Overview

When considering the purchase of a home, we understand how daunting the process can feel, especially when it comes to down payments. Conventional mortgage down payments are typically required upfront, ranging from 3% to 20% or more, depending on lender requirements and your unique circumstances.

Larger down payments can significantly ease your financial burden. They often lead to lower monthly payments and better interest rates. Additionally, making a larger down payment can eliminate the need for private mortgage insurance (PMI), which is an added expense many families want to avoid.

By taking these steps, you can enhance your financial stability and move closer to achieving your dream of homeownership. Remember, we’re here to support you every step of the way as you navigate this important journey.

Introduction

Navigating the path to homeownership can feel overwhelming, especially when faced with the conventional mortgage down payment. This initial investment, which can range from as low as 3% to over 20% of a home’s purchase price, is crucial in shaping your family’s financial future. We understand how significant this decision is; it influences not only your monthly payments and interest rates but also your eligibility for various assistance programs.

However, many families find themselves asking: is a larger down payment always the best strategy? Or could it potentially limit your financial flexibility in the long run? It’s a question worth exploring, and we’re here to support you every step of the way.

Define Conventional Mortgage Down Payments

When you’re looking to buy a home, the initial loan deposit can feel like a daunting hurdle. This deposit, often a percentage of the home’s purchase price, is typically the first step in your journey. Unlike government-supported loans, traditional loans are not backed by federal entities, which means lenders may ask for a larger upfront contribution to help mitigate their risk.

We understand how overwhelming this can be. The conventional mortgage down payment can vary from as low as 3% to as high as 20% or more, depending on your lender’s requirements and your financial circumstances. Making a larger conventional mortgage down payment can lead to better loan terms and lower monthly payments, making it a crucial consideration for families eager to secure their dream home.

Remember, we’re here to support you every step of the way. Taking the time to understand your options and preparing for this initial contribution can empower you in your home-buying journey. You are not alone in this process, and with the right guidance, you can navigate these challenges successfully.

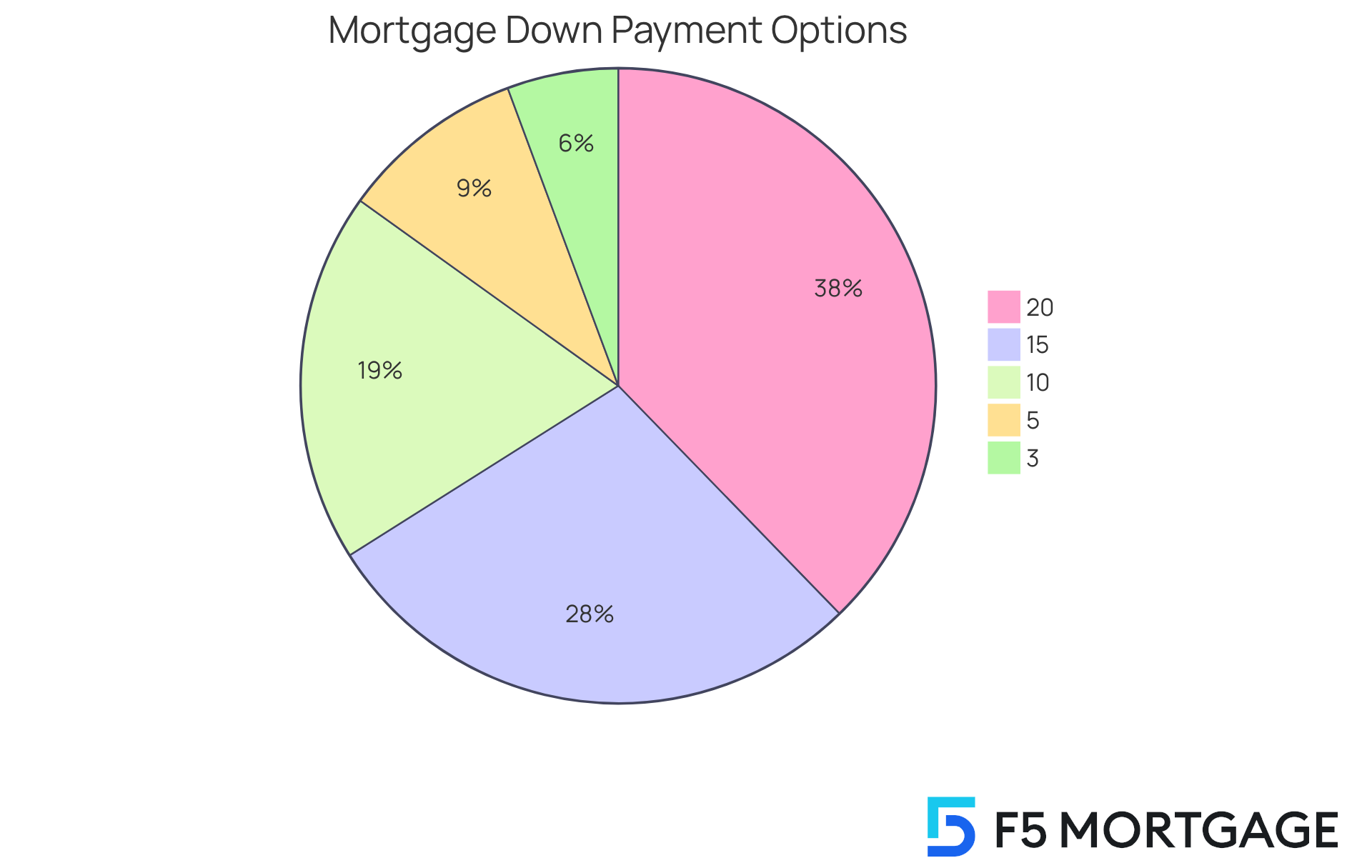

Outline Minimum Down Payment Requirements

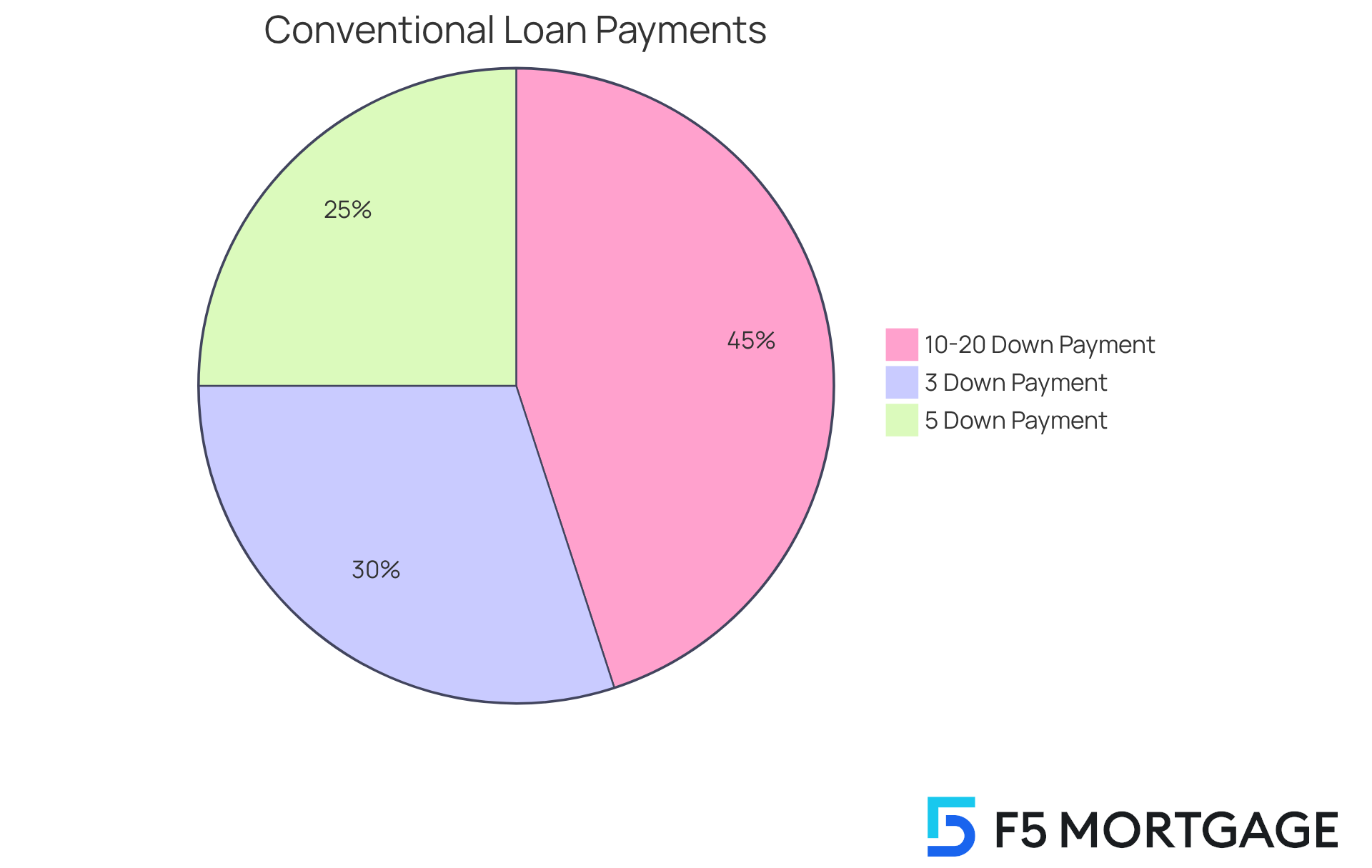

For conventional loans, the minimum conventional mortgage down payment typically starts at 3% for first-time homebuyers. However, some lenders may require a higher percentage based on the borrower’s creditworthiness and financial situation. We understand how daunting this can seem, but an endorsement from a lender signifies that they view you as a suitable candidate for a loan, which can influence the down deposit options available to you. Here are the common minimum down payment requirements:

- 3%: This option is available for first-time homebuyers through specific programs, allowing you to enter the housing market with a lower initial investment.

- 5%: A conventional mortgage down payment of this amount is a common requirement for many conventional loans, providing a balance between accessibility and lender security.

- 10% to 20%: A conventional mortgage down payment of larger initial contributions is often recommended, as it can eliminate the need for private mortgage insurance (PMI) and lead to better interest rates.

We know how important it is for families to make informed decisions. Therefore, we encourage you to seek advice from your loan advisor to identify the best initial investment strategy based on your unique financial circumstances and goals. Remember, we’re here to support you every step of the way.

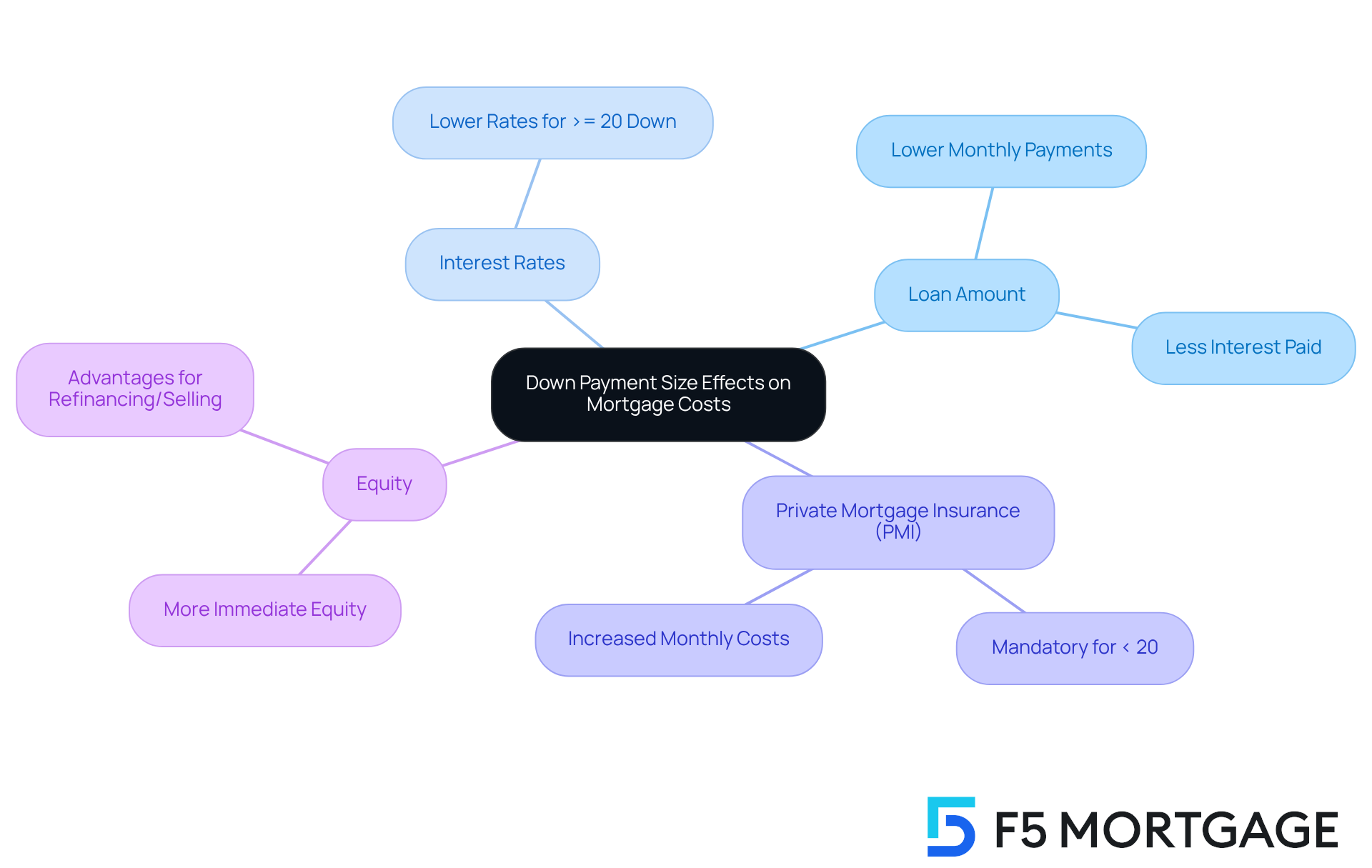

Analyze How Down Payment Size Affects Mortgage Costs

The size of a conventional mortgage down payment significantly influences various aspects of a mortgage, and we understand how challenging this can be for families. Understanding these elements can empower you in your home-buying journey:

- Loan Amount: A larger down payment reduces the total amount borrowed, leading to lower monthly payments and less interest paid over the life of the loan. This can ease financial stress in the long run.

- Interest Rates: Lenders frequently offer improved interest rates to borrowers who make a larger conventional mortgage down payment, as this reduces their risk. For instance, a conventional mortgage down payment of 20% or more can often qualify you for lower rates compared to those who put down less.

- Private Mortgage Insurance (PMI): If your initial deposit is below 20%, lenders generally mandate PMI, which increases your monthly mortgage expense compared to making a conventional mortgage down payment. Eliminating PMI can result in significant savings, giving you more breathing room in your budget.

- Equity: A larger initial contribution results in more immediate equity in the property. This can be advantageous for refinancing or selling later, providing you with options down the road.

Families should carefully consider how much they can afford for a conventional mortgage down payment, as this decision can have lasting effects on their financial health. Moreover, we’re here to support you every step of the way. F5 Mortgage offers several down payment assistance programs that can help families in California, Texas, and Florida. For example, the MyHome Assistance Program from the California Housing Finance Authority (CalHFA) provides up to 3% of the home’s purchase price. In Texas, the My Choice Texas Home program from the Texas Department of Housing and Community Affairs (TDHCA) offers up to 5% for down payment assistance and closing support. Florida’s programs, such as the Florida Assist Second Mortgage Program, can provide up to $10,000 for upfront costs. These choices can greatly alleviate the strain of initial costs and make homeownership more attainable.

Evaluate Benefits and Drawbacks of Larger Down Payments

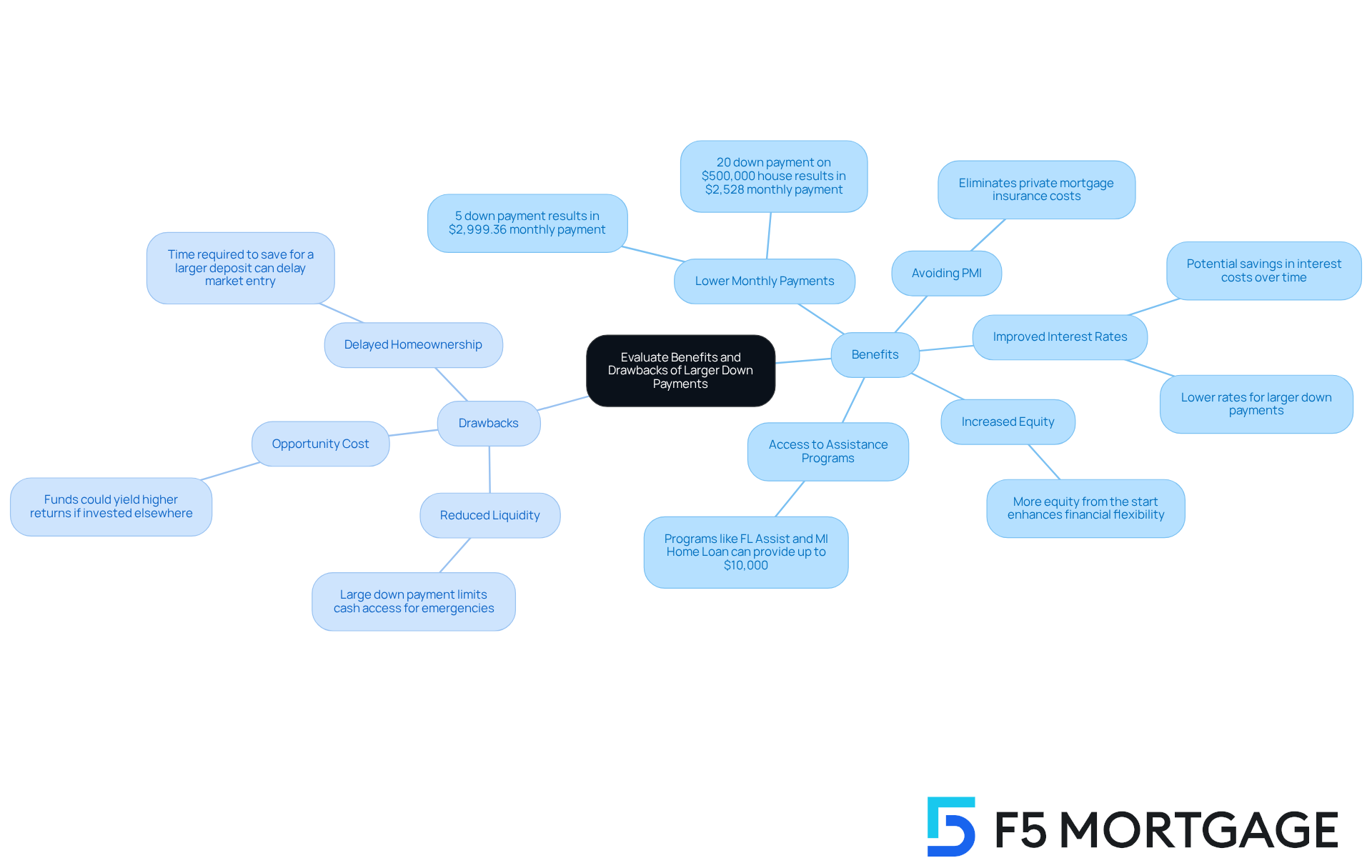

Choosing a larger conventional mortgage down payment can significantly influence your family’s mortgage experience, presenting both advantages and challenges that deserve careful consideration.

Benefits:

- Lower Monthly Payments: A larger down payment decreases the loan amount, leading to reduced monthly mortgage payments. For instance, a 20% conventional mortgage down payment on a $500,000 house translates to an initial investment of $100,000, which can greatly lessen your monthly responsibilities compared to a smaller deposit. Specifically, with a 20% down payment, your monthly fee would be approximately $2,528, in contrast to $2,999.36 with a 5% down contribution.

- Avoiding PMI: By making a conventional mortgage down payment of 20% or more, you can eliminate the cost of private mortgage insurance (PMI), resulting in substantial savings over the life of your loan.

- Improved Interest Rates: Lenders often reward a conventional mortgage down payment with lower interest rates, which can reduce the total cost of your mortgage. This means significant savings in interest costs over time. As Melissa Cohn highlights, “The best priced loans are going to require a larger upfront contribution, so the less you invest initially, the higher the rate is, the greater the risk.”

- Increased Equity: A conventional mortgage down payment can allow you to start with more equity in your property, providing your family with greater financial flexibility for future borrowing or selling, thereby enhancing your overall financial stability.

- Access to Assistance Programs: F5 Mortgage offers various down payment aid programs, including the FL Assist and MI Home Loan programs, which can provide up to $10,000 to help your family with the conventional mortgage down payment necessary to achieve homeownership. These initiatives can significantly enhance your home buying opportunities, making it easier to secure your dream home. For example, Alley Cohen shared, “Everything went very smoothly!” illustrating the ease of accessing these programs.

Drawbacks:

- Reduced Liquidity: Committing a large sum to a down payment can limit your access to cash for emergencies or other investment opportunities, potentially affecting your family’s financial resilience.

- Opportunity Cost: The funds set aside for a larger down payment might yield higher returns if invested elsewhere, such as in retirement accounts or stocks, which could be more beneficial in the long run. For instance, investing those deposit funds could potentially generate greater returns than the savings from a conventional mortgage down payment.

- Delayed Homeownership: The time required to save for a larger deposit can delay your entry into the housing market, which may be a disadvantage in a rising market where home prices are increasing.

As you navigate these options, it’s essential to evaluate your financial circumstances and long-term objectives. Consulting with a mortgage advisor at F5 Mortgage can provide you with tailored insights, ensuring that your chosen approach aligns with your unique needs and goals. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of conventional mortgage down payments is essential for families aiming to secure their dream homes. We know how challenging this can be. The down payment, which can range from as low as 3% to over 20%, plays a pivotal role in shaping the overall mortgage experience. By grasping the significance of this initial investment, families can make informed decisions that align with their financial goals and aspirations.

Throughout this article, we’ve provided key insights on:

- Minimum down payment requirements

- The effects of down payment size on mortgage costs

- The benefits and drawbacks associated with larger contributions

A larger down payment can lead to lower monthly payments, better interest rates, and the elimination of private mortgage insurance (PMI). This ultimately enhances financial stability. However, it’s crucial for families to weigh the potential downsides, such as reduced liquidity and opportunity costs, as they plan their home-buying journey.

Ultimately, the decision regarding down payments is not just about numbers; it reflects a family’s readiness to invest in their future. By considering available assistance programs and consulting with mortgage advisors, families can navigate the complexities of homeownership more effectively. We’re here to support you every step of the way. Embracing the right strategy will not only empower families in their immediate pursuit of a home but also set the stage for long-term financial well-being.

Frequently Asked Questions

What is a conventional mortgage down payment?

A conventional mortgage down payment is the initial loan deposit required when purchasing a home, typically expressed as a percentage of the home’s purchase price.

How much is the typical down payment for a conventional mortgage?

The conventional mortgage down payment can vary from as low as 3% to as high as 20% or more, depending on the lender’s requirements and the borrower’s financial circumstances.

Why might lenders require a larger down payment for conventional loans?

Lenders may ask for a larger upfront contribution for conventional loans because these loans are not backed by federal entities, which helps mitigate their risk.

What are the benefits of making a larger down payment on a conventional mortgage?

Making a larger down payment can lead to better loan terms and lower monthly payments, making it a crucial consideration for families looking to secure their dream home.

How can I prepare for the conventional mortgage down payment?

Taking the time to understand your options and preparing for the initial contribution can empower you in your home-buying journey. Seeking guidance can help you navigate the challenges associated with this process.