Overview

This article is designed to guide homebuyers through the essential steps of calculating the Debt Service Coverage Ratio (DSCR) and understanding its significance in real estate financing. We know how challenging this can be, and mastering the DSCR calculation is crucial for your journey. Not only does it reflect your ability to meet loan obligations, but it also enhances your chances of securing favorable loan terms.

Throughout the article, we provide detailed explanations of the calculation process and the importance of maintaining a strong ratio. By understanding the DSCR, you empower yourself with the knowledge needed to navigate the mortgage landscape confidently. Remember, we’re here to support you every step of the way.

Introduction

We know how daunting it can be to navigate the intricacies of real estate financing, especially for homebuyers like you who are facing the complexities of loan applications. Central to this journey is the Debt Service Coverage Ratio (DSCR). This critical metric not only reflects a property’s income-generating potential but also plays a significant role in loan approval outcomes.

As you seek favorable financing options, the challenge lies in mastering the DSCR calculation and understanding its implications.

How can you leverage this powerful tool to enhance your chances of securing the best loan terms? We’re here to support you every step of the way.

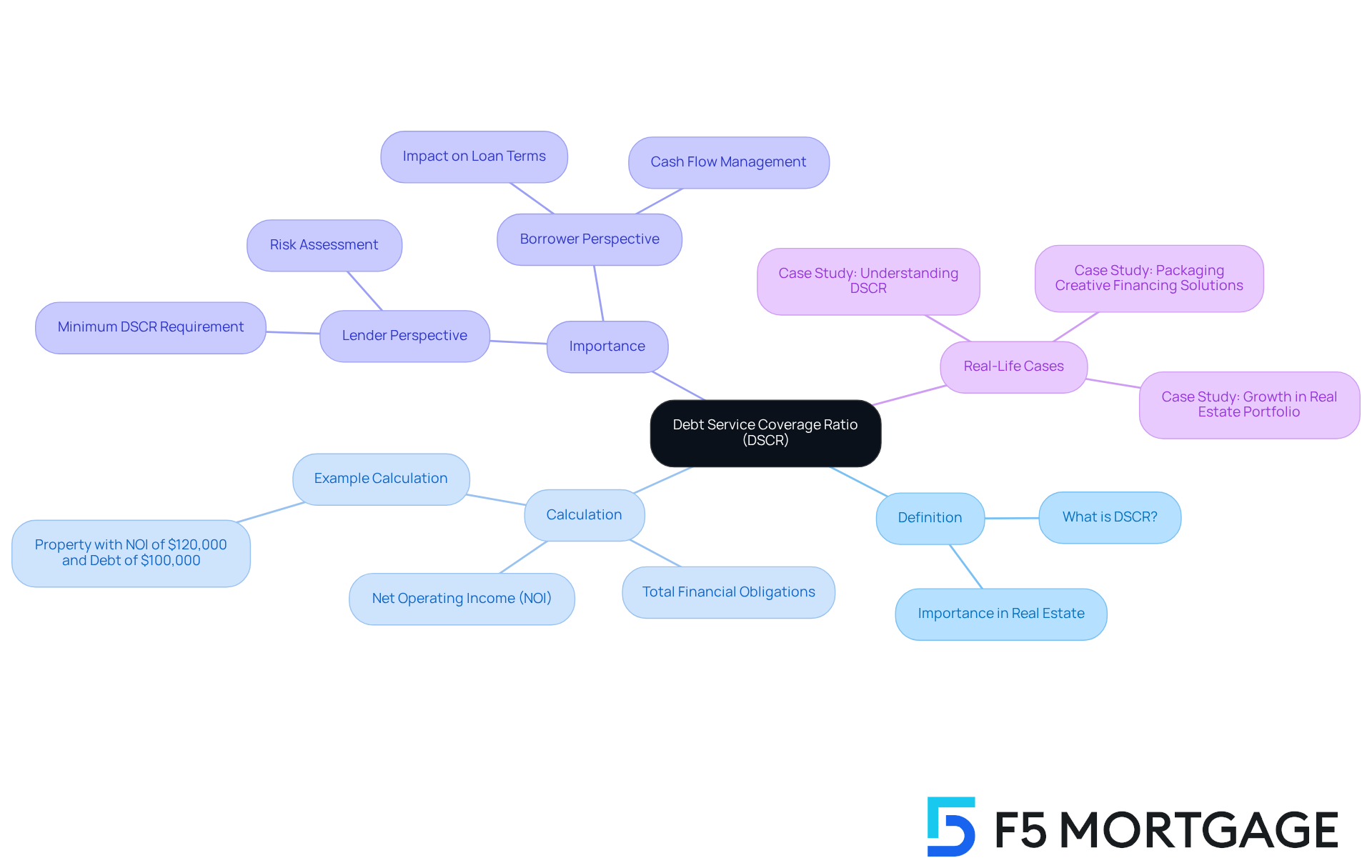

Define Debt Service Coverage Ratio (DSCR) and Its Importance in Real Estate

The dscr calculation is a vital metric that helps you understand your ability to meet loan obligations. The dscr calculation is performed by dividing a real estate’s net operating income (NOI) by its total financial obligations, which encompass both principal and interest payments. If your debt service coverage ratio is above 1, it means your asset is generating enough income to comfortably handle its debt. Conversely, a ratio below 1 may indicate potential financial strain, which can be concerning.

In the realm of real estate, lenders rely heavily on the dscr calculation to assess the risks associated with mortgage applications. This is why it’s so important for homebuyers like you to grasp its implications when seeking financing. A strong debt service coverage ratio, as indicated by the dscr calculation, not only reflects your asset’s income-generating potential but also significantly boosts your chances of securing favorable loan terms and conditions.

Many lenders prefer a minimum debt service coverage ratio of 1.25, as the dscr calculation shows a healthy cash flow that can withstand fluctuations in rental income. For instance, if a property has an NOI of $120,000 against annual debt payments of $100,000, the dscr calculation shows a debt service coverage ratio of 1.20, showcasing a reliable income stream.

Real-life case studies highlight the importance of the debt service coverage ratio in real estate transactions. Brokers who specialize in DSCR loans can attract a diverse clientele, including individual investors and limited liability companies that may not qualify for traditional financing. By mastering the intricacies of debt service coverage ratios and the dscr calculation, brokers can position themselves as trusted advisors, guiding clients through the complexities of real estate financing while maximizing their investment potential. We know how challenging this can be, and we’re here to support you every step of the way.

Calculate DSCR: Step-by-Step Guide to the Formula and Components

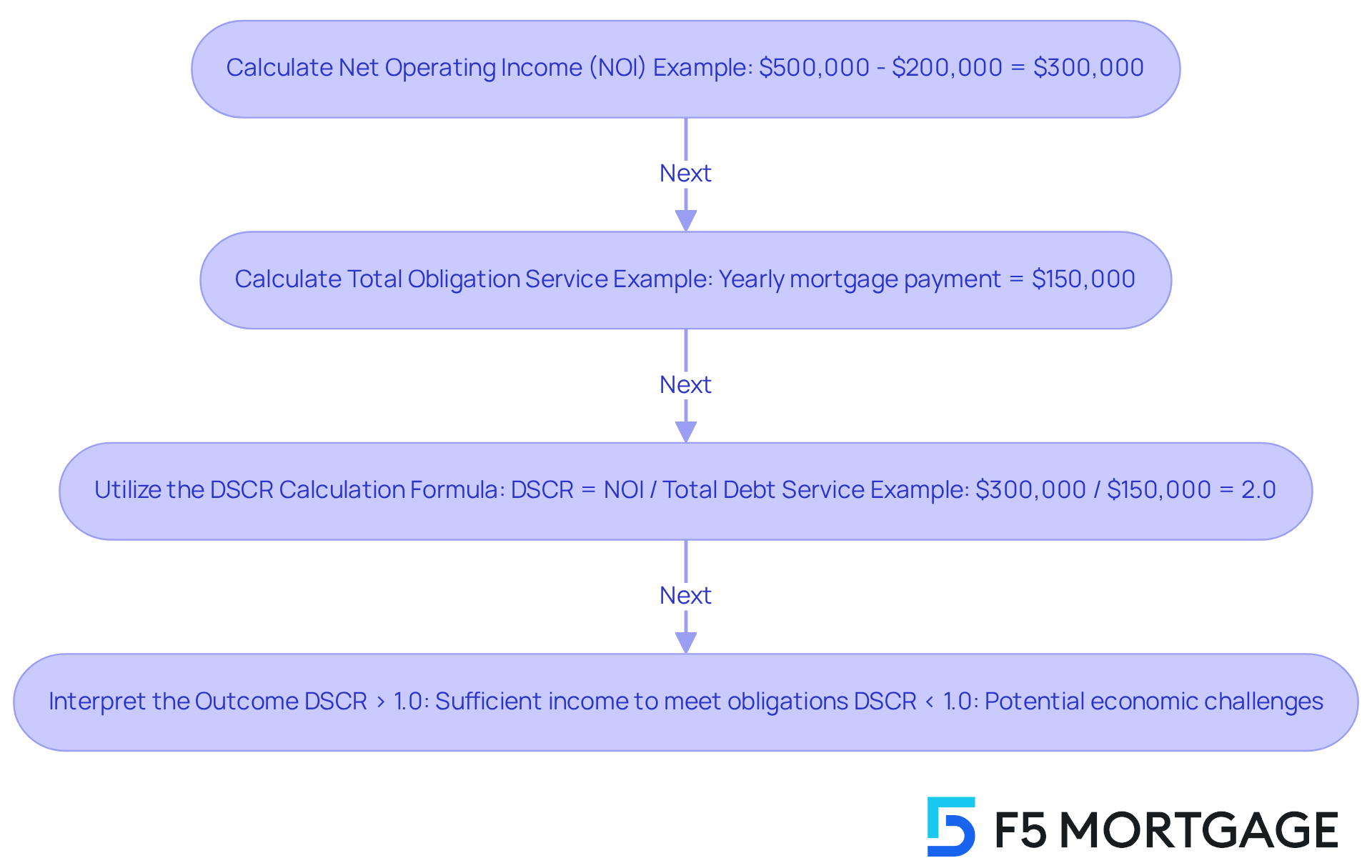

The dscr calculation can feel overwhelming, but we’re here to guide you through it step by step. It’s important to approach this systematically to ensure clarity and accuracy. Let’s break it down:

-

Calculate Net Operating Income (NOI): This figure represents the total income generated from your asset after deducting operating expenses. For example, if your rental property brings in $500,000 in gross rental income but incurs $200,000 in expenses, your NOI would be $300,000. This dscr calculation is vital as it shows the cash flow available to meet your financial obligations.

-

Calculate Total Obligation Service: This includes all periodic payments needed to service your obligation, such as principal and interest. If your yearly mortgage payment is $150,000, that’s your total financial obligation.

-

Utilize the dscr calculation: The formula for calculating the Debt Service Coverage Ratio is straightforward: Debt Service Coverage Ratio = NOI / Total Debt Service. Referring back to our example, if the NOI is $300,000 and the total loan service is $150,000, the calculation would be coverage ratio = $300,000 / $150,000 = 2.0. This means your property generates double the revenue needed to meet its obligations, indicating strong economic health.

-

Interpret the Outcome: A debt service coverage ratio above 1.0 means you have sufficient income to meet your debt obligations, while a ratio below 1.0 could signal potential economic challenges. Many lenders prefer a debt service coverage ratio of at least 1.25, providing a safety net against income fluctuations or unexpected expenses. If your ratio falls below 1.0, it may be time to reassess your asset’s economic condition, considering options like rent increases, property improvements, or restructuring loan terms.

Understanding the dscr calculation is crucial for real estate investors, as it helps evaluate the financial viability of assets and informs strategic decisions regarding acquisitions and funding. Additionally, monitoring the debt service coverage ratio over time can help identify financial trends and potential issues before they escalate. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

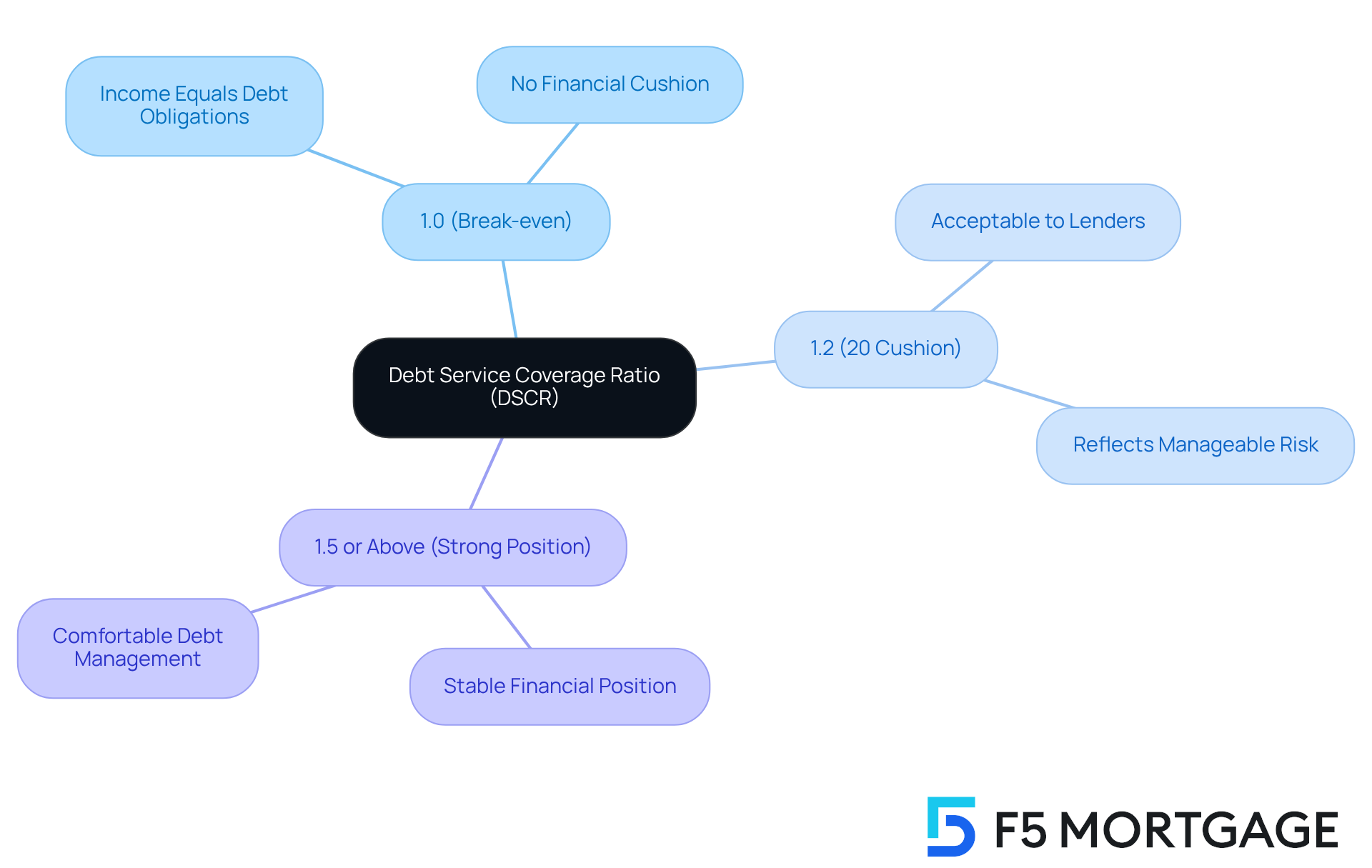

Interpret DSCR Values: What Lenders Look For and What Constitutes a Good Ratio

Lenders typically seek a ratio of at least 1.20 to 1.25 in the DSCR calculation. This indicates that the asset generates enough revenue to meet its financial commitments while also providing a buffer for unexpected costs. A ratio below 1.0 is often seen as concerning, as it suggests that the property does not generate sufficient revenue to cover its obligations. For instance:

- DSCR of 1.0: This is the break-even point, where income equals debt obligations, indicating no financial cushion.

- Debt Service Coverage Ratio of 1.2: This ratio offers a 20% cushion, which is generally acceptable to lenders, reflecting manageable risk.

- Debt Service Coverage Ratio of 1.5 or above: A ratio in this range is considered strong, suggesting that the borrower is in a stable position and can comfortably manage debt payments.

Understanding these thresholds is crucial for homebuyers when considering the DSCR calculation. It helps you plan your resources effectively, enhancing your chances of loan approval. By aiming for a higher debt service coverage ratio, you can present yourself as a lower-risk candidate, potentially leading to better loan terms and conditions.

When comparing lenders, consider reaching out to F5 Mortgage. They offer competitive rates and personalized service tailored to your needs, ensuring you find the best fit for your financial situation. We know how challenging this process can be, but we’re here to support you every step of the way.

Enhance Your DSCR: Strategies for Improvement and Common Challenges

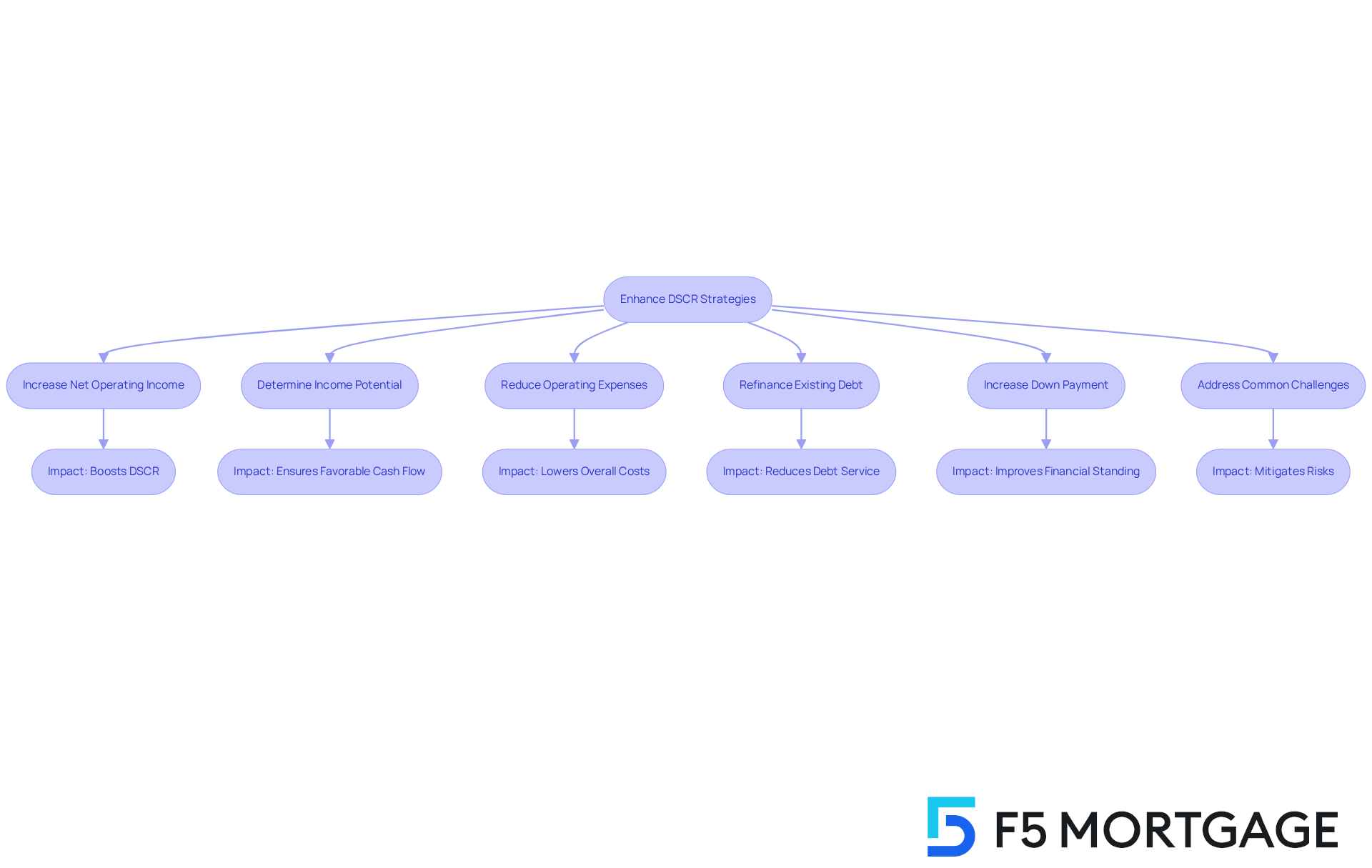

Improving your dscr calculation is essential for strengthening your loan application, and we understand how important this is for you. Here are some effective strategies to consider:

-

Increase Net Operating Income (NOI): Raising rents or minimizing vacancies can significantly boost your income. For instance, efficient management techniques can improve tenant retention, resulting in a more stable income stream. We know that investors who implemented strategic upgrades and improved tenant screening saw a notable increase in their NOI, which had a positive effect on their dscr calculation.

-

Determine Income Potential of the Asset: Evaluating the income potential of your asset is crucial. This means examining local rental markets, understanding tenant demographics, and assessing similar listings to establish competitive rental rates. A comprehensive assessment can help ensure your property generates favorable cash flow, which is essential for the dscr calculation requirements.

-

Reduce Operating Expenses: Conducting a thorough analysis of your expenses can reveal potential cost-saving measures. For example, switching to energy-saving appliances is one way to reduce utility expenses, enhancing your overall financial health.

-

Refinance Existing Debt: If possible, refinancing with F5 Mortgage can secure lower interest rates, reducing your overall debt service and positively impacting your dscr calculation. Given the recent decline in mortgage rates in Colorado, now is an opportune time to explore refinancing options. This approach has benefited many investors, allowing them to allocate more funds toward income-generating activities and potentially access cash for home improvements.

-

Increase Down Payment: A larger down payment not only lowers the loan amount but also enhances your financial standing, resulting in a more favorable debt service coverage ratio. This strategy can be particularly effective in a competitive lending environment, where the dscr calculation is crucial for securing advantageous loan conditions.

-

Address common challenges by being mindful of factors like fluctuating rental markets or unexpected repairs that can negatively impact your dscr calculation. Creating a financial cushion or emergency fund can help mitigate these risks, ensuring you maintain a healthy DSCR even during challenging times.

By applying these strategies, you can significantly enhance your DSCR calculation, making your mortgage application more appealing to lenders. Remember, the dscr calculation reflects your ability to manage debt obligations effectively, which is a key factor in securing favorable financing options. With the current market trends in Colorado, leveraging refinancing opportunities with F5 Mortgage can further strengthen your financial strategy. We’re here to support you every step of the way.

Conclusion

Understanding the Debt Service Coverage Ratio (DSCR) is crucial for homebuyers navigating the complexities of real estate financing. We know how challenging this can be. This metric not only evaluates an asset’s income potential but also serves as a critical indicator for lenders assessing loan applications. A solid grasp of the DSCR calculation empowers homebuyers to make informed decisions, enhancing their chances of securing favorable loan terms while effectively managing their financial obligations.

Throughout this article, we provided key insights on:

- Calculating the DSCR

- Interpreting its values

- Recognizing what lenders look for in a strong ratio

We detailed the steps to calculate the ratio, emphasizing the importance of net operating income and total debt service. Additionally, we discussed strategies for improving the DSCR, such as:

- Increasing rental income

- Reducing operating expenses

- Refinancing existing debt

These elements illustrate how a well-managed DSCR can bolster a homebuyer’s financial standing in the competitive real estate market.

Ultimately, mastering the DSCR calculation is more than just a numerical exercise; it is a vital skill that can lead to better financing opportunities and long-term investment success. Homebuyers are encouraged to proactively assess and enhance their DSCR, ensuring they are well-prepared to meet lender expectations. By implementing the strategies outlined, individuals can create a more resilient financial profile, paving the way for successful real estate investments and a secure financial future. We’re here to support you every step of the way.

Frequently Asked Questions

What is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) is a financial metric that measures an entity’s ability to meet its loan obligations. It is calculated by dividing a real estate’s net operating income (NOI) by its total financial obligations, which include both principal and interest payments.

Why is the DSCR important in real estate?

The DSCR is important because it helps lenders assess the risks associated with mortgage applications. A strong DSCR indicates that an asset is generating sufficient income to handle its debt, which can lead to more favorable loan terms and conditions for homebuyers.

What does a DSCR above 1 indicate?

A DSCR above 1 indicates that the asset is generating enough income to comfortably cover its debt obligations, suggesting financial stability.

What does a DSCR below 1 mean?

A DSCR below 1 may indicate potential financial strain, suggesting that the asset is not generating enough income to meet its debt obligations, which can be concerning for lenders and investors.

What is the minimum DSCR preferred by many lenders?

Many lenders prefer a minimum DSCR of 1.25, as this reflects a healthy cash flow that can withstand fluctuations in rental income.

Can you provide an example of a DSCR calculation?

For instance, if a property has a net operating income (NOI) of $120,000 and annual debt payments of $100,000, the DSCR would be 1.20, indicating a reliable income stream.

How does understanding DSCR benefit real estate brokers?

By mastering the intricacies of DSCR and its calculation, brokers can position themselves as trusted advisors, guiding clients through the complexities of real estate financing and maximizing their investment potential.