Overview

If you’re a family facing the challenge of obtaining a home equity loan with bad credit, know that you’re not alone. Many families find themselves in similar situations, and there are steps you can take to improve your chances.

Start by demonstrating sufficient equity in your home. This is crucial, as lenders often look for this as a sign of financial stability.

Next, maintaining a favorable debt-to-income ratio can make a significant difference. Lenders want to see that you can manage your existing debts while taking on new ones. Additionally, providing proof of income is essential; it shows lenders that you have a reliable source of funds to repay the loan.

While many lenders prefer a credit score of 680 or higher, some may accept scores as low as 620, especially if other financial indicators are strong. This opens up potential pathways for families with financial challenges to secure the financing they need. Remember, we know how challenging this can be, but with the right approach, you can navigate this process successfully.

Take action today by gathering your financial documents and assessing your home equity. You’re taking the first step toward achieving your financial goals, and we’re here to support you every step of the way.

Introduction

Navigating the world of home equity loans can feel overwhelming, especially for families facing financial difficulties. We understand how challenging this can be. As homeowners look to tap into their property’s value, grasping the requirements and processes becomes essential—particularly when credit scores aren’t ideal.

This guide aims to illuminate the path for families seeking to secure a home equity loan despite credit challenges. We’re here to support you every step of the way, offering practical steps and strategies to enhance your chances of approval.

What if you could turn this daunting task into a manageable opportunity for financial relief? Let’s explore the key factors that can help you achieve this goal.

Understand Home Equity Loans and Their Requirements

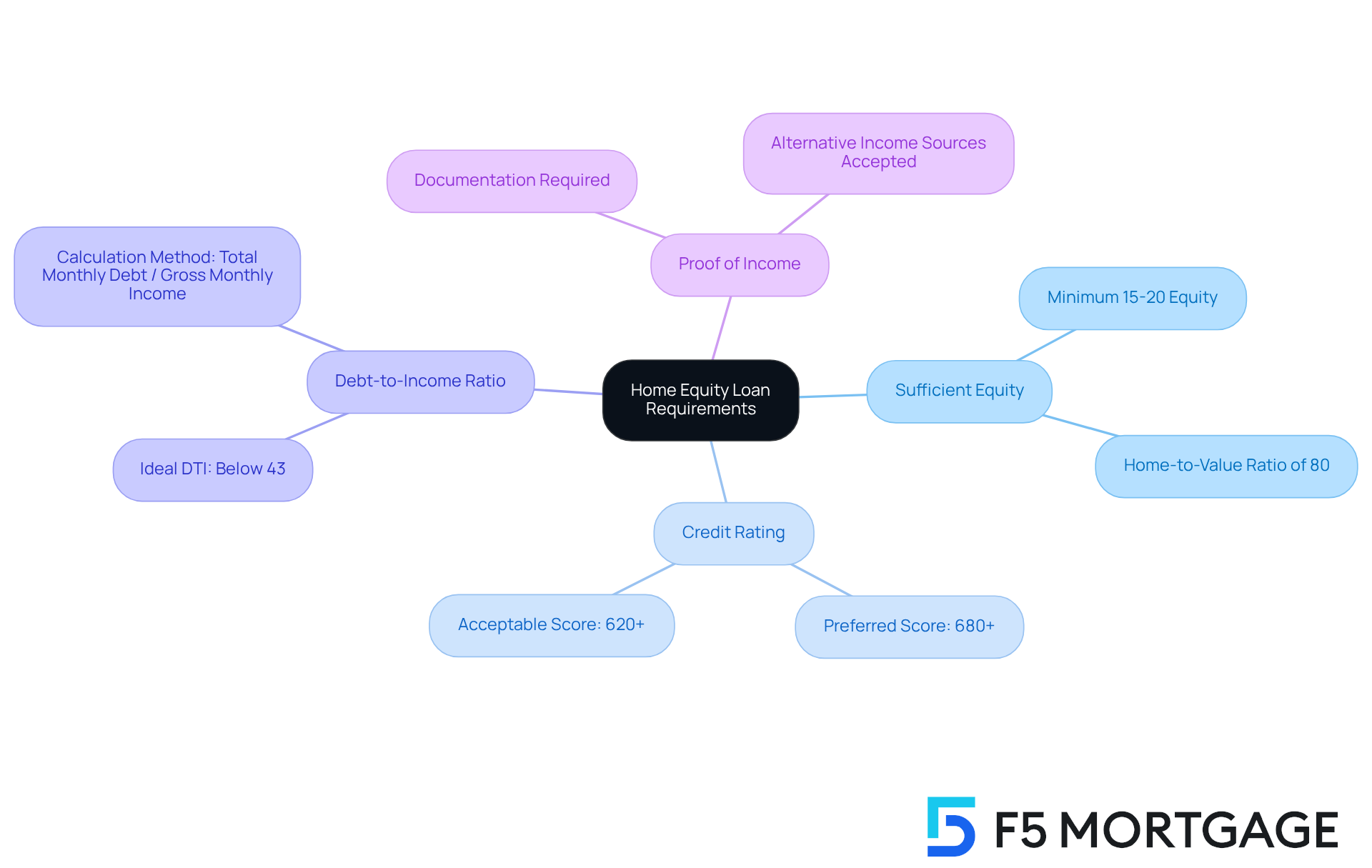

Navigating property financing can feel overwhelming, especially for families facing financial hurdles. A property financing option allows homeowners to tap into the value of their asset, which is the difference between the property’s current market worth and the remaining mortgage balance. If you’re considering a home equity loan, particularly with a lower credit score, it’s essential to understand a few key requirements that can help you on this journey:

- Sufficient Equity: Most lenders typically look for at least 15-20% equity in your home, meaning your home-to-value loan ratio should be at least 80%. For instance, if your home is valued at $300,000, you should aim for at least $45,000 to $60,000 in equity.

- Credit Rating: While many lenders prefer a score of 680 or higher, some may accept scores as low as 620, especially if other financial factors, like income and debt levels, are favorable. This flexibility can be a lifeline for families facing tough times.

- Debt-to-Income Ratio: A lower debt-to-income (DTI) ratio, ideally below 43%, is often necessary to show financial stability. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income. Keeping this percentage low can significantly boost your chances of approval.

- Proof of Income: Lenders will need documentation to verify your income, which could include pay stubs, tax returns, and bank statements. If you don’t have traditional employment, don’t worry—alternative income sources can also be considered, as long as they’re well-documented.

Understanding how to get a home equity loan with bad credit is crucial for families navigating the mortgage process, especially those with less-than-perfect financial backgrounds. Experts agree that maintaining a solid financial profile can enhance your chances of approval, even if your credit score isn’t ideal. With the typical ownership percentage needed hovering around 15-20%, it’s important for families to assess their financial situation and prepare accordingly. Remember, we’re here to support you every step of the way.

Evaluate Your Financial Health and Home Equity

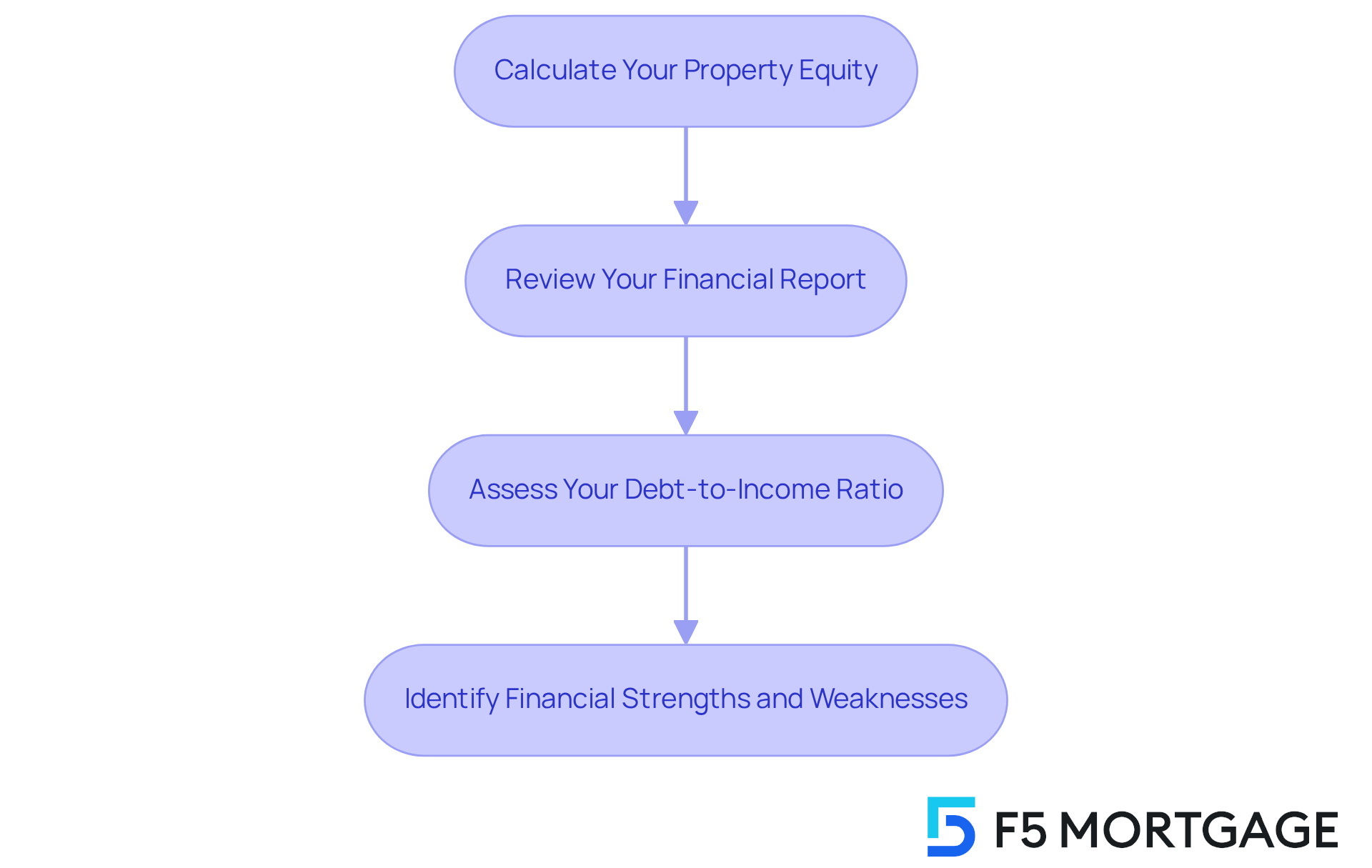

Evaluating your financial health and home equity can feel overwhelming, but we’re here to support you every step of the way. By following these steps, you can gain a clearer understanding of your situation and make informed decisions.

Calculate Your Property Equity: Start by determining your home’s current market value. You can do this through an appraisal or by using online valuation tools. Once you have that number, subtract your remaining mortgage balance to find out how much of your home you truly own.

- For example, if your home is valued at $300,000 and you owe $200,000, your equity stands at $100,000.

Review your financial report: It’s important to understand how to get a home equity loan with bad credit by obtaining a free report from major credit agencies. Take the time to verify any mistakes and understand your credit score, as this knowledge is crucial for learning how to get a home equity loan with bad credit, which will significantly impact your borrowing options.

Assess Your Debt-to-Income Ratio: To calculate your DTI, divide your total monthly debt payments by your gross monthly income. Ideally, you want to keep your DTI below 43% to improve your chances of loan approval.

Identify Financial Strengths and Weaknesses: Reflect on factors like job stability, savings, and existing debts. This holistic view will empower you to understand your borrowing capacity and prepare for discussions with lenders.

We know how challenging this can be, but taking these steps will help you feel more confident in your financial journey.

Apply for a Home Equity Loan: Step-by-Step Process

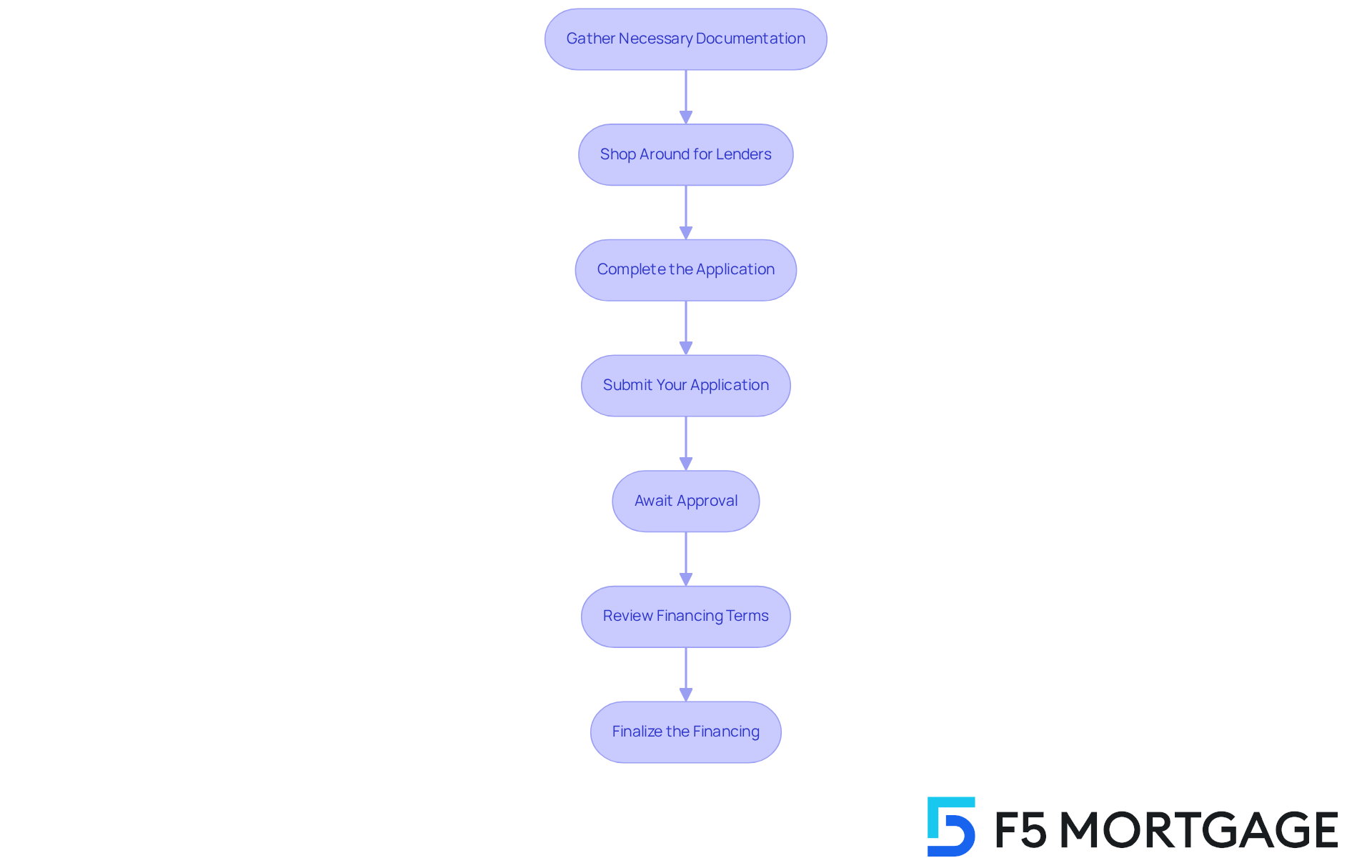

Applying for a home equity loan can feel overwhelming, but we’re here to support you every step of the way. Follow these essential steps to make the process smoother:

Gather Necessary Documentation: Start by preparing the following documents:

- Proof of income (like pay stubs and tax returns)

- Your credit report

- A home appraisal or market value estimate

- Current mortgage statement

Shop Around for Lenders: Take the time to research various lenders. When comparing rates and terms, it’s important to consider how to get a home equity loan with bad credit. For instance, F5 Mortgage is known for its competitive rates and personalized service.

Complete the Application: When you’re ready, fill out the application form from your chosen lender. Be open about your financial situation; honesty can lead to better negotiations.

Submit Your Application: Double-check your application for accuracy before submitting it along with the required documentation.

Await Approval: After submission, the lender will review your application. This process can take several days to weeks, so be prepared to answer any follow-up questions they might have.

Review Financing Terms: If you’re accepted, take the time to thoroughly assess the financing terms. Look closely at interest rates, fees, and repayment schedules. Don’t hesitate to negotiate if something doesn’t feel right. Many lenders, including F5 Mortgage, typically allow borrowing up to 80% to 90% of your property’s value, minus any existing mortgage balance. Remember, lenders often require a minimum of an 80% value-to-equity ratio, meaning you should have reduced at least 20% of your initial borrowing amount or your home should have appreciated in value. Additionally, a maximum of a 43% debt-to-income (DTI) ratio is usually necessary for residential financing, which compares your current debt to your income.

Finalize the Financing: Once you’re comfortable with the terms, sign the financing documents. The funds will then be distributed, allowing you to access your property value.

By following these steps, families with challenging financial histories can learn how to get a home equity loan with bad credit, which will help them navigate the property financing process more effectively and secure the best conditions for their needs. Just a reminder: to qualify for tax deductibility, funds from property value loans should be used to significantly enhance the property.

We know how challenging this can be, but with the right guidance, you can achieve your financial goals.

Navigate Challenges and Consider Alternatives

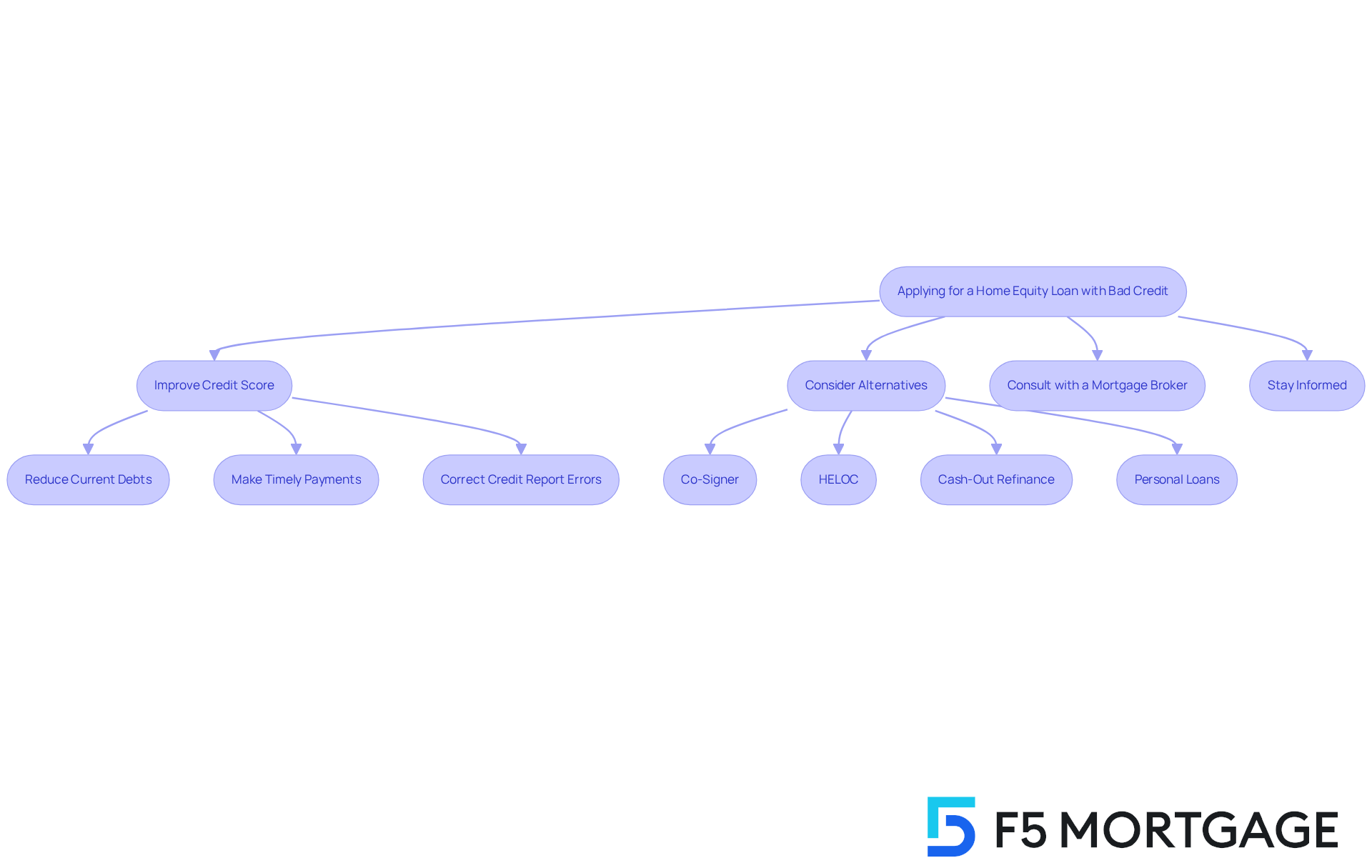

Applying for a home equity loan can feel daunting, especially when learning how to get a home equity loan with bad credit. But don’t worry; there are strategies to help you navigate these challenges with confidence:

Enhance Your Rating: We know how important your credit score is. Before you apply, take some time to boost it. Focus on reducing your current debts, making timely payments, and correcting any errors on your credit report.

Consider a Co-Signer: If you can, think about enlisting a co-signer with better credit. This can significantly improve your chances of approval and may even lead to better financing terms.

Explore Alternative Loan Options: If a traditional home equity loan isn’t the right fit, there are other options to consider:

- Home Equity Line of Credit (HELOC): This option might offer you more flexibility and lower initial payments.

- Cash-Out Refinance: With this choice, you can refinance your existing mortgage for more than you owe and take the difference in cash.

- Personal Loans: These can serve similar purposes, but keep in mind they may come with higher interest rates.

Consult with a Mortgage Broker: A knowledgeable mortgage broker can be a great ally. They can help you navigate the complexities of how to get a home equity loan with bad credit and connect you with lenders who understand your credit situation.

Stay Informed: It’s essential to keep up with market trends and lender requirements. These can change, and staying informed may open up new opportunities for securing financing.

Remember, we’re here to support you every step of the way as you explore your options.

Conclusion

Navigating the complexities of obtaining a home equity loan with bad credit can feel overwhelming for families. We understand how challenging this can be, but there’s hope. By grasping the fundamental requirements, evaluating your financial health, and following a structured application process, you can empower yourself to access the funds you need. Understanding equity, credit ratings, and debt-to-income ratios is key to positioning yourself for success in securing a loan.

Consider these important insights:

- Maintaining a sufficient equity percentage

- Exploring various lender options

- Preparing the necessary documentation

- Improving your credit score

- Considering alternative financing options

Each step you take towards understanding and managing your financial health is crucial in navigating the home equity loan landscape.

Ultimately, securing a home equity loan isn’t just about overcoming credit challenges; it’s about making informed decisions and seeking support when needed. By staying proactive and informed, you can unlock the potential of your home equity, paving the way for financial stability and growth. Embracing this journey with confidence can lead to valuable opportunities for investment and improvement in your financial situation. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan allows homeowners to borrow against the value of their property, which is the difference between the property’s current market value and the remaining mortgage balance.

What equity percentage do lenders typically require for a home equity loan?

Most lenders look for at least 15-20% equity in your home, meaning your home-to-value loan ratio should be at least 80%.

How is equity calculated in a home equity loan?

Equity is calculated by determining the difference between the property’s current market value and the remaining mortgage balance. For example, if your home is valued at $300,000, you should aim for at least $45,000 to $60,000 in equity.

What credit score do lenders prefer for home equity loans?

While many lenders prefer a credit score of 680 or higher, some may accept scores as low as 620, especially if other financial factors, like income and debt levels, are favorable.

What is the ideal debt-to-income (DTI) ratio for obtaining a home equity loan?

An ideal DTI ratio is below 43%, which shows financial stability. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income.

What documentation is needed to prove income for a home equity loan?

Lenders require documentation to verify your income, which may include pay stubs, tax returns, and bank statements. Alternative income sources can also be considered if they are well-documented.

How can families with bad credit improve their chances of getting a home equity loan?

Maintaining a solid financial profile, including a good equity percentage and a low DTI, can enhance the chances of approval, even if the credit score is not ideal.

What should families do before applying for a home equity loan?

Families should assess their financial situation, aim for the required equity percentage, and prepare the necessary documentation to improve their chances of approval.