Overview

This article offers families a compassionate guide to mastering budgeting effectively on a $250,000 income. We understand how challenging financial management can be, and our aim is to support you every step of the way. Here, we outline essential budgeting concepts, practical allocation strategies, and helpful tools to manage your finances.

- It’s crucial to track your income and expenses.

- We encourage you to adjust your budgets regularly.

By doing so, you can work towards achieving financial stability and peace of mind.

Introduction

Managing a substantial income can feel overwhelming for many families. With an average household income of $250,000, the importance of a well-structured budget cannot be overstated. This guide aims to walk you through the essential steps to not only create a master budget but also allocate your income wisely, paving the way for financial stability and growth.

However, we know that life can be unpredictable. What happens when unexpected expenses arise or impulse spending threatens to disrupt even the best-laid plans? By exploring these challenges and their solutions, we hope to empower you to take control of your financial future. We’re here to support you every step of the way.

Understand the Basics of Budgeting

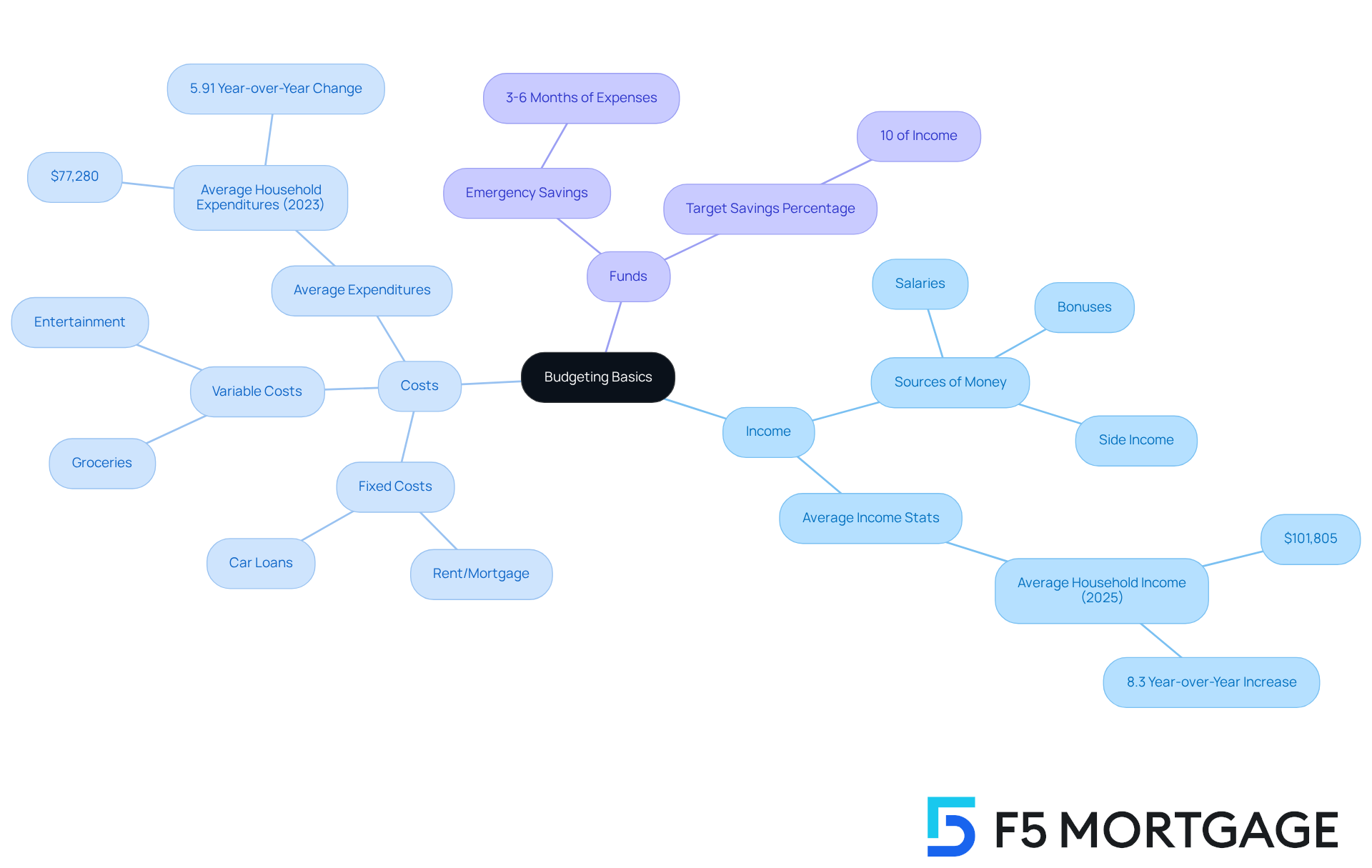

Budgeting is an essential procedure that involves creating a structured strategy to manage your income and costs effectively. We know how challenging this can be, and understanding the following key concepts is crucial:

-

Income: This encompasses all sources of money entering your household, including salaries, bonuses, and any side income. In 2025, the average household income in the U.S. is approximately $101,805, reflecting an 8.3% year-over-year increase. This indicates a positive economic trend for families.

-

Costs: These are the outlays related to daily living, categorized into fixed costs (like rent or mortgage payments) and variable costs (such as groceries and entertainment). The average household expenditures are around $77,280, with a year-over-year change of 5.91%. This highlights the importance of monitoring these costs closely as they continue to rise.

-

Funds: It’s essential to set aside a portion of your earnings for funds to prepare for emergencies and future financial objectives. Financial advisors suggest regarding savings as a necessary cost, ideally targeting at least 10% of your income.

To start your budgeting journey, monitor your income and spending for a month. This practice will provide insights into your spending habits, allowing you to identify areas where you can reduce expenses and save more effectively. For instance, households can benefit from examining their grocery expenditures, which are often the largest optional cost. Participating in budgeting conversations as a household can promote accountability and support wiser spending choices. Engaging children in these discussions not only educates them about money management but also helps them grasp the significance of adhering to a budget. As one child wisely reminded their parent, ‘Mama, we need to stick to the plan.’

Practical examples, such as families using budgeting tools like Google Sheets, illustrate how monitoring income and costs can lead to more informed monetary decisions. By regularly reviewing your budget—at least once a month—you can adapt to changing circumstances and ensure that your financial goals remain achievable. We’re here to support you every step of the way.

Allocate Your Income Wisely

To allocate your income effectively, follow these structured steps:

-

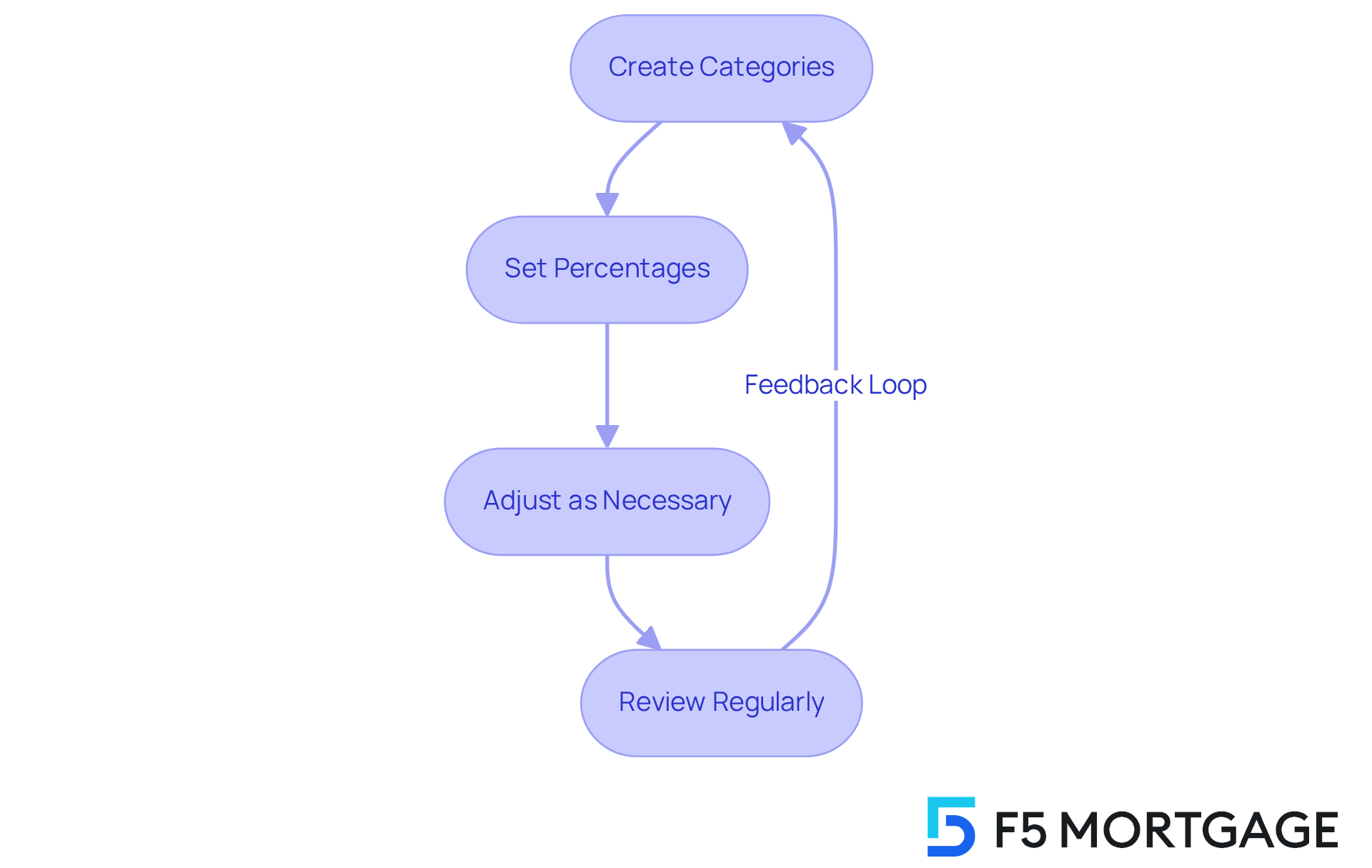

Create Categories: We know how challenging it can be to manage expenses. Start by organizing your expenses into necessary sections like housing, utilities, groceries, transportation, and leisure. This categorization helps clarify where your money is going, making it easier to understand your financial landscape.

-

Set Percentages: Consider utilizing the 50/30/20 principle as a basic guideline. Designate 50% of your income for necessities (like housing and groceries), 30% for desires (such as dining out and entertainment), and 20% for reserves and debt repayment. As budgeting specialist Mary Hines Droesch states, “The 50/30/20 rule is a broadly useful budgeting approach for anyone beginning their economic journey or seeking a reliable method to maintain their savings objectives.”

-

Adjust as Necessary: Tailor these percentages to fit your family’s distinct economic situation. If you are handling high-interest debt, think about raising the share designated for debt repayment to accelerate your economic independence. Money advisors suggest that if debt has high interest rates, it is wise to allocate the entire 20% towards paying off that debt. We’re here to support you every step of the way.

-

Review Regularly: Conduct monthly assessments of your allocations to ensure they align with your changing monetary goals. Adjustments may be necessary as circumstances change, such as income fluctuations or unexpected expenses. Consistently examining your budget is essential for sustaining economic stability and adapting to new challenges.

By following these steps, households can gain better control over their finances. This ensures that essential needs are met while also allowing for discretionary spending and savings. This balanced approach not only promotes financial stability but also fosters a healthier relationship with money.

Utilize Tools and Resources for Effective Budgeting

To simplify the budgeting process for families, we know how challenging this can be, so consider leveraging a variety of tools and resources:

-

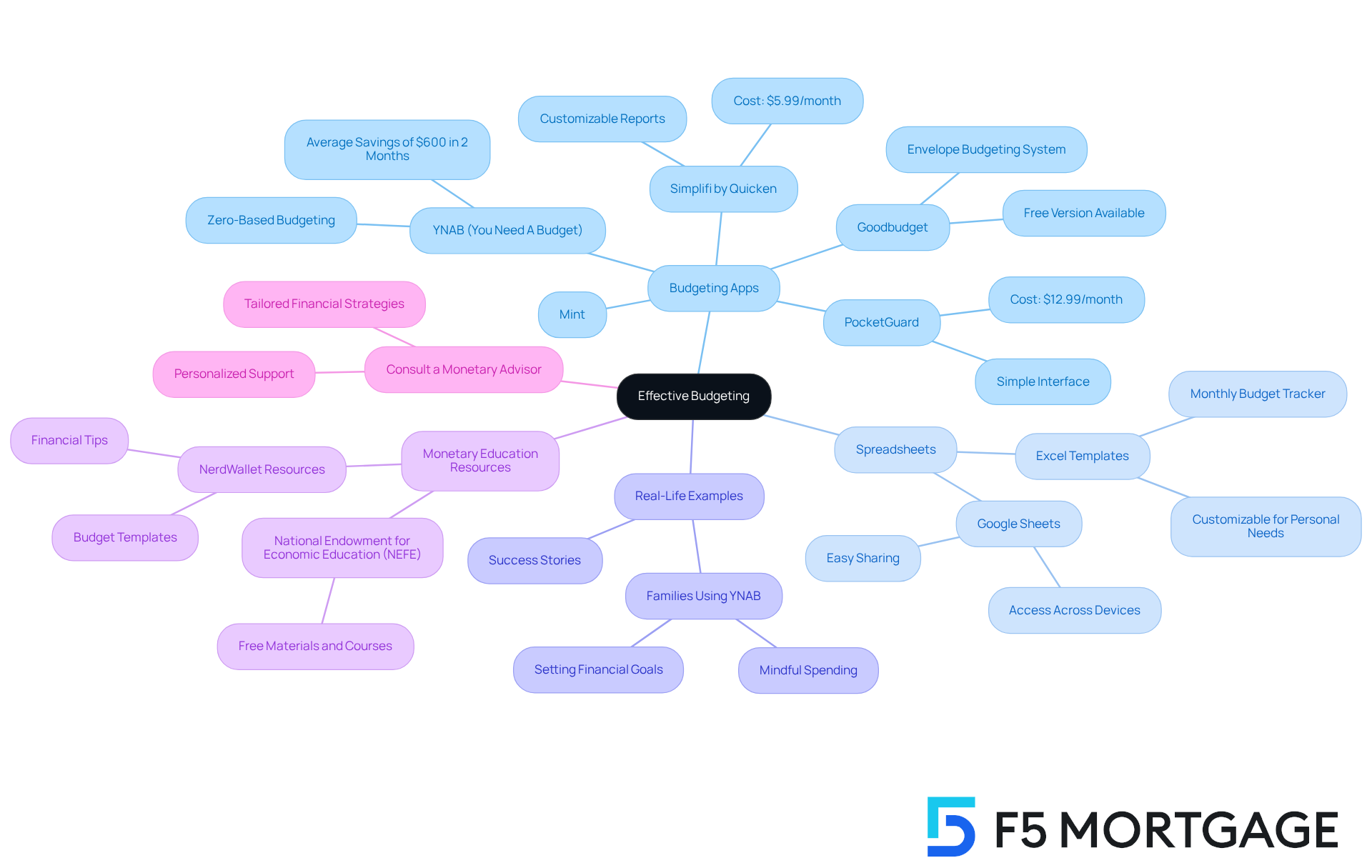

Budgeting Apps: Applications such as YNAB (You Need A Budget), Mint, and EveryDollar are designed to help families track their income and expenses in real-time. YNAB, for instance, employs a zero-based budgeting approach, encouraging users to allocate every dollar to specific categories. Did you know that, according to YNAB, users save an average of $600 in the first two months? This demonstrates the app’s effectiveness in promoting mindful spending and saving habits.

-

Spreadsheets: For those who prefer a more hands-on method, creating a budgeting spreadsheet using Excel or Google Sheets can be highly effective. This method enables personalization suited to your household’s distinct economic circumstances. Plus, templates can be easily modified to adapt to changing needs, making it a flexible option for ongoing financial management.

-

Real-Life Examples: Many families have successfully utilized budgeting apps to manage their finances. For instance, users of YNAB indicate that they set aside an average of $600 in the initial two months, showcasing the app’s effectiveness in encouraging mindful expenditure and accumulation practices. As Jim Wang, creator of Best Wallet Hacks, wisely states, “A budget assists you in achieving your monetary objectives because it provides a complete understanding of your spending and saving.”

-

Monetary Education Resources: Websites such as the National Endowment for Economic Education (NEFE) offer complimentary materials and courses centered on budgeting and economic literacy. These resources empower households to make informed monetary choices.

-

Consult a Monetary Advisor: If your economic situation is complex, seeking advice from a financial expert can be advantageous. Advisors can provide customized support tailored to your household’s monetary objectives, assisting you in managing budgeting difficulties efficiently.

By utilizing these tools and resources, families can enhance their budgeting efforts, leading to improved financial health and stability. We’re here to support you every step of the way.

Overcome Budgeting Challenges

Budgeting can be quite challenging, especially when unexpected costs arise. But don’t worry; there are effective strategies to help you navigate these hurdles with confidence:

-

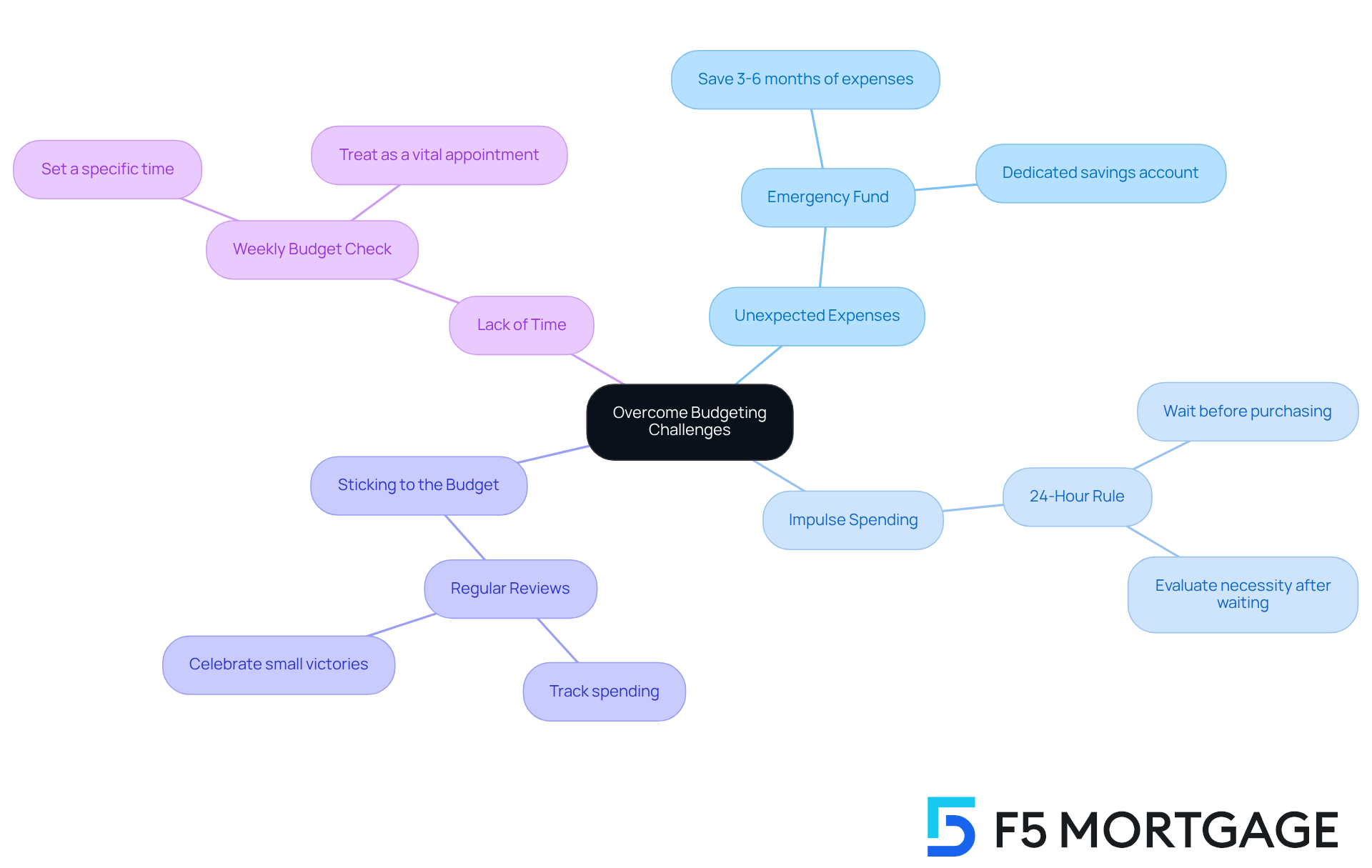

Unexpected Expenses: It’s wise to set aside a portion of your budget specifically for emergencies. Financial experts often suggest saving three to six months’ worth of essential living expenses in an emergency fund. This preparation can truly safeguard your budget from disruptions when unforeseen expenses pop up. As Kimberlee Davis, a partner and managing director at The Bahnsen Group, wisely notes, “If you budget, it will allow you to get through good times and bad times without the whole house of cards falling apart.”

-

Impulse Spending: To combat impulse purchases, consider implementing a waiting period for non-essential items. If you still feel strongly about the item after 24 hours, then it might be worth considering. This simple strategy can significantly curb those impulse buys that threaten to derail your budget.

-

Sticking to the Budget: Regularly reviewing and adjusting your budget is essential. Celebrating small victories along the way can keep you motivated and committed to your financial goals. Recent surveys have shown that families who actively track their spending tend to stay within their budget more effectively.

-

Lack of Time: Carve out a specific time each week to assess your budget and spending. Treat this as a vital appointment to ensure consistency in your money management.

For instance, many households that have successfully managed unexpected costs often highlight the importance of having a dedicated savings account. This practice can greatly enhance financial stability. Additionally, families are encouraged to reach out to local bankers at Rivers Edge Bank for assistance with their finances, providing a supportive resource for those seeking further help. Remember, we’re here to support you every step of the way.

Conclusion

Mastering the art of budgeting is essential for families managing a substantial income, such as $250,000 annually. We understand how challenging this can be, and a well-structured budget not only aids in tracking income and expenses but also empowers families to make informed financial decisions that align with their goals. By grasping the fundamentals of budgeting, allocating income wisely, utilizing effective tools, and overcoming common challenges, families can achieve financial stability and peace of mind.

In this article, we’ve explored key strategies that can make a difference. The significance of:

- Categorizing expenses

- Implementing the 50/30/20 rule

- Regularly reviewing financial allocations

cannot be overstated. We’ve also emphasized the importance of leveraging budgeting apps and educational resources, showing how these tools can streamline the budgeting process and enhance financial literacy. Additionally, practical tips for overcoming unexpected expenses and impulse spending have been outlined, ensuring that families are well-prepared to handle financial hurdles.

Ultimately, effective budgeting is not just about managing money; it’s about fostering a healthy relationship with finances and achieving long-term financial goals. We encourage families to take action by implementing these strategies and utilizing the available resources. By prioritizing budgeting, families can not only secure their financial future but also cultivate a culture of financial responsibility and awareness that benefits all members, especially the younger generation. Together, we can navigate this journey toward financial well-being.

Frequently Asked Questions

What is budgeting?

Budgeting is a structured strategy for managing income and costs effectively, which involves planning how to allocate financial resources.

What does income include in budgeting?

Income includes all sources of money entering a household, such as salaries, bonuses, and side income.

What is the average household income in the U.S. for 2025?

The average household income in the U.S. for 2025 is approximately $101,805, reflecting an 8.3% year-over-year increase.

What are costs in the context of budgeting?

Costs are the expenses related to daily living, categorized into fixed costs (like rent or mortgage) and variable costs (such as groceries and entertainment).

What is the average household expenditure?

The average household expenditures are around $77,280, with a year-over-year change of 5.91%.

How much of your income should you ideally save?

Financial advisors suggest saving at least 10% of your income as a necessary cost for emergencies and future financial goals.

How can I start my budgeting journey?

To start budgeting, monitor your income and spending for a month to gain insights into your spending habits and identify areas for potential savings.

Why is it beneficial to participate in budgeting conversations as a household?

Participating in budgeting conversations promotes accountability and supports wiser spending choices, and it also educates children about money management.

How can families use tools for budgeting?

Families can use budgeting tools like Google Sheets to monitor their income and costs, which helps lead to more informed financial decisions.

How often should I review my budget?

It is recommended to review your budget at least once a month to adapt to changing circumstances and ensure financial goals remain achievable.