Overview

This article aims to guide you through securing better refinancing terms, especially if you’re facing the challenges of bad credit. We understand how daunting this can feel, but by grasping the nuances of credit score categories and exploring available government programs, you can take significant steps towards improving your situation.

One key aspect is enhancing your credit score, which opens doors to better refinancing options. We’ll discuss various avenues, including FHA and VA loans, that might be available to you. Each of these options is designed to support individuals like you in achieving more favorable loan conditions.

To empower you further, we provide actionable steps to enhance your creditworthiness. Remember, every small improvement can significantly increase your chances of obtaining the loan terms you deserve. We’re here to support you every step of the way, ensuring you feel confident and informed throughout this process.

Introduction

Navigating the world of refinancing can feel overwhelming, especially for those facing the challenges of bad credit. We understand how daunting this landscape can be, but it’s important to know that opportunities are available for borrowers to restructure their loans and secure better terms.

In this article, we will explore essential steps and strategies designed to empower you to improve your financial standing. Together, we will look at various refinancing options and how to effectively collaborate with lenders.

As we embark on this journey, consider this: what are the most effective ways to overcome the hurdles of bad credit and achieve a successful refinance?

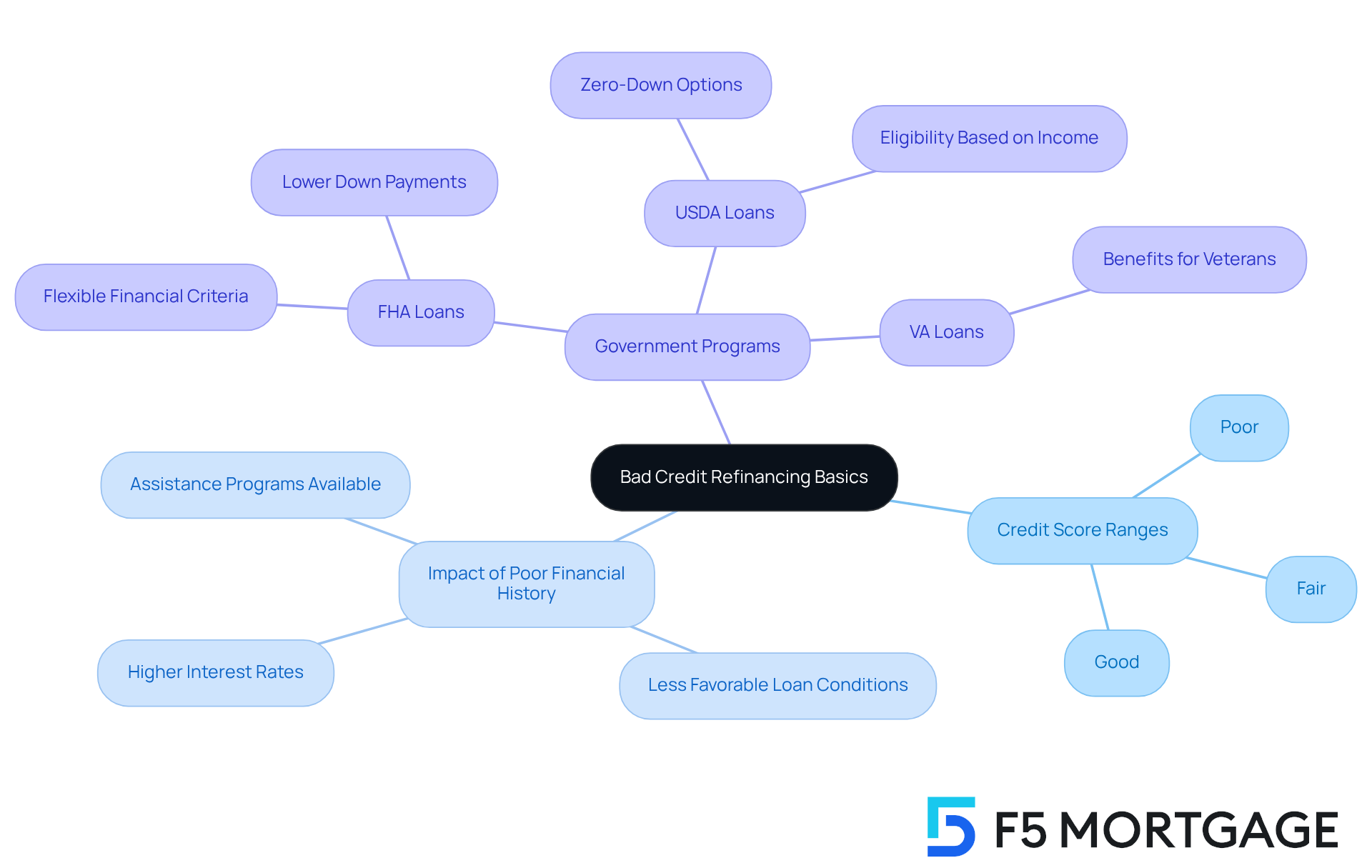

Understand Bad Credit Refinancing Basics

Restructuring a poor score can feel daunting, but it often involves a bad credit refinance to obtain a new mortgage, even if your scores are generally under 620. We understand how challenging this can be, and while a poor financial history may limit your options, it certainly doesn’t eliminate them. Here are some key considerations to keep in mind:

- Credit Score Ranges: By understanding credit score categories—poor, fair, and good—you can better assess your financial standing and explore potential refinancing options that suit your needs.

- Impact of Poor Financial History: Borrowers with a challenging financial background often face higher interest rates and less favorable loan conditions. However, there are various programs designed to assist these borrowers seeking bad credit refinance, making loan restructuring more accessible.

- Government Programs: FHA, VA, and USDA loans typically offer more flexible financial criteria, presenting practical choices for loan restructuring. These programs can provide significant benefits, including lower down payments and competitive rates.

As we look ahead to 2025, the landscape for borrowers seeking a bad credit refinance is evolving. Government-backed loans are paving the way for better terms. For instance, the Federal Housing Finance Agency (FHFA) has adjusted conforming loan limits, reflecting a 5.2% increase in average home prices, which could impact your loan modification opportunities. By understanding these dynamics, you can navigate the restructuring process with confidence and identify options tailored to your unique financial situation. We’re here to support you every step of the way.

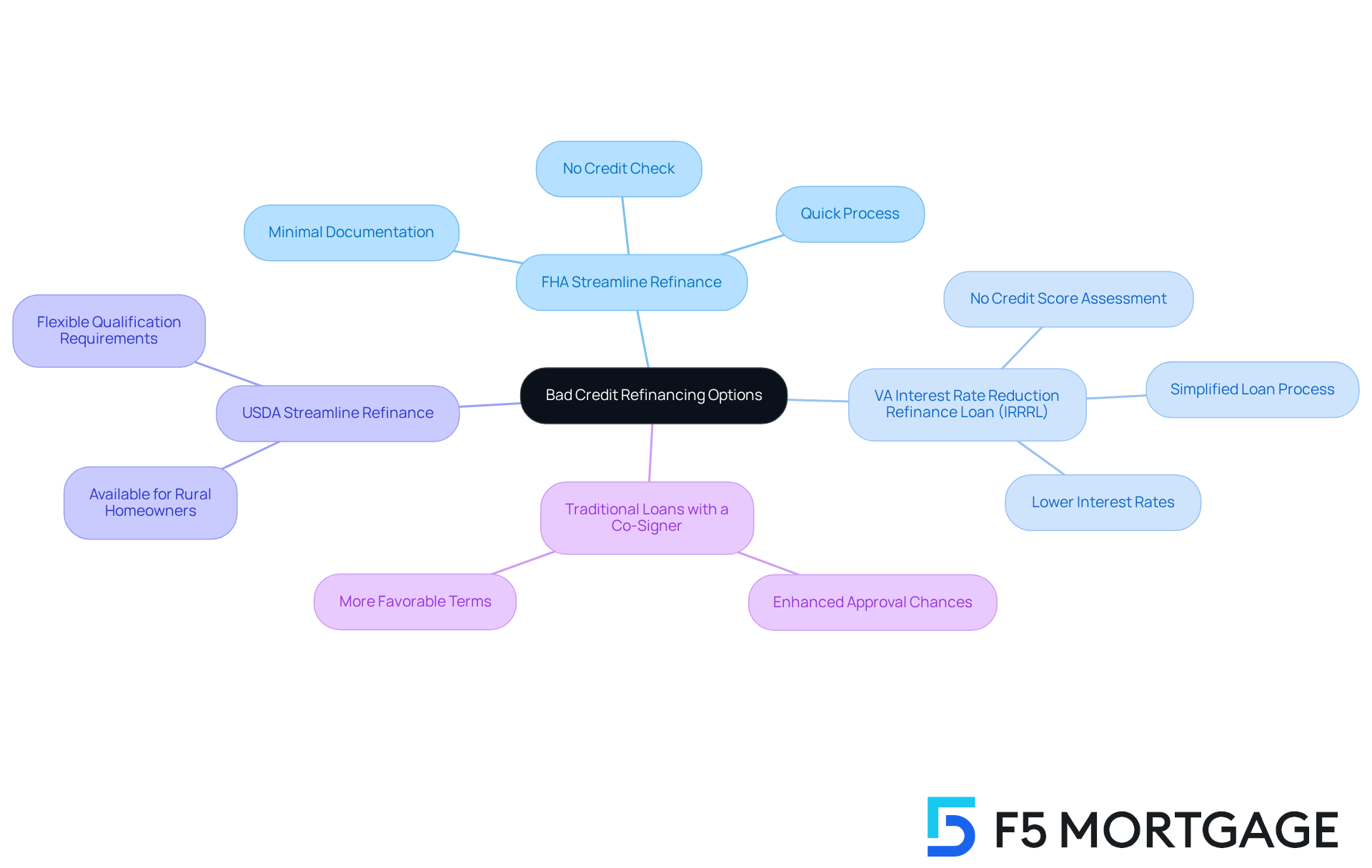

Explore Available Refinancing Options

If you’re navigating the world of bad credit refinance, know that there are several pathways that can provide you relief and improved terms. Let’s explore these options together.

-

FHA Streamline Refinance: This program is designed specifically for homeowners with existing FHA loans. It allows for refinancing with minimal documentation and no credit check. This can be particularly appealing for those facing financial difficulties, as it simplifies the process significantly.

-

VA Interest Rate Reduction Refinance Loan (IRRRL): For our veterans, this simplified loan process enables you to reduce your interest rates without needing a credit score assessment. It’s created to make bad credit refinance accessible, even for individuals with less-than-perfect financial histories.

-

USDA Streamline Refinance: Similar to the FHA option, this program is available for rural homeowners. It offers flexible qualification requirements, making it a great choice for those in eligible areas looking to refinance.

-

Traditional Loans with a Co-Signer: If you have a trustworthy person with better financial standing, applying for a loan with a co-signer can enhance your chances of approval and help you secure more favorable terms. This strategy can effectively help you overcome financial hurdles.

By considering these options, you can identify the most suitable path for restructuring your loans. This could lead to significant savings and improved loan conditions. Remember, we’re here to support you every step of the way as you make these important decisions.

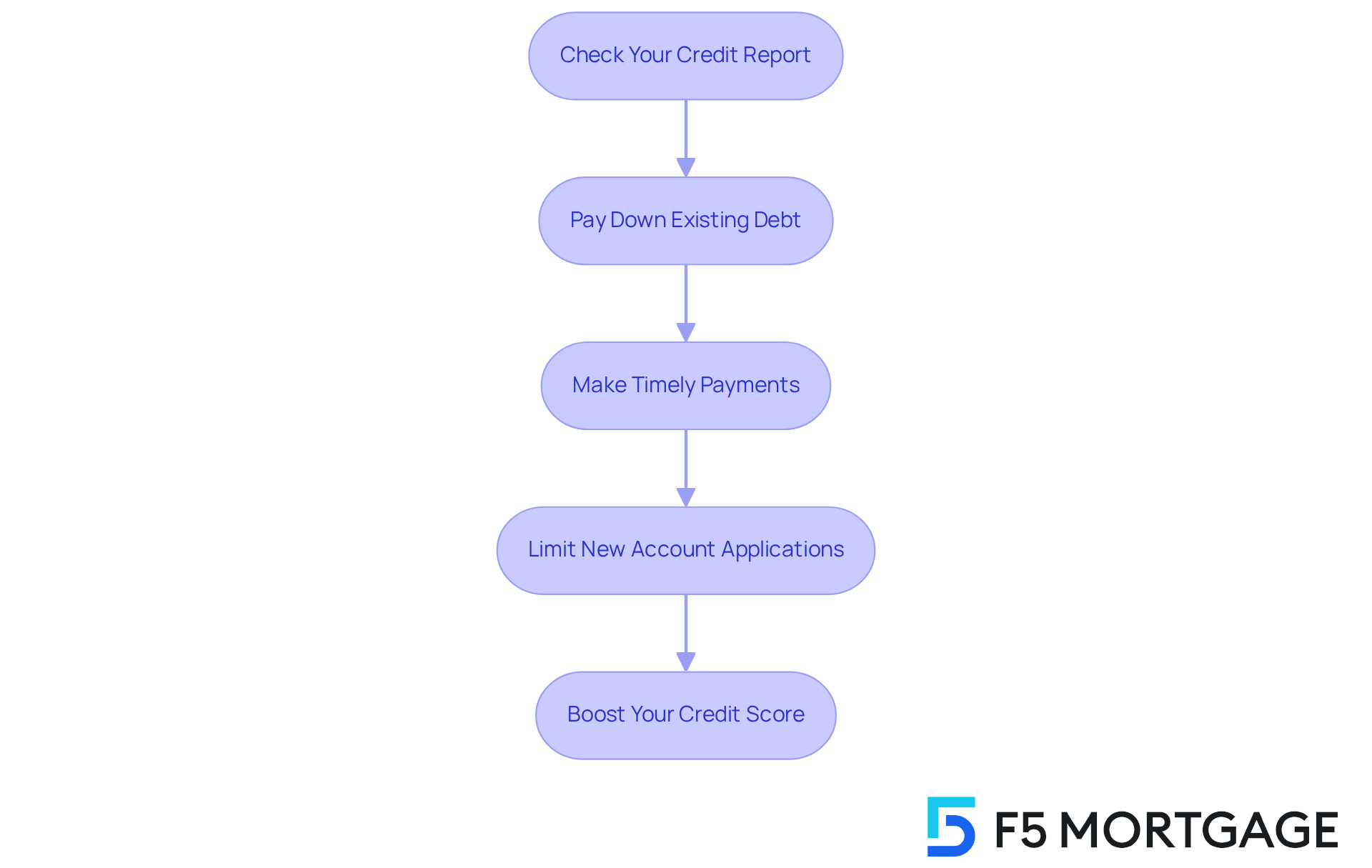

Improve Your Credit Score Before Applying

To enhance your chances of securing favorable terms for a bad credit refinance, we understand how important it is to improve your credit score. Here are some essential steps to consider:

-

Check Your Credit Report: Start by obtaining a free copy of your credit report from the three major bureaus. Take the time to review it meticulously for any errors. We know that over one-third of Americans have inaccurate or outdated information on their reports. Disputing these inaccuracies can significantly boost your score and help you feel more confident.

-

Pay Down Existing Debt: Focus on reducing card balances and other obligations. Lowering your utilization ratio can positively affect your score, making you a more appealing candidate for bad credit refinance options. Remember, every little bit helps!

-

Make Timely Payments: It’s essential to settle all your bills punctually. Payment history constitutes 35% of your score, and late payments can linger on your report for up to seven years. This can severely impact your creditworthiness, so we encourage you to prioritize this.

-

Limit New Account Applications: Before restructuring, try to avoid applying for new accounts. Each application results in a hard inquiry, which can temporarily decrease your score.

By applying these strategies, you can boost your score and feel more empowered in your loan opportunities. We’re here to support you every step of the way.

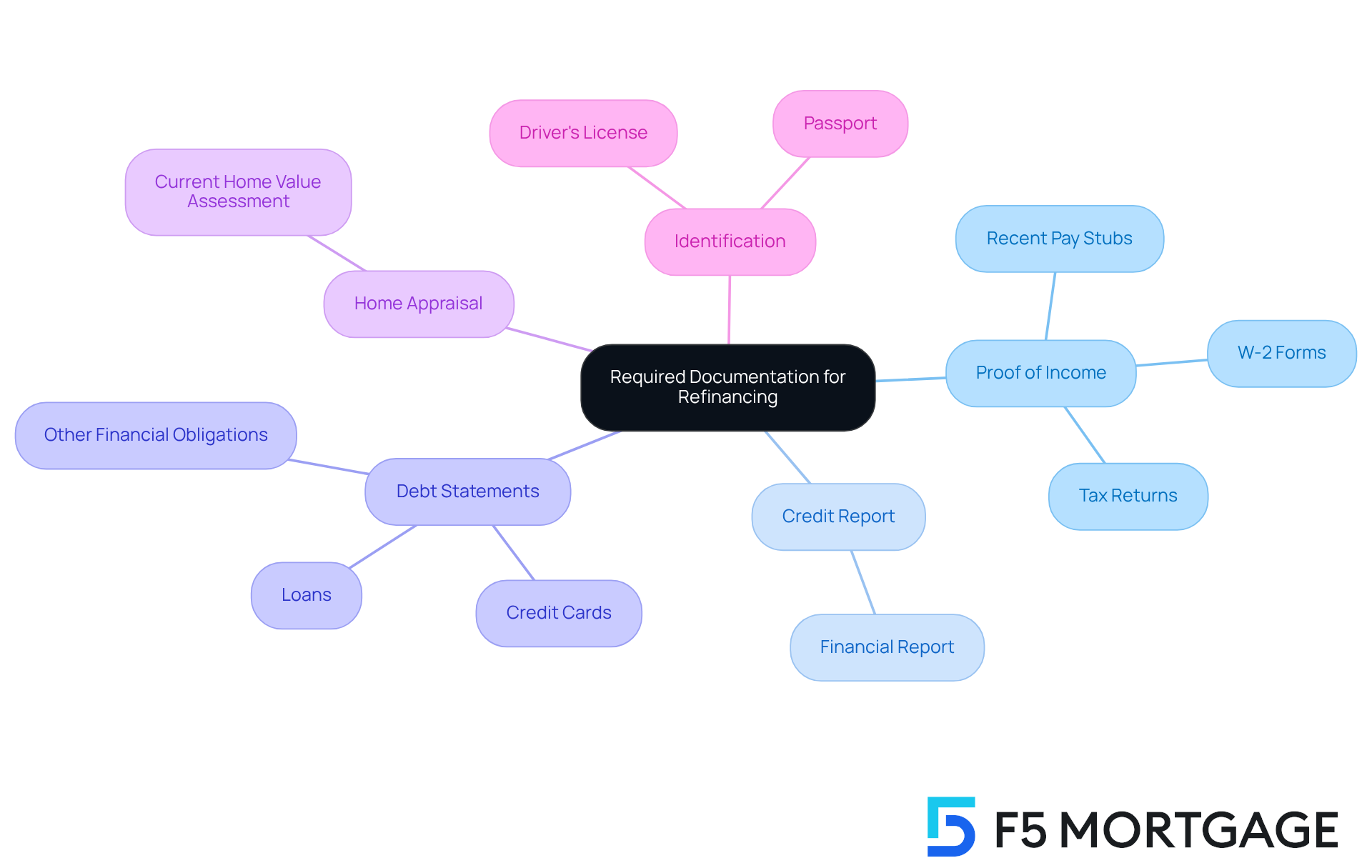

Gather Required Documentation for Refinancing

Navigating the refinancing process with F5 Mortgage can feel overwhelming, but we’re here to support you every step of the way. To make your application smoother, it’s essential to gather the following documentation:

- Proof of Income: Recent pay stubs, W-2 forms, or tax returns to verify your income.

- Credit Report: A copy of your financial report provides lenders with insight into your history, which is crucial for understanding your eligibility for bad credit refinance, particularly if you have faced financial challenges.

- Debt Statements: Documentation of all current debts, including credit cards, loans, and other financial obligations, helps assess your debt-to-income ratio.

- Home Appraisal: Some lenders may require a recent appraisal to determine the current value of your home, an important step in the loan modification process.

- Identification: A government-issued ID, such as a driver’s license or passport.

Having these documents ready will not only facilitate a smoother application process but also empower you to understand and calculate your break-even point effectively. We know how challenging this can be, and we’re here to help you through it.

Collaborate with Lenders for Better Terms

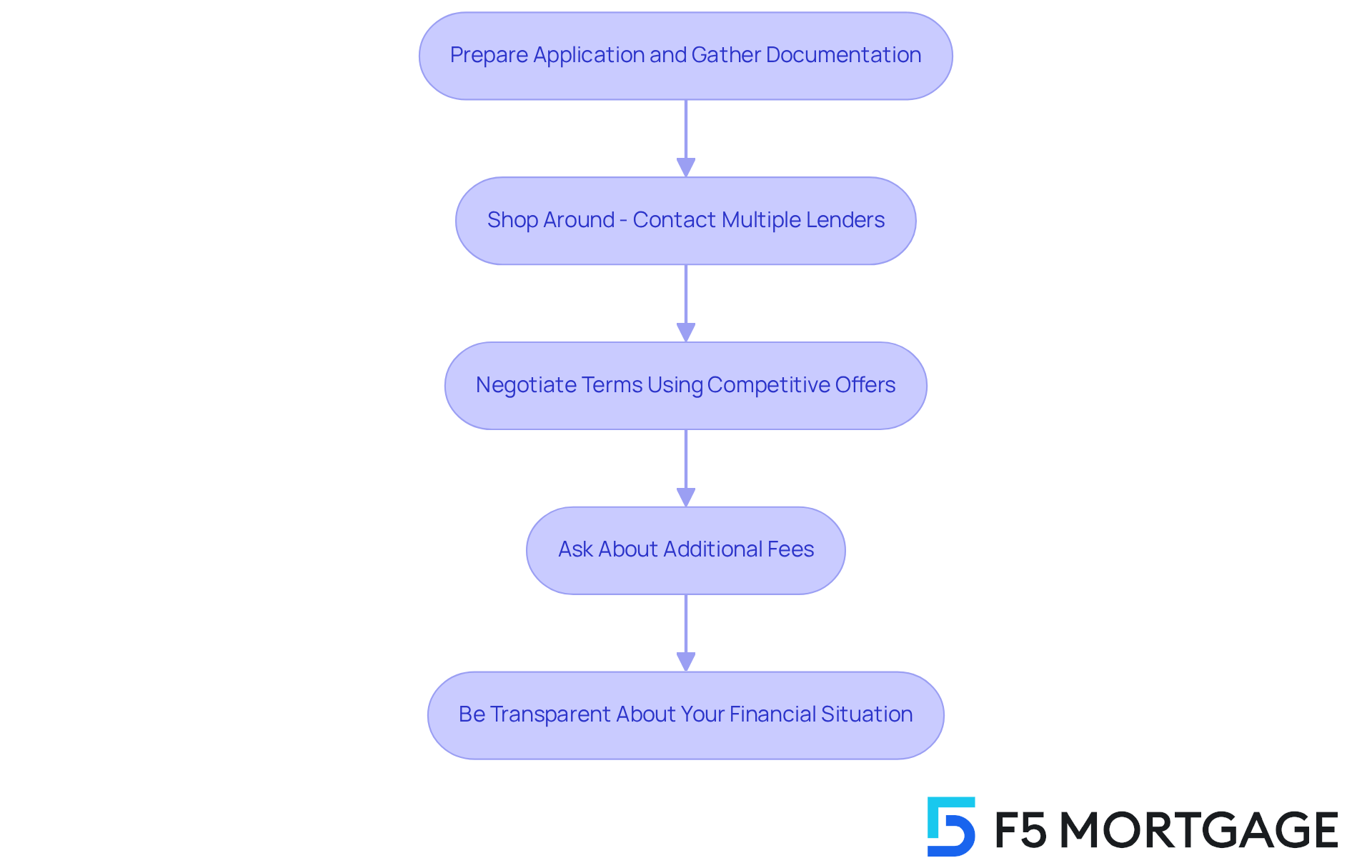

Once you have prepared your application and gathered the necessary documentation, we know how important it is to collaborate with lenders effectively. Here are some thoughtful steps to guide you:

- Shop Around: Contact multiple lenders to compare rates and terms. Remember, don’t settle for the first offer; competition can lead to better deals that truly fit your needs.

- Negotiate Terms: Use the information gathered from different lenders to negotiate better terms. If one lender offers a lower rate, consider asking others if they can match or beat it. This proactive approach can make a significant difference.

- Ask About Fees: Inquire about any additional fees associated with the refinancing process. Some lenders may provide no-closing-cost options, which can save you money upfront and ease your financial burden.

- Be Transparent: Share your financial situation openly with lenders. By doing so, they might have initiatives or choices available that can assist you in obtaining improved conditions tailored to your unique circumstances.

By actively collaborating with lenders, you can enhance your chances of obtaining favorable refinancing terms that align with your financial goals. Remember, we’re here to support you every step of the way.

Conclusion

Mastering the process of bad credit refinancing is not just about overcoming obstacles; it’s about unlocking opportunities for better financial terms. We know how challenging this can be, but navigating refinancing with a less-than-stellar credit score can lead to significant improvements in loan conditions when you understand your options and take proactive steps. The journey toward a successful refinance begins with knowledge and preparation, empowering you to make informed decisions.

Key insights discussed throughout the article highlight the importance of:

- Understanding credit score categories

- Exploring government programs

- Identifying various refinancing options tailored for those with bad credit

Additionally, practical strategies for improving credit scores, such as:

- Checking reports for inaccuracies

- Making timely bill payments

- Collaborating effectively with lenders

can significantly enhance your refinancing experience. By gathering the necessary documentation and actively negotiating with lenders, you can secure favorable terms that align with your financial goals.

Ultimately, the significance of mastering bad credit refinance lies in the potential for financial recovery and stability. Embracing the available resources and support can transform what may seem like a daunting task into a pathway toward improved financial health. So, if you’re seeking to refinance with bad credit, take action today. Leverage the insights shared to pave the way for a brighter financial future.

Frequently Asked Questions

What is bad credit refinancing?

Bad credit refinancing involves obtaining a new mortgage to restructure a poor credit score, typically for borrowers with scores under 620. It aims to improve loan conditions despite a challenging financial history.

How do credit score ranges affect refinancing options?

Understanding credit score categories—poor, fair, and good—helps borrowers assess their financial standing and explore refinancing options that may suit their needs.

What impact does a poor financial history have on refinancing?

Borrowers with a poor financial history often face higher interest rates and less favorable loan conditions. However, various programs exist to assist these borrowers in seeking bad credit refinancing.

What government programs are available for bad credit refinancing?

FHA, VA, and USDA loans offer more flexible financial criteria, providing options for loan restructuring with benefits like lower down payments and competitive rates.

How is the landscape for bad credit refinancing changing?

As of 2025, government-backed loans are evolving to offer better terms, influenced by adjustments in conforming loan limits due to rising home prices, which can affect loan modification opportunities.

What is the FHA Streamline Refinance program?

The FHA Streamline Refinance program is designed for homeowners with existing FHA loans, allowing refinancing with minimal documentation and no credit check, making it accessible for those facing financial difficulties.

What is the VA Interest Rate Reduction Refinance Loan (IRRRL)?

The VA IRRRL is a simplified loan process for veterans that enables them to reduce interest rates without needing a credit score assessment, making refinancing accessible for those with poor credit.

What is the USDA Streamline Refinance program?

The USDA Streamline Refinance program is for rural homeowners, offering flexible qualification requirements and simplifying the refinancing process for eligible areas.

How can a co-signer help in bad credit refinancing?

Applying for a loan with a trustworthy co-signer who has better financial standing can enhance the chances of approval and help secure more favorable loan terms, effectively overcoming financial hurdles.