Overview

We understand how challenging it can be for families to manage HELOC interest rates. By improving credit scores, increasing home equity, and shopping around for competitive offers from various lenders, families can truly make a difference. Consider strategies like:

- Making timely debt payments

- Negotiating terms

These actions can lead to more favorable borrowing conditions.

Ultimately, understanding these factors empowers homeowners to enhance their financial outcomes. Remember, we’re here to support you every step of the way as you navigate this process.

Introduction

Navigating the world of home financing can be daunting, and we know how challenging this can be, especially when considering options like Home Equity Lines of Credit (HELOCs). With rising interest rates and fluctuating market conditions, understanding how to leverage home equity effectively is crucial for families looking to save. This article delves into strategies that can empower homeowners to secure the best HELOC interest rates. We will highlight the benefits and potential drawbacks of this financial tool.

But what challenges might arise when trying to maximize savings? It’s important to consider how families can ensure they are making informed decisions in an ever-changing economic landscape. We’re here to support you every step of the way as you explore your options.

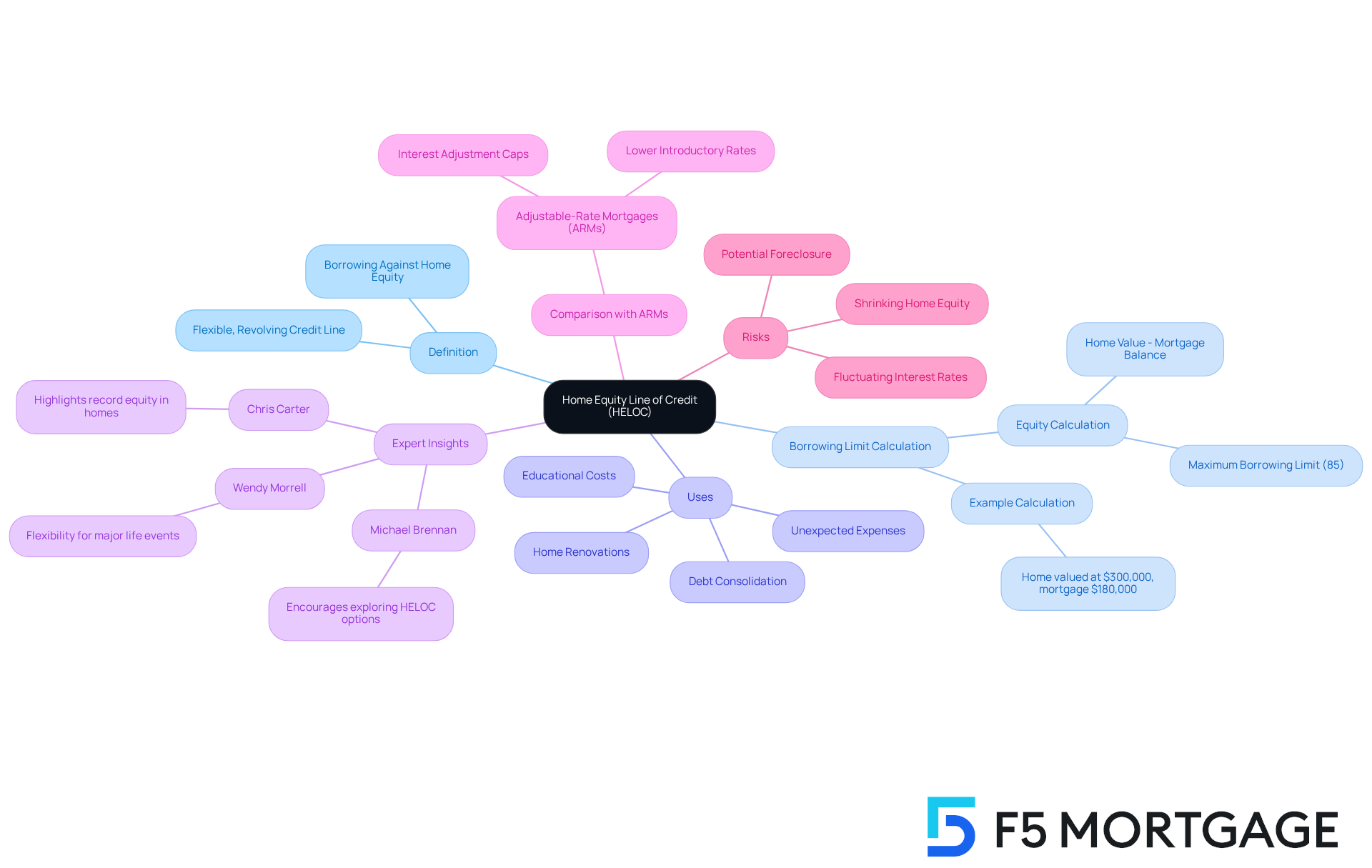

Define Home Equity Lines of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is a flexible, revolving credit line designed for property owners to borrow against the equity in their homes. Unlike conventional equity loans that provide a lump sum, a HELOC allows you to access funds as needed, up to a predetermined limit. This flexibility makes HELOCs particularly appealing for significant expenses, such as home renovations or debt consolidation. In 2025, the average interest rate on HELOC remains competitive, often lower than those for unsecured loans, which can lead to substantial savings for borrowers.

The amount you can borrow is determined by the equity in your property, which is calculated by subtracting your mortgage balance from your home’s current market value. For instance, if your home is valued at $300,000 and you owe $180,000 on your mortgage, you could potentially access up to $85,500 through a HELOC, assuming you qualify for the maximum borrowing limit of 85% of your asset’s value.

Homeowners have successfully used HELOCs for various purposes, including funding renovations that enhance their living spaces and increase property value. Imagine a family using a home equity line of credit to finance a kitchen renovation. Not only does this improve their home, but it can also provide a return on investment when they decide to sell.

Experts emphasize the importance of understanding the interest rate on HELOC and the terms of a home equity line of credit. As Michael Brennan, President at Nationwide Mortgage Bankers, notes, ‘It’s still a good time for prospective borrowers to consider a HELOC.’ This perspective reflects the current market conditions, where homeowners can leverage their equity without disrupting existing low-rate primary mortgages.

Additionally, homeowners should consider the advantages of adjustable-rate mortgages (ARMs) when exploring their financing options. ARMs typically offer lower introductory rates for a set period, after which the rates adjust according to market conditions, generally every six months. Interest adjustment caps help protect borrowers from significant interest increases. This can be beneficial for those planning to refinance or sell in the near future. However, it is essential to recognize the potential risks associated with HELOCs and ARMs, such as fluctuating interest rates and the possibility of foreclosure if the loan is not repaid.

In summary, a home equity line of credit serves as a versatile financial resource for homeowners, enabling access to funds for major expenses while maintaining the flexibility to borrow as needed. Collaborating with a lender like F5 Mortgage, which offers competitive pricing and personalized service, can further enhance your experience. Remember, we understand how challenging this can be, and we’re here to support you every step of the way.

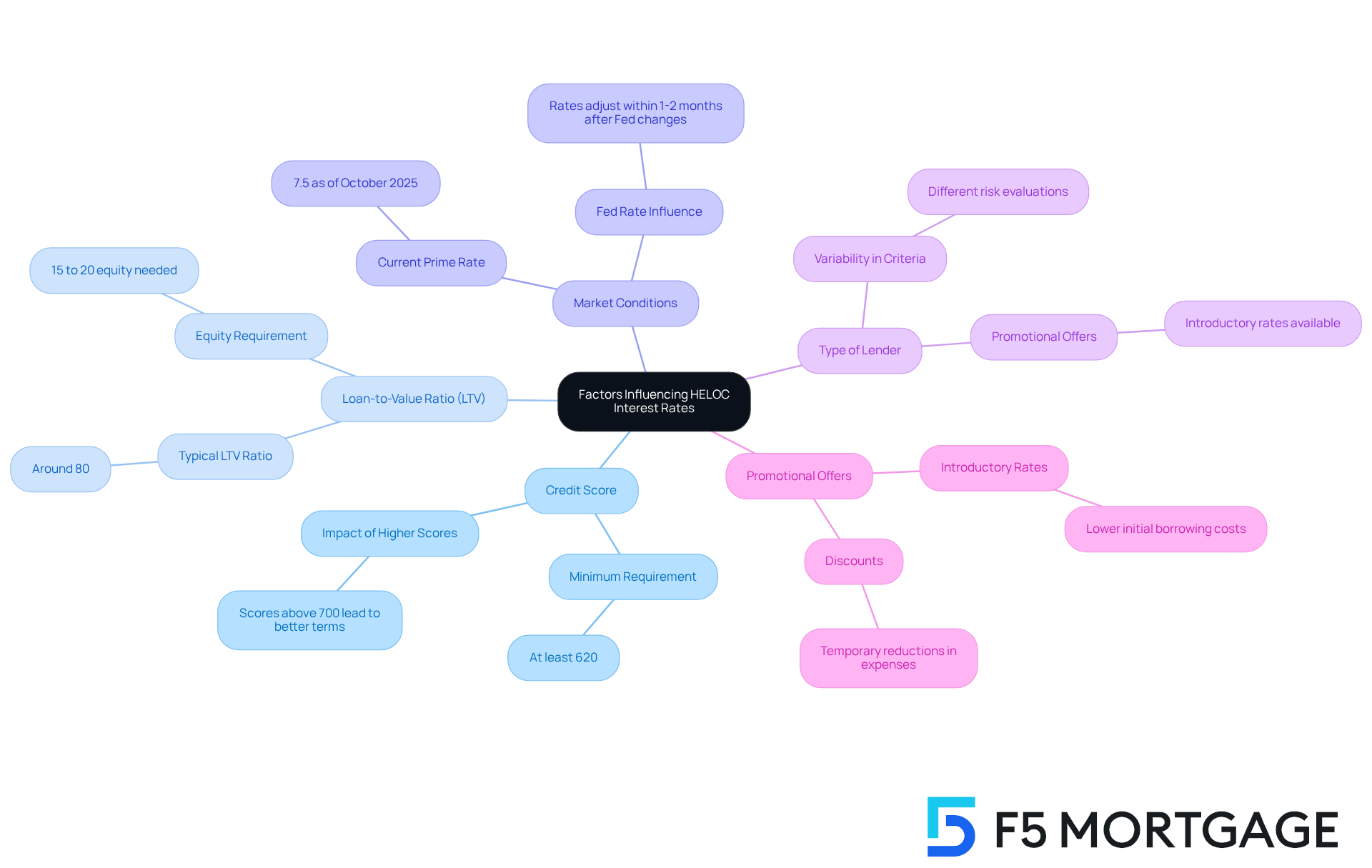

Explore Factors Influencing HELOC Interest Rates

Several key factors influence HELOC interest rates, which are crucial for families looking to leverage their home equity effectively:

-

Credit Score: We understand that a higher credit score generally leads to lower interest rates. Lenders perceive borrowers with strong credit histories as less risky. Typically, borrowers need a credit score of at least 620 to be eligible for a HELOC. Those with scores above 700 often enjoy considerably more favorable terms compared to those near 620, who might face increased expenses.

-

Loan-to-Value Ratio (LTV): The LTV ratio, which compares the loan amount to the assessed value of the property, plays a vital role in determining fees. Lower LTV ratios usually lead to more advantageous interest levels, as they signify reduced risk for lenders. In 2025, average LTV ratios for home equity lines of credit are around 80%, with many lenders requiring at least 15% to 20% equity in the home.

-

Market Conditions: Economic factors, particularly the Federal Reserve’s interest policies, significantly influence overall lending costs. As of October 2025, the prime interest rate stands at 7.5%, having reached a high of 8.5% in the past year. This fluctuation impacts the interest rate on HELOCs, which often changes in response to Fed decisions. Current HELOC borrowers can expect their interest rate on HELOC and payments to adjust within one to two months following a Federal Reserve adjustment.

-

Type of Lender: We know how important it is for homeowners to explore various lenders, as they possess distinct criteria and risk evaluations, resulting in a spectrum of prices. We encourage you to look for competitive deals, as some lenders may offer promotional terms that can temporarily reduce borrowing expenses. Consider collaborating with F5 Mortgage for tailored assistance that meets your family’s unique needs.

-

Promotional Offers: Many lenders provide introductory rates or discounts that can lower initial borrowing costs. These offers can be especially beneficial for families planning to utilize their home equity line of credit for ongoing expenses or projects.

Comprehending these elements can empower families to make informed choices when contemplating a home equity line of credit, ultimately leading to improved financial outcomes.

Identify Strategies to Secure the Best HELOC Rates

To secure the best interest rate on HELOC, we understand that you may have concerns. Here are some strategies that can help you navigate this process:

-

Improve Your Credit Score: We know how challenging it can be to manage debts. Paying down existing debts and ensuring timely payments can significantly boost your credit score. A score between 620 and 700 is often sufficient to qualify for favorable HELOC terms, while scores below 600 may complicate the process.

-

Increase Home Equity: Making additional mortgage payments can enhance your home equity, improving your loan-to-value (LTV) ratio. Regular payments not only reduce your loan balance but also contribute to building equity over time. For instance, homeowners who make biweekly payments or an extra payment each year can accelerate their equity-building efforts, which can be a great relief.

-

Shop Around: It’s essential to compare offers from various lenders, including banks, credit unions, and online platforms. Did you know that the average tappable equity per borrower has risen by nearly $102,000? This makes it a competitive market for HELOCs, giving you more options.

-

Negotiate Terms: Don’t hesitate to discuss with lenders for improved conditions or terms based on your financial profile. Demonstrating a solid credit history and sufficient equity can provide leverage in these discussions, and we’re here to support you every step of the way.

-

Consider Fixed vs. Variable Costs: Assess whether a fixed or fluctuating cost suits your financial condition, particularly in a changing market. Understanding the implications of each option can help you make a more informed decision, empowering you to choose what’s best for your family.

By applying these strategies, families can improve their likelihood of obtaining an advantageous interest rate on HELOC terms, ultimately using their home equity to reach financial objectives. Remember, we’re here to help you through this journey.

Evaluate Advantages and Disadvantages of HELOCs

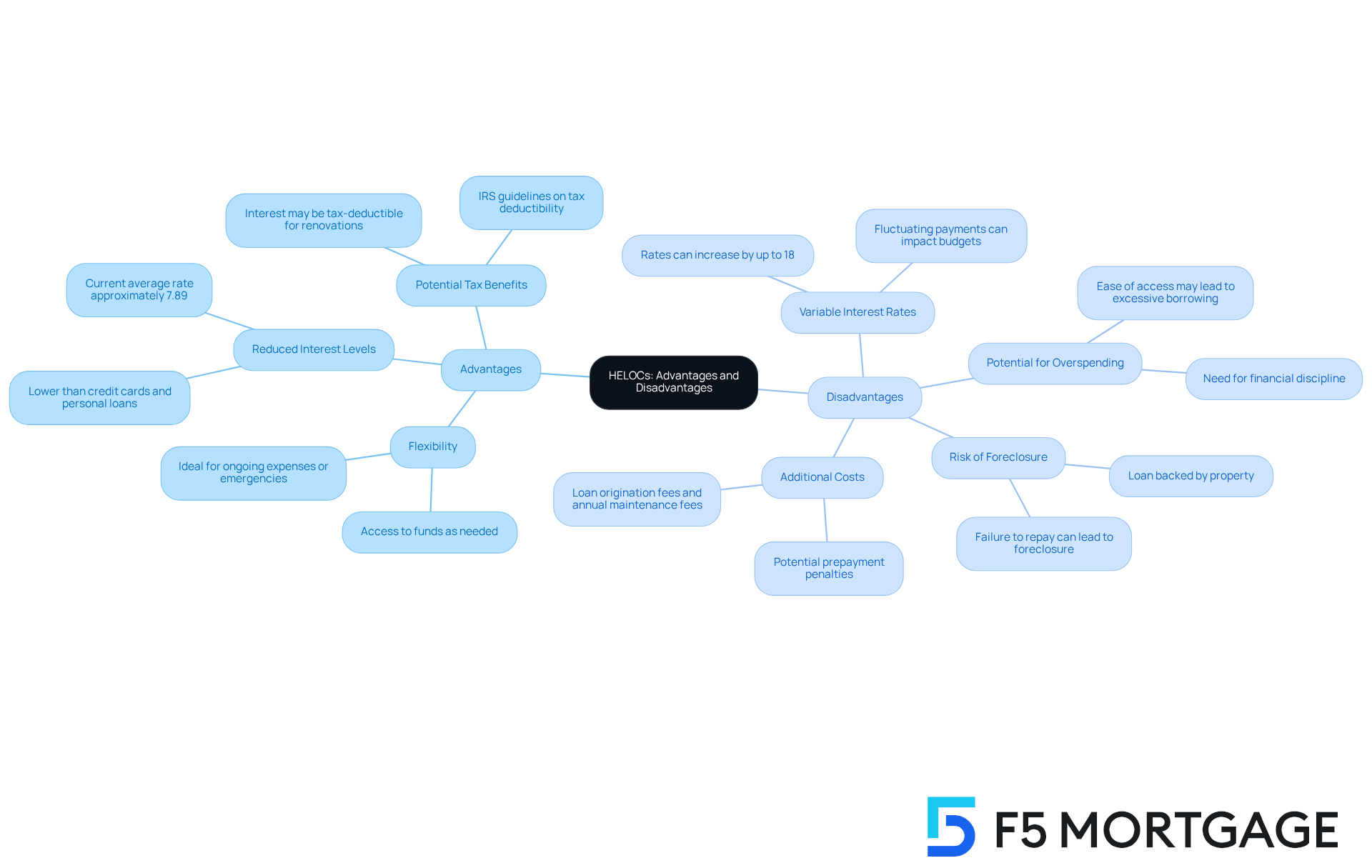

HELOCs offer a range of advantages and disadvantages that homeowners should carefully consider, especially when navigating their financial journey.

Advantages:

- Flexibility: We understand that financial needs can arise unexpectedly. HELOCs provide borrowers the ability to access funds as needed, making them ideal for ongoing expenses or emergencies. This flexibility allows homeowners to manage their financial needs without disturbing their primary mortgage.

- Reduced Interest Levels: Generally, the interest rate on HELOC is lower compared to credit cards and personal loans. For instance, the current interest rate on HELOC is approximately 7.89%, influenced by the Fed’s monetary policy. This is considerably lower than typical credit card rates, which often exceed 15%, particularly in comparison to the interest rate on HELOC.

- Potential Tax Benefits: Homeowners may find that the interest paid on a home equity line of credit could be tax-deductible if the funds are used for renovations. This offers an additional financial motivation for property owners. As Linda Bell states, “Interest paid on a HELOC is tax deductible as long as it’s used to ‘buy, build or substantially enhance the property that secures the loan,’ according to the IRS.”

Disadvantages:

- Variable Interest Rates: We know how challenging it can be to manage fluctuating expenses. Many HELOCs come with variable rates that can increase over time, potentially leading to higher payments. Borrowers should be prepared for these fluctuations that could impact their monthly budget.

- Risk of Foreclosure: Since the loan is backed by the property, failure to repay can lead to foreclosure. It’s essential for borrowers to ensure they can handle upcoming payments.

- Potential for Overspending: The ease of access to funds can sometimes lead to borrowing more than necessary, increasing overall debt. Homeowners must exercise discipline to avoid financial pitfalls associated with overspending.

- Additional Costs: There may be extra expenses related to home equity lines of credit, such as loan origination fees, annual maintenance fees, and potential prepayment penalties. These should be carefully considered when evaluating this option.

As we look ahead to 2025, the flexibility of home equity lines of credit continues to be a significant benefit. Homeowners can leverage their accrued equity for various financial needs, such as home renovations or debt consolidation. However, it is essential to weigh these advantages against the potential risks and costs associated with HELOCs. By doing so, you can make informed financial decisions that align with your goals.

Conclusion

A Home Equity Line of Credit (HELOC) is not just a financial tool; it’s an opportunity for homeowners to tap into their property’s equity to meet various needs. We understand how important it is to make informed decisions that align with your financial goals. By grasping the dynamics of HELOC interest rates and employing effective strategies, families can truly maximize their savings.

In this article, we highlighted key factors such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

These elements play a crucial role in influencing HELOC rates. We also discussed practical strategies like:

- Improving credit scores

- Increasing home equity

- Shopping around for competitive offers

These steps can help families secure the best possible terms, ensuring they make the most of their home equity.

While HELOCs offer advantages like lower interest rates and flexibility, it’s essential to weigh these against potential risks, such as variable rates and the threat of foreclosure. Navigating these complexities requires careful consideration and proactive planning.

We encourage homeowners to explore their options and seek personalized assistance. Remember, we’re here to support you every step of the way. By remaining vigilant about your financial management, you can effectively utilize your home equity to achieve your financial aspirations while mitigating associated risks. Together, we can turn your financial goals into a reality.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a flexible, revolving credit line that allows property owners to borrow against the equity in their homes, providing access to funds as needed up to a predetermined limit.

How does a HELOC differ from a conventional equity loan?

Unlike conventional equity loans that provide a lump sum, a HELOC allows homeowners to withdraw funds as needed, making it more flexible for significant expenses.

What can a HELOC be used for?

Homeowners use HELOCs for various purposes, including funding home renovations, debt consolidation, and other major expenses.

How is the borrowing amount determined for a HELOC?

The amount you can borrow is based on the equity in your property, calculated by subtracting your mortgage balance from your home’s current market value.

What is an example of how much one could borrow through a HELOC?

For example, if a home is valued at $300,000 and the mortgage balance is $180,000, the homeowner could potentially access up to $85,500 through a HELOC, assuming they qualify for a maximum borrowing limit of 85% of the home’s value.

What are the current interest rates for HELOCs?

In 2025, the average interest rate on HELOCs remains competitive and is often lower than those for unsecured loans, potentially leading to substantial savings for borrowers.

What should borrowers consider regarding interest rates on HELOCs?

Borrowers should understand the interest rate and terms of a HELOC, as well as the potential risks associated with fluctuating interest rates.

What are adjustable-rate mortgages (ARMs) and how do they relate to HELOCs?

ARMs typically offer lower introductory rates for a set period, after which rates adjust according to market conditions. They can be beneficial for those planning to refinance or sell soon, but they also carry risks of fluctuating interest rates.

What are the risks associated with HELOCs?

The risks include fluctuating interest rates and the possibility of foreclosure if the loan is not repaid.

How can a lender assist homeowners considering a HELOC?

Working with a lender like F5 Mortgage can enhance the experience by offering competitive pricing and personalized service to support homeowners in accessing their equity.