Overview

This article is dedicated to helping families in Hawaii navigate the complexities of HELOC rates. We understand how challenging it can be to grasp the basics, recognize the key factors influencing rates, and compare lenders effectively. By outlining the benefits and risks associated with HELOCs, we aim to empower families with the knowledge they need to make informed financial decisions regarding home equity lines of credit.

We know how important it is to feel confident in your financial choices. That’s why we provide practical steps for preparing and applying for a HELOC. Our goal is to equip you with the tools and insights necessary to approach this process with clarity and assurance. With the right information, you can take control of your financial future and make choices that truly benefit your family.

Introduction

Navigating the world of home financing can be particularly daunting for families in Hawaii. We understand how challenging this can be, especially when property values soar and financial decisions carry significant weight.

A Home Equity Line of Credit (HELOC) offers a flexible solution, allowing homeowners to tap into their equity for various needs, from home improvements to educational expenses. However, with average HELOC rates hovering between 8.0% and 8.5% in 2025, understanding the nuances of these loans becomes crucial.

What factors influence these rates, and how can families ensure they secure the best terms? This guide aims to demystify the HELOC process, empowering families to make informed choices that align with their financial goals.

We’re here to support you every step of the way.

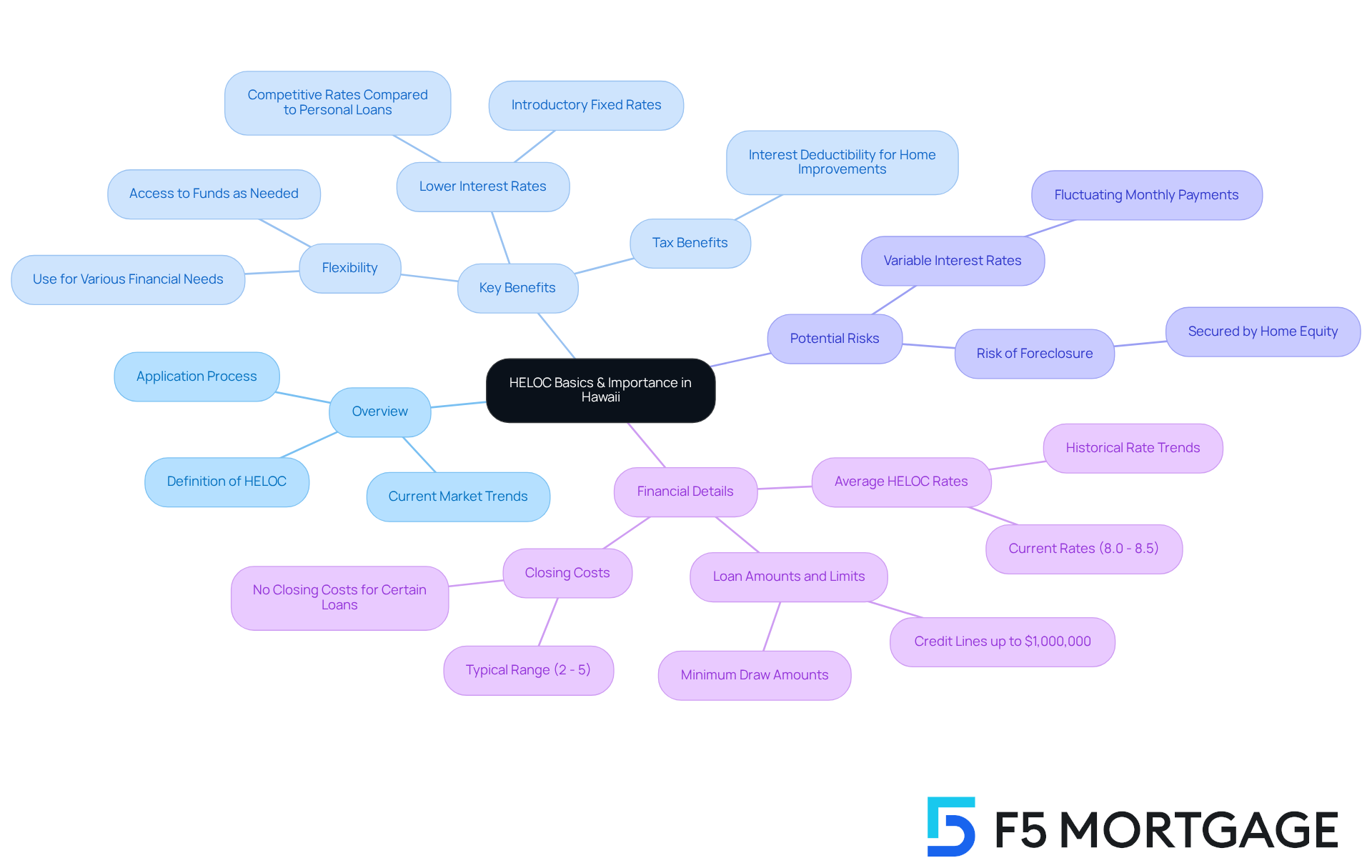

Understand HELOC Basics and Importance in Hawaii

A Home Equity Line of Credit (HELOC) is a revolving credit line that allows homeowners to borrow against the equity in their homes. In Hawaii, where property values can be high, understanding [HELOC rates Hawaii](https://f5mortgage.com/understanding-current-heloc-interest-rates-and-their-impact) is essential for families seeking to finance home improvements, education, or consolidate debt. We know how challenging it can be to navigate these financial decisions, and HELOCs generally provide compared to personal loans or credit cards, making them an appealing choice.

As of 2025, the average home equity line of credit interest rates, known as HELOC rates in Hawaii, vary from 8.0% to 8.5%. This offers a competitive advantage for borrowers, but it’s important to remember that HELOCs are secured by your home. This means that failure to repay could lead to foreclosure. Therefore, understanding the terms and conditions is vital before proceeding.

Key Benefits of HELOCs in Hawaii:

- Flexibility: Borrow only what you need, when you need it.

- Lower Interest Rates: HELOC rates Hawaii are generally lower than unsecured loans.

- Tax Benefits: Interest may be tax-deductible if used for home improvements, providing potential savings.

However, it’s crucial to consider the potential risks as well:

- Variable Interest Rates: Rates can fluctuate, impacting monthly payments.

- Risk of Foreclosure: As a secured loan, failure to repay can lead to losing your home.

By understanding these fundamentals, households can make informed choices about whether a home equity line of credit is the right option for their financial requirements. Furthermore, HFS FCU covers $2,000 in closing costs for approved HELOC lines, making it an attractive choice for families considering this financial tool. We’re here to support you every step of the way as you explore your options.

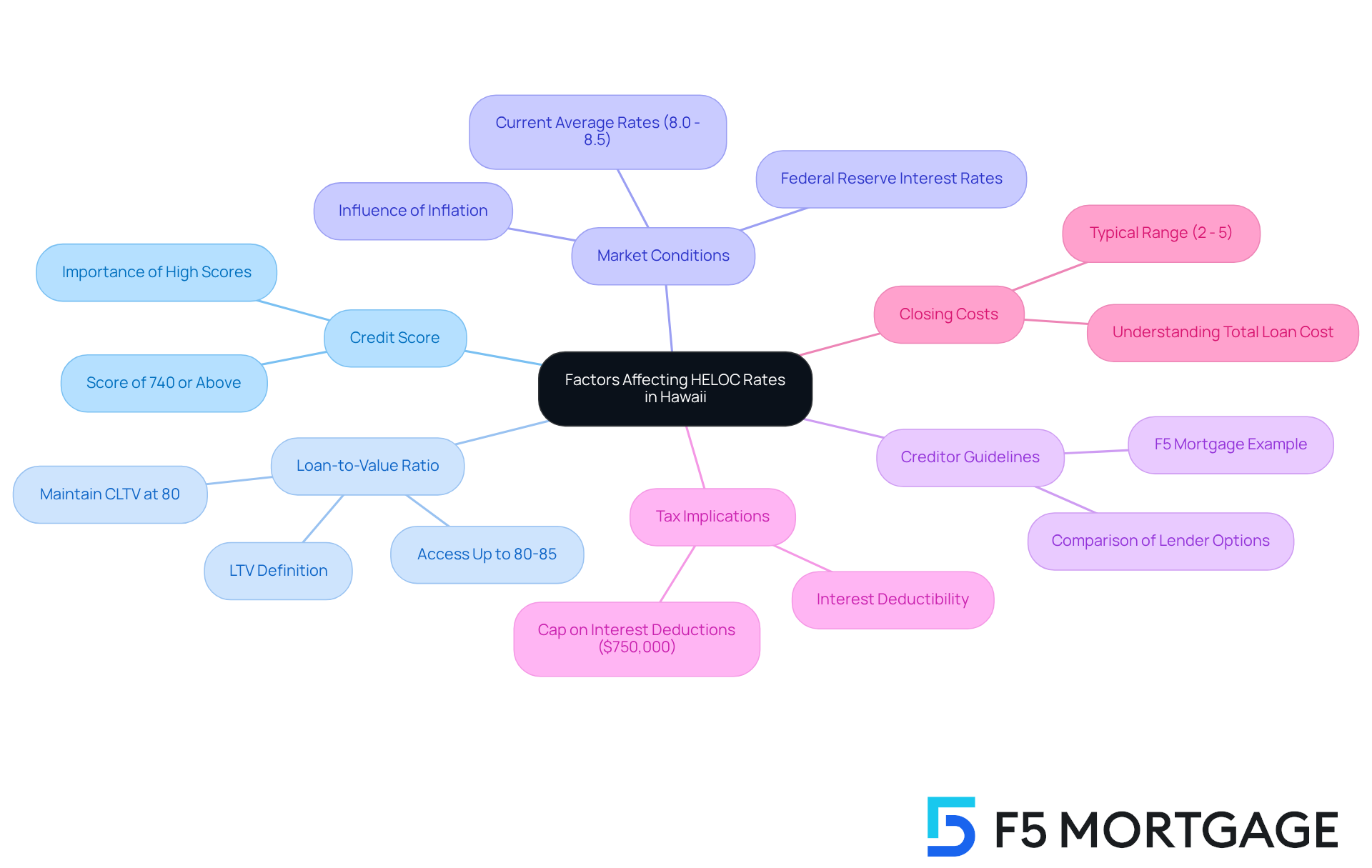

Identify Key Factors Affecting HELOC Rates

Several factors significantly influence the HELOC rates in Hawaii, and understanding these can empower families to secure more favorable terms.

- Credit Score: We know how crucial a strong credit score is. Higher scores typically lead to lower interest rates. Families should regularly review their credit reports and take steps to improve their scores if needed. For instance, sustaining a credit score of 740 or above can enhance the chances of securing favorable terms.

- Loan-to-Value Ratio (LTV): This ratio, which compares the loan amount to the appraised value of the home, plays a vital role in determining terms. A lower LTV suggests reduced risk to financiers, frequently leading to improved terms. In Hawaii, homeowners can generally access up to 80% to 85% of their home’s value, minus any outstanding mortgage balance. Additionally, maintaining a combined loan-to-value ratio (CLTV) at 80% or below can further demonstrate lower risk to lenders.

- Market Conditions: Economic factors, including inflation and the Federal Reserve’s interest rate choices, can influence home equity line of credit pricing. As of 2025, the average HELOC rates in Hawaii vary from 8.0% to 8.5%, reflecting the current economic landscape.

- Creditor Guidelines: Every creditor has distinct criteria and charges, making it crucial for households to compare options. Families ought to evaluate prices, expenses, and conditions from various lenders to identify the most suitable option for their requirements. F5 Mortgage, for example, distinguishes itself by providing attractive pricing and tailored assistance, which can aid households in maneuvering through the intricacies of obtaining a home equity line of credit.

- Tax Implications: It’s important to note that interest paid on a home equity line of credit may be tax-deductible if the funds are used for purchasing, constructing, or greatly enhancing the residence securing the loan, which can be a considerable financial factor for households.

- Closing Costs: Families should also be aware of potential closing costs associated with HELOCs, which typically range from 2% to 5% of the loan amount. Understanding these costs is essential for assessing the total loan cost.

By understanding these factors and considering institutions like F5 Mortgage, households can better prepare themselves to negotiate and secure the best HELOC rates Hawaii offers. We’re here to support you every step of the way, helping you make that align with your homeownership objectives.

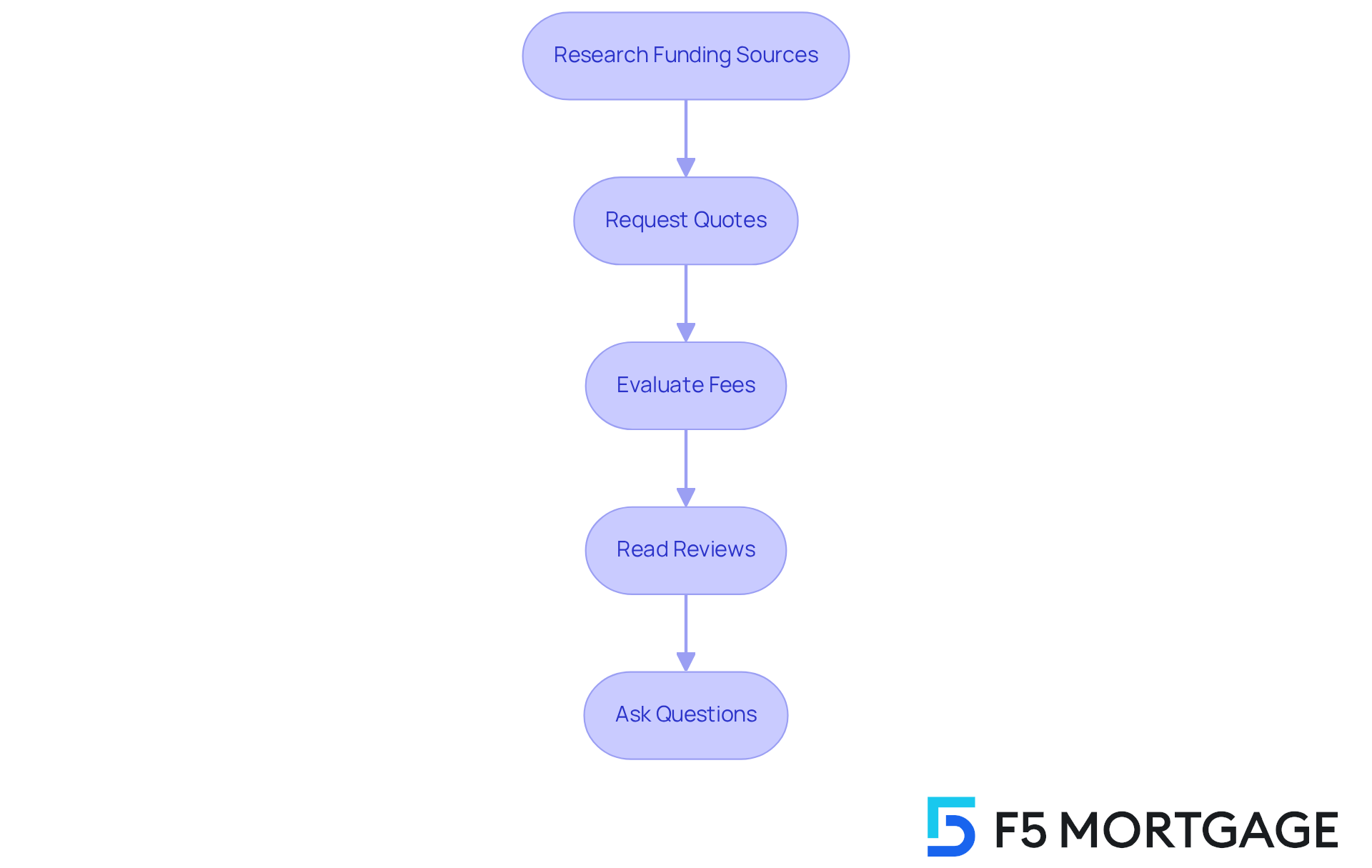

Compare Lenders and Their Offerings

When obtaining a HELOC, we understand how challenging it can be for families to navigate the different options available. Not all financial institutions provide the same conditions or service, and that’s why it’s essential to take a structured approach to effectively compare lenders.

Steps to Compare Lenders:

- Research Funding Sources: Start by assembling a varied list of possible financiers, including conventional banks, credit unions, and online platforms. Each type may offer unique benefits. For example, consider F5 Mortgage, which focuses on technology to provide extremely competitive pricing without the burden of aggressive sales methods.

- Request Quotes: Reach out to each financial institution to obtain estimates for HELOC conditions and terms. Providing consistent information to each lender will help you make accurate comparisons.

- Evaluate Fees: Beyond interest rates, it’s important to scrutinize any associated fees, such as application fees, annual fees, and closing costs. In Hawaii, heloc rates hawaii can vary significantly, typically ranging from 2% to 5% of the total line of credit, which may impact the overall cost of the HELOC.

- Read Reviews: Investigate customer reviews and ratings to gauge the provider’s reputation and quality of service. Positive feedback can indicate a financial institution’s reliability and responsiveness. F5 Mortgage, for instance, takes pride in delivering personal, no-pressure service that enhances the customer experience.

- Ask Questions: Engage with lenders by inquiring about their policies, repayment terms, and any potential penalties for early repayment. Understanding these details can help prevent unexpected costs down the line.

According to financial expert Peter Warden, ‘heloc rates hawaii today are usually varying between 8% and 8.5% for most borrowers.’ By diligently following these steps and considering these insights, households can make informed choices that align with their financial goals. We’re here to support you every step of the way, ensuring you secure the for your needs.

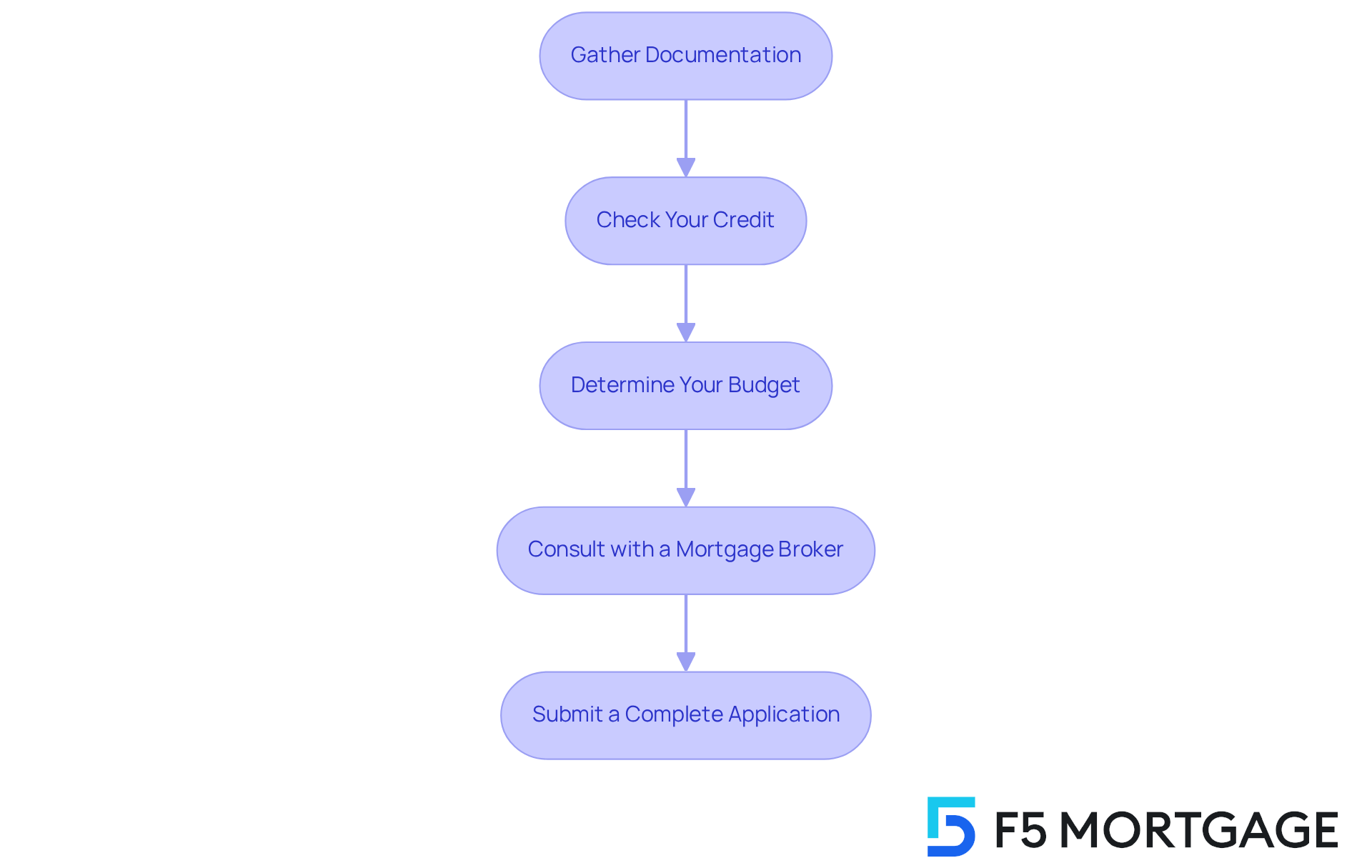

Prepare for a Successful HELOC Application

To increase the likelihood of a successful HELOC application, families can take several important steps that will guide them through the process with confidence:

- Gather Documentation: Start by collecting essential documents such as proof of income, tax returns, Social Security numbers, bank statements, and details about existing debts and assets. This comprehensive documentation is crucial for financial institutions to evaluate your financial situation accurately. We know how overwhelming this can feel, but having everything organized will make the process smoother.

- Check Your Credit: It’s vital to review your credit report for any inaccuracies and address them before applying. Generally, a credit score of at least 620 is required, but achieving a score of 700 or higher can significantly improve your chances of approval. Remember, maintaining a strong history of timely bill payments enhances your financial profile, as late payments can linger on your credit report for up to seven years.

- Determine Your Budget: Understanding how much you need to borrow is key. Evaluate your debt-to-income (DTI) ratio, which financial institutions generally prefer to be no greater than 43%. For instance, if your monthly income is $5,000, aim for total monthly debt payments not exceeding $2,500. A borrower with a DTI of 40% on a monthly income of $3,000 and total payments of $1,200 meets the lender’s requirements, indicating a manageable level of debt.

- Consult with a Mortgage Broker: Engaging with a mortgage broker can provide personalized advice and help you navigate the application process. They can assist in understanding the documentation required and the nuances of different loan options, including HELOCs. We’re here to support you every step of the way.

- Submit a Complete Application: Ensure that all information provided is accurate and complete to avoid processing delays. Missing or inaccurate information can lead to difficulties in obtaining your home equity line of credit.

By diligently following these preparation steps, families can feel empowered and well-prepared for a successful HELOC application that aligns with the current HELOC rates Hawaii and meets their financial needs and goals.

Conclusion

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) is crucial for families in Hawaii who are looking to leverage their home equity for various financial needs. We know how challenging this can be, but by grasping the basics of HELOCs—including their benefits and potential risks—homeowners can make informed decisions that align with their financial goals. With current HELOC rates in Hawaii ranging from 8.0% to 8.5%, families have access to a valuable financial tool that can aid in home improvements, education, or debt consolidation.

This guide has highlighted key factors influencing HELOC rates, such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

Moreover, the importance of comparing lenders and understanding their offerings cannot be overstated. Families are encouraged to conduct thorough research, gather necessary documentation, and prepare for their applications to enhance their chances of securing favorable terms. Institutions like F5 Mortgage stand out for their competitive pricing and personalized service, making them worthy options for consideration.

In conclusion, navigating the HELOC landscape in Hawaii requires diligence and preparation. By taking proactive steps, families can not only secure the best possible rates but also utilize their home equity effectively to achieve their financial aspirations. As the market continues to evolve, staying informed about current trends and lender offerings will be essential for making sound financial decisions. Embrace the opportunity to explore your options and take control of your financial future with a well-planned approach to HELOCs.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a revolving credit line that allows homeowners to borrow against the equity in their homes.

Why is understanding HELOC rates important in Hawaii?

Understanding HELOC rates in Hawaii is essential for families seeking to finance home improvements, education, or consolidate debt, especially given the high property values in the state.

What are the average HELOC interest rates in Hawaii as of 2025?

As of 2025, the average HELOC interest rates in Hawaii vary from 8.0% to 8.5%.

What are the advantages of using a HELOC in Hawaii?

Key benefits of HELOCs in Hawaii include flexibility to borrow only what you need, lower interest rates compared to unsecured loans, and potential tax benefits if the interest is used for home improvements.

What are the risks associated with HELOCs?

Risks include variable interest rates that can fluctuate, impacting monthly payments, and the risk of foreclosure if the borrower fails to repay, as HELOCs are secured by the home.

What should borrowers consider before getting a HELOC?

Borrowers should understand the terms and conditions of the HELOC, including interest rates, repayment obligations, and the potential risks of losing their home if they fail to repay.

Are there any incentives for families considering a HELOC?

Yes, HFS FCU covers $2,000 in closing costs for approved HELOC lines, making it an attractive choice for families.