market value.

What is the average borrowing amount for a HELOC projected in 2025?

The average borrowing amount for a HELOC in 2025 is projected to be around $121,613.

Why do financial advisors recommend HELOCs for property enhancements?

Financial advisors often recommend HELOCs because they can provide a cost-effective way to secure funds at lower interest rates compared to personal loans or credit cards.

How can HELOCs be used for debt consolidation?

Homeowners can merge high-interest debts into a single, lower-interest HELOC, streamlining their finances and lowering monthly payments.

What is the average equity gained by homeowners as of 2025?

As of 2025, homeowners have gained an average of nearly $150,000 in equity, making HELOCs an appealing choice for those seeking financial flexibility.