Overview

A credit score of 700 is often seen as a beacon of hope for families navigating the mortgage process. This score reflects responsible credit management, which can significantly enhance your chances of securing favorable mortgage options and lower interest rates. We understand how challenging this journey can be, and knowing that a 700 score positions you as a lower risk in the eyes of lenders can provide some reassurance.

With a score like this, you gain access to a variety of loan types, opening doors to potential savings on interest payments. These savings can greatly impact your financial stability during the home buying process. Imagine the peace of mind that comes with knowing you’re making informed decisions that benefit your family’s future.

We’re here to support you every step of the way. Understanding your credit score and its implications is a crucial part of this journey. By focusing on responsible credit management, you can empower yourself and your family to achieve your homeownership dreams.

Introduction

A credit score of 700 often serves as a pivotal threshold in the realm of personal finance, especially when it comes to home buying. This score reflects a history of responsible credit management and can unlock a variety of mortgage options and favorable interest rates for potential homeowners.

However, we know how challenging navigating the housing market can be. The question remains: is a 700 credit score truly sufficient? Understanding the nuances of this rating is crucial, as it can significantly influence your financial decisions and long-term stability. We’re here to support you every step of the way.

Defining a 700 Credit Score

A credit rating of 700 is often regarded as a strong benchmark within the FICO evaluation system, leading to the question, is 700 a good credit score, since the range spans from 300 to 850. This rating reflects a history of responsible credit management, characterized by timely payments and a low credit utilization ratio. We know how important it is to consider if 700 is a good credit score; individuals with this rating are generally viewed as lower risk by lenders, which can significantly enhance their chances of securing various types of credit, including mortgages.

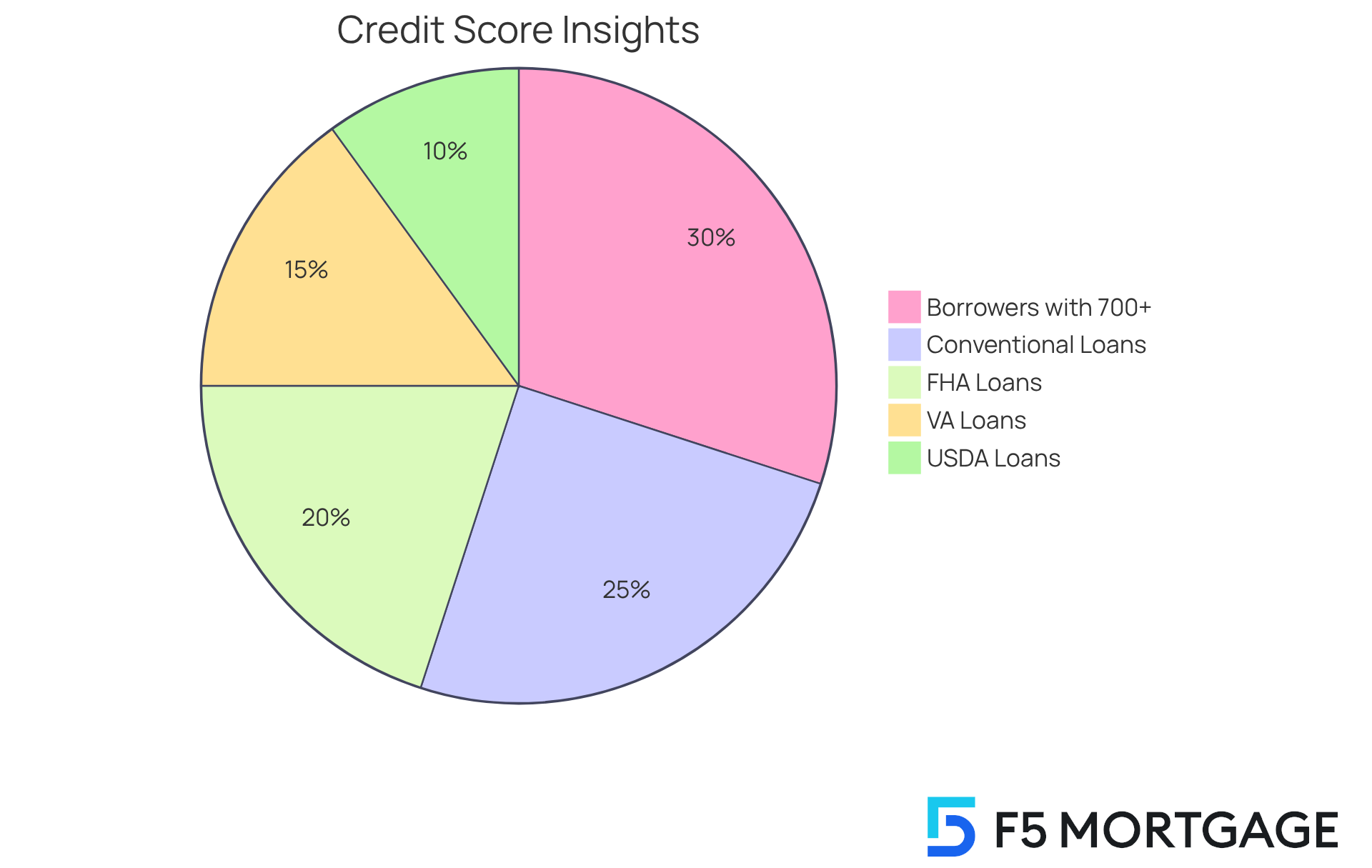

This rating not only simplifies the credit application process but also plays a crucial role in determining interest rates and credit eligibility. For instance, individuals with a 700 rating can access a range of mortgage options, such as:

- Conventional loans

- FHA loans

- VA loans

- USDA loans

These options often come with more favorable terms. In fact, approximately 30% of borrowers achieve a rating of 700 or higher, highlighting its vital role in the home buying journey.

Understanding whether 700 is a good credit score is essential for prospective homebuyers. It can greatly influence their financial opportunities and overall affordability in the housing market. We’re here to support you every step of the way as you navigate these important decisions.

Importance of a 700 Credit Score in Financial Decisions

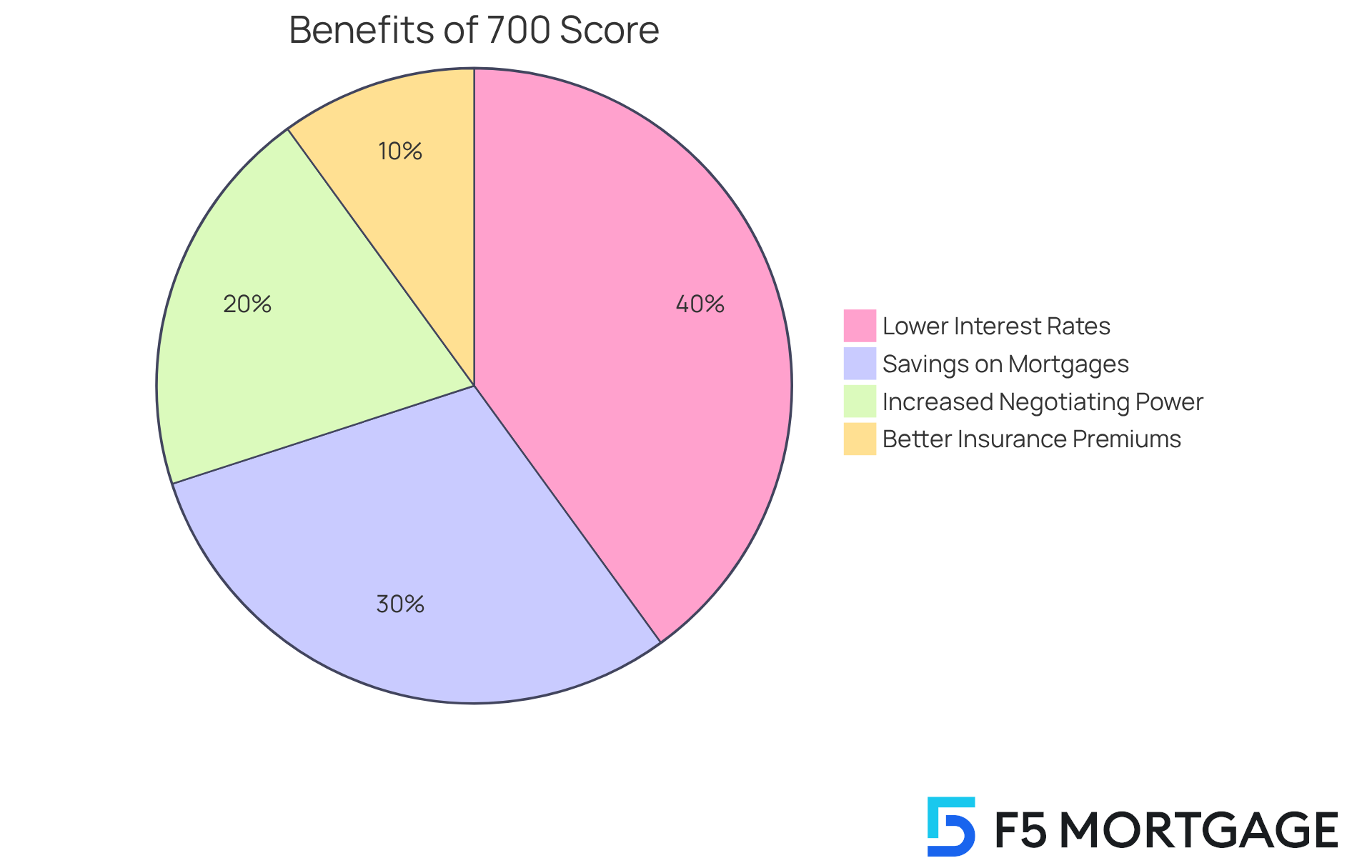

When considering if 700 is a good credit score, it’s important to note that it is more than just a number; it plays a crucial role in your financial journey, especially when navigating the mortgage landscape. We understand how overwhelming this process can be, and lenders often view this rating as a key indicator of eligibility across various loan products. When you have a rating of 700, you typically qualify for lower interest rates, which can lead to significant savings over the life of your mortgage.

For instance, imagine securing interest rates between 6.25% and 7%. In contrast, those with lower ratings may face elevated rates, resulting in thousands of dollars saved in interest payments throughout the life of the loan. This difference can truly impact your financial future.

Moreover, a strong credit rating enhances your negotiating power, allowing you to seek more favorable terms and conditions. This leverage is especially valuable in competitive markets where lenders are eager to attract qualified borrowers like you. Beyond mortgages, a 700 rating also positively affects other financial aspects, such as insurance premiums and credit card interest rates, underscoring its importance in maintaining your overall financial health.

Therefore, achieving and maintaining a rating of 700 is a good credit score that is not just beneficial for purchasing a home; it is a strategic step toward lasting financial stability. We’re here to support you every step of the way on this journey.

Key Factors Influencing a 700 Credit Score

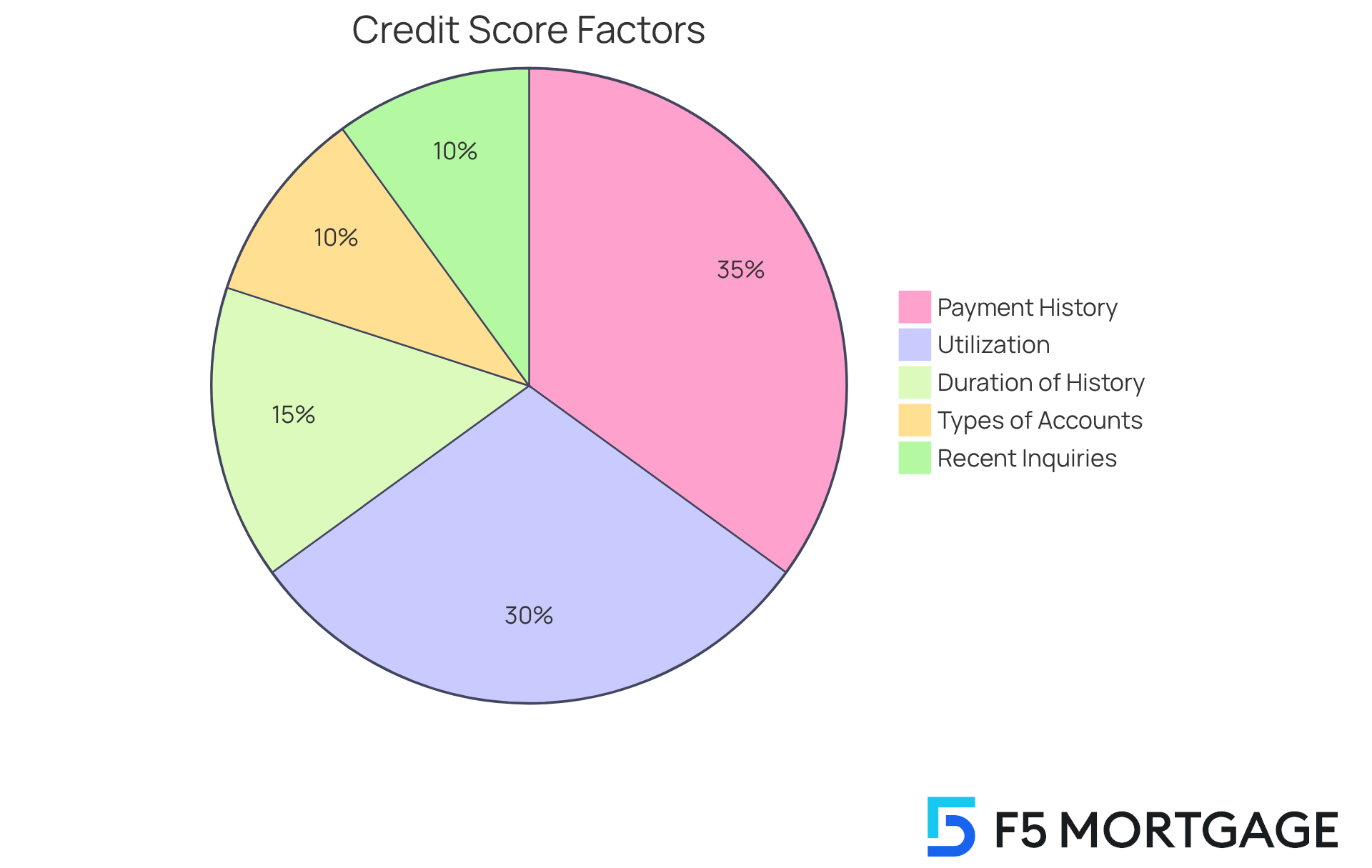

Understanding your borrowing rating can feel overwhelming, but we know how important it is for your financial future. Several key elements influence this rating, including:

- Payment history

- Utilization

- The duration of your financial history

- Types of accounts

- Recent inquiries

Among these, payment history holds the most weight, representing 35% of your rating. This makes timely payments essential. If payments are neglected, it can lead to significant declines in your financial ratings, especially in today’s economic climate where delinquency rates are on the rise. For instance, FICO data reveals that many younger Americans, particularly those in Gen Z, are facing challenges with their financial ratings due to rising borrowing costs and increased economic pressures.

When it comes to credit usage, it’s best to keep your utilization below 30%. For borrowers, the question of whether 700 is a good credit score can be answered by noting that the average utilization ratio is around 20%, which reflects responsible financial management. The length of your borrowing history contributes 15% to your rating, so keeping older accounts open can be beneficial. Additionally, having a mix of credit types, such as revolving accounts and installment loans, can positively impact your rating. For example, if you maintain a long-standing credit card account alongside a recent auto loan, you may present a well-rounded financial profile that lenders appreciate.

Tommy Lee at FICO advises that those looking to improve their ratings should focus on:

- Making timely payments

- Keeping utilization low

- Maintaining a diverse range of account types

These steps not only enhance your financial ratings but also significantly affect mortgage applications, as lenders often view higher ratings as indicators of lower risk. By understanding and managing these factors, you can take proactive steps toward achieving your homeownership dreams. We’re here to support you every step of the way.

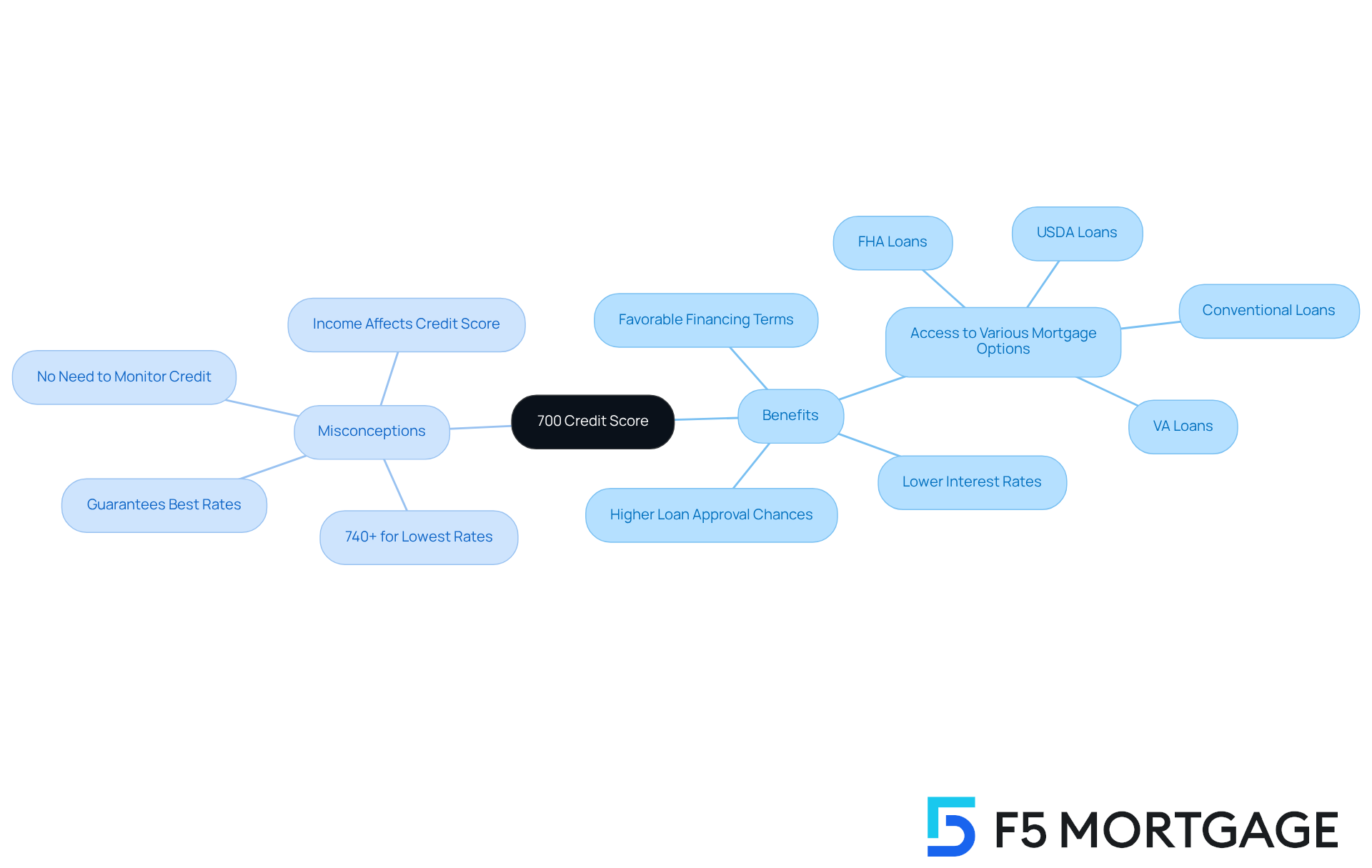

Benefits and Misconceptions of a 700 Credit Score

Many major agencies consider a credit rating of 700 as ‘good’, which makes people wonder, is 700 a good credit score? It opens the door to lower interest rates, favorable financing terms, and a greater likelihood of loan approval. At F5 Mortgage, we understand how important this is for families. With a 700 credit rating, you can explore various mortgage options tailored to your needs, including conventional, FHA, VA, and streamlined choices.

However, it’s essential to address some common misconceptions regarding what is 700 a good credit score. Many people believe that if is 700 a good credit score, it guarantees the best rates or qualifies them for any loan type. While this rating is indeed beneficial, lenders also consider other critical factors, such as your income and debt-to-income ratio, when making decisions. We know how challenging this can be, and we’re here to support you every step of the way.

Another misconception is that reaching a 700 rating means you can stop monitoring your financial history. In reality, maintaining good financial habits is crucial for keeping that strong rating over time. It’s also important to note that while the question of whether is 700 a good credit score is impressive, it may not qualify you for the absolute lowest interest rates, which typically require a score of 740 or higher.

Understanding these nuances empowers you to make informed decisions. By working with F5 Mortgage, you can optimize your mortgage options while enjoying exceptional service and competitive rates.

Conclusion

A credit score of 700 is more than just a number; it serves as a vital benchmark in your financial journey, especially if you’re considering home ownership. This score reflects your responsible credit management and opens doors to a range of mortgage options with favorable terms. Understanding what a 700 credit score means is essential for prospective buyers, as it can significantly enhance your financial opportunities and affordability in the housing market.

We know how challenging navigating the mortgage process can be. Key points have emerged about the importance of this score:

- It plays a crucial role in determining your eligibility for various loan types.

- It influences interest rates.

- It boosts your negotiating power with lenders.

It’s also important to recognize the factors that contribute to achieving and maintaining this score, such as your payment history, credit utilization, and the diversity of your credit accounts. Misconceptions can arise, like the belief that a 700 score guarantees the best rates or that you can stop monitoring your financial health. This highlights the need for ongoing diligence in managing your credit.

Ultimately, a 700 credit score represents a strategic advantage on your path to financial stability and homeownership. By understanding the nuances of credit scores and actively managing your financial health, you can position yourself for success in the competitive housing market. As the significance of a good credit score becomes clearer, remember to stay informed and proactive. Align your financial decisions with your long-term goals, and know that we’re here to support you every step of the way.

Frequently Asked Questions

What is a 700 credit score considered to be?

A credit score of 700 is often regarded as a strong benchmark within the FICO evaluation system.

What does a 700 credit score reflect about an individual’s credit management?

A 700 credit score reflects a history of responsible credit management, characterized by timely payments and a low credit utilization ratio.

How do lenders view individuals with a 700 credit score?

Individuals with a 700 credit score are generally viewed as lower risk by lenders, which can enhance their chances of securing various types of credit.

What types of loans can individuals with a 700 credit score access?

Individuals with a 700 credit score can access a range of mortgage options, including conventional loans, FHA loans, VA loans, and USDA loans.

What advantages do borrowers with a 700 credit score have when applying for loans?

Borrowers with a 700 credit score often receive more favorable loan terms, which can simplify the credit application process and influence interest rates.

How common is it for borrowers to achieve a 700 credit score or higher?

Approximately 30% of borrowers achieve a credit score of 700 or higher.

Why is it important for prospective homebuyers to understand their credit score?

Understanding whether 700 is a good credit score is essential for prospective homebuyers, as it greatly influences their financial opportunities and overall affordability in the housing market.