Introduction

Navigating the world of home financing can feel overwhelming, especially for families with FHA loans. We understand how challenging this can be, but the FHA Streamline Refinance program offers a unique opportunity to ease some of that financial burden. This program simplifies the refinancing process, allowing homeowners to potentially lower their monthly payments and interest rates with minimal documentation and no appraisal required.

As you consider this option, it’s natural to weigh the benefits against any potential drawbacks. The pressing question remains: is FHA Streamline Refinance truly a wise choice for enhancing your financial stability? Exploring this option could lead to significant savings and a more manageable mortgage. However, understanding the eligibility criteria and limitations is crucial for making an informed decision.

We’re here to support you every step of the way as you explore your options.

Define FHA Streamline Refinance and Its Purpose

If you have an FHA mortgage, you may wonder, is FHA streamline refinance a good idea for you? We understand how overwhelming the refinancing process can feel, and this program is designed to make it easier. With minimal documentation required and no need for a home appraisal, it’s a straightforward way to potentially lower your monthly payments and interest rates.

To qualify, you’ll need to:

- Have made at least six on-time payments.

- Wait 210 days since your first payment on your current FHA loan.

- Be current on your mortgage, with no more than one 30-day late payment in the past year.

This program aims to help you achieve more affordable homeownership, and we’re here to support you every step of the way.

By simplifying the loan restructuring process, F5 Mortgage reduces the complexity and time usually associated with traditional refinancing methods. This means you can take advantage of favorable market conditions without the usual stress. Plus, if you restructure your loan within the first three years, you may even receive a partial reimbursement of the upfront mortgage insurance premium (UFMIP). What a great incentive to explore this option!

As industry expert Alex Braham puts it, “With an FHA Streamline Refinance, in many cases, you can kiss that appraisal goodbye!” This really highlights how this program can help you overcome common refinancing hurdles, ultimately enhancing your financial stability, which makes one wonder, is FHA streamline refinance a good idea?

With F5 Mortgage’s competitive rates and dedicated support, families like yours can navigate this process with ease. We know how challenging this can be, but you don’t have to do it alone. Let’s explore your options together!

Explore Key Benefits of FHA Streamline Refinancing

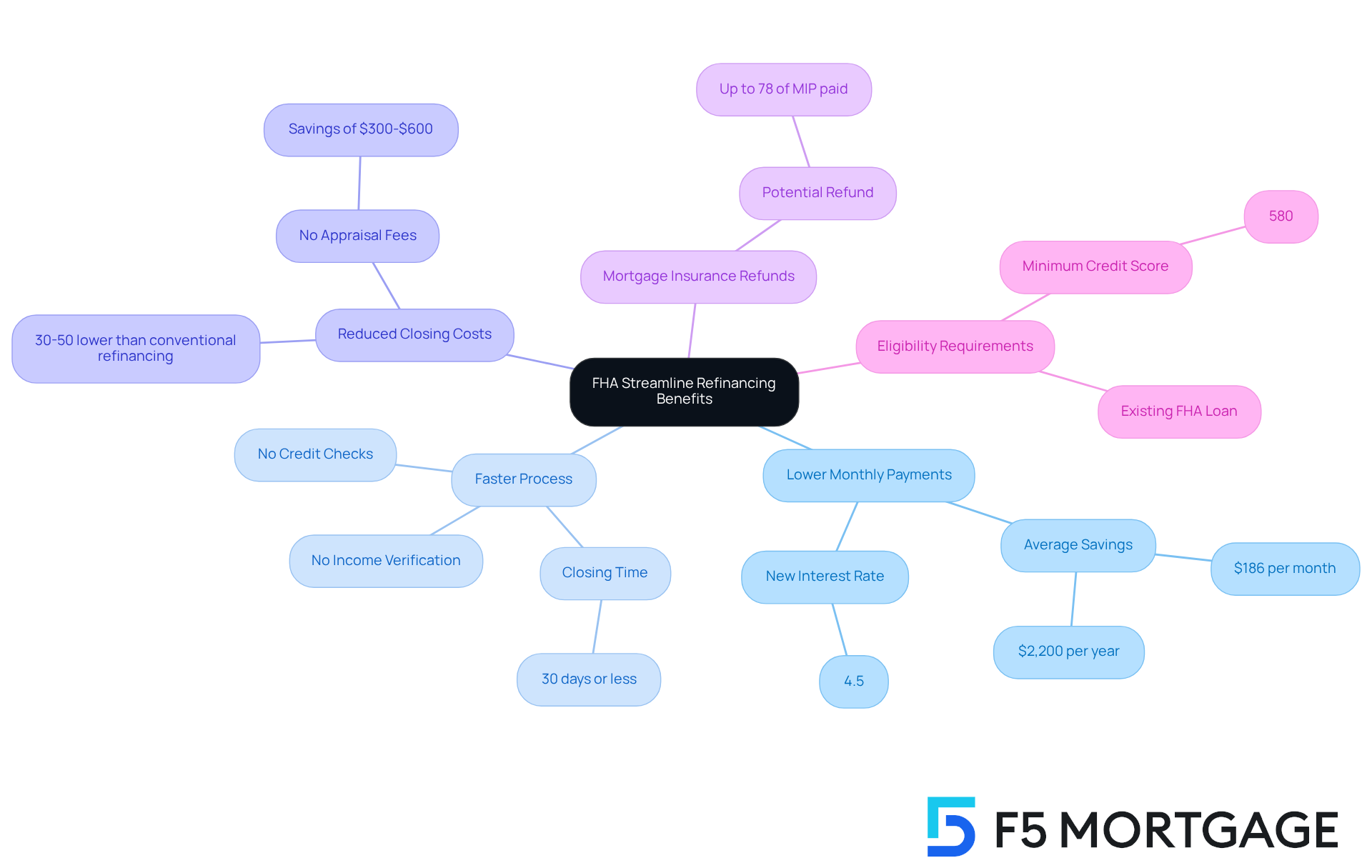

Many benefits of FHA Streamline Refinancing lead to the question of whether FHA Streamline Refinance is a good idea for property owners. We know how challenging financial pressures can be, and one of the primary advantages of this option is the potential for significantly lower monthly payments. Many property owners save an average of $186 each month, leading to yearly savings of about $2,200. This reduction can ease financial strain, allowing families to allocate funds toward other essential needs.

The loan restructuring process is also much faster. Borrowers can often finalize it without the extensive documentation usually required for conventional loan modifications. This means no income verification or credit checks, which can be especially helpful for self-employed individuals or those with fluctuating credit scores. Plus, the FHA Streamline program doesn’t require appraisals, simplifying the process even further and saving property owners between $300 and $600 in appraisal fees.

This streamlined method not only saves time but also reduces closing costs, which are typically 30-50% less than those for traditional loan restructuring. Homeowners may even be eligible for a refund on their mortgage insurance premiums, enhancing their overall savings. In Colorado, FHA refinance loans are available to property owners with a minimum credit score of 580, making it a viable option for many families.

In today’s market, where the average FHA rate hovers around 6.13%, many are asking if FHA streamline refinance is a good idea to secure lower payments and improve financial stability without the usual refinancing hurdles. Overall, many families wonder if FHA streamline refinance is a good idea to enhance their financial situation. We’re here to support you every step of the way.

Outline Eligibility Criteria for FHA Streamline Refinancing

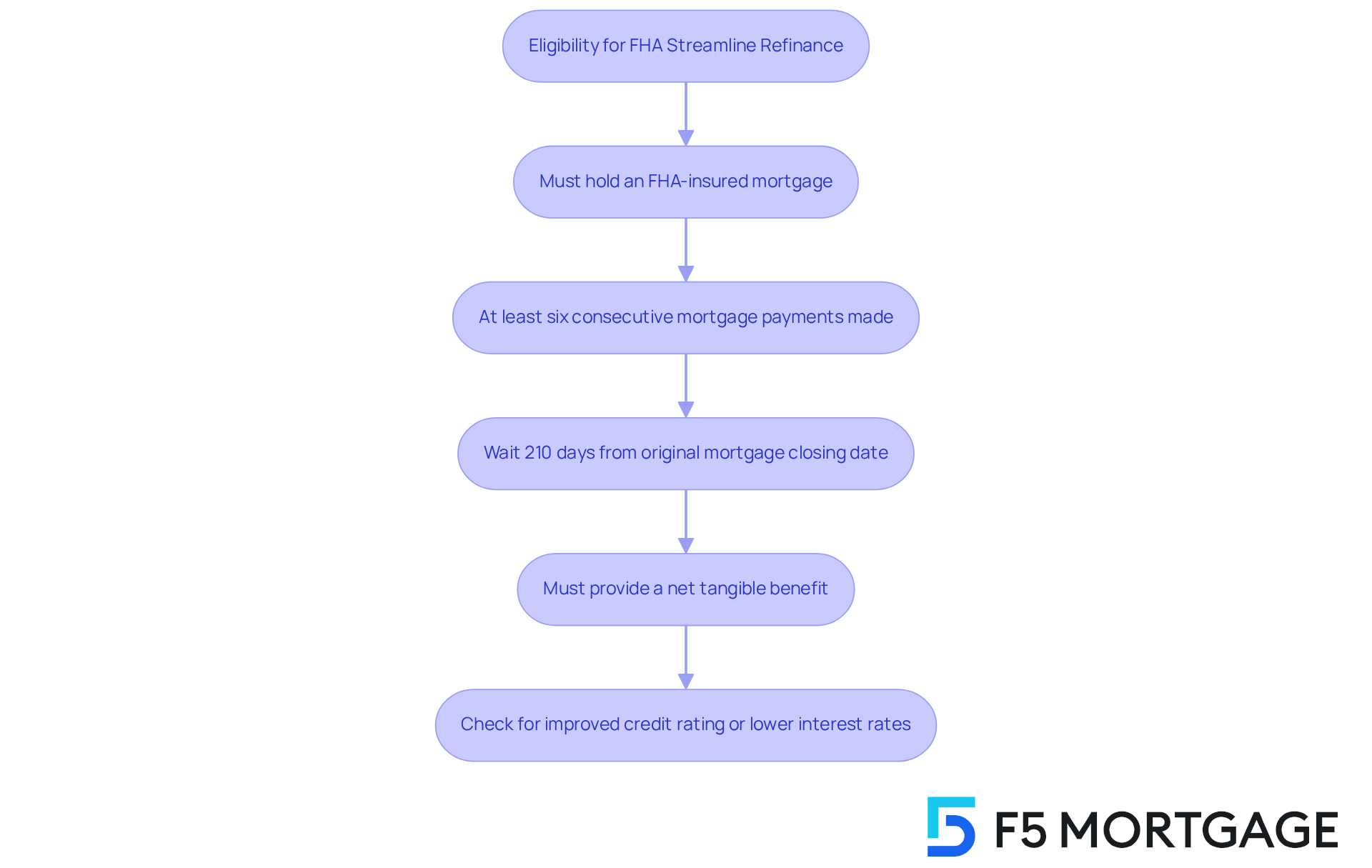

Navigating the FHA Streamline Refinance can feel overwhelming, especially when considering if the FHA streamline refinance is a good idea, but we’re here to support you every step of the way. To qualify, homeowners need to meet specific eligibility criteria. First and foremost, you must currently hold an FHA-insured mortgage. It’s essential to stay up to date on your mortgage payments, having made at least six consecutive payments on your current loan.

You’ll also need to wait 210 days from the closing date of your original mortgage before applying for the streamline refinance. This waiting period is crucial, as it allows you to fully benefit from the program. Importantly, the refinance must provide a ‘net tangible benefit’ to you, such as a lower interest rate or reduced monthly payments. This requirement ensures that the program is effectively utilized by those who stand to gain the most from it.

Looking ahead to 2025, many property owners with FHA loans may find themselves eligible for this streamlined process, especially if they’ve maintained a good payment history. If you’ve noticed an improvement in your credit rating or if interest rates have declined, you might discover that you qualify for loan restructuring under these favorable conditions.

Understanding the question of whether the FHA streamline refinance is a good idea is essential for making informed choices about your loan options. We know how challenging this can be, but grasping these details can empower you to take the next steps toward financial relief.

Analyze Potential Drawbacks of FHA Streamline Refinancing

FHA Streamline Refinancing offers some benefits, but it’s essential to consider whether FHA streamline refinance is a good idea and understand its limitations too. One major drawback is that borrowers can’t cash out equity from their homes; this raises the question of whether FHA streamline refinance is a good idea since the program is designed strictly for rate-and-term refinancing. While the process aims to be straightforward, families still face closing costs, which typically range from 2% to 5% of the mortgage amount, raising the question: is FHA streamline refinance a good idea? Unfortunately, these costs can’t be rolled into the new financing, creating a financial hurdle for many.

We know how challenging this can be. On top of that, the ongoing requirement to pay mortgage insurance premiums (MIP) can add to the overall expense, which leads to the question of whether an FHA streamline refinance is a good idea to potentially reduce any savings you might expect. For instance, homeowners who refinanced mortgages taken out between 2010 and 2015 may encounter higher MIP rates that last for the life of the loan.

Moreover, it’s crucial to note that FHA streamline refinance is a good idea for those with existing FHA loans. This means many homeowners with conventional loans miss out on these benefits, limiting the program’s reach and effectiveness in addressing the financial needs of a broader audience.

But don’t worry – F5 Mortgage is here to help. We’re committed to guiding families through these challenges and exploring refinancing options that fit your unique needs. Let us support you every step of the way.

Conclusion

FHA Streamline Refinance offers a wonderful opportunity for families looking to ease their financial burdens. By reducing monthly mortgage payments and simplifying the refinancing process, this program is designed with your needs in mind. We understand how overwhelming traditional refinancing can be, and this streamlined approach can lead to significant savings and greater financial stability.

Throughout this article, we’ve shared valuable insights into the advantages of FHA Streamline Refinancing. Imagine enjoying lower monthly payments, faster processing times, and reduced closing costs. The eligibility criteria are straightforward, allowing many homeowners to benefit without the usual hurdles of credit checks and appraisals. However, it’s important to recognize some limitations, such as the inability to cash out equity and the ongoing requirement for mortgage insurance premiums, which could affect your overall savings.

Given these considerations, we encourage families to reflect on their unique financial situations. Does FHA Streamline Refinance align with your goals? By taking proactive steps and seeking guidance, you can navigate the complexities of refinancing and potentially find a path to greater financial relief. The benefits of this program, combined with the support from dedicated mortgage professionals, can empower you to make informed decisions that enhance your financial well-being. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is FHA streamline refinance?

FHA streamline refinance is a program designed for homeowners with an FHA mortgage to simplify the refinancing process, allowing them to potentially lower their monthly payments and interest rates with minimal documentation and no home appraisal required.

What are the eligibility requirements for FHA streamline refinance?

To qualify for FHA streamline refinance, you must have made at least six on-time payments, wait 210 days since your first payment on your current FHA loan, and be current on your mortgage with no more than one 30-day late payment in the past year.

What are the benefits of FHA streamline refinance?

The benefits include the potential for lower monthly payments and interest rates, reduced complexity and time associated with traditional refinancing, and the possibility of receiving a partial reimbursement of the upfront mortgage insurance premium (UFMIP) if you restructure your loan within the first three years.

How does FHA streamline refinance differ from traditional refinancing?

FHA streamline refinance differs from traditional refinancing by requiring minimal documentation and no home appraisal, making it a more straightforward and less stressful process for homeowners.

Can I receive support during the FHA streamline refinance process?

Yes, companies like F5 Mortgage offer dedicated support to help you navigate the FHA streamline refinance process, making it easier for families to explore their options.