Overview

The significance of the number 85,000 is profound, serving as a benchmark for financial stability and comfort for many families. We understand how crucial this figure can be in discussions about income and budgeting. This number influences various financial decisions, including housing affordability and investment choices. Moreover, it reflects broader economic trends and societal conversations surrounding income inequality. Recognizing its importance can empower families to make informed financial choices that align with their needs and aspirations.

Introduction

Understanding the significance of the number 85,000 can provide families with crucial insights into their financial landscape. We know how challenging it can be to navigate finances, and this figure often serves as a benchmark for a comfortable lifestyle. It influences budgeting, investment decisions, and even social discussions about income inequality.

But what happens when this number becomes a focal point in financial planning? Exploring its implications reveals both opportunities and challenges that families face in today’s economic climate. Grasping its multifaceted role in personal finance is essential for making informed decisions.

Define 85000: Significance and Representation

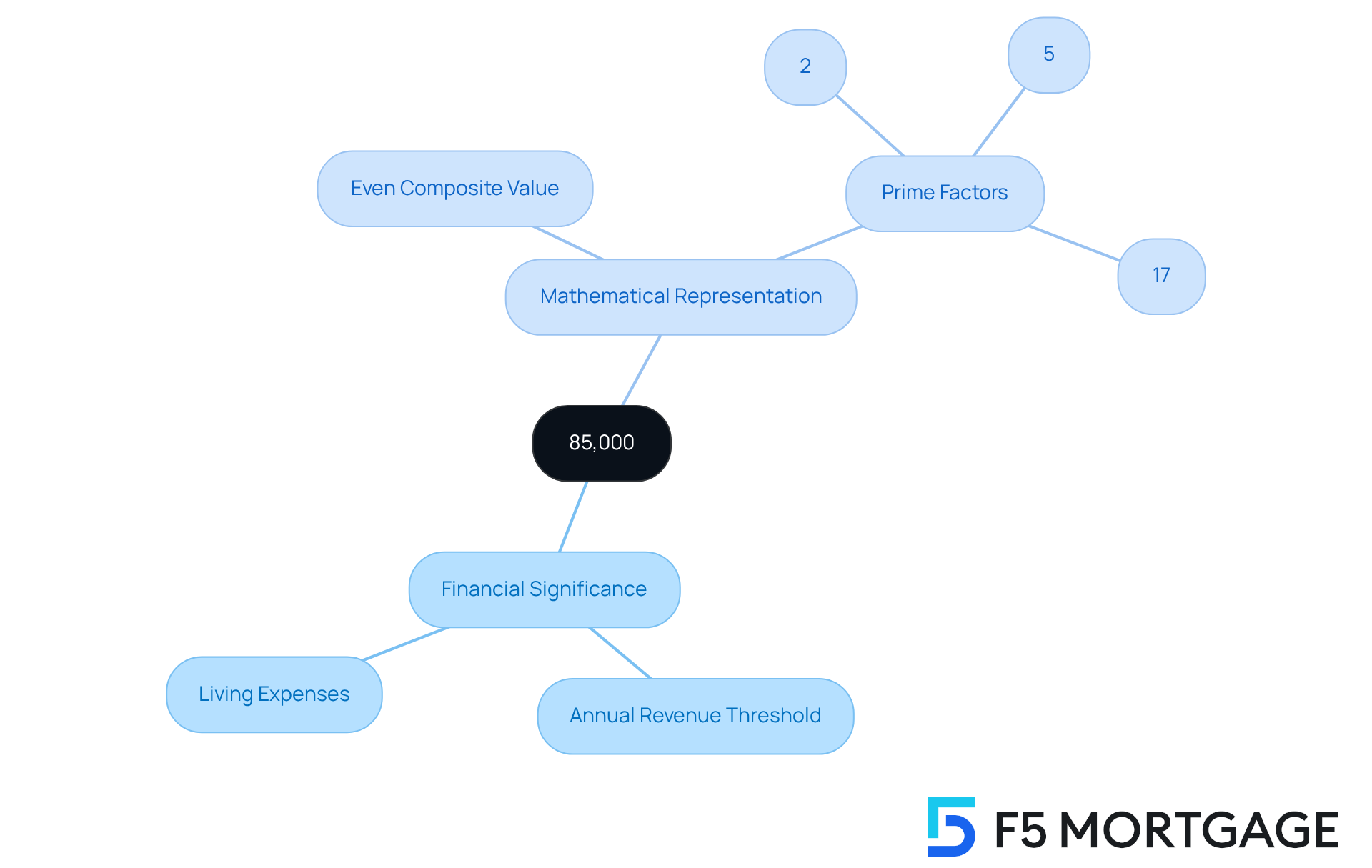

The number 85,000 holds different meanings depending on the context, and we understand how significant it can be for families navigating their financial landscape. In financial discussions, it often represents an annual revenue threshold of 85000 that many families consider essential for a comfortable living. Recent surveys reveal that American families believe an income of 85000 is crucial to meet basic living expenses. This insight highlights the importance of understanding financial goals and aspirations.

Beyond finances, in the realm of mathematics, 85,000 is an even composite value, which can be broken down into its prime factors: 2, 5, and 17. Recognizing these representations helps us appreciate the number’s role in both everyday economic conversations and mathematical applications. By grasping these concepts, families can better contextualize 85000 in their lives, whether they are discussing budgets or exploring mathematical ideas. We’re here to support you every step of the way as you navigate these discussions.

Write 85000 in Words: Guidelines and Common Mistakes

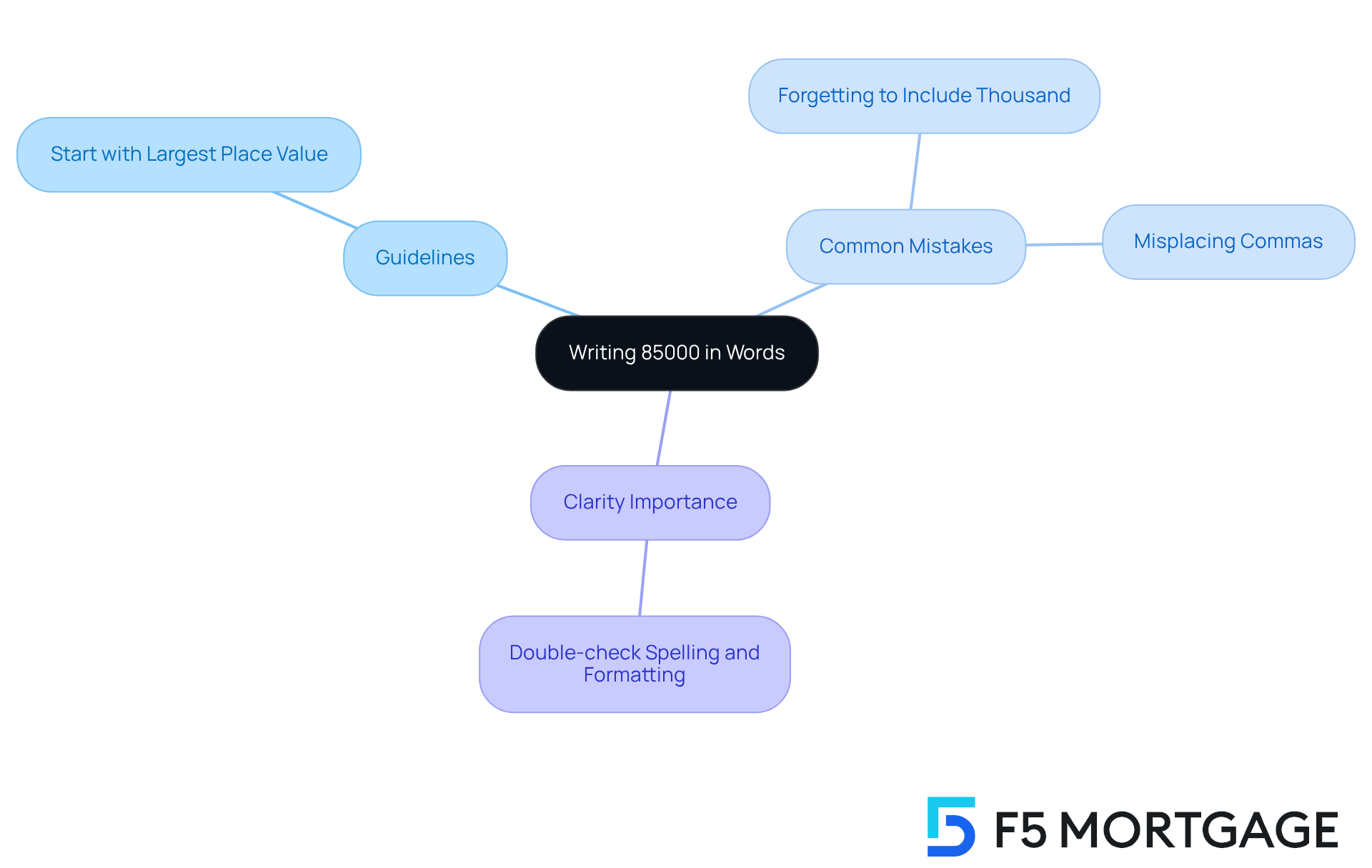

When you want to express the number 85000 in words, you would say ‘eighty-five thousand.’ We understand that this can be a bit tricky, so here are some helpful guidelines to ensure you get it right:

- Start with the largest place value. In this case, ‘eighty’ represents the 85,000, while ‘five’ represents the 5,000.

- Be mindful of common mistakes, such as forgetting to include the word ‘thousand’ or misplacing commas.

- Remember, especially when writing checks or formal documents, clarity is essential. Take a moment to double-check your spelling and formatting; we’re here to support you every step of the way.

Convert 85000: Applications in Financial Contexts

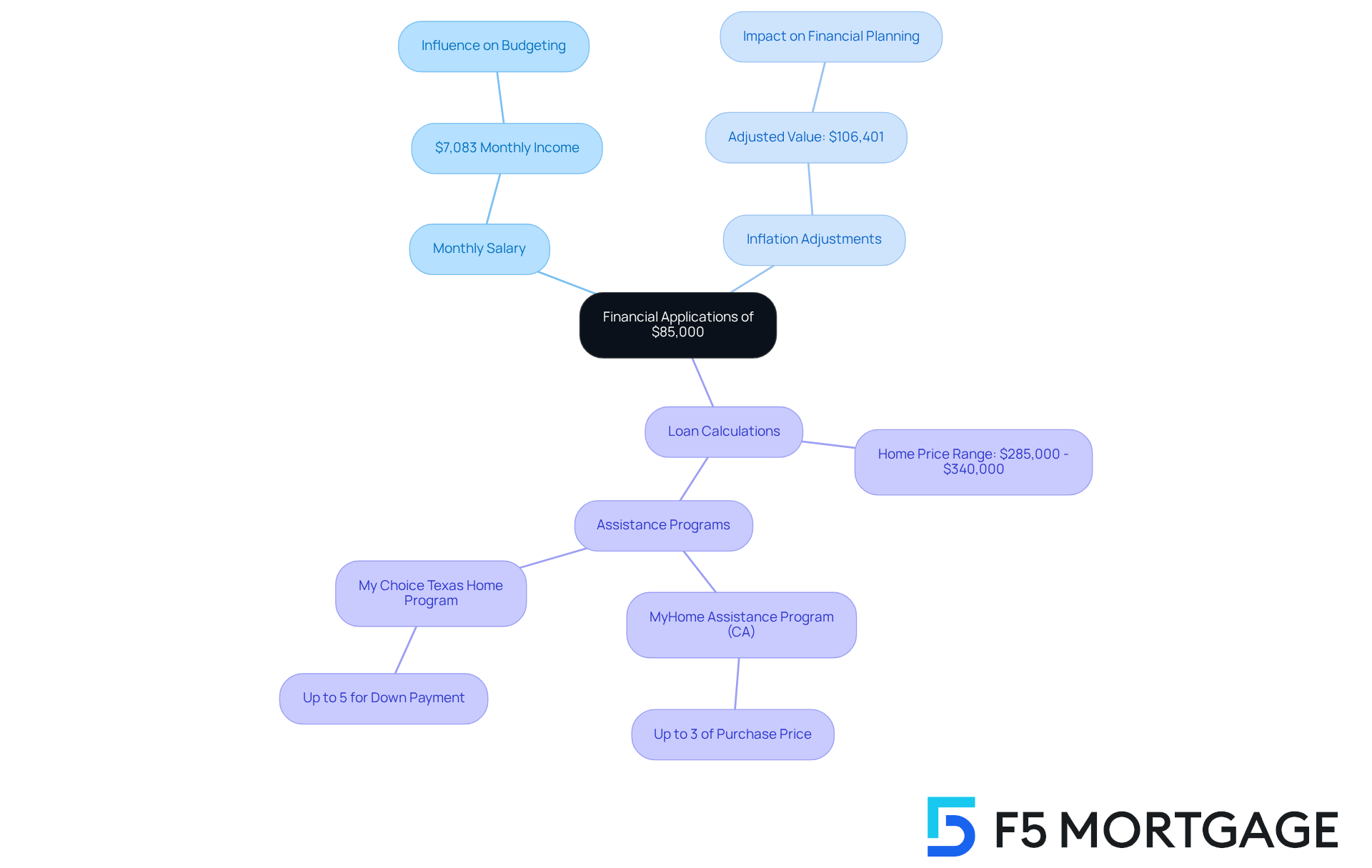

In financial contexts, a sum of 85,000 dollars can be transformed into various forms to illustrate its impact. We understand how challenging financial decisions can be, and we’re here to support you every step of the way.

Monthly Salary: If your annual earnings are $85,000, your monthly income before taxes is approximately $7,083. This figure can significantly influence your budgeting and lifestyle choices.

Inflation Adjustments: The purchasing power of a sum can change over time due to inflation. For instance, an amount in 2020 is comparable to approximately $106,401 today, indicating a rise in living expenses that can affect your financial planning.

Loan Calculations: When considering a mortgage, an earning of 85,000 can affect the sum you can borrow. Typically, this allows for a home purchase price ranging from $285,000 to $340,000, depending on other economic factors. With F5 Mortgage’s flexible mortgage rates, families can achieve homeownership faster. Programs like the MyHome Assistance Program in California offer up to 3% of the home’s purchase price, while the My Choice Texas Home program provides up to 5% for down payment and closing assistance. As one satisfied customer noted, ‘F5 Mortgage made the process seamless and stress-free, helping us secure our dream home.’ We know how important it is to find the right support in your journey to homeownership.

Explore 85000: Contextual Applications and Implications

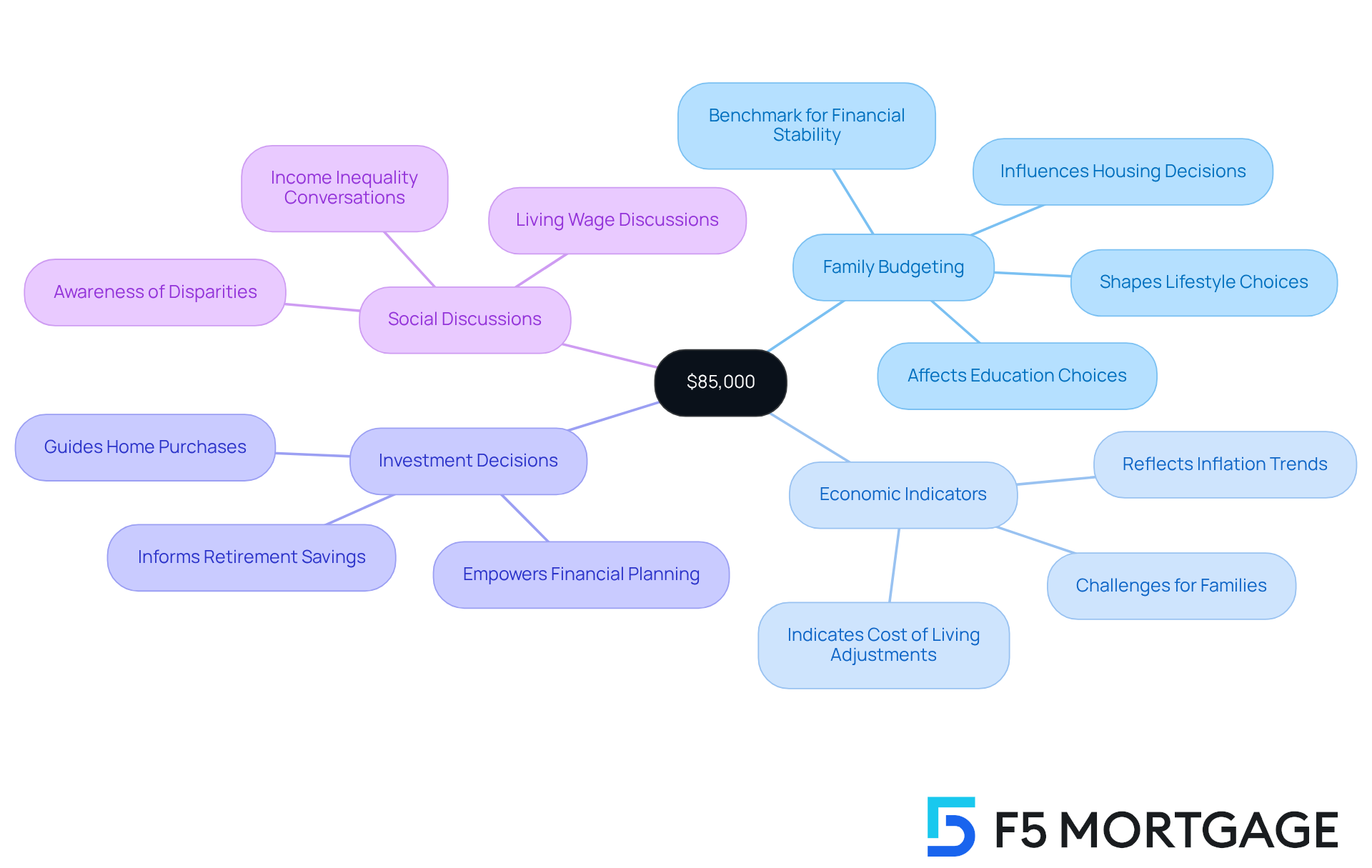

The number 85,000 carries significant implications in various contexts that resonate with many families:

Family Budgeting: For numerous families, $85,000 serves as a benchmark for financial stability. This figure plays a crucial role in shaping decisions regarding housing, education, and lifestyle choices.

Economic Indicators: The belief that $85,000 is essential for a comfortable life reflects broader economic trends, including inflation and cost of living adjustments. We know how challenging these economic conditions can be for families trying to make ends meet.

Investment Decisions: Understanding the revenue required for a comfortable lifestyle can empower families to make informed investment choices, such as saving for retirement or purchasing a home. We’re here to support you every step of the way in navigating these important decisions.

Social Discussions: This number often emerges in conversations about income inequality and the living wage, highlighting the disparities between different income levels in our society. Recognizing these challenges is the first step toward finding solutions that work for everyone.

Conclusion

Understanding the significance of the number 85,000 is crucial for families as they navigate their financial landscapes. This figure represents not only a benchmark for annual income but also serves as a critical point of reference in discussions about budgeting, economic stability, and the pursuit of a comfortable lifestyle. By grasping the implications of 85,000, families can align their financial goals and aspirations more effectively.

Throughout this article, we have explored various facets of the number 85,000, including its representation in both financial contexts and mathematics. From its role as a target income for achieving financial stability to its applications in budgeting, investment decisions, and social discussions about income inequality, the number resonates deeply within family dynamics. Additionally, practical advice on how to accurately write 85,000 in words emphasizes the importance of clarity in financial communications.

Ultimately, recognizing the broader implications of 85,000 can empower families to make informed financial decisions. Whether it’s planning for homeownership, understanding economic trends, or engaging in meaningful conversations about financial equity, the insights gained from this exploration are invaluable. Embracing the significance of 85,000 not only enhances individual financial literacy but also fosters a more informed and engaged community.

Frequently Asked Questions

What does the number 85,000 represent in financial discussions?

In financial discussions, 85,000 often represents an annual revenue threshold that many families consider essential for a comfortable living.

Why is an income of 85,000 significant for American families?

Recent surveys indicate that American families believe an income of 85,000 is crucial to meet basic living expenses, highlighting its importance in financial planning.

How is the number 85,000 relevant in mathematics?

In mathematics, 85,000 is an even composite number that can be broken down into its prime factors: 2, 5, and 17.

What is the importance of understanding the number 85,000 in everyday life?

Understanding the number 85,000 helps families contextualize their financial goals and aspirations, whether discussing budgets or exploring mathematical concepts.