Overview

We know how challenging managing a mortgage can be. To help you pay it off in just five years, consider effective strategies like:

- Making extra payments

- Switching to biweekly installments

- Refinancing to a shorter term

These methods not only can significantly reduce the total interest you pay but also shorten the duration of your loan.

However, it’s essential to approach these options with care. We’re here to support you every step of the way, reminding you to consider potential risks, such as:

- Liquidity concerns

- Possible prepayment penalties

By weighing these factors thoughtfully, you can make informed decisions that align with your financial goals.

Introduction

Navigating the complexities of a mortgage can feel overwhelming, especially when you aspire to pay it off in just five years. With home prices on the rise and interest rates fluctuating, it’s more important than ever to understand the intricacies of mortgage structures. We know how challenging this can be, and this article explores effective strategies that not only promise financial freedom but also empower you to take control of your financial future.

However, amidst the allure of rapid payoff, it’s essential to consider the challenges and factors that must be addressed. What steps can you take to ensure that this ambitious goal does not come at a cost? We’re here to support you every step of the way.

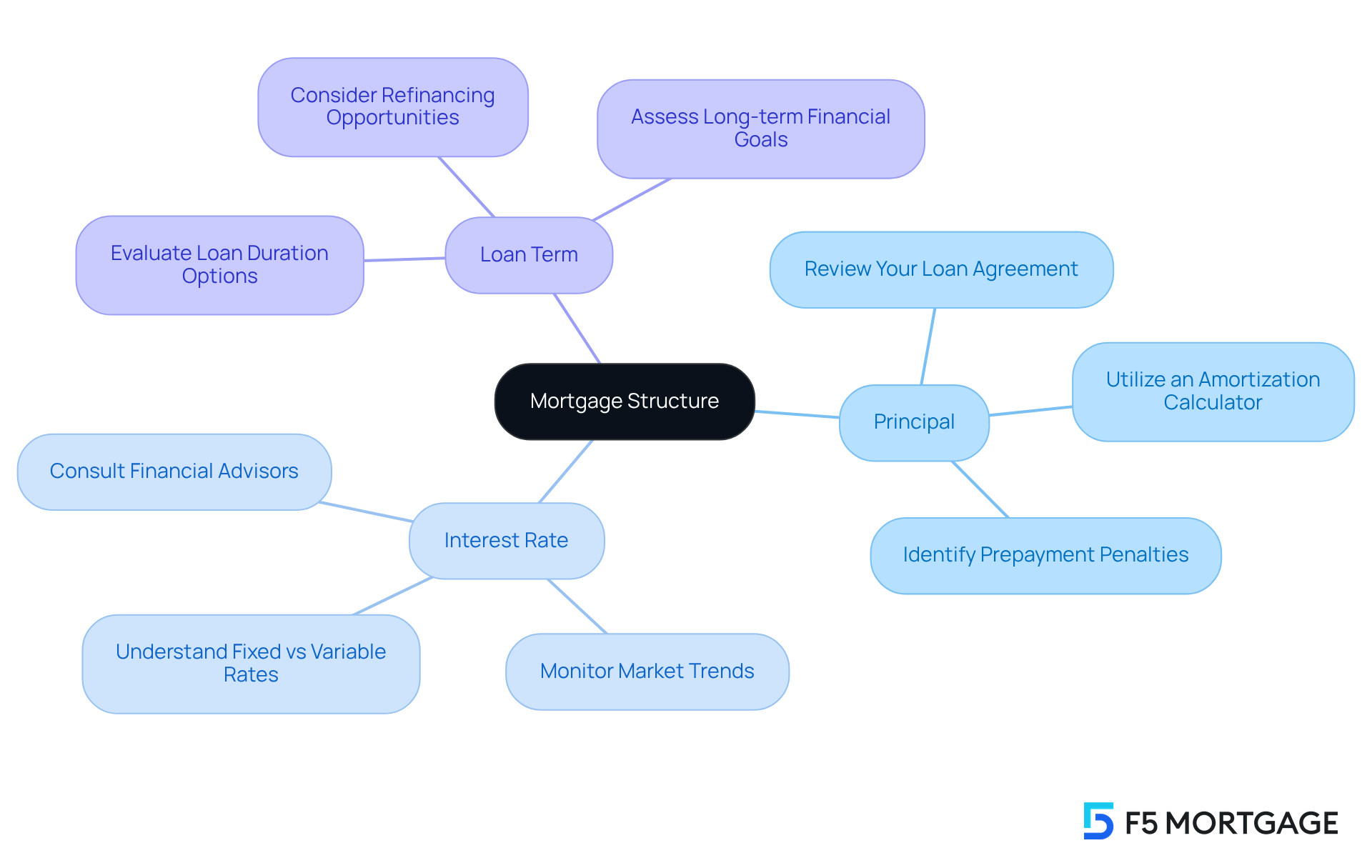

Understand Your Mortgage Structure

To understand how to pay off mortgage in 5 years effectively, we know how essential it is to grasp its structure. This structure comprises several key components that can feel overwhelming at times:

- Principal: This is the original loan amount you borrowed.

- Interest Rate: The percentage charged on the principal, which can be fixed or variable.

- Loan Term: The duration over which you agree to repay the loan, typically 15 or 30 years.

Let’s take a moment to analyze your mortgage together:

- Review Your Loan Agreement: Examine the total amount borrowed, interest rate, and payment schedule. Understanding these details is crucial.

- Utilize an Amortization Calculator: This helpful tool enables you to see how much of each installment goes toward principal versus interest, which is essential for planning your contributions effectively.

- Identify Prepayment Penalties: It’s important to determine if your loan includes penalties for early repayment, as this could influence your strategy moving forward.

Grasping these components empowers you to make informed choices about how to pay off mortgage in 5 years by directing additional funds toward your loan payments. In 2025, the average loan principal amounts are expected to reflect the continuous increase in home prices, which have risen by 17% since early 2022. This context highlights the significance of being proactive in managing your loan to prevent greater expenses in the long term.

Furthermore, think about consulting with advisors who can provide insights on how these components can influence your overall monetary strategy. As financial specialists often say, “Comprehending your loan components is essential for making knowledgeable choices that can help you save money over time.” This proactive method can assist families like yours in improving their homes and exploring financing options effectively.

Implement Effective Payment Strategies

Managing your mortgage can feel overwhelming, but with the right strategies on how to pay off mortgage in 5 years, you can achieve faster payment and gain peace of mind. Here are some compassionate approaches to consider:

-

Make Extra Payments: If you find yourself with surplus funds, like bonuses or tax refunds, think about directing those towards your loan principal. This simple action not only reduces your overall costs but can also significantly shorten your loan duration. For instance, by making additional contributions each month, you could save over $33,000 in interest and reduce a 30-year loan to just 24 years and 7 months.

-

Switch to Biweekly Installments: Instead of sticking to the traditional monthly payment schedule, consider paying half of your loan every two weeks. This method results in 26 half-payments each year—effectively giving you one extra full payment annually. This small change can really help speed up your payoff timeline.

-

Refinance to a Shorter Term: If it’s feasible for you, refinancing your mortgage to a shorter term, like from 30 years to 15 years, can lead to lower rates and a faster payoff. While this may increase your monthly costs, the long-term savings on interest can be quite significant, helping you feel more secure in your financial future.

-

Round Up Amounts: Another simple adjustment is to round your monthly payment to the nearest hundred dollars. For example, if your payment is $1,200, consider rounding it up to $1,300. This small change can have a big impact on your principal balance over time, leading to quicker mortgage clearance and lower financing costs.

-

Utilize a Mortgage Payoff Calculator: Don’t forget to leverage online tools like mortgage payoff calculators to explore different financing scenarios. These calculators can provide valuable insights into how additional payments can affect your payoff schedule and total interest savings, empowering you to make informed financial decisions.

By embracing these strategies, you can take meaningful steps towards how to pay off mortgage in 5 years and achieve the financial freedom you deserve. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

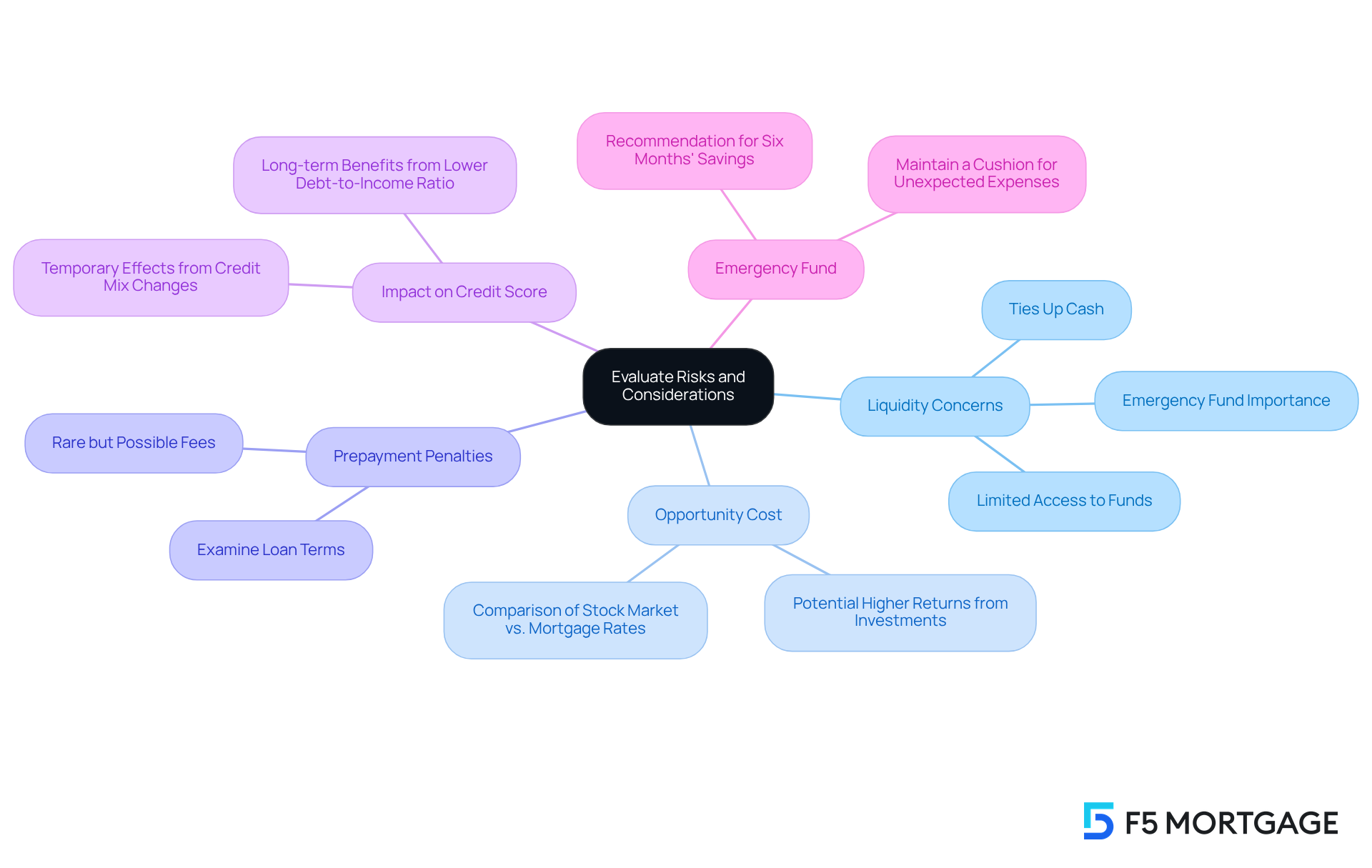

Evaluate Risks and Considerations

Before committing to an aggressive five-year mortgage payoff strategy, we know how crucial it is to evaluate several key risks and factors that might affect your financial journey:

-

Liquidity Concerns: Settling your home loan can significantly tie up cash in your residence, potentially limiting access to funds for emergencies or investment opportunities. This lack of liquidity can be a critical issue, especially if unexpected expenses arise. We understand that having ready access to cash is important for peace of mind.

-

Opportunity Cost: Consider whether the funds allocated to loan repayment could generate higher returns if invested elsewhere, such as in retirement accounts or diversified investment portfolios. Historically, the average stock market return over a decade is approximately 12%, which may exceed the savings from settling a home loan with an average interest rate of 7%. This emphasizes the potential opportunity cost of allocating resources for loan repayment instead of investment. It’s worth reflecting on how best to utilize your hard-earned money.

-

Prepayment Penalties: Certain loan agreements may include fees for early repayment. While prepayment penalties are rare, it’s vital to examine your loan terms to comprehend any possible penalties and include these expenses in your financial planning. Understanding your loan’s specifics can empower you to make informed decisions.

-

Impact on Credit Score: While paying off your home loan may temporarily affect your credit score due to changes in your credit mix, it can ultimately enhance your score by lowering your debt-to-income ratio. This long-term benefit should be weighed against any short-term impacts, and we’re here to support you in navigating these changes.

-

Emergency Fund: Prioritize maintaining a strong emergency fund before actively reducing your home loan. Economic stability is essential, as exhausting savings to settle a loan can leave you exposed to unexpected monetary difficulties. Experts recommend having a cushion that protects you for at least six months. We understand that having a safety net can make all the difference during challenging times.

By carefully assessing these risks, you can make a more informed decision on how to pay off mortgage in 5 years with an aggressive payoff strategy, ensuring that your financial health remains intact. Remember, we’re here to support you every step of the way.

Conclusion

Understanding how to pay off a mortgage in just five years can feel overwhelming, but with the right strategies, you can navigate this journey successfully. By familiarizing yourself with your mortgage structure—including principal, interest rates, and loan terms—you empower yourself to make informed decisions that lead to significant savings and a quicker payoff.

We know how challenging this can be, which is why we’ve outlined several actionable strategies to help you expedite your mortgage repayment. Consider:

- Making extra payments

- Switching to a biweekly payment plan

- Refinancing to a shorter term

- Rounding up payments

- Utilizing mortgage payoff calculators

Each of these methods can substantially reduce the time it takes to pay off your loan while also minimizing the interest paid over the life of the mortgage. However, it’s important to weigh the potential risks, such as liquidity concerns, opportunity costs, and the impact on your credit score.

Ultimately, the journey to paying off a mortgage in five years is not just about financial discipline; it’s about making informed choices that align with your overall financial strategy. By weighing the benefits against the risks and implementing the right strategies, financial freedom is within reach. Take the first step today by reviewing your mortgage details and exploring these strategies. Together, we can pave the way toward a debt-free future.

Frequently Asked Questions

What are the key components of a mortgage structure?

The key components of a mortgage structure include the principal (the original loan amount), the interest rate (the percentage charged on the principal, which can be fixed or variable), and the loan term (the duration over which you agree to repay the loan, typically 15 or 30 years).

How can I effectively analyze my mortgage?

You can effectively analyze your mortgage by reviewing your loan agreement to understand the total amount borrowed, interest rate, and payment schedule. Additionally, utilizing an amortization calculator can help you see how much of each installment goes toward principal versus interest.

What should I check for regarding prepayment penalties?

It is important to check if your loan includes prepayment penalties, as these could affect your strategy for paying off the mortgage early.

Why is it important to understand the components of my mortgage?

Understanding the components of your mortgage empowers you to make informed choices about how to pay off the mortgage effectively, allowing you to direct additional funds toward your loan payments and potentially save money over time.

What is the trend in home prices and how does it relate to mortgage management?

Home prices have risen by 17% since early 2022, which highlights the importance of being proactive in managing your loan to prevent greater expenses in the long term.

Should I seek professional advice regarding my mortgage?

Yes, consulting with financial advisors can provide insights on how your mortgage components can influence your overall monetary strategy and help you explore effective financing options.